Key Insights

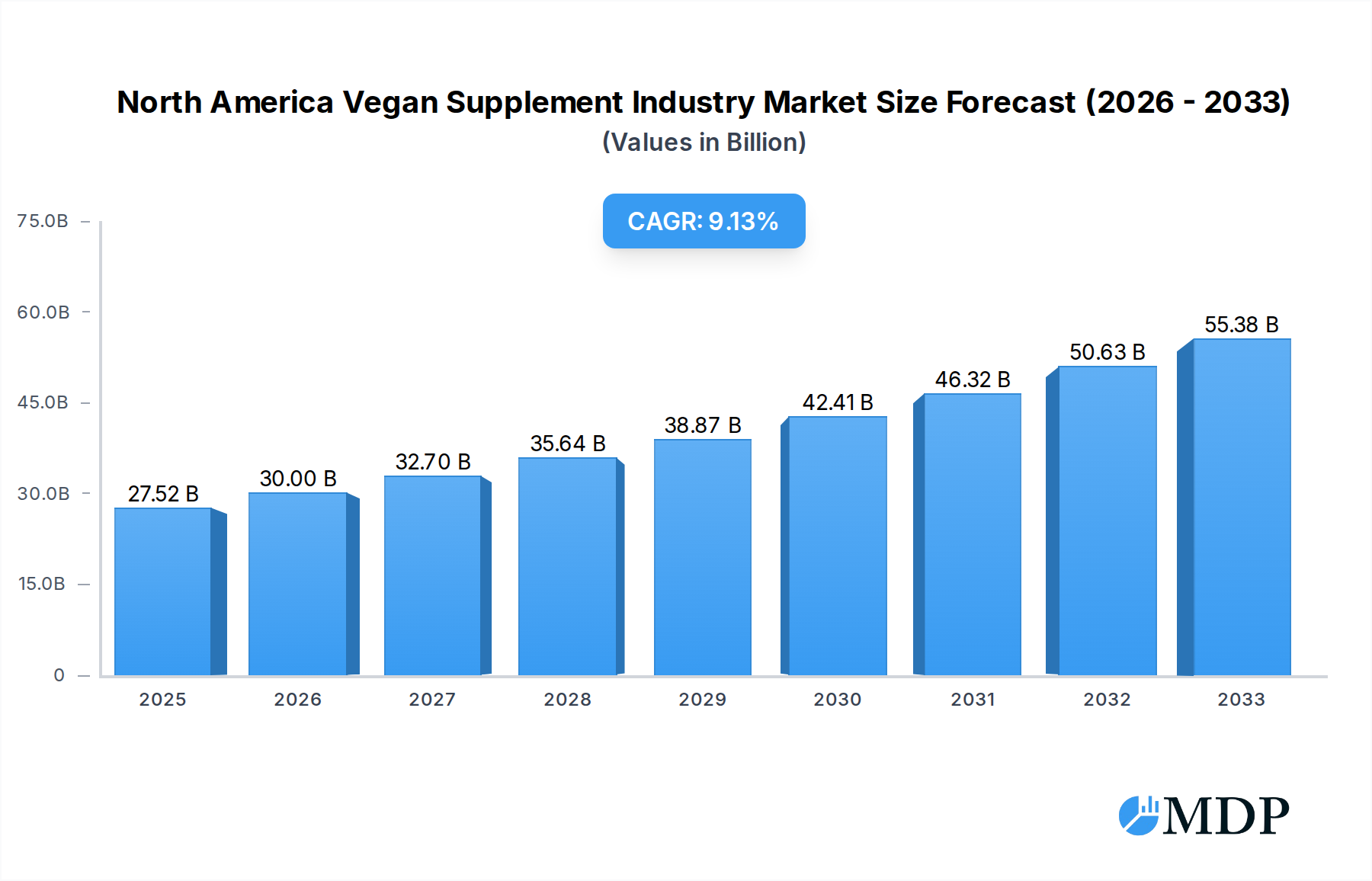

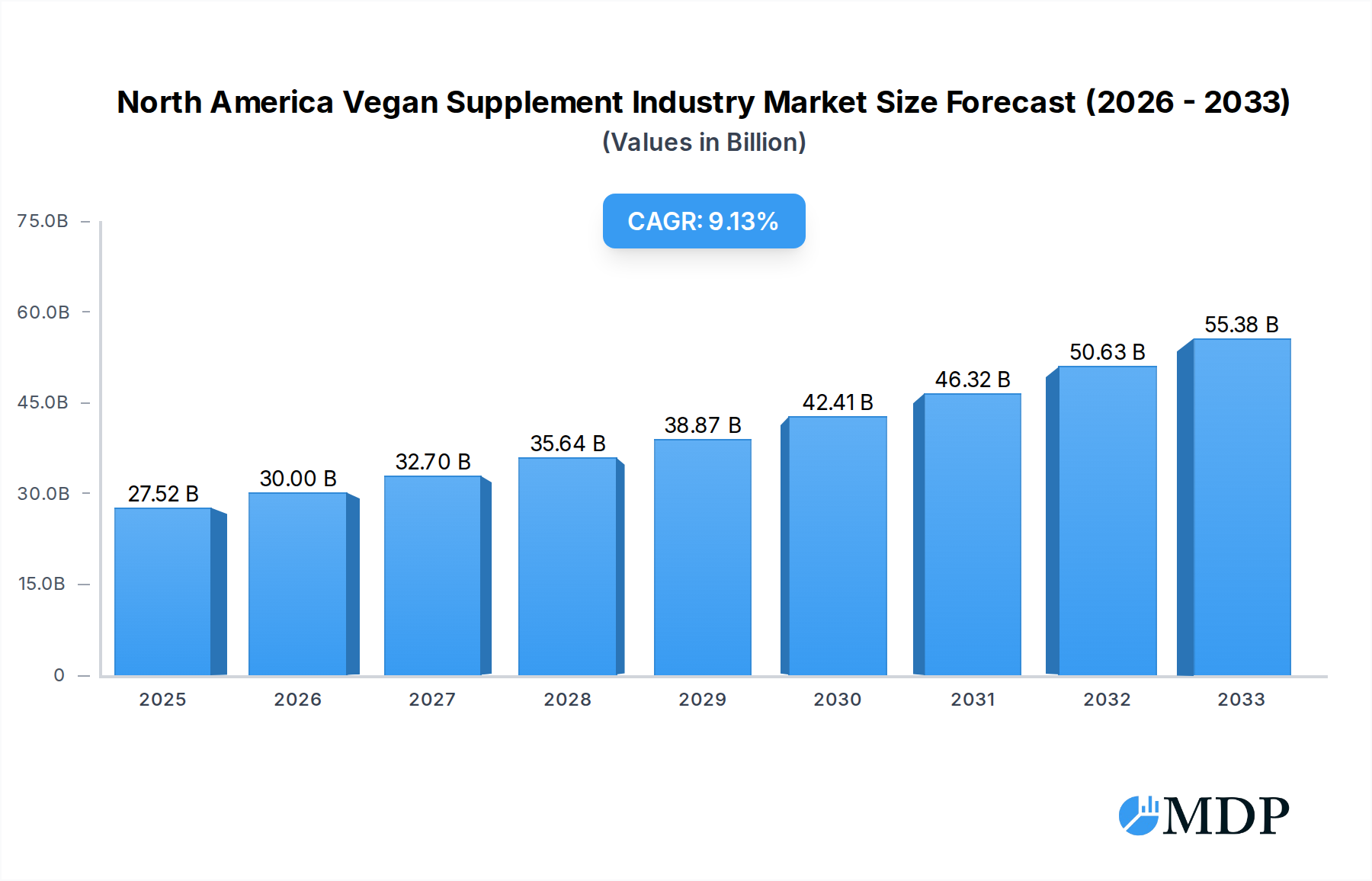

The North American vegan supplement market is poised for substantial growth, projected to reach $27.52 billion in 2025, driven by a confluence of rising health consciousness, increasing adoption of plant-based diets, and growing awareness of the environmental and ethical benefits of veganism. The market is expected to expand at a compound annual growth rate (CAGR) of 9% from 2025 through 2033, indicating a robust and sustained upward trajectory. Key growth drivers include the expanding vegan population across the United States, Canada, and Mexico, coupled with an elevated demand for specialized vegan formulations catering to specific nutritional needs, such as protein, vitamins, and omega-3 fatty acids. The increasing availability and accessibility of vegan supplements through diverse distribution channels, including pharmacies, supermarkets, and rapidly growing online platforms, further fuels market penetration. Emerging trends also point towards a greater emphasis on clean-label products with transparent sourcing and minimal artificial ingredients, aligning with the core values of vegan consumers.

North America Vegan Supplement Industry Market Size (In Billion)

The market's expansion, however, is not without its challenges. While the overall outlook is highly positive, potential restraints could include the perceived higher cost of some vegan supplements compared to their conventional counterparts, though this is being mitigated by increasing economies of scale and wider brand competition. Furthermore, ensuring consistent product quality and efficacy across a diverse range of vegan ingredients remains a continuous area of focus for manufacturers. The competitive landscape features established players like Nestlé S.A. and NOW Health Group Inc., alongside innovative startups focusing on specialized vegan nutrition. The segmentation by product type highlights the dominance of protein and vitamin supplements, while the burgeoning interest in omega supplements and other specialized vegan offerings underscores evolving consumer demands. The prevalence of online channels as a primary distribution route reflects the digital-native nature of a significant portion of the vegan consumer base.

North America Vegan Supplement Industry Company Market Share

Here is an SEO-optimized, engaging report description for the North America Vegan Supplement Industry, designed for maximum visibility and stakeholder attraction, with no need for further modification.

North America Vegan Supplement Industry: Market Dynamics, Trends, and Growth Opportunities 2025-2033

Unlock comprehensive insights into the burgeoning North America Vegan Supplement Industry with this in-depth market research report. Spanning the historical period of 2019–2024 and extending to a robust forecast period of 2025–2033, with 2025 as the base and estimated year, this report provides an unparalleled analysis of market dynamics, key trends, leading segments, and strategic opportunities. Essential for industry stakeholders including manufacturers, suppliers, investors, and health professionals, this report leverages high-traffic keywords such as "vegan supplements North America," "plant-based nutrition market," "sustainable supplements," "omega-3 vegan," "vegan protein powder," and "nutraceuticals market growth" to ensure maximum search visibility. Dive into detailed market segmentation by product type (Protein, Vitamins, Omega Supplements, Other Vegan Supplements) and distribution channel (Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Online Channels, Others, Convenience Food, Other Distribution Channels).

Explore critical industry developments, including the strategic importance of companies like Nestlé S.A., NOW Health Group Inc., Canopy Growth Corporation (Biosteel Sports Nutrition Inc.), Ora Organic, Wonder Laboratories, Future Kind, FORGE Supplements, Country Life LLC, Blueroot Health, Life Extension, and BrainMD Health. This report offers actionable intelligence on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities, alongside an analysis of CAGR and market penetration. Understand the economic policies, infrastructure, and consumer preferences shaping the market landscape.

Report Structure:

North America Vegan Supplement Industry Market Dynamics & Concentration

The North America Vegan Supplement Industry exhibits a dynamic and evolving market concentration, driven by a growing consumer demand for plant-based health solutions. Innovation is a key differentiator, with companies continuously introducing novel formulations and sustainable sourcing methods. Regulatory frameworks, while generally supportive of the health and wellness sector, present nuanced compliance requirements that manufacturers must navigate. Product substitutes, primarily conventional supplements derived from animal sources, are gradually losing ground to vegan alternatives as consumer awareness and ethical considerations rise. End-user trends are strongly influenced by health consciousness, environmental concerns, and a desire for transparency in ingredient sourcing. Mergers and acquisitions (M&A) activities are on the rise, as established players seek to expand their vegan portfolios and new entrants vie for market share. The M&A deal count is projected to increase by xx% over the forecast period, indicating a consolidating yet competitive landscape. Market share is increasingly fragmented, with a strong emphasis on niche brands carving out significant portions through specialized offerings and strong online presence. The industry is moving towards a more mature stage, necessitating strategic partnerships and R&D investments to maintain competitive advantage.

North America Vegan Supplement Industry Industry Trends & Analysis

The North America Vegan Supplement Industry is experiencing robust growth, fueled by a confluence of market growth drivers, technological disruptions, evolving consumer preferences, and intensifying competitive dynamics. The overall market size is projected to reach an estimated value exceeding \$75 billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This significant expansion is propelled by heightened consumer awareness regarding the health benefits of plant-based diets and the ethical and environmental implications of animal product consumption. Technological advancements in extraction and formulation processes are enabling the development of more bioavailable and effective vegan supplements, addressing historical limitations. Consumer preferences are shifting towards transparent ingredient sourcing, clean labels, and sustainable packaging, creating a demand for premium, science-backed vegan products. The competitive landscape is characterized by both established multinational corporations entering the vegan space and agile startups disrupting traditional markets. Market penetration for vegan supplements is steadily increasing across various demographics, especially among younger generations and health-conscious individuals. Innovations in areas like vegan omega-3 and plant-based protein alternatives are capturing significant market attention. The increasing availability of vegan options in mainstream retail channels further bolsters market accessibility and growth. The influence of social media and wellness influencers also plays a crucial role in shaping consumer perceptions and driving demand. The market's trajectory is further supported by an increasing number of dietary recommendations and endorsements for plant-based nutrition from health organizations and practitioners.

Leading Markets & Segments in North America Vegan Supplement Industry

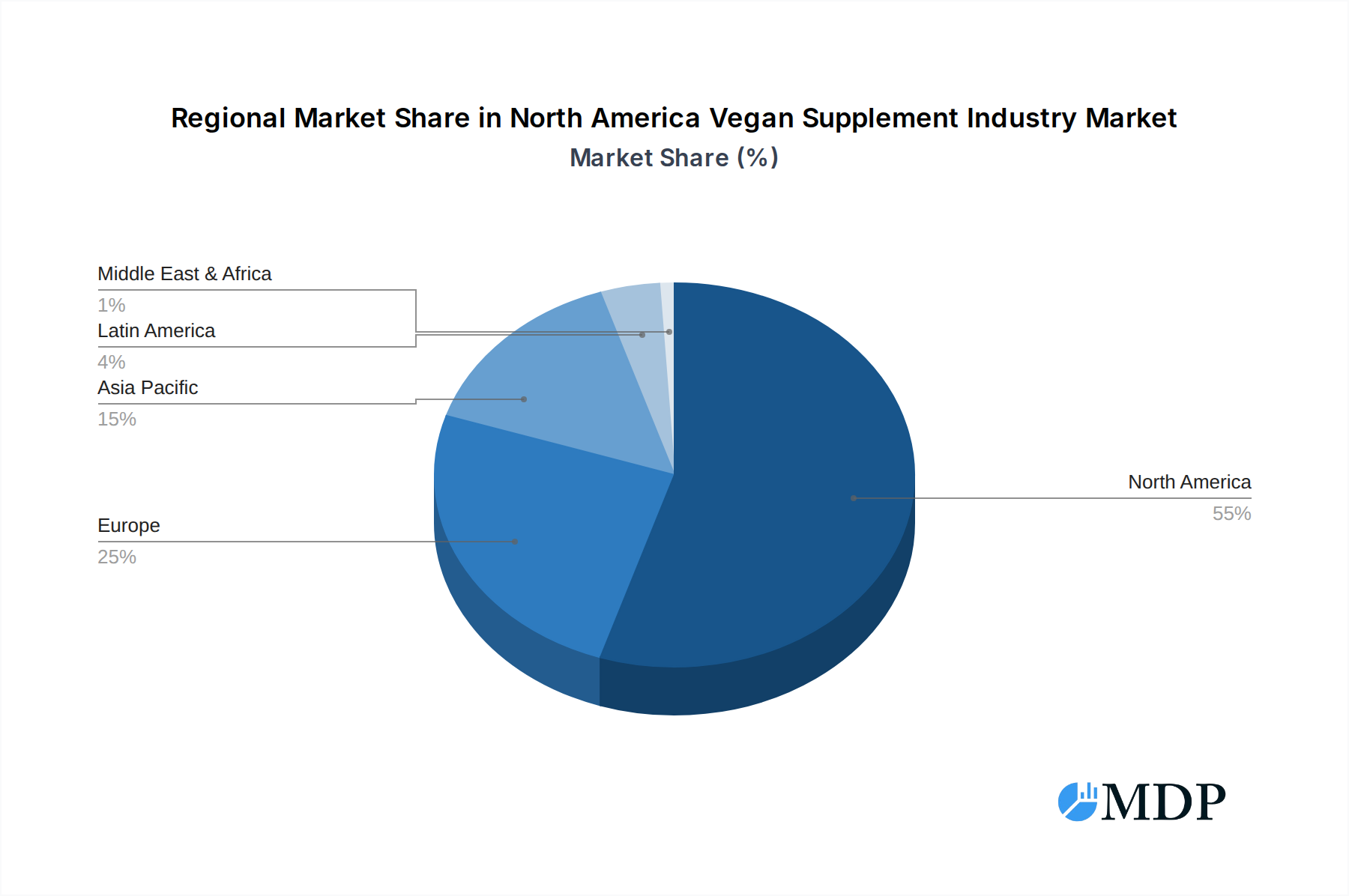

The North America Vegan Supplement Industry is dominated by the United States market, accounting for over 70% of the regional share. This dominance is attributed to a highly developed healthcare infrastructure, significant consumer spending on health and wellness products, and a strong advocacy for plant-based lifestyles.

Leading Segments by Type:

- Protein Supplements: This segment holds a substantial market share, driven by the popularity of vegan protein powders among athletes, fitness enthusiasts, and individuals seeking plant-based protein sources. Key drivers include the demand for muscle recovery, weight management, and the growing adoption of plant-based diets for general health.

- Vitamins: The vitamins segment is a cornerstone of the vegan supplement market.

- Drivers: Increasing awareness of nutrient deficiencies in plant-based diets (e.g., B12, Iron, Vitamin D), demand for immune support, and preventative healthcare practices.

- Dominance: Driven by the ease of formulation, wide range of applications, and widespread consumer understanding of vitamin benefits.

- Omega Supplements: This segment is experiencing rapid growth, particularly vegan omega-3 derived from algae.

- Drivers: Growing awareness of the benefits of EPA and DHA for cognitive function, heart health, and anti-inflammatory properties, coupled with concerns about mercury and contaminants in fish oil.

- Dominance: Algae-based omega-3s offer a sustainable and ethical alternative, appealing to environmentally conscious consumers.

- Other Vegan Supplements: This broad category encompasses a variety of products including herbal supplements, probiotics, digestive enzymes, and specialty formulations.

- Drivers: Niche market demands, personalized nutrition trends, and the increasing exploration of plant-based solutions for specific health concerns.

Leading Segments by Distribution Channel:

- Online Channels: This segment dominates the North American vegan supplement market, fueled by convenience, wider product selection, competitive pricing, and direct-to-consumer models.

- Drivers: E-commerce infrastructure development, digital marketing strategies, subscription services, and consumer preference for home delivery.

- Supermarkets & Hypermarkets: These channels are gaining traction as major retailers expand their health and wellness sections to include a broader array of vegan products.

- Drivers: Increased shelf space, accessibility for mass consumers, and the growing trend of 'one-stop shopping' for health-conscious individuals.

- Pharmacies & Drug Stores: These traditional channels play a crucial role, especially for consumers seeking scientifically validated and trusted supplement brands.

- Drivers: Prescription access to certain supplements, pharmacist recommendations, and consumer trust in established pharmacy brands.

- Others (including Convenience Food and Other Distribution Channels): This category represents emerging and niche distribution points, including health food stores, direct selling, and specialized vegan retailers.

North America Vegan Supplement Industry Product Developments

Product innovation in the North America vegan supplement industry is characterized by a strong focus on leveraging sustainable sourcing and advanced formulation to enhance efficacy and market appeal. Key developments include the introduction of novel vegan omega-3 supplements derived from marine algae, offering potent EPA/DHA benefits comparable to fish oil without the environmental impact or contaminants. Advancements in plant-based protein extraction are yielding powders with improved taste, texture, and amino acid profiles. The launch of plant-based multivitamins formulated to provide comprehensive nutritional support, often incorporating superfoods and digestive aids, is also a significant trend. These innovations aim to meet the growing consumer demand for clean-label, ethically produced, and highly effective vegan nutritional solutions, providing distinct competitive advantages in a rapidly expanding market.

Key Drivers of North America Vegan Supplement Industry Growth

Several key drivers are propelling the growth of the North America Vegan Supplement Industry. Technological advancements in sustainable ingredient sourcing and bioavailability enhancement are crucial. Economic factors, including rising disposable incomes and increased spending on health and wellness, further contribute. Growing consumer awareness regarding the health benefits of plant-based diets and the ethical/environmental concerns associated with animal products is a primary catalyst. Furthermore, favorable regulatory frameworks that support the nutraceutical industry and increasing endorsements from health professionals for plant-based nutrition are accelerating market expansion. The trend towards personalized nutrition also plays a significant role in driving demand for specialized vegan formulations.

Challenges in the North America Vegan Supplement Industry Market

Despite its robust growth, the North America Vegan Supplement Industry faces several challenges. Regulatory hurdles related to labeling, claims substantiation, and quality control can pose barriers to entry and market expansion. Supply chain complexities, particularly in sourcing consistent, high-quality vegan ingredients globally, can impact product availability and cost. Intense competitive pressure from both established players and emerging brands necessitates continuous innovation and effective marketing strategies. Consumer education gaps regarding the efficacy and specific benefits of certain vegan supplements can also limit market penetration in certain segments.

Emerging Opportunities in North America Vegan Supplement Industry

Emerging opportunities in the North America Vegan Supplement Industry are abundant, driven by technological breakthroughs and evolving consumer demands. The development of novel, plant-derived active ingredients with enhanced bioavailability and targeted health benefits represents a significant avenue for growth. Strategic partnerships between supplement manufacturers and food companies to integrate vegan supplements into everyday food products present a substantial market expansion strategy. Furthermore, the increasing global interest in plant-based nutrition opens doors for market expansion beyond North America, offering significant long-term growth potential for innovative companies. The demand for personalized vegan nutrition solutions, leveraging AI and genetic data, also presents a nascent yet promising opportunity.

Leading Players in the North America Vegan Supplement Industry Sector

- Nestlé S.A.

- NOW Health Group Inc.

- Canopy Growth Corporation (Biosteel Sports Nutrition Inc.)

- Ora Organic

- Wonder Laboratories

- Future Kind

- FORGE Supplements

- Country Life LLC

- Blueroot Health

- Life Extension

- BrainMD Health

Key Milestones in North America Vegan Supplement Industry Industry

- August 2022: BrainMD Health, a leader in premium-quality, science-based nutraceuticals, launched an EPA/DHA vegan omega-3 supplement. The product was made using sustainable and certified marine algae.

- April 2022: Blueroot Health brand Vital Nutrients launched Ultra Pure Vegan Omega SPM+, a vegan supplement made from algae. The company claims that this supplement can be a good alternative to fish oil omega-3 supplements.

- September 2021: Life Extension launched a new plant-based multivitamin. The company claims that the multivitamin is derived from sustainable sources and is equivalent to three servings of vegetables and two servings of fruits.

Strategic Outlook for North America Vegan Supplement Industry Market

The strategic outlook for the North America Vegan Supplement Industry remains exceptionally positive, driven by sustained consumer interest in health and wellness, ethical consumption, and environmental sustainability. Future growth will likely be accelerated by continued innovation in product development, focusing on enhanced bioavailability, novel plant-based ingredients, and targeted health solutions. Strategic partnerships and collaborations will be crucial for expanding market reach and product portfolios. The growing acceptance of vegan lifestyles across broader demographics presents a significant opportunity for market penetration into new consumer segments. Companies that prioritize transparency, sustainability, and scientific validation in their offerings will be best positioned for long-term success in this dynamic and rapidly evolving market.

North America Vegan Supplement Industry Segmentation

-

1. Type

- 1.1. Protein

- 1.2. Vitamins

- 1.3. Omega Supplements

- 1.4. Other Vegan Supplements

-

2. Distribution Channel

- 2.1. Pharmacies & Drug Stores

- 2.2. Supermarkets & Hypermarkets

- 2.3. Online Channels

- 2.4. Others

- 2.5. Convenience Food

- 2.6. Other Distribution Channels

North America Vegan Supplement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vegan Supplement Industry Regional Market Share

Geographic Coverage of North America Vegan Supplement Industry

North America Vegan Supplement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Veganism in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vegan Supplement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Protein

- 5.1.2. Vitamins

- 5.1.3. Omega Supplements

- 5.1.4. Other Vegan Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Pharmacies & Drug Stores

- 5.2.2. Supermarkets & Hypermarkets

- 5.2.3. Online Channels

- 5.2.4. Others

- 5.2.5. Convenience Food

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NOW Health Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Canopy Growth Corporation (Biosteel Sports Nutrition Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ora Organic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wonder Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Future Kind

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FORGE Supplements

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Country Life LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blueroot Health*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Life Extension

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BrainMD Health

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Nestlé S A

List of Figures

- Figure 1: North America Vegan Supplement Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Vegan Supplement Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Vegan Supplement Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Vegan Supplement Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Vegan Supplement Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Vegan Supplement Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Vegan Supplement Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Vegan Supplement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Vegan Supplement Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Vegan Supplement Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Vegan Supplement Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vegan Supplement Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the North America Vegan Supplement Industry?

Key companies in the market include Nestlé S A, NOW Health Group Inc, Canopy Growth Corporation (Biosteel Sports Nutrition Inc ), Ora Organic, Wonder Laboratories, Future Kind, FORGE Supplements, Country Life LLC, Blueroot Health*List Not Exhaustive, Life Extension, BrainMD Health.

3. What are the main segments of the North America Vegan Supplement Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Veganism in the Region.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: BrainMD Health, a leader in premium-quality, science-based nutraceuticals, launched an EPA/DHA vegan omega-3 supplement. The product was made using sustainable and certified marine algae.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vegan Supplement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vegan Supplement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vegan Supplement Industry?

To stay informed about further developments, trends, and reports in the North America Vegan Supplement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence