Key Insights

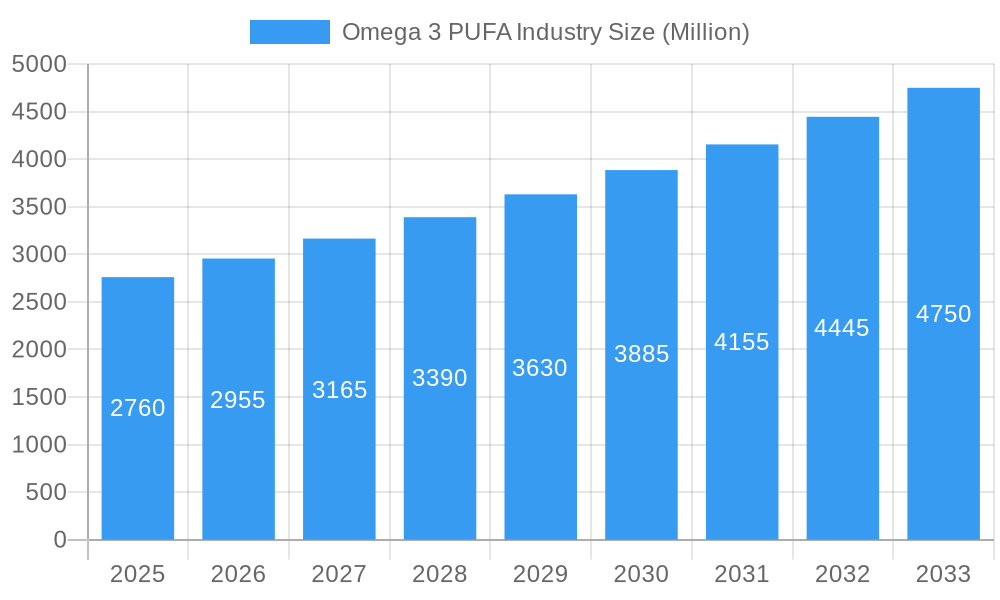

The global Omega-3 PUFA (Polyunsaturated Fatty Acid) market is experiencing robust growth, projected to reach approximately $2.76 billion by 2025. This expansion is fueled by a significant Compound Annual Growth Rate (CAGR) of 7.05%, indicating a sustained upward trajectory for the foreseeable future. Key drivers for this market surge include increasing consumer awareness regarding the health benefits of Omega-3s, particularly for cardiovascular health, cognitive function, and infant development. The rising demand for fortified foods and beverages, alongside the expanding dietary supplement sector, are critical contributors to this growth. Furthermore, advancements in extraction and purification technologies are leading to higher quality and more diverse Omega-3 products, catering to a broader range of applications.

Omega 3 PUFA Industry Market Size (In Billion)

The market segmentation reveals a diverse landscape, with Docosahexaenoic Acid (DHA) and Eicosapentaenoic Acid (EPA) dominating the type segment due to their well-established health advantages. The Food and Beverages sector, encompassing functional foods and infant formula, is a primary application area, highlighting the integration of Omega-3s into everyday consumables. Dietary supplements and pharmaceuticals also represent substantial segments, reflecting their importance in preventative healthcare and therapeutic interventions. While the market is characterized by strong growth potential, challenges such as volatile raw material prices and increasing regulatory scrutiny in some regions could present moderate restraints. However, the overarching trend is towards increased demand driven by a growing global emphasis on health and wellness.

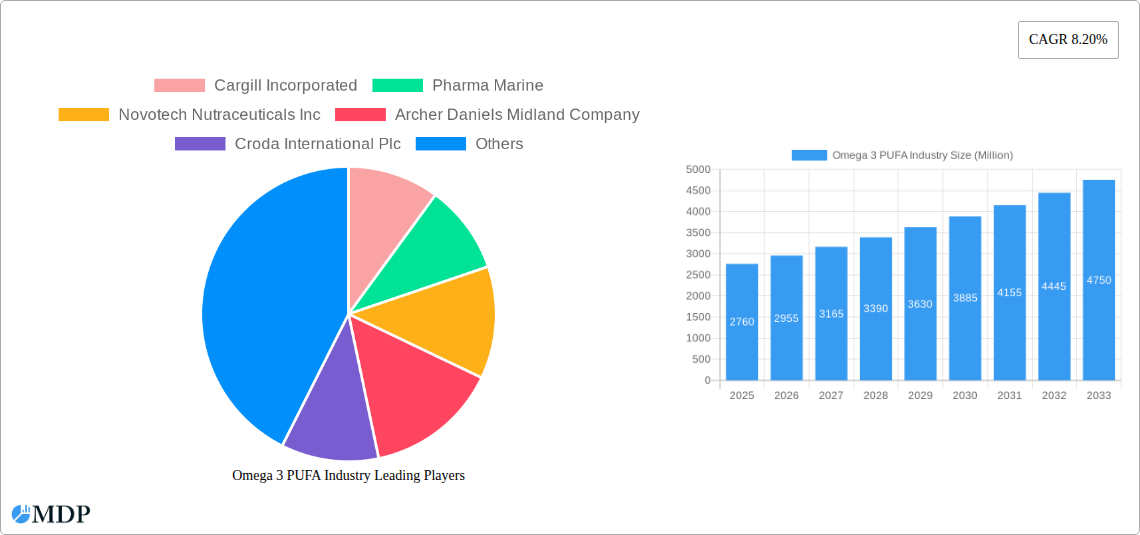

Omega 3 PUFA Industry Company Market Share

Here's the SEO-optimized and engaging report description for the Omega 3 PUFA Industry:

Omega 3 PUFA Industry Market Dynamics & Concentration

This comprehensive report delves into the dynamic Omega 3 PUFA (Polyunsaturated Fatty Acids) market, a rapidly expanding sector driven by increasing consumer awareness of health benefits. The market exhibits a moderate concentration, with key players like Cargill Incorporated, Archer Daniels Midland Company, and BASF SE holding significant market share. Innovation is a critical driver, fueled by advancements in extraction technologies and the development of novel delivery formats. Regulatory frameworks surrounding health claims and product quality play a crucial role in shaping market entry and competition. Product substitutes, such as other healthy fats, exist but the unique health benefits of omega-3s, particularly EPA and DHA, offer a distinct advantage. End-user trends are increasingly leaning towards preventative healthcare and fortified foods, boosting demand. Merger and acquisition (M&A) activities are on the rise, with approximately 5-7 significant M&A deals observed in the historical period (2019-2024), indicating a strategic consolidation aimed at expanding product portfolios and geographical reach.

- Market Share: Dominant players hold an estimated 15-20% market share each.

- M&A Deal Counts: Estimated at 5-7 significant deals in the historical period.

- Innovation Drivers: Technological advancements in extraction and purification, novel applications in food and pharmaceuticals.

- Regulatory Frameworks: FDA, EFSA guidelines on health claims and ingredient standards.

- Product Substitutes: Other healthy fats, plant-based oils with different fatty acid profiles.

- End-User Trends: Growing demand for functional foods, dietary supplements, and fortified infant formula.

Omega 3 PUFA Industry Industry Trends & Analysis

The Omega 3 PUFA industry is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust expansion is propelled by a confluence of factors, including escalating global health consciousness and a deeper understanding of the physiological benefits associated with EPA and DHA. Consumers are increasingly proactive about incorporating omega-3s into their diets, viewing them as essential for cardiovascular health, cognitive function, and reducing inflammation. This heightened demand is manifesting across various applications, from dietary supplements to functional foods and beverages, and even in specialized pharmaceutical formulations. Technological disruptions are continuously optimizing production processes, leading to higher purity and bioavailability of omega-3 ingredients, thereby enhancing their efficacy and market appeal. Furthermore, advancements in microencapsulation and other formulation techniques are addressing challenges related to taste and stability, making omega-3 fortified products more palatable and consumer-friendly. Competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their offerings through proprietary technologies and unique product formulations. The market penetration of omega-3 rich products is expected to rise significantly as awareness campaigns and product availability expand.

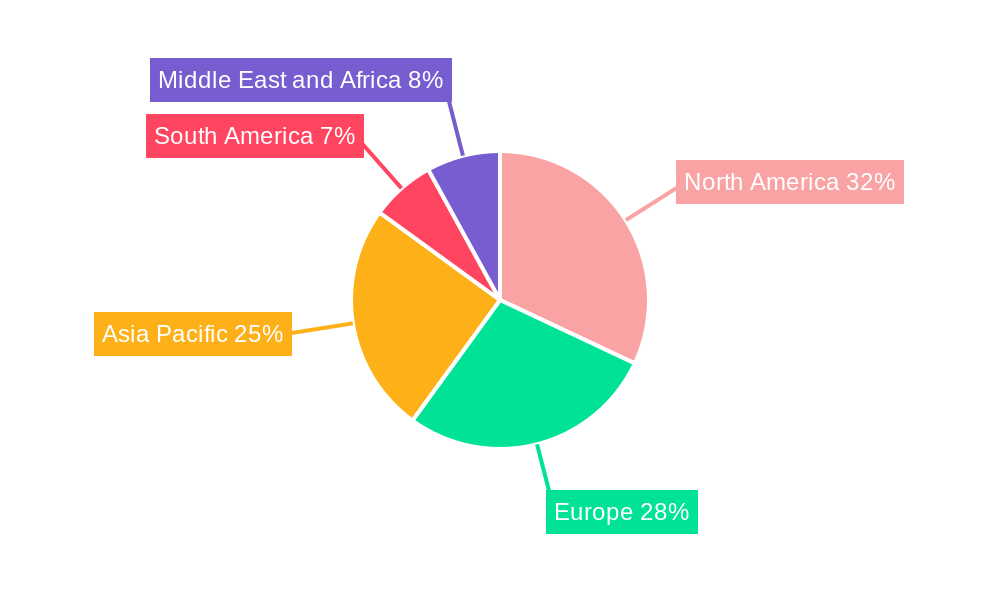

Leading Markets & Segments in Omega 3 PUFA Industry

The Omega 3 PUFA industry showcases distinct regional dominance and segment preferences. North America is currently the leading market, driven by high disposable incomes, a strong emphasis on preventative healthcare, and well-established dietary supplement consumption patterns. Within North America, the United States spearheads market growth.

Source: The Marine source segment remains dominant, primarily due to the high concentration of EPA and DHA in fish oil. However, Plant-based omega-3s, particularly from sources like algae and flaxseed, are experiencing significant growth due to increasing consumer preference for vegan and vegetarian options and growing concerns about the sustainability of fish stocks.

Type: Docosahexaenoic acid (DHA) and Eicosapentaenoic acid (EPA) are the most sought-after types of omega-3s, accounting for the majority of the market share due to their well-documented health benefits. Alpha-Linolenic Acid (ALA), while an essential omega-3, has a lower conversion rate in the body, leading to comparatively lower demand.

Concentration: High Concentrated omega-3 products are gaining traction as consumers seek more potent and efficient delivery of these essential fatty acids, particularly in dietary supplements and specialized pharmaceutical applications.

Application: The Dietary Supplements segment is the largest and fastest-growing application, driven by proactive health management. Food and Beverages, particularly Functional Foods & Beverages and Infant Formula, represent a significant and expanding market as manufacturers fortify products to offer added health benefits. The Pharmaceuticals segment, though smaller, is critical for specific therapeutic applications.

- Dominant Region: North America (United States leading)

- Key Drivers for Regional Dominance: High disposable income, strong healthcare awareness, established supplement market.

- Dominant Source: Marine (growing influence of Plant-based)

- Key Drivers for Source Dominance: Established extraction technologies (Marine), rising veganism and sustainability concerns (Plant-based).

- Dominant Type: DHA & EPA

- Key Drivers for Type Dominance: Scientifically proven health benefits for cardiovascular and cognitive health.

- Dominant Concentration: High Concentrated

- Key Drivers for Concentration Dominance: Consumer demand for potency and efficacy.

- Dominant Application: Dietary Supplements

- Key Drivers for Application Dominance: Preventative health trends, widespread product availability.

Omega 3 PUFA Industry Product Developments

Product innovation in the Omega 3 PUFA industry is centered on enhancing bioavailability, expanding application versatility, and addressing consumer preferences for sustainable and clean-label ingredients. Companies are developing advanced microencapsulation techniques to mask the taste and odor of omega-3 oils, improving consumer compliance, especially in food and beverage applications like dairy and baked goods. The rise of algae-based DHA and EPA is a significant development, offering a vegan and sustainable alternative to marine sources, opening new market segments. Furthermore, research into synergistic combinations of omega-3s with other beneficial compounds like vitamins and antioxidants is leading to the development of multi-functional supplements and fortified foods, providing enhanced health benefits and a competitive edge.

Key Drivers of Omega 3 PUFA Industry Growth

Several pivotal factors are propelling the Omega 3 PUFA industry's upward trajectory. Technologically, advancements in extraction and purification methods are yielding higher purity omega-3 oils, increasing their potency and efficacy for both dietary and therapeutic uses. Economically, rising disposable incomes in emerging economies are expanding consumer access to health-conscious products, including omega-3 supplements and fortified foods. Regulatory bodies are increasingly recognizing and approving health claims associated with omega-3 fatty acids, lending credibility and driving consumer demand. Furthermore, a growing global emphasis on preventative healthcare and the documented benefits of omega-3s for cardiovascular health, cognitive function, and inflammation management are significant market catalysts.

Challenges in the Omega 3 PUFA Industry Market

Despite its robust growth, the Omega 3 PUFA industry faces several hurdles. Regulatory hurdles related to health claim substantiation and labeling can create market access complexities for new entrants and require substantial investment in clinical research. Supply chain issues, particularly for marine-derived omega-3s, can arise from overfishing, sustainability concerns, and geopolitical factors affecting raw material availability and price volatility, with potential for XX% price fluctuations annually. Competitive pressures from a crowded marketplace and the increasing availability of plant-based omega-3 alternatives necessitate continuous innovation and effective differentiation strategies. Furthermore, the perception and management of potential oxidation and off-flavors in omega-3 products remain a challenge, impacting consumer satisfaction.

Emerging Opportunities in Omega 3 PUFA Industry

The Omega 3 PUFA industry is ripe with emerging opportunities, primarily driven by technological breakthroughs and evolving consumer demands. The development of highly sustainable and traceable omega-3 sources, such as advanced fermentation techniques and genetically modified microalgae, presents a significant avenue for growth, appealing to environmentally conscious consumers. Strategic partnerships between ingredient manufacturers and food & beverage giants are creating novel opportunities for product co-development and wider market penetration through innovative fortified consumer goods. The burgeoning interest in personalized nutrition also opens doors for customized omega-3 formulations tailored to individual health needs and genetic predispositions, creating a niche yet high-value market segment. Expansion into emerging markets with growing health awareness and increasing disposable incomes offers substantial untapped potential for market expansion.

Leading Players in the Omega 3 PUFA Industry Sector

- Cargill Incorporated

- Pharma Marine

- Novotech Nutraceuticals Inc

- Archer Daniels Midland Company

- Croda International Plc

- BASF SE

- Stepan company

- Omega Protein Corporation

- Corbion NV

- Clover Corporation Ltd

Key Milestones in Omega 3 PUFA Industry Industry

- 2021: Cargill, Incorporated acquired Croda's Biobased industrial business. This strategic acquisition is aimed at leveraging Croda's technologies and chemical expertise to develop innovative omega-3 PUFA supplements, catering to diverse consumer needs and driving business expansion.

- 2021: Pharma Marine partnered with GEA, a prominent entity in the food and beverage industry. This collaboration is strategically focused on augmenting fish oil production capacity along Norway's west coast, enhancing supply chain capabilities.

Strategic Outlook for Omega 3 PUFA Industry Market

The strategic outlook for the Omega 3 PUFA industry is overwhelmingly positive, driven by an increasing global focus on health and wellness. Future growth will be accelerated by continued innovation in bioavailability and delivery systems, making omega-3s more accessible and effective across a wider range of applications. The burgeoning demand for sustainable and plant-based alternatives will necessitate strategic investments in these novel sources. Expansion into emerging markets, coupled with a deeper understanding of personalized nutrition, will unlock significant new revenue streams. Companies that can effectively navigate regulatory landscapes, secure sustainable supply chains, and clearly communicate the scientifically validated health benefits of their omega-3 products will be best positioned for sustained market leadership and profitable growth in the coming years.

Omega 3 PUFA Industry Segmentation

-

1. Source

- 1.1. Plant

- 1.2. Marine

-

2. Type

- 2.1. Docosahexanoic acid (DHA)

- 2.2. Eicosapentanoic acid (EPA)

- 2.3. Alpha-Linolenic Acid (ALA)

- 2.4. Others

-

3. Concentration

- 3.1. High Concentrated

- 3.2. Medium Concentrated

- 3.3. Low Concentrated

-

4. Application

-

4.1. Food and Beverages

- 4.1.1. Functional Foods & Beverages

- 4.1.2. Infant Formula

- 4.2. Dietary Supplements

- 4.3. Pharmaceuticals

- 4.4. Animal Nutrition

-

4.1. Food and Beverages

Omega 3 PUFA Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Omega 3 PUFA Industry Regional Market Share

Geographic Coverage of Omega 3 PUFA Industry

Omega 3 PUFA Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Increasing Demand for EPA Contained Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Omega 3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Plant

- 5.1.2. Marine

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Docosahexanoic acid (DHA)

- 5.2.2. Eicosapentanoic acid (EPA)

- 5.2.3. Alpha-Linolenic Acid (ALA)

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Concentration

- 5.3.1. High Concentrated

- 5.3.2. Medium Concentrated

- 5.3.3. Low Concentrated

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Food and Beverages

- 5.4.1.1. Functional Foods & Beverages

- 5.4.1.2. Infant Formula

- 5.4.2. Dietary Supplements

- 5.4.3. Pharmaceuticals

- 5.4.4. Animal Nutrition

- 5.4.1. Food and Beverages

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Omega 3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Plant

- 6.1.2. Marine

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Docosahexanoic acid (DHA)

- 6.2.2. Eicosapentanoic acid (EPA)

- 6.2.3. Alpha-Linolenic Acid (ALA)

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Concentration

- 6.3.1. High Concentrated

- 6.3.2. Medium Concentrated

- 6.3.3. Low Concentrated

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Food and Beverages

- 6.4.1.1. Functional Foods & Beverages

- 6.4.1.2. Infant Formula

- 6.4.2. Dietary Supplements

- 6.4.3. Pharmaceuticals

- 6.4.4. Animal Nutrition

- 6.4.1. Food and Beverages

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Omega 3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Plant

- 7.1.2. Marine

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Docosahexanoic acid (DHA)

- 7.2.2. Eicosapentanoic acid (EPA)

- 7.2.3. Alpha-Linolenic Acid (ALA)

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Concentration

- 7.3.1. High Concentrated

- 7.3.2. Medium Concentrated

- 7.3.3. Low Concentrated

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Food and Beverages

- 7.4.1.1. Functional Foods & Beverages

- 7.4.1.2. Infant Formula

- 7.4.2. Dietary Supplements

- 7.4.3. Pharmaceuticals

- 7.4.4. Animal Nutrition

- 7.4.1. Food and Beverages

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Omega 3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Plant

- 8.1.2. Marine

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Docosahexanoic acid (DHA)

- 8.2.2. Eicosapentanoic acid (EPA)

- 8.2.3. Alpha-Linolenic Acid (ALA)

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Concentration

- 8.3.1. High Concentrated

- 8.3.2. Medium Concentrated

- 8.3.3. Low Concentrated

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Food and Beverages

- 8.4.1.1. Functional Foods & Beverages

- 8.4.1.2. Infant Formula

- 8.4.2. Dietary Supplements

- 8.4.3. Pharmaceuticals

- 8.4.4. Animal Nutrition

- 8.4.1. Food and Beverages

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Omega 3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Plant

- 9.1.2. Marine

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Docosahexanoic acid (DHA)

- 9.2.2. Eicosapentanoic acid (EPA)

- 9.2.3. Alpha-Linolenic Acid (ALA)

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Concentration

- 9.3.1. High Concentrated

- 9.3.2. Medium Concentrated

- 9.3.3. Low Concentrated

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Food and Beverages

- 9.4.1.1. Functional Foods & Beverages

- 9.4.1.2. Infant Formula

- 9.4.2. Dietary Supplements

- 9.4.3. Pharmaceuticals

- 9.4.4. Animal Nutrition

- 9.4.1. Food and Beverages

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Omega 3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Plant

- 10.1.2. Marine

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Docosahexanoic acid (DHA)

- 10.2.2. Eicosapentanoic acid (EPA)

- 10.2.3. Alpha-Linolenic Acid (ALA)

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Concentration

- 10.3.1. High Concentrated

- 10.3.2. Medium Concentrated

- 10.3.3. Low Concentrated

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Food and Beverages

- 10.4.1.1. Functional Foods & Beverages

- 10.4.1.2. Infant Formula

- 10.4.2. Dietary Supplements

- 10.4.3. Pharmaceuticals

- 10.4.4. Animal Nutrition

- 10.4.1. Food and Beverages

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pharma Marine

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novotech Nutraceuticals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Croda International Plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stepan company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omega Protein Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Corbion NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Clover Corporation Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Omega 3 PUFA Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Omega 3 PUFA Industry Revenue (undefined), by Source 2025 & 2033

- Figure 3: North America Omega 3 PUFA Industry Revenue Share (%), by Source 2025 & 2033

- Figure 4: North America Omega 3 PUFA Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Omega 3 PUFA Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Omega 3 PUFA Industry Revenue (undefined), by Concentration 2025 & 2033

- Figure 7: North America Omega 3 PUFA Industry Revenue Share (%), by Concentration 2025 & 2033

- Figure 8: North America Omega 3 PUFA Industry Revenue (undefined), by Application 2025 & 2033

- Figure 9: North America Omega 3 PUFA Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Omega 3 PUFA Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Omega 3 PUFA Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Omega 3 PUFA Industry Revenue (undefined), by Source 2025 & 2033

- Figure 13: Europe Omega 3 PUFA Industry Revenue Share (%), by Source 2025 & 2033

- Figure 14: Europe Omega 3 PUFA Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Omega 3 PUFA Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Omega 3 PUFA Industry Revenue (undefined), by Concentration 2025 & 2033

- Figure 17: Europe Omega 3 PUFA Industry Revenue Share (%), by Concentration 2025 & 2033

- Figure 18: Europe Omega 3 PUFA Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: Europe Omega 3 PUFA Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Omega 3 PUFA Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Europe Omega 3 PUFA Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Omega 3 PUFA Industry Revenue (undefined), by Source 2025 & 2033

- Figure 23: Asia Pacific Omega 3 PUFA Industry Revenue Share (%), by Source 2025 & 2033

- Figure 24: Asia Pacific Omega 3 PUFA Industry Revenue (undefined), by Type 2025 & 2033

- Figure 25: Asia Pacific Omega 3 PUFA Industry Revenue Share (%), by Type 2025 & 2033

- Figure 26: Asia Pacific Omega 3 PUFA Industry Revenue (undefined), by Concentration 2025 & 2033

- Figure 27: Asia Pacific Omega 3 PUFA Industry Revenue Share (%), by Concentration 2025 & 2033

- Figure 28: Asia Pacific Omega 3 PUFA Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Asia Pacific Omega 3 PUFA Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Omega 3 PUFA Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Omega 3 PUFA Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Omega 3 PUFA Industry Revenue (undefined), by Source 2025 & 2033

- Figure 33: South America Omega 3 PUFA Industry Revenue Share (%), by Source 2025 & 2033

- Figure 34: South America Omega 3 PUFA Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: South America Omega 3 PUFA Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Omega 3 PUFA Industry Revenue (undefined), by Concentration 2025 & 2033

- Figure 37: South America Omega 3 PUFA Industry Revenue Share (%), by Concentration 2025 & 2033

- Figure 38: South America Omega 3 PUFA Industry Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Omega 3 PUFA Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Omega 3 PUFA Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Omega 3 PUFA Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Omega 3 PUFA Industry Revenue (undefined), by Source 2025 & 2033

- Figure 43: Middle East and Africa Omega 3 PUFA Industry Revenue Share (%), by Source 2025 & 2033

- Figure 44: Middle East and Africa Omega 3 PUFA Industry Revenue (undefined), by Type 2025 & 2033

- Figure 45: Middle East and Africa Omega 3 PUFA Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Omega 3 PUFA Industry Revenue (undefined), by Concentration 2025 & 2033

- Figure 47: Middle East and Africa Omega 3 PUFA Industry Revenue Share (%), by Concentration 2025 & 2033

- Figure 48: Middle East and Africa Omega 3 PUFA Industry Revenue (undefined), by Application 2025 & 2033

- Figure 49: Middle East and Africa Omega 3 PUFA Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Middle East and Africa Omega 3 PUFA Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Middle East and Africa Omega 3 PUFA Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Concentration 2020 & 2033

- Table 4: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 7: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Concentration 2020 & 2033

- Table 9: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 16: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Concentration 2020 & 2033

- Table 18: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Spain Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Germany Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 28: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Concentration 2020 & 2033

- Table 30: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: China Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Japan Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: India Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Australia Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Asia Pacific Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 38: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Concentration 2020 & 2033

- Table 40: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 41: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Brazil Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Argentina Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of South America Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Source 2020 & 2033

- Table 46: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 47: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Concentration 2020 & 2033

- Table 48: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 49: Global Omega 3 PUFA Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: South Africa Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Saudi Arabia Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Middle East and Africa Omega 3 PUFA Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Omega 3 PUFA Industry?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the Omega 3 PUFA Industry?

Key companies in the market include Cargill Incorporated, Pharma Marine, Novotech Nutraceuticals Inc, Archer Daniels Midland Company, Croda International Plc, BASF SE, Stepan company, Omega Protein Corporation, Corbion NV, Clover Corporation Ltd*List Not Exhaustive.

3. What are the main segments of the Omega 3 PUFA Industry?

The market segments include Source, Type, Concentration, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Increasing Demand for EPA Contained Food.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

In 2021, Cargill, Incorporated has acquired Croda's Biobased industrial business. The key strategy behind the acquisition of Croda's technologies and chemical business will be useful in developing new products which will be beneficial in meeting the varying requirements of the consumers around the globe, as using different technologies the company can offer numerous innovative omega-3 PUFA supplements to the consumer and also it will play a major role in business expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Omega 3 PUFA Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Omega 3 PUFA Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Omega 3 PUFA Industry?

To stay informed about further developments, trends, and reports in the Omega 3 PUFA Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence