Key Insights

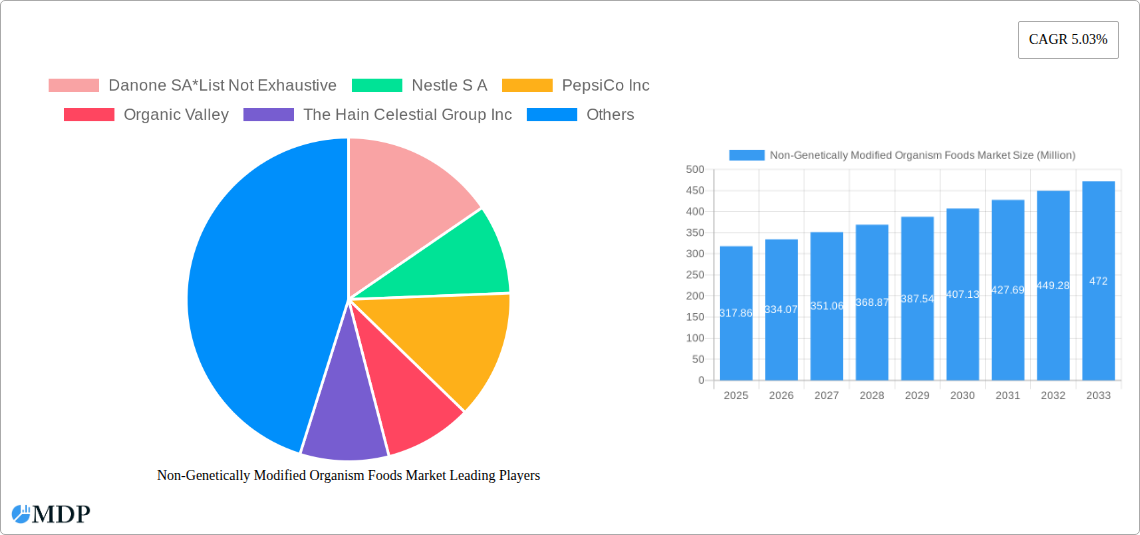

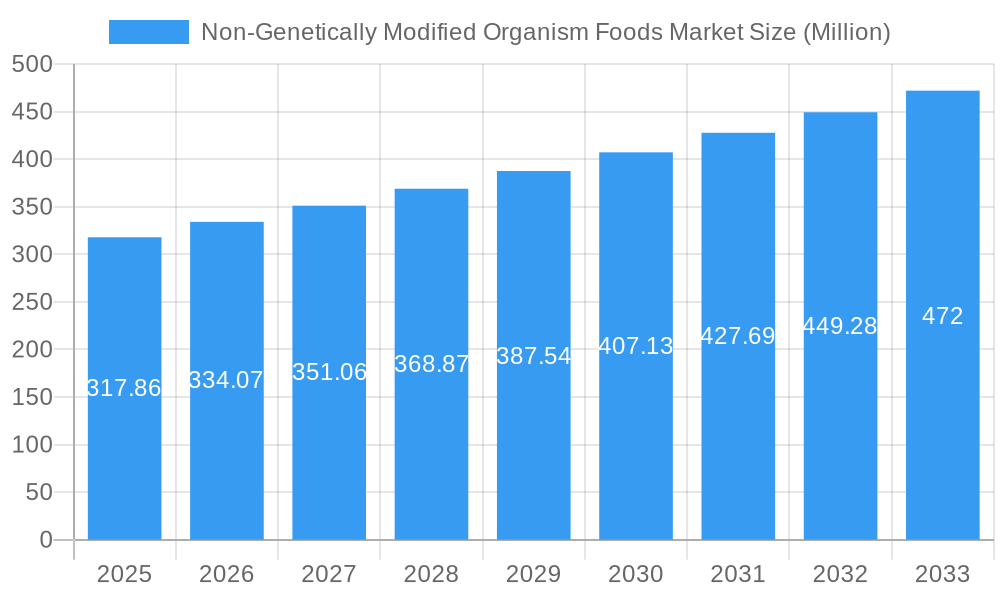

The Non-Genetically Modified Organism (Non-GMO) Foods Market is poised for robust growth, with an estimated market size of USD 317.86 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.03% through 2033. This upward trajectory is primarily fueled by increasing consumer awareness and demand for healthier, more natural food options. A significant driver is the growing preference for transparency in food sourcing and production, pushing manufacturers to offer Non-GMO certified products. The "clean label" movement, emphasizing natural ingredients and minimal processing, further bolsters this trend. Consumers are actively seeking out Non-GMO alternatives due to perceived health benefits and concerns about the environmental impact of genetically modified crops. This heightened consumer consciousness translates directly into increased sales across various food categories, including beverages, dairy products, baby foods, bakery items, and confectionery. The market's expansion is also supported by evolving regulatory landscapes and a growing number of certifications that build consumer trust.

Non-Genetically Modified Organism Foods Market Market Size (In Million)

The market is experiencing significant diversification across product types and distribution channels. Within food segments, dairy products, baby foods, and bakery products are emerging as key growth areas, reflecting parental concerns and the demand for everyday staples made with Non-GMO ingredients. Edible oils and cereal products also represent substantial market shares. On the distribution front, supermarkets and hypermarkets remain dominant, offering wider selections and catering to bulk purchases. However, online retail stores are rapidly gaining traction, driven by convenience and the accessibility of specialized Non-GMO brands. This shift underscores the evolving shopping habits of consumers who increasingly leverage digital platforms to find products aligning with their dietary preferences. The competitive landscape is characterized by the presence of major global players like Danone SA and Nestle S.A., alongside specialized Non-GMO brands, indicating a dynamic and evolving market driven by both established industry giants and agile niche players.

Non-Genetically Modified Organism Foods Market Company Market Share

Non-Genetically Modified Organism Foods Market: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Non-Genetically Modified Organism (Non-GMO) Foods Market, offering critical insights for industry stakeholders, investors, and manufacturers. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report delves into market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and a strategic outlook. Discover the evolving landscape of the Non-GMO food sector, driven by increasing consumer demand for healthier, more transparent food choices.

Non-Genetically Modified Organism Foods Market Market Dynamics & Concentration

The Non-GMO Foods Market exhibits moderate concentration, with a significant presence of both established food giants and specialized organic and natural food companies. Innovation is a primary driver, fueled by continuous research and development in non-GMO ingredient sourcing, processing technologies, and product formulation. Regulatory frameworks, such as the Non-GMO Project Verified label, play a crucial role in shaping consumer trust and market accessibility. Product substitutes, including conventional GMO foods and organic certified products, present a competitive landscape. End-user trends highlight a growing preference for transparency, health benefits, and sustainable sourcing, leading to increased adoption of non-GMO alternatives. Merger and acquisition (M&A) activities are observed as companies seek to expand their non-GMO portfolios and market reach. The market's M&A deal count has seen a steady increase over the historical period. Key players are actively pursuing strategic collaborations and acquisitions to solidify their market positions and capture a larger share of the rapidly expanding Non-GMO foods market.

Non-Genetically Modified Organism Foods Market Industry Trends & Analysis

The Non-GMO Foods Market is experiencing robust growth, driven by a confluence of factors including escalating consumer awareness regarding the potential health implications of genetically modified organisms and a growing demand for transparent food labeling. This heightened consumer consciousness is prompting a significant shift in purchasing decisions, with a premium placed on products that are free from genetic modification. Technological advancements in agriculture are also playing a role, with increased availability of non-GMO seed varieties and improved cultivation practices. Market penetration of non-GMO products is steadily rising across developed and developing economies alike. The compound annual growth rate (CAGR) for the Non-GMO Foods Market is projected to remain strong throughout the forecast period, indicating sustained expansion. Consumer preferences are increasingly leaning towards products that align with healthier lifestyles, driving demand for non-GMO options across various food categories. Competitive dynamics within the market are characterized by fierce competition, with both private label brands and established food manufacturers vying for market share. Product diversification and innovation are key strategies employed by companies to cater to evolving consumer tastes and dietary needs. The trend towards plant-based alternatives, which are predominantly non-GMO, is further accelerating market growth. The demand for clean labels and recognizable ingredients is a significant contributor to the expansion of the non-GMO food sector. The market's trajectory suggests a continued upward trend, fueled by both demand-side pull from consumers and supply-side innovation from producers.

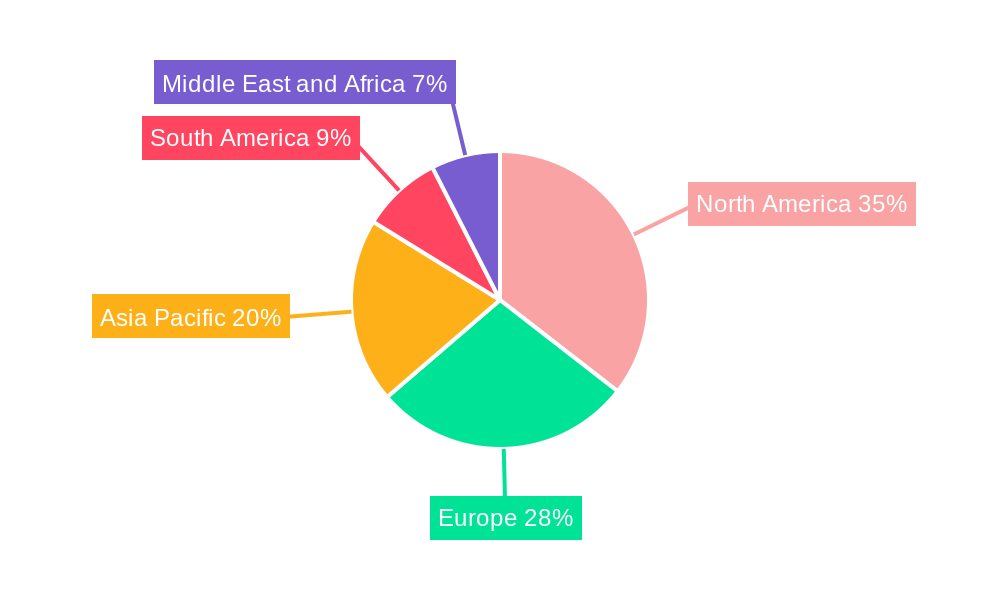

Leading Markets & Segments in Non-Genetically Modified Organism Foods Market

North America currently dominates the Non-GMO Foods Market, with the United States leading consumption due to its well-established non-GMO certification programs and high consumer awareness. Economic policies supportive of agricultural innovation and stringent labeling regulations in countries like the US and Canada have fostered a favorable environment for non-GMO product growth. In terms of product segments, Food holds the largest market share, with Dairy Products and Baby Foods and Infant Formula Products exhibiting particularly strong growth.

Product Type Dominance:

- Food: This broad category encompasses a vast array of non-GMO products, from staple ingredients to processed goods.

- Dairy Products: Driven by consumer concerns about the feed given to dairy cows, non-GMO milk, cheese, and yogurt have seen significant demand. Key drivers include the growing perception of dairy as a healthier choice when sourced from non-GMO feed.

- Baby Foods and Infant Formula Products: Parents are increasingly prioritizing non-GMO ingredients for their infants, making this a high-growth segment. Stringent regulatory oversight and parental vigilance are major contributing factors.

- Bakery Products: The demand for non-GMO flours, breads, and pastries is on the rise, reflecting a broader trend towards cleaner labels.

- Confectionary Products: Consumers are seeking guilt-free indulgence, pushing manufacturers to offer non-GMO chocolate, candies, and other sweet treats.

- Meat and Poultry Products: The focus on animal feed ingredients directly influences the non-GMO demand in this segment.

- Cereals and Grains: A foundational category for non-GMO products, cereals and grains continue to be a significant driver of market expansion.

- Edible Oil: Non-GMO cooking oils are gaining traction as consumers scrutinize ingredient lists.

- Beverage (Non-Alcoholic Beverages): While a smaller segment compared to food, non-GMO juices, teas, and other beverages are experiencing steady growth as consumers seek healthier drink options.

- Food: This broad category encompasses a vast array of non-GMO products, from staple ingredients to processed goods.

Distribution Channel Dominance:

- Supermarkets/Hypermarkets: These remain the primary distribution channel, offering wide product availability and convenient shopping experiences. The ability to physically inspect products and access a broad range of non-GMO options makes them a preferred choice for many consumers.

- Online Retail Stores: E-commerce platforms are rapidly gaining market share, offering convenience, a wider selection, and specialized non-GMO product offerings. The ease of comparison and direct-to-consumer delivery models are significant growth accelerators.

- Convenience Stores: While a smaller channel, convenience stores are increasingly stocking non-GMO options to cater to impulse purchases and on-the-go consumers.

- Other Distribution Channels: This includes specialized health food stores, farmers' markets, and direct-to-consumer sales, which cater to niche markets and highly discerning consumers.

Non-Genetically Modified Organism Foods Market Product Developments

Product innovation in the Non-GMO Foods Market is characterized by a focus on transparency, clean labels, and appealing taste profiles. Companies are actively developing new formulations that leverage non-GMO ingredients across various product categories, from dairy alternatives to plant-based meats and baked goods. These developments often emphasize enhanced nutritional value and cater to specific dietary needs, such as gluten-free or vegan options. The competitive advantage lies in securing reliable non-GMO supply chains and communicating product authenticity effectively to consumers. Technological trends are driving the development of novel processing methods that maintain the integrity of non-GMO ingredients and improve shelf life without artificial preservatives.

Key Drivers of Non-Genetically Modified Organism Foods Market Growth

The Non-GMO Foods Market is propelled by several key drivers. Foremost is the escalating consumer demand for healthier food options and a growing distrust of genetically modified ingredients, fueled by widespread media coverage and educational initiatives. Regulatory support, such as mandatory GMO labeling in various countries, further empowers consumers and incentivizes manufacturers to offer non-GMO alternatives. Technological advancements in agriculture are increasing the availability and affordability of non-GMO seeds and crops. Economic factors, including rising disposable incomes in emerging markets, also contribute by enabling consumers to opt for premium non-GMO products. The strong emphasis on transparency and traceability throughout the food supply chain also significantly boosts the market.

Challenges in the Non-Genetically Modified Organism Foods Market Market

Despite its growth, the Non-GMO Foods Market faces several challenges. The cost of non-GMO sourcing and certification can be higher than conventional production, leading to premium pricing that may limit accessibility for some consumers. Ensuring a consistent and reliable supply chain for non-GMO ingredients can also be complex, especially for niche crops. Stringent and sometimes varying regulatory requirements across different regions can create hurdles for market entry. Furthermore, consumer education remains an ongoing challenge, as misconceptions about GMOs and non-GMO foods persist. Competitive pressures from established conventional food producers and the increasing availability of organic alternatives also present ongoing restraints.

Emerging Opportunities in Non-Genetically Modified Organism Foods Market

Emerging opportunities in the Non-GMO Foods Market are vast and expanding. Technological breakthroughs in biotechnology are enabling the development of new non-GMO crop varieties with enhanced traits, opening doors for novel ingredients. Strategic partnerships between ingredient suppliers, food manufacturers, and retailers can streamline supply chains and expand product availability. Market expansion into developing economies, where awareness and demand for non-GMO products are growing rapidly, presents significant untapped potential. The increasing popularity of plant-based diets, which are largely non-GMO, offers a substantial growth avenue. Furthermore, the development of innovative non-GMO ingredients for functional foods and beverages caters to a growing health and wellness conscious consumer base.

Leading Players in the Non-Genetically Modified Organism Foods Market Sector

- Danone SA

- Nestle S A

- PepsiCo Inc

- Organic Valley

- The Hain Celestial Group Inc

- Blue Diamond Growers

- Clif Bar & Company

- Amy's Kitchen Inc

- The Kellogg's Company

- Pernod Ricard

Key Milestones in Non-Genetically Modified Organism Foods Market Industry

- August 2022: Nomoo New American Burgers partnered with Nestle SA to develop a proprietary line of plant-based products, offering gluten-free, non-GMO pea protein burgers and plant-based chicken burgers with cheese.

- March 2022: PepsiCo Inc and Beyond Meat launched Beyond Meat Jerky from the planet partnership, featuring non-GMO plant-based ingredients, free from soy or gluten.

- April 2021: Kellogg's Company launched Incogmeato, a new plant-based Chick'n Tenders under its Morningstar Farms brand, made with non-GMO soy and no artificial flavors, available in Original and Sweet BBQ.

Strategic Outlook for Non-Genetically Modified Organism Foods Market Market

The strategic outlook for the Non-GMO Foods Market is highly positive, characterized by sustained growth driven by evolving consumer preferences and technological advancements. Key growth accelerators include the continued expansion of plant-based product offerings, increased investment in non-GMO research and development, and the growing adoption of stringent non-GMO certification standards. Strategic opportunities lie in catering to emerging markets, fostering collaborations that enhance supply chain transparency, and innovating with novel non-GMO ingredients to meet the demand for healthier, more sustainable food choices. The market is poised for further consolidation and innovation, with companies that can effectively communicate their commitment to non-GMO principles and deliver on taste and quality set to thrive.

Non-Genetically Modified Organism Foods Market Segmentation

-

1. Product Type

-

1.1. Beverage

- 1.1.1. Non-Alcoholic Beverages

-

1.2. Food

- 1.2.1. Dairy Products

- 1.2.2. Baby Foods and Infant Formula Products

- 1.2.3. Bakery Products

- 1.2.4. Confectionary Products

- 1.2.5. Meat and Poultry Products

- 1.2.6. Cereals and Grains

- 1.2.7. Edible Oil

- 1.2.8. Others

-

1.1. Beverage

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Non-Genetically Modified Organism Foods Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Non-Genetically Modified Organism Foods Market Regional Market Share

Geographic Coverage of Non-Genetically Modified Organism Foods Market

Non-Genetically Modified Organism Foods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Non-GMO Food and Beverage Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Genetically Modified Organism Foods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverage

- 5.1.1.1. Non-Alcoholic Beverages

- 5.1.2. Food

- 5.1.2.1. Dairy Products

- 5.1.2.2. Baby Foods and Infant Formula Products

- 5.1.2.3. Bakery Products

- 5.1.2.4. Confectionary Products

- 5.1.2.5. Meat and Poultry Products

- 5.1.2.6. Cereals and Grains

- 5.1.2.7. Edible Oil

- 5.1.2.8. Others

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Non-Genetically Modified Organism Foods Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beverage

- 6.1.1.1. Non-Alcoholic Beverages

- 6.1.2. Food

- 6.1.2.1. Dairy Products

- 6.1.2.2. Baby Foods and Infant Formula Products

- 6.1.2.3. Bakery Products

- 6.1.2.4. Confectionary Products

- 6.1.2.5. Meat and Poultry Products

- 6.1.2.6. Cereals and Grains

- 6.1.2.7. Edible Oil

- 6.1.2.8. Others

- 6.1.1. Beverage

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Non-Genetically Modified Organism Foods Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beverage

- 7.1.1.1. Non-Alcoholic Beverages

- 7.1.2. Food

- 7.1.2.1. Dairy Products

- 7.1.2.2. Baby Foods and Infant Formula Products

- 7.1.2.3. Bakery Products

- 7.1.2.4. Confectionary Products

- 7.1.2.5. Meat and Poultry Products

- 7.1.2.6. Cereals and Grains

- 7.1.2.7. Edible Oil

- 7.1.2.8. Others

- 7.1.1. Beverage

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Non-Genetically Modified Organism Foods Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beverage

- 8.1.1.1. Non-Alcoholic Beverages

- 8.1.2. Food

- 8.1.2.1. Dairy Products

- 8.1.2.2. Baby Foods and Infant Formula Products

- 8.1.2.3. Bakery Products

- 8.1.2.4. Confectionary Products

- 8.1.2.5. Meat and Poultry Products

- 8.1.2.6. Cereals and Grains

- 8.1.2.7. Edible Oil

- 8.1.2.8. Others

- 8.1.1. Beverage

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Non-Genetically Modified Organism Foods Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beverage

- 9.1.1.1. Non-Alcoholic Beverages

- 9.1.2. Food

- 9.1.2.1. Dairy Products

- 9.1.2.2. Baby Foods and Infant Formula Products

- 9.1.2.3. Bakery Products

- 9.1.2.4. Confectionary Products

- 9.1.2.5. Meat and Poultry Products

- 9.1.2.6. Cereals and Grains

- 9.1.2.7. Edible Oil

- 9.1.2.8. Others

- 9.1.1. Beverage

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Non-Genetically Modified Organism Foods Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Beverage

- 10.1.1.1. Non-Alcoholic Beverages

- 10.1.2. Food

- 10.1.2.1. Dairy Products

- 10.1.2.2. Baby Foods and Infant Formula Products

- 10.1.2.3. Bakery Products

- 10.1.2.4. Confectionary Products

- 10.1.2.5. Meat and Poultry Products

- 10.1.2.6. Cereals and Grains

- 10.1.2.7. Edible Oil

- 10.1.2.8. Others

- 10.1.1. Beverage

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danone SA*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PepsiCo Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Organic Valley

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Hain Celestial Group Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Blue Diamond Growers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Clif Bar & Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amy's Kitchen Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Kellogg's Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pernod Ricard

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Danone SA*List Not Exhaustive

List of Figures

- Figure 1: Global Non-Genetically Modified Organism Foods Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Non-Genetically Modified Organism Foods Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Non-Genetically Modified Organism Foods Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Non-Genetically Modified Organism Foods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Non-Genetically Modified Organism Foods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Non-Genetically Modified Organism Foods Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Non-Genetically Modified Organism Foods Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Non-Genetically Modified Organism Foods Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Non-Genetically Modified Organism Foods Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Non-Genetically Modified Organism Foods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Non-Genetically Modified Organism Foods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Non-Genetically Modified Organism Foods Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Non-Genetically Modified Organism Foods Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Non-Genetically Modified Organism Foods Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Non-Genetically Modified Organism Foods Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Non-Genetically Modified Organism Foods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Non-Genetically Modified Organism Foods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Non-Genetically Modified Organism Foods Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Non-Genetically Modified Organism Foods Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Non-Genetically Modified Organism Foods Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Non-Genetically Modified Organism Foods Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Non-Genetically Modified Organism Foods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Non-Genetically Modified Organism Foods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Non-Genetically Modified Organism Foods Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Non-Genetically Modified Organism Foods Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Non-Genetically Modified Organism Foods Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Non-Genetically Modified Organism Foods Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Genetically Modified Organism Foods Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the Non-Genetically Modified Organism Foods Market?

Key companies in the market include Danone SA*List Not Exhaustive, Nestle S A, PepsiCo Inc, Organic Valley, The Hain Celestial Group Inc, Blue Diamond Growers, Clif Bar & Company, Amy's Kitchen Inc, The Kellogg's Company, Pernod Ricard.

3. What are the main segments of the Non-Genetically Modified Organism Foods Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 317.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Increase in Demand for Non-GMO Food and Beverage Products.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In August 2022, Nomoo New American Burgers Partnered with Nestle SA to develop a proprietary line of plant-based products. The company offers gluten-free, non-GMO pea protein burgers with plant-based chicken burgers and cheese.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Genetically Modified Organism Foods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Genetically Modified Organism Foods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Genetically Modified Organism Foods Market?

To stay informed about further developments, trends, and reports in the Non-Genetically Modified Organism Foods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence