Key Insights

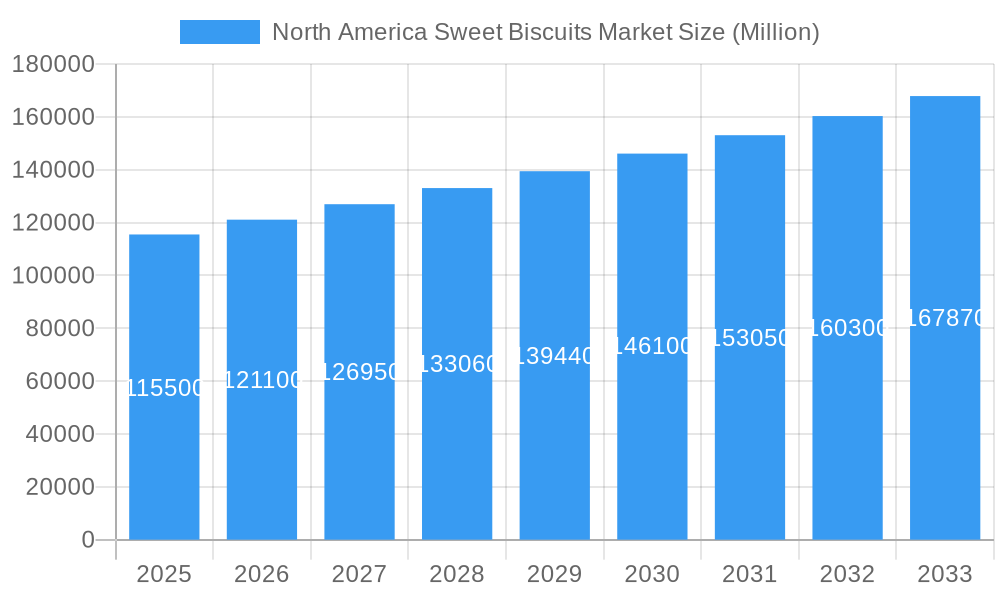

The North America Sweet Biscuits Market is poised for steady expansion, projected to reach USD 115.5 billion in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This robust growth is primarily fueled by evolving consumer preferences for convenient, indulgent, and premium snack options. The rising disposable incomes across North America, particularly in countries like the United States and Canada, are empowering consumers to spend more on value-added sweet biscuits. Furthermore, a growing trend towards health-conscious indulgence, leading to increased demand for biscuits with natural ingredients, reduced sugar content, and added nutritional benefits, is a significant driver. Product innovation, including the introduction of diverse flavors, textures, and unique fillings, plays a crucial role in capturing consumer attention and expanding market share. The increasing popularity of artisanal and gourmet biscuits, catering to discerning palates, also contributes to market dynamism.

North America Sweet Biscuits Market Market Size (In Billion)

Distribution channels are evolving to meet modern consumer shopping habits. Online retail stores are witnessing substantial growth, driven by convenience and wider product availability. Supermarkets and hypermarkets continue to be dominant channels, offering a broad selection of brands and products. However, the strategic placement of sweet biscuits in convenience stores, targeting impulse purchases, also contributes to market penetration. While the market is characterized by strong demand, certain factors could influence its trajectory. Rising raw material costs, particularly for ingredients like wheat, sugar, and cocoa, could pose a challenge, potentially impacting profit margins for manufacturers. Additionally, increasing competition from alternative snack categories and the growing awareness of sugar's health implications may necessitate strategic product development and marketing efforts to sustain growth.

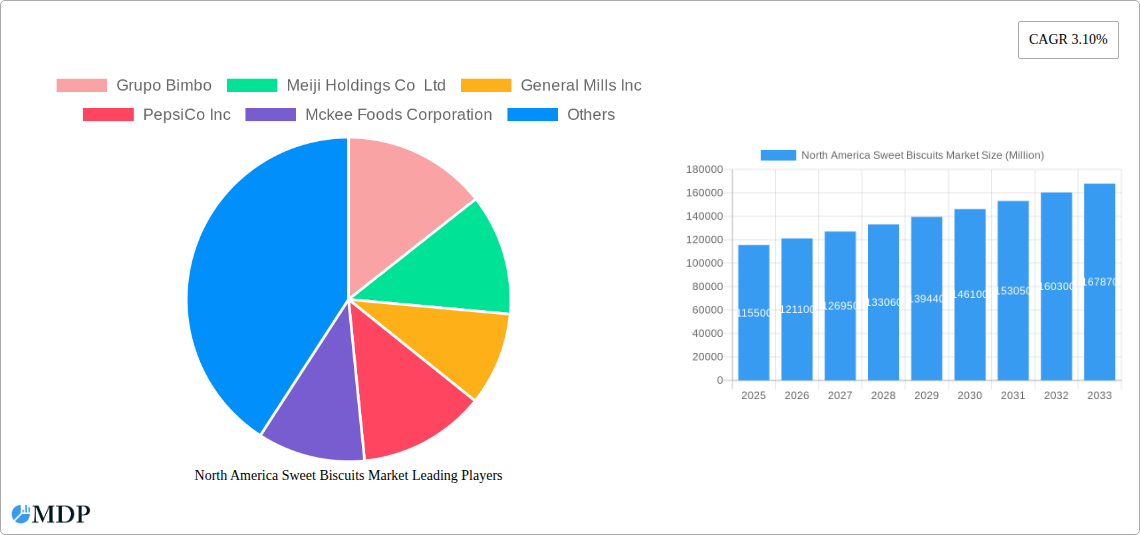

North America Sweet Biscuits Market Company Market Share

Dive deep into the thriving North America sweet biscuits market with this indispensable report. Uncover critical insights into market dynamics, innovation drivers, and consumer preferences that are shaping the future of this dynamic industry. Analyze key segments including Chocolate-coated Biscuits, Cookies, Filled Biscuits, Plain Biscuits, Sandwich Biscuits, and Other Sweet Biscuits. Understand the impact of distribution channels like Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and Other Distribution Channels across the United States, Canada, Mexico, and the Rest of North America. This report provides actionable intelligence for stakeholders looking to capitalize on growth opportunities in the North American sweet biscuits sector, projecting a market value of billions by 2033.

North America Sweet Biscuits Market Market Dynamics & Concentration

The North America sweet biscuits market exhibits moderate to high concentration, with a few key players dominating significant market share. Innovation drivers are primarily focused on premiumization, clean-label ingredients, and indulgence, responding to evolving consumer demands. Regulatory frameworks, particularly concerning food safety and labeling, play a crucial role in market operations. Product substitutes, such as cakes, pastries, and other confectionery items, pose a constant competitive threat. End-user trends indicate a growing preference for healthier options, convenient packaging, and unique flavor profiles. Merger and acquisition (M&A) activities are moderate, driven by the desire to expand product portfolios and market reach. The market is expected to see ongoing consolidation as larger players seek to acquire innovative smaller brands.

- Market Concentration: Dominated by a few major players, but with room for niche brands.

- Innovation Drivers: Premiumization, health-conscious ingredients, unique flavor development, and convenient formats.

- Regulatory Frameworks: Stringent food safety and labeling standards are paramount.

- Product Substitutes: Cakes, pastries, cookies, and other snack items.

- End-User Trends: Demand for natural ingredients, lower sugar options, and artisanal products.

- M&A Activities: Ongoing, with a focus on strategic acquisitions for portfolio enhancement.

North America Sweet Biscuits Market Industry Trends & Analysis

The North America sweet biscuits market is poised for significant expansion, driven by a confluence of robust growth drivers, technological advancements, and shifting consumer preferences. The projected Compound Annual Growth Rate (CAGR) is expected to be substantial, indicating a healthy upward trajectory for market penetration. Key growth drivers include the increasing disposable income, particularly in developing regions within North America, and a growing consumer inclination towards affordable indulgence and convenient snacking options. The rising popularity of online retail channels has democratized access to a wider variety of sweet biscuits, including gourmet and international brands, further fueling market growth. Technological disruptions are evident in the adoption of advanced manufacturing processes that enhance product quality, consistency, and shelf-life. Innovations in ingredient sourcing and formulation are also key, with a growing demand for clean-label products, organic ingredients, and options catering to dietary restrictions such as gluten-free and vegan. Consumer preferences are evolving rapidly, moving beyond traditional flavors to embrace more sophisticated and exotic taste profiles, as well as a desire for aesthetically appealing packaging. The competitive landscape is characterized by fierce rivalry among established global brands and agile regional players, all vying for consumer attention through product innovation, strategic marketing campaigns, and optimized distribution networks. The market penetration of sweet biscuits remains high, with potential for further growth driven by new product introductions and expanding consumption occasions, such as on-the-go snacking and dessert accompaniments.

- Market Growth Drivers: Increasing disposable income, demand for convenient snacks, and the rise of online retail.

- Technological Disruptions: Advanced manufacturing, innovative ingredient formulations, and sustainable packaging.

- Consumer Preferences: Demand for premium, healthier, and exotic flavor options.

- Competitive Dynamics: Intense competition with established brands and emerging players.

- Market Penetration: High, with continued growth potential through innovation and new consumer segments.

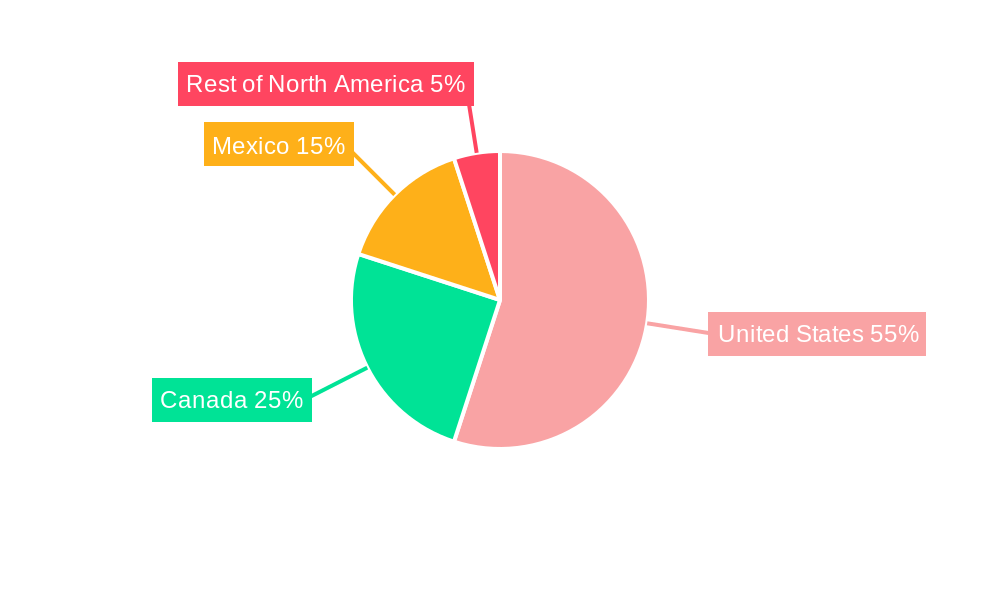

Leading Markets & Segments in North America Sweet Biscuits Market

The United States stands as the dominant market within North America for sweet biscuits, driven by its large consumer base, high disposable income, and established retail infrastructure. Within the product type segment, Cookies and Chocolate-coated Biscuits command the largest market share, reflecting enduring consumer appeal and continuous innovation in flavors and formats. The Supermarkets/Hypermarkets distribution channel remains the primary avenue for sweet biscuit sales, offering broad accessibility and a wide selection. However, Online Retail Stores are witnessing rapid growth, fueled by convenience and the increasing adoption of e-commerce for grocery shopping. Economic policies that support consumer spending and robust supply chain networks are key drivers of the US market's dominance. Canada follows as a significant market, exhibiting similar consumption patterns to the United States, albeit on a smaller scale. Mexico's market is characterized by a growing middle class and an increasing demand for both traditional and modern sweet biscuit offerings. The "Rest of North America" segment, though smaller, presents nascent growth opportunities, particularly for niche and premium products.

- Dominant Region: United States, accounting for the largest market share due to its extensive consumer base and purchasing power.

- Dominant Product Types:

- Cookies: Consistently popular due to diverse flavors and textures.

- Chocolate-coated Biscuits: High demand driven by premiumization and indulgence trends.

- Dominant Distribution Channels:

- Supermarkets/Hypermarkets: Established preference for one-stop shopping and a wide product assortment.

- Online Retail Stores: Experiencing significant growth, driven by convenience and expanding product availability.

- Key Drivers for Dominance:

- Economic Policies: Favorable consumer spending and market accessibility.

- Infrastructure: Well-developed retail and logistics networks.

- Consumer Demographics: Large population segments with a propensity for confectionery purchases.

North America Sweet Biscuits Market Product Developments

Product innovation in the North America sweet biscuits market is characterized by a strong emphasis on catering to evolving consumer preferences for healthier options, novel flavors, and premium experiences. Manufacturers are actively developing biscuits with reduced sugar content, incorporating whole grains, and utilizing natural and clean-label ingredients. The integration of premium ingredients like exotic fruits, artisanal chocolate, and sophisticated spices is a key trend, offering a more indulgent and differentiated product. Furthermore, product developments are increasingly focused on convenient packaging formats for on-the-go consumption and single-serve options. Competitive advantages are being carved out through unique flavor combinations, appealing visual aesthetics, and targeted marketing campaigns that resonate with specific consumer demographics.

- Key Innovations: Reduced sugar content, whole grain inclusion, clean-label and natural ingredients.

- Premiumization: Use of exotic fruits, artisanal chocolate, and sophisticated spices.

- Convenience: Development of on-the-go and single-serve packaging.

- Differentiation: Unique flavor profiles and visually appealing product designs.

Key Drivers of North America Sweet Biscuits Market Growth

The North America sweet biscuits market is propelled by several key drivers. Economic factors, such as rising disposable incomes and a growing middle class, directly translate to increased consumer spending on discretionary items like sweet biscuits. Technological advancements in manufacturing processes enable efficient production and the development of innovative product formulations, including healthier options. Shifting consumer preferences towards convenience snacking, premium indulgence, and a desire for novel flavor experiences are significant growth catalysts. Evolving distribution channels, particularly the rapid expansion of e-commerce, provide wider accessibility and reach for sweet biscuit manufacturers. Strategic marketing and promotional activities by leading companies also play a crucial role in driving consumer demand and brand loyalty.

- Economic Factors: Rising disposable incomes and expanding middle-class segments.

- Technological Advancements: Efficient production and innovative product formulations.

- Consumer Preferences: Demand for convenience, premiumization, and novel flavors.

- Distribution Channel Evolution: Growth of e-commerce and online retail.

- Marketing & Promotions: Strategic campaigns to enhance brand visibility and consumer engagement.

Challenges in the North America Sweet Biscuits Market Market

Despite robust growth prospects, the North America sweet biscuits market faces several challenges. Intensifying competition from both domestic and international players, as well as from substitute snack categories, necessitates continuous innovation and competitive pricing strategies. Rising raw material costs, particularly for key ingredients like flour, sugar, and chocolate, can impact profit margins. Stringent regulatory frameworks related to food safety, labeling, and health claims require constant adherence and can increase compliance costs. Supply chain disruptions, exacerbated by global events, can affect ingredient availability and logistics. Furthermore, the increasing consumer focus on health and wellness presents a challenge for traditional sweet biscuit formulations, requiring manufacturers to adapt by offering healthier alternatives without compromising on taste and texture.

- Competitive Pressures: Intense rivalry and the threat of substitute products.

- Raw Material Volatility: Fluctuations in the cost of key ingredients.

- Regulatory Compliance: Adherence to evolving food safety and labeling standards.

- Supply Chain Vulnerabilities: Risks associated with ingredient sourcing and logistics.

- Health & Wellness Trends: Demand for healthier alternatives to traditional biscuits.

Emerging Opportunities in North America Sweet Biscuits Market

Several emerging opportunities offer significant growth potential for the North America sweet biscuits market. The increasing demand for premium and artisanal sweet biscuits provides a niche for manufacturers focusing on high-quality ingredients and unique flavor profiles. The health and wellness trend opens avenues for innovative product development, such as sugar-free, gluten-free, and plant-based sweet biscuits, catering to specific dietary needs and preferences. The continued expansion of online retail and direct-to-consumer (DTC) channels offers direct access to consumers and opportunities for personalized marketing and product offerings. Strategic partnerships and collaborations, including co-branding and celebrity endorsements, can enhance brand visibility and attract new consumer segments. Furthermore, exploring emerging geographic markets within North America and developing culturally relevant product offerings can unlock untapped potential.

- Premiumization & Artisanal Offerings: Catering to sophisticated consumer tastes with high-quality ingredients.

- Health & Wellness Products: Developing sugar-free, gluten-free, and plant-based alternatives.

- E-commerce & DTC Growth: Leveraging online platforms for direct consumer engagement and sales.

- Strategic Collaborations: Partnerships for co-branding, product development, and market expansion.

- Untapped Markets: Exploring niche segments and culturally diverse consumer groups.

Leading Players in the North America Sweet Biscuits Market Sector

- Grupo Bimbo

- Meiji Holdings Co Ltd

- General Mills Inc

- PepsiCo Inc

- Mckee Foods Corporation

- Ferrero Group

- Girl Scouts of the USA

- Campbell Soup Company

- Mondelez International

- Sweet Nutrition

Key Milestones in North America Sweet Biscuits Market Industry

- February 2022: Carl Brandt, Inc. launched Kambly Swiss Biscuits in four new items in the United States, including Matterhorn Swiss Biscuits, Chocolate Bretzeli Swiss Biscuits, Bretzeli Tin Gold, and the Primavera Gift Box, emphasizing all-natural, clean-label ingredients for a sustainable world.

- January 2022: Girl Scouts of the USA collaborated with DoorDash to offer its products through a hybrid selling model combining online and offline channels.

- June 2021: General Mills brand Pillsbury launched Mini Sweet Biscuits in four flavors: Chocolate Chip, Blueberry, Honey Butter, and Cinnamon Sugar varieties.

Strategic Outlook for North America Sweet Biscuits Market Market

The strategic outlook for the North America sweet biscuits market is exceptionally positive, driven by sustained consumer demand for indulgence, convenience, and evolving health-conscious options. Growth accelerators will include further innovation in product formulation, particularly focusing on clean-label ingredients, reduced sugar, and plant-based alternatives, aligning with increasing consumer awareness of health and wellness. The expansion of online retail and direct-to-consumer strategies will be critical for market penetration and personalized consumer engagement. Manufacturers are likely to focus on premiumization, offering unique flavor experiences and high-quality ingredients to command higher price points. Strategic acquisitions and partnerships will continue to play a role in consolidating market share and expanding product portfolios. Investment in sustainable packaging and ethical sourcing will also become increasingly important for brand reputation and consumer loyalty, ensuring long-term market viability and growth.

North America Sweet Biscuits Market Segmentation

-

1. Product Type

- 1.1. Chocolate-coated Biscuits

- 1.2. Cookies

- 1.3. Filled Biscuits

- 1.4. Plain Biscuits

- 1.5. Sandwich Biscuits

- 1.6. Other Sweet Biscuits

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Sweet Biscuits Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Sweet Biscuits Market Regional Market Share

Geographic Coverage of North America Sweet Biscuits Market

North America Sweet Biscuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. Increased Innovations in Sweet Biscusts

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Chocolate-coated Biscuits

- 5.1.2. Cookies

- 5.1.3. Filled Biscuits

- 5.1.4. Plain Biscuits

- 5.1.5. Sandwich Biscuits

- 5.1.6. Other Sweet Biscuits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Chocolate-coated Biscuits

- 6.1.2. Cookies

- 6.1.3. Filled Biscuits

- 6.1.4. Plain Biscuits

- 6.1.5. Sandwich Biscuits

- 6.1.6. Other Sweet Biscuits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Chocolate-coated Biscuits

- 7.1.2. Cookies

- 7.1.3. Filled Biscuits

- 7.1.4. Plain Biscuits

- 7.1.5. Sandwich Biscuits

- 7.1.6. Other Sweet Biscuits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Chocolate-coated Biscuits

- 8.1.2. Cookies

- 8.1.3. Filled Biscuits

- 8.1.4. Plain Biscuits

- 8.1.5. Sandwich Biscuits

- 8.1.6. Other Sweet Biscuits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Chocolate-coated Biscuits

- 9.1.2. Cookies

- 9.1.3. Filled Biscuits

- 9.1.4. Plain Biscuits

- 9.1.5. Sandwich Biscuits

- 9.1.6. Other Sweet Biscuits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Grupo Bimbo

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Meiji Holdings Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PepsiCo Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mckee Foods Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ferrero Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Girl Scouts of the USA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Campbell Soup Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sweet Nutrition*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mondelez International

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Grupo Bimbo

List of Figures

- Figure 1: North America Sweet Biscuits Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Sweet Biscuits Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sweet Biscuits Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Sweet Biscuits Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Sweet Biscuits Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Sweet Biscuits Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: North America Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Sweet Biscuits Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Sweet Biscuits Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: North America Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Sweet Biscuits Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Sweet Biscuits Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: North America Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Sweet Biscuits Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: North America Sweet Biscuits Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: North America Sweet Biscuits Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Sweet Biscuits Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Sweet Biscuits Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sweet Biscuits Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the North America Sweet Biscuits Market?

Key companies in the market include Grupo Bimbo, Meiji Holdings Co Ltd, General Mills Inc, PepsiCo Inc, Mckee Foods Corporation, Ferrero Group, Girl Scouts of the USA, Campbell Soup Company, Sweet Nutrition*List Not Exhaustive, Mondelez International.

3. What are the main segments of the North America Sweet Biscuits Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

Increased Innovations in Sweet Biscusts.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

In February 2022, Carl Brandt, Inc. launched Kambly Swiss Biscuits in four new items in the United States which include Matterhorn Swiss Biscuits, Chocolate Bretzeli Swiss Biscuits, Bretzeli Tin Gold, and the Primavera Gift Box. The company claims that the Kambly's line of indulgent Swiss biscuits is made with the finest all-natural, clean-label ingredients for a sustainable world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sweet Biscuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sweet Biscuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sweet Biscuits Market?

To stay informed about further developments, trends, and reports in the North America Sweet Biscuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence