Key Insights

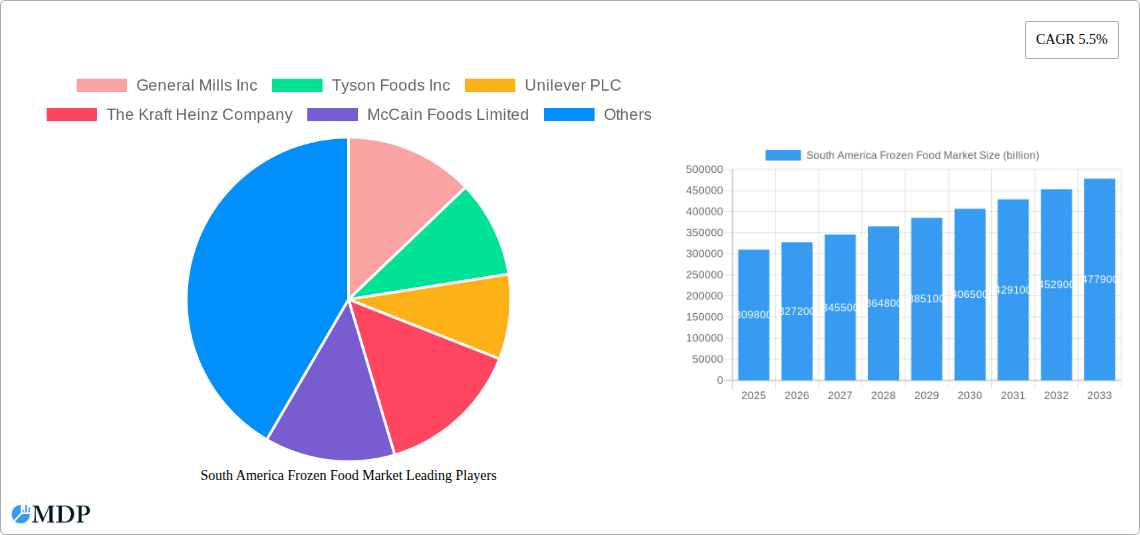

The South America Frozen Food Market is poised for significant expansion, projected to reach USD 309.8 billion by 2025, driven by a robust CAGR of 5.5% over the forecast period of 2025-2033. This growth trajectory is underpinned by several key factors that are reshaping consumer preferences and purchasing habits across the region. The increasing demand for convenience, driven by urbanization and busier lifestyles, is a primary catalyst, encouraging consumers to opt for quick and easy meal solutions offered by frozen food products. Furthermore, advancements in freezing technologies have led to improved product quality, taste, and nutritional value, effectively dispelling past misconceptions about frozen foods being inferior to fresh alternatives. The growing awareness of food safety and extended shelf life associated with frozen products also contributes to consumer confidence and adoption. The expanding middle class in South America, coupled with rising disposable incomes, further fuels the demand for a wider variety of frozen food options, from staple items like frozen fruits and vegetables and frozen poultry and seafood to more indulgent categories such as frozen desserts and prepared meals.

South America Frozen Food Market Market Size (In Billion)

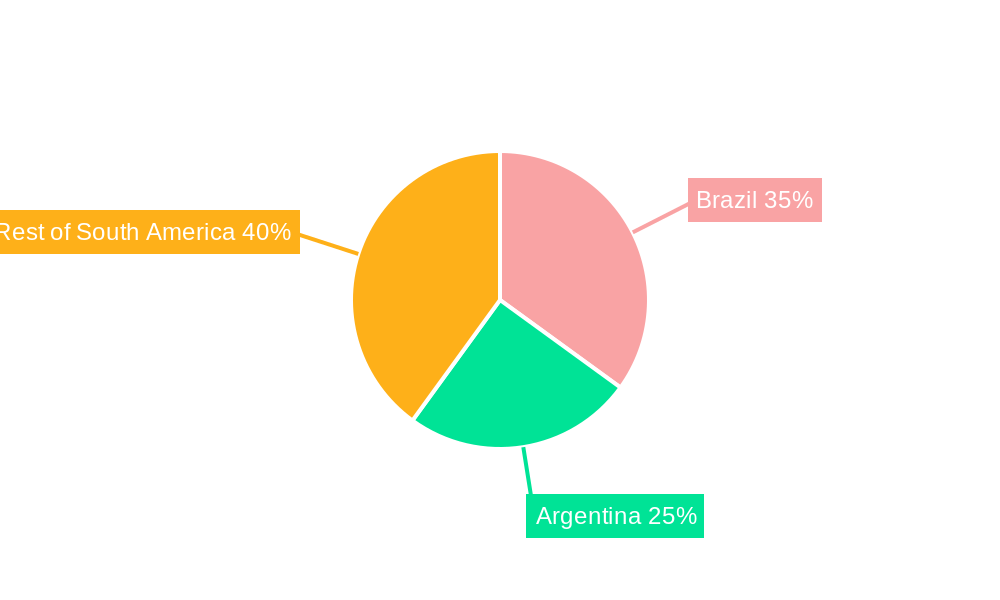

The market is segmented across various product types and distribution channels, reflecting diverse consumer needs. Frozen fruits and vegetables, along with frozen poultry and seafood, are expected to maintain strong demand due to their versatility and perceived health benefits. Frozen prepared foods are also experiencing a surge in popularity as consumers seek convenient yet satisfying meal solutions. The distribution landscape is evolving, with a notable shift towards online retailers alongside traditional channels like supermarkets, hypermarkets, and convenience stores, catering to the growing digital adoption and preference for home delivery. Geographically, Brazil and Argentina are anticipated to be dominant markets, owing to their large populations and established food industries. The rest of South America is also showing promising growth potential as economic development and consumer adoption of frozen food products increase. Key players like General Mills Inc., Tyson Foods Inc., and Nestlé S.A. are strategically focusing on product innovation, expanding their distribution networks, and leveraging marketing strategies to capture a larger share of this dynamic and expanding market.

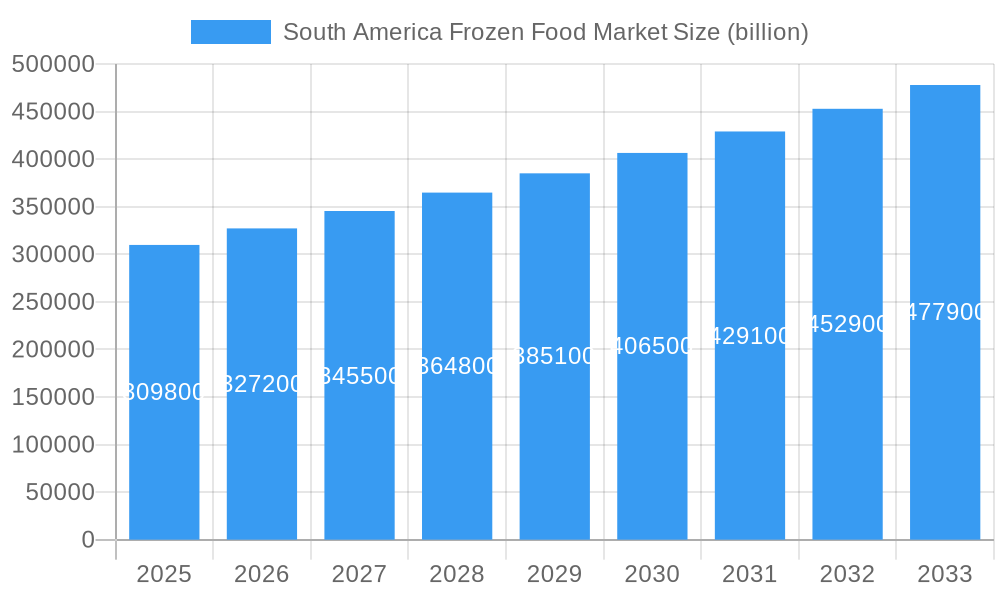

South America Frozen Food Market Company Market Share

This comprehensive report dives deep into the dynamic South America Frozen Food Market, a sector poised for significant expansion. With an estimated market size projected to reach $XX billion by 2033, driven by a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, this analysis provides critical insights for industry stakeholders. We examine key market drivers, emerging trends, leading players, and untapped opportunities within this burgeoning region. This report is essential for understanding the evolving consumer landscape, technological advancements, and regulatory shifts shaping the future of frozen foods across Brazil, Argentina, and the wider South American continent.

South America Frozen Food Market Market Dynamics & Concentration

The South America frozen food market is characterized by a moderate level of concentration, with a few dominant players holding substantial market share. However, the presence of numerous regional and emerging brands fosters a competitive environment. Innovation remains a key driver, fueled by increasing consumer demand for convenience, healthier options, and diverse culinary experiences. Regulatory frameworks, while evolving, are generally supportive of food safety and quality standards, influencing product development and market entry strategies. The threat of product substitutes, such as fresh and chilled alternatives, exists but is being offset by the superior shelf-life and convenience offered by frozen products. End-user trends are leaning towards value-added frozen meals, plant-based options, and ready-to-cook items. Mergers and acquisitions (M&A) activities, while not at peak levels, are anticipated to increase as larger players seek to expand their product portfolios and market reach. The market is observing approximately XX M&A deals annually, indicating strategic consolidation. Key market players are actively pursuing strategies to enhance their market share and competitive positioning.

South America Frozen Food Market Industry Trends & Analysis

The South America frozen food market is experiencing robust growth, propelled by a confluence of factors including rising disposable incomes, urbanization, and a growing demand for convenient food solutions. The CAGR for this market is projected to be XX% over the forecast period (2025-2033), reflecting its strong upward trajectory. Technological disruptions, particularly in freezing techniques and packaging, are enhancing product quality, extending shelf life, and improving nutritional value, thereby increasing market penetration. Consumer preferences are shifting towards healthier frozen options, including fruits, vegetables, and lean proteins, as well as an increasing interest in plant-based and allergen-free frozen foods. The competitive dynamics are intensifying, with both international giants and local producers vying for market dominance. The historical period (2019-2024) has seen steady growth, with the base year (2025) marking a pivotal point for accelerated expansion. The market penetration of frozen foods is estimated at XX% in the base year, with significant room for further growth.

Leading Markets & Segments in South America Frozen Food Market

Brazil stands as the leading market within the South America frozen food sector, driven by its large population, robust economy, and increasing consumer adoption of frozen food products. The Frozen Poultry and Seafood segment is a dominant force, catering to the region's strong demand for protein. The Supermarkets/Hypermarkets distribution channel accounts for the largest share, owing to their extensive reach and diverse product offerings.

- Dominant Segments & Drivers:

- Frozen Fruits and Vegetables: Growing health consciousness and demand for convenient, year-round availability of produce are key drivers. Economic policies supporting agricultural exports and investment in cold chain infrastructure are crucial.

- Frozen Poultry and Seafood: High protein content, affordability, and versatility in cooking make these segments highly popular. Government initiatives promoting local poultry and seafood production and export further bolster this segment.

- Frozen Prepared Food: The increasing urbanization and busier lifestyles of consumers are fueling the demand for ready-to-eat and ready-to-cook frozen meals. Investment in advanced processing technologies and efficient supply chains are critical for sustained growth.

- Frozen Dessert: The indulgence factor and accessibility of frozen desserts contribute to their steady demand. Innovation in flavors and healthier formulations are key to capturing market share.

- Frozen Snack: The convenience and impulse purchase nature of frozen snacks make them a significant contributor to market growth, especially among younger demographics.

- Supermarkets/Hypermarkets: Widespread availability, competitive pricing, and a broad product assortment make these channels the primary point of sale. Infrastructure development supporting retail expansion is a key enabler.

- Online Retailer: The burgeoning e-commerce landscape in South America is opening new avenues for frozen food sales, offering convenience and wider selection. Investment in last-mile delivery and cold chain logistics is crucial.

South America Frozen Food Market Product Developments

Product innovation in the South America frozen food market is increasingly focused on health and convenience. Manufacturers are launching a wider array of plant-based frozen alternatives, gluten-free options, and ready-to-heat meals fortified with essential nutrients. Technological advancements in flash freezing and smart packaging are extending shelf life and preserving nutritional integrity, offering consumers higher quality and safer products. These developments cater to evolving consumer preferences for healthier eating habits and time-saving meal solutions, creating a competitive advantage for companies that can effectively integrate these innovations into their offerings.

Key Drivers of South America Frozen Food Market Growth

The South America frozen food market is being propelled by several key growth drivers.

- Urbanization and Changing Lifestyles: A growing urban population with busy schedules seeks convenient and time-saving food options, making frozen foods an attractive choice.

- Rising Disposable Incomes: As economies in South America strengthen, consumers have more discretionary income to spend on a wider variety of food products, including premium frozen items.

- Health and Wellness Trends: An increasing awareness of health and nutrition is driving demand for frozen fruits, vegetables, and lean protein options, as well as plant-based alternatives.

- Technological Advancements: Innovations in freezing, packaging, and logistics are improving product quality, extending shelf life, and enhancing accessibility.

- Expanding Retail Infrastructure: The growth of modern retail formats like supermarkets and hypermarkets, alongside the rise of online grocery platforms, is increasing the availability and accessibility of frozen foods.

Challenges in the South America Frozen Food Market Market

Despite its growth potential, the South America frozen food market faces several challenges.

- Cold Chain Infrastructure Limitations: Inadequate and inconsistent cold chain logistics, particularly in remote or less developed areas, can lead to product spoilage and impact consumer trust.

- Price Sensitivity: A significant portion of the South American population remains price-sensitive, which can limit the adoption of premium or value-added frozen products.

- Consumer Perceptions: Historical perceptions of frozen foods as being less fresh or nutritious than their fresh counterparts can still be a barrier to widespread adoption in some segments.

- Regulatory Hurdles: Navigating diverse and evolving food safety regulations across different countries within South America can be complex and costly for manufacturers.

- Supply Chain Disruptions: Geopolitical factors, natural disasters, and economic volatility can disrupt raw material sourcing and transportation, impacting production and availability.

Emerging Opportunities in South America Frozen Food Market

Several emerging opportunities present significant catalysts for long-term growth in the South America frozen food market.

- Plant-Based and Alternative Proteins: The rising global trend of plant-based diets is creating a substantial opportunity for innovation in frozen vegan and vegetarian products tailored to local palates.

- Value-Added and Gourmet Frozen Foods: As consumers seek more sophisticated and convenient meal solutions, there is a growing demand for ready-to-eat gourmet meals, ethnic cuisines, and artisanal frozen desserts.

- E-commerce Expansion: The continued growth of online retail platforms and dedicated grocery delivery services presents a vast opportunity to reach a wider customer base and offer greater convenience.

- Strategic Partnerships and Collaborations: Collaborating with local producers, distributors, and technology providers can help companies overcome logistical challenges and tap into regional market nuances.

- Focus on Sustainability: Consumers are increasingly demanding sustainable sourcing and packaging. Companies that prioritize eco-friendly practices can gain a competitive edge.

Leading Players in the South America Frozen Food Market Sector

- General Mills Inc

- Tyson Foods Inc

- Unilever PLC

- The Kraft Heinz Company

- McCain Foods Limited

- BRF SA

- JBS SA

- D'Aucy Frozen Foods

- Conagra Foods Inc

- Dr Oetker

- Nestlé S A

Key Milestones in South America Frozen Food Market Industry

- November 2022: Nestlé SA announced plans to establish a new Research & Development (R&D) Center in the Latin American region to innovate its products, including the frozen food range, to increase its consumer base in the region while leveraging the company's global science and technological capabilities.

- September 2022: Lamb Weston Holdings announced its plans to expand the French fries processing capacity in Argentina with the construction of a new manufacturing plant in Mar del Plata, Buenos Aires. The newly constructed french fry processing facility is anticipated to produce approximately 200 million pounds of frozen French fries and other potato products annually for the Latin American market.

- June 2021: Brazi Bites, a pioneer of delicious Latin-inspired, naturally gluten-free foods, launched Pizza'nadas, an extension of the brand's popular Empanadas line of frozen pizza.

Strategic Outlook for South America Frozen Food Market Market

The strategic outlook for the South America frozen food market is highly optimistic, driven by strong demographic trends, evolving consumer preferences, and ongoing technological advancements. Key growth accelerators include expanding the product portfolio to include more plant-based and healthy options, investing in robust cold chain infrastructure to ensure product quality and reach, and leveraging the expanding e-commerce landscape for wider distribution. Companies that can effectively cater to the growing demand for convenience while addressing health and sustainability concerns are poised for significant success. Strategic partnerships and localized product development will be crucial for navigating diverse market dynamics and capitalizing on the vast untapped potential within the region.

South America Frozen Food Market Segmentation

-

1. Product Type

- 1.1. Frozen Fruits and Vegetables

- 1.2. Frozen Poultry and Seafood

- 1.3. Frozen Prepared Food

- 1.4. Frozen Dessert

- 1.5. Frozen Snack

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Grocery/Convinience Stores

- 2.3. Online Retailer

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Frozen Food Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Frozen Food Market Regional Market Share

Geographic Coverage of South America Frozen Food Market

South America Frozen Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus On Health and Wellness; Surge in Product Innovation

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes

- 3.4. Market Trends

- 3.4.1. Increase in Consumer Expenditure on Convenience Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Fruits and Vegetables

- 5.1.2. Frozen Poultry and Seafood

- 5.1.3. Frozen Prepared Food

- 5.1.4. Frozen Dessert

- 5.1.5. Frozen Snack

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Grocery/Convinience Stores

- 5.2.3. Online Retailer

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Frozen Fruits and Vegetables

- 6.1.2. Frozen Poultry and Seafood

- 6.1.3. Frozen Prepared Food

- 6.1.4. Frozen Dessert

- 6.1.5. Frozen Snack

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Grocery/Convinience Stores

- 6.2.3. Online Retailer

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Frozen Fruits and Vegetables

- 7.1.2. Frozen Poultry and Seafood

- 7.1.3. Frozen Prepared Food

- 7.1.4. Frozen Dessert

- 7.1.5. Frozen Snack

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Grocery/Convinience Stores

- 7.2.3. Online Retailer

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Frozen Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Frozen Fruits and Vegetables

- 8.1.2. Frozen Poultry and Seafood

- 8.1.3. Frozen Prepared Food

- 8.1.4. Frozen Dessert

- 8.1.5. Frozen Snack

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Grocery/Convinience Stores

- 8.2.3. Online Retailer

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 General Mills Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Tyson Foods Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Unilever PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 The Kraft Heinz Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 McCain Foods Limited

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BRF SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 JBS SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 D'Aucy Frozen Foods*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Conagra Foods Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Dr Oetker

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Nestlé S A

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 General Mills Inc

List of Figures

- Figure 1: South America Frozen Food Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Frozen Food Market Share (%) by Company 2025

List of Tables

- Table 1: South America Frozen Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Frozen Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Frozen Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Frozen Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Frozen Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: South America Frozen Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Frozen Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Frozen Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Frozen Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Frozen Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Frozen Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Frozen Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Frozen Food Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: South America Frozen Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Frozen Food Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Frozen Food Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Frozen Food Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the South America Frozen Food Market?

Key companies in the market include General Mills Inc, Tyson Foods Inc, Unilever PLC, The Kraft Heinz Company, McCain Foods Limited, BRF SA, JBS SA, D'Aucy Frozen Foods*List Not Exhaustive, Conagra Foods Inc, Dr Oetker, Nestlé S A.

3. What are the main segments of the South America Frozen Food Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 309.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus On Health and Wellness; Surge in Product Innovation.

6. What are the notable trends driving market growth?

Increase in Consumer Expenditure on Convenience Food Products.

7. Are there any restraints impacting market growth?

Presence of Substitutes.

8. Can you provide examples of recent developments in the market?

November 2022: Nestlé SA announced plans to establish a new Research & Development (R&D) Center in the Latin American region to innovate its products, including the frozen food range, to increase its consumer base in the region while leveraging the company's global science and technological capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Frozen Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Frozen Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Frozen Food Market?

To stay informed about further developments, trends, and reports in the South America Frozen Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence