Key Insights

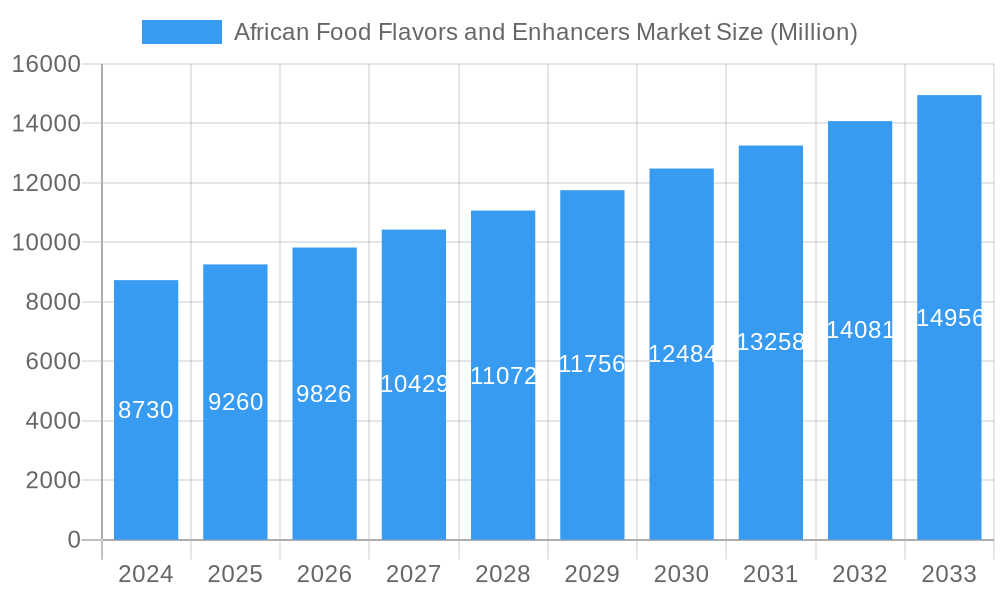

The African Food Flavors and Enhancers Market is poised for robust growth, reaching an estimated USD 8.73 billion in 2024. This expansion is driven by a confluence of factors, including the increasing demand for processed and convenience foods across the continent, rising disposable incomes, and a growing consumer preference for diverse and appealing taste profiles. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.18% from 2025 to 2033, reflecting sustained innovation and adoption of sophisticated flavoring solutions. Key drivers such as urbanization, a burgeoning young population, and the expansion of the food processing industry are fueling this upward trajectory. Furthermore, the growing awareness of health and wellness trends is also influencing product development, leading to an increased demand for natural and nature-identical flavors, as well as enhancers that can reduce sugar and salt content without compromising taste. The competitive landscape features prominent global players alongside regional innovators, all vying to capture market share by offering tailored solutions for the diverse African palate.

African Food Flavors and Enhancers Market Market Size (In Billion)

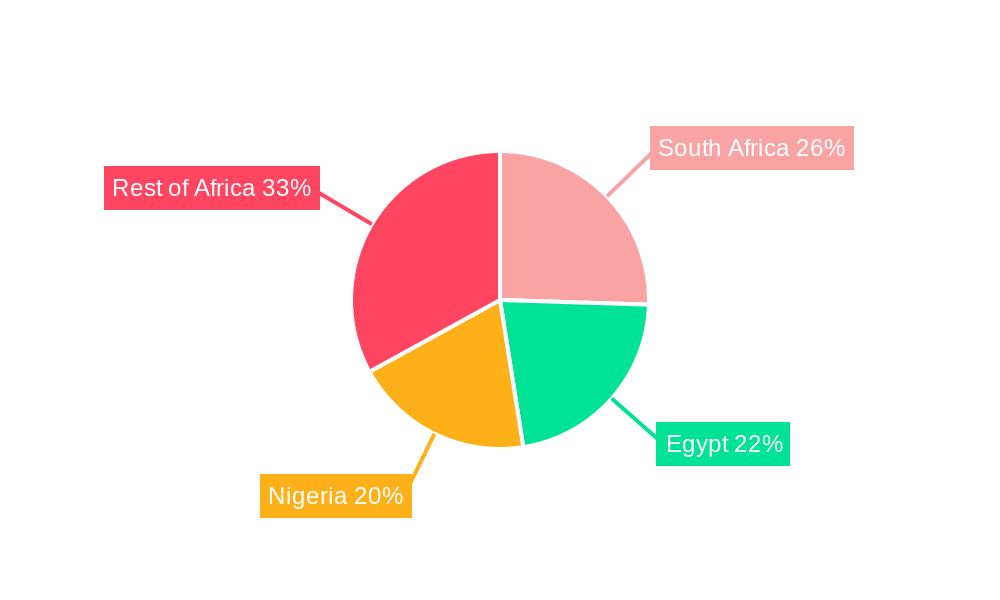

The market segments reveal a dynamic landscape. Natural Flavors are expected to witness significant traction due to consumer demand for clean labels and perceived health benefits. Synthetic Flavors and Nature Identical Flavoring will continue to hold substantial share due to cost-effectiveness and wide applicability in various food products. Flavor Enhancers play a crucial role in elevating the sensory experience of food and beverages. The application segments highlight the dominance of the Beverage and Dairy Products sectors, followed closely by Bakery and Confectionery, owing to their widespread consumption. Processed Foods also represent a substantial and growing segment. Geographically, South Africa, Egypt, and Nigeria are anticipated to be the leading markets, driven by their relatively developed food processing industries and larger consumer bases. The Rest of Africa, while fragmented, offers immense untapped potential for growth as economies develop and food manufacturing capabilities expand. Strategic collaborations, mergers, and acquisitions are likely to shape the market further as companies seek to broaden their product portfolios and geographical reach within this vibrant and evolving market.

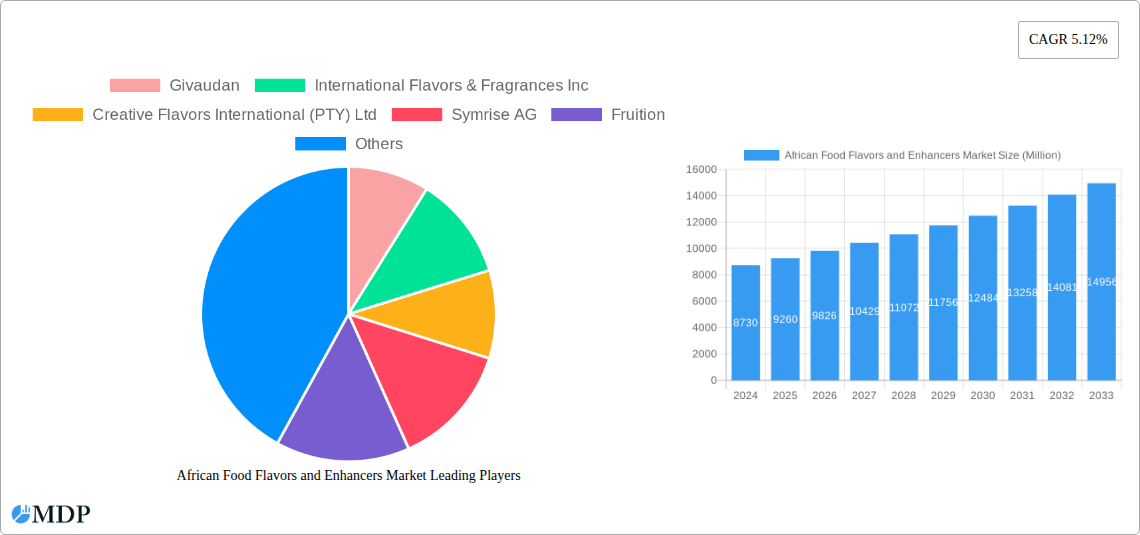

African Food Flavors and Enhancers Market Company Market Share

This comprehensive report provides an in-depth analysis of the African Food Flavors and Enhancers Market, a rapidly evolving sector driven by increasing consumer demand for taste, convenience, and healthier food options across the continent. With a study period spanning from 2019 to 2033, this report leverages a base year of 2025 and forecasts significant growth through 2033. We delve into the intricate market dynamics, emerging trends, leading segments, and pivotal players shaping the future of African food innovation.

African Food Flavors and Enhancers Market Market Dynamics & Concentration

The African Food Flavors and Enhancers Market is characterized by a moderate to high concentration, with key global players and a growing number of regional innovators vying for market share. Innovation is a critical driver, fueled by an increasing demand for natural and healthier ingredients, as well as a desire for novel taste experiences that reflect the diverse culinary heritage of Africa. Regulatory frameworks, while evolving, play a crucial role in shaping product development and market entry, with a growing emphasis on food safety and ingredient transparency. Product substitutes, such as home-grown spices and traditional preservation methods, present a unique competitive dynamic, pushing manufacturers to offer superior taste profiles and functional benefits. End-user trends are strongly influenced by rising disposable incomes, urbanization, and the growing middle class, leading to increased consumption of processed foods and beverages. Mergers and acquisitions (M&A) activities are anticipated to rise as larger companies seek to expand their footprint, acquire local expertise, and diversify their product portfolios. Recent M&A activity indicates a trend towards consolidation, with an estimated XX deals in the historical period, indicating a proactive approach to market expansion.

African Food Flavors and Enhancers Market Industry Trends & Analysis

The African Food Flavors and Enhancers Market is poised for substantial expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This robust growth is primarily propelled by a confluence of factors. Rising Consumer Demand for Palatable and Convenient Food Products: As urbanization accelerates and disposable incomes rise across the continent, consumers are increasingly seeking out processed foods and beverages that offer convenience and enhanced taste experiences. This trend directly fuels the demand for sophisticated flavor and enhancer solutions. Growing Health and Wellness Consciousness: A significant shift towards healthier eating habits is emerging. Consumers are actively seeking products with natural ingredients, reduced sugar, and lower salt content. This presents a lucrative opportunity for manufacturers specializing in natural flavors and enhancers that cater to these evolving preferences. Increasing Investment in Food Processing Infrastructure: Governments and private entities are investing heavily in modernizing and expanding food processing capabilities across Africa. This expansion necessitates a greater supply of high-quality flavors and enhancers to meet the demands of new and existing food manufacturers. Emergence of African Culinary Fusion: The continent's rich and diverse culinary traditions are inspiring innovative flavor profiles. Food manufacturers are increasingly looking to incorporate authentic African taste notes into their products, creating a unique demand for regionally inspired flavors and enhancers. Technological Advancements in Flavor Creation: Innovations in biotechnology and extraction methods are enabling the development of more authentic, potent, and cost-effective flavors and enhancers. These advancements allow for greater product customization and cater to niche market demands. Market Penetration: Current market penetration of sophisticated flavors and enhancers, while growing, still has significant room for expansion, particularly in emerging economies within the continent. The estimated market penetration stands at XX% in 2025, with expectations of reaching XX% by 2033. The competitive landscape is dynamic, featuring a mix of global giants and agile local players, all striving to capture market share through product innovation, strategic partnerships, and aggressive marketing strategies.

Leading Markets & Segments in African Food Flavors and Enhancers Market

Dominant Region: The Rest of Africa segment is projected to be the largest and fastest-growing geographical market for food flavors and enhancers in the coming years, driven by rapidly developing economies, burgeoning populations, and increasing consumer adoption of processed food products. While South Africa, Egypt, and Nigeria currently represent significant markets, the economic diversification and rising consumer spending power in countries like Kenya, Ghana, and Ethiopia are propelling them to the forefront of market growth.

Key Segment Dominance and Drivers:

- Type: Natural Flavor

- Drivers: Growing consumer preference for clean labels, health and wellness trends, and a demand for authentic taste experiences. The rich biodiversity of Africa offers immense potential for sourcing unique natural flavor ingredients.

- Application: Beverage

- Drivers: The beverage sector, particularly fruit juices, carbonated drinks, and functional beverages, is experiencing robust growth across Africa. Enhanced flavors are crucial for product differentiation and meeting diverse consumer tastes, from traditional to modern palates.

- Application: Dairy Products

- Drivers: Increasing consumption of yogurt, ice cream, and flavored milk, especially among the growing urban population, fuels the demand for a wide array of appealing dairy flavors.

- Application: Confectionery

- Drivers: The burgeoning confectionery market, driven by gifting culture and impulse purchases, requires vibrant and appealing flavors to attract consumers.

- Application: Processed Food

- Drivers: A significant increase in the consumption of ready-to-eat meals, snacks, and convenience foods directly translates to a higher demand for flavors and enhancers that improve taste and shelf appeal.

- Geography: Nigeria

- Drivers: With its large population and growing economy, Nigeria represents a significant consumer base for food and beverage products. The increasing urbanization and the expanding food processing industry are key drivers for flavor and enhancer demand.

- Geography: Egypt

- Drivers: A well-established food processing industry, coupled with a large population and evolving consumer preferences for diverse food options, makes Egypt a crucial market.

African Food Flavors and Enhancers Market Product Developments

Product innovation in the African Food Flavors and Enhancers Market is increasingly focused on creating authentic, regionally inspired flavor profiles that resonate with local tastes. Manufacturers are prioritizing the development of natural flavors derived from indigenous African fruits, spices, and herbs, catering to the growing demand for clean labels and healthy options. There is a notable trend towards developing flavor enhancers that mask off-notes in plant-based proteins and improve the sensory experience of functional foods and beverages. Competitive advantages are being secured through enhanced product stability, cost-effectiveness, and customization to meet the specific needs of diverse African food manufacturers.

Key Drivers of African Food Flavors and Enhancers Market Growth

Several pivotal factors are propelling the growth of the African Food Flavors and Enhancers Market. Technologically, advancements in natural extraction and flavor synthesis are enabling the creation of more authentic and diverse taste profiles. Economically, rising disposable incomes and a burgeoning middle class are driving increased demand for processed foods and beverages with enhanced taste. Regulatory support, with a growing emphasis on food safety and quality standards, encourages the adoption of high-quality ingredients. Furthermore, the increasing adoption of innovative food processing techniques across the continent directly translates to a higher demand for sophisticated flavors and enhancers.

Challenges in the African Food Flavors and Enhancers Market Market

Despite its promising growth, the African Food Flavors and Enhancers Market faces several challenges. Regulatory hurdles, including varying standards across different countries and complex import/export procedures, can impede market entry and product diffusion. Supply chain inefficiencies and logistical complexities in certain regions can lead to increased costs and potential disruptions. Furthermore, the prevalence of informal food production and the use of traditional flavoring methods present a competitive pressure, particularly for niche applications. The volatile economic conditions in some African nations can also impact consumer spending on processed food products.

Emerging Opportunities in African Food Flavors and Enhancers Market

The African Food Flavors and Enhancers Market is ripe with emerging opportunities. The rising demand for plant-based food products presents a significant avenue for specialized flavor solutions that enhance palatability. Strategic partnerships between global flavor houses and local African ingredient suppliers can unlock unique flavor profiles and ensure sustainable sourcing. Market expansion into untapped rural areas, coupled with educational initiatives on the benefits of processed foods and advanced flavoring techniques, can further accelerate market penetration. Technological breakthroughs in encapsulation and controlled release of flavors also offer opportunities for product differentiation and extended shelf life.

Leading Players in the African Food Flavors and Enhancers Market Sector

- Givaudan

- International Flavors & Fragrances Inc

- Creative Flavors International (PTY) Ltd

- Symrise AG

- Fruition

- Sensient Technologies Corporation

- Firmenich SA

Key Milestones in African Food Flavors and Enhancers Market Industry

- 2019: Increased investment in R&D for natural flavor extraction from African botanicals.

- 2020: Launch of new product lines focusing on sugar-reduced and low-sodium flavor solutions.

- 2021: Strategic partnerships formed to enhance distribution networks in key African markets like Nigeria and Egypt.

- 2022: Growing emphasis on certifications for halal and kosher flavors to cater to specific consumer segments.

- 2023: Acquisition of smaller regional flavor companies by larger international players to expand market share.

- 2024: Introduction of innovative flavor enhancer technologies for plant-based protein applications.

Strategic Outlook for African Food Flavors and Enhancers Market Market

The strategic outlook for the African Food Flavors and Enhancers Market is exceptionally positive, driven by sustained economic growth, evolving consumer preferences, and increasing investments in the food processing sector. Key growth accelerators include a continued focus on natural and healthy flavor solutions, the exploration of unique African taste profiles for product differentiation, and strategic expansions into underserved markets. Companies that invest in understanding local palates, navigating regulatory landscapes, and fostering strong supply chain relationships will be best positioned to capitalize on the immense potential of this dynamic market.

African Food Flavors and Enhancers Market Segmentation

-

1. Type

- 1.1. Natural Flavor

- 1.2. Synthetic Flavor

- 1.3. Nature Identical Flavoring

- 1.4. Flavor Enhancers

-

2. Application

- 2.1. Dairy Products

- 2.2. Bakery

- 2.3. Confectionery

- 2.4. Processed Food

- 2.5. Beverage

- 2.6. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Nigeria

- 3.4. Rest of Africa

African Food Flavors and Enhancers Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Nigeria

- 4. Rest of Africa

African Food Flavors and Enhancers Market Regional Market Share

Geographic Coverage of African Food Flavors and Enhancers Market

African Food Flavors and Enhancers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Processed Food Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Food Flavors and Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Flavor

- 5.1.2. Synthetic Flavor

- 5.1.3. Nature Identical Flavoring

- 5.1.4. Flavor Enhancers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy Products

- 5.2.2. Bakery

- 5.2.3. Confectionery

- 5.2.4. Processed Food

- 5.2.5. Beverage

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Nigeria

- 5.3.4. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Nigeria

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa African Food Flavors and Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Flavor

- 6.1.2. Synthetic Flavor

- 6.1.3. Nature Identical Flavoring

- 6.1.4. Flavor Enhancers

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy Products

- 6.2.2. Bakery

- 6.2.3. Confectionery

- 6.2.4. Processed Food

- 6.2.5. Beverage

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Nigeria

- 6.3.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Egypt African Food Flavors and Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Flavor

- 7.1.2. Synthetic Flavor

- 7.1.3. Nature Identical Flavoring

- 7.1.4. Flavor Enhancers

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy Products

- 7.2.2. Bakery

- 7.2.3. Confectionery

- 7.2.4. Processed Food

- 7.2.5. Beverage

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Nigeria

- 7.3.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Nigeria African Food Flavors and Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Flavor

- 8.1.2. Synthetic Flavor

- 8.1.3. Nature Identical Flavoring

- 8.1.4. Flavor Enhancers

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy Products

- 8.2.2. Bakery

- 8.2.3. Confectionery

- 8.2.4. Processed Food

- 8.2.5. Beverage

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Nigeria

- 8.3.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Africa African Food Flavors and Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Flavor

- 9.1.2. Synthetic Flavor

- 9.1.3. Nature Identical Flavoring

- 9.1.4. Flavor Enhancers

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy Products

- 9.2.2. Bakery

- 9.2.3. Confectionery

- 9.2.4. Processed Food

- 9.2.5. Beverage

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Egypt

- 9.3.3. Nigeria

- 9.3.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Givaudan

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Flavors & Fragrances Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Creative Flavors International (PTY) Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Symrise AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fruition

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sensient Technologies Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Firmenich SA*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Givaudan

List of Figures

- Figure 1: African Food Flavors and Enhancers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: African Food Flavors and Enhancers Market Share (%) by Company 2025

List of Tables

- Table 1: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: African Food Flavors and Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Food Flavors and Enhancers Market?

The projected CAGR is approximately 6.18%.

2. Which companies are prominent players in the African Food Flavors and Enhancers Market?

Key companies in the market include Givaudan, International Flavors & Fragrances Inc, Creative Flavors International (PTY) Ltd, Symrise AG, Fruition, Sensient Technologies Corporation, Firmenich SA*List Not Exhaustive.

3. What are the main segments of the African Food Flavors and Enhancers Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Demand for Processed Food Ingredients.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Food Flavors and Enhancers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Food Flavors and Enhancers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Food Flavors and Enhancers Market?

To stay informed about further developments, trends, and reports in the African Food Flavors and Enhancers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence