Key Insights

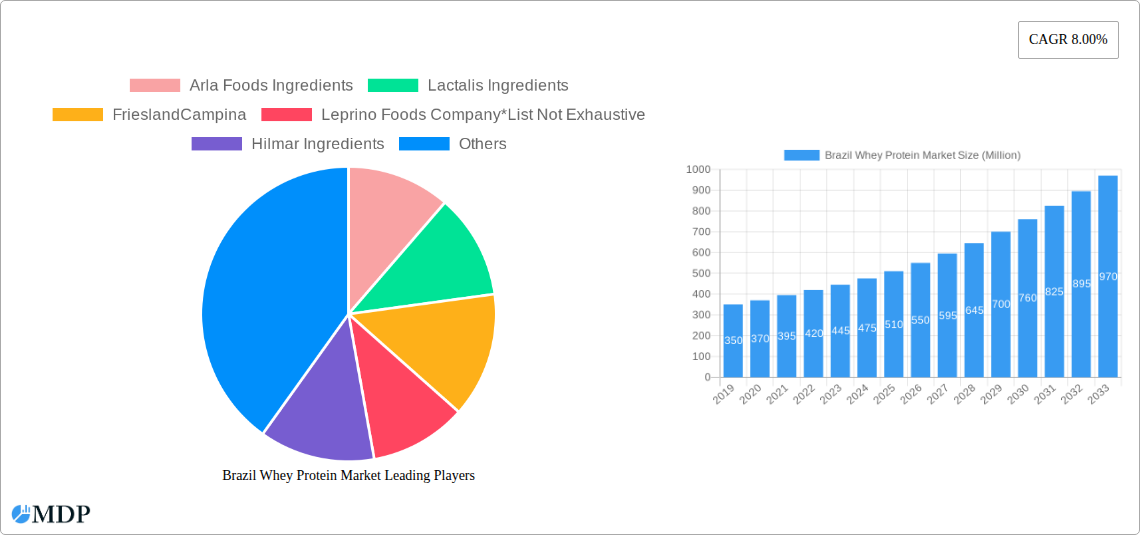

The Brazilian whey protein market is projected for significant expansion, anticipated to reach approximately $10.32 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 12.29%, indicating a strong upward trend during the forecast period of 2025-2033. Key growth catalysts include heightened consumer health awareness, escalating demand for sports nutrition, and the increasing integration of whey protein into functional foods and infant nutrition. Rising disposable incomes and a greater understanding of protein's health benefits are further stimulating market penetration.

Brazil Whey Protein Market Market Size (In Billion)

Evolving consumer preferences and advancements in protein processing technologies are shaping market dynamics. While challenges such as fluctuating raw material costs and the availability of alternative protein sources exist, sustained interest in healthy lifestyles, Brazil's vibrant sports culture, and the demand for premium protein ingredients in fortified foods are expected to drive continued growth. The Whey Protein Concentrate and Whey Protein Isolate segments are poised for substantial demand, driven by their versatility in sports nutrition, infant formulas, and functional food applications. Prominent industry players are actively pursuing innovation and market expansion strategies.

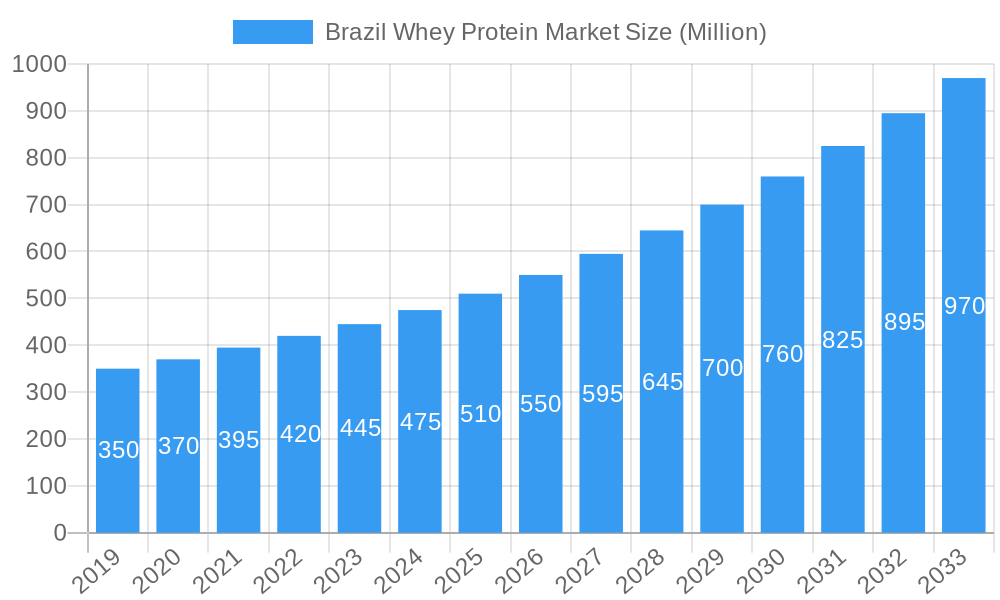

Brazil Whey Protein Market Company Market Share

Gain comprehensive insights into the Brazil Whey Protein Market. This report details market dynamics, emerging trends, key participants, and the future outlook from 2019 to 2033, with a focus on the base year 2025 and the forecast period 2025–2033. It offers actionable intelligence for manufacturers, suppliers, investors, and distributors seeking to leverage the growing demand for premium protein supplements in Brazil.

Brazil Whey Protein Market Market Dynamics & Concentration

The Brazil Whey Protein Market exhibits a XX% market concentration, with key players vying for market share. Innovation drivers are primarily centered around product development for niche applications and enhanced bioavailability, alongside evolving manufacturing technologies. Regulatory frameworks, overseen by bodies like ANVISA, are crucial in dictating product standards and market access. The presence of substitute products, such as soy protein and plant-based alternatives, presents a competitive challenge, although whey protein's superior amino acid profile offers a distinct advantage. End-user trends are heavily influenced by a growing awareness of health and wellness, driving demand across all segments. Merger and acquisition (M&A) activities are moderate, with XX M&A deals recorded historically, indicating a consolidating yet opportunity-rich landscape. The market share distribution is influenced by brand reputation, product quality, and distribution networks.

Brazil Whey Protein Market Industry Trends & Analysis

The Brazil Whey Protein Market is poised for significant growth, driven by a confluence of powerful market growth drivers. A burgeoning health and fitness consciousness among Brazilian consumers is a primary catalyst, with an increasing emphasis on protein intake for muscle building, weight management, and overall well-being. This trend is further amplified by the rising popularity of gym culture and athletic pursuits across all age demographics. Technological disruptions are playing a pivotal role, with advancements in processing techniques leading to improved protein extraction, purity, and digestibility, thereby enhancing product efficacy and consumer appeal. Furthermore, the development of specialized whey protein formulations tailored to specific dietary needs and performance goals is gaining traction.

Consumer preferences are evolving rapidly, moving beyond basic protein supplementation to encompass functional benefits. Consumers are actively seeking whey protein products fortified with vitamins, minerals, probiotics, and other bioactive compounds that offer added health advantages, such as immune support, gut health, and cognitive function. This shift towards value-added products necessitates continuous innovation from manufacturers.

The competitive dynamics within the Brazil Whey Protein Market are characterized by intense rivalry, with both global giants and local players striving for market dominance. Strategies such as product differentiation, aggressive marketing campaigns, and strategic pricing are commonly employed. The increasing accessibility of whey protein through online retail channels and specialized nutrition stores has broadened market reach, contributing to higher market penetration. The estimated CAGR for the Brazil Whey Protein Market is projected to be XX%, signaling robust expansion. This growth is underpinned by a growing middle class with increased disposable income, enabling greater investment in health and nutrition. The market penetration of whey protein, while substantial, still offers considerable room for growth, particularly in non-traditional consumer segments.

Leading Markets & Segments in Brazil Whey Protein Market

Within the Brazil Whey Protein Market, Sports and Performance Nutrition emerges as the dominant application segment, driven by the nation's passion for sports and fitness. The growing number of gyms, fitness centers, and organized athletic activities fuels a consistent demand for whey protein as a key supplement for muscle recovery, growth, and enhanced athletic performance. Economic policies supporting sports infrastructure and health initiatives further bolster this segment.

In terms of product type, Whey Protein Concentrate (WPC) holds a significant market share due to its cost-effectiveness and versatile applications, making it accessible to a broader consumer base. However, Whey Protein Isolate (WPI) is experiencing robust growth, driven by its higher protein content and lower lactose levels, appealing to individuals with lactose intolerance and those seeking purer protein forms. Hydrolyzed Whey Protein (HWP), while a niche segment, is gaining traction due to its faster absorption rate, catering to elite athletes and individuals with specific recovery needs.

The Infant Formula segment, though smaller in comparison, represents a stable and essential market. Strict quality standards and the recognized nutritional benefits of whey derivatives in infant nutrition contribute to its consistent demand. Government initiatives promoting infant health and nutrition indirectly support this segment.

The Functional/Fortified Food segment is a rapidly expanding area, reflecting the broader trend of health-conscious eating. Manufacturers are increasingly incorporating whey protein into everyday food products such as dairy beverages, baked goods, and snack bars, offering consumers convenient ways to boost their protein intake. This trend is fueled by consumer interest in convenient, health-enhancing food options. Infrastructure development facilitating the distribution of these fortified products across Brazil further supports market growth.

Brazil Whey Protein Market Product Developments

Product innovation in the Brazil Whey Protein Market is characterized by the development of ultra-premium and specialized formulations. Manufacturers are focusing on creating products with enhanced bioavailability and digestibility, often employing advanced hydrolysis techniques. The trend towards plant-based alternatives, including plant-based whey protein, is also a significant development, catering to a growing vegan and flexitarian consumer base. These innovations aim to provide competitive advantages through unique ingredient profiles, improved taste, and targeted health benefits.

Key Drivers of Brazil Whey Protein Market Growth

The Brazil Whey Protein Market is propelled by a trifecta of key drivers. Firstly, the escalating health and wellness trend, coupled with a strong emphasis on fitness and sports, fuels demand for protein supplements. Secondly, technological advancements in processing and product formulation are leading to the development of more effective and appealing whey protein products. Lastly, supportive government initiatives promoting protein-rich diets and the consumption of functional foods, alongside favorable economic conditions, are creating a fertile ground for market expansion.

Challenges in the Brazil Whey Protein Market Market

Despite robust growth prospects, the Brazil Whey Protein Market faces several challenges. Regulatory hurdles related to product approvals and labeling requirements can impact market entry and product launches. Fluctuations in raw material prices, particularly for dairy, can affect production costs and profitability. Furthermore, intense competition from both established global brands and emerging local players, as well as the increasing availability of diverse protein substitutes, necessitates continuous innovation and competitive pricing strategies. Supply chain complexities in a vast country like Brazil also pose logistical challenges.

Emerging Opportunities in Brazil Whey Protein Market

Emerging opportunities in the Brazil Whey Protein Market lie in several key areas. The increasing demand for specialized and functional whey protein products, such as those designed for gut health, cognitive function, or specific athletic disciplines, presents significant growth potential. Strategic partnerships between whey protein suppliers and fitness industry professionals, as well as collaborations with food manufacturers for product innovation, offer avenues for market expansion. The growing e-commerce landscape in Brazil also provides a powerful channel for direct-to-consumer sales and wider market reach.

Leading Players in the Brazil Whey Protein Market Sector

- Arla Foods Ingredients

- Lactalis Ingredients

- FrieslandCampina

- Leprino Foods Company

- Hilmar Ingredients

- Fonterra Co-Operative Group

- Carbery Group

- Nestlé S.A.

- Danone S.A.

- Glanbia plc

Key Milestones in Brazil Whey Protein Market Industry

- 2023: Launch of new plant-based whey protein products by leading manufacturers, catering to a growing vegan and flexitarian consumer base.

- 2022: Strategic partnerships between whey protein suppliers and fitness industry professionals, increasing brand visibility and product adoption among athletes and fitness enthusiasts.

- 2021: Government initiatives to promote the consumption of protein-rich foods, including whey protein, aimed at improving public health and nutrition.

- 2020: Investment in research and development of functional whey protein supplements, focusing on enhanced health benefits like immune support and cognitive function.

Strategic Outlook for Brazil Whey Protein Market Market

The strategic outlook for the Brazil Whey Protein Market is characterized by sustained growth and evolving consumer demands. Key growth accelerators include the continued emphasis on health and fitness, the increasing demand for customized and functional protein solutions, and the expanding reach of e-commerce channels. Companies are expected to focus on product innovation, particularly in plant-based and hydrolysed whey protein segments, and forge strategic alliances to enhance market penetration and brand loyalty. The market is ripe for strategic investments in R&D and market expansion, promising significant returns for stakeholders poised to capitalize on these evolving trends.

Brazil Whey Protein Market Segmentation

-

1. Product Type

- 1.1. Whey Protein Concentrate

- 1.2. Whey Protein Isolate

- 1.3. Hydrolyzed Whey Protein

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

Brazil Whey Protein Market Segmentation By Geography

- 1. Brazil

Brazil Whey Protein Market Regional Market Share

Geographic Coverage of Brazil Whey Protein Market

Brazil Whey Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for sports nutritional supplements

- 3.3. Market Restrains

- 3.3.1. Rising demand for plant-based protein

- 3.4. Market Trends

- 3.4.1. Entrenched Fitness Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Whey Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whey Protein Concentrate

- 5.1.2. Whey Protein Isolate

- 5.1.3. Hydrolyzed Whey Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arla Foods Ingredients

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lactalis Ingredients

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FrieslandCampina

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leprino Foods Company*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hilmar Ingredients

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fonterra Co-Operative Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carbery Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestlé S.A.

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danone S.A.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Glanbia plc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arla Foods Ingredients

List of Figures

- Figure 1: Brazil Whey Protein Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Whey Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Whey Protein Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Brazil Whey Protein Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Brazil Whey Protein Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Brazil Whey Protein Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Brazil Whey Protein Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Brazil Whey Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Brazil Whey Protein Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Brazil Whey Protein Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Brazil Whey Protein Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Brazil Whey Protein Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Brazil Whey Protein Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Brazil Whey Protein Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Whey Protein Market?

The projected CAGR is approximately 12.29%.

2. Which companies are prominent players in the Brazil Whey Protein Market?

Key companies in the market include Arla Foods Ingredients, Lactalis Ingredients, FrieslandCampina, Leprino Foods Company*List Not Exhaustive, Hilmar Ingredients, Fonterra Co-Operative Group, Carbery Group, Nestlé S.A., Danone S.A. , Glanbia plc.

3. What are the main segments of the Brazil Whey Protein Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for sports nutritional supplements.

6. What are the notable trends driving market growth?

Entrenched Fitness Industry.

7. Are there any restraints impacting market growth?

Rising demand for plant-based protein.

8. Can you provide examples of recent developments in the market?

Launch of new plant-based whey protein products by leading manufacturers

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Whey Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Whey Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Whey Protein Market?

To stay informed about further developments, trends, and reports in the Brazil Whey Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence