Key Insights

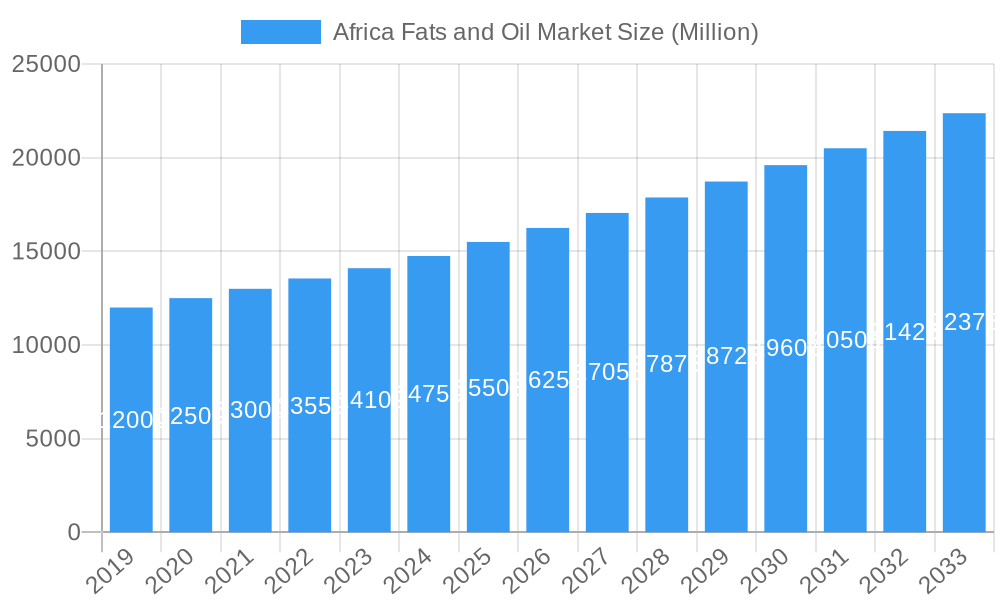

The Africa Fats and Oils Market is projected to experience substantial growth, reaching an estimated USD 13.01 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 9.66% through 2033. This expansion is primarily driven by escalating demand from the food and beverage industry, particularly in bakery, confectionery, and dairy applications. The rise of a growing middle class and increasing consumer preference for convenience and processed foods across the continent are significant growth catalysts. Additionally, expanding industrial applications in cosmetics and biofuel further bolster market vitality. The market's diverse segmentation, including soybean, palm, coconut, and olive oils, alongside fats such as butter and lard, addresses a wide array of consumer and industrial requirements, reinforcing its growth potential.

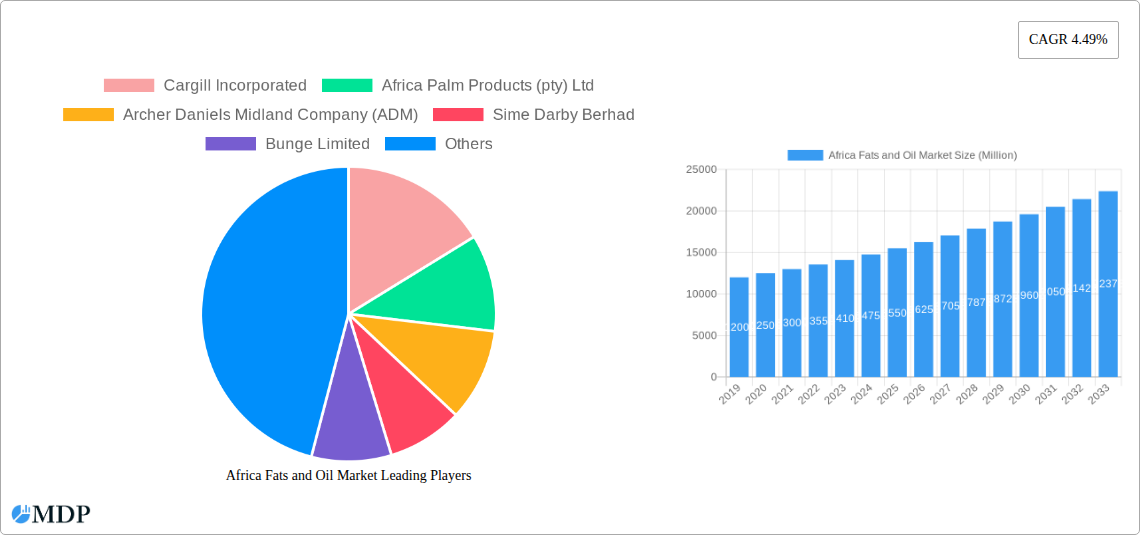

Africa Fats and Oil Market Market Size (In Billion)

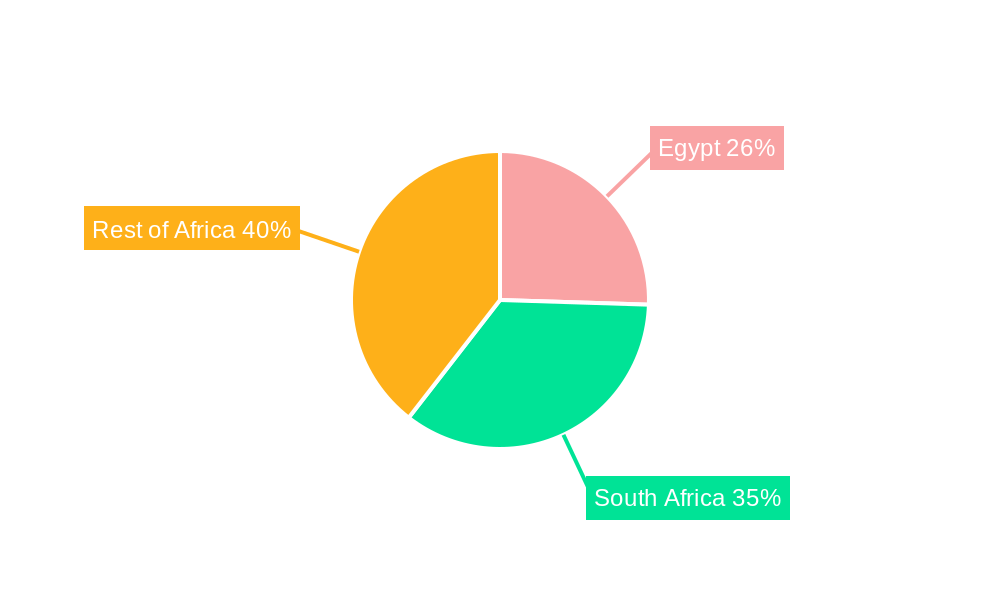

Challenges such as fluctuating raw material prices and sustainability concerns related to palm oil cultivation may influence market dynamics. However, the prevailing trend of increasing urbanization and subsequent shifts in dietary habits towards processed and ready-to-eat meals are anticipated to mitigate these constraints. South Africa and Egypt are expected to dominate market share, supported by their advanced economies and robust food processing sectors. The "Rest of Africa" segment, characterized by rapidly expanding populations and rising disposable incomes, presents a significant and largely untapped growth opportunity. The competitive landscape is marked by intense activity from major global and regional players, fostering innovation and enhancing production and distribution efficiencies.

Africa Fats and Oil Market Company Market Share

Africa Fats and Oil Market: Comprehensive Analysis and Growth Opportunities (2019–2033)

This in-depth report provides a thorough analysis of the Africa fats and oil market, a dynamic and rapidly expanding sector crucial for food security, industrial applications, and economic development across the continent. Covering the historical period from 2019–2024, base and estimated year of 2025, and an extensive forecast period of 2025–2033, this report offers actionable insights into market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. With a focus on high-traffic keywords such as "African edible oil market," "Africa palm oil demand," "African soybean oil market," "Africa biofuel feedstock," "African food ingredients," and "African cosmetic oils," this report is designed to maximize search visibility and attract industry stakeholders. The market is segmented by product type (Oils: Soybean Oil, Palm Oil, Coconut Oil, Olive Oil, Canola Oil, Sunflower Seed Oil, Other Oils; Fats: Butter, Lard, Other Fats) and application (Foods and Beverages: Bakery and Confectionery, Dairy Products, Snacks and Savories; Animal Feed; Industrial: Cosmetics, Paints, Biofuel, Lubricants and Greases), with a geographical focus on Egypt, South Africa, and the Rest of Africa.

Africa Fats and Oil Market Market Dynamics & Concentration

The Africa fats and oil market exhibits a moderately concentrated landscape, with a few key global players holding significant market share, alongside a growing number of regional and local enterprises. Innovation is primarily driven by demand for healthier oil alternatives, sustainable sourcing practices, and the increasing utilization of fats and oils in biofuel production. Regulatory frameworks are evolving across the continent, with governments focusing on food safety standards, import/export policies, and incentives for local processing to boost domestic production of edible oils. Product substitutes are prevalent, particularly within the edible oils segment, where consumers can readily switch between options like soybean oil, palm oil, and sunflower seed oil based on price, availability, and perceived health benefits. End-user trends reveal a growing preference for processed foods, leading to increased demand for fats and oils in the bakery and confectionery, and snacks and savories sub-segments. The industrial sector, especially for biofuel and cosmetics, is also witnessing robust growth. Merger and acquisition (M&A) activities are expected to increase as larger players seek to expand their footprint and secure raw material supply chains, alongside local companies consolidating to gain competitive advantages. Anticipated M&A deal counts for the forecast period are estimated to be in the range of 15-20 significant transactions.

Africa Fats and Oil Market Industry Trends & Analysis

The Africa fats and oil market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including a rapidly growing population, increasing disposable incomes, and evolving dietary habits across the continent. The demand for edible oils, particularly African palm oil and African soybean oil, remains a primary growth driver, supported by their versatility in food preparation and their affordability. The African edible oil market is also benefiting from a rising middle class that is increasingly demanding processed and convenience foods, thereby boosting the consumption of fats and oils in bakery and confectionery, dairy products, and snacks and savories.

Technological disruptions are playing a pivotal role, with investments in modern processing facilities and extraction technologies aimed at improving efficiency, product quality, and yield. The growing emphasis on sustainable sourcing and production methods is also influencing industry trends, as consumers and regulators alike push for environmentally responsible practices. Market penetration for specialized oils like African coconut oil and African sunflower seed oil is steadily increasing due to their perceived health benefits and diverse applications.

Competitive dynamics are intensifying, with both multinational corporations and local enterprises vying for market share. Strategic partnerships and expansions, such as new plant constructions and capacity enhancements, are key strategies employed by leading players. The African biofuel feedstock market, driven by government mandates and a global push for renewable energy, presents a significant emerging opportunity, increasing demand for oils like palm and soybean. Furthermore, the burgeoning African cosmetic oils market, catering to both domestic and international demand for natural and organic ingredients, is another significant growth area. The overall market penetration of fats and oils in industrial applications is projected to reach approximately 25% by 2033.

Leading Markets & Segments in Africa Fats and Oil Market

South Africa currently dominates the Africa fats and oil market, driven by its well-established industrial infrastructure, significant agricultural output, and strong consumer demand for processed foods and biofuels. The African edible oil market within South Africa benefits from robust domestic production and efficient distribution networks. Key drivers for its dominance include supportive government policies encouraging local manufacturing and agricultural development, along with significant investments in processing facilities.

Within product types, Palm Oil remains the leading segment in terms of volume and value, owing to its widespread use in food products and its cost-effectiveness. However, Soybean Oil is experiencing rapid growth, driven by its versatility in food applications and its increasing demand as an ingredient in animal feed. The Other Oils category, encompassing sunflower seed oil and canola oil, is also gaining traction due to growing consumer awareness of their health benefits.

In terms of applications, the Foods and Beverages segment is the largest, with the Bakery and Confectionery sub-segment being particularly dominant. This is directly correlated with the increasing consumption of processed foods and snacks across the continent. The Animal Feed application is also a significant contributor to market growth, as livestock farming expands to meet rising protein demands. The Industrial segment, particularly Biofuel and Cosmetics, is emerging as a high-growth area. The demand for African cosmetic oils is on an upward trajectory, fueled by a growing awareness of natural ingredients and a rising middle class with disposable income. The Rest of Africa is projected to witness the highest growth rate due to rapidly developing economies, expanding populations, and increasing investments in agricultural processing and food manufacturing. Countries within East Africa are showing particular promise in the African coconut oil and African palm oil sectors. Egypt represents a substantial market, with a strong demand for edible oils driven by its large population and significant food processing industry.

Africa Fats and Oil Market Product Developments

Product innovation in the Africa fats and oil market is focused on developing healthier, more sustainable, and specialized offerings. This includes the introduction of high-oleic sunflower seed oils and canola oils with improved nutritional profiles, catering to the growing demand for African healthy cooking oils. The development of specialty fats for confectionery applications, offering enhanced texture and stability, is also a key trend. Furthermore, advancements in processing technologies are enabling the extraction of higher yields and the creation of novel oleochemicals derived from fats and oils for industrial uses, such as biodegradable lubricants and cosmetic ingredients. The competitive advantage lies in offering ethically sourced and sustainably produced products that align with evolving consumer preferences and regulatory demands.

Key Drivers of Africa Fats and Oil Market Growth

The Africa fats and oil market is propelled by several key growth drivers. A rapidly expanding population and increasing urbanization are leading to a significant rise in demand for food, especially processed and convenience foods that rely heavily on fats and oils. Growing disposable incomes are enabling consumers to opt for higher-value oils and fats, including specialty products and those perceived as healthier. Technological advancements in agricultural practices and processing technologies are improving yields and efficiency, making production more viable and cost-effective. Government initiatives promoting local agricultural development, food processing, and biofuel production are also acting as significant catalysts. For instance, policies encouraging the cultivation of oilseeds and the establishment of domestic refining capacity are boosting local supply and reducing reliance on imports. The increasing global and regional focus on renewable energy is also driving demand for African biofuel feedstock.

Challenges in the Africa Fats and Oil Market Market

Despite its strong growth potential, the Africa fats and oil market faces several challenges. Volatility in raw material prices, often influenced by weather patterns, global supply and demand, and geopolitical factors, can impact profitability and market stability. Inadequate infrastructure, including poor road networks and limited cold chain facilities in certain regions, hampers efficient transportation and distribution of both raw materials and finished products. Regulatory hurdles and inconsistencies across different African nations can create complexities for businesses operating continent-wide. Intense competition from established global players and the presence of informal market segments also present competitive pressures. Supply chain disruptions, exacerbated by logistical challenges and unforeseen events, can lead to shortages and price spikes, affecting market dynamics.

Emerging Opportunities in Africa Fats and Oil Market

The Africa fats and oil market is ripe with emerging opportunities for long-term growth. The increasing demand for plant-based alternatives and functional foods presents significant avenues for innovation in specialized oils and fats. The growing awareness of health and wellness is driving demand for nutritionally enriched oils and fats with specific health benefits, such as omega-3 and omega-6 fatty acids. The expansion of the biofuel sector, driven by government mandates and a global transition towards renewable energy sources, offers substantial opportunities for oils like palm and soybean as feedstocks. Strategic partnerships between local agricultural cooperatives and international food manufacturers can enhance supply chain reliability and product quality. Furthermore, the untapped potential in niche applications, such as premium African cosmetic oils and specialized industrial oleochemicals, presents lucrative prospects for market expansion and diversification.

Leading Players in the Africa Fats and Oil Market Sector

- Cargill Incorporated

- Africa Palm Products (pty) Ltd

- Archer Daniels Midland Company (ADM)

- Sime Darby Berhad

- Bunge Limited

- Olam International

- Wilmar International Ltd

- Fuji Vegetable Oil Inc

- CEOCO (Pty) Ltd

- Supa Oils

Key Milestones in Africa Fats and Oil Market Industry

- March 2023: Wilmar International Ltd (WILMAR) initiated the construction of an edible oil plant in Richards Bay, KwaZulu-Natal, South Africa. This USD 81 million project, which commenced in 2020, includes a fractionator, shortening plant, and packaging facility, significantly boosting South Africa's edible oil production capacity.

- July 2022: Eni introduced the first vegetable oil production facility for biorefining in Kenya. This venture involved the establishment of an oilseed collection and pressing plant, marking the inception of vegetable oil production for bio-refineries and contributing to the African biofuel feedstock market.

- June 2021: WA Group made a substantial investment of USD 114 million in a processing plant in Ethiopia aimed at boosting edible oil production. This strategic investment enabled the company to cease importing edible oils and focus on refining crude palm oil and processing locally cultivated oilseeds such as sesame seeds, peanut seeds, niger seeds, soya beans, and haricot beans, strengthening the Ethiopian edible oil market.

Strategic Outlook for Africa Fats and Oil Market Market

The strategic outlook for the Africa fats and oil market is highly positive, characterized by robust growth accelerators and promising future potential. The increasing demand for essential food ingredients, coupled with the expanding industrial applications, provides a solid foundation for market expansion. Key strategies for future growth include further investment in sustainable agricultural practices and value-added processing to enhance product quality and competitiveness. Companies that can effectively navigate the evolving regulatory landscape, invest in advanced technologies, and forge strategic alliances will be best positioned to capitalize on the burgeoning opportunities. The growing significance of the African cosmetic oils and African biofuel feedstock segments offers significant avenues for diversification and market penetration. Focus on local sourcing and value chain integration will be critical for long-term success and contribution to the continent's economic development.

Africa Fats and Oil Market Segmentation

-

1. Product Type

-

1.1. Oils

- 1.1.1. Soybean Oil

- 1.1.2. Palm Oil

- 1.1.3. Coconut Oil

- 1.1.4. Olive Oil

- 1.1.5. Canola Oil

- 1.1.6. Sunflower Seed Oil

- 1.1.7. Other Oils

-

1.2. Fats

- 1.2.1. Butter

- 1.2.2. Lard

- 1.2.3. Other Fats

-

1.1. Oils

-

2. Application

-

2.1. Foods and Beverages

- 2.1.1. Bakery and Confectionery

- 2.1.2. Dairy Products

- 2.1.3. Snacks and Savories

- 2.2. Animal Feed

-

2.3. Industrial

- 2.3.1. Cosmetics

- 2.3.2. Paints

- 2.3.3. Biofuel

- 2.3.4. Lubricants and Greases

-

2.1. Foods and Beverages

-

3. Geography

- 3.1. Egypt

- 3.2. South Africa

- 3.3. Rest of Africa

Africa Fats and Oil Market Segmentation By Geography

- 1. Egypt

- 2. South Africa

- 3. Rest of Africa

Africa Fats and Oil Market Regional Market Share

Geographic Coverage of Africa Fats and Oil Market

Africa Fats and Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies

- 3.3. Market Restrains

- 3.3.1. Volatility in Imports and Supply Chain of Oils

- 3.4. Market Trends

- 3.4.1. Wide Applications of Oils and Fats in Different End-Use Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Fats and Oil Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Oils

- 5.1.1.1. Soybean Oil

- 5.1.1.2. Palm Oil

- 5.1.1.3. Coconut Oil

- 5.1.1.4. Olive Oil

- 5.1.1.5. Canola Oil

- 5.1.1.6. Sunflower Seed Oil

- 5.1.1.7. Other Oils

- 5.1.2. Fats

- 5.1.2.1. Butter

- 5.1.2.2. Lard

- 5.1.2.3. Other Fats

- 5.1.1. Oils

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Foods and Beverages

- 5.2.1.1. Bakery and Confectionery

- 5.2.1.2. Dairy Products

- 5.2.1.3. Snacks and Savories

- 5.2.2. Animal Feed

- 5.2.3. Industrial

- 5.2.3.1. Cosmetics

- 5.2.3.2. Paints

- 5.2.3.3. Biofuel

- 5.2.3.4. Lubricants and Greases

- 5.2.1. Foods and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Egypt

- 5.3.2. South Africa

- 5.3.3. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.4.2. South Africa

- 5.4.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Egypt Africa Fats and Oil Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Oils

- 6.1.1.1. Soybean Oil

- 6.1.1.2. Palm Oil

- 6.1.1.3. Coconut Oil

- 6.1.1.4. Olive Oil

- 6.1.1.5. Canola Oil

- 6.1.1.6. Sunflower Seed Oil

- 6.1.1.7. Other Oils

- 6.1.2. Fats

- 6.1.2.1. Butter

- 6.1.2.2. Lard

- 6.1.2.3. Other Fats

- 6.1.1. Oils

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Foods and Beverages

- 6.2.1.1. Bakery and Confectionery

- 6.2.1.2. Dairy Products

- 6.2.1.3. Snacks and Savories

- 6.2.2. Animal Feed

- 6.2.3. Industrial

- 6.2.3.1. Cosmetics

- 6.2.3.2. Paints

- 6.2.3.3. Biofuel

- 6.2.3.4. Lubricants and Greases

- 6.2.1. Foods and Beverages

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Egypt

- 6.3.2. South Africa

- 6.3.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Africa Fats and Oil Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Oils

- 7.1.1.1. Soybean Oil

- 7.1.1.2. Palm Oil

- 7.1.1.3. Coconut Oil

- 7.1.1.4. Olive Oil

- 7.1.1.5. Canola Oil

- 7.1.1.6. Sunflower Seed Oil

- 7.1.1.7. Other Oils

- 7.1.2. Fats

- 7.1.2.1. Butter

- 7.1.2.2. Lard

- 7.1.2.3. Other Fats

- 7.1.1. Oils

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Foods and Beverages

- 7.2.1.1. Bakery and Confectionery

- 7.2.1.2. Dairy Products

- 7.2.1.3. Snacks and Savories

- 7.2.2. Animal Feed

- 7.2.3. Industrial

- 7.2.3.1. Cosmetics

- 7.2.3.2. Paints

- 7.2.3.3. Biofuel

- 7.2.3.4. Lubricants and Greases

- 7.2.1. Foods and Beverages

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Egypt

- 7.3.2. South Africa

- 7.3.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Africa Africa Fats and Oil Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Oils

- 8.1.1.1. Soybean Oil

- 8.1.1.2. Palm Oil

- 8.1.1.3. Coconut Oil

- 8.1.1.4. Olive Oil

- 8.1.1.5. Canola Oil

- 8.1.1.6. Sunflower Seed Oil

- 8.1.1.7. Other Oils

- 8.1.2. Fats

- 8.1.2.1. Butter

- 8.1.2.2. Lard

- 8.1.2.3. Other Fats

- 8.1.1. Oils

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Foods and Beverages

- 8.2.1.1. Bakery and Confectionery

- 8.2.1.2. Dairy Products

- 8.2.1.3. Snacks and Savories

- 8.2.2. Animal Feed

- 8.2.3. Industrial

- 8.2.3.1. Cosmetics

- 8.2.3.2. Paints

- 8.2.3.3. Biofuel

- 8.2.3.4. Lubricants and Greases

- 8.2.1. Foods and Beverages

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Egypt

- 8.3.2. South Africa

- 8.3.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Africa Palm Products (pty) Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Archer Daniels Midland Company (ADM)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Sime Darby Berhad

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Bunge Limited

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Olam International

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Wilmar International Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Fuji Vegetable Oil Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 CEOCO (Pty) Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Supa Oils

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: Africa Fats and Oil Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Fats and Oil Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Fats and Oil Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Africa Fats and Oil Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Africa Fats and Oil Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Africa Fats and Oil Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Africa Fats and Oil Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Africa Fats and Oil Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Africa Fats and Oil Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Africa Fats and Oil Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Africa Fats and Oil Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Africa Fats and Oil Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Africa Fats and Oil Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Africa Fats and Oil Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Africa Fats and Oil Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Africa Fats and Oil Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Africa Fats and Oil Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Africa Fats and Oil Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Africa Fats and Oil Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Africa Fats and Oil Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: Africa Fats and Oil Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Africa Fats and Oil Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Africa Fats and Oil Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Africa Fats and Oil Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Africa Fats and Oil Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Africa Fats and Oil Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Africa Fats and Oil Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Africa Fats and Oil Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Africa Fats and Oil Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Africa Fats and Oil Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Africa Fats and Oil Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Africa Fats and Oil Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Africa Fats and Oil Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Africa Fats and Oil Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Fats and Oil Market?

The projected CAGR is approximately 9.66%.

2. Which companies are prominent players in the Africa Fats and Oil Market?

Key companies in the market include Cargill Incorporated, Africa Palm Products (pty) Ltd, Archer Daniels Midland Company (ADM), Sime Darby Berhad, Bunge Limited, Olam International, Wilmar International Ltd, Fuji Vegetable Oil Inc, CEOCO (Pty) Ltd, Supa Oils.

3. What are the main segments of the Africa Fats and Oil Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies.

6. What are the notable trends driving market growth?

Wide Applications of Oils and Fats in Different End-Use Industries.

7. Are there any restraints impacting market growth?

Volatility in Imports and Supply Chain of Oils.

8. Can you provide examples of recent developments in the market?

March 2023: Wilmar International Ltd (WILMAR) initiated the construction of an edible oil plant located in Richards Bay, KwaZulu-Natal, South Africa. This USD 81 million project encompasses the development of a fractionator, a shortening plant, and a packaging facility. Notably, this endeavor commenced in 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Fats and Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Fats and Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Fats and Oil Market?

To stay informed about further developments, trends, and reports in the Africa Fats and Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence