Key Insights

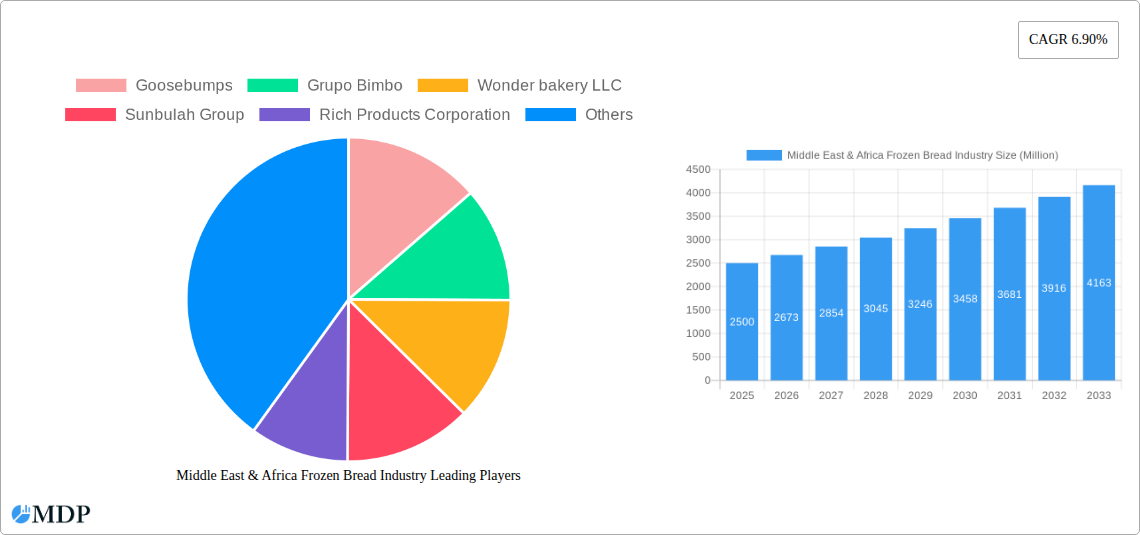

The Middle East & Africa (MEA) frozen bread market is experiencing robust expansion, driven by evolving consumer lifestyles, increasing urbanization, and a growing demand for convenient and ready-to-bake food solutions. With a current market size estimated at USD 2,500 million, the industry is projected to witness a Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033, reaching an estimated value of USD 4,275 million by 2033. This significant growth is propelled by a confluence of factors, including the rising disposable incomes across key nations like Saudi Arabia and the United Arab Emirates, which allows consumers to invest more in premium and convenient food options. Furthermore, the increasing penetration of modern retail formats such as supermarkets and hypermarkets, alongside the burgeoning online retail sector, is enhancing product accessibility and stimulating sales. The demand for diverse product offerings, from par-baked loaves to fully baked frozen items catering to both everyday consumption and special occasions, is also a key driver. Manufacturers are responding by innovating with healthier options, diverse flavor profiles, and artisanal-style frozen breads to capture a wider consumer base and differentiate in a competitive landscape.

Middle East & Africa Frozen Bread Industry Market Size (In Billion)

Despite the optimistic outlook, the MEA frozen bread market faces certain restraints that require strategic consideration. The sensitivity of a significant portion of the consumer base to price fluctuations, coupled with the logistical challenges and costs associated with maintaining the cold chain for frozen products across vast and diverse geographical terrains, presents a hurdle. However, the persistent trend towards convenience, accelerated by busy urban lifestyles and the expansion of working women demographics, continues to outweigh these challenges. Distribution channels like supermarkets/hypermarkets and specialist stores are currently leading sales, but online retail is rapidly gaining traction, offering unparalleled convenience and a broader product selection. Key players such as Grupo Bimbo, Rich Products Corporation, and Lantmannen Unibake are actively investing in product innovation and expanding their distribution networks to capitalize on the market's potential. The strategic focus on expanding offerings in countries like Saudi Arabia and the UAE, with their strong economic foundations and receptive consumer bases, will be crucial for sustained market leadership in the coming years.

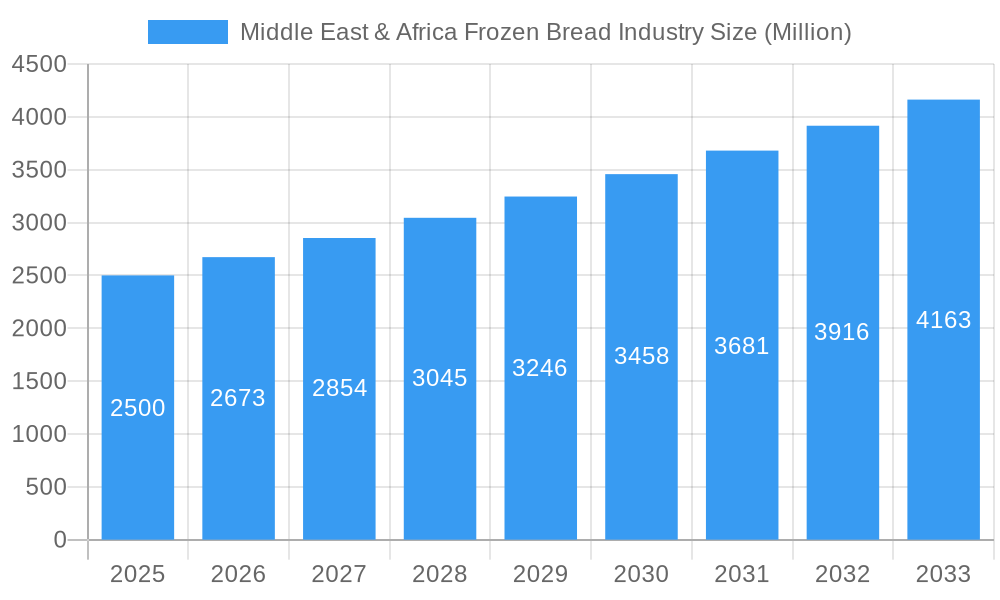

Middle East & Africa Frozen Bread Industry Company Market Share

This comprehensive report delves into the dynamic Middle East & Africa (MEA) Frozen Bread Industry, offering in-depth analysis of market forces, growth trajectories, and strategic opportunities. Covering the historical period from 2019 to 2024, a base year of 2025, and a forecast period extending to 2033, this study provides essential insights for industry stakeholders seeking to navigate and capitalize on this rapidly evolving market. With a projected market size of USD 10 Million by 2025, the MEA Frozen Bread Industry is poised for significant expansion, driven by changing consumer lifestyles, increasing urbanization, and a growing demand for convenience food solutions.

Middle East & Africa Frozen Bread Industry Market Dynamics & Concentration

The MEA Frozen Bread Industry is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Global players are increasingly acquiring local frozen bread manufacturers, indicating a consolidation trend aimed at expanding reach and production capacity. Key innovation drivers include advancements in freezing technology, leading to improved product quality and shelf life, as well as the development of value-added frozen bread products. Regulatory frameworks, while varying across countries, are generally supportive of food industry growth, with a focus on food safety and import/export regulations. Product substitutes, such as fresh bread and other baked goods, pose a moderate competitive threat, but the convenience and extended shelf life of frozen bread continue to drive consumer preference. End-user trends highlight a growing demand for healthier options, including whole wheat and gluten-free frozen bread. M&A activities are expected to remain a crucial aspect of market dynamics as companies seek to gain a competitive edge and expand their portfolios.

- Market Share: Global players collectively hold approximately 60% of the MEA Frozen Bread market.

- M&A Deal Counts: An average of 5-7 significant M&A deals are anticipated annually during the forecast period.

Middle East & Africa Frozen Bread Industry Industry Trends & Analysis

The MEA Frozen Bread Industry is experiencing robust growth, driven by a confluence of factors. Rising disposable incomes and a burgeoning middle class across the region are translating into increased consumer spending on convenience food products. Urbanization is further accelerating this trend, with city dwellers seeking quick and easy meal solutions. Technological advancements in freezing techniques, including advanced flash freezing and cryogenic freezing, are crucial in maintaining the freshness, texture, and taste of frozen bread, thereby enhancing consumer satisfaction. The proliferation of modern retail formats, such as supermarkets and hypermarkets, coupled with the rapid growth of e-commerce platforms, has significantly improved the accessibility of frozen bread products to a wider consumer base.

Consumer preferences are also undergoing a significant evolution. There's a discernible shift towards healthier options, with a growing demand for whole wheat, multi-grain, and gluten-free frozen bread varieties. This dietary consciousness is fueled by increasing awareness of health and wellness. Furthermore, consumers are seeking greater variety and innovation in their food choices, leading to a demand for specialty frozen breads, such as artisanal loaves, flavored breads, and ethnic varieties. The competitive landscape is intensifying, with both domestic and international players vying for market dominance. Companies are investing heavily in brand building, product differentiation, and expanding their distribution networks to capture a larger share of the market. The ongoing expansion of production capacity by key players is a testament to the optimistic outlook for this sector.

- CAGR: The MEA Frozen Bread Industry is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period.

- Market Penetration: The market penetration of frozen bread is expected to reach 35% by 2033.

Leading Markets & Segments in Middle East & Africa Frozen Bread Industry

The Supermarket/Hypermarket distribution channel currently dominates the MEA Frozen Bread Industry, reflecting the increasing reliance of consumers on these large retail formats for their grocery needs. The convenience of one-stop shopping, coupled with a wide array of product choices and competitive pricing, makes supermarkets and hypermarkets the preferred destination for frozen bread purchases. Economic policies in many MEA countries are geared towards encouraging retail sector growth, with investments in modern infrastructure and streamlined import processes further bolstering the presence of these channels.

- Dominance Drivers for Supermarkets/Hypermarkets:

- Infrastructure Development: Significant investment in modern retail infrastructure across major cities.

- Consumer Habits: Growing preference for organized retail and bulk purchasing.

- Product Visibility: Ample shelf space and prominent placement for frozen products.

- Promotional Activities: Regular discounts and offers driving sales volume.

The Online Retail segment, while still nascent compared to traditional channels, is emerging as a significant growth engine. The rapid adoption of e-commerce, facilitated by increased internet penetration and smartphone usage, coupled with the rise of online grocery delivery services, is making frozen bread more accessible than ever. Countries with robust digital ecosystems are witnessing particularly rapid growth in this segment.

- Growth Drivers for Online Retail:

- Digital Penetration: High smartphone and internet usage across the region.

- Convenience: Doorstep delivery and time-saving shopping experiences.

- Expansion of E-commerce Platforms: Growing number of online grocery retailers and marketplaces.

- Logistical Improvements: Advancements in cold chain logistics for online deliveries.

Specialist Stores and Convenience Stores also contribute to the distribution landscape, catering to niche markets and immediate purchase needs, respectively. However, their market share remains comparatively smaller. The strategic positioning of frozen bread within these outlets, coupled with targeted marketing efforts, will be crucial for their sustained growth.

Middle East & Africa Frozen Bread Industry Product Developments

Product innovation in the MEA Frozen Bread Industry is primarily focused on meeting evolving consumer demands for healthier options and greater variety. This includes the development of whole wheat, gluten-free, and low-carbohydrate frozen bread formulations, catering to specific dietary requirements and health-conscious consumers. Furthermore, manufacturers are introducing specialty and ethnic flavored frozen breads, tapping into the region's diverse culinary landscape. Competitive advantages are being carved out through advanced freezing technologies that preserve freshness and texture, along with innovative packaging solutions that enhance shelf appeal and extend product life. The introduction of ready-to-bake and partially baked frozen bread products also caters to the growing demand for convenience and quick meal preparation.

Key Drivers of Middle East & Africa Frozen Bread Industry Growth

Several key factors are propelling the growth of the MEA Frozen Bread Industry. The increasing adoption of Western dietary habits, coupled with a growing demand for convenience food, is a primary driver. Economic prosperity and rising disposable incomes across the region are enabling consumers to spend more on convenient and value-added food products. Technological advancements in freezing and packaging are crucial for maintaining product quality and extending shelf life, making frozen bread a viable alternative to fresh bread. Furthermore, the expansion of modern retail infrastructure, including supermarkets and hypermarkets, coupled with the rapid growth of e-commerce, is improving product accessibility. Government initiatives aimed at promoting food processing and agricultural development also contribute to a favorable market environment.

Challenges in the Middle East & Africa Frozen Bread Industry Market

Despite the positive growth trajectory, the MEA Frozen Bread Industry faces several challenges. Inadequate cold chain infrastructure in some sub-regions can lead to product spoilage and quality degradation, impacting consumer trust. Intense price competition from both local and international players can put pressure on profit margins. Furthermore, evolving consumer preferences and the demand for healthier alternatives necessitate continuous product innovation, requiring significant investment in research and development. Regulatory hurdles and varying import/export regulations across different countries can also pose complexities for market entry and expansion. Supply chain disruptions, influenced by geopolitical factors and logistical challenges, can also impact the availability and cost of raw materials.

Emerging Opportunities in Middle East & Africa Frozen Bread Industry

Emerging opportunities within the MEA Frozen Bread Industry are ripe for exploitation. The burgeoning demand for plant-based and free-from frozen bread options presents a significant untapped market. Strategic partnerships with local bakeries and food distributors can facilitate wider market penetration and leverage existing distribution networks. The increasing adoption of sustainable packaging solutions and ethical sourcing practices can enhance brand reputation and appeal to environmentally conscious consumers. Furthermore, the development of fortified frozen bread products, enriched with vitamins and minerals, can cater to the growing health and wellness trend, offering a value-added proposition. Investing in innovative marketing strategies that highlight the convenience, quality, and health benefits of frozen bread will be crucial for capturing future growth.

Leading Players in the Middle East & Africa Frozen Bread Industry Sector

- Goosebumps

- Grupo Bimbo

- Wonder bakery LLC

- Sunbulah Group

- Rich Products Corporation

- Lantmannen Unibake

- Aryzta AG

- Agthia Group

- Sofie’s Frozen Bakery

- Kronenbrot

Key Milestones in Middle East & Africa Frozen Bread Industry Industry

- 2019: Significant expansion of production capacity by global players to meet the escalating demand for frozen bread.

- 2020: Acquisition of several local frozen bread manufacturers by multinational corporations to gain market share and expand their regional footprint.

- 2021: Launch of new product lines focusing on healthier options, such as whole wheat and gluten-free frozen breads, to cater to evolving consumer preferences.

- 2022: Increased investment in cold chain logistics to improve the distribution and availability of frozen bread products across the MEA region.

- 2023: Emergence of innovative online retail platforms specializing in frozen food delivery, further boosting accessibility.

- 2024: Introduction of artisanal and specialty flavored frozen breads, appealing to a growing demand for diverse culinary experiences.

Strategic Outlook for Middle East & Africa Frozen Bread Industry Market

The strategic outlook for the MEA Frozen Bread Industry is overwhelmingly positive, driven by sustained economic growth, evolving consumer lifestyles, and continuous innovation. Companies that can effectively leverage advanced freezing technologies, develop diversified product portfolios catering to health-conscious consumers, and establish robust distribution networks, particularly through e-commerce, will be well-positioned for success. Strategic collaborations and acquisitions will remain vital for market consolidation and expansion. Furthermore, a focus on sustainability and ethical sourcing will be increasingly important for building brand loyalty and meeting consumer expectations. The MEA Frozen Bread market presents a compelling landscape for growth and investment, with significant potential for those who adapt to its dynamic nature.

Middle East & Africa Frozen Bread Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarket/Hypermarket

- 1.2. Specialist Stores

- 1.3. Convenience Stores

- 1.4. Online Retail

- 1.5. Other Distribution Channels

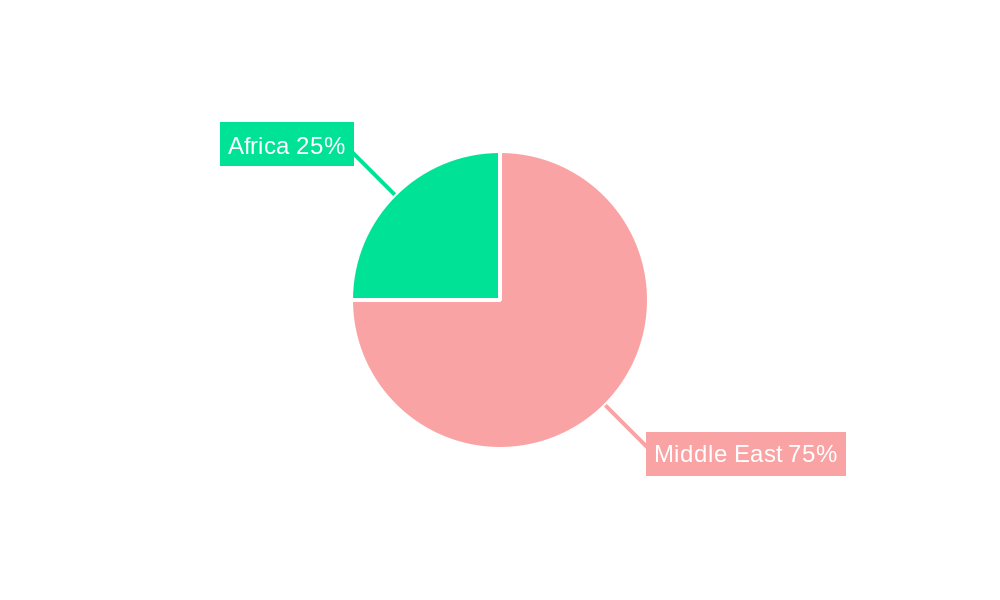

Middle East & Africa Frozen Bread Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & Africa Frozen Bread Industry Regional Market Share

Geographic Coverage of Middle East & Africa Frozen Bread Industry

Middle East & Africa Frozen Bread Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. Expanding Distribution Channels Offer Potential Opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Frozen Bread Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarket/Hypermarket

- 5.1.2. Specialist Stores

- 5.1.3. Convenience Stores

- 5.1.4. Online Retail

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Goosebumps

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grupo Bimbo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wonder bakery LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbulah Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rich Products Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lantmannen Unibake

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aryzta AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agthia Group*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofie’s Frozen Bakery

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kronenbrot

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Goosebumps

List of Figures

- Figure 1: Middle East & Africa Frozen Bread Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Frozen Bread Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Frozen Bread Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 2: Middle East & Africa Frozen Bread Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East & Africa Frozen Bread Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Middle East & Africa Frozen Bread Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Middle East & Africa Frozen Bread Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Middle East & Africa Frozen Bread Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East & Africa Frozen Bread Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Middle East & Africa Frozen Bread Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Saudi Arabia Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: United Arab Emirates Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: United Arab Emirates Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Israel Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Israel Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Qatar Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Kuwait Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Oman Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Oman Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Bahrain Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Bahrain Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Jordan Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Jordan Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Lebanon Middle East & Africa Frozen Bread Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Lebanon Middle East & Africa Frozen Bread Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Frozen Bread Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Middle East & Africa Frozen Bread Industry?

Key companies in the market include Goosebumps, Grupo Bimbo, Wonder bakery LLC, Sunbulah Group, Rich Products Corporation, Lantmannen Unibake, Aryzta AG, Agthia Group*List Not Exhaustive, Sofie’s Frozen Bakery , Kronenbrot.

3. What are the main segments of the Middle East & Africa Frozen Bread Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

Expanding Distribution Channels Offer Potential Opportunities.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

Acquisition of local frozen bread manufacturers by global players

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Frozen Bread Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Frozen Bread Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Frozen Bread Industry?

To stay informed about further developments, trends, and reports in the Middle East & Africa Frozen Bread Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence