Key Insights

The global malted wheat flour market is set for substantial growth, projected to reach $16.24 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.46% through 2033. This expansion is driven by rising consumer preference for premium and artisanal food products, where malted wheat flour's distinct flavor, superior texture, and nutritional benefits are highly sought after. The beverage industry, particularly craft brewing and specialty drink production, is a significant contributor, leveraging malted wheat flour for its impact on color, flavor, and mouthfeel. Concurrently, the food sector is witnessing increased demand for baked goods, snacks, and cereals offering richer taste and enhanced quality, further stimulating market growth. This trend toward differentiated and healthier food options presents considerable opportunities for market participants.

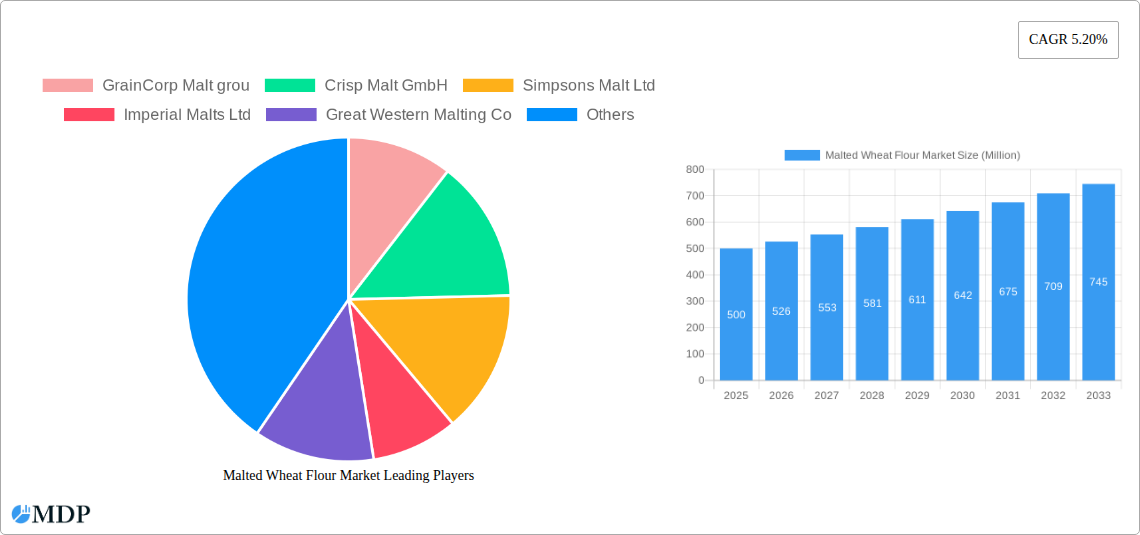

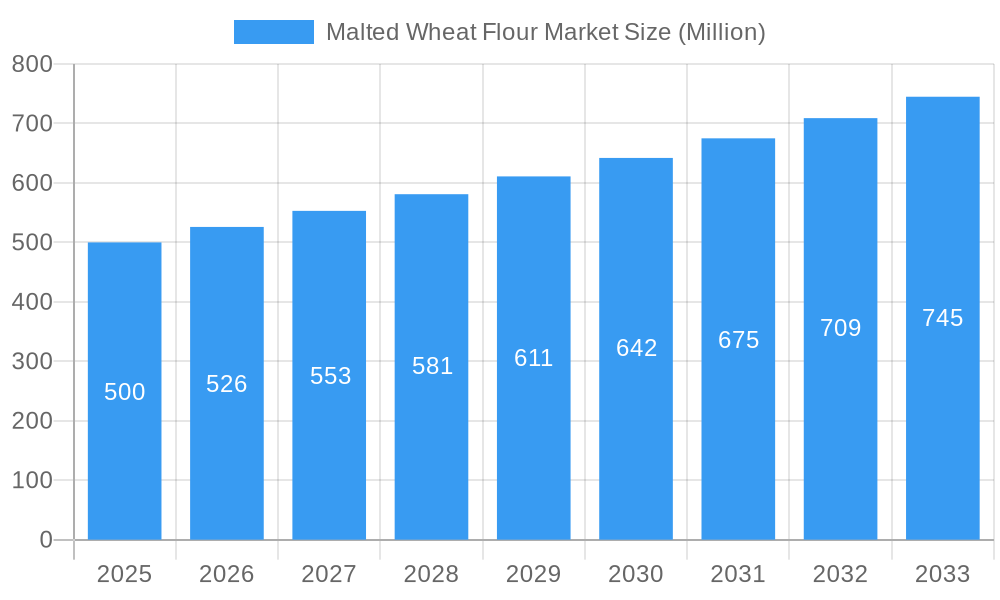

Malted Wheat Flour Market Market Size (In Billion)

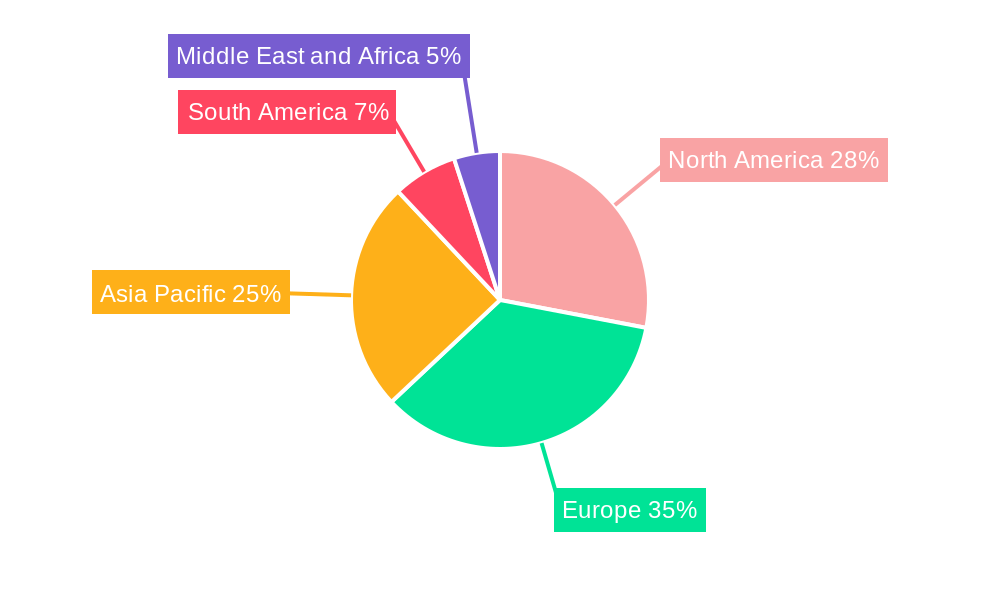

While the market outlook is positive, challenges include the price fluctuations of raw wheat and malt, potentially affecting profitability and affordability. The availability of alternative flours and starches with comparable functionalities, alongside regional regulatory complexities regarding food additives, may also present hurdles. Nevertheless, continuous innovation in malting techniques and the development of specialized malted wheat flour variants for specific applications are expected to alleviate these constraints. The market features a dynamic competitive environment, with leading companies focusing on research and development, capacity expansion, and strategic alliances. The Asia Pacific region, fueled by rapid industrialization and evolving consumer preferences, is anticipated to become a key growth engine, complementing established markets in North America and Europe.

Malted Wheat Flour Market Company Market Share

This comprehensive report offers a critical analysis of the global Malted Wheat Flour Market, forecasting significant expansion from 2019 to 2033. With a base year of 2025, the forecast period of 2025–2033 provides actionable intelligence for industry stakeholders. Our study encompasses the historical period of 2019–2024, establishing a strong foundation for understanding market dynamics, competitive landscapes, and future prospects.

Malted Wheat Flour Market Dynamics & Concentration

The Malted Wheat Flour Market exhibits a moderate level of concentration, with key players like GrainCorp Malt Group, Crisp Malt GmbH, Simpsons Malt Ltd, Imperial Malts Ltd, Great Western Malting Co, IREKS GmbH, Muntons plc, and Malteurop dominating significant market share. Innovation remains a primary driver, fueled by advancements in malting technologies that enhance flavor profiles and functional properties, appealing to evolving consumer preferences in both the beverage and food segments. Regulatory frameworks, particularly concerning food safety and ingredient labeling, play a crucial role in shaping market entry and product development. While direct substitutes are limited due to malted wheat flour's unique characteristics, alternative grain flours can pose indirect competition. End-user trends are strongly influenced by the demand for premium and artisanal food and beverage products, as well as the increasing use of malted wheat flour in specialized industrial applications. Mergers and acquisitions (M&A) activities are expected to continue as companies seek to consolidate their market position, expand their product portfolios, and achieve economies of scale. M&A deal counts have been steadily increasing in recent years as established players look to acquire innovative startups or gain access to new geographical markets.

Malted Wheat Flour Market Industry Trends & Analysis

The global Malted Wheat Flour Market is poised for robust expansion, driven by a confluence of escalating demand for premium ingredients in the food and beverage industries and burgeoning awareness of its health benefits. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. Technological disruptions in malting processes, including advancements in enzymatic treatments and controlled fermentation, are enabling the production of malted wheat flour with tailored flavor profiles and enhanced functional attributes. This technological evolution is directly impacting consumer preferences, with an increasing appetite for natural, wholesome ingredients and unique taste experiences. The competitive dynamics are characterized by strategic collaborations, product differentiation, and a focus on sustainability. Market penetration is deepening as malted wheat flour gains traction beyond traditional brewing applications into bakery goods, confectionery, and specialized dietary products. The demand for artisanal bread, craft beers, and innovative food formulations significantly bolsters market growth. Furthermore, the growing consumer inclination towards health-conscious choices is indirectly benefiting malted wheat flour due to its perceived nutritional advantages. The market penetration in the beverage sector, particularly in craft brewing and specialty distilled spirits, is substantial and projected to grow. In the food segment, its application in premium bakery products and gluten-free formulations is a significant growth catalyst. The industry is observing a trend towards vertical integration by some players to control the supply chain from grain sourcing to finished malted flour.

Leading Markets & Segments in Malted Wheat Flour Market

The Beverage segment stands as the dominant force within the Malted Wheat Flour Market, driven by its extensive use in brewing and distilling. The demand for craft beers and specialty spirits, which heavily rely on malted grains for their distinctive flavors and aromas, continues to surge globally. Economic policies that support the growth of the beverage industry, coupled with the development of microbreweries and distilleries, further fuel this dominance. Infrastructure development in emerging economies is also facilitating the expansion of beverage production, consequently increasing the demand for malted wheat flour.

- Beverage Segment Dominance:

- Craft Beer Revolution: The exponential growth of craft beer production worldwide, characterized by innovative flavor profiles and unique brewing techniques, is a primary driver for malted wheat flour. Brewers utilize it for its contribution to body, head retention, and subtle flavor notes.

- Specialty Spirits: The increasing popularity of specialty whiskey, vodka, and other distilled spirits that incorporate malted wheat for nuanced flavor profiles contributes significantly to market demand.

- Emerging Markets: Rapid urbanization and rising disposable incomes in regions like Asia-Pacific are leading to increased consumption of alcoholic beverages, thereby expanding the market for malted wheat flour in brewing and distilling.

- Regulatory Support: Favorable regulations for the beverage industry in key markets, such as reduced taxation on small breweries, stimulate production and the demand for raw materials like malted wheat flour.

The Food segment, while currently secondary to beverages, presents substantial growth potential. The rising consumer interest in healthy and natural food ingredients, coupled with the expanding bakery and confectionery industries, is propelling the adoption of malted wheat flour. Its application in artisanal bread, breakfast cereals, and as a natural sweetener or flavor enhancer in various food products is gaining momentum.

- Food Segment Growth Drivers:

- Artisanal Bakery: The resurgence of artisanal baking and the demand for high-quality, flavorful bread are driving the use of malted wheat flour for its browning properties, crust development, and enhanced taste.

- Health & Wellness Trend: Consumers are increasingly seeking out ingredients perceived as natural and wholesome. Malted wheat flour, with its perceived nutritional benefits and natural processing, aligns well with this trend.

- Confectionery Applications: Its use in cereals, biscuits, and confectionery items for flavor enhancement and texture modification is a growing area of application.

- Gluten-Free Innovation: As the market for gluten-free products expands, malted wheat flour is finding its way into specialized formulations, offering unique flavor profiles where traditional wheat is excluded.

Malted Wheat Flour Market Product Developments

Product developments in the Malted Wheat Flour Market are focused on enhancing enzymatic activity, achieving specific color profiles, and improving solubility for diverse applications. Innovations in malting processes allow for the production of malted wheat flour with tailored flavor characteristics, ranging from subtly sweet to intensely roasted, catering to distinct end-user needs in both the beverage and food industries. These advancements provide competitive advantages by enabling manufacturers to offer specialized ingredients that meet precise formulation requirements. The market is also witnessing developments in functional malted wheat flours with improved shelf-life and digestibility.

Key Drivers of Malted Wheat Flour Market Growth

The Malted Wheat Flour Market is propelled by several key drivers. The escalating global demand for premium and artisanal food and beverages, particularly craft beers and specialty baked goods, is a primary growth accelerant. Technological advancements in malting processes are enabling the creation of diverse flavor profiles and enhanced functionalities, directly appealing to evolving consumer preferences for natural and wholesome ingredients. Furthermore, supportive government regulations in key beverage-producing regions and the growing awareness of malted wheat flour’s perceived health benefits are contributing to its increasing market penetration. The expanding food processing industry, especially in emerging economies, also represents a significant growth avenue.

Challenges in the Malted Wheat Flour Market Market

Despite its promising growth trajectory, the Malted Wheat Flour Market faces certain challenges. Fluctuations in raw material prices, particularly wheat and barley, can impact production costs and profitability. Stringent regulatory requirements in certain regions regarding food processing and ingredient labeling can pose hurdles for market entry and expansion. Intense competition from other malted grain flours and alternative ingredients necessitates continuous innovation and cost-effective production strategies. Supply chain disruptions, exacerbated by global events, can also affect the availability and timely delivery of malted wheat flour.

Emerging Opportunities in Malted Wheat Flour Market

Emerging opportunities in the Malted Wheat Flour Market are abundant, driven by technological breakthroughs and strategic market expansion. The development of novel malting techniques to produce highly specialized malted wheat flours with unique functional properties, such as enhanced enzymatic power or specific aroma compounds, presents significant potential. Strategic partnerships between malt producers and food/beverage manufacturers can lead to the co-creation of innovative products, further driving demand. Market expansion into untapped geographical regions, particularly in developing economies with a burgeoning middle class and growing appetite for processed foods and beverages, offers substantial long-term growth prospects.

Leading Players in the Malted Wheat Flour Market Sector

- GrainCorp Malt Group

- Crisp Malt GmbH

- Simpsons Malt Ltd

- Imperial Malts Ltd

- Great Western Malting Co

- IREKS GmbH

- Muntons plc

- Malteurop

Key Milestones in Malted Wheat Flour Market Industry

- 2019: Increased investment in R&D for advanced malting technologies leading to new flavor profiles.

- 2020: Significant surge in demand for malted wheat flour in home baking due to global lockdowns.

- 2021: Growing popularity of craft breweries and distilleries globally, boosting demand.

- 2022: Greater emphasis on sustainable sourcing and production practices by leading players.

- 2023: Introduction of specialized malted wheat flours for gluten-free and keto-friendly food applications.

- 2024: Expansion of malt production facilities in emerging markets to cater to rising demand.

Strategic Outlook for Malted Wheat Flour Market Market

The strategic outlook for the Malted Wheat Flour Market is exceptionally positive, with growth accelerators centered on innovation and market diversification. Continued investment in advanced malting technologies will enable the development of value-added products with unique functionalities and sensory attributes, catering to niche applications. Strategic collaborations between ingredient suppliers and end-users will foster product development and market penetration. Expanding into untapped geographical regions and exploring new application areas beyond traditional beverage and food sectors will be crucial for sustained growth and capturing future market potential.

Malted Wheat Flour Market Segmentation

-

1. Application

- 1.1. Beverage

- 1.2. Food

Malted Wheat Flour Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Malted Wheat Flour Market Regional Market Share

Geographic Coverage of Malted Wheat Flour Market

Malted Wheat Flour Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Growing demand for brewing industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Malted Wheat Flour Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beverage

- 5.1.2. Food

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Malted Wheat Flour Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Beverage

- 6.1.2. Food

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Malted Wheat Flour Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Beverage

- 7.1.2. Food

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Malted Wheat Flour Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Beverage

- 8.1.2. Food

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Malted Wheat Flour Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Beverage

- 9.1.2. Food

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Malted Wheat Flour Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Beverage

- 10.1.2. Food

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GrainCorp Malt grou

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crisp Malt GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Simpsons Malt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Imperial Malts Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Great Western Malting Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IREKS GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Muntons plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Malteurop

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 GrainCorp Malt grou

List of Figures

- Figure 1: Global Malted Wheat Flour Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Malted Wheat Flour Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Malted Wheat Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Malted Wheat Flour Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Malted Wheat Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Malted Wheat Flour Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Malted Wheat Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Malted Wheat Flour Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Malted Wheat Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Malted Wheat Flour Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Malted Wheat Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Malted Wheat Flour Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Malted Wheat Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Malted Wheat Flour Market Revenue (billion), by Application 2025 & 2033

- Figure 15: South America Malted Wheat Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Malted Wheat Flour Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Malted Wheat Flour Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Malted Wheat Flour Market Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Malted Wheat Flour Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Malted Wheat Flour Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Malted Wheat Flour Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Malted Wheat Flour Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Malted Wheat Flour Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Malted Wheat Flour Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Malted Wheat Flour Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Malted Wheat Flour Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Malted Wheat Flour Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Spain Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Malted Wheat Flour Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Malted Wheat Flour Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Australia Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Malted Wheat Flour Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Malted Wheat Flour Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Malted Wheat Flour Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Malted Wheat Flour Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South Africa Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Malted Wheat Flour Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malted Wheat Flour Market?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the Malted Wheat Flour Market?

Key companies in the market include GrainCorp Malt grou, Crisp Malt GmbH, Simpsons Malt Ltd, Imperial Malts Ltd, Great Western Malting Co, IREKS GmbH, Muntons plc, Malteurop.

3. What are the main segments of the Malted Wheat Flour Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.24 billion as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Growing demand for brewing industries.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malted Wheat Flour Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malted Wheat Flour Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malted Wheat Flour Market?

To stay informed about further developments, trends, and reports in the Malted Wheat Flour Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence