Key Insights

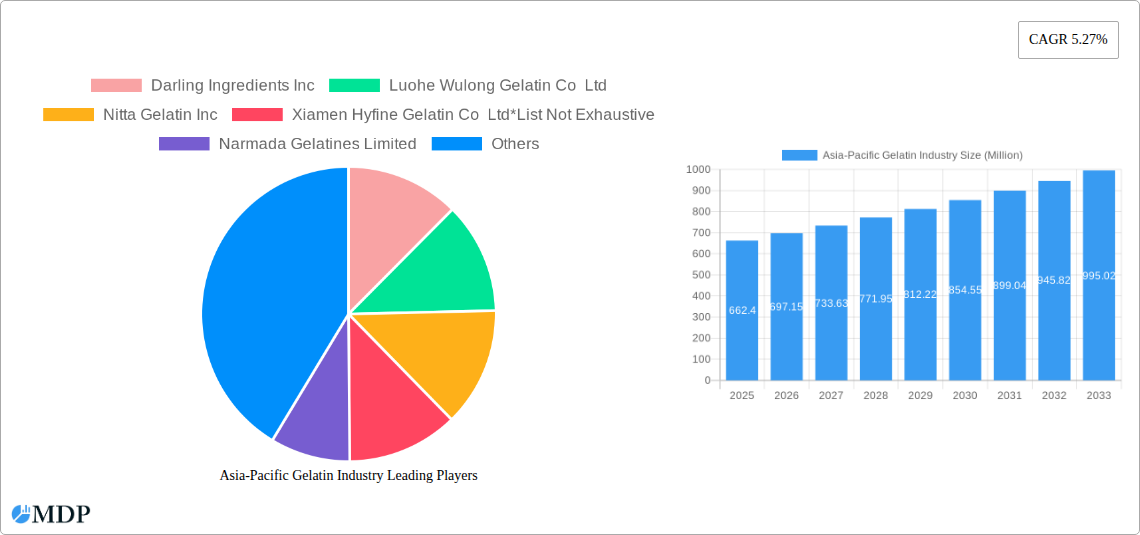

The Asia-Pacific Gelatin Industry is poised for robust growth, with a current market size estimated at $662.4 million and a projected Compound Annual Growth Rate (CAGR) of 5.27% through 2033. This expansion is primarily fueled by the increasing demand for gelatin in the food and beverage sector, particularly in bakery, confectionery, and dairy products, where its gelling, stabilizing, and emulsifying properties are highly valued. The personal care and cosmetics industry also presents a significant driver, as gelatin's moisturizing and film-forming qualities are incorporated into skincare and haircare formulations. Emerging economies within the Asia-Pacific region, such as China and India, are witnessing a surge in disposable income and a growing consumer preference for processed foods and premium personal care products, directly contributing to gelatin consumption.

Asia-Pacific Gelatin Industry Market Size (In Million)

While animal-based gelatin continues to dominate the market due to its widespread availability and cost-effectiveness, marine-based gelatin is gaining traction, driven by growing consumer awareness regarding food safety and a demand for alternative protein sources. The industry faces certain restraints, including fluctuating raw material prices and potential ethical concerns associated with animal sourcing. However, continuous innovation in processing technologies and the exploration of new applications are expected to mitigate these challenges. The study period from 2019 to 2033, with a base year of 2025, indicates a stable and upward trajectory for the Asia-Pacific gelatin market, underscoring its importance as a key ingredient across diverse consumer industries.

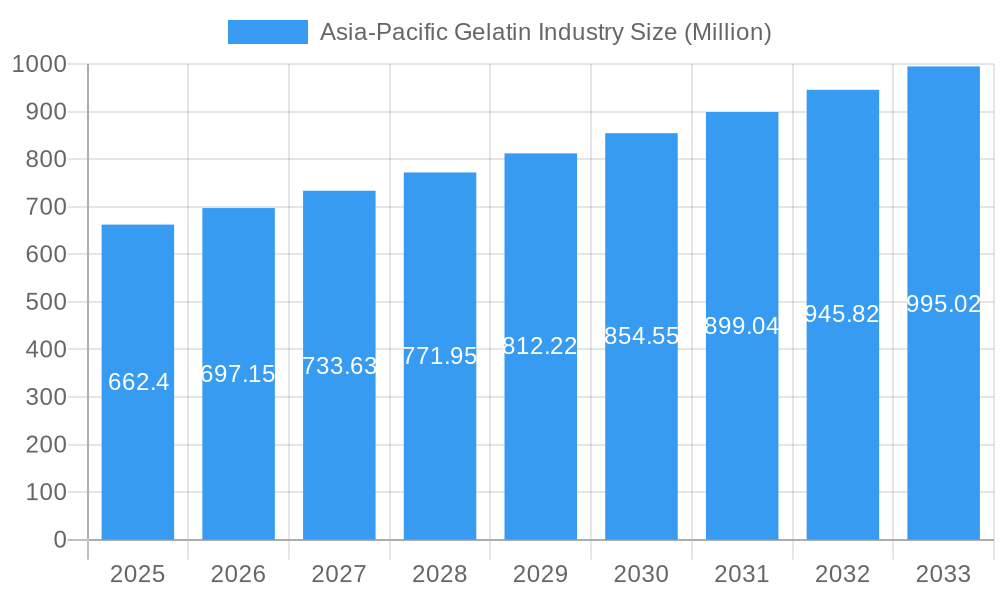

Asia-Pacific Gelatin Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Asia-Pacific Gelatin Industry, covering market dynamics, trends, leading segments, product developments, growth drivers, challenges, opportunities, and key players. The study encompasses the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, building upon historical data from 2019-2024. Gain actionable insights into the Asia-Pacific gelatin market size, gelatin market share Asia, animal-based gelatin market, marine-based gelatin, food and beverage gelatin applications, personal care gelatin usage, and gelatin market forecast Asia Pacific. Discover market-penetrating strategies and understand the competitive landscape shaped by major industry players.

Asia-Pacific Gelatin Industry Market Dynamics & Concentration

The Asia-Pacific gelatin industry exhibits a moderate market concentration, with several key players vying for dominance. Innovation in food-grade gelatin, pharmaceutical-grade gelatin, and specialty gelatin is a primary driver, fueled by increasing R&D investments by leading companies. Regulatory frameworks surrounding food safety and pharmaceutical standards significantly influence market entry and product development, with stringent compliance required for exporting and domestic sales. Product substitutes, such as pectin, agar-agar, and carrageenan, pose a competitive challenge, particularly in vegan and vegetarian product formulations. End-user trends are shifting towards higher demand for clean-label ingredients, sustainable sourcing, and specialized gelatin functionalities in confectionery, bakery, dairy, and nutraceuticals. Mergers and acquisition (M&A) activities, though not at an extremely high volume, are strategic moves to gain market share, acquire new technologies, and expand geographical reach. For instance, there have been 2 M&A deals recorded within the last three years as companies aim to consolidate their positions. Market share is fragmented, with China holding the largest share, estimated at 35%, followed by India at 20%.

Asia-Pacific Gelatin Industry Industry Trends & Analysis

The Asia-Pacific gelatin industry is experiencing robust growth, projected to reach an estimated market size of $X.XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025-2033. Key market growth drivers include the burgeoning food and beverage sector, particularly the confectionery and bakery segments, where gelatin's gelling, stabilizing, and emulsifying properties are indispensable. The increasing consumer preference for convenient and ready-to-eat (RTE/RTC) food products further amplifies demand. Technological disruptions are evident in the development of specialized gelatin types, such as highly purified pharmaceutical-grade gelatin for capsule manufacturing and advanced marine-based gelatin as a sustainable alternative. Consumer preferences are increasingly leaning towards health and wellness, driving demand for gelatin-rich products and supplements. Competitive dynamics are characterized by intense price competition, a focus on product quality, and strategic partnerships between ingredient suppliers and food manufacturers. Market penetration in the personal care and cosmetics segment is also on the rise, with gelatin being incorporated into skincare and haircare formulations for its moisturizing and film-forming properties. The animal-based gelatin segment continues to dominate, accounting for an estimated 85% market share, though the marine-based gelatin segment is showing promising growth.

Leading Markets & Segments in Asia-Pacific Gelatin Industry

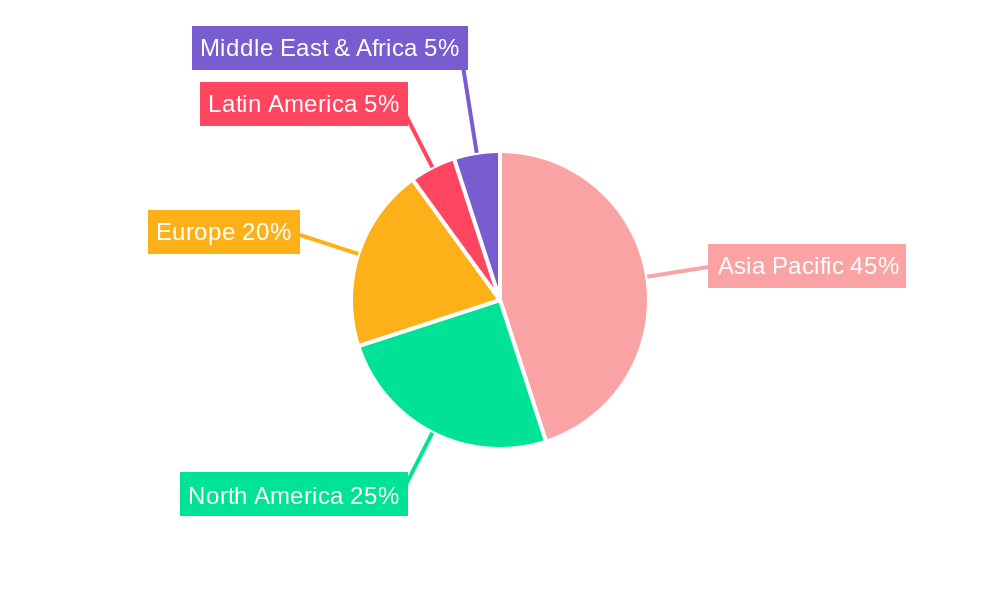

The Asia Pacific region stands as the dominant market for gelatin, driven by its large and growing population, expanding middle class, and rapidly industrializing economies. Within this region, China is the leading market, estimated to contribute 40% of the total regional revenue, owing to its significant manufacturing capabilities and vast domestic consumption of food and pharmaceutical products. India follows closely as the second-largest market, with an estimated 25% share, propelled by its strong food and beverage industry and a growing pharmaceutical sector.

- Dominant Segment by Form: Animal Based Gelatin holds a commanding position, estimated at 90% market share. This dominance is attributed to its widespread availability, established production processes, and cost-effectiveness. The primary sources include bovine and porcine raw materials.

- Dominant Segment by End-User: The Food and Beverage segment is the largest consumer of gelatin, accounting for approximately 70% of the market. Within this segment:

- Confectionery: This sub-segment is a major driver, utilizing gelatin extensively in gummies, marshmallows, and jellies.

- Bakery: Gelatin serves as a stabilizer and emulsifier in various baked goods.

- Dairy and Dairy Alternative Products: It's used in yogurts, mousses, and ice creams for texture and stability.

- Beverages: Gelatin finds application in clarifying beverages like wine and beer.

- Condiments/Sauces & Snacks: These segments are also significant contributors.

- RTE/RTC Food Products: The growing demand for convenience foods fuels gelatin consumption.

- Emerging Segment: The Personal Care and Cosmetics segment is witnessing steady growth, estimated at 15% market share, driven by the incorporation of gelatin in anti-aging creams, hair masks, and other beauty products for its moisturizing and film-forming properties.

- Geographical Dominance:

- China: Leads in production and consumption, with substantial demand from its food processing and pharmaceutical industries. Economic policies supporting manufacturing and a large consumer base are key drivers.

- India: Rapidly growing due to its expanding food industry, increasing disposable incomes, and a robust pharmaceutical manufacturing base. Government initiatives promoting food processing further bolster its position.

- Australia: A mature market with a strong focus on high-quality food products and a growing demand for specialized gelatin applications.

- Japan: Known for its stringent quality standards and innovation in functional foods and pharmaceutical applications.

Asia-Pacific Gelatin Industry Product Developments

Product innovation in the Asia-Pacific gelatin industry is characterized by a focus on enhanced functionality, sustainability, and specialized applications. Recent developments include advanced texturizing gelatin solutions for the food service industry, offering improved flavor, mouthfeel, and stability, such as TEXTURA Tempo Ready. The introduction of highly purified, pharmaceutical-grade gelatin, like X-Pure® GelDAT, caters to the stringent requirements of the healthcare sector, enabling new applications in drug delivery and medical devices. Furthermore, the development of gelatin derived from alternative sources and sustainable manufacturing processes is gaining traction, appealing to environmentally conscious consumers and manufacturers. These innovations aim to meet evolving consumer preferences for clean labels, enhanced nutritional profiles, and ethically sourced ingredients, while also expanding the use of gelatin in novel applications across food, pharmaceuticals, and cosmetics.

Key Drivers of Asia-Pacific Gelatin Industry Growth

Several key factors are propelling the growth of the Asia-Pacific gelatin industry. The expanding food and beverage sector, particularly the confectionery and bakery industries, continues to be a primary driver, fueled by rising disposable incomes and changing dietary habits. Technological advancements leading to specialized gelatin variants for pharmaceutical and nutraceutical applications are creating new market avenues. Increased consumer awareness regarding the health benefits of gelatin, such as its role in joint health and skin elasticity, is driving demand for collagen peptides and gelatin-rich supplements. Furthermore, the growing demand for clean-label products and the ongoing shift towards sustainable sourcing are encouraging manufacturers to innovate and adopt more eco-friendly production methods.

Challenges in the Asia-Pacific Gelatin Industry Market

The Asia-Pacific gelatin industry faces several challenges that could impede its growth trajectory. Stringent regulatory frameworks and evolving food safety standards across different countries can create compliance complexities and increase operational costs for manufacturers. Fluctuations in the availability and price of raw materials, primarily animal by-products, can impact production costs and supply chain stability. The increasing demand for vegan and vegetarian alternatives to gelatin, driven by ethical and environmental concerns, presents a significant competitive threat. Moreover, intense price competition among market players, especially for standard gelatin grades, can exert pressure on profit margins. Supply chain disruptions due to geopolitical factors or unforeseen events can also pose a risk to consistent product delivery.

Emerging Opportunities in Asia-Pacific Gelatin Industry

The Asia-Pacific gelatin industry is poised for significant expansion driven by several emerging opportunities. The growing global demand for nutraceuticals and dietary supplements presents a substantial avenue for growth, with gelatin's role in collagen production being a key selling point. Advancements in marine-based gelatin offer a sustainable and alternative source, appealing to a wider consumer base concerned about animal welfare and environmental impact. The pharmaceutical sector continues to be a lucrative market, with increasing applications in drug encapsulation, medical device coatings, and wound healing. Furthermore, strategic partnerships and collaborations between gelatin manufacturers and end-user industries, such as food and beverage companies and cosmetic brands, can foster innovation and unlock new market potential. The expanding middle class in emerging economies within the region also represents a significant opportunity for increased consumption of gelatin-containing products.

Leading Players in the Asia-Pacific Gelatin Industry Sector

- Darling Ingredients Inc.

- Luohe Wulong Gelatin Co Ltd

- Nitta Gelatin Inc.

- Xiamen Hyfine Gelatin Co Ltd

- Narmada Gelatines Limited

- Asahi Gelatine Industrial Co Ltd

- GELITA AG

- Foodchem International Corporation

- Jellice Group

- India Gelatine & Chemicals Ltd

- Italgelatine SpA

Key Milestones in Asia-Pacific Gelatin Industry Industry

- November 2022: PB Leiner, a subsidiary of Tessenderlo Group, unveiled TEXTURA Tempo Ready, a new texturizing gelatin solution for the food service industry.

- May 2021: Darling Ingredients Inc. expanded its Rousselot brand portfolio with the launch of X-Pure® GelDAT, a purified, pharmaceutical-grade, and modified gelatin.

- January 2021: Nitta Gelatin India entered the HoReCa market with a superior-grade gelatin produced using advanced Japanese technology and adhering to stringent GMP and HACCP standards.

Strategic Outlook for Asia-Pacific Gelatin Industry Market

The strategic outlook for the Asia-Pacific gelatin industry is highly positive, driven by sustained demand from diverse end-user segments and ongoing innovation. Key growth accelerators include the expansion of the pharmaceutical and nutraceutical industries, the increasing consumer preference for clean-label and functional food products, and the growing adoption of sustainable and marine-based gelatin alternatives. Companies that focus on product differentiation, such as developing specialized gelatin for specific applications (e.g., high-bloom gelatin for confectionery, highly purified gelatin for pharmaceuticals) and investing in R&D for novel applications in the cosmetics and healthcare sectors, are well-positioned for future success. Strategic expansions, M&A activities to consolidate market share, and a strong emphasis on supply chain resilience will be crucial for navigating competitive dynamics and capitalizing on emerging opportunities in this dynamic market.

Asia-Pacific Gelatin Industry Segmentation

-

1. Form

- 1.1. Animal Based

- 1.2. Marine Based

-

2. End -ser

- 2.1. Personal Care and Cosmetics

-

2.2. Food and Beverage

- 2.2.1. Bakery

- 2.2.2. Confectionery

- 2.2.3. Condiments/Sauces

- 2.2.4. Beverages

- 2.2.5. Dairy and Dairy Alternative Products

- 2.2.6. Snacks

- 2.2.7. RTE/RTC Food Products

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Australia

- 3.1.4. Japan

- 3.1.5. Rest of Asia Pacific

-

3.1. Asia Pacific

Asia-Pacific Gelatin Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Australia

- 1.4. Japan

- 1.5. Rest of Asia Pacific

Asia-Pacific Gelatin Industry Regional Market Share

Geographic Coverage of Asia-Pacific Gelatin Industry

Asia-Pacific Gelatin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Low-Fat and Fat-Free Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Gelatin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Animal Based

- 5.1.2. Marine Based

- 5.2. Market Analysis, Insights and Forecast - by End -ser

- 5.2.1. Personal Care and Cosmetics

- 5.2.2. Food and Beverage

- 5.2.2.1. Bakery

- 5.2.2.2. Confectionery

- 5.2.2.3. Condiments/Sauces

- 5.2.2.4. Beverages

- 5.2.2.5. Dairy and Dairy Alternative Products

- 5.2.2.6. Snacks

- 5.2.2.7. RTE/RTC Food Products

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Australia

- 5.3.1.4. Japan

- 5.3.1.5. Rest of Asia Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luohe Wulong Gelatin Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nitta Gelatin Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xiamen Hyfine Gelatin Co Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Narmada Gelatines Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Asahi Gelatine Industrial Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GELITA AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Foodchem International Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jellice Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 India Gelatine & Chemicals Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Italgelatine SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: Asia-Pacific Gelatin Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Gelatin Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Gelatin Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by Form 2020 & 2033

- Table 3: Asia-Pacific Gelatin Industry Revenue Million Forecast, by End -ser 2020 & 2033

- Table 4: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by End -ser 2020 & 2033

- Table 5: Asia-Pacific Gelatin Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Gelatin Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Gelatin Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 10: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by Form 2020 & 2033

- Table 11: Asia-Pacific Gelatin Industry Revenue Million Forecast, by End -ser 2020 & 2033

- Table 12: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by End -ser 2020 & 2033

- Table 13: Asia-Pacific Gelatin Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Gelatin Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Gelatin Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Gelatin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Gelatin Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Gelatin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Gelatin Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Gelatin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Gelatin Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Japan Asia-Pacific Gelatin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Asia-Pacific Gelatin Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Asia-Pacific Gelatin Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Asia-Pacific Gelatin Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Gelatin Industry?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the Asia-Pacific Gelatin Industry?

Key companies in the market include Darling Ingredients Inc, Luohe Wulong Gelatin Co Ltd, Nitta Gelatin Inc, Xiamen Hyfine Gelatin Co Ltd*List Not Exhaustive, Narmada Gelatines Limited, Asahi Gelatine Industrial Co Ltd, GELITA AG, Foodchem International Corporation, Jellice Group, India Gelatine & Chemicals Ltd, Italgelatine SpA.

3. What are the main segments of the Asia-Pacific Gelatin Industry?

The market segments include Form, End -ser, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 662.4 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

Increasing Demand for Low-Fat and Fat-Free Food Products.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

November 2022: PB Leiner, a subsidiary of Tessenderlo Group, made a significant stride in the food service industry by unveiling TEXTURA Tempo Ready-a cutting-edge texturizing gelatin solution. This innovative product comes conveniently packaged in small pouches and is exclusively distributed to culinary professionals through carefully selected wholesalers. TEXTURA Tempo Ready promises to elevate gastronomic experiences with its remarkable attributes, including intense flavor, exquisite mouthfeel, and exceptional stability over time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Gelatin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Gelatin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Gelatin Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Gelatin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence