Key Insights

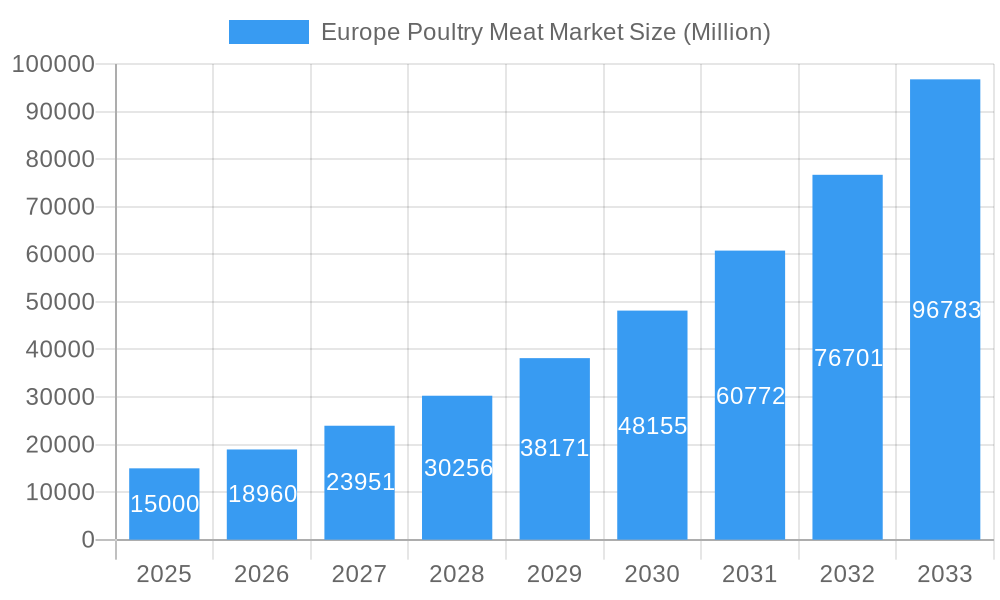

The European poultry meat market is projected for significant expansion, anticipated to reach 59.68 billion by 2032. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 1.07% from a base year of 2025. Key factors fueling this expansion include increasing consumer health consciousness, leading to higher demand for lean protein sources like poultry. Additionally, a growing emphasis on sustainable and ethically produced food aligns with poultry industry practices, bolstering consumer trust and market adoption. Evolving consumer preferences and innovative processed poultry products, particularly convenient ready-to-cook and value-added options, are also contributing to sustained market growth.

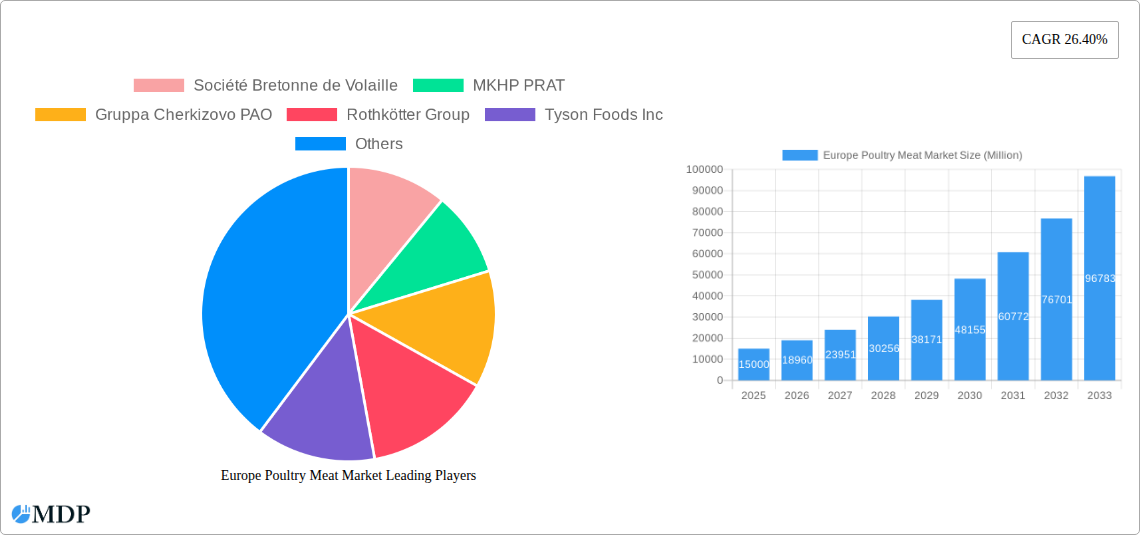

Europe Poultry Meat Market Market Size (In Billion)

While the outlook is positive, challenges such as rising feed and energy costs, influenced by global supply chain volatility, may impact production expenses and consumer pricing. Stringent EU regulations on animal welfare, food safety, and environmental sustainability require substantial investment, potentially posing a hurdle for smaller businesses. The market exhibits strong demand for both fresh/chilled and processed poultry products. Distribution channels are diversifying, with off-trade channels, including online platforms and supermarkets, showing significant growth alongside the traditional on-trade sector. Leading companies are focusing on innovation and product portfolio expansion to capitalize on evolving market dynamics and capture growth in key European regions.

Europe Poultry Meat Market Company Market Share

Europe Poultry Meat Market Analysis: Size, Trends, and Forecast (2025-2033)

Gain a comprehensive understanding of the European poultry meat market with this detailed report, offering strategic insights for industry stakeholders. This analysis, with a base year of 2025, examines market dynamics, key trends, product innovations, growth drivers, challenges, and emerging opportunities through 2033. Identify leading players and pivotal industry developments to secure a competitive advantage.

Europe Poultry Meat Market Market Dynamics & Concentration

The Europe poultry meat market exhibits a moderate to high concentration, with a few dominant players holding significant market share, estimated to be around 65% of the total market value. Innovation is a key differentiator, driven by increasing demand for convenience, health-conscious options, and sustainable production methods. Regulatory frameworks, particularly concerning animal welfare, food safety (e.g., HACCP implementation), and labeling, play a crucial role in shaping market practices. Product substitutes, including other meat types like pork and beef, as well as plant-based protein alternatives, present a growing challenge. End-user trends reveal a strong preference for fresh/chilled and processed poultry products, fueled by busy lifestyles and evolving culinary preferences. Mergers and acquisitions (M&A) are active, with an estimated 10-15 significant M&A deals occurring annually between 2019 and 2024, consolidating market power and expanding product portfolios. Key M&A activities focus on acquiring smaller producers, enhancing distribution networks, and integrating processing capabilities to meet diverse consumer demands.

Europe Poultry Meat Market Industry Trends & Analysis

The Europe poultry meat market is poised for significant expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. This growth is propelled by several interconnected trends. Increasing consumer awareness regarding the health benefits of lean protein, coupled with a preference for poultry over red meat due to perceived lower fat content and higher nutritional value, is a primary market driver. The rising disposable incomes across various European nations further bolster demand, enabling consumers to opt for higher-quality and value-added poultry products. Technological advancements in farming, processing, and packaging are revolutionizing the industry. Innovations in automated processing lines, advanced chilling and freezing technologies, and sustainable feed formulations are enhancing efficiency, reducing waste, and improving product quality and shelf life. Furthermore, the growing popularity of e-commerce and online grocery platforms has opened new avenues for poultry product distribution, contributing to increased market penetration. Consumer preferences are shifting towards convenience, with a rising demand for pre-marinated, ready-to-cook, and fully cooked poultry products, including deli meats, sausages, and nuggets. The emphasis on traceability and ethical sourcing is also gaining traction, with consumers actively seeking products that align with their values regarding animal welfare and environmental sustainability. Competitive dynamics are intensifying, with established players investing in product differentiation, branding, and expanding their product ranges to cater to niche markets and specific dietary requirements, such as halal and organic poultry. The market penetration of processed poultry products, in particular, has seen a substantial increase, reflecting the evolving lifestyles and eating habits of European consumers.

Leading Markets & Segments in Europe Poultry Meat Market

The Fresh / Chilled segment consistently dominates the Europe poultry meat market, accounting for an estimated 55% of the total market value. Within this segment, Supermarkets and Hypermarkets are the leading distribution channels, capturing approximately 60% of off-trade sales. Germany, France, and the United Kingdom emerge as the leading national markets, driven by robust economies, established food retail infrastructure, and high per capita poultry consumption.

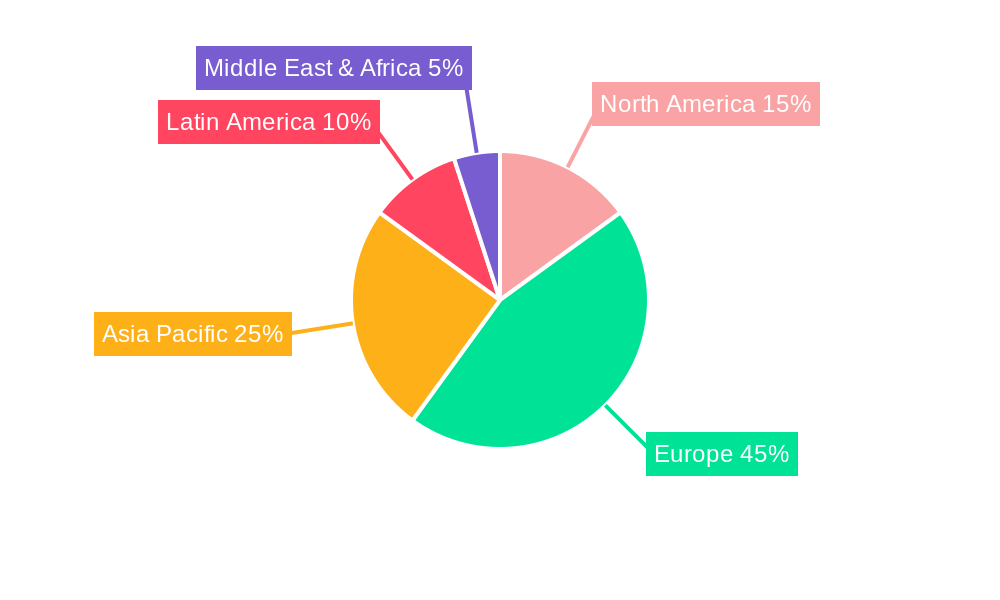

- Dominant Region: Western Europe remains the powerhouse of the European poultry meat market, characterized by high consumer spending power and sophisticated retail networks.

- Dominant Country: Germany leads the market, owing to its large population, strong agricultural base, and widespread acceptance of poultry as a staple protein.

- Dominant Segment (Form):

- Fresh / Chilled: Valued at over 25,000 Million Euros, this segment's dominance is attributed to its versatility in cooking and preference for perceived freshness. Key drivers include:

- High consumer trust in fresh products.

- Widespread availability in all retail channels.

- Adaptability to various culinary preparations.

- Fresh / Chilled: Valued at over 25,000 Million Euros, this segment's dominance is attributed to its versatility in cooking and preference for perceived freshness. Key drivers include:

- Dominant Segment (Distribution Channel):

- Off-Trade (Supermarkets and Hypermarkets): Representing a market share of over 20,000 Million Euros in off-trade sales, these channels offer convenience and a wide product selection. Key drivers include:

- Extensive store networks reaching a broad consumer base.

- Competitive pricing strategies.

- Effective in-store marketing and promotions.

- Processed Poultry: This segment, valued at over 18,000 Million Euros, is witnessing rapid growth, particularly in categories like Deli Meats and Sausages. Key drivers include:

- Increasing demand for convenience and ready-to-eat options.

- Product innovation with diverse flavors and culinary applications.

- Growing popularity for snacking and on-the-go consumption.

- Off-Trade (Supermarkets and Hypermarkets): Representing a market share of over 20,000 Million Euros in off-trade sales, these channels offer convenience and a wide product selection. Key drivers include:

Europe Poultry Meat Market Product Developments

Product development in the Europe poultry meat market is increasingly focused on health, convenience, and sustainability. Innovations include the introduction of premium quality, free-range, and organic poultry options, catering to the growing segment of health-conscious consumers. Value-added products such as marinated skewers, ready-to-cook meal kits, and plant-based poultry alternatives are gaining traction. Technological advancements in processing are enabling the creation of enhanced textures and flavors in processed poultry products like sausages and deli meats. Furthermore, eco-friendly packaging solutions and transparent sourcing information are becoming crucial competitive advantages, aligning with consumer demand for ethical and environmentally responsible products. The market is witnessing a surge in specialized offerings, such as reduced-sodium or low-fat processed poultry, further diversifying the product landscape.

Key Drivers of Europe Poultry Meat Market Growth

The Europe poultry meat market's growth is primarily driven by the increasing global demand for protein, with poultry being a preferred choice due to its perceived health benefits and cost-effectiveness compared to other meat sources. Growing disposable incomes across European nations enhance consumers' purchasing power, leading to higher consumption of poultry products. Technological advancements in poultry farming, processing, and supply chain management are improving efficiency, reducing production costs, and ensuring higher product quality and safety standards. The expanding middle class and evolving dietary habits, favoring leaner protein sources, also contribute significantly to market expansion. Furthermore, supportive government policies promoting domestic poultry production and trade liberalization initiatives facilitate market growth.

Challenges in the Europe Poultry Meat Market Market

Despite robust growth, the Europe poultry meat market faces several challenges. Stringent animal welfare regulations and environmental concerns necessitate significant investments in sustainable farming practices, potentially increasing production costs. Outbreaks of avian influenza and other diseases pose a constant threat to supply chains and consumer confidence, leading to potential trade restrictions and market volatility. Intense competition from domestic producers, as well as imports from other regions, exerts downward pressure on prices. Shifting consumer preferences towards plant-based protein alternatives, driven by environmental and ethical concerns, present a growing challenge to traditional meat consumption. Supply chain disruptions, geopolitical instability, and fluctuating feed costs also impact profitability and market stability.

Emerging Opportunities in Europe Poultry Meat Market

Emerging opportunities in the Europe poultry meat market lie in the growing demand for sustainably produced and ethically sourced poultry. Investments in advanced farming technologies, such as precision agriculture and alternative feed sources, can enhance efficiency and reduce environmental impact. The expansion of the halal and kosher poultry segments, driven by diverse consumer demographics, presents significant growth potential. Furthermore, the increasing popularity of ready-to-cook and value-added poultry products, catering to convenience-seeking consumers, opens avenues for product innovation and market penetration. Strategic partnerships with food service providers and retailers to develop specialized product lines and distribution strategies can also unlock new market segments.

Leading Players in the Europe Poultry Meat Market Sector

- Société Bretonne de Volaille

- MKHP PRAT

- Gruppa Cherkizovo PAO

- Rothkötter Group

- Tyson Foods Inc

- Lambert Dodard Chancereul (LDC) Group

- PHW Group

- Veronesi Holding S p A

- Plukon Food Group

- Cargill Inc

- 2 Sisters Food Group

- JBS SA

Key Milestones in Europe Poultry Meat Market Industry

- August 2023: Cherkizovo Group expanded their line of products under the brands of Cherkizovo and Cherkizovo Premium by adding over 200 products including cooked and smoked sausages, dry sausages and a variety of deli meats. This significantly broadened their processed meat offerings, catering to diverse consumer preferences.

- June 2023: Cherkizovo group announced the partnership with Gastreet festival in Sochi for the third consecutive time, and they presented dishes prepared by the company's chefs in the festival. This collaboration enhanced brand visibility and consumer engagement within the food industry.

- April 2023: Cherkizovo Group expanded their range of halal products under Latifa brand. Apart from chicken, it now includes turkey meat produced on the Company’s own farms. The launch of new products is driven by the growing demand for halal meat among both Muslim and non-Muslim people in Russia. This strategic move capitalized on the increasing demand for religiously certified food products.

Strategic Outlook for Europe Poultry Meat Market Market

The strategic outlook for the Europe poultry meat market is overwhelmingly positive, driven by sustained consumer demand for protein and ongoing innovation. Key growth accelerators include the continued expansion of value-added and convenience poultry products, particularly in the processed meat segment. Investments in sustainable and ethical farming practices will be paramount for long-term success and consumer trust. The increasing adoption of e-commerce and direct-to-consumer models offers new avenues for market reach and customer engagement. Furthermore, strategic collaborations and potential consolidation through M&A activities will shape the competitive landscape, enabling companies to enhance their product portfolios and expand their geographical presence. The focus on health and wellness trends, alongside a growing demand for transparency in food production, will continue to guide product development and marketing strategies.

Europe Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Poultry Meat Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Poultry Meat Market Regional Market Share

Geographic Coverage of Europe Poultry Meat Market

Europe Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Rising consumption of poultry meat boosting the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Poultry Meat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Société Bretonne de Volaille

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MKHP PRAT

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gruppa Cherkizovo PAO

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rothkötter Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tyson Foods Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lambert Dodard Chancereul (LDC) Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PHW Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Veronesi Holding S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plukon Food Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cargill Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 2 Sisters Food Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 JBS SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Société Bretonne de Volaille

List of Figures

- Figure 1: Europe Poultry Meat Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Poultry Meat Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Poultry Meat Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Europe Poultry Meat Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Poultry Meat Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Poultry Meat Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: Europe Poultry Meat Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Poultry Meat Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Poultry Meat Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Poultry Meat Market?

The projected CAGR is approximately 1.07%.

2. Which companies are prominent players in the Europe Poultry Meat Market?

Key companies in the market include Société Bretonne de Volaille, MKHP PRAT, Gruppa Cherkizovo PAO, Rothkötter Group, Tyson Foods Inc, Lambert Dodard Chancereul (LDC) Group, PHW Group, Veronesi Holding S p A, Plukon Food Group, Cargill Inc, 2 Sisters Food Group, JBS SA.

3. What are the main segments of the Europe Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Rising consumption of poultry meat boosting the market growth.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

August 2023: Cherkizovo Group expanded their line of products under the brands of Cherkizovo and Cherkizovo Premium by adding over 200 products including cooked and smoked sausages, dry sausages and a variety of deli meats.June 2023: Cherkizovo group announced the partnership with Gastreet festival in Sochi for the third consecutive time, and they presented dishes prepared by the company's chefs in the festival.April 2023: Cherkizovo Group expanded their range of halal products under Latifa brand. Apart from chicken, it now includes turkey meat produced on the Company’s own farms. The launch of new products is driven by the growing demand for halal meat among both Muslim and non-Muslim people in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Europe Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence