Key Insights

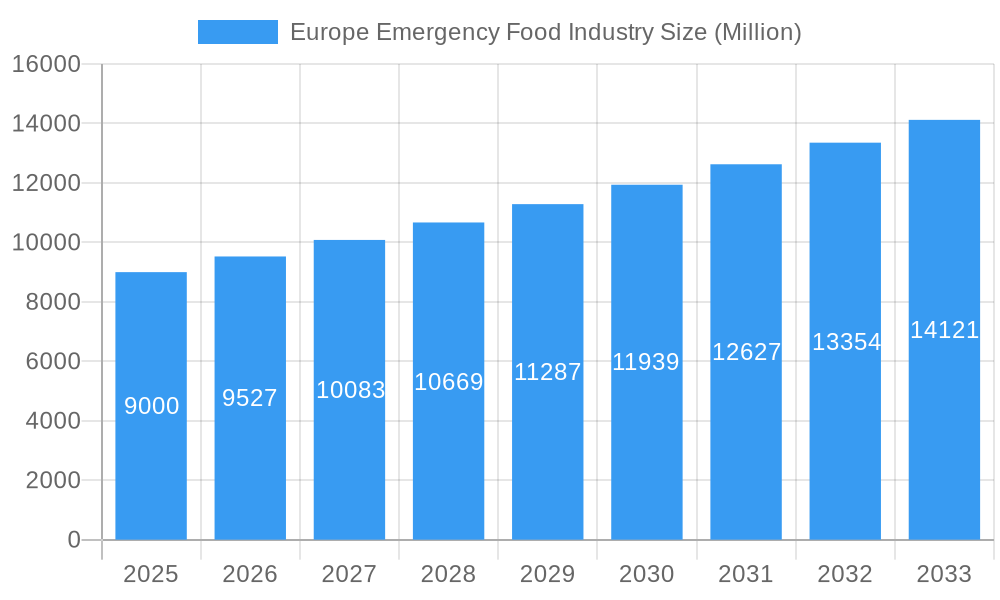

The Europe Emergency Food Industry is poised for significant growth, with an estimated market size of $9 billion in 2025. This expansion is driven by increasing consumer awareness regarding preparedness for natural disasters, geopolitical uncertainties, and the growing popularity of outdoor recreational activities such as camping and hiking, which require shelf-stable and portable food options. The industry is projected to witness a robust CAGR of 5.83% during the forecast period of 2025-2033. Key product segments like freeze-dried and canned fruits and vegetables, along with freeze-dried ready meals, are expected to lead the market due to their long shelf life, nutritional value, and convenience. The rising demand for specialized emergency food products catering to diverse dietary needs, including vegetarian and vegan options, further fuels market expansion. Companies are focusing on innovation in packaging and product formulation to enhance appeal and accessibility.

Europe Emergency Food Industry Market Size (In Billion)

The market's growth trajectory is also influenced by favorable government initiatives and stockpiling efforts by disaster management agencies. However, certain restraints, such as the relatively high cost of some specialized emergency food products and consumer inertia towards proactive preparedness, may temper growth. The competitive landscape is dynamic, featuring established players like The Kellogg Company and specialized emergency food providers such as Readywise and SOS Food Lab Inc. Geographically, Europe's diverse risk landscape, from extreme weather events to border security concerns, contributes to varied regional demand. Countries like Germany and the United Kingdom are anticipated to be key markets, reflecting a heightened sense of preparedness among their populations. The industry's evolution is characterized by a continuous effort to balance affordability, nutritional completeness, and long-term storability to meet the evolving needs of consumers and organizations.

Europe Emergency Food Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Emergency Food Industry, a critical sector driven by growing demand for preparedness, disaster relief, and extended shelf-life solutions. Covering the historical period from 2019 to 2024, a base year of 2025, and a forecast period extending to 2033, this report provides actionable insights for stakeholders seeking to navigate this evolving market. We delve into market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions. Explore key industry trends, growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report also highlights leading markets and segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook.

Europe Emergency Food Industry Market Dynamics & Concentration

The Europe Emergency Food Industry exhibits a moderate to high concentration, with several key players dominating market share. Innovation is a primary driver, fueled by advancements in food preservation technologies and a growing consumer emphasis on nutritional value and convenience in emergency provisions. Regulatory frameworks, including stringent food safety standards and labeling requirements across EU member states, play a significant role in shaping market entry and product development. Product substitutes, such as traditional non-perishable goods, pose a continuous challenge, yet specialized emergency food products offer superior shelf-life and nutritional profiles. End-user trends indicate a rising demand from individual consumers for personal preparedness kits, alongside continued reliance from governmental agencies and humanitarian organizations for disaster relief. Mergers & Acquisitions (M&A) activity has been moderate, with strategic consolidations aimed at expanding product portfolios and geographical reach. Anticipated M&A deal counts for the forecast period are estimated at xx, reflecting ongoing consolidation potential. Market share for the top 5 players is estimated to be around 55% in the base year.

Europe Emergency Food Industry Industry Trends & Analysis

The Europe Emergency Food Industry is poised for significant expansion, driven by an escalating global focus on disaster preparedness and resilience. The Compound Annual Growth Rate (CAGR) is projected to be robust, estimated at XX% from 2025 to 2033, signaling a dynamic growth trajectory. This growth is propelled by a confluence of factors, including increasing frequency and severity of natural disasters, heightened geopolitical instability, and a growing awareness among individuals and organizations regarding the importance of maintaining adequate emergency food supplies. Technological disruptions are at the forefront of this evolution, with significant advancements in freeze-drying, vacuum sealing, and innovative packaging solutions extending product shelf-life and enhancing nutritional content. These innovations are crucial in meeting the demand for longer-term storage and improved palatability, thereby increasing market penetration among diverse consumer groups. Consumer preferences are shifting towards more palatable, nutritious, and diverse emergency food options. Gone are the days of solely utilitarian, bland rations; consumers now seek variety, taste, and complete nutritional profiles in their emergency provisions. This shift is prompting manufacturers to develop a wider range of ready-to-eat meals, freeze-dried fruits and vegetables, and even specialized dietary options. Competitive dynamics within the industry are intensifying, characterized by a blend of established players and emerging innovators. Companies are actively investing in research and development to create more sustainable, cost-effective, and user-friendly emergency food solutions. The increasing market penetration, estimated to reach XX% of the relevant consumer base by 2033, underscores the growing acceptance and adoption of these specialized products. Furthermore, the rise of e-commerce platforms has democratized access to emergency food supplies, allowing smaller manufacturers to reach a broader customer base and fostering a more competitive landscape. The demand for long-term food storage solutions is further amplified by individuals preparing for potential supply chain disruptions, economic uncertainties, and personal emergencies, solidifying the industry's growth trajectory.

Leading Markets & Segments in Europe Emergency Food Industry

The Europe Emergency Food Industry is characterized by distinct regional dominance and segment preferences.

Dominant Region: Western Europe, specifically Germany, France, and the United Kingdom, consistently emerges as the leading market. This dominance is attributed to:

- Economic Stability and High Disposable Income: These countries possess robust economies, enabling higher per capita expenditure on preparedness and emergency supplies.

- Strong Disaster Preparedness Culture: A well-established culture of personal and governmental preparedness for various emergencies, including natural disasters and civil unrest, fuels consistent demand.

- Advanced Infrastructure and Distribution Networks: Efficient logistics and established retail channels facilitate widespread availability and accessibility of emergency food products.

- Governmental Procurement Policies: Significant government contracts for emergency relief and military rations contribute substantially to market volume.

Dominant Segment by Product Type:

- Freeze-dried Ready Meals: This segment is experiencing substantial growth due to its lightweight, long shelf-life, and ease of preparation.

- Key Drivers:

- Technological advancements in freeze-drying leading to improved taste and texture.

- Demand for convenient, complete meal solutions for various emergency scenarios.

- Portability for outdoor enthusiasts and military applications.

- Key Drivers:

- Freeze-dried/Canned Fruits and Vegetables: Essential for nutritional completeness and vitamin intake during emergencies.

- Key Drivers:

- Long shelf-life and preservation of nutritional value.

- Growing consumer awareness of the importance of balanced nutrition.

- Versatility in usage, from direct consumption to ingredient incorporation.

- Key Drivers:

While Snack Bars and Canned Juice also hold significant market share, their growth is relatively slower compared to the more specialized emergency food categories. Freeze-dried Dairy and Freeze-dried Meat are niche but growing segments, catering to specific dietary needs and preferences for extended emergency storage. The overall market penetration for emergency food products in the base year is estimated at XX%, with significant potential for further expansion across all segments, driven by increased awareness and product innovation.

Europe Emergency Food Industry Product Developments

Product innovation in the Europe Emergency Food Industry is predominantly focused on enhancing nutritional value, extending shelf-life, and improving palatability. Leading companies are leveraging advanced freeze-drying techniques to preserve nutrients and textures, offering a wider array of palatable freeze-dried meals, fruits, and vegetables. Innovations also include the development of allergen-free and specific dietary requirement (e.g., vegan, gluten-free) emergency food options, catering to a broader consumer base. Packaging advancements, such as nitrogen-flushed pouches and durable cans, ensure product integrity for decades, while lightweight and compact designs optimize storage and portability. The competitive advantage lies in offering a combination of long-term viability, complete nutrition, and enjoyable taste, making these products indispensable for preparedness kits and disaster relief efforts.

Key Drivers of Europe Emergency Food Industry Growth

The Europe Emergency Food Industry's growth is propelled by several critical factors. Technological advancements in food preservation, particularly freeze-drying and advanced packaging, are extending shelf-life and improving product quality, making emergency food more accessible and appealing. Increasing global concerns regarding natural disasters and geopolitical instability are fostering a heightened sense of urgency for individual and governmental preparedness. Growing consumer awareness of the need for emergency food supplies, driven by media coverage and educational initiatives, is also a significant driver. Furthermore, supportive government policies related to disaster relief and national security, including procurement of emergency rations, contribute to market expansion.

Challenges in the Europe Emergency Food Industry Market

Despite its growth trajectory, the Europe Emergency Food Industry faces several hurdles. High production costs associated with specialized preservation techniques can lead to higher retail prices, potentially limiting mass adoption. Strict and varying regulatory frameworks across different European countries regarding food safety, labeling, and import/export can create complexities for manufacturers. Intense competition from traditional non-perishable food items that are perceived as more cost-effective for everyday consumption poses a challenge to market penetration. Furthermore, supply chain disruptions and the need for robust inventory management to ensure product availability during emergencies remain critical operational concerns.

Emerging Opportunities in Europe Emergency Food Industry

Emerging opportunities in the Europe Emergency Food Industry are numerous and diverse. The increasing demand for sustainable and eco-friendly packaging solutions presents a significant avenue for innovation and market differentiation. Strategic partnerships with governmental agencies, NGOs, and disaster relief organizations can open up substantial procurement channels. Expansion into niche markets, such as specialized foods for extreme sports enthusiasts, hikers, and individuals with specific dietary needs, offers untapped potential. Furthermore, the digitalization of sales channels, including robust e-commerce platforms and direct-to-consumer models, can enhance market reach and customer engagement.

Leading Players in the Europe Emergency Food Industry Sector

- The Kellogg Company

- Readywise

- SOS Food Lab Inc

- European Freeze Dry Ltd

- Katadyn Products Inc

- Expedition Foods Limited

- Malton Foods Limited

- Melograno SRL

- Lyofood SP Z O O

Key Milestones in Europe Emergency Food Industry Industry

- 2019: Increased governmental investment in national emergency preparedness programs across several European nations.

- 2020: Significant surge in consumer purchases of emergency food kits due to the onset of the COVID-19 pandemic.

- 2021: Introduction of new freeze-dried meal technologies by key players, enhancing taste profiles and nutritional content.

- 2022: Growing emphasis on sustainable packaging solutions and reduced environmental impact by manufacturers.

- 2023: Expansion of e-commerce channels, facilitating wider accessibility of emergency food products.

- 2024: Increased focus on developing specialized dietary emergency food options (e.g., vegan, allergen-free).

Strategic Outlook for Europe Emergency Food Industry Market

The strategic outlook for the Europe Emergency Food Industry is exceptionally positive, driven by a continuous need for resilience and preparedness. Future growth will likely be accelerated by further technological innovations in food preservation and packaging, leading to more affordable, nutritious, and palatable products. Strategic partnerships between manufacturers, distributors, and governmental bodies will be crucial for expanding market reach and ensuring widespread availability during crises. The industry can also capitalize on the growing trend of conscious consumerism by offering ethically sourced and sustainably produced emergency food options, further solidifying its long-term market potential and securing a vital role in safeguarding populations against unforeseen events.

Europe Emergency Food Industry Segmentation

-

1. Product Type

- 1.1. Freeze-dried/Canned Fruits and Vegetables

- 1.2. Freeze-dried Ready Meals

- 1.3. Snack Bars

- 1.4. Canned Juice

- 1.5. Freeze-dried Dairy

- 1.6. Freeze-dried Meat

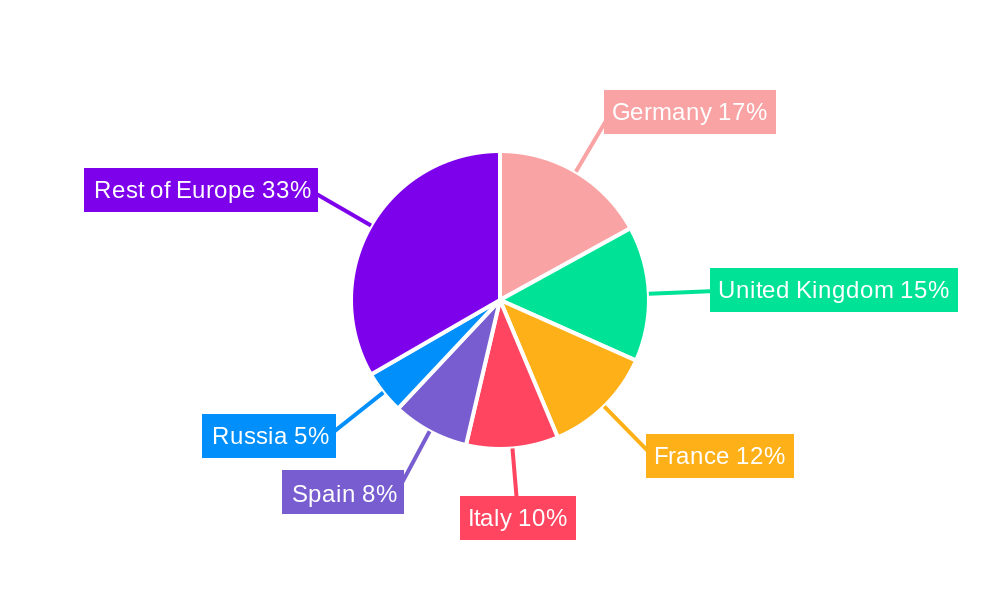

Europe Emergency Food Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe Emergency Food Industry Regional Market Share

Geographic Coverage of Europe Emergency Food Industry

Europe Emergency Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried/Canned Fruits and Vegetables

- 5.1.2. Freeze-dried Ready Meals

- 5.1.3. Snack Bars

- 5.1.4. Canned Juice

- 5.1.5. Freeze-dried Dairy

- 5.1.6. Freeze-dried Meat

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Russia

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Freeze-dried/Canned Fruits and Vegetables

- 6.1.2. Freeze-dried Ready Meals

- 6.1.3. Snack Bars

- 6.1.4. Canned Juice

- 6.1.5. Freeze-dried Dairy

- 6.1.6. Freeze-dried Meat

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Freeze-dried/Canned Fruits and Vegetables

- 7.1.2. Freeze-dried Ready Meals

- 7.1.3. Snack Bars

- 7.1.4. Canned Juice

- 7.1.5. Freeze-dried Dairy

- 7.1.6. Freeze-dried Meat

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Freeze-dried/Canned Fruits and Vegetables

- 8.1.2. Freeze-dried Ready Meals

- 8.1.3. Snack Bars

- 8.1.4. Canned Juice

- 8.1.5. Freeze-dried Dairy

- 8.1.6. Freeze-dried Meat

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Freeze-dried/Canned Fruits and Vegetables

- 9.1.2. Freeze-dried Ready Meals

- 9.1.3. Snack Bars

- 9.1.4. Canned Juice

- 9.1.5. Freeze-dried Dairy

- 9.1.6. Freeze-dried Meat

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Freeze-dried/Canned Fruits and Vegetables

- 10.1.2. Freeze-dried Ready Meals

- 10.1.3. Snack Bars

- 10.1.4. Canned Juice

- 10.1.5. Freeze-dried Dairy

- 10.1.6. Freeze-dried Meat

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Freeze-dried/Canned Fruits and Vegetables

- 11.1.2. Freeze-dried Ready Meals

- 11.1.3. Snack Bars

- 11.1.4. Canned Juice

- 11.1.5. Freeze-dried Dairy

- 11.1.6. Freeze-dried Meat

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Freeze-dried/Canned Fruits and Vegetables

- 12.1.2. Freeze-dried Ready Meals

- 12.1.3. Snack Bars

- 12.1.4. Canned Juice

- 12.1.5. Freeze-dried Dairy

- 12.1.6. Freeze-dried Meat

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Kellogg Company*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Readywise

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 SOS Food Lab Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 European Freeze Dry Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Katadyn Products Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Expedition Foods Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Malton Foods Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Melograno SRL

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lyofood SP Z O O

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 The Kellogg Company*List Not Exhaustive

List of Figures

- Figure 1: Europe Emergency Food Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Emergency Food Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Europe Emergency Food Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Europe Emergency Food Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Europe Emergency Food Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Emergency Food Industry?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Europe Emergency Food Industry?

Key companies in the market include The Kellogg Company*List Not Exhaustive, Readywise, SOS Food Lab Inc, European Freeze Dry Ltd, Katadyn Products Inc, Expedition Foods Limited, Malton Foods Limited, Melograno SRL, Lyofood SP Z O O.

3. What are the main segments of the Europe Emergency Food Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Emergency Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Emergency Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Emergency Food Industry?

To stay informed about further developments, trends, and reports in the Europe Emergency Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence