Key Insights

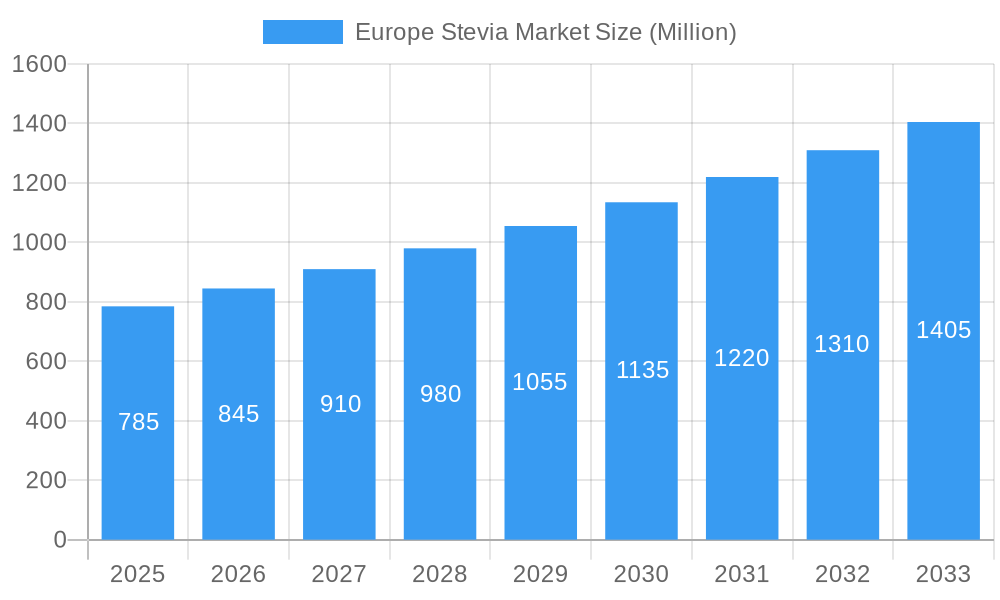

The European Stevia Market is projected for substantial growth, expected to reach a market size of $143.01 million by 2025. Anticipated to expand at a Compound Annual Growth Rate (CAGR) of 10.7%, this upward trend is fueled by escalating consumer preference for natural, low-calorie sweeteners and a rising global focus on health and wellness. European food and beverage manufacturers are increasingly integrating stevia to meet demand for healthier options, reduce sugar content, and adhere to regulatory mandates. Key applications in bakery, dairy, beverages, and confectionery are driving significant adoption, positioning stevia as a vital ingredient for product innovation. Its availability in liquid, powder, and leaf forms enhances its versatility and widespread application.

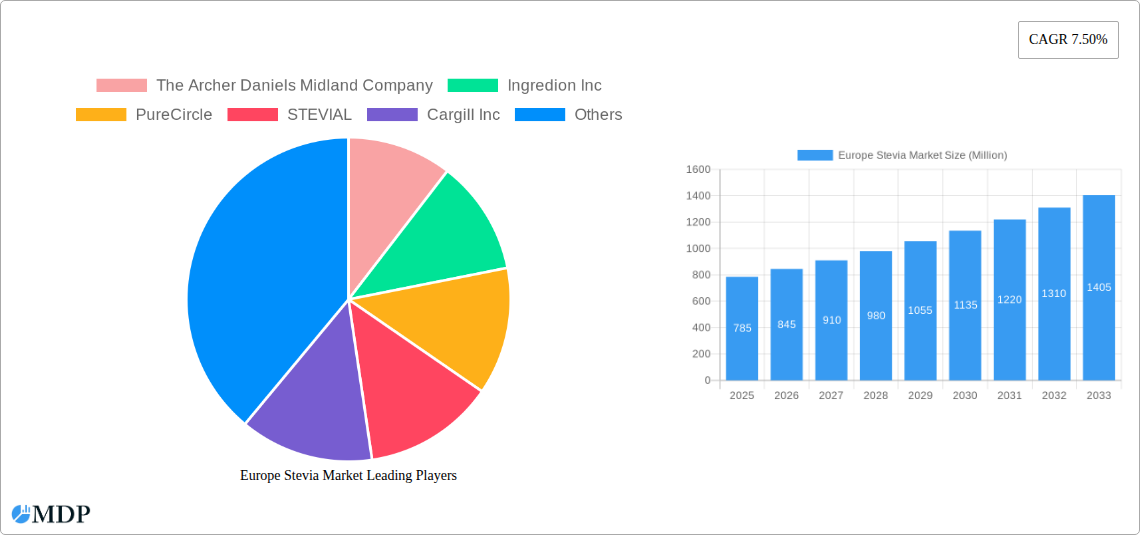

Europe Stevia Market Market Size (In Million)

Challenges impacting market expansion include ongoing regulatory evaluations of specific steviol glycosides, potential raw material supply chain disruptions, and lingering consumer perceptions regarding stevia's taste. Nevertheless, ongoing research and development are improving extraction methods and introducing advanced stevia-based ingredients with superior taste profiles. The increasing use of stevia in dietary supplements and functional foods presents new growth opportunities. Major companies such as The Archer Daniels Midland Company, Ingredion Inc., PureCircle, and Cargill Inc. are strategically investing in R&D and production expansion to address the rising demand within the European market.

Europe Stevia Market Company Market Share

Europe Stevia Market: Comprehensive Insights and Future Outlook (2019–2033)

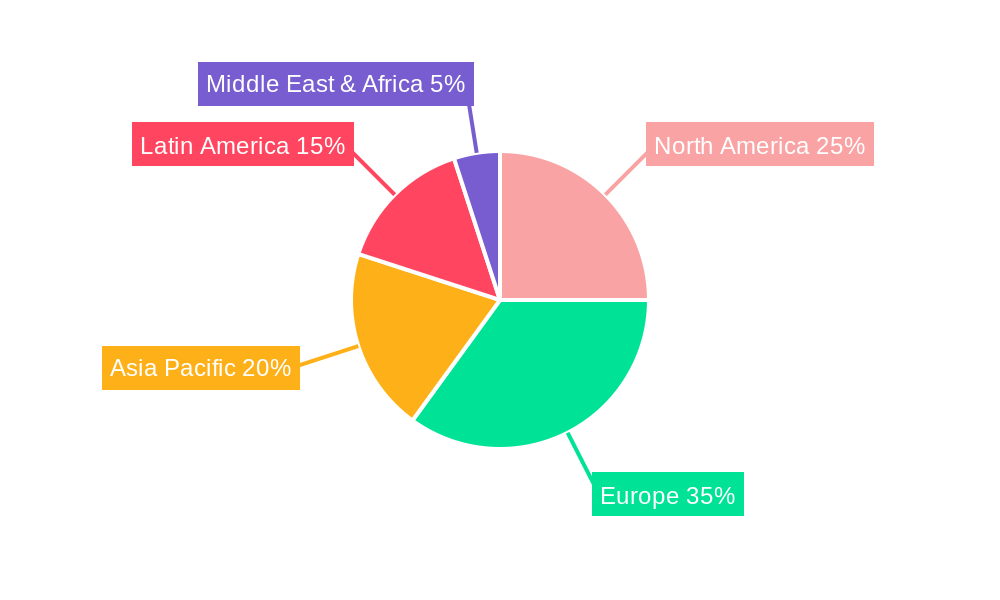

This in-depth report delivers critical insights into the dynamic Europe Stevia Market, a rapidly expanding sector driven by increasing consumer demand for natural, low-calorie sweeteners. Spanning the historical period of 2019–2024, a base year of 2025, and a robust forecast period from 2025 to 2033, this analysis provides actionable intelligence for stakeholders seeking to navigate the complexities and capitalize on the immense opportunities within this burgeoning market. Our study meticulously examines market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, key players, and pivotal milestones, culminating in a strategic outlook for future market expansion. The global stevia market is projected to reach $XXX Billion by 2025, with Europe representing a significant and growing share of this valuation, estimated at $XXX Billion for the base year.

Europe Stevia Market Market Dynamics & Concentration

The Europe Stevia Market is characterized by a moderate to high concentration, with key players actively investing in production capacity and innovation. The Ingredion Inc. acquisition of PureCircle in 2020 significantly reshaped the competitive landscape, consolidating market share and enhancing capabilities in high-purity steviol glycoside extraction. Innovation is a primary driver, fueled by ongoing research into novel stevia extracts with improved taste profiles and reduced aftertastes, alongside advancements in sustainable cultivation and extraction technologies. Regulatory frameworks, such as those established by the European Food Safety Authority (EFSA), continue to evolve, influencing product approvals and market access for various stevia ingredients. Product substitutes, including other high-intensity sweeteners (both natural and artificial) and sugar alcohols, pose a competitive challenge, though the "natural" appeal of stevia offers a distinct advantage. End-user trends show a strong preference for clean-label products, driving demand for stevia as a sugar alternative in various food and beverage applications. M&A activities, exemplified by the Ingredion-PureCircle deal, are expected to continue as companies seek to expand their portfolios and market reach. The market has seen approximately XX M&A deals in the historical period, with significant investment flowing into research and development.

Europe Stevia Market Industry Trends & Analysis

The Europe Stevia Market is experiencing robust growth, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is primarily attributed to a confluence of escalating consumer consciousness regarding health and wellness, leading to a strong preference for sugar reduction and natural ingredients. The rising prevalence of lifestyle diseases such as obesity and diabetes across Europe further accentuates the demand for low-calorie and sugar-free alternatives, positioning stevia as a leading solution. Technological advancements in stevia cultivation and extraction processes are instrumental in improving the purity and taste profiles of stevia-based sweeteners, thereby addressing historical consumer concerns about off-flavors. Innovations in extraction techniques, including enzymatic modifications and fermentation-based production, are enhancing the cost-effectiveness and scalability of stevia ingredient manufacturing. Furthermore, the "natural" perception of stevia, derived from the Stevia rebaudiana plant, resonates deeply with European consumers increasingly scrutinizing ingredient labels for artificial additives. This trend is reflected in the growing market penetration of stevia in various food and beverage categories, from carbonated drinks and juices to dairy products and baked goods. Competitive dynamics within the market are characterized by strategic investments in R&D, capacity expansions, and product differentiation by leading manufacturers. Companies are focusing on developing stevia formulations that offer a more sugar-like taste experience, thereby encouraging broader consumer adoption and application in diverse culinary contexts. The regulatory environment, while generally supportive of stevia as a permitted food additive, continues to shape the market through stringent purity standards and labeling requirements. The market penetration of stevia is estimated to reach XX% by the end of the forecast period.

Leading Markets & Segments in Europe Stevia Market

Within the Europe Stevia Market, Germany consistently emerges as a dominant region, driven by its large consumer base, strong emphasis on health and wellness, and proactive food industry adoption of sugar alternatives. This leadership is further bolstered by supportive government initiatives promoting healthier food choices and robust economic policies fostering innovation. The Beverages segment commands the largest market share, owing to the widespread application of stevia in soft drinks, juices, and flavored waters, driven by the global trend towards reduced sugar intake.

Key drivers for the dominance of these markets and segments include:

- Economic Policies: Favorable trade agreements and government subsidies for agricultural and food processing sectors in leading European countries.

- Consumer Awareness: High levels of consumer education regarding the health benefits of sugar reduction and the natural origin of stevia.

- Product Innovation: Continuous development of stevia-based ingredients that enhance taste and functionality in diverse applications.

The Powder form of stevia exhibits substantial growth, driven by its ease of use and versatility in dry mixes, confectionery, and tabletop sweeteners. The Bakery segment is also a significant contributor, with stevia increasingly incorporated into cakes, biscuits, and pastries to cater to the demand for healthier dessert options. The Dairy Food Products segment, including yogurts and ice creams, is witnessing steady growth as manufacturers seek to offer reduced-sugar alternatives without compromising taste. The Dietary Supplements sector also plays a crucial role, leveraging stevia's natural, zero-calorie properties in formulations. The Confectionery market, encompassing chocolates and candies, is a key area for stevia adoption, offering a sugar-free indulgence option. While these segments represent the core, the Others category, encompassing applications in pharmaceuticals and personal care, is also showing promising growth.

Europe Stevia Market Product Developments

Europe has witnessed a surge in innovative stevia-based products designed to mimic the taste and mouthfeel of sugar more closely. Key developments include the introduction of novel steviol glycosides, such as Reb D and Reb M, which offer a cleaner, less bitter taste profile compared to older extracts. Manufacturers are also focusing on blended sweetener solutions, combining stevia with other natural ingredients to achieve optimal sweetness intensity and flavor balance. These product advancements are crucial for expanding stevia's application range across various food and beverage categories, including baked goods, dairy products, and confectionery, providing consumers with healthier and more palatable options.

Key Drivers of Europe Stevia Market Growth

The Europe Stevia Market's growth is primarily propelled by a trifecta of factors: escalating consumer demand for natural and low-calorie sweeteners driven by health consciousness, supportive regulatory frameworks that facilitate the use of stevia as a food additive, and ongoing technological innovations in cultivation and extraction processes. The increasing global awareness and concern regarding obesity and diabetes continue to fuel the shift towards sugar alternatives. Furthermore, favorable government policies and approvals from bodies like EFSA have solidified stevia's position as a safe and viable option for food and beverage manufacturers. Advances in agricultural practices for Stevia rebaudiana and efficient extraction techniques are improving the quality and cost-effectiveness of stevia ingredients, making them more accessible and appealing to a wider market.

Challenges in the Europe Stevia Market Market

Despite its significant growth potential, the Europe Stevia Market faces several challenges. Regulatory hurdles, though generally favorable, can still present complexities in specific regions or for novel stevia derivatives, potentially delaying market entry. The supply chain for stevia can be susceptible to climatic variations and agricultural challenges, impacting availability and price stability. Competitive pressures from other high-intensity sweeteners, both natural and artificial, continue to exert influence on market share. Furthermore, lingering consumer perceptions regarding the taste profile of certain stevia extracts, although improving, can sometimes hinder widespread adoption in specific applications.

Emerging Opportunities in Europe Stevia Market

Emerging opportunities in the Europe Stevia Market are centered around technological breakthroughs and strategic market expansion. The development of advanced fermentation and enzymatic processes to produce high-purity steviol glycosides offers a sustainable and cost-effective alternative to traditional agricultural methods, potentially stabilizing supply and reducing costs. Strategic partnerships between stevia ingredient suppliers and major food and beverage manufacturers are crucial for co-creating innovative products and expanding stevia's reach into new application areas. Furthermore, untapped markets within the broader European food service sector and the continued growth in the "free-from" and "clean-label" product categories present significant avenues for future market expansion.

Leading Players in the Europe Stevia Market Sector

- The Archer Daniels Midland Company

- Ingredion Inc

- PureCircle

- STEVIAL

- Cargill Inc

- Tereos S A

- GLG LIFE TECH CORP

- Tate & Lyle

Key Milestones in Europe Stevia Market Industry

- 2020: Ingredion Inc. completed the acquisition of PureCircle, a move that significantly consolidated market share and enhanced its portfolio of high-purity stevia ingredients.

- 2021: Tate & Lyle launched Optimizer Stevia, a new stevia-based sweetener aimed at improving taste profiles and cost-effectiveness in various food and beverage applications.

- 2022: The Archer Daniels Midland Company and Cargill Inc. made significant investments in expanding their stevia production facilities, signaling confidence in future market growth and a commitment to meeting increasing demand.

Strategic Outlook for Europe Stevia Market Market

The strategic outlook for the Europe Stevia Market remains exceptionally positive, driven by sustained consumer demand for healthier, natural ingredients. Continued investment in research and development to refine taste profiles and expand applications will be paramount. Collaboration between ingredient manufacturers and end-product innovators will accelerate the introduction of novel stevia-based products across diverse food and beverage categories. Furthermore, advancements in sustainable sourcing and production technologies are expected to address supply chain concerns and enhance the market's environmental credentials, positioning stevia for continued leadership in the global sweetener landscape.

Europe Stevia Market Segmentation

-

1. Form

- 1.1. Liquid

- 1.2. Powder

- 1.3. Leaf

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Food Products

- 2.3. Beverages

- 2.4. Dietary Supplements

- 2.5. Confectionery

- 2.6. Others

Europe Stevia Market Segmentation By Geography

-

1. Europe

- 1.1. Spain

- 1.2. United Kingdom

- 1.3. Germany

- 1.4. France

- 1.5. Italy

- 1.6. Russia

- 1.7. Rest of Europe

Europe Stevia Market Regional Market Share

Geographic Coverage of Europe Stevia Market

Europe Stevia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand For Plant Based Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Stevia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Liquid

- 5.1.2. Powder

- 5.1.3. Leaf

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Food Products

- 5.2.3. Beverages

- 5.2.4. Dietary Supplements

- 5.2.5. Confectionery

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Archer Daniels Midland Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ingredion Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PureCircle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 STEVIAL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tereos S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GLG LIFE TECH CORP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 The Archer Daniels Midland Company

List of Figures

- Figure 1: Europe Stevia Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Stevia Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Stevia Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: Europe Stevia Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Stevia Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Stevia Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: Europe Stevia Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Stevia Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Spain Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Kingdom Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Germany Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: France Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Italy Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Russia Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Stevia Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Stevia Market?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the Europe Stevia Market?

Key companies in the market include The Archer Daniels Midland Company, Ingredion Inc, PureCircle, STEVIAL, Cargill Inc, Tereos S A, GLG LIFE TECH CORP, Tate & Lyle.

3. What are the main segments of the Europe Stevia Market?

The market segments include Form, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 143.01 million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Growing Demand For Plant Based Ingredients.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of PureCircle by Ingredion Inc in 2020 2. Launch of Tate & Lyle's new stevia-based sweetener, Optimizer Stevia, in 2021 3. Investment in stevia production facilities by The Archer Daniels Midland Company and Cargill Inc in 2022

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Stevia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Stevia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Stevia Market?

To stay informed about further developments, trends, and reports in the Europe Stevia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence