Key Insights

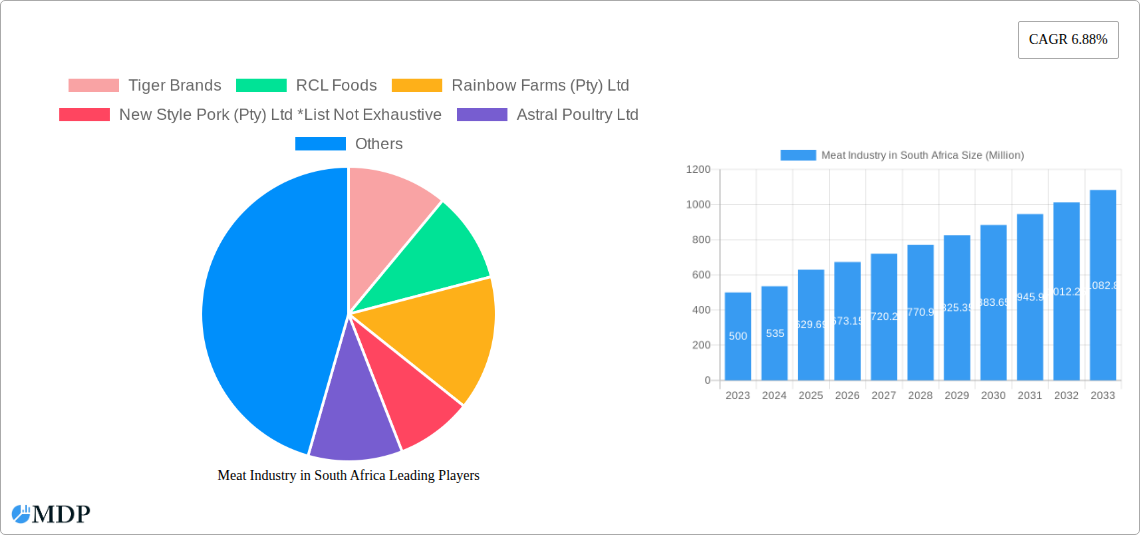

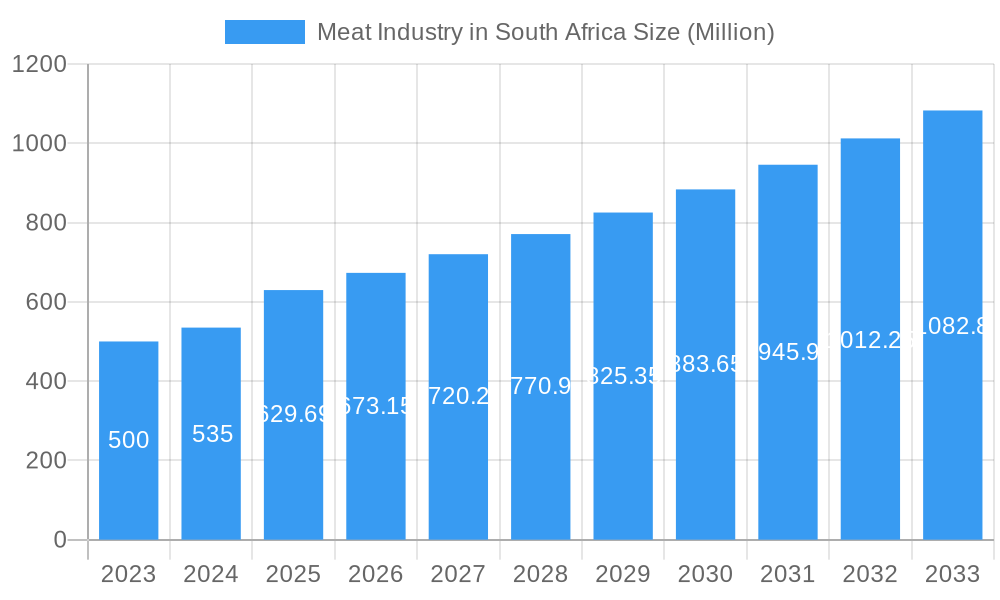

The South African meat industry is poised for significant growth, projected to reach a substantial market size of R 629.69 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.88% expected over the forecast period of 2025-2033. This expansion is fueled by several key drivers, including an increasing demand for protein-rich diets among a growing population, a rising disposable income that allows for greater consumption of premium meat products, and a growing middle class with a preference for convenience and quality. The industry is also benefiting from advancements in meat processing and preservation technologies, leading to a wider availability of chilled, frozen, and shelf-stable meat products. Furthermore, the evolving retail landscape, with a significant surge in online retail channels alongside traditional offline channels, is enhancing accessibility and driving sales. Emerging trends such as the increasing popularity of convenience foods, a greater focus on sustainable and ethically sourced meat, and the growing influence of e-commerce platforms are shaping consumer purchasing decisions and industry strategies.

Meat Industry in South Africa Market Size (In Million)

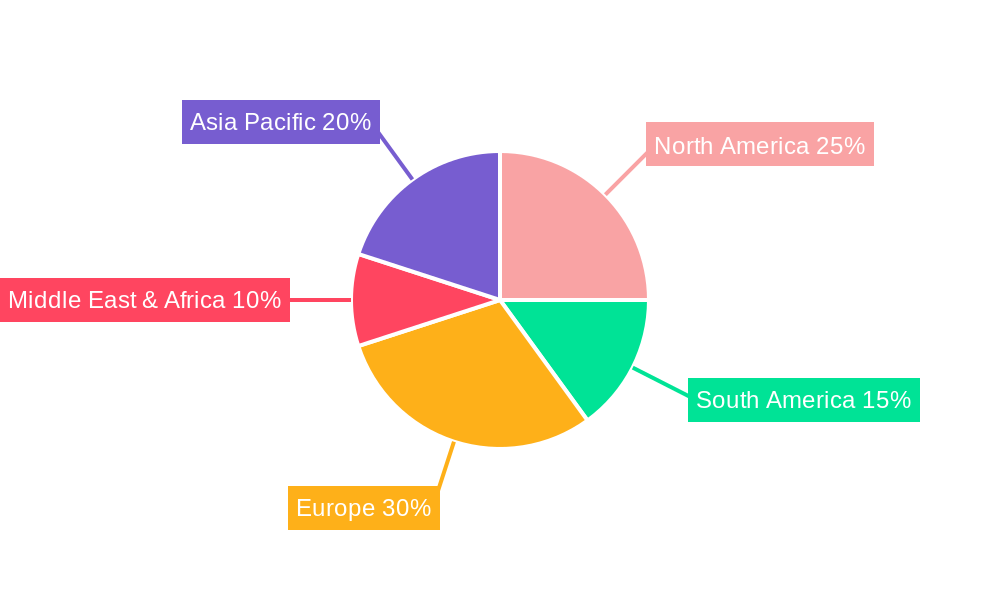

Despite the optimistic outlook, the industry faces certain restraints. Fluctuations in raw material prices, particularly for feed and livestock, can impact profitability. Stringent regulatory frameworks governing food safety, animal welfare, and environmental impact also present compliance challenges and can increase operational costs. Moreover, volatile economic conditions and potential outbreaks of animal diseases could disrupt supply chains and consumer confidence. However, the market's resilience is evident in the strategic focus of major players like Tiger Brands, RCL Foods, and Astral Poultry Ltd, who are investing in innovation, expanding their product portfolios, and optimizing their distribution networks. The competitive landscape also includes global giants such as JBS SA and Tyson Foods, highlighting the international significance of the South African market. The diversified regional presence across North America, South America, Europe, the Middle East & Africa, and Asia Pacific underscores the interconnectedness of the global meat trade and the opportunities for South African producers.

Meat Industry in South Africa Company Market Share

Unlocking the Potential: The South African Meat Industry Report (2019-2033)

Gain unparalleled insights into South Africa's dynamic meat sector with this comprehensive market analysis. This report, meticulously researched for the period 2019-2033, with a base year of 2025, offers deep dives into market concentration, growth drivers, evolving trends, and leading players. Essential for investors, producers, distributors, and policymakers, this report provides actionable intelligence to navigate and capitalize on the rapidly expanding South African meat market. Discover crucial data on key segments like Poultry, Pork, Beef, and Mutton, product types including Chilled, Frozen, and Shelf Stable, and distribution channels from Online to Offline Retail. Understand the impact of recent industry developments and equip yourself with the knowledge to strategize for future success.

Meat Industry in South Africa Market Dynamics & Concentration

The South African meat industry exhibits a moderately concentrated market landscape, characterized by the presence of several large, established players alongside a growing number of smaller, specialized producers. Market share distribution indicates a significant portion is held by companies like Tiger Brands and RCL Foods, particularly within the poultry and processed meat segments. Innovation drivers are increasingly focused on sustainable farming practices, improved animal welfare, and the development of value-added products. Regulatory frameworks, while robust, are continually evolving to address food safety, import/export regulations, and animal health concerns, influencing market entry and operational strategies. Product substitutes, such as plant-based alternatives, are gaining traction, presenting a growing competitive challenge. End-user trends highlight a rising demand for convenience, healthier options, and ethically sourced meat products. Mergers and acquisitions (M&A) activities, while not at an extreme level, have been instrumental in market consolidation and expansion, with an estimated XX M&A deal count observed over the historical period, aimed at enhancing supply chain control and product portfolios. The market share of key players, such as Astral Poultry Ltd, continues to evolve, reflecting strategic investments and market positioning.

Meat Industry in South Africa Industry Trends & Analysis

The South African meat industry is poised for significant expansion, driven by a confluence of demographic shifts, economic development, and evolving consumer preferences. Over the forecast period of 2025–2033, the industry is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX%, fueled by an increasing population and a growing middle class with greater disposable income for protein consumption. Market penetration for various meat types is on an upward trajectory, with poultry continuing to hold a dominant position due to its affordability and versatility. Technological disruptions are playing an increasingly vital role, from advancements in animal genetics and feed efficiency to sophisticated cold chain logistics and traceability solutions. Consumer preferences are shifting towards healthier, leaner meat options, and there is a growing demand for ethically and sustainably produced products, influencing sourcing and production methods. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Companies are investing in expanding their production capacities and diversifying their product offerings to cater to a broader consumer base. The rise of e-commerce and online retail channels is also reshaping distribution strategies, offering new avenues for market access and consumer engagement. Furthermore, the industry is responding to the growing interest in food safety and transparency, with an emphasis on robust quality control measures throughout the supply chain. The potential for value-added processing, including ready-to-eat meals and marinated products, presents a significant growth avenue as consumers seek convenience. The impact of climate change and the imperative for sustainable agricultural practices are also becoming central to long-term industry strategies.

Leading Markets & Segments in Meat Industry in South Africa

The South African meat industry is segmented across several key areas, with Poultry emerging as the leading source, driven by its widespread availability, affordability, and versatility across various culinary applications. The market penetration for poultry products is exceptionally high, catering to a broad consumer base.

Dominant Source: Poultry

- Key Drivers: Cost-effectiveness, high protein content, consistent supply, and widespread consumer acceptance across all income brackets. The development of advanced farming techniques has significantly boosted production efficiency.

- Market Dominance Analysis: Poultry accounts for a substantial market share, estimated at over XX% of the total meat consumption. This dominance is further solidified by the presence of major players like Astral Poultry Ltd and Rainbow Farms (Pty) Ltd, who have invested heavily in integrated value chains from feed production to processing and distribution.

Product Type: Chilled & Frozen

- Key Drivers: Consumer preference for freshness and convenience, supported by robust cold chain infrastructure. Frozen products offer longer shelf life and wider accessibility.

- Market Dominance Analysis: Both chilled and frozen segments are critical. Chilled products cater to immediate consumption and premium markets, while frozen products dominate the mass market and export potential. The demand for convenience is driving innovation in pre-packaged and ready-to-cook chilled meats.

Distribution: Offline Retail Channels

- Key Drivers: Traditional consumer shopping habits, extensive reach of supermarkets, butcheries, and informal markets across urban and rural areas.

- Market Dominance Analysis: Offline retail channels, including major supermarket chains and independent stores, continue to represent the largest proportion of meat sales. However, online retail channels are experiencing rapid growth, indicating a shift in consumer behavior.

Other Significant Segments:

- Pork: Experiencing steady growth due to increasing consumer acceptance and the presence of dedicated producers like New Style Pork (Pty) Ltd.

- Beef: Remains a staple, with demand influenced by economic factors and consumer preference for traditional meals.

- Mutton: Holds a significant cultural importance, particularly in certain regions, and continues to be a key segment.

- Shelf-Stable Products: While a smaller segment, it offers opportunities in convenience foods and for consumers seeking longer shelf-life options.

The economic policies of South Africa, including import tariffs and agricultural subsidies, play a crucial role in shaping the competitive landscape of these segments. Infrastructure development, particularly in cold chain logistics, is vital for maintaining product quality and expanding market reach, especially for perishable goods.

Meat Industry in South Africa Product Developments

Product innovation in the South African meat industry is increasingly focused on enhancing consumer appeal and addressing evolving dietary needs. Value-added products such as marinated meats, pre-portioned cuts, and ready-to-cook meal kits are gaining traction, catering to the demand for convenience. There's a notable trend towards developing healthier options, including lower-fat and reduced-sodium processed meat products, appealing to health-conscious consumers. Furthermore, the emergence of cultivated meat technologies, as evidenced by CULT Food Science Corp.'s portfolio company Mogale Meat Co. creating Africa's first cultivated chicken breast, signifies a significant technological advancement with potential long-term market disruption. Competitive advantages are being built on product quality, traceability, ethical sourcing, and unique flavor profiles.

Key Drivers of Meat Industry in South Africa Growth

Several pivotal factors are propelling the growth of the South African meat industry. Economic upliftment and a growing middle class are increasing disposable incomes, leading to higher per capita meat consumption. Technological advancements in animal husbandry, feed optimization, and processing technologies are enhancing efficiency and product quality. Favorable demographics, including a young and growing population, translate into sustained demand. Government initiatives aimed at supporting the agricultural sector and promoting food security also contribute significantly. For instance, the increased access of companies like JBS SA and BRF SA to the South African market through approved export licenses for products such as chicken and sausages underscores the impact of trade agreements and regulatory frameworks on market expansion.

Challenges in the Meat Industry in South Africa Market

Despite robust growth, the South African meat industry faces several significant challenges. Stringent and evolving regulatory frameworks, particularly concerning food safety and import/export standards, can pose compliance hurdles and increase operational costs. Supply chain vulnerabilities, including fluctuations in feed prices, disease outbreaks, and logistical bottlenecks, can disrupt production and distribution. Intense competitive pressures from both domestic and international players, coupled with the growing popularity of meat substitutes, demand continuous innovation and cost management. Infrastructure limitations, especially in remote agricultural areas, can hinder efficient transportation and cold chain management. The impact of these challenges can lead to price volatility and reduced profit margins for producers, estimated to affect XX% of smallholder farmers annually.

Emerging Opportunities in Meat Industry in South Africa

The South African meat industry is rife with emerging opportunities, particularly in the realm of value-added processing and specialty products. Growing consumer interest in organic, free-range, and sustainably sourced meats presents a premium market segment. The development and adoption of innovative technologies, including precision agriculture and advanced processing techniques, offer avenues for enhanced efficiency and reduced environmental impact. Export market expansion, leveraging trade agreements and increased international demand for South African produce, remains a significant growth catalyst. Strategic partnerships and collaborations, both within the industry and with technology providers, can unlock new market access and foster innovation. The ongoing development of the alternative protein sector, while a challenge, also presents opportunities for diversification and co-existence with traditional meat production.

Leading Players in the Meat Industry in South Africa Sector

- Tiger Brands

- RCL Foods

- Rainbow Farms (Pty) Ltd

- New Style Pork (Pty) Ltd

- Astral Poultry Ltd

- BRF SA

- JBS SA

- Tyson Foods

- Eskort Co-operative

- Irvin & Johnson ltd

Key Milestones in Meat Industry in South Africa Industry

- May 2022: JBS announced that two plants of the subsidiary Seara were approved to export chicken meat to South Africa. With that, the company now has 28 units ready to export chickens and pigs to the African country.

- April 2022: CULT Food Science Corp. announced that its portfolio company, Mogale Meat Co., had created its first cultivated chicken breast product in Africa.

- March 2022: BRF was granted a license to export sausages to South Africa. A company statement stated that the item was produced in Marau, in northern Rio Grande do Sul, specifically for the South African market.

Strategic Outlook for Meat Industry in South Africa Market

The strategic outlook for the South African meat industry is characterized by a dual focus on enhancing domestic market penetration and exploring international growth opportunities. Key accelerators include continued investment in efficient and sustainable production methods, particularly within the poultry and pork sectors. The industry must strategically navigate the growing demand for ethically sourced and healthier meat products, potentially through certifications and transparent labeling. Leveraging advancements in cold chain logistics and e-commerce will be crucial for expanding reach and improving consumer accessibility. Furthermore, strategic alliances and targeted mergers and acquisitions will likely play a role in consolidating market share and achieving economies of scale. The industry's adaptability to technological innovations, including potential disruptions from alternative protein sources, will be paramount for long-term resilience and sustained profitability.

Meat Industry in South Africa Segmentation

-

1. Source

- 1.1. Poultry

- 1.2. Pork

- 1.3. Beef

- 1.4. Mutton

-

2. Product Type

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Shelf Stable

-

3. Distribution

- 3.1. Online Retail Channels

- 3.2. Offline Retail Channels

Meat Industry in South Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Meat Industry in South Africa Regional Market Share

Geographic Coverage of Meat Industry in South Africa

Meat Industry in South Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Growth of Foodservice Restaurants Increased Meat Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Meat Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Poultry

- 5.1.2. Pork

- 5.1.3. Beef

- 5.1.4. Mutton

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Shelf Stable

- 5.3. Market Analysis, Insights and Forecast - by Distribution

- 5.3.1. Online Retail Channels

- 5.3.2. Offline Retail Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Meat Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Poultry

- 6.1.2. Pork

- 6.1.3. Beef

- 6.1.4. Mutton

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.2.3. Shelf Stable

- 6.3. Market Analysis, Insights and Forecast - by Distribution

- 6.3.1. Online Retail Channels

- 6.3.2. Offline Retail Channels

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. South America Meat Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Poultry

- 7.1.2. Pork

- 7.1.3. Beef

- 7.1.4. Mutton

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.2.3. Shelf Stable

- 7.3. Market Analysis, Insights and Forecast - by Distribution

- 7.3.1. Online Retail Channels

- 7.3.2. Offline Retail Channels

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Europe Meat Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Poultry

- 8.1.2. Pork

- 8.1.3. Beef

- 8.1.4. Mutton

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.2.3. Shelf Stable

- 8.3. Market Analysis, Insights and Forecast - by Distribution

- 8.3.1. Online Retail Channels

- 8.3.2. Offline Retail Channels

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Middle East & Africa Meat Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Poultry

- 9.1.2. Pork

- 9.1.3. Beef

- 9.1.4. Mutton

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.2.3. Shelf Stable

- 9.3. Market Analysis, Insights and Forecast - by Distribution

- 9.3.1. Online Retail Channels

- 9.3.2. Offline Retail Channels

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Asia Pacific Meat Industry in South Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Poultry

- 10.1.2. Pork

- 10.1.3. Beef

- 10.1.4. Mutton

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.2.3. Shelf Stable

- 10.3. Market Analysis, Insights and Forecast - by Distribution

- 10.3.1. Online Retail Channels

- 10.3.2. Offline Retail Channels

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tiger Brands

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RCL Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rainbow Farms (Pty) Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 New Style Pork (Pty) Ltd *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Astral Poultry Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BRF SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JBS SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tyson Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eskort Co-operative

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Irvin & Johnson ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tiger Brands

List of Figures

- Figure 1: Global Meat Industry in South Africa Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Meat Industry in South Africa Revenue (Million), by Source 2025 & 2033

- Figure 3: North America Meat Industry in South Africa Revenue Share (%), by Source 2025 & 2033

- Figure 4: North America Meat Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Meat Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Meat Industry in South Africa Revenue (Million), by Distribution 2025 & 2033

- Figure 7: North America Meat Industry in South Africa Revenue Share (%), by Distribution 2025 & 2033

- Figure 8: North America Meat Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Meat Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Meat Industry in South Africa Revenue (Million), by Source 2025 & 2033

- Figure 11: South America Meat Industry in South Africa Revenue Share (%), by Source 2025 & 2033

- Figure 12: South America Meat Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 13: South America Meat Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America Meat Industry in South Africa Revenue (Million), by Distribution 2025 & 2033

- Figure 15: South America Meat Industry in South Africa Revenue Share (%), by Distribution 2025 & 2033

- Figure 16: South America Meat Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Meat Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Meat Industry in South Africa Revenue (Million), by Source 2025 & 2033

- Figure 19: Europe Meat Industry in South Africa Revenue Share (%), by Source 2025 & 2033

- Figure 20: Europe Meat Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Europe Meat Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Meat Industry in South Africa Revenue (Million), by Distribution 2025 & 2033

- Figure 23: Europe Meat Industry in South Africa Revenue Share (%), by Distribution 2025 & 2033

- Figure 24: Europe Meat Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Meat Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Meat Industry in South Africa Revenue (Million), by Source 2025 & 2033

- Figure 27: Middle East & Africa Meat Industry in South Africa Revenue Share (%), by Source 2025 & 2033

- Figure 28: Middle East & Africa Meat Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa Meat Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa Meat Industry in South Africa Revenue (Million), by Distribution 2025 & 2033

- Figure 31: Middle East & Africa Meat Industry in South Africa Revenue Share (%), by Distribution 2025 & 2033

- Figure 32: Middle East & Africa Meat Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Meat Industry in South Africa Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Meat Industry in South Africa Revenue (Million), by Source 2025 & 2033

- Figure 35: Asia Pacific Meat Industry in South Africa Revenue Share (%), by Source 2025 & 2033

- Figure 36: Asia Pacific Meat Industry in South Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Meat Industry in South Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Meat Industry in South Africa Revenue (Million), by Distribution 2025 & 2033

- Figure 39: Asia Pacific Meat Industry in South Africa Revenue Share (%), by Distribution 2025 & 2033

- Figure 40: Asia Pacific Meat Industry in South Africa Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Meat Industry in South Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Meat Industry in South Africa Revenue Million Forecast, by Source 2020 & 2033

- Table 2: Global Meat Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Meat Industry in South Africa Revenue Million Forecast, by Distribution 2020 & 2033

- Table 4: Global Meat Industry in South Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Meat Industry in South Africa Revenue Million Forecast, by Source 2020 & 2033

- Table 6: Global Meat Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Meat Industry in South Africa Revenue Million Forecast, by Distribution 2020 & 2033

- Table 8: Global Meat Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Meat Industry in South Africa Revenue Million Forecast, by Source 2020 & 2033

- Table 13: Global Meat Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Meat Industry in South Africa Revenue Million Forecast, by Distribution 2020 & 2033

- Table 15: Global Meat Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Meat Industry in South Africa Revenue Million Forecast, by Source 2020 & 2033

- Table 20: Global Meat Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Meat Industry in South Africa Revenue Million Forecast, by Distribution 2020 & 2033

- Table 22: Global Meat Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Meat Industry in South Africa Revenue Million Forecast, by Source 2020 & 2033

- Table 33: Global Meat Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Meat Industry in South Africa Revenue Million Forecast, by Distribution 2020 & 2033

- Table 35: Global Meat Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Meat Industry in South Africa Revenue Million Forecast, by Source 2020 & 2033

- Table 43: Global Meat Industry in South Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Meat Industry in South Africa Revenue Million Forecast, by Distribution 2020 & 2033

- Table 45: Global Meat Industry in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Meat Industry in South Africa Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meat Industry in South Africa?

The projected CAGR is approximately 6.88%.

2. Which companies are prominent players in the Meat Industry in South Africa?

Key companies in the market include Tiger Brands, RCL Foods, Rainbow Farms (Pty) Ltd, New Style Pork (Pty) Ltd *List Not Exhaustive, Astral Poultry Ltd, BRF SA, JBS SA, Tyson Foods, Eskort Co-operative, Irvin & Johnson ltd.

3. What are the main segments of the Meat Industry in South Africa?

The market segments include Source, Product Type, Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 629.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Growth of Foodservice Restaurants Increased Meat Consumption.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

May 2022: JBS announced that two plants of the subsidiary Seara were approved to export chicken meat to South Africa. With that, the company now has 28 units ready to export chickens and pigs to the African country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meat Industry in South Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meat Industry in South Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meat Industry in South Africa?

To stay informed about further developments, trends, and reports in the Meat Industry in South Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence