Key Insights

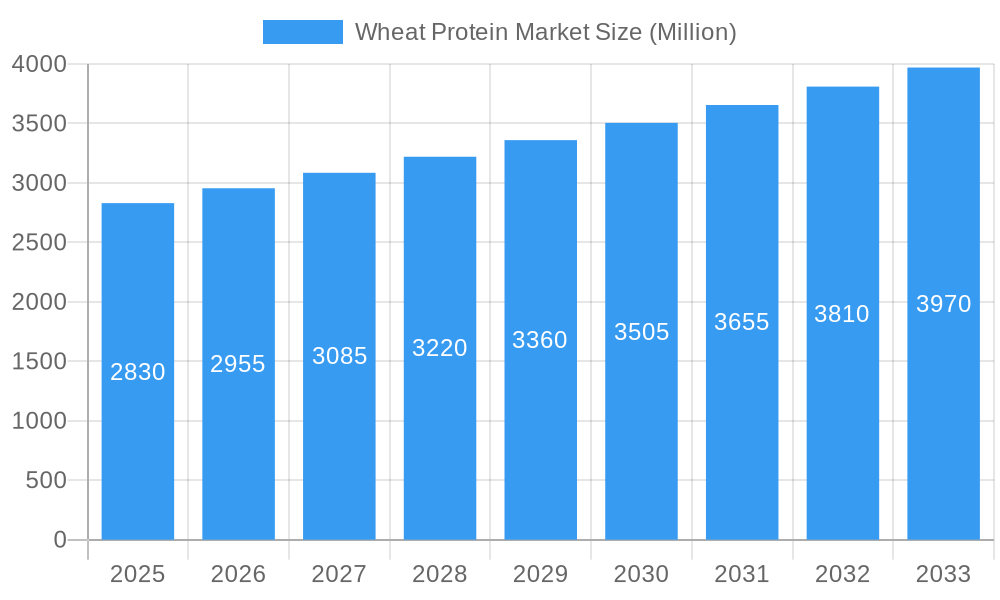

The global Wheat Protein Market is poised for robust growth, projected to reach a substantial market size from its current valuation. With an estimated Compound Annual Growth Rate (CAGR) of 4.45% from 2025 to 2033, this expansion is fueled by a confluence of evolving consumer preferences and technological advancements. The market's value, expressed in millions, is set to climb steadily as demand for plant-based protein alternatives intensifies across various industries. Key drivers include the increasing health consciousness among consumers, leading to a higher adoption of protein-rich diets, and the growing awareness of the environmental benefits associated with plant-based protein sources compared to animal proteins. Furthermore, the versatility of wheat protein, manifesting in forms like concentrate, isolate, and textured protein, allows for its integration into a wide array of products, from dairy and bakery goods to sports nutrition and animal feed, thereby broadening its market appeal and application scope.

Wheat Protein Market Market Size (In Billion)

The market's upward trajectory is also significantly influenced by emerging trends such as the focus on clean label products and the demand for non-GMO and allergen-friendly protein solutions, where wheat protein finds a strategic niche. Innovations in processing technologies are further enhancing the functionality and appeal of wheat protein ingredients, making them more competitive and suitable for diverse food formulations. Despite the promising outlook, certain restraints, such as potential supply chain volatilities and the perceived allergenicity of wheat for a segment of the population, warrant strategic mitigation. However, the sustained demand from the sports food sector, driven by athletes and fitness enthusiasts, and the expanding use in infant nutrition and meat alternatives, are expected to outweigh these challenges, ensuring a dynamic and expanding market landscape. Key players are actively investing in research and development to create novel applications and improve product quality, further stimulating market growth.

Wheat Protein Market Company Market Share

Here's the SEO-optimized and engaging report description for the Wheat Protein Market:

This comprehensive report delves into the dynamic wheat protein market, a rapidly expanding sector driven by burgeoning demand for plant-based proteins, health-conscious consumerism, and innovative food applications. We provide an in-depth analysis of market trends, growth drivers, challenges, and opportunities across the globe. The study covers the historical period of 2019–2024, with the base year and estimated year set at 2025, and offers a detailed forecast for 2025–2033. Explore the competitive landscape, key player strategies, and emerging segments that are shaping the future of the wheat protein industry.

Wheat Protein Market Market Dynamics & Concentration

The wheat protein market exhibits a moderate concentration, with key players like Cargill Incorporated, MGP, Manildra Group, Kröner Stärke, and Archer Daniels Midland Company holding significant market shares. Innovation is a primary driver, fueled by ongoing research and development in protein extraction techniques, functionality enhancement, and novel application development. Regulatory frameworks, particularly concerning food labeling, safety standards, and sustainability, are increasingly influencing market strategies. Product substitutes, such as soy protein and pea protein, present competitive pressures, necessitating continuous differentiation and value proposition enhancement for wheat protein products. End-user trends lean towards clean labels, non-GMO ingredients, and improved nutritional profiles. Merger and acquisition (M&A) activities have been observed, though at a moderate pace, with companies seeking to expand their product portfolios, geographical reach, and technological capabilities. A notable M&A deal count of xx contributed to market consolidation and strategic alignment over the historical period.

Wheat Protein Market Industry Trends & Analysis

The wheat protein market is poised for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of xx% projected during the forecast period. This growth is intrinsically linked to the accelerating global shift towards plant-based diets, driven by concerns surrounding health, environmental sustainability, and animal welfare. Consumers are actively seeking protein alternatives that are both nutritious and ethically sourced, making wheat protein a compelling choice. Technological advancements in processing are unlocking new functionalities for wheat proteins, allowing for their incorporation into a wider array of food and beverage products. This includes improved emulsification, water-holding capacity, and texturization, which are crucial for replicating traditional animal-based textures and mouthfeels. The rising awareness of the health benefits associated with protein intake, particularly among athletes and health-conscious individuals, is further stimulating demand for wheat protein isolates and concentrates in sports nutrition and dietary supplements. Market penetration is steadily increasing across various applications, from traditional bakery goods to dairy alternatives and meat substitutes. Competitive dynamics are characterized by a focus on product quality, price competitiveness, and innovation in developing specialized wheat protein ingredients tailored to specific application needs. The increasing demand for animal feed with enhanced protein content is also a substantial contributor to market growth, offering a cost-effective and sustainable protein source for livestock.

Leading Markets & Segments in Wheat Protein Market

North America currently stands as a leading market for wheat protein, driven by its well-established food processing industry and a strong consumer preference for plant-based alternatives. Within this region, the United States accounts for a substantial portion of the market share, influenced by extensive research and development activities and supportive government initiatives promoting healthy eating.

By Type:

- Wheat Protein Isolate is experiencing robust growth due to its high protein content (typically above 80%) and versatile application in specialized food products, particularly in nutritional supplements and sports food. Its purity and functionality make it ideal for formulations requiring precise protein levels.

- Wheat Concentrate holds a significant market share owing to its cost-effectiveness and broad applicability in bakery, dairy, and animal feed. Its ease of integration into existing product lines makes it a popular choice for manufacturers.

- Textured Wheat Protein is gaining traction as a meat analogue ingredient, catering to the growing demand for plant-based meat alternatives. Its fibrous texture closely mimics that of meat, making it a direct substitute in many culinary applications.

By Application:

- Bakery remains a cornerstone application, with wheat protein enhancing texture, shelf-life, and nutritional value in a wide range of baked goods.

- Sports Food is a rapidly expanding segment, driven by the demand for high-protein products to support muscle growth and recovery among athletes and fitness enthusiasts.

- Nutritional Supplements are a key growth area, with wheat protein isolates being formulated into powders, bars, and ready-to-drink beverages for convenient protein intake.

- Dairy applications are witnessing innovation with the development of plant-based dairy alternatives that utilize wheat protein for texture and nutritional fortification.

- Animal Feed represents a substantial market, as wheat protein offers an economical and sustainable protein source for livestock, poultry, and aquaculture.

- Confectionery and Others are emerging segments, showcasing the expanding versatility of wheat protein in diverse food formulations.

Wheat Protein Market Product Developments

Product innovations in the wheat protein market are centered on enhancing functionality, bioavailability, and sustainability. Manufacturers are developing novel wheat protein ingredients with improved solubility, emulsifying properties, and heat stability for wider food applications. New extraction technologies are yielding higher purity isolates and concentrates, while advancements in texturization are creating more realistic meat analogues. These developments cater to the growing consumer demand for plant-based foods that offer comparable taste, texture, and nutritional value to their animal-derived counterparts, providing significant competitive advantages.

Key Drivers of Wheat Protein Market Growth

The wheat protein market is propelled by several key drivers. The escalating global demand for plant-based proteins, fueled by health consciousness and environmental concerns, is a primary catalyst. Technological advancements in protein processing and extraction are enabling the creation of higher-quality and more functional wheat protein ingredients. The growing popularity of sports nutrition and dietary supplements, where wheat protein serves as a valuable protein source, further bolsters market expansion. Furthermore, supportive government policies promoting healthy eating and sustainable agriculture, along with innovations in the food industry leading to the development of new applications, are contributing significantly to the sustained growth of the wheat protein industry.

Challenges in the Wheat Protein Market Market

Despite its promising growth, the wheat protein market faces several challenges. Regulatory hurdles concerning novel food ingredients and labeling requirements can impede market entry and product development. Supply chain volatility, including fluctuations in wheat prices and availability, can impact production costs and profitability. Intense competition from other plant-based protein sources, such as soy and pea protein, necessitates continuous innovation and competitive pricing strategies. Consumer perception regarding allergens, though often overstated for wheat protein derivatives, can also present a barrier to adoption in certain demographics. Overcoming these challenges requires strategic sourcing, efficient processing, and clear communication of product benefits.

Emerging Opportunities in Wheat Protein Market

Emerging opportunities in the wheat protein market are abundant, driven by ongoing food innovation and evolving consumer preferences. The expanding market for plant-based meat alternatives presents a significant avenue for growth, with textured wheat protein offering a versatile and cost-effective ingredient. Strategic partnerships between wheat protein manufacturers and food product developers are crucial for co-creating novel applications and accelerating market penetration. Furthermore, advancements in biotechnology could lead to the development of wheat varieties with enhanced protein content and improved functional properties, creating new avenues for product differentiation and market expansion. The increasing focus on sustainable sourcing and circular economy principles also offers opportunities for companies to develop environmentally friendly wheat protein production processes.

Leading Players in the Wheat Protein Market Sector

- Cargill Incorporated

- MGP

- Manildra Group

- Kröner Stärke

- Archer Daniels Midland Company

- CropEnergies AG

- GLICO NUTRITION CO LT

- Roquette Frères

- Crespel & Deiters

- Tereos Syrol

Key Milestones in Wheat Protein Market Industry

- 2019: Increased investment in R&D for plant-based protein applications.

- 2020: Rising consumer interest in plant-based diets accelerates demand for wheat protein.

- 2021: Development of enhanced texturization techniques for wheat protein.

- 2022: Expansion of wheat protein use in dairy alternative products.

- 2023: Focus on sustainable sourcing and production of wheat protein ingredients.

- 2024: Introduction of new wheat protein isolates with superior functional properties.

- Base Year 2025: Expected market valuation of approximately $X.XX Billion.

- 2026: Anticipated growth in the animal feed segment utilizing wheat protein.

- 2028: Potential for new regulatory approvals for specific wheat protein applications.

- 2030: Significant market penetration in the global sports nutrition sector.

- 2032: Further innovation in allergen-friendly wheat protein derivatives.

- 2033: Projected market value of approximately $Y.YY Billion.

Strategic Outlook for Wheat Protein Market Market

The wheat protein market is on a trajectory of robust growth, fueled by persistent global trends towards plant-based diets and enhanced nutritional awareness. Strategic focus on product diversification, particularly in high-growth segments like sports nutrition and meat alternatives, will be crucial. Investing in advanced processing technologies to improve functionality and cost-effectiveness will provide a competitive edge. Furthermore, establishing strong partnerships across the value chain, from agriculture to food manufacturers, will facilitate innovation and market access. Companies that prioritize sustainability and transparent sourcing will likely resonate with environmentally conscious consumers, driving long-term market success. The outlook remains highly positive, with ample opportunities for expansion and innovation.

Wheat Protein Market Segmentation

-

1. Type

- 1.1. Wheat Concentrate

- 1.2. Wheat Protein Isolate

- 1.3. Textured Wheat Protein

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Sports Food

- 2.4. Confectionery

- 2.5. Nutritional Supplements

- 2.6. Animal Feed

- 2.7. Others

Wheat Protein Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Wheat Protein Market Regional Market Share

Geographic Coverage of Wheat Protein Market

Wheat Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Plant-Based Food and Beverages; Increasing Application of Plant Proteins in Animal Feed

- 3.3. Market Restrains

- 3.3.1. Higher Cost of Production of Plant Proteins

- 3.4. Market Trends

- 3.4.1. Growing Significance for Nutrition and Weight Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wheat Concentrate

- 5.1.2. Wheat Protein Isolate

- 5.1.3. Textured Wheat Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Sports Food

- 5.2.4. Confectionery

- 5.2.5. Nutritional Supplements

- 5.2.6. Animal Feed

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wheat Concentrate

- 6.1.2. Wheat Protein Isolate

- 6.1.3. Textured Wheat Protein

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy

- 6.2.2. Bakery

- 6.2.3. Sports Food

- 6.2.4. Confectionery

- 6.2.5. Nutritional Supplements

- 6.2.6. Animal Feed

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wheat Concentrate

- 7.1.2. Wheat Protein Isolate

- 7.1.3. Textured Wheat Protein

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy

- 7.2.2. Bakery

- 7.2.3. Sports Food

- 7.2.4. Confectionery

- 7.2.5. Nutritional Supplements

- 7.2.6. Animal Feed

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wheat Concentrate

- 8.1.2. Wheat Protein Isolate

- 8.1.3. Textured Wheat Protein

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy

- 8.2.2. Bakery

- 8.2.3. Sports Food

- 8.2.4. Confectionery

- 8.2.5. Nutritional Supplements

- 8.2.6. Animal Feed

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wheat Concentrate

- 9.1.2. Wheat Protein Isolate

- 9.1.3. Textured Wheat Protein

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy

- 9.2.2. Bakery

- 9.2.3. Sports Food

- 9.2.4. Confectionery

- 9.2.5. Nutritional Supplements

- 9.2.6. Animal Feed

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wheat Concentrate

- 10.1.2. Wheat Protein Isolate

- 10.1.3. Textured Wheat Protein

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy

- 10.2.2. Bakery

- 10.2.3. Sports Food

- 10.2.4. Confectionery

- 10.2.5. Nutritional Supplements

- 10.2.6. Animal Feed

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wheat Concentrate

- 11.1.2. Wheat Protein Isolate

- 11.1.3. Textured Wheat Protein

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dairy

- 11.2.2. Bakery

- 11.2.3. Sports Food

- 11.2.4. Confectionery

- 11.2.5. Nutritional Supplements

- 11.2.6. Animal Feed

- 11.2.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cargill Incorporated

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 MGP

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Manildra Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kroener Staerke

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Archer Daniels Midland Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CropEnergies AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GLICO NUTRITION CO LT

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Roquette Freres

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Crespel & Deiters

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tereos Syrol

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Wheat Protein Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Wheat Protein Market Revenue (Million), by Type 2025 & 2033

- Figure 33: South Africa Wheat Protein Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South Africa Wheat Protein Market Revenue (Million), by Application 2025 & 2033

- Figure 35: South Africa Wheat Protein Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: South Africa Wheat Protein Market Revenue (Million), by Country 2025 & 2033

- Figure 37: South Africa Wheat Protein Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Wheat Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Wheat Protein Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Wheat Protein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Wheat Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Wheat Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wheat Protein Market?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Wheat Protein Market?

Key companies in the market include Cargill Incorporated, MGP, Manildra Group, Kroener Staerke, Archer Daniels Midland Company, CropEnergies AG, GLICO NUTRITION CO LT, Roquette Freres, Crespel & Deiters, Tereos Syrol.

3. What are the main segments of the Wheat Protein Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plant-Based Food and Beverages; Increasing Application of Plant Proteins in Animal Feed.

6. What are the notable trends driving market growth?

Growing Significance for Nutrition and Weight Management.

7. Are there any restraints impacting market growth?

Higher Cost of Production of Plant Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wheat Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wheat Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wheat Protein Market?

To stay informed about further developments, trends, and reports in the Wheat Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence