Key Insights

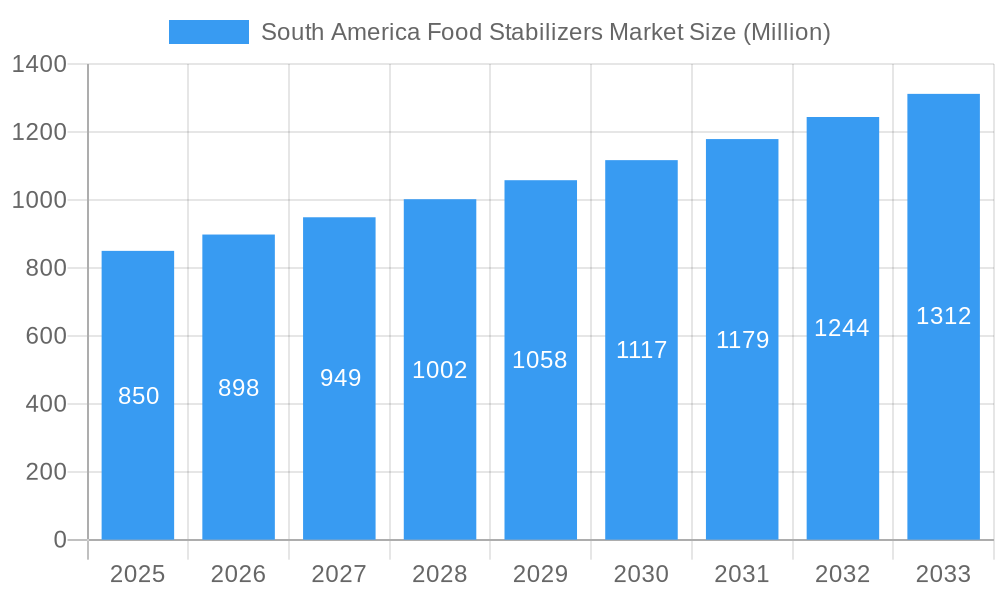

The South America Food Stabilizers Market is projected for substantial growth, with an estimated market size of $2.5 billion in the base year 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 3.8%. This growth is primarily driven by the escalating demand for processed foods, beverages, and convenience products throughout the region, with Brazil and Argentina leading the way. Key application segments fueling this expansion include bakery, confectionery, and the expanding dairy sector. Growing consumer preference for natural ingredients is significantly boosting the demand for natural food stabilizers, a trend manufacturers are actively addressing. This shift is coupled with the need to meet stringent regulatory requirements and cater to a health-conscious consumer base.

South America Food Stabilizers Market Market Size (In Billion)

Advancements in food processing technologies and a focus on enhancing shelf-life, product texture, and consistency further support the market's upward trajectory. Potential restraints, such as volatile raw material costs and the perceived expense of specialized stabilizers, may present challenges. However, the overall market outlook remains highly promising. The forecast period anticipates sustained expansion, with the market poised for considerable growth. Key industry players are strategically investing in research and development to launch innovative stabilization solutions and diversify their product offerings across various applications, including meat and poultry, sauces, and dressings, thereby reinforcing the market's robust growth momentum.

South America Food Stabilizers Market Company Market Share

South America Food Stabilizers Market Report: Insights, Trends, and Growth Opportunities

This comprehensive report delves into the South America Food Stabilizers Market, offering an in-depth analysis of its dynamics, key trends, leading segments, and future outlook. Covering the study period from 2019 to 2033, with a base year of 2025, this report provides critical intelligence for stakeholders seeking to navigate and capitalize on this evolving market.

South America Food Stabilizers Market Market Dynamics & Concentration

The South America Food Stabilizers Market exhibits moderate to high concentration, with a few key players holding significant market share. Companies like DuPont de Nemours Inc., Ingredion Inc., Archer Daniels Midland Company, Bunge Limited, Cargill Inc., and AOM SA are prominent. The market is driven by continuous innovation in natural and synthetic stabilizers, catering to an increasing demand for clean-label ingredients and improved product texture and shelf-life. Regulatory frameworks across South American countries play a crucial role, with stringent approvals required for new food additives. Product substitutes, such as enhanced processing techniques, pose a challenge, but the inherent functional benefits of stabilizers in diverse applications continue to drive demand. End-user trends are leaning towards processed and convenience foods, fueling the need for effective stabilizers. Mergers and acquisitions (M&A) activities, such as x M&A deals observed in the historical period, are expected to continue as companies seek to expand their product portfolios and geographical reach, further shaping market concentration. The market share of leading players is estimated to be between 10-20% each.

South America Food Stabilizers Market Industry Trends & Analysis

The South America Food Stabilizers Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is fueled by several interconnected trends and factors. A primary growth driver is the escalating consumer demand for processed and convenience foods across the region. As urban populations grow and lifestyles become more fast-paced, consumers increasingly rely on ready-to-eat meals, snacks, and beverages, all of which benefit significantly from the textural enhancement, stability, and extended shelf-life provided by food stabilizers. The burgeoning middle class in many South American nations contributes to this trend, affording greater purchasing power for a wider variety of food products.

Technological disruptions are also playing a pivotal role. Advances in processing technologies and an increased understanding of hydrocolloid functionalities are leading to the development of novel and more efficient food stabilizers. This includes innovations in encapsulating technologies, slow-release mechanisms, and the creation of synergistic blends that offer superior performance at lower concentrations. For instance, the development of specialized gellan gums and pectin formulations for specific dairy applications showcases this trend.

Consumer preferences are undergoing a significant shift towards healthier and more natural ingredients. This has spurred a notable rise in the demand for natural food stabilizers derived from sources like plant gums (e.g., guar gum, xanthan gum), carrageenan, and starches. Manufacturers are actively reformulating their products to incorporate these clean-label alternatives, driving the market for natural stabilizers. Conversely, synthetic stabilizers, while still holding a considerable market share due to their cost-effectiveness and specific functionalities, are facing increased scrutiny and regulatory pressure in certain markets.

Competitive dynamics within the South America Food Stabilizers Market are characterized by strategic partnerships, product innovation, and expanding distribution networks. Key players are investing heavily in research and development to cater to evolving consumer demands and to create value-added solutions for food manufacturers. The market penetration of advanced stabilizers is steadily increasing, particularly in segments like dairy and bakery, where consumers are highly discerning about product quality and sensory attributes. The market is also witnessing a trend towards customization, with suppliers offering tailored stabilizer solutions to meet the unique requirements of different food applications. The overall market penetration for food stabilizers is estimated to be around 70% in developed South American countries.

Leading Markets & Segments in South America Food Stabilizers Market

The Bakery and Confectionery segment is a dominant force within the South America Food Stabilizers Market, showcasing significant growth and market penetration. This dominance is attributed to several key drivers. The consistent demand for bread, cakes, pastries, and confectionery items across all income levels in South America underpins the extensive use of stabilizers. These ingredients are crucial for improving dough handling, enhancing crumb structure, preventing staling, and providing desirable textures and mouthfeel in baked goods. In confectionery, stabilizers contribute to gloss, chewiness, and preventing sugar crystallization in products like candies and chocolates.

Economically, the robust growth of the food processing industry in countries like Brazil, Argentina, and Mexico directly translates to increased demand for stabilizers in their expansive bakery and confectionery sectors. Government initiatives promoting food safety standards and encouraging domestic food production further bolster this segment.

Infrastructure development, particularly in logistics and cold chain management, ensures the efficient distribution of both raw ingredients and finished products, further supporting the widespread adoption of stabilizers. Consumer preferences in South America often lean towards visually appealing and texturally satisfying sweets and baked goods, making stabilizers indispensable for manufacturers aiming to meet these expectations.

Within the broader South America Food Stabilizers Market, the Natural source segment is experiencing rapid expansion, driven by growing consumer consciousness regarding health and wellness. This surge is particularly evident in premium product categories and export-oriented food manufacturing. The demand for plant-based ingredients and the aversion to synthetic additives are pushing manufacturers to reformulate using natural alternatives like pectin, starches, and various gums.

Key Drivers for Segment Dominance:

- Consumer Demand for Natural Ingredients: A significant portion of the South American population is increasingly seeking "clean label" products, free from artificial additives.

- Versatility in Applications: Natural stabilizers offer a wide range of functionalities, from thickening and gelling to emulsification, making them suitable for diverse food products.

- Innovation in Extraction and Processing: Advancements in extracting and processing natural gums and hydrocolloids have improved their efficacy and cost-competitiveness.

- Regulatory Support for Natural Alternatives: In some countries, regulatory bodies are increasingly favoring natural ingredients.

The Dairy segment also represents a significant and growing market for food stabilizers. Stabilizers are essential in dairy products such as yogurts, ice creams, cheeses, and milk-based beverages to prevent syneresis (whey separation), improve texture, provide creaminess, and enhance freeze-thaw stability. The increasing consumption of yogurt and other fermented dairy products, driven by perceived health benefits and convenience, is a major growth catalyst for this segment.

South America Food Stabilizers Market Product Developments

Product innovation in the South America Food Stabilizers Market is characterized by a strong focus on clean-label solutions and enhanced functionalities. Key developments include the creation of novel blends of natural hydrocolloids that offer synergistic effects, providing superior texture and stability in applications like plant-based dairy alternatives and low-fat products. Manufacturers are also investing in technologies for microencapsulation of flavors and active ingredients, often facilitated by stabilizer systems, to improve product shelf-life and controlled release. The development of stabilizers derived from underutilized regional agricultural resources is also gaining traction, offering both economic and sustainability advantages. These advancements aim to meet evolving consumer preferences for healthier, more natural, and high-performance food products, giving companies a competitive edge.

Key Drivers of South America Food Stabilizers Market Growth

Several key factors are propelling the growth of the South America Food Stabilizers Market. Firstly, the rising disposable income and a burgeoning middle class are driving increased consumption of processed and convenience foods, which heavily rely on stabilizers for texture, shelf-life, and visual appeal. Secondly, a growing consumer awareness regarding health and wellness is fueling the demand for clean-label and natural food stabilizers. Technological advancements in stabilizer formulations, offering enhanced functionalities and cost-effectiveness, are also significant growth accelerators. Finally, favorable government policies promoting food safety and quality standards, coupled with an expanding food processing industry across the region, provide a conducive environment for market expansion.

Challenges in the South America Food Stabilizers Market Market

Despite its growth potential, the South America Food Stabilizers Market faces certain challenges. Fluctuations in the prices of raw materials for natural stabilizers, such as plant gums and starches, can impact manufacturing costs and profit margins. Stringent and sometimes fragmented regulatory frameworks across different South American countries can create complexities for market entry and product approvals. Furthermore, the presence of counterfeit or sub-standard stabilizers poses a threat to product quality and consumer safety. Intense competition from established global players and emerging local manufacturers can also exert pressure on pricing and market share. Supply chain disruptions, particularly in remote regions, can affect the timely delivery of ingredients.

Emerging Opportunities in South America Food Stabilizers Market

Emerging opportunities within the South America Food Stabilizers Market are abundant, driven by shifting consumer demands and technological advancements. The rapidly growing plant-based food sector presents a significant avenue for growth, requiring specialized stabilizers to mimic the texture and mouthfeel of traditional dairy and meat products. Strategic partnerships between stabilizer manufacturers and food processors can lead to the co-creation of innovative solutions tailored to specific regional tastes and preferences. Furthermore, the increasing demand for functional foods, incorporating probiotics, vitamins, and minerals, opens doors for stabilizers that can effectively encapsulate and deliver these beneficial ingredients. Exploring sustainable sourcing and production methods for natural stabilizers can also unlock new market segments and appeal to environmentally conscious consumers.

Leading Players in the South America Food Stabilizers Market Sector

- DuPont de Nemours Inc.

- Ingredion Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Meridional TCS

- Cargill Inc.

- Fismer Lecithin

- AOM SA

Key Milestones in South America Food Stabilizers Market Industry

- 2019: Launch of a new line of pectin-based stabilizers by a major player to cater to the growing demand for natural ingredients in jams and jellies.

- 2020: Several key companies reported an increased focus on R&D for plant-based dairy alternative stabilizers in response to growing veganism trends.

- 2021: A significant acquisition in the Brazilian market by a global food ingredient supplier, aiming to strengthen its presence in South America.

- 2022: Introduction of innovative carrageenan blends offering improved freeze-thaw stability for frozen desserts.

- 2023: Increased regulatory scrutiny on certain synthetic stabilizers in select South American countries, prompting manufacturers to explore natural alternatives.

- 2024: Announcement of investment in expanded production capacity for xanthan gum to meet rising demand in bakery and sauces.

Strategic Outlook for South America Food Stabilizers Market Market

The strategic outlook for the South America Food Stabilizers Market is characterized by sustained growth, driven by an increasing focus on health-conscious consumers and the expanding processed food industry. Companies that prioritize innovation in natural and clean-label stabilizers, alongside functional ingredient solutions for emerging food categories like plant-based alternatives, are poised for success. Strategic collaborations with local food manufacturers and investments in robust distribution networks will be crucial for expanding market reach. Furthermore, adapting to evolving regulatory landscapes and focusing on sustainable sourcing will be key differentiators. The market presents significant opportunities for companies that can offer tailored solutions and demonstrate strong technical support to their clientele, solidifying their position as indispensable partners in the South American food industry.

South America Food Stabilizers Market Segmentation

-

1. Source

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Dairy

- 2.3. Meat and Poultry

- 2.4. Beverages

- 2.5. Sauces and Dressings

- 2.6. Others

South America Food Stabilizers Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Food Stabilizers Market Regional Market Share

Geographic Coverage of South America Food Stabilizers Market

South America Food Stabilizers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Bakery and Confectionery Sector is Likely to Foster the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Food Stabilizers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy

- 5.2.3. Meat and Poultry

- 5.2.4. Beverages

- 5.2.5. Sauces and Dressings

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DuPont de Nemours Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingredion Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bunge Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Meridional TCS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fismer Lecithin*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AOM SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 DuPont de Nemours Inc

List of Figures

- Figure 1: South America Food Stabilizers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Food Stabilizers Market Share (%) by Company 2025

List of Tables

- Table 1: South America Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: South America Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: South America Food Stabilizers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South America Food Stabilizers Market Revenue billion Forecast, by Source 2020 & 2033

- Table 5: South America Food Stabilizers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: South America Food Stabilizers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Food Stabilizers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Food Stabilizers Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the South America Food Stabilizers Market?

Key companies in the market include DuPont de Nemours Inc, Ingredion Inc, Archer Daniels Midland Company, Bunge Limited, Meridional TCS, Cargill Inc, Fismer Lecithin*List Not Exhaustive, AOM SA.

3. What are the main segments of the South America Food Stabilizers Market?

The market segments include Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Bakery and Confectionery Sector is Likely to Foster the Market Growth.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Food Stabilizers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Food Stabilizers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Food Stabilizers Market?

To stay informed about further developments, trends, and reports in the South America Food Stabilizers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence