Key Insights

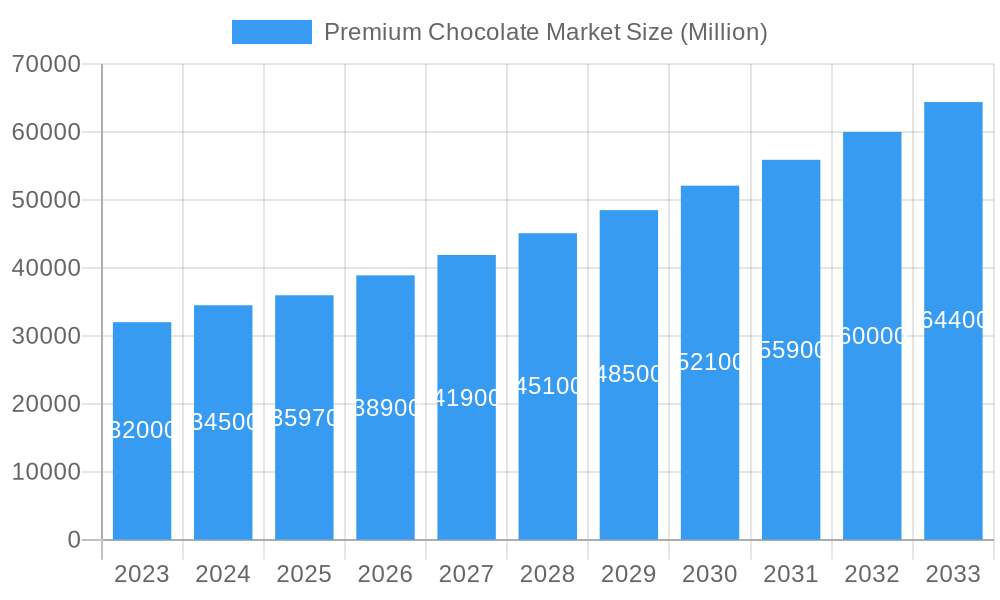

The global Premium Chocolate Market is experiencing robust growth, projected to reach a substantial market size by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.83% through 2033. This expansion is fueled by an increasing consumer preference for high-quality, ethically sourced, and artisanal chocolate products. The "premium" segment is attracting discerning buyers who are willing to pay a higher price for superior taste, unique flavor profiles, and sophisticated packaging. This trend is particularly evident in developed economies and is gradually gaining traction in emerging markets as disposable incomes rise and consumers become more aware of global culinary trends. The market's value unit is in millions, reflecting the significant financial scale of this industry.

Premium Chocolate Market Market Size (In Billion)

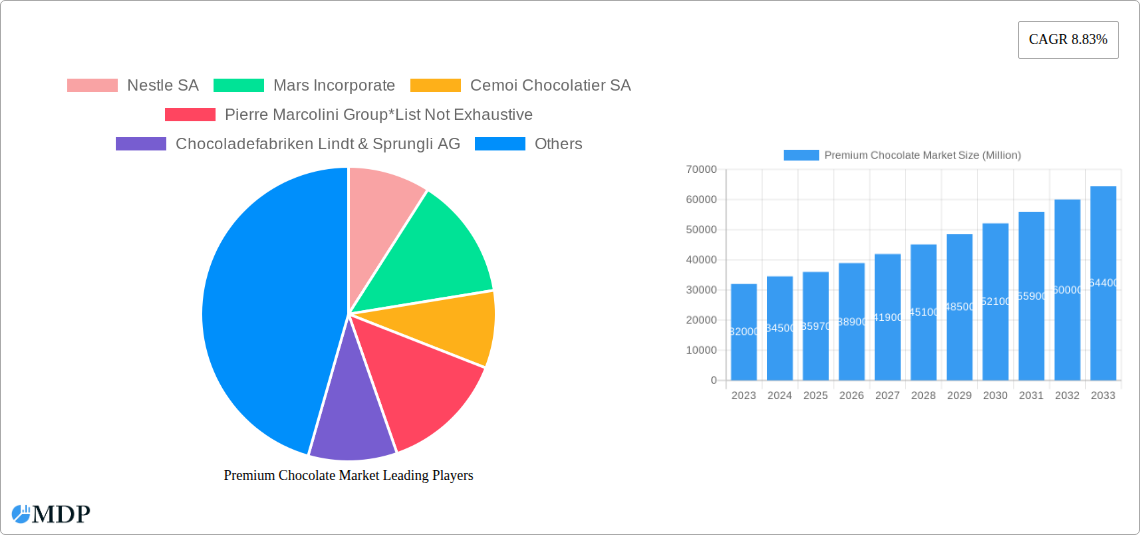

Key drivers behind this market surge include the growing demand for dark premium chocolate, driven by its perceived health benefits and rich flavor. White and milk premium chocolates also hold significant appeal, catering to a broader consumer base seeking indulgence and comfort. The distribution landscape is evolving, with online stores emerging as a powerful channel, offering convenience and a wider selection. Hypermarkets and supermarkets continue to be dominant, providing accessibility, while convenience stores cater to impulse purchases. The competitive landscape is characterized by a mix of established multinational corporations and niche artisanal chocolatiers, all vying for market share. Major players like Nestle SA, Mars Incorporated, Mondelez International Inc., and Ferrero SpA are investing in product innovation and premium brand positioning. The market is poised for continued expansion, with regions like North America and Europe leading in consumption, while the Asia Pacific region presents significant growth opportunities.

Premium Chocolate Market Company Market Share

Premium Chocolate Market Report: Unveiling Growth, Trends, and Leading Players (2019-2033)

Dive deep into the premium chocolate market with this comprehensive report, meticulously analyzed for the study period of 2019–2033, with 2025 serving as the base year and estimated year, followed by a robust forecast period of 2025–2033, building upon historical data from 2019–2024. Discover actionable insights into the burgeoning demand for high-quality confectionery, driven by evolving consumer preferences for artisanal, ethically sourced, and indulgent chocolate experiences. This report is your definitive guide to understanding the market dynamics, key players, and future trajectory of the luxury chocolate industry, gourmet chocolate market, and artisan chocolate sales.

Premium Chocolate Market Market Dynamics & Concentration

The premium chocolate market exhibits a moderate to high concentration, with a few dominant players holding significant market share, estimated to be around 70% by leading companies. Innovation remains a primary driver, fueled by a growing consumer appetite for unique flavor profiles, sustainable sourcing, and health-conscious options. Regulatory frameworks, particularly concerning food safety and labeling, play a crucial role in shaping market entry and product development. Product substitutes, such as other premium confectionery or high-end desserts, exert some pressure, but the inherent indulgence factor of premium chocolate offers a distinct competitive advantage. End-user trends increasingly favor transparency in ingredient sourcing and production processes. Mergers and acquisitions (M&A) activities, with approximately 15-20 deals annually in the past five years, are strategically employed by major players to expand their product portfolios, gain market access, and consolidate their positions.

Premium Chocolate Market Industry Trends & Analysis

The global premium chocolate market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is propelled by a confluence of factors including rising disposable incomes in emerging economies, a growing awareness of the health benefits associated with dark chocolate, and a persistent demand for indulgent, high-quality treats. Technological disruptions are increasingly shaping the industry, with advancements in cocoa bean processing and flavor infusion techniques enabling the creation of more sophisticated and unique chocolate products. Consumer preferences are shifting towards ethically sourced, organic, and single-origin chocolates, with a significant segment willing to pay a premium for these attributes. The competitive landscape is characterized by intense product innovation, strategic branding, and targeted marketing campaigns aimed at affluent demographics. Market penetration is deepening, with premium chocolate brands increasingly available through diverse channels, reaching a broader consumer base.

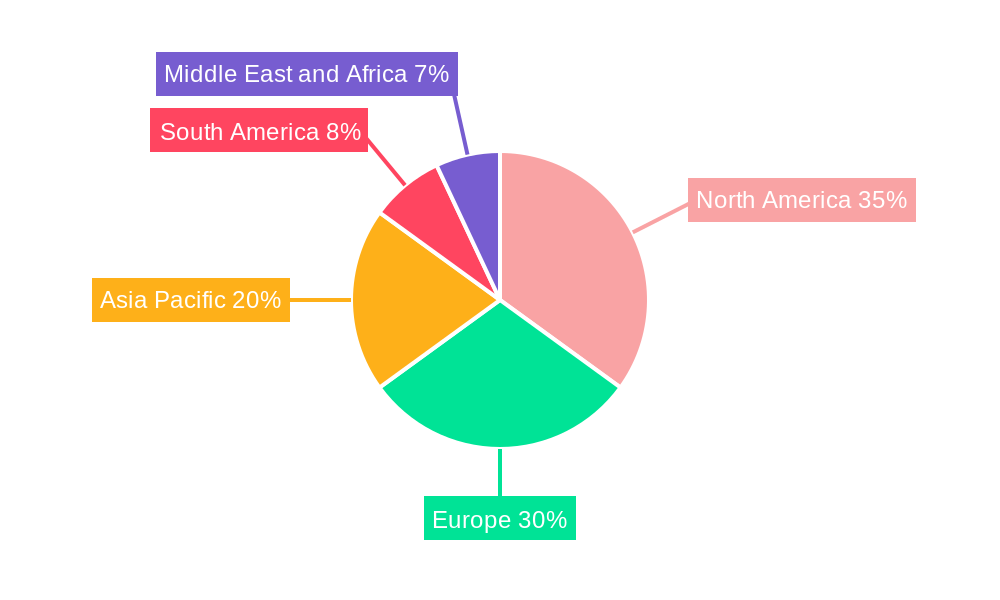

Leading Markets & Segments in Premium Chocolate Market

North America currently dominates the premium chocolate market, driven by a mature consumer base with a high propensity for luxury goods and a strong appreciation for quality confectionery. Within North America, the United States represents the largest country-specific market, owing to its significant disposable income and established premium chocolate culture.

Product Type Dominance:

- Dark Premium Chocolate: This segment commands the largest market share, estimated at over 45%, owing to increasing consumer awareness of its perceived health benefits and complex flavor profiles.

- White and Milk Premium Chocolate: These segments follow closely, catering to a broader palate and often appealing to younger demographics or those seeking sweeter indulgence.

Distribution Channel Dominance:

- Hypermarkets/Supermarkets: This channel remains a key contributor, offering accessibility and convenience to a wide range of consumers, accounting for approximately 40% of sales.

- Online Stores: The e-commerce channel is experiencing rapid growth, projected to capture over 25% of the market by 2033, driven by the ease of purchasing niche and premium products.

- Convenience Stores: These outlets are gaining traction for impulse purchases of smaller premium chocolate items.

- Other Distribution Channels: This includes specialty chocolate boutiques, gourmet food stores, and direct-to-consumer sales, which cater to a highly discerning customer base.

Economic policies that support trade and reduce import tariffs on high-quality cocoa beans can further boost market growth. Infrastructure development, particularly in logistics and cold chain capabilities, is crucial for ensuring the quality and timely delivery of premium chocolate products, especially in the rapidly expanding online segment.

Premium Chocolate Market Product Developments

Product development in the premium chocolate market is heavily influenced by trends in health and wellness, sustainability, and unique flavor experiences. Innovations focus on incorporating natural ingredients, reducing sugar content, and offering vegan and allergen-free options. For instance, the development of cocoa-free chocolate alternatives caters to sustainability concerns and ethical sourcing demands. Competitive advantages are built on distinct artisanal craftsmanship, unique ingredient pairings (e.g., exotic fruits, spices), and visually appealing packaging that reflects the luxury positioning of the product. Technological advancements in processing allow for finer textures and more intense flavor extraction, differentiating premium offerings from mass-market alternatives.

Key Drivers of Premium Chocolate Market Growth

Several key drivers are propelling the growth of the premium chocolate market. Rising disposable incomes globally, particularly in emerging economies, enable a larger consumer segment to afford luxury confectionery. A growing consumer consciousness towards health and wellness fuels demand for premium dark chocolates with higher cocoa content and perceived health benefits. The increasing emphasis on ethical sourcing, fair trade practices, and sustainable cocoa farming resonates with a socially responsible consumer base. Technological advancements in product innovation, allowing for unique flavor profiles and artisanal production methods, also contribute significantly. Furthermore, effective marketing and branding strategies that emphasize quality, exclusivity, and indulgence are crucial in attracting and retaining premium chocolate consumers.

Challenges in the Premium Chocolate Market Market

The premium chocolate market faces several challenges that can restrain its growth. Volatility in cocoa bean prices, influenced by climate change and geopolitical factors, can impact profitability and pricing strategies. Supply chain complexities, from bean cultivation to final distribution, require careful management to ensure quality and consistency. Increasing competition from both established luxury brands and emerging artisanal producers intensifies market pressures. Stringent regulatory frameworks regarding food safety, labeling, and ingredient sourcing can add to operational costs and complexity. Furthermore, the perception of premium chocolate as an occasional indulgence rather than a daily staple can limit market penetration for some segments.

Emerging Opportunities in Premium Chocolate Market

The premium chocolate market is ripe with emerging opportunities. The burgeoning demand for plant-based and vegan premium chocolates presents a significant growth avenue, driven by evolving dietary choices and ethical considerations. Expanding into niche markets, such as single-origin chocolates from specific regions or chocolates with unique functional ingredients (e.g., added probiotics, adaptogens), can attract discerning consumers. Strategic partnerships with complementary luxury brands, hotels, or high-end retailers can enhance brand visibility and market reach. Leveraging e-commerce platforms for direct-to-consumer sales allows for greater control over brand experience and customer engagement. Furthermore, the increasing global interest in artisanal and craft products creates opportunities for small-batch producers and unique flavor innovations.

Leading Players in the Premium Chocolate Market Sector

- Nestle SA

- Mars Incorporated

- Cemoi Chocolatier SA

- Pierre Marcolini Group

- Chocoladefabriken Lindt & Sprungli AG

- Lake Champlain Chocolates

- Mondelez International Inc.

- Yildiz Holding

- Ferrero SpA

- The Hershey Company

Key Milestones in Premium Chocolate Market Industry

- December 2023: Lindt partnered with German cocoa-free chocolate brand ChoViva to expand its popular Hello range with a limited edition vegan soft and creamy Hazelnut Bar, signaling a move towards plant-based innovations.

- October 2023: Lindt expanded its dairy-free range in the US market with vegan versions of the famous Lindor truffles, available in oat milk and dark oat milk varieties, catering to the growing vegan consumer base.

- June 2023: Lindt and Sprungli launched a chocolate bar under the "One for One" initiative in the Canadian market, featuring a distinct modern packaging and three flavors (Milk Chocolate, Milk Chocolate Hazelnut, and Milk Chocolate Salted Caramel), aiming to attract a younger, design-conscious audience.

Strategic Outlook for Premium Chocolate Market Market

The strategic outlook for the premium chocolate market remains highly optimistic, with continued growth fueled by evolving consumer demands for quality, sustainability, and unique experiences. Key growth accelerators include further innovation in plant-based and health-conscious chocolate options, expansion into emerging markets with rising disposable incomes, and enhanced utilization of e-commerce for direct consumer engagement. Strategic acquisitions and partnerships will likely continue to shape the competitive landscape, enabling players to broaden their product portfolios and geographic reach. Investing in transparent and ethical sourcing practices will be paramount for building brand loyalty and meeting consumer expectations. The market's future success hinges on its ability to adapt to evolving dietary trends and maintain its core promise of indulgent, high-quality confectionery.

Premium Chocolate Market Segmentation

-

1. Product Type

- 1.1. Dark Premium Chocolate

- 1.2. White and Milk Premium Chocolate

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Premium Chocolate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Poland

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Premium Chocolate Market Regional Market Share

Geographic Coverage of Premium Chocolate Market

Premium Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. White and Milk Chocolates are More Popular than Dark Variants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Premium Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dark Premium Chocolate

- 5.1.2. White and Milk Premium Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Premium Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dark Premium Chocolate

- 6.1.2. White and Milk Premium Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Premium Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dark Premium Chocolate

- 7.1.2. White and Milk Premium Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Premium Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dark Premium Chocolate

- 8.1.2. White and Milk Premium Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Premium Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dark Premium Chocolate

- 9.1.2. White and Milk Premium Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Dark Premium Chocolate

- 10.1.2. White and Milk Premium Chocolate

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mars Incorporate

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cemoi Chocolatier SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pierre Marcolini Group*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chocoladefabriken Lindt & Sprungli AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lake Champlain Chocolates

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mondelez International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yildiz Holding

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ferrero SpA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Hershey Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Premium Chocolate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Premium Chocolate Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Premium Chocolate Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Premium Chocolate Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Premium Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Premium Chocolate Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Premium Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Premium Chocolate Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Premium Chocolate Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Premium Chocolate Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Premium Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Premium Chocolate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Premium Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Premium Chocolate Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Premium Chocolate Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Premium Chocolate Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Premium Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Premium Chocolate Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Premium Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Premium Chocolate Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Premium Chocolate Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Premium Chocolate Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Premium Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Premium Chocolate Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Premium Chocolate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Premium Chocolate Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Premium Chocolate Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Premium Chocolate Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Premium Chocolate Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Premium Chocolate Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Premium Chocolate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Premium Chocolate Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Premium Chocolate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Premium Chocolate Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Premium Chocolate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Premium Chocolate Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Premium Chocolate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Poland Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Premium Chocolate Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Premium Chocolate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Premium Chocolate Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Premium Chocolate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Premium Chocolate Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Premium Chocolate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Chocolate Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Premium Chocolate Market?

Key companies in the market include Nestle SA, Mars Incorporate, Cemoi Chocolatier SA, Pierre Marcolini Group*List Not Exhaustive, Chocoladefabriken Lindt & Sprungli AG, Lake Champlain Chocolates, Mondelez International Inc, Yildiz Holding, Ferrero SpA, The Hershey Company.

3. What are the main segments of the Premium Chocolate Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

White and Milk Chocolates are More Popular than Dark Variants.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2023: Lindt partnered with German cocoa-free chocolate brand ChoViva to expand its popular Hello range with a limited edition vegan soft and creamy Hazelnut Bar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Premium Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Premium Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Premium Chocolate Market?

To stay informed about further developments, trends, and reports in the Premium Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence