Key Insights

The African Water Enhancer Market is projected for substantial growth, anticipated to reach $3.42 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 10.3% from 2025 to 2033. This expansion is propelled by increasing consumer demand for healthier hydration options and growing awareness of water enhancers' role in promoting adequate fluid intake. As health consciousness rises across nations like Nigeria, South Africa, and Kenya, consumers are actively seeking convenient and palatable alternatives to plain water. Enhanced disposable incomes further support this trend, enabling greater spending on functional beverages and health-focused products. Strategic market presence and innovation from key players, including Dyla LLC (Stur) and NUTRITECH, alongside expanding online retail accessibility, are critical growth enablers.

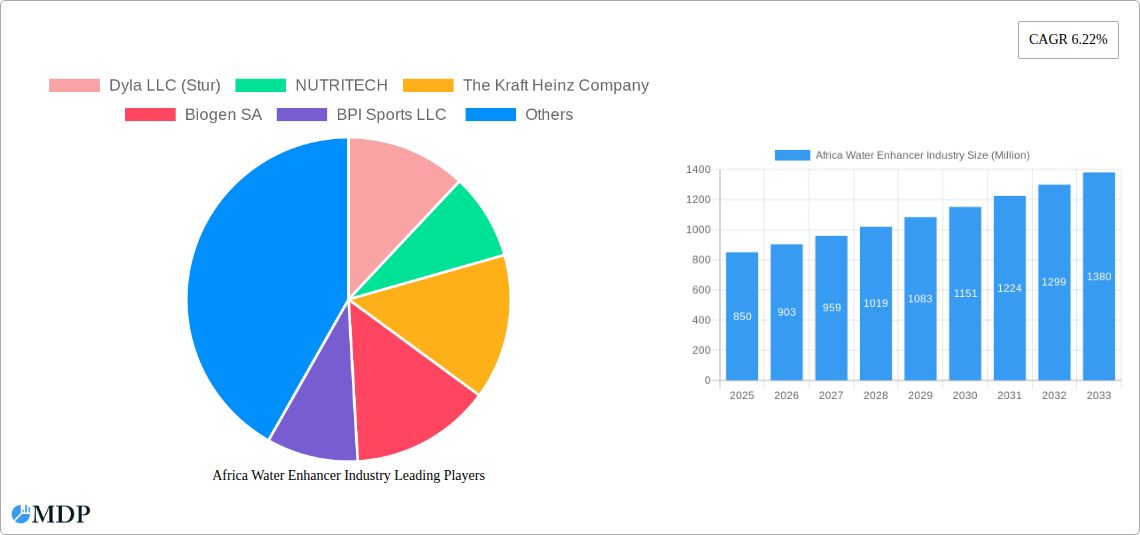

Africa Water Enhancer Industry Market Size (In Billion)

Evolving consumer preferences towards natural and low-sugar water enhancers, aligned with global wellness trends, define the market's dynamic landscape. Manufacturers are innovating with natural sweeteners and fruit extracts to meet demand for healthier formulations. Expanded distribution through supermarkets, hypermarkets, and health stores improves product accessibility. While price sensitivity and supply chain complexities present challenges, strong drivers of health consciousness, convenience, and product innovation indicate a robust future for the African Water Enhancer Market, with significant growth expected in economies such as Egypt and Ethiopia.

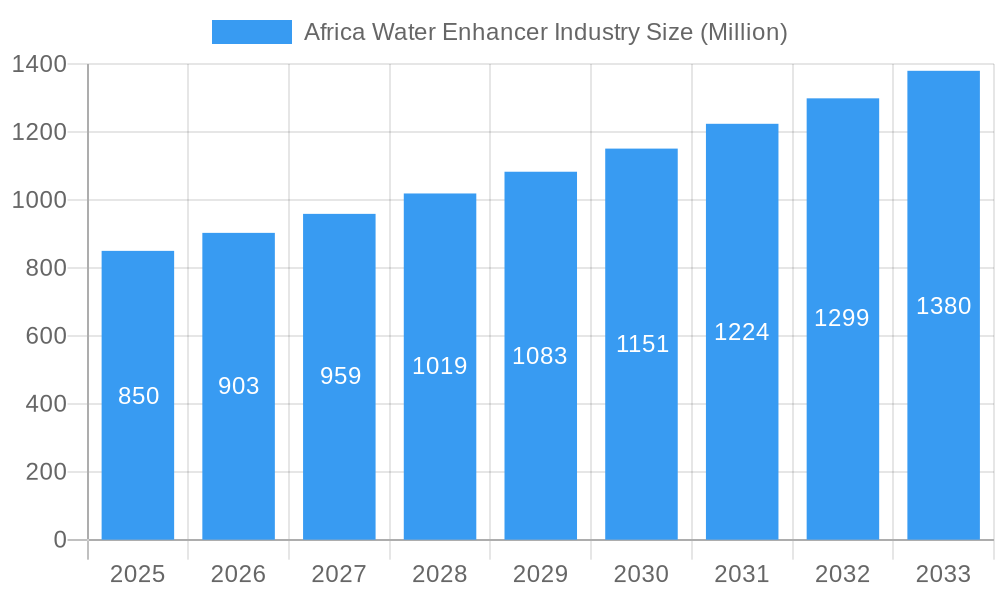

Africa Water Enhancer Industry Company Market Share

Africa Water Enhancer Industry: Comprehensive Market Analysis & Growth Strategies (2019-2033)

Unlock the vast potential of the Africa Water Enhancer Market with this in-depth, SEO-optimized report. Designed for industry stakeholders seeking actionable insights, this analysis covers market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, and strategic opportunities. The report delves into a meticulously researched market landscape, incorporating high-traffic keywords such as "water enhancers Africa," "beverage additives market," "functional beverages Africa," "hydration solutions," and "health and wellness drinks Africa" to maximize visibility and attract relevant decision-makers. With a study period spanning from 2019–2033, a Base Year of 2025, and a Forecast Period of 2025–2033, this report provides a comprehensive view of historical performance and future projections.

Africa Water Enhancer Industry Market Dynamics & Concentration

The Africa Water Enhancer Industry is characterized by a moderate to high market concentration, with a few dominant players holding significant market share, estimated at 65%. Innovation is a key driver, fueled by increasing consumer demand for healthier, convenient, and flavored beverage options. Companies are investing heavily in research and development to introduce novel formulations, including natural sweeteners, functional ingredients (vitamins, minerals, electrolytes), and zero-calorie options. Regulatory frameworks across African nations are evolving, with a growing emphasis on food safety standards and ingredient transparency, influencing product formulations and market entry strategies. Product substitutes, such as traditional juices, flavored milks, and even plain water with added fruits, present a competitive challenge. However, the unique selling proposition of water enhancers – portability, cost-effectiveness, and customization – continues to drive adoption. End-user trends lean towards health-conscious consumers seeking to increase their daily water intake and explore diverse flavor profiles. Mergers and Acquisitions (M&A) activity is on the rise, with an estimated 8 major M&A deals in the historical period (2019-2024) indicating consolidation and strategic expansion. Key M&A strategies include acquiring smaller, innovative brands and expanding distribution networks.

Africa Water Enhancer Industry Industry Trends & Analysis

The Africa Water Enhancer Industry is poised for substantial growth, driven by a confluence of favorable factors. A significant market growth driver is the rising prevalence of health and wellness trends across the continent, with consumers actively seeking ways to improve their hydration and overall well-being. This is further amplified by the increasing disposable incomes in many African economies, enabling greater expenditure on premium and functional food and beverage products. Technological disruptions are playing a crucial role, with advancements in formulation science leading to the development of more stable, concentrated, and appealing water enhancer products. The widespread adoption of online retail stores in Africa is also a major trend, offering unparalleled access to a diverse range of water enhancer brands and catering to the convenience-driven purchasing habits of modern consumers. Consumer preferences are shifting towards natural ingredients, low-sugar options, and functional benefits like added vitamins and electrolytes. This has spurred manufacturers to innovate and launch products that align with these evolving demands. The competitive landscape is intensifying, with both established beverage giants and agile startups vying for market share. This competition fosters continuous product development and marketing innovation. The market penetration of water enhancers, while still nascent in some regions, is steadily increasing, driven by aggressive marketing campaigns and increasing availability through various distribution channels. The projected Compound Annual Growth Rate (CAGR) for the Africa Water Enhancer Market is estimated at XX% for the forecast period, indicating a robust expansion trajectory. The total market size in the base year of 2025 is expected to reach XX Million USD.

Leading Markets & Segments in Africa Water Enhancer Industry

The Supermarkets/Hypermarkets distribution channel currently dominates the Africa Water Enhancer Industry, reflecting the widespread availability and purchasing habits of consumers across the continent. These large retail formats offer broad product selection, competitive pricing, and convenient one-stop shopping experiences, making them the primary point of purchase for a significant portion of the African population. The substantial market share of this segment, estimated at 45%, is a testament to its enduring appeal. Economic policies promoting retail development, coupled with improving infrastructure that facilitates supply chain logistics to these outlets, are key drivers behind their dominance.

- Key Drivers of Supermarkets/Hypermarkets Dominance:

- Broad Consumer Reach: Access to a diverse demographic, from urban to peri-urban populations.

- Promotional Activities: Frequent sales, discounts, and in-store promotions that attract price-sensitive consumers.

- Brand Visibility: Prime shelf space and prominent displays enhance brand awareness.

- Emerging Middle Class: Growing purchasing power of the middle class, who are increasingly adopting these retail formats.

The Online Retail Stores segment is rapidly emerging as a significant force, projected to capture a substantial market share of XX% by the end of the forecast period. This growth is fueled by increasing internet penetration, smartphone adoption, and the growing trust in e-commerce platforms across Africa. Online retailers offer unparalleled convenience, a wider array of niche and international brands, and the ability to compare prices and read reviews, catering to a digitally savvy consumer base.

- Key Drivers of Online Retail Stores Growth:

- Convenience and Accessibility: Shopping from home, 24/7 availability, and delivery services.

- Wider Product Selection: Access to global brands and specialized water enhancers not readily available in physical stores.

- Competitive Pricing and Deals: Online platforms often offer exclusive discounts and bundle deals.

- Digital Literacy: Growing comfort and trust in online payment and shopping experiences.

The Convenience Stores segment, while smaller, plays a vital role in providing readily accessible options for impulse purchases and immediate hydration needs, holding an estimated XX% market share. Pharmacy & Health Stores, catering to health-conscious consumers seeking specific functional benefits, represent another important, albeit niche, segment with an estimated XX% market share. The Others category, encompassing smaller independent retailers and direct-to-consumer sales, accounts for the remaining XX%.

Africa Water Enhancer Industry Product Developments

The Africa Water Enhancer Industry is witnessing a wave of innovative product developments focused on enhancing consumer appeal and functional benefits. Key trends include the introduction of zero-calorie and natural sweetener options, addressing growing health consciousness and demand for sugar-free alternatives. There's also a significant surge in functionally fortified enhancers, incorporating vitamins, minerals, electrolytes, and even adaptogens to cater to specific health needs like immunity support and stress relief. Concentrated liquid formats remain popular for their portability and ease of use, while powdered sachets are gaining traction for their single-serving convenience and shelf-stability. Companies are also exploring novel flavor profiles, moving beyond traditional fruit flavors to include more exotic and sophisticated options. Competitive advantages are being built through superior taste, innovative ingredient combinations, attractive packaging, and strong brand storytelling that resonates with African consumers' aspirations for health and vitality. The market fit is amplified by products designed for easy integration into daily routines, from gym bags to office desks.

Key Drivers of Africa Water Enhancer Industry Growth

The Africa Water Enhancer Industry's growth is propelled by a powerful combination of factors. Rising health and wellness awareness is paramount, as consumers actively seek convenient ways to enhance their daily water intake and incorporate beneficial ingredients. Increasing disposable incomes across several African nations empower consumers to invest in value-added beverage products. Technological advancements in food and beverage formulation enable the creation of more appealing, stable, and functional water enhancers. Furthermore, the growing penetration of online retail and mobile commerce significantly expands market reach and accessibility. Regulatory initiatives promoting healthy hydration and clearer labeling also contribute positively by fostering consumer trust and encouraging product development aligned with health standards.

Challenges in the Africa Water Enhancer Industry Market

Despite the promising growth, the Africa Water Enhancer Industry faces several significant challenges. Regulatory hurdles and inconsistencies across different African countries can complicate market entry and product standardization, impacting an estimated XX% of market expansion efforts. Supply chain disruptions and logistical complexities, particularly in remote regions, can affect product availability and increase distribution costs, potentially impacting XX% of sales. Intense competition from established beverage players and readily available substitutes like traditional juices and flavored drinks necessitates continuous innovation and aggressive marketing. Consumer price sensitivity in certain markets can limit the adoption of premium or specialized water enhancers, posing a challenge to market penetration for an estimated XX% of potential customers. Limited consumer education regarding the benefits of water enhancers also presents a barrier, requiring sustained efforts to build awareness and trust.

Emerging Opportunities in Africa Water Enhancer Industry

The Africa Water Enhancer Industry is ripe with emerging opportunities for sustained long-term growth. Technological breakthroughs in natural ingredient extraction and flavor encapsulation offer the potential to develop even healthier and more appealing product lines, catering to the growing demand for clean labels. Strategic partnerships with local health and wellness influencers, gyms, and corporate wellness programs can significantly amplify brand reach and build consumer trust. Market expansion into underpenetrated urban and semi-urban areas, coupled with tailored product offerings for specific regional tastes and needs, presents a vast untapped market potential. Developing sustainable and eco-friendly packaging solutions can resonate with an increasingly environmentally conscious consumer base, creating a distinct competitive advantage. The burgeoning youth population, coupled with their embrace of digital platforms, offers a prime demographic for targeted marketing and direct-to-consumer sales strategies.

Leading Players in the Africa Water Enhancer Industry Sector

- Dyla LLC (Stur)

- NUTRITECH

- The Kraft Heinz Company

- Biogen SA

- BPI Sports LLC

- 4C Foods

- ds international

- Elvin Group

Key Milestones in Africa Water Enhancer Industry Industry

- 2019: Introduction of plant-based sweetener options, aligning with rising vegan and vegetarian consumer trends.

- 2020: Significant increase in online sales driven by pandemic-related lockdowns, boosting e-commerce platform adoption.

- 2021: Launch of functional water enhancers fortified with Vitamin C and Zinc to support immunity.

- 2022: Expansion of product lines by major players to include a wider range of zero-sugar and natural flavor options.

- 2023: Increased M&A activity as larger companies seek to acquire innovative startups with unique product formulations.

- 2024 (Projected): Growing adoption of personalized hydration solutions and customizability features in water enhancers.

Strategic Outlook for Africa Water Enhancer Industry Market

The strategic outlook for the Africa Water Enhancer Industry is exceptionally bright, characterized by sustained growth and evolving consumer demand. Future market potential is anchored in the increasing prioritization of health and wellness, the expanding middle class, and the continuous adoption of digital technologies for commerce and information dissemination. Growth accelerators include strategic product innovation focusing on natural ingredients and functional benefits, aggressive marketing campaigns leveraging digital channels and influencer collaborations, and targeted market expansion into underserved regions. Companies that can effectively navigate regulatory landscapes, optimize supply chains, and foster strong brand loyalty through product quality and value will be well-positioned for long-term success in this dynamic and rapidly growing market. The focus will increasingly shift towards creating personalized hydration experiences and offering a holistic approach to well-being through beverage enhancers.

Africa Water Enhancer Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Online Retail Stores

- 1.4. Pharmacy & Health Store

- 1.5. Others

Africa Water Enhancer Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Water Enhancer Industry Regional Market Share

Geographic Coverage of Africa Water Enhancer Industry

Africa Water Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Increasing Trend of Non-Alcoholic Beverages and Experimentation with Flavours

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Online Retail Stores

- 5.1.4. Pharmacy & Health Store

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dyla LLC (Stur)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NUTRITECH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Kraft Heinz Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Biogen SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BPI Sports LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4C Foods

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ds international

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Elvin Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dyla LLC (Stur)

List of Figures

- Figure 1: Africa Water Enhancer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Water Enhancer Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Water Enhancer Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Africa Water Enhancer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Africa Water Enhancer Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Africa Water Enhancer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Water Enhancer Industry?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the Africa Water Enhancer Industry?

Key companies in the market include Dyla LLC (Stur), NUTRITECH, The Kraft Heinz Company, Biogen SA, BPI Sports LLC , 4C Foods, ds international, Elvin Group.

3. What are the main segments of the Africa Water Enhancer Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.42 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Increasing Trend of Non-Alcoholic Beverages and Experimentation with Flavours.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Water Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Water Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Water Enhancer Industry?

To stay informed about further developments, trends, and reports in the Africa Water Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence