Key Insights

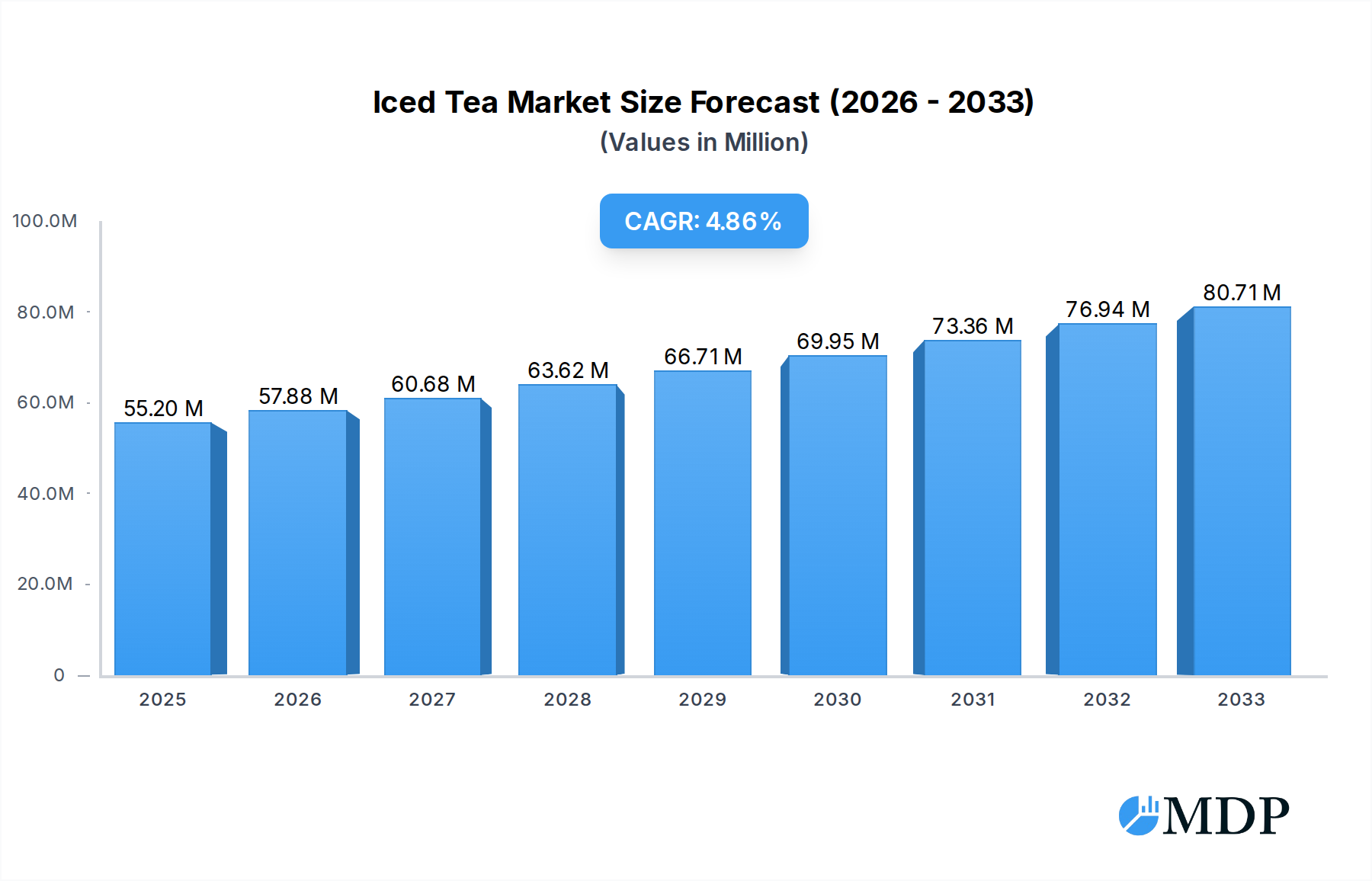

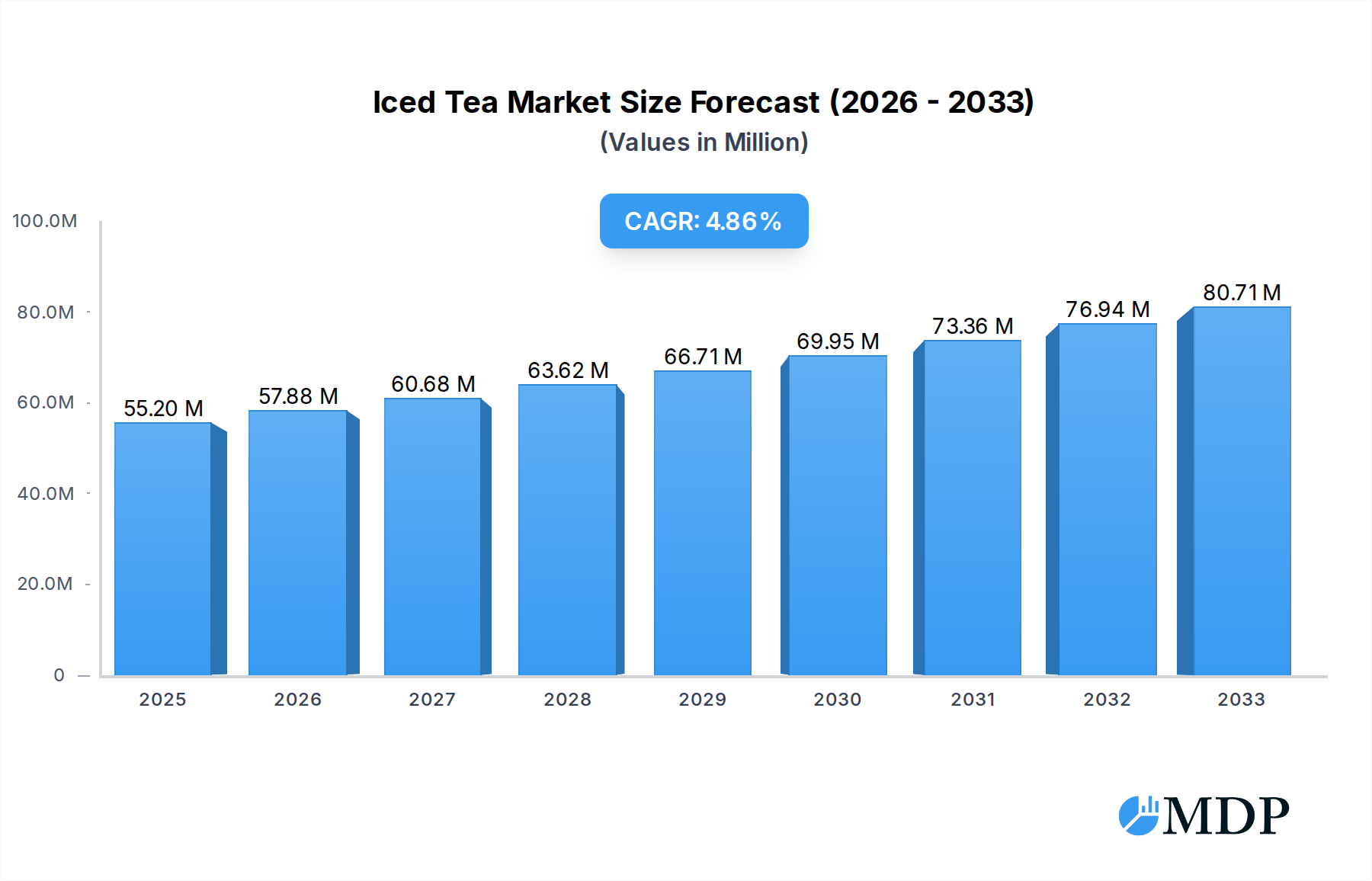

The global Iced Tea Market is poised for significant expansion, projected to reach $55.20 Million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 4.83% through 2033. This robust growth is fueled by a confluence of factors, including an increasing consumer preference for healthier beverage alternatives, the growing demand for ready-to-drink (RTD) options, and the innovative expansion of product portfolios by leading market players. The Iced Tea Market is experiencing a dynamic shift, moving beyond traditional black tea varieties to encompass a wider spectrum of flavors and functional benefits. Green iced tea, with its perceived health advantages, and herbal iced teas, catering to diverse wellness trends, are gaining substantial traction. The convenience offered by liquid/ready-to-drink formats continues to dominate consumer choices, while the powder/premix segment is adapting with improved dissolvability and flavor profiles. Distribution channels are also evolving, with online retail experiencing accelerated growth, complementing the established presence of supermarkets and convenience stores. This market's dynamism is further propelled by strategic product development and marketing initiatives from major corporations like Nestle SA, PepsiCo Inc., and The Coca-Cola Company, who are actively innovating to meet evolving consumer tastes and demands for both traditional and novel iced tea experiences.

Iced Tea Market Market Size (In Million)

The market's upward trajectory is underpinned by several key drivers. A significant driver is the escalating awareness among consumers regarding the health benefits associated with tea, particularly green tea and herbal infusions, positioning iced tea as a more appealing alternative to sugary sodas and artificial beverages. Furthermore, busy lifestyles and a demand for on-the-go consumption are propelling the sales of RTD iced teas. Emerging markets, particularly in the Asia Pacific and South America regions, represent significant untapped potential, driven by a burgeoning middle class and increasing disposable incomes. However, certain restraints could influence market expansion. Fluctuations in raw material prices, such as the cost of tea leaves and sweeteners, can impact profitability. Intense competition from other beverage categories, including flavored waters and functional drinks, also presents a challenge. Nevertheless, the overarching trend of health consciousness and the continuous innovation in product formulations and marketing strategies by industry leaders are expected to more than offset these challenges, ensuring a sustained and healthy growth trajectory for the global iced tea market throughout the forecast period.

Iced Tea Market Company Market Share

This comprehensive report delves into the dynamic global iced tea market, providing in-depth analysis and actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this study offers a meticulous examination of market trends, competitive landscapes, and future opportunities. Discover the untapped potential of this rapidly expanding beverage category, driven by evolving consumer preferences for healthier, convenient, and flavorful options.

The iced tea industry is experiencing robust growth, fueled by a burgeoning demand for refreshing and low-calorie beverages. Our report analyzes key market segments, including Black Iced Tea, Green Iced Tea, Herbal Iced Tea, and Other Iced Tea products, alongside their diverse forms: Powder/Premix and Liquid/Ready-to-drink. We also dissect the impact of various distribution channels such as Supermarkets/Hypermarkets, Convenience Stores, and Online Retail Stores on market penetration and consumer access. Explore the strategies of leading players like Nestle SA, Harris Freeman & Co, PepsiCo Inc, and The Coca-Cola Company as they innovate and expand their offerings to capture market share.

Iced Tea Market Market Dynamics & Concentration

The iced tea market exhibits a moderately concentrated landscape, with key players like Nestle SA, PepsiCo Inc, and The Coca-Cola Company holding significant market share. Innovation drivers are paramount, with manufacturers focusing on developing new flavors, healthier formulations with reduced sugar content, and convenient packaging solutions. Regulatory frameworks, while generally supportive of beverage production, can influence ingredient sourcing and labeling requirements, impacting market entry for new entrants. Product substitutes, including other ready-to-drink beverages like sodas, juices, and functional drinks, pose a constant competitive challenge. End-user trends lean towards demand for natural ingredients, functional benefits (e.g., antioxidants from green tea), and sustainable packaging. Merger and acquisition (M&A) activities are ongoing, albeit at a moderate pace, as companies seek to expand their product portfolios or geographical reach. For instance, strategic partnerships, like the one between Molson Coors and Coca-Cola for Peace Hard Tea, highlight innovative approaches to market expansion and product diversification. The market share distribution is dynamic, with established brands leveraging their extensive distribution networks while niche players focus on specialized offerings.

Iced Tea Market Industry Trends & Analysis

The iced tea market is poised for substantial expansion, driven by a confluence of compelling industry trends and evolving consumer behaviors. The increasing global focus on health and wellness is a primary catalyst, propelling demand for iced tea as a perceived healthier alternative to sugary carbonated beverages. Consumers are actively seeking low-calorie, low-sugar, and natural beverage options, a trend that brands like Lipton, under Unilever Plc, are capitalizing on with their diverse flavor expansions and product launches. The convenience factor also plays a crucial role, with ready-to-drink (RTD) iced tea formats experiencing significant growth. Busy lifestyles and on-the-go consumption patterns favor pre-packaged beverages that offer immediate refreshment. Technological advancements in beverage processing and packaging are enabling manufacturers to create more stable, flavorful, and shelf-ready iced tea products. This includes innovations in brewing techniques, flavor infusion, and the development of sustainable packaging solutions.

The competitive dynamics within the iced tea industry are characterized by both established global beverage giants and agile regional players. Companies are investing heavily in marketing and product innovation to differentiate themselves and capture consumer attention. The rise of online retail channels has democratized market access, allowing smaller brands to reach a wider audience and consumers to discover a broader array of products. The CAGR of the iced tea market is projected to remain robust throughout the forecast period, reflecting sustained consumer interest and strategic market initiatives. Furthermore, the increasing penetration of iced tea in emerging economies, coupled with a growing awareness of its potential health benefits, signifies a long-term growth trajectory. The introduction of novel flavor profiles, functional ingredients, and even alcoholic variants like Peace Hard Tea by Molson Coors and Coca-Cola, indicates a continuous effort to broaden the appeal and consumption occasions for iced tea. This dynamic environment necessitates constant adaptation and innovation from all market participants to maintain and enhance their market position.

Leading Markets & Segments in Iced Tea Market

The iced tea market is segmented and analyzed to identify key growth areas and dominant players. In terms of Product Type, Black Iced Tea continues to hold a significant market share due to its widespread popularity and classic appeal. However, Green Iced Tea is experiencing robust growth, driven by increasing consumer awareness of its antioxidant properties and perceived health benefits. Herbal Iced Tea is also gaining traction as consumers seek caffeine-free and wellness-focused beverage options.

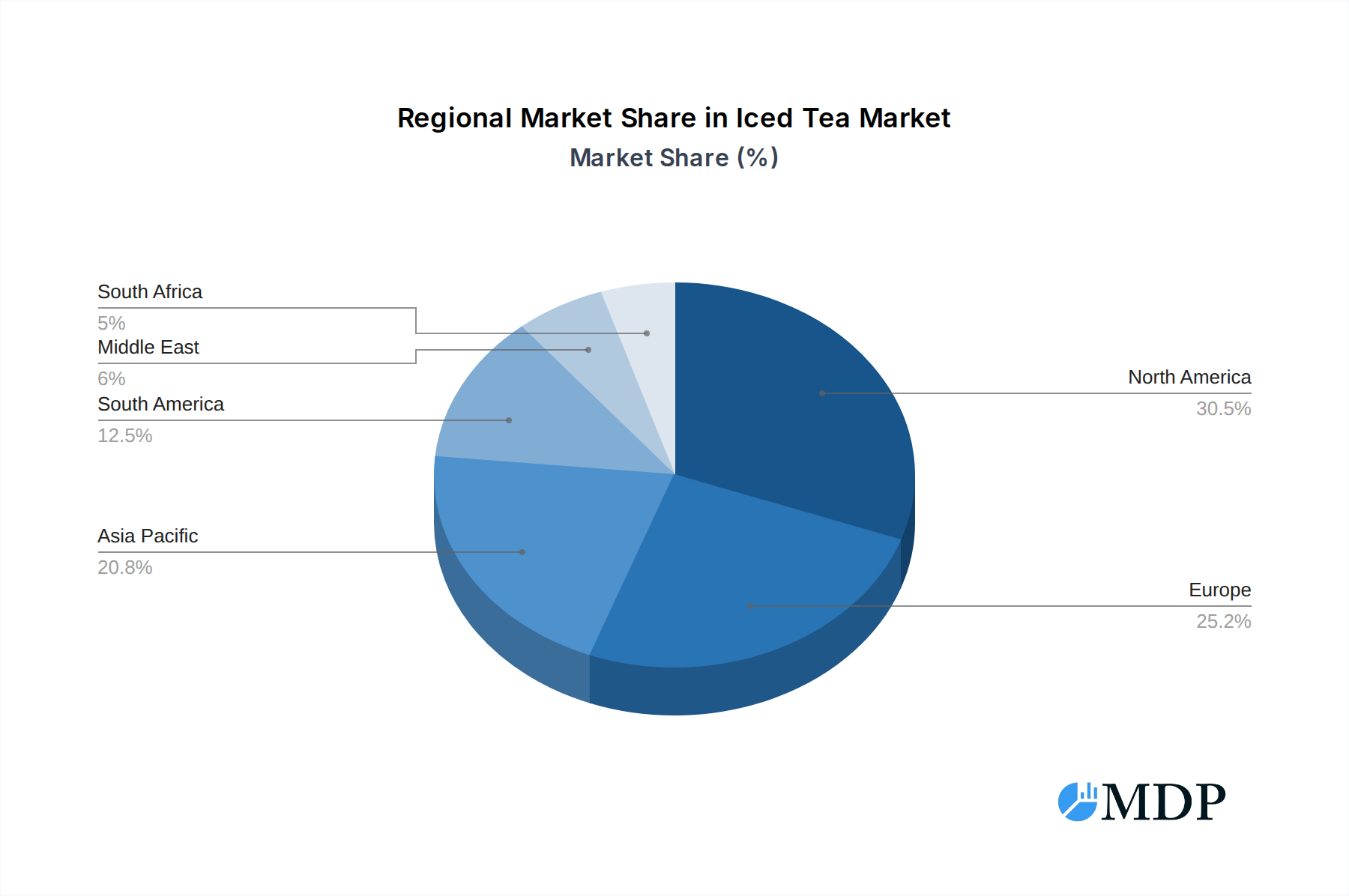

Geographically, North America and Europe currently represent leading markets, owing to established consumption habits and a strong presence of key manufacturers. However, the Asia-Pacific region is emerging as a high-growth area, fueled by rising disposable incomes, urbanization, and a growing preference for convenient and refreshing beverages. Within this region, countries like China and India are witnessing substantial expansion in the iced tea market.

Analyzing by Form, the Liquid/Ready-to-drink segment dominates the market, offering unparalleled convenience for on-the-go consumption. The Powder/Premix segment, while smaller, caters to consumers who prefer to prepare their iced tea at home, offering cost-effectiveness and customization options.

Distribution channels are critical for market penetration. Supermarkets/Hypermarkets remain the primary distribution channel, offering broad reach and accessibility. Online Retail Stores are rapidly gaining prominence, facilitating direct-to-consumer sales and expanding the reach of both large and small brands. Convenience Stores also play a vital role in providing immediate access to popular iced tea options for impulse purchases.

Key drivers for segment dominance include:

- Economic Policies: Favorable trade policies and reduced import duties in emerging markets can boost market accessibility.

- Infrastructure Development: Improved logistics and cold chain infrastructure are crucial for the efficient distribution of RTD iced tea.

- Consumer Income Levels: Rising disposable incomes in developing economies enable consumers to spend more on premium and convenience beverages.

- Marketing and Promotions: Effective marketing campaigns by key players are instrumental in driving consumer preference and segment growth.

Iced Tea Market Product Developments

The iced tea market is characterized by continuous product innovation aimed at capturing evolving consumer preferences. Key developments include the introduction of functional iced teas infused with vitamins, antioxidants, and adaptogens, catering to the growing wellness trend. Manufacturers are also focusing on natural sweeteners and a reduction in added sugar content, aligning with health-conscious consumer demands. Flavor innovation remains a crucial aspect, with companies experimenting with exotic fruit blends, floral notes, and savory infusions to create unique taste experiences. Sustainable packaging solutions, such as recyclable materials and reduced plastic usage, are also gaining prominence, reflecting environmental consciousness. These product developments are strategically designed to offer competitive advantages by meeting specific consumer needs, enhancing perceived health benefits, and differentiating brands in a crowded marketplace, ultimately driving market penetration and brand loyalty.

Key Drivers of Iced Tea Market Growth

Several key factors are propelling the growth of the iced tea market. The primary driver is the escalating global demand for healthier beverage alternatives, with consumers increasingly opting for iced tea over sugary soft drinks due to its lower calorie and sugar content. This aligns with the overarching trend of health and wellness. Technological advancements in processing and packaging are enabling the development of more diverse and convenient RTD iced tea products, enhancing shelf-life and flavor retention. Economic growth in emerging markets is leading to increased disposable incomes, making premium and convenient beverages like iced tea more accessible to a broader consumer base. Furthermore, the growing popularity of green and herbal tea varieties, attributed to their perceived health benefits, is directly fueling the expansion of these segments within the iced tea market. Regulatory support for product innovation and labeling transparency also contributes positively to market expansion.

Challenges in the Iced Tea Market Market

Despite its robust growth trajectory, the iced tea market faces several challenges. Intense competition from other beverage categories, including carbonated soft drinks, juices, and functional beverages, poses a significant restraint on market share expansion. Fluctuations in the prices of raw materials, such as tea leaves and flavorings, can impact production costs and profit margins. Stringent regulatory requirements concerning food safety, labeling, and ingredient sourcing can present hurdles for new entrants and require continuous compliance from established players. Furthermore, the increasing consumer demand for zero-sugar options necessitates ongoing reformulation efforts, which can be complex and costly. Supply chain disruptions, as witnessed in recent global events, can also affect the availability and distribution of both raw materials and finished products, impacting market stability.

Emerging Opportunities in Iced Tea Market

The iced tea market is ripe with emerging opportunities poised to drive long-term growth. The expanding wellness trend presents a significant opportunity for functional iced teas, incorporating ingredients like probiotics, adaptogens, and vitamins to offer added health benefits beyond basic hydration. The growing demand for plant-based and vegan-friendly products opens avenues for ingredient innovation and product development catering to these consumer segments. The continued expansion of online retail and direct-to-consumer (DTC) channels offers a powerful platform for brands to reach niche markets and build stronger customer relationships. Furthermore, strategic partnerships and collaborations, such as the one between Molson Coors and Coca-Cola for Peace Hard Tea, highlight the potential for innovation in product categories and market segments. Exploring new flavor profiles inspired by global cuisines and catering to diverse palates will also be crucial for capturing broader consumer interest and driving market penetration.

Leading Players in the Iced Tea Market Sector

- Nestle SA

- Harris Freeman & Co

- PepsiCo Inc

- 4C Foods Corp

- Unilever PLC

- Tata Consumers Products Limited

- Arizona Beverages USA

- The Coca-Cola Company

- BOS Brands

- Keurig Dr Pepper Inc

Key Milestones in Iced Tea Market Industry

- August 2023: Lipton brand launched 330ml cans of its classic lemon and peach flavor ice teas into the United Kingdom market with six-pack multipack variants.

- April 2023: Unilever Plc brand Lipton expanded its iced tea business by launching new iced tea products. The iced teas have different flavors, including lemon, peach, and lychee.

- April 2023: Molson Coors and Coca-Cola added a new beverage through their partnership with the launch of Peace Hard Tea. According to the company's claim, Peace Hard Tea is available in single-serve 24 oz cans in three different flavors.

Strategic Outlook for Iced Tea Market Market

The iced tea market presents a compelling strategic outlook characterized by sustained growth and innovation. Manufacturers should focus on expanding their product portfolios to include functional and low-sugar variants, directly addressing consumer demand for healthier options. Leveraging the growing e-commerce landscape through robust online retail strategies and direct-to-consumer initiatives will be crucial for market penetration and customer engagement. Exploring novel flavor combinations and regional tastes can tap into diverse consumer preferences, driving incremental sales. Strategic partnerships and collaborations, particularly in areas like hard tea or specialized functional beverages, can unlock new market segments and revenue streams. Furthermore, a commitment to sustainable packaging and ethical sourcing will resonate with an increasingly environmentally conscious consumer base, building brand loyalty and enhancing market reputation.

Iced Tea Market Segmentation

-

1. Product Type

- 1.1. Black Iced Tea

- 1.2. Green Iced Tea

- 1.3. Herbal Iced Tea

- 1.4. Other Iced Tea

-

2. Form

- 2.1. Powder/Premix

- 2.2. Liquid/Ready-to-drink

-

3. Distribution Channel

- 3.1. Supermarkets/ Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retail Stores

- 3.4. Other Retail Distribution Channels

Iced Tea Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Iced Tea Market Regional Market Share

Geographic Coverage of Iced Tea Market

Iced Tea Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Iced Tea as a Healthy Alternative for Daily Intake; Introduction of Innovative and Flavorful Iced Tea Options

- 3.3. Market Restrains

- 3.3.1. Competiton From Substitutes

- 3.4. Market Trends

- 3.4.1. Iced Tea as a Healthy Alternative for Daily Intake

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Black Iced Tea

- 5.1.2. Green Iced Tea

- 5.1.3. Herbal Iced Tea

- 5.1.4. Other Iced Tea

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Powder/Premix

- 5.2.2. Liquid/Ready-to-drink

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/ Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Retail Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Black Iced Tea

- 6.1.2. Green Iced Tea

- 6.1.3. Herbal Iced Tea

- 6.1.4. Other Iced Tea

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Powder/Premix

- 6.2.2. Liquid/Ready-to-drink

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/ Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Retail Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Black Iced Tea

- 7.1.2. Green Iced Tea

- 7.1.3. Herbal Iced Tea

- 7.1.4. Other Iced Tea

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Powder/Premix

- 7.2.2. Liquid/Ready-to-drink

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/ Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Retail Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Black Iced Tea

- 8.1.2. Green Iced Tea

- 8.1.3. Herbal Iced Tea

- 8.1.4. Other Iced Tea

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Powder/Premix

- 8.2.2. Liquid/Ready-to-drink

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/ Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Retail Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Black Iced Tea

- 9.1.2. Green Iced Tea

- 9.1.3. Herbal Iced Tea

- 9.1.4. Other Iced Tea

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Powder/Premix

- 9.2.2. Liquid/Ready-to-drink

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/ Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Retail Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Black Iced Tea

- 10.1.2. Green Iced Tea

- 10.1.3. Herbal Iced Tea

- 10.1.4. Other Iced Tea

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Powder/Premix

- 10.2.2. Liquid/Ready-to-drink

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/ Hypermarkets

- 10.3.2. Convenience Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Retail Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. South Africa Iced Tea Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Black Iced Tea

- 11.1.2. Green Iced Tea

- 11.1.3. Herbal Iced Tea

- 11.1.4. Other Iced Tea

- 11.2. Market Analysis, Insights and Forecast - by Form

- 11.2.1. Powder/Premix

- 11.2.2. Liquid/Ready-to-drink

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkets/ Hypermarkets

- 11.3.2. Convenience Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Other Retail Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Nestle SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Harris Freeman & Co

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PepsiCo Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 4C Foods Corp

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Unilever PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Tata Consumers Products Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Arizona Beverages USA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Coca-Cola Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 BOS Brands

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Keurig Dr Pepper Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nestle SA

List of Figures

- Figure 1: Global Iced Tea Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Iced Tea Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Iced Tea Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Iced Tea Market Revenue (Million), by Form 2025 & 2033

- Figure 5: North America Iced Tea Market Revenue Share (%), by Form 2025 & 2033

- Figure 6: North America Iced Tea Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Iced Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Iced Tea Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Iced Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Iced Tea Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Iced Tea Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Iced Tea Market Revenue (Million), by Form 2025 & 2033

- Figure 13: Europe Iced Tea Market Revenue Share (%), by Form 2025 & 2033

- Figure 14: Europe Iced Tea Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Iced Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Iced Tea Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Iced Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Iced Tea Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Iced Tea Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Iced Tea Market Revenue (Million), by Form 2025 & 2033

- Figure 21: Asia Pacific Iced Tea Market Revenue Share (%), by Form 2025 & 2033

- Figure 22: Asia Pacific Iced Tea Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Iced Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Iced Tea Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Iced Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Iced Tea Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Iced Tea Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Iced Tea Market Revenue (Million), by Form 2025 & 2033

- Figure 29: South America Iced Tea Market Revenue Share (%), by Form 2025 & 2033

- Figure 30: South America Iced Tea Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Iced Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Iced Tea Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Iced Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Iced Tea Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East Iced Tea Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East Iced Tea Market Revenue (Million), by Form 2025 & 2033

- Figure 37: Middle East Iced Tea Market Revenue Share (%), by Form 2025 & 2033

- Figure 38: Middle East Iced Tea Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Iced Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Iced Tea Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Iced Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Africa Iced Tea Market Revenue (Million), by Product Type 2025 & 2033

- Figure 43: South Africa Iced Tea Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: South Africa Iced Tea Market Revenue (Million), by Form 2025 & 2033

- Figure 45: South Africa Iced Tea Market Revenue Share (%), by Form 2025 & 2033

- Figure 46: South Africa Iced Tea Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: South Africa Iced Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: South Africa Iced Tea Market Revenue (Million), by Country 2025 & 2033

- Figure 49: South Africa Iced Tea Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 3: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Iced Tea Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 7: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Iced Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 15: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Iced Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spain Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 25: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Iced Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 34: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Iced Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 41: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Iced Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Global Iced Tea Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Iced Tea Market Revenue Million Forecast, by Form 2020 & 2033

- Table 45: Global Iced Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Iced Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 47: Saudi Arabia Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Middle East Iced Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iced Tea Market?

The projected CAGR is approximately 4.83%.

2. Which companies are prominent players in the Iced Tea Market?

Key companies in the market include Nestle SA, Harris Freeman & Co, PepsiCo Inc, 4C Foods Corp, Unilever PLC, Tata Consumers Products Limited, Arizona Beverages USA, The Coca-Cola Company, BOS Brands, Keurig Dr Pepper Inc *List Not Exhaustive.

3. What are the main segments of the Iced Tea Market?

The market segments include Product Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Iced Tea as a Healthy Alternative for Daily Intake; Introduction of Innovative and Flavorful Iced Tea Options.

6. What are the notable trends driving market growth?

Iced Tea as a Healthy Alternative for Daily Intake.

7. Are there any restraints impacting market growth?

Competiton From Substitutes.

8. Can you provide examples of recent developments in the market?

August 2023: Lipton brand launched 330ml cans of its classic lemon and peach flavor ice teas into the United Kingdom market with six-pack multipack variants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iced Tea Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iced Tea Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iced Tea Market?

To stay informed about further developments, trends, and reports in the Iced Tea Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence