Key Insights

The global beeswax market is projected for robust growth, anticipated to reach approximately 579.37 million by 2025. A compound annual growth rate (CAGR) of 4.8% is expected to propel the market to exceed 700 million by 2033. This expansion is primarily driven by escalating consumer demand for natural and organic ingredients across diverse sectors. In cosmetics and personal care, beeswax's emollient, emulsifying, and structuring properties make it a favored ingredient in lip balms, lotions, creams, and makeup. Its application in pharmaceuticals as excipients for tablets, ointments, and suppositories, coupled with traditional uses in candles and polishes, significantly contributes to market value. The "clean beauty" movement and a rising preference for sustainable, ethically sourced products are key growth catalysts, encouraging manufacturers to adopt beeswax as a natural alternative to synthetic ingredients. Its non-toxic and biodegradable nature aligns with global environmental consciousness, further enhancing market appeal.

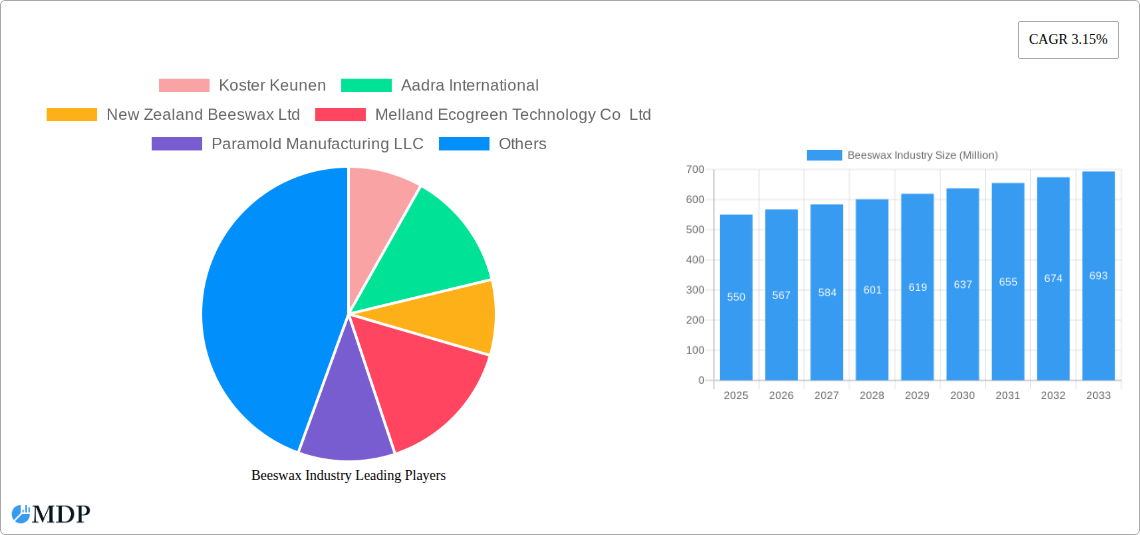

Beeswax Industry Market Size (In Million)

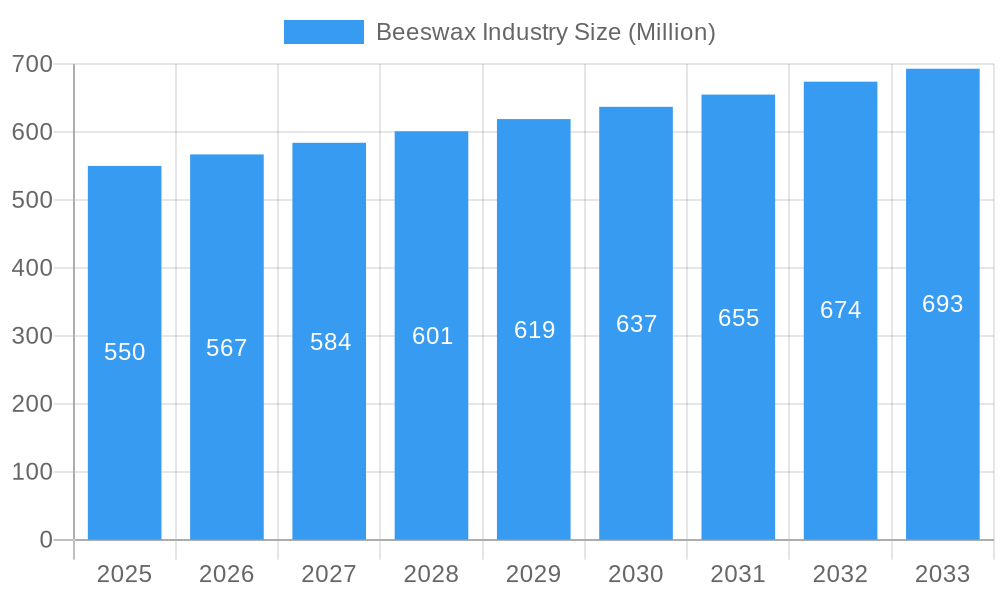

Despite the positive trajectory, the beeswax market encounters challenges. Fluctuations in bee populations, influenced by diseases, pesticide exposure, and climate change, can affect supply and price stability. While often more affordable, synthetic alternatives present a competitive hurdle, particularly in price-sensitive applications. However, the perceived superior quality and consumer preference for natural beeswax often outweigh cost considerations in premium product segments. Emerging applications in food additives, agriculture, and advanced materials present new growth opportunities. Leading companies, including Koster Keunen, Aadra International, and New Zealand Beeswax Ltd, are prioritizing sustainable sourcing and production to meet evolving consumer demands and regulatory standards, reinforcing their market positions. Innovations in beeswax processing and purification are also expected to enhance its functional properties and unlock new market segments.

Beeswax Industry Company Market Share

This comprehensive market research report offers an in-depth analysis of the global beeswax industry, covering the period from 2019 to 2033. With 2025 as the base and estimated year, and detailed forecasts from 2025–2033, this report provides critical insights into market dynamics, emerging trends, key segments, and major players. Access actionable intelligence for stakeholders aiming to navigate and capitalize on the rapidly evolving beeswax market. Discover the intricate factors driving growth, from surging demand for natural ingredients in cosmetics and pharmaceuticals to innovative sustainable applications.

Beeswax Industry Market Dynamics & Concentration

The global beeswax industry exhibits a moderate level of market concentration, with several key players dominating various regional markets. Innovation is a significant driver, fueled by increasing consumer demand for natural and sustainable products. Regulatory frameworks, while generally supportive of natural ingredients, can vary by region, influencing product development and market access. Product substitutes, such as synthetic waxes and petroleum-based alternatives, pose a competitive challenge, particularly in price-sensitive applications. However, the inherent properties of beeswax, including its natural origin, biodegradability, and unique texture, provide a strong competitive advantage. End-user trends overwhelmingly favor natural and organic ingredients, especially in the cosmetics and personal care sectors, which are crucial growth engines for the beeswax market. Mergers and acquisitions (M&A) activities, while not highly prevalent, are strategic moves by established companies to expand their product portfolios and geographical reach. The historical period (2019-2024) has seen a steady increase in beeswax consumption, driven by these factors. M&A deal counts are estimated at xx during the historical period.

- Market Concentration: Moderate, with key players holding significant regional shares.

- Innovation Drivers: Consumer preference for natural, organic, and sustainable ingredients.

- Regulatory Frameworks: Varied by region, impacting market entry and product claims.

- Product Substitutes: Synthetic waxes, petroleum-based alternatives, offering cost advantages.

- End-User Trends: Strong demand for natural ingredients in cosmetics, pharmaceuticals, and food applications.

- M&A Activities: Strategic acquisitions focused on market expansion and portfolio diversification.

- Market Share Dominance: Key players hold substantial shares in niche and broad applications.

Beeswax Industry Industry Trends & Analysis

The beeswax industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This expansion is primarily fueled by the escalating consumer consciousness towards natural and organic products across various sectors. The cosmetics and personal care industry, a significant consumer of beeswax, is experiencing a surge in demand for natural ingredients, driving beeswax incorporation into lip balms, lotions, creams, and makeup. The pharmaceutical sector also contributes to this growth, utilizing beeswax for its emollient and binding properties in ointments, suppositories, and coatings. Furthermore, the rising popularity of sustainable alternatives in household goods, such as beeswax food wraps, represents a burgeoning segment, aligning with global environmental concerns. Technological advancements in extraction and purification processes are enhancing the quality and availability of beeswax, making it more accessible and competitive. Market penetration of beeswax is steadily increasing as brands increasingly highlight the natural origins and benefits of their products. The competitive landscape is characterized by a blend of established global suppliers and niche artisanal producers, each catering to specific market demands. Economic policies supporting sustainable agriculture and natural product development indirectly bolster the beeswax market. The historical period (2019–2024) witnessed a steady upward trajectory, laying a strong foundation for future expansion. The estimated market size in the base year of 2025 is xx Million.

Leading Markets & Segments in Beeswax Industry

The global beeswax market is segmented by application into cosmetics, pharmaceuticals, and other applications, and by product type into organic and conventional beeswax. The cosmetics segment is the dominant market, driven by the unceasing demand for natural and organic beauty products. Consumers are increasingly seeking formulations free from synthetic chemicals, making beeswax an attractive ingredient for its moisturizing, protective, and texturizing properties. This segment's dominance is further amplified by the growing popularity of "clean beauty" trends and ingredient transparency. The pharmaceutical segment, while smaller, presents steady growth opportunities due to beeswax's established use as an excipient and active ingredient in various topical and oral medications. Its biocompatibility and natural origin make it a preferred choice for sensitive pharmaceutical formulations.

In terms of product type, organic beeswax is experiencing a more rapid growth rate than conventional beeswax. This is directly attributable to the heightened consumer preference for sustainably sourced and chemical-free products across all applications. The "organic" label resonates strongly with environmentally conscious consumers and those with sensitive skin or health concerns. The infrastructure supporting organic farming and certification processes is maturing, making organic beeswax more readily available.

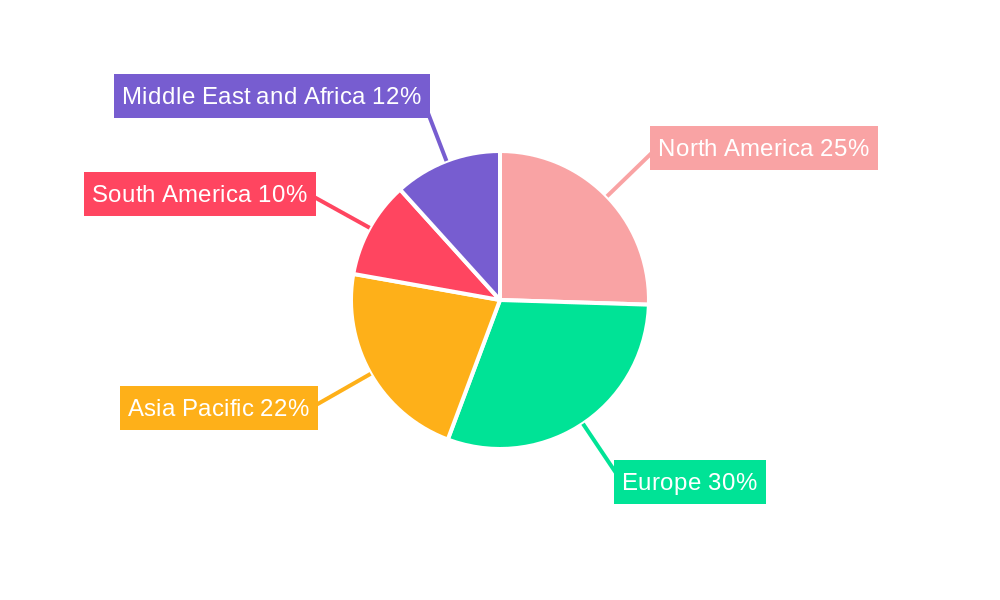

Geographically, North America and Europe are leading markets for beeswax, owing to their established cosmetics and pharmaceutical industries and a highly informed consumer base that values natural and sustainable products. Economic policies in these regions often incentivize the use of natural ingredients and sustainable practices. However, Asia-Pacific is emerging as a high-growth region, driven by increasing disposable incomes, a growing middle class adopting Western beauty trends, and a rising awareness of natural product benefits.

- Dominant Application Segment: Cosmetics, driven by natural and organic beauty trends.

- Key Drivers for Cosmetics Dominance: Consumer demand for clean beauty, ingredient transparency, and natural formulations.

- Promising Application Segment: Pharmaceuticals, due to biocompatibility and excipient properties.

- Dominant Product Type: Organic Beeswax, experiencing faster growth due to sustainability and health consciousness.

- Key Drivers for Organic Dominance: Consumer preference for chemical-free, sustainably sourced ingredients.

- Leading Geographical Regions: North America and Europe, with Asia-Pacific as a rapidly growing market.

- Key Drivers for Regional Dominance: Developed cosmetics/pharma industries, consumer awareness, economic policies supporting natural products.

Beeswax Industry Product Developments

Recent product developments in the beeswax industry showcase a clear trend towards natural ingredients and sustainable applications. For instance, Hilltop's December 2021 launch of an original beeswax lip balm, formulated with natural emulsifiers for hydration and UV protection, directly caters to the surging consumer demand for natural products. Similarly, Bacofoil's November 2021 introduction of new beeswax wraps, made with organic beeswax, expands their sustainable food wrap portfolio, highlighting beeswax's utility in eco-friendly household goods. Charlotte Tilbury's May 2021 magic lip scrub, incorporating natural ingredients like shea butter and beeswax, further emphasizes the market's significant push towards organic products and their efficacy in personal care. These innovations underscore beeswax's versatility and its ability to meet evolving market needs for natural, effective, and environmentally conscious solutions, providing significant competitive advantages for companies investing in R&D.

Key Drivers of Beeswax Industry Growth

The beeswax industry's growth is propelled by several interconnected factors. The escalating consumer demand for natural and organic products across cosmetics, pharmaceuticals, and food applications is a primary catalyst. Technological advancements in beekeeping practices and beeswax processing enhance purity and accessibility. Favorable regulatory frameworks in many regions that encourage natural ingredients and sustainable sourcing also contribute positively. Furthermore, the increasing awareness among consumers about the environmental benefits of biodegradable and natural products like beeswax, compared to synthetic alternatives, is a significant growth driver. The economic stability in key consuming regions supports sustained demand for premium, natural ingredients.

Challenges in the Beeswax Industry Market

Despite its promising growth, the beeswax industry faces several challenges. Fluctuations in raw material availability due to environmental factors impacting bee populations can lead to supply chain volatility and price instability. The presence of synthetic substitutes, often at lower price points, poses a competitive threat, especially in price-sensitive market segments. Stringent quality control and certification processes for organic beeswax can add to production costs. Furthermore, varying international regulations regarding the use and labeling of beeswax can create market entry barriers for some players. The economic impact of diseases affecting bee colonies globally remains a significant concern, potentially limiting overall supply.

Emerging Opportunities in Beeswax Industry

Emerging opportunities in the beeswax industry are centered on innovation and market expansion. The growing demand for sustainable and biodegradable packaging solutions presents a significant avenue, with beeswax-based coatings and wraps gaining traction. The expansion of the "farm-to-table" movement and interest in natural food preservation methods offer new applications for beeswax. Advancements in biotechnology and extraction techniques could lead to novel uses for beeswax derivatives in specialized pharmaceutical and cosmetic formulations. Strategic partnerships between beeswax producers and formulators can foster co-innovation and unlock new market segments. Furthermore, increased consumer education on the benefits of beeswax can further drive demand and market penetration.

Leading Players in the Beeswax Industry Sector

- Koster Keunen

- Aadra International

- New Zealand Beeswax Ltd

- Melland Ecogreen Technology Co Ltd

- Paramold Manufacturing LLC

- Strahl and Pitsch

- Alfa Chemistry

- Beeswax-Store

- Beeswax Products Company LLC

- British Wax Refining Company Limited

Key Milestones in Beeswax Industry Industry

- December 2021: Hilltop launched an original beeswax lip balm containing natural emulsifiers that hydrate, replenish, and protect against UV rays. It caters to the demand for natural products recently created by consumers.

- November 2021: Bacofoil launched new beeswax wraps made with organic beeswax, expanding their product portfolio of sustainable food wraps with high-quality product performance.

- May 2021: Charlotte Tilbury launched magic lip scrub with natural products like shea butter and beeswax to buff away dead skin cells, creating a massive market for organic products.

Strategic Outlook for Beeswax Industry Market

The strategic outlook for the beeswax industry remains highly positive, driven by the enduring consumer preference for natural, sustainable, and organic ingredients. Future growth accelerators include continued innovation in product development, particularly in the cosmetics, personal care, and sustainable packaging sectors. Expanding into emerging markets with growing disposable incomes and increasing awareness of natural product benefits will be crucial. Strategic alliances and collaborations between raw material suppliers, manufacturers, and end-users will foster innovation and market penetration. Investments in sustainable beekeeping practices and advanced extraction technologies will ensure a stable and high-quality supply chain. The industry's ability to adapt to evolving consumer demands and regulatory landscapes will be key to capitalizing on its significant future potential.

Beeswax Industry Segmentation

-

1. Application

- 1.1. Cosmetics

- 1.2. Pharmaceuticals

- 1.3. Other Applications

-

2. Product Type

- 2.1. Organic

- 2.2. Conventional

Beeswax Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest od South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Beeswax Industry Regional Market Share

Geographic Coverage of Beeswax Industry

Beeswax Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Beeswax

- 3.3. Market Restrains

- 3.3.1. Beeswax

- 3.4. Market Trends

- 3.4.1. Rising Preference for Natural Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beeswax Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cosmetics

- 5.1.2. Pharmaceuticals

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Organic

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Beeswax Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cosmetics

- 6.1.2. Pharmaceuticals

- 6.1.3. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Organic

- 6.2.2. Conventional

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Beeswax Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cosmetics

- 7.1.2. Pharmaceuticals

- 7.1.3. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Organic

- 7.2.2. Conventional

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Beeswax Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cosmetics

- 8.1.2. Pharmaceuticals

- 8.1.3. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Organic

- 8.2.2. Conventional

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Beeswax Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cosmetics

- 9.1.2. Pharmaceuticals

- 9.1.3. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Organic

- 9.2.2. Conventional

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Beeswax Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cosmetics

- 10.1.2. Pharmaceuticals

- 10.1.3. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Organic

- 10.2.2. Conventional

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Koster Keunen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aadra International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 New Zealand Beeswax Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Melland Ecogreen Technology Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Paramold Manufacturing LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Strahl and Pitsch

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alfa Chemistry

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beeswax-Store

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beeswax Products Company LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 British Wax Refining Company Limited *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Koster Keunen

List of Figures

- Figure 1: Global Beeswax Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Beeswax Industry Revenue (million), by Application 2025 & 2033

- Figure 3: North America Beeswax Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Beeswax Industry Revenue (million), by Product Type 2025 & 2033

- Figure 5: North America Beeswax Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Beeswax Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America Beeswax Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Beeswax Industry Revenue (million), by Application 2025 & 2033

- Figure 9: Europe Beeswax Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Beeswax Industry Revenue (million), by Product Type 2025 & 2033

- Figure 11: Europe Beeswax Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Beeswax Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Beeswax Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Beeswax Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Asia Pacific Beeswax Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Beeswax Industry Revenue (million), by Product Type 2025 & 2033

- Figure 17: Asia Pacific Beeswax Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Pacific Beeswax Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Beeswax Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Beeswax Industry Revenue (million), by Application 2025 & 2033

- Figure 21: South America Beeswax Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Beeswax Industry Revenue (million), by Product Type 2025 & 2033

- Figure 23: South America Beeswax Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: South America Beeswax Industry Revenue (million), by Country 2025 & 2033

- Figure 25: South America Beeswax Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Beeswax Industry Revenue (million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Beeswax Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Beeswax Industry Revenue (million), by Product Type 2025 & 2033

- Figure 29: Middle East and Africa Beeswax Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East and Africa Beeswax Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Beeswax Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Beeswax Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Beeswax Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Global Beeswax Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Beeswax Industry Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Beeswax Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Beeswax Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Beeswax Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Beeswax Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 13: Global Beeswax Industry Revenue million Forecast, by Country 2020 & 2033

- Table 14: Germany Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: France Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Russia Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Spain Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Global Beeswax Industry Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global Beeswax Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Beeswax Industry Revenue million Forecast, by Country 2020 & 2033

- Table 23: India Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: China Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Japan Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Beeswax Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Beeswax Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 29: Global Beeswax Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Brazil Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Rest od South America Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Global Beeswax Industry Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global Beeswax Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 35: Global Beeswax Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Beeswax Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beeswax Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Beeswax Industry?

Key companies in the market include Koster Keunen, Aadra International, New Zealand Beeswax Ltd, Melland Ecogreen Technology Co Ltd, Paramold Manufacturing LLC, Strahl and Pitsch, Alfa Chemistry, Beeswax-Store, Beeswax Products Company LLC, British Wax Refining Company Limited *List Not Exhaustive.

3. What are the main segments of the Beeswax Industry?

The market segments include Application, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 579.37 million as of 2022.

5. What are some drivers contributing to market growth?

Beeswax: a Multifunctional Excipient.

6. What are the notable trends driving market growth?

Rising Preference for Natural Ingredients.

7. Are there any restraints impacting market growth?

Beeswax: a Multifunctional Excipient.

8. Can you provide examples of recent developments in the market?

December 2021: Hilltop launched an original beeswax lip balm containing natural emulsifiers that hydrate, replenish, and protect against UV rays. It caters to the demand for natural products recently created by consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beeswax Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beeswax Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beeswax Industry?

To stay informed about further developments, trends, and reports in the Beeswax Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence