Key Insights

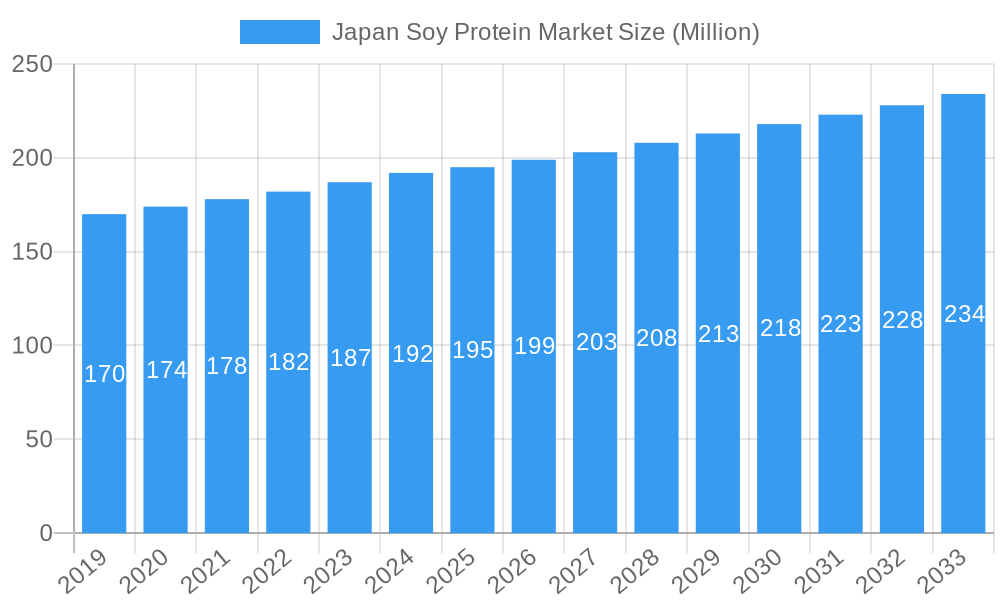

The Japan Soy Protein Market is poised for steady growth, projected to reach approximately USD 195 million by 2025. This expansion is driven by a confluence of factors, including the increasing consumer preference for plant-based protein alternatives, growing health consciousness, and the versatile applications of soy protein across various food and beverage segments. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 2.66% from 2025 to 2033, indicating a sustained upward trajectory. Key growth drivers include the rising demand for high-quality protein in animal feed to enhance livestock health and productivity, and the burgeoning personal care and cosmetics industry's adoption of soy-derived ingredients for their beneficial properties. Furthermore, the food and beverage sector, particularly in segments like bakery, dairy alternatives, and snacks, continues to be a significant contributor, as manufacturers leverage soy protein to meet the demand for healthier and more sustainable product options.

Japan Soy Protein Market Market Size (In Million)

The market's segmentation reflects its broad applicability. In terms of form, concentrates, hydrolyzed soy protein, and isolates all play crucial roles, catering to specific product formulations and functional requirements. The end-user landscape is diverse, encompassing animal feed, personal care and cosmetics, and a wide array of food and beverage categories, including bakery, breakfast cereals, condiments and sauces, dairy and dairy alternative products, ready-to-eat/ready-to-cook food products, and snacks. The supplements segment, particularly baby food and infant formula, elderly nutrition and medical nutrition, and sports/performance nutrition, also presents substantial growth opportunities. While the provided data focuses on Japan, the global trends of increasing plant-based consumption and demand for functional ingredients suggest a robust future for the soy protein market in the region, supported by technological advancements in processing and product innovation from leading companies such as Mitsubishi Chemical Corporation, DuPont de Nemours Inc, and Archer Daniels Midland Company.

Japan Soy Protein Market Company Market Share

Japan Soy Protein Market: Growth, Trends, and Strategic Insights 2019-2033

Dive deep into the burgeoning Japan soy protein market with this comprehensive, SEO-optimized report. Uncover critical insights into market dynamics, industry trends, leading segments, and future outlooks from 2019 to 2033. This report is designed for industry stakeholders, including manufacturers, suppliers, investors, and researchers, seeking to capitalize on the expanding opportunities in the Japanese plant-based protein sector. Explore the latest soy protein concentrate, hydrolyzed soy protein, and soy protein isolate innovations, alongside their diverse applications in food and beverages, supplements, animal feed, and personal care.

Japan Soy Protein Market Market Dynamics & Concentration

The Japan soy protein market is characterized by a moderate to high concentration, with a few key global players dominating the landscape alongside emerging domestic innovators. Major companies like Mitsubishi Chemical Corporation, DuPont de Nemours Inc., Archer Daniels Midland Company, Bunge Limited, Fuji Oil Group, Cargill Inc., CHS Inc., Kerry Group PLC, A Costantino & C SpA, and Royal DSM hold significant market shares. Innovation is a primary driver, fueled by intense research and development in protein extraction, processing, and functional ingredient development. The increasing consumer demand for plant-based foods, health and wellness products, and sustainable protein sources compels companies to invest in novel technologies and product formulations. Regulatory frameworks in Japan, particularly concerning food safety, labeling, and health claims, play a crucial role in shaping market access and product development strategies. However, the market also faces challenges from product substitutes, including other plant proteins like pea and rice protein, and to a lesser extent, animal-derived proteins. End-user trends, such as the growing preference for non-GMO and clean-label products, are also influencing product innovation and sourcing strategies. Mergers, acquisitions, and strategic partnerships are key to maintaining competitive advantage and expanding market reach. For instance, the merger of DuPont's Nutrition Business with International Flavors & Fragrances (IFF) in February 2021, creating a USD 11 billion entity, highlights the trend of consolidation. The number of M&A deals in this specific market is projected to increase as companies seek to strengthen their portfolios and gain access to new technologies and customer bases.

Japan Soy Protein Market Industry Trends & Analysis

The Japan soy protein market is experiencing robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and supportive industry trends. The projected Compound Annual Growth Rate (CAGR) for this market is expected to be significant over the forecast period, reflecting its increasing penetration across various consumer segments. A primary growth driver is the escalating consumer demand for plant-based protein alternatives in Japan. This surge is propelled by a growing awareness of health benefits associated with soy protein, including its role in muscle building, satiety, and cardiovascular health, as well as a heightened concern for environmental sustainability and ethical considerations related to animal agriculture. This shift in consumer mindset is evident across a wide spectrum of food and beverage applications, from bakery and breakfast cereals to dairy and dairy alternative products, RTE/RTC food products, and snacks.

Technological disruptions are playing a pivotal role in enhancing the functionality and appeal of soy protein ingredients. Innovations in processing techniques, such as advanced isolation and hydrolysis methods, are yielding soy protein products with improved solubility, emulsification, and texturization properties. These advancements are crucial for overcoming traditional limitations and enabling wider adoption in diverse food formulations, including condiments and sauces. Furthermore, the development of highly pure soy protein isolates with neutral flavors and improved digestibility is catering to the premium segment of the market.

Consumer preferences are increasingly leaning towards clean-label, non-GMO, and allergen-conscious products. This trend necessitates manufacturers to focus on sourcing high-quality, traceable soy ingredients and transparently communicating their product attributes. The demand for fortified foods and functional ingredients is also on the rise, with soy protein being incorporated into products targeting specific nutritional needs, such as baby food and infant formula, elderly nutrition and medical nutrition, and sport/performance nutrition supplements. The competitive dynamics within the Japan soy protein market are intense, with both established global players and agile domestic companies vying for market share. Strategic collaborations, mergers, and acquisitions are prevalent as companies aim to consolidate their positions, expand their product portfolios, and enhance their research and development capabilities. The market penetration of soy protein is expected to deepen as its versatility and benefits become more widely recognized and as product innovation continues to address specific consumer demands and application challenges.

Leading Markets & Segments in Japan Soy Protein Market

The Japan soy protein market is segmented across various forms and end-user industries, each exhibiting distinct growth trajectories and market dominance.

Dominant Segments by Form:

- Soy Protein Isolates: This segment is projected to hold a significant market share due to its high protein content (typically 90% or more) and neutral flavor profile. Its excellent functional properties, including emulsification and binding, make it a preferred ingredient in a wide array of food and beverage applications, particularly in premium products and specialized nutritional supplements.

- Key Drivers: High protein concentration, minimal carbohydrates and fats, versatile functionality in food processing, and suitability for low-carbohydrate and high-protein diets.

- Soy Protein Concentrates: This form, offering a protein content of around 70-80%, remains a strong contender, particularly in applications where cost-effectiveness is a primary consideration. Its widespread use in animal feed and as a functional ingredient in processed foods contributes to its steady demand.

- Key Drivers: Cost-effectiveness, good emulsifying and texturizing properties, and broad applicability in processed foods and animal nutrition.

- Hydrolyzed Soy Proteins: While a smaller segment, hydrolyzed soy proteins are gaining traction due to their enhanced digestibility and solubility. This makes them suitable for specialized nutritional products, including infant formulas and medical foods, where ease of absorption is critical.

- Key Drivers: Improved digestibility and solubility, suitability for sensitive populations, and applications in specialized nutrition.

Dominant Segments by End-User:

Food and Beverages: This is the largest and most dynamic segment, encompassing a broad range of sub-categories.

- Dairy and Dairy Alternative Products: The booming market for plant-based milk, yogurt, and cheese alternatives is a major growth catalyst for soy protein. Its ability to mimic the texture and protein content of dairy products is invaluable.

- Key Drivers: Rising veganism and lactose intolerance, consumer preference for sustainable options, and demand for plant-based protein fortification.

- Bakery and Breakfast Cereals: Soy protein is incorporated to enhance the nutritional profile, improve texture, and extend shelf life in these staple food items.

- Key Drivers: Growing demand for fortified cereals and healthy baked goods, and interest in plant-based protein enrichment.

- Snacks: The demand for protein-rich and convenient snack options is driving the inclusion of soy protein in bars, crisps, and other savory and sweet snacks.

- Key Drivers: Consumer demand for convenient, healthy, and protein-fortified snacks.

- RTE/RTC Food Products: Ready-to-eat and ready-to-cook meals benefit from soy protein's texturizing and binding capabilities, contributing to improved mouthfeel and ingredient stability.

- Key Drivers: Busy lifestyles and demand for convenient meal solutions with enhanced nutritional value.

- Condiments/Sauces: Soy protein can be used as a texturizer or thickener in various sauces and condiments.

- Key Drivers: Innovation in sauce formulations and demand for plant-based ingredients.

- Dairy and Dairy Alternative Products: The booming market for plant-based milk, yogurt, and cheese alternatives is a major growth catalyst for soy protein. Its ability to mimic the texture and protein content of dairy products is invaluable.

Supplements: This segment is a significant contributor to the growth of the Japan soy protein market, driven by increasing health consciousness and demand for targeted nutritional solutions.

- Sport/Performance Nutrition: Soy protein is a popular choice for athletes and fitness enthusiasts due to its role in muscle repair and growth.

- Key Drivers: Growing fitness culture, demand for plant-based protein for muscle building, and post-workout recovery.

- Baby Food and Infant Formula: The use of soy-based formulas as an alternative to dairy-based options for infants with allergies or dietary restrictions fuels demand.

- Key Drivers: Prevalence of infant allergies, parental demand for dairy-free alternatives, and scientific validation of soy protein safety.

- Elderly Nutrition and Medical Nutrition: Soy protein's digestibility and potential health benefits make it valuable in formulations for the elderly and individuals with specific medical needs.

- Key Drivers: Aging population, increased awareness of protein's importance in geriatric health, and use in specialized therapeutic diets.

- Sport/Performance Nutrition: Soy protein is a popular choice for athletes and fitness enthusiasts due to its role in muscle repair and growth.

Animal Feed: While not as high-growth as food and supplements, the animal feed sector remains a substantial market for soy protein concentrates, valued for their nutritional content and cost-effectiveness.

- Key Drivers: Demand for affordable and nutrient-rich animal feed ingredients.

Personal Care and Cosmetics: Emerging applications in skincare and haircare products, leveraging soy protein's moisturizing and conditioning properties, are contributing to incremental growth in this segment.

- Key Drivers: Consumer preference for natural and plant-derived ingredients in personal care products.

Japan Soy Protein Market Product Developments

Product innovation in the Japan soy protein market is actively driven by advancements in extraction and processing technologies, aiming to enhance functionality and broaden applications. Manufacturers are focusing on developing highly purified soy protein isolates with superior solubility, emulsification, and texturization properties, catering to the premium food and supplement sectors. Emphasis is also placed on creating clean-label, non-GMO, and allergen-free soy protein ingredients to meet evolving consumer demands for healthier and more transparent products. Furthermore, the development of hydrolyzed soy proteins with improved digestibility and neutral taste profiles is expanding their utility in infant nutrition and medical foods. These product developments are crucial for enabling soy protein’s successful integration into diverse formulations, from plant-based dairy alternatives and meat substitutes to advanced sports nutrition products and specialized dietary supplements, thereby strengthening its competitive advantage against other protein sources.

Key Drivers of Japan Soy Protein Market Growth

The growth of the Japan soy protein market is underpinned by several key factors. Firstly, a significant surge in consumer preference for plant-based diets and alternative proteins is a primary accelerator, driven by health consciousness, environmental concerns, and ethical considerations. Secondly, technological advancements in processing, such as improved isolation and hydrolysis techniques, are enhancing the functionality, taste, and digestibility of soy protein, making it more versatile and appealing for a wider range of food and beverage applications and supplements. Thirdly, the increasing awareness of the health benefits associated with soy protein, including its role in muscle development and cardiovascular health, is boosting its demand in the sport/performance nutrition and general wellness sectors. Lastly, supportive government initiatives promoting healthier eating habits and sustainable food production, coupled with a growing demand for fortified and functional foods, are further propelling market expansion.

Challenges in the Japan Soy Protein Market Market

Despite its strong growth trajectory, the Japan soy protein market faces several challenges. A significant barrier is the perception of soy as a common allergen, which can limit its adoption among a segment of consumers. Competition from other plant-based protein sources like pea, rice, and fava bean protein, which are often perceived as novel or hypoallergenic, also presents a competitive pressure. Price volatility of raw soybeans due to agricultural factors and global supply chain dynamics can impact production costs and, consequently, the market price of soy protein ingredients. Furthermore, consumer skepticism regarding the taste and texture of some soy protein-based products, particularly in meat alternatives, continues to be a challenge that requires ongoing product innovation and reformulation. Regulatory complexities regarding labeling, health claims, and the approval of new food ingredients can also pose hurdles for market entry and product development.

Emerging Opportunities in Japan Soy Protein Market

The Japan soy protein market is ripe with emerging opportunities driven by continuous innovation and evolving consumer landscapes. The growing demand for high-quality plant-based meat alternatives presents a significant avenue for growth, with soy protein being a key ingredient in achieving desired textures and protein profiles. Furthermore, the expanding functional foods and beverages sector, particularly those targeting specific health benefits like bone health, cognitive function, and gut health, offers substantial scope for fortified soy protein products. The increasing interest in sustainable and ethical sourcing of ingredients creates an opportunity for companies to differentiate through transparent supply chains and environmentally friendly production methods. Strategic partnerships between ingredient manufacturers and food brands, as well as investments in innovative startups focused on novel soy processing technologies, are poised to unlock new market potentials and drive long-term growth in the Japanese plant-based protein landscape.

Leading Players in the Japan Soy Protein Market Sector

- Mitsubishi Chemical Corporation

- DuPont de Nemours Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Fuji Oil Group

- Cargill Inc.

- CHS inc.

- Kerry Group PLC

- A Costantino & C SpA

- Royal DSM

Key Milestones in Japan Soy Protein Market Industry

- January 2023: Roquette Freres, a plant-based ingredient manufacturer, made a strategic investment in the Japanese startup Daiz Inc. Daiz Inc. specializes in extrusion technology, which is instrumental in advancing the development of innovative plant-based ingredients. This partnership signals a move towards leveraging advanced processing for soy-based innovations.

- February 2021: DuPont completed a merger that united its Nutrition Business with International Flavors & Fragrances (IFF), creating a formidable entity poised to become a prominent supplier of ingredients to the United States' food industry. The resulting company achieved an impressive revenue of USD 11 billion and is well-positioned to offer a wide range of ingredients, including soy proteins, for various consumer products, indicating significant consolidation and strengthening of key players.

- December 2020: Marubeni Corporation entered into a partnership agreement with Daiz, a Japanese startup specializing in soy-based protein production for use in meat alternatives. Marubeni Corporation invested USD 0.95 million in this promising startup venture, highlighting strategic investments in emerging Japanese soy protein technology and the burgeoning alternative meat market.

Strategic Outlook for Japan Soy Protein Market Market

The strategic outlook for the Japan soy protein market is highly positive, driven by sustained consumer demand for healthier, more sustainable, and plant-based food options. Growth will be further accelerated by ongoing innovation in product development, focusing on enhancing taste, texture, and nutritional functionality to overcome existing consumer perceptions and expand applications across diverse food and beverage, supplement, and personal care segments. Strategic investments in advanced processing technologies, such as enzymatic hydrolysis and precision fermentation, will be crucial for unlocking new product formats and value-added ingredients. Furthermore, strong emphasis on clean-label claims, non-GMO sourcing, and transparent supply chains will differentiate market players and build consumer trust. Collaborations between ingredient suppliers, food manufacturers, and research institutions will foster an ecosystem of innovation, positioning the Japan soy protein market for continued robust expansion and deeper market penetration in the coming years.

Japan Soy Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Hydrolyzed

- 1.3. Isolates

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. RTE/RTC Food Products

- 2.3.6. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Japan Soy Protein Market Segmentation By Geography

- 1. Japan

Japan Soy Protein Market Regional Market Share

Geographic Coverage of Japan Soy Protein Market

Japan Soy Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Plant Based Protein Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Soy Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Hydrolyzed

- 5.1.3. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. RTE/RTC Food Products

- 5.2.3.6. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Chemical Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPont de Nemours Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bunge Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fuji Oil Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CHS inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kerry Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A Costantino & C SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal DSM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Chemical Corporation

List of Figures

- Figure 1: Japan Soy Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Soy Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Soy Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Japan Soy Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Japan Soy Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Soy Protein Market Revenue Million Forecast, by Form 2020 & 2033

- Table 5: Japan Soy Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Japan Soy Protein Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Soy Protein Market?

The projected CAGR is approximately 2.66%.

2. Which companies are prominent players in the Japan Soy Protein Market?

Key companies in the market include Mitsubishi Chemical Corporation, DuPont de Nemours Inc, Archer Daniels Midland Company, Bunge Limited, Fuji Oil Group, Cargill Inc*List Not Exhaustive, CHS inc, Kerry Group PLC, A Costantino & C SpA, Royal DSM.

3. What are the main segments of the Japan Soy Protein Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 195 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Demand for Plant Based Protein Products.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

January 2023: Roquette Freres, a plant-based ingredient manufacturer, made a strategic investment in the Japanese startup Daiz Inc. Daiz Inc. specializes in extrusion technology, which is instrumental in advancing the development of innovative plant-based ingredients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Soy Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Soy Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Soy Protein Market?

To stay informed about further developments, trends, and reports in the Japan Soy Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence