Key Insights

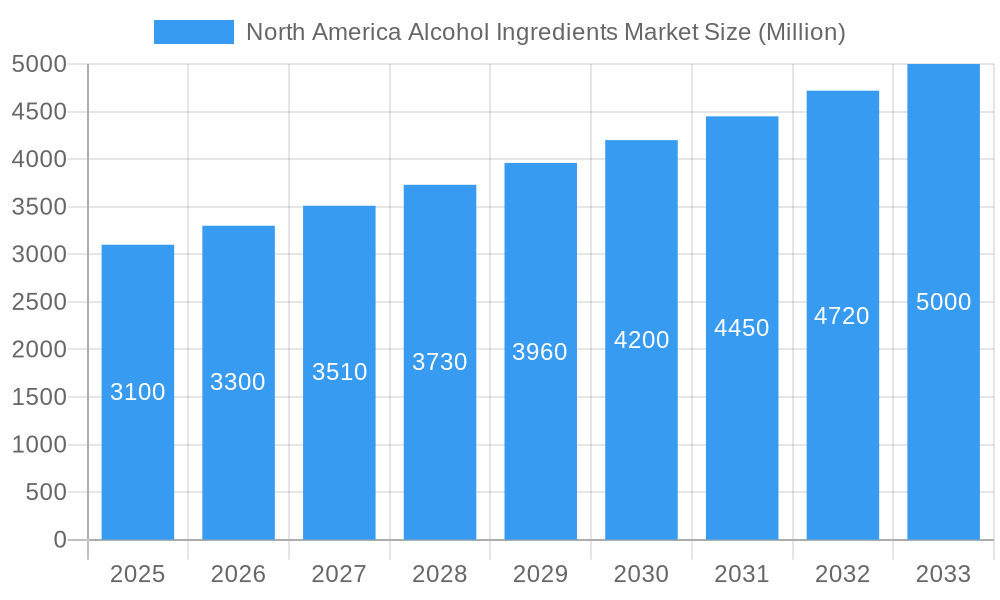

The North American alcohol ingredients market is poised for significant expansion, projected to reach USD 3.1 billion in 2025 and grow at a robust CAGR of 6.5% through 2033. This growth is fueled by a confluence of dynamic consumer preferences and evolving production methodologies within the beverage alcohol sector. A key driver is the escalating demand for premium and artisanal beverages, particularly in segments like craft beers and specialty spirits, which rely heavily on high-quality yeast, sophisticated flavorings, and unique colorants to differentiate themselves. Furthermore, advancements in enzyme technology are enhancing fermentation efficiency and flavor profiles, making them indispensable for producers aiming for consistency and innovation. The increasing consumer focus on natural and clean-label ingredients is also steering the market towards naturally derived colorants and flavors, presenting a substantial opportunity for ingredient suppliers.

North America Alcohol Ingredients Market Market Size (In Billion)

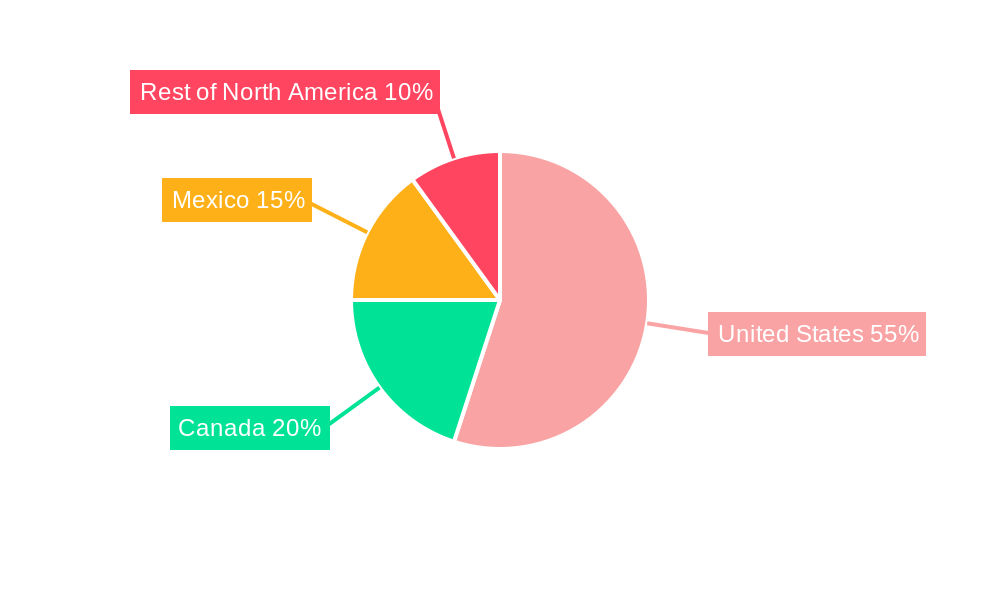

The market's trajectory is further shaped by prevailing trends such as the rise of low- and no-alcohol (LNA) beverages, which, while seemingly counterintuitive, still require sophisticated flavoring and coloring agents to replicate the sensory experience of traditional alcoholic drinks. This necessitates innovation in non-alcoholic ingredient solutions. Conversely, challenges such as stringent regulatory landscapes surrounding food additives and the volatility of raw material prices can pose restraints. Despite these hurdles, the market's segmentation by ingredient type, including yeast, enzymes, colorants, and flavors & salts, highlights diverse avenues for growth. Geographically, the United States dominates the market, followed by Canada and Mexico, with the "Rest of North America" also contributing to the overall expansion as regional beverage industries mature. Leading companies like ADM, Sensient Technologies Corporation, Cargill, and DSM are actively investing in research and development to capitalize on these emerging opportunities and maintain a competitive edge.

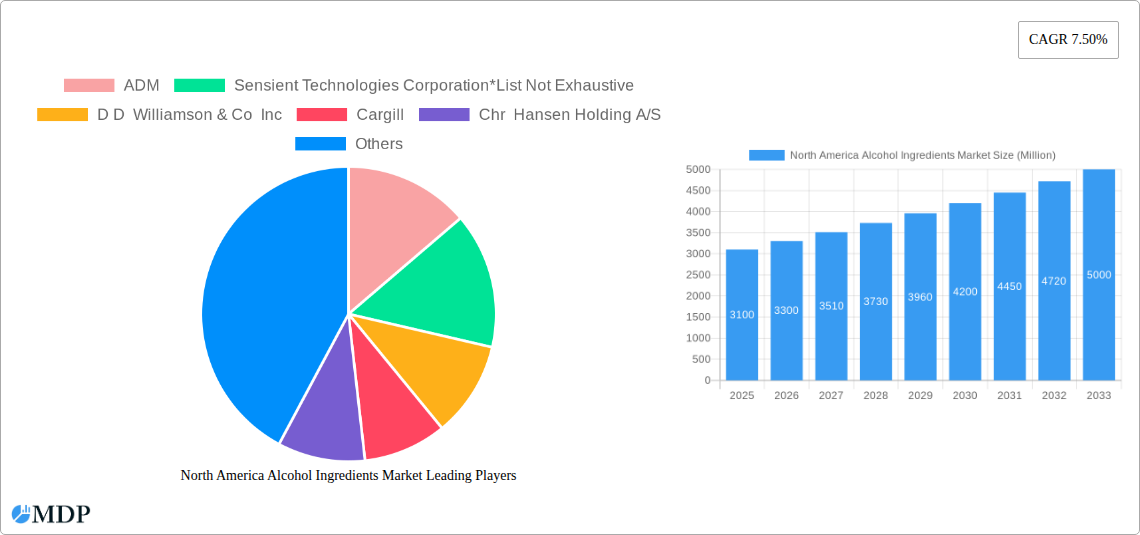

North America Alcohol Ingredients Market Company Market Share

Dive deep into the dynamic North America Alcohol Ingredients Market with this comprehensive report, offering actionable insights and data-driven analysis from 2019–2033. With the base year set at 2025 and a detailed forecast period of 2025–2033, this study provides an unparalleled view of market trends, key players, and growth opportunities. Discover the critical ingredients shaping the future of the beverage industry, including Yeast, Enzymes, Colorants, Flavors & Salts, essential for Beer, Spirits, and Wine production across the United States, Canada, and Mexico.

North America Alcohol Ingredients Market Market Dynamics & Concentration

The North America Alcohol Ingredients Market is characterized by moderate to high concentration, with a few major players holding significant market share. Key innovation drivers include the demand for natural and clean-label ingredients, advancements in fermentation technology, and the growing popularity of low- and no-alcohol beverage options. Regulatory frameworks, particularly those pertaining to food safety and labeling standards across the United States, Canada, and Mexico, play a crucial role in shaping market access and product development. Product substitutes, while present, often struggle to replicate the specific functionalities and sensory profiles offered by traditional alcohol ingredients. End-user trends are heavily influenced by evolving consumer preferences for premiumization, craft beverages, and functional alcoholic drinks. Merger and acquisition (M&A) activities have been moderate, driven by the desire for vertical integration and portfolio expansion. For instance, over the study period (2019-2033), an estimated 15-20 M&A deals are projected, with an average deal value in the hundreds of millions. Major companies like ADM and Cargill are actively involved in strategic acquisitions to bolster their ingredient offerings and market reach.

North America Alcohol Ingredients Market Industry Trends & Analysis

The North America Alcohol Ingredients Market is poised for robust growth, driven by a confluence of factors that are reshaping the beverage landscape. The increasing consumer preference for premium and craft beverages, particularly in the spirits and wine segments, directly fuels demand for high-quality and specialized ingredients. Technological advancements in enzyme technology are enabling more efficient fermentation processes and the development of novel flavor profiles, contributing to a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025-2033). Market penetration of natural colorants and flavors is steadily increasing as consumers become more health-conscious and seek transparency in ingredient sourcing. The expansion of the craft beer movement across the United States and Canada, alongside the growing popularity of artisanal spirits, creates significant opportunities for ingredient suppliers offering unique and authentic solutions. Furthermore, the increasing adoption of sustainable ingredient sourcing and production methods is becoming a critical competitive differentiator. For example, the demand for organic yeast strains has seen a notable increase. The competitive dynamics are intensifying, with established players investing heavily in research and development to innovate and maintain market leadership. The overall market size is expected to reach over $30 billion by 2033, demonstrating substantial expansion.

Leading Markets & Segments in North America Alcohol Ingredients Market

The United States stands as the dominant market within the North America Alcohol Ingredients sector, driven by its large consumer base, sophisticated beverage industry, and high disposable income. Within the United States, the Spirits segment exhibits the most significant growth potential, fueled by the burgeoning craft spirits movement and a strong consumer appetite for premium and experimental products. Flavors & Salts are particularly crucial in this segment, contributing to the diverse and complex taste profiles consumers seek. Yeast, a foundational ingredient, sees consistent demand across all beverage types, with specialized strains gaining traction for specific fermentation characteristics.

- Dominant Geography: United States

- Key Drivers: High consumer spending power, extensive craft beverage scene, supportive regulatory environment for product innovation.

- Market Size Contribution: Estimated to account for over 65% of the total North American market by 2033.

- Leading Beverage Type: Spirits

- Key Drivers: Growing consumer interest in premiumization, diverse product offerings (whiskey, gin, vodka, rum), innovation in aging and flavor infusion.

- Market Size Contribution: Projected to capture over 40% of the alcohol ingredients market by 2033.

- Key Ingredient Type: Flavors & Salts

- Key Drivers: Essential for creating unique taste profiles, demand for natural and exotic flavorings, customization for craft beverages.

- Market Penetration: Widely used across all beverage categories, with specialized flavor blends seeing accelerated adoption.

- Other Significant Segments:

- Beer: Continues to be a massive market, with demand for specialized yeast strains and natural colorants for craft brewing.

- Wine: Stable demand for yeast and enzymes, with a growing interest in natural clarification agents and flavor enhancers.

- Canada & Mexico: Significant contributing markets, with Canada showing strong growth in craft beer and Spirits, and Mexico's burgeoning spirits industry offering substantial opportunities. Rest of North America, encompassing smaller markets, is also showing incremental growth.

North America Alcohol Ingredients Market Product Developments

Product innovation in the North America Alcohol Ingredients Market is characterized by a focus on natural sourcing, enhanced functionality, and tailored solutions. Companies are investing in R&D to develop novel yeast strains that yield specific flavor profiles and improve fermentation efficiency. The demand for natural colorants derived from fruits, vegetables, and other botanical sources is driving innovation in extraction and stabilization technologies. Furthermore, the development of enzyme blends designed for specific beverage types, such as those optimizing mouthfeel in spirits or aiding clarification in wines, is gaining traction. These advancements are not only meeting evolving consumer preferences but also providing manufacturers with competitive advantages through improved product quality and cost-effectiveness.

Key Drivers of North America Alcohol Ingredients Market Growth

The North America Alcohol Ingredients Market is experiencing significant growth, propelled by several key factors. Firstly, the persistent and evolving consumer demand for premium and craft alcoholic beverages, especially in the spirits and beer segments, necessitates a diverse range of high-quality ingredients. Secondly, ongoing technological advancements in enzyme and fermentation technologies are enhancing efficiency and enabling the creation of novel flavor and aroma profiles. Thirdly, a growing emphasis on natural and clean-label ingredients, driven by health-conscious consumers, is spurring innovation in ingredient sourcing and processing. Finally, favorable economic conditions and increasing disposable incomes in key North American markets contribute to higher spending on alcoholic beverages, thereby boosting ingredient demand.

Challenges in the North America Alcohol Ingredients Market Market

Despite the positive growth trajectory, the North America Alcohol Ingredients Market faces several challenges. Stringent and evolving regulatory frameworks concerning food additives, labeling, and origin claims across different North American countries can create compliance hurdles and impact market entry. Supply chain disruptions, exacerbated by global events, can lead to price volatility and availability issues for certain raw materials. Intense competition among established players and emerging suppliers puts pressure on profit margins. Furthermore, the increasing consumer scrutiny of ingredient lists and a preference for minimal processing can pose challenges for ingredients perceived as artificial or highly processed, requiring manufacturers to focus on transparency and natural alternatives.

Emerging Opportunities in North America Alcohol Ingredients Market

Several emerging opportunities are poised to shape the future of the North America Alcohol Ingredients Market. The rapid growth of the low- and no-alcohol beverage sector presents a significant avenue for ingredient innovation, requiring new flavor compounds and fermentation solutions that mimic the sensory experience of traditional alcoholic drinks. Strategic partnerships between ingredient suppliers and beverage manufacturers for co-development of unique products can unlock new market segments. The increasing demand for sustainable and ethically sourced ingredients is creating opportunities for companies that can demonstrate robust environmental and social responsibility throughout their supply chains. Furthermore, the expansion of the ready-to-drink (RTD) cocktail market is driving demand for convenient and high-quality flavorings and functional ingredients.

Leading Players in the North America Alcohol Ingredients Market Sector

- ADM

- Sensient Technologies Corporation

- D D Williamson & Co Inc

- Cargill

- Chr Hansen Holding A/S

- DSM

- Kerry Group

- Dohler Group SE

- Tate & Lyle

- Symrise

Key Milestones in North America Alcohol Ingredients Market Industry

- 2020: Increased consumer focus on at-home beverage consumption drives demand for premium ingredients for home brewing and mixology.

- 2021: Growing adoption of enzymes for enhanced flavor development and efficiency in craft spirits production.

- 2022: Significant investments in R&D for natural colorants and flavors to meet clean-label demands.

- 2023: Launch of new yeast strains optimized for specific fermentation profiles in craft beer and wine production.

- 2024: Strategic M&A activities to consolidate market share and expand product portfolios in key segments.

Strategic Outlook for North America Alcohol Ingredients Market Market

The strategic outlook for the North America Alcohol Ingredients Market is exceptionally positive, driven by sustained consumer interest in diverse and evolving alcoholic beverages. Key growth accelerators include the continued expansion of the craft beverage movement, the burgeoning low- and no-alcohol market, and the increasing demand for natural and sustainably sourced ingredients. Companies that can effectively innovate in flavor creation, enhance fermentation efficiencies through advanced enzymes, and offer transparent, clean-label solutions will be best positioned for success. Strategic collaborations and a focus on niche market segments, such as functional alcoholic beverages and premium RTDs, will further bolster market leadership and long-term profitability.

North America Alcohol Ingredients Market Segmentation

-

1. Ingredient Type

- 1.1. Yeast

- 1.2. Enzymes

- 1.3. Colorants

- 1.4. Flavors & Salts

-

2. Beverage Type

- 2.1. Beer

- 2.2. Spirits

- 2.3. Wine

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Alcohol Ingredients Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Alcohol Ingredients Market Regional Market Share

Geographic Coverage of North America Alcohol Ingredients Market

North America Alcohol Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Obesity and Cadiovascular Diseases; Growing Trend of Veganism Drives the Market

- 3.3. Market Restrains

- 3.3.1. Associated Allergies With Plant Proteins

- 3.4. Market Trends

- 3.4.1. Growing Preference for Craft Spirits in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Yeast

- 5.1.2. Enzymes

- 5.1.3. Colorants

- 5.1.4. Flavors & Salts

- 5.2. Market Analysis, Insights and Forecast - by Beverage Type

- 5.2.1. Beer

- 5.2.2. Spirits

- 5.2.3. Wine

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. United States North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Yeast

- 6.1.2. Enzymes

- 6.1.3. Colorants

- 6.1.4. Flavors & Salts

- 6.2. Market Analysis, Insights and Forecast - by Beverage Type

- 6.2.1. Beer

- 6.2.2. Spirits

- 6.2.3. Wine

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Canada North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Yeast

- 7.1.2. Enzymes

- 7.1.3. Colorants

- 7.1.4. Flavors & Salts

- 7.2. Market Analysis, Insights and Forecast - by Beverage Type

- 7.2.1. Beer

- 7.2.2. Spirits

- 7.2.3. Wine

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Mexico North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Yeast

- 8.1.2. Enzymes

- 8.1.3. Colorants

- 8.1.4. Flavors & Salts

- 8.2. Market Analysis, Insights and Forecast - by Beverage Type

- 8.2.1. Beer

- 8.2.2. Spirits

- 8.2.3. Wine

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Rest of North America North America Alcohol Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Yeast

- 9.1.2. Enzymes

- 9.1.3. Colorants

- 9.1.4. Flavors & Salts

- 9.2. Market Analysis, Insights and Forecast - by Beverage Type

- 9.2.1. Beer

- 9.2.2. Spirits

- 9.2.3. Wine

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ADM

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sensient Technologies Corporation*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 D D Williamson & Co Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cargill

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Chr Hansen Holding A/S

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DSM

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dohler Group SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tate & Lyle

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Symrise

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ADM

List of Figures

- Figure 1: North America Alcohol Ingredients Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Alcohol Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 2: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 3: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 4: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 5: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: North America Alcohol Ingredients Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Alcohol Ingredients Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 10: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 11: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 12: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 13: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 18: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 19: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 20: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 21: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 26: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 27: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 28: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 29: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: North America Alcohol Ingredients Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 34: North America Alcohol Ingredients Market Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 35: North America Alcohol Ingredients Market Revenue undefined Forecast, by Beverage Type 2020 & 2033

- Table 36: North America Alcohol Ingredients Market Volume K Tons Forecast, by Beverage Type 2020 & 2033

- Table 37: North America Alcohol Ingredients Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: North America Alcohol Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: North America Alcohol Ingredients Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: North America Alcohol Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Alcohol Ingredients Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the North America Alcohol Ingredients Market?

Key companies in the market include ADM, Sensient Technologies Corporation*List Not Exhaustive, D D Williamson & Co Inc, Cargill, Chr Hansen Holding A/S, DSM, Kerry Group, Dohler Group SE, Tate & Lyle , Symrise.

3. What are the main segments of the North America Alcohol Ingredients Market?

The market segments include Ingredient Type, Beverage Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Obesity and Cadiovascular Diseases; Growing Trend of Veganism Drives the Market.

6. What are the notable trends driving market growth?

Growing Preference for Craft Spirits in the Region.

7. Are there any restraints impacting market growth?

Associated Allergies With Plant Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Alcohol Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Alcohol Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Alcohol Ingredients Market?

To stay informed about further developments, trends, and reports in the North America Alcohol Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence