Key Insights

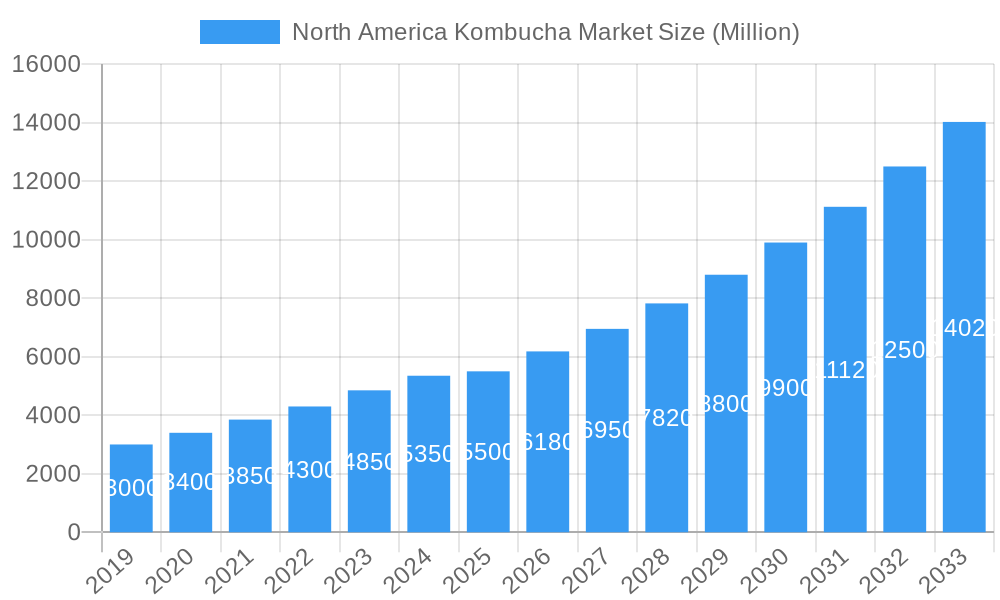

The North American kombucha market is poised for significant expansion, projected to reach $1878.5 million by 2024, with an impressive Compound Annual Growth Rate (CAGR) of 13.9%. This growth is driven by escalating consumer demand for healthier, functional beverages, and a heightened awareness of kombucha's probiotic benefits. Key factors fueling this expansion include rising health consciousness, a preference for fermented products, and continuous product innovation featuring diverse flavors and functional ingredients. Widespread availability across retail channels further supports market penetration.

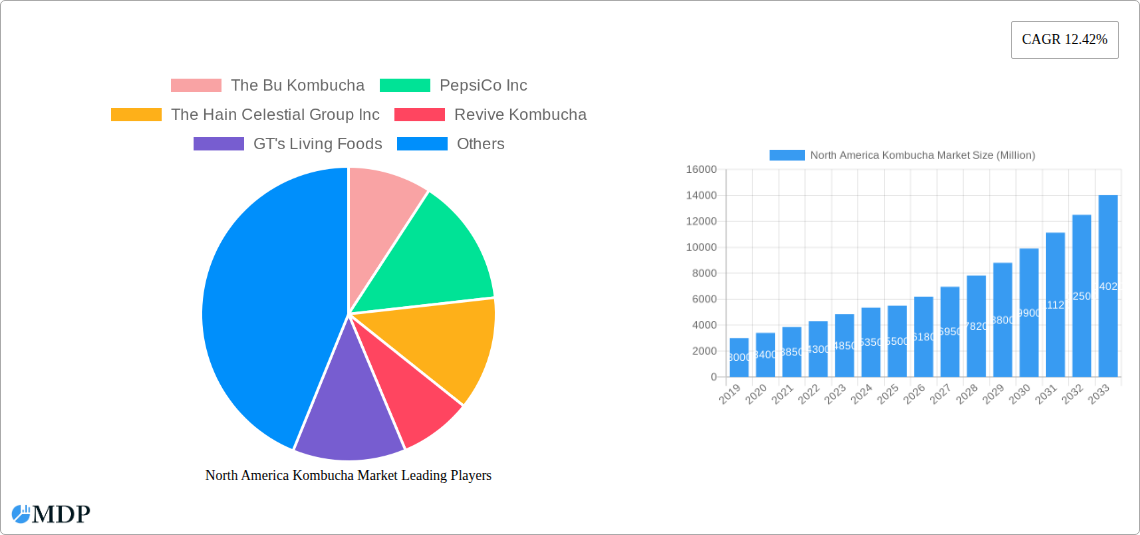

North America Kombucha Market Market Size (In Billion)

The competitive arena features both established beverage corporations and specialized kombucha producers. Market segmentation is characterized by popular varieties such as "Original/Regular" and "Flavored" products, distributed primarily through supermarkets/hypermarkets and online retail. While challenges such as fluctuating raw material costs and substitute beverage options exist, the overarching trend towards wellness and kombucha's acceptance as a lifestyle beverage are expected to sustain its robust growth trajectory.

North America Kombucha Market Company Market Share

North America Kombucha Market: Growth Drivers, Consumer Trends, and Competitive Landscape (2019-2033)

Explore the dynamic North America Kombucha Market with our comprehensive report, providing in-depth analysis of market size, trends, and future projections. This report delves into the burgeoning demand for fermented beverages, focusing on market segmentation by product type and distribution channel, alongside an extensive overview of leading players and industry developments. Discover actionable insights into market concentration, innovation, and regulatory frameworks shaping the future of kombucha consumption across the United States and Canada. With a detailed forecast period of 2025-2033 and historical data from 2019-2024, this report offers a critical resource for investors, manufacturers, and stakeholders navigating this rapidly evolving beverage sector.

North America Kombucha Market Market Dynamics & Concentration

The North America Kombucha Market exhibits moderate concentration, characterized by a mix of established beverage giants and agile craft producers. Innovation remains a key driver, fueled by consumer interest in health and wellness, leading to the development of novel flavors and functional formulations. Regulatory frameworks, primarily focused on food safety and labeling, generally support market growth. Product substitutes, such as other fermented drinks and functional beverages, present a competitive landscape, yet kombucha's unique probiotic benefits and taste profile offer a distinct advantage. End-user trends point towards increasing demand for low-sugar, organic, and plant-based options. Mergers and acquisition (M&A) activities are observed as larger companies seek to capitalize on the growing kombucha segment, with an estimated xx M&A deal count in the historical period. Key players like PepsiCo Inc. and The Hain Celestial Group Inc. are actively involved in strategic acquisitions to expand their market share and product portfolios.

North America Kombucha Market Industry Trends & Analysis

The North America Kombucha Market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is primarily driven by heightened consumer awareness regarding the health benefits associated with probiotic-rich beverages, including improved digestion and immune support. The growing preference for natural and low-calorie alternatives to sugary drinks further propels market penetration. Technological advancements in fermentation processes and packaging solutions are enhancing product quality and shelf-life, making kombucha more accessible to a wider consumer base. Evolving consumer preferences lean towards diverse flavor profiles, from classic original/regular options to innovative fruit and herb infusions. The competitive dynamics are intensifying, with both established brands and emerging players vying for market dominance through product differentiation and aggressive marketing strategies. The market penetration of kombucha is estimated to reach XX% by 2033, signifying a significant shift in beverage consumption habits.

Leading Markets & Segments in North America Kombucha Market

The United States currently leads the North America Kombucha Market, driven by a well-established health and wellness culture and a higher disposable income. Within the United States, key regions exhibiting significant market penetration include California, New York, and the Pacific Northwest.

Product Type Dominance:

- Flavored Kombucha: This segment is experiencing rapid growth, outpacing the Original/Regular segment due to a broader appeal to consumers seeking diverse and exciting taste experiences. Innovations in flavor combinations, such as tropical fruits, exotic spices, and botanical infusions, are key market drivers.

- Original/Regular Kombucha: While still holding a substantial market share, this segment caters to purists and consumers who prefer the authentic tart and tangy taste of kombucha.

Distribution Channel Dominance:

- Supermarkets/Hypermarkets: These remain the primary distribution channels, offering wide product availability and convenience to a broad consumer base. Economic policies favoring grocery retail infrastructure and consumer spending power significantly contribute to their dominance.

- Specialist Stores: Health food stores and dedicated beverage retailers play a crucial role in catering to niche consumer segments and promoting artisanal kombucha brands.

- Online Retail Stores: The e-commerce segment is witnessing substantial growth, driven by convenience and the ability to access a wider variety of brands and flavors. This channel is crucial for reaching consumers in less accessible geographical areas.

- Convenience Stores/Grocery Stores: These are gaining traction as manufacturers introduce smaller, ready-to-drink formats suitable for impulse purchases.

North America Kombucha Market Product Developments

Product innovation in the North America Kombucha Market is characterized by a focus on enhanced functionality, novel flavor profiles, and improved ingredient sourcing. Companies are increasingly incorporating adaptogens, probiotics, and prebiotics to offer specific health benefits beyond general wellness. The development of low-sugar and zero-sugar variants is a significant trend, catering to health-conscious consumers. Packaging advancements, including sustainable materials and smaller serving sizes, are also crucial for market appeal and environmental consciousness. Competitive advantages are being built on unique brewing techniques, proprietary yeast strains, and the use of premium, organic ingredients.

Key Drivers of North America Kombucha Market Growth

The North America Kombucha Market is propelled by several key drivers. The escalating consumer focus on health and wellness, coupled with the recognized probiotic benefits of kombucha for gut health and immunity, is a primary catalyst. The growing demand for natural, organic, and plant-based beverages, aligning with evolving dietary preferences, significantly contributes to market expansion. Technological advancements in production and packaging are improving product quality and accessibility. Favorable regulatory environments in most North American countries support the growth of the functional beverage sector. Furthermore, increasing disposable incomes and a willingness to spend on premium health products further fuel market growth.

Challenges in the North America Kombucha Market Market

Despite its growth, the North America Kombucha Market faces several challenges. Stringent regulations concerning labeling and health claims can create hurdles for new entrants and smaller producers. The relatively short shelf life of some kombucha products necessitates efficient supply chain management and cold chain logistics, which can be costly. Intense competition from established beverage brands and a growing array of alternative health drinks pose pricing pressures and market saturation risks. Educating consumers about the specific benefits and taste profile of kombucha, especially for those new to the beverage, remains an ongoing marketing challenge. Supply chain disruptions and fluctuating raw material costs can also impact profitability.

Emerging Opportunities in North America Kombucha Market

Emerging opportunities in the North America Kombucha Market lie in the continued innovation of functional blends, targeting specific health needs such as stress relief, enhanced energy, or improved sleep. The expansion into new geographical markets within North America, particularly in underserved regions, presents significant growth potential. Strategic partnerships with foodservice providers, airlines, and corporate wellness programs can unlock new distribution avenues. The development of ready-to-drink (RTD) formats with unique flavor profiles and added nutritional benefits will cater to the on-the-go consumer. Furthermore, the increasing consumer interest in sustainability and ethical sourcing provides opportunities for brands that prioritize eco-friendly practices and transparent ingredient origins.

Leading Players in the North America Kombucha Market Sector

- The Bu Kombucha

- PepsiCo Inc.

- The Hain Celestial Group Inc

- Revive Kombucha

- GT's Living Foods

- NessAlla Kombucha

- Health-Ade Kombucha

- Wonder Drink

- humm kombucha

- Brew Dr. Kombucha

Key Milestones in North America Kombucha Market Industry

- June 2022: Remedy Drinks significantly expanded its presence in the United States, securing partnerships with major national retailers such as Albertsons, Safeway, and Banners. Furthermore, the company introduced a new kombucha flavor, Mango Passion, to delight American consumers.

- February 2022: Brew Dr. unveiled its latest kombucha creation, Just Peachy, boasting the use of high-quality loose-leaf green tea and a blend of five varieties of organic peaches for an exquisite flavor profile.

- September 2021: Brew Dr. launched a unique kombucha infused with hop flavors. This innovative offering combined locally sourced hops, including Simcoe, Palisade, and Centennial, harmoniously blended with the zesty essence of Yuzu orange and green tea, providing a distinctive and refreshing taste experience.

Strategic Outlook for North America Kombucha Market Market

The strategic outlook for the North America Kombucha Market remains highly optimistic, driven by sustained consumer demand for healthy and functional beverages. Future growth will be propelled by continued product innovation, particularly in the realm of customized functional benefits and novel flavor combinations. Expansion into new distribution channels, including partnerships with mainstream retailers and online platforms, will be crucial for market penetration. Companies will likely focus on enhancing their sustainability practices and transparent sourcing to resonate with environmentally conscious consumers. Strategic collaborations, mergers, and acquisitions are expected to continue as major players aim to consolidate their market positions and capitalize on emerging trends, ensuring long-term market expansion and profitability.

North America Kombucha Market Segmentation

-

1. Product Type

- 1.1. Original/Regular

- 1.2. Flavored

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores/Grocery Stores

- 2.3. Specialist Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

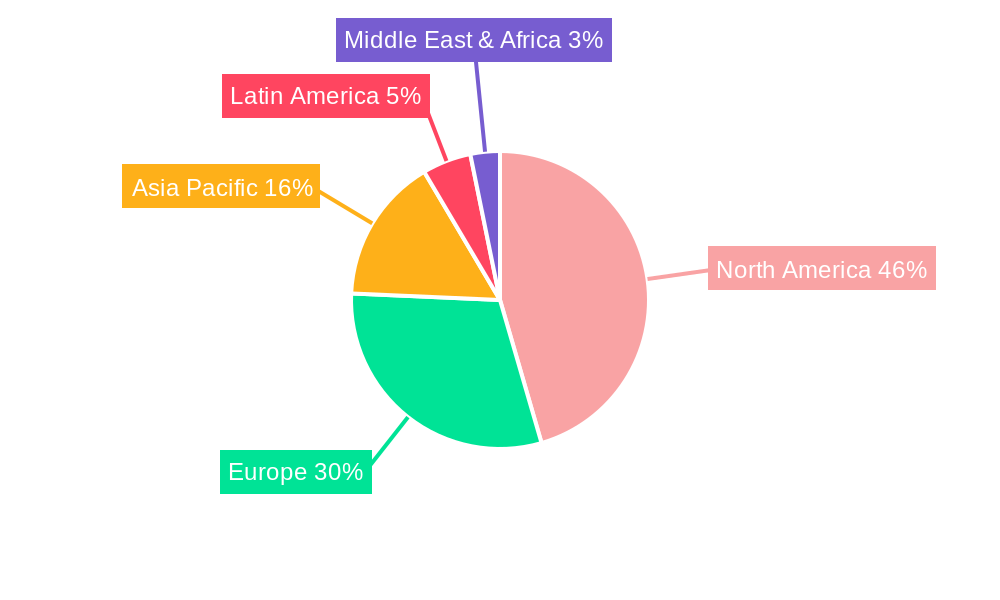

North America Kombucha Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Kombucha Market Regional Market Share

Geographic Coverage of North America Kombucha Market

North America Kombucha Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Fermented Beverages in the Region; Increasing Demand for Innovative Flavored Kombucha Drinks

- 3.3. Market Restrains

- 3.3.1. High Price of Kombucha Hampering the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fermented Beverages across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Kombucha Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Original/Regular

- 5.1.2. Flavored

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores/Grocery Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Bu Kombucha

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Hain Celestial Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Revive Kombucha

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GT's Living Foods

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NessAlla Kombucha

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Health-Ade Kombucha

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wonder Drink*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 humm kombucha

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brew Dr Kombucha

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Bu Kombucha

List of Figures

- Figure 1: North America Kombucha Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Kombucha Market Share (%) by Company 2025

List of Tables

- Table 1: North America Kombucha Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: North America Kombucha Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Kombucha Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Kombucha Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: North America Kombucha Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Kombucha Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States North America Kombucha Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Kombucha Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Kombucha Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Kombucha Market?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the North America Kombucha Market?

Key companies in the market include The Bu Kombucha, PepsiCo Inc, The Hain Celestial Group Inc, Revive Kombucha, GT's Living Foods, NessAlla Kombucha, Health-Ade Kombucha, Wonder Drink*List Not Exhaustive, humm kombucha, Brew Dr Kombucha.

3. What are the main segments of the North America Kombucha Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1878.5 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Fermented Beverages in the Region; Increasing Demand for Innovative Flavored Kombucha Drinks.

6. What are the notable trends driving market growth?

Rising Demand for Fermented Beverages across the Region.

7. Are there any restraints impacting market growth?

High Price of Kombucha Hampering the Market Growth.

8. Can you provide examples of recent developments in the market?

June 2022: Remedy Drinks significantly expanded its presence in the United States, securing partnerships with major national retailers such as Albertsons, Safeway, and Banners. Furthermore, the company introduced a new kombucha flavor, Mango Passion, to delight American consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Kombucha Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Kombucha Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Kombucha Market?

To stay informed about further developments, trends, and reports in the North America Kombucha Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence