Key Insights

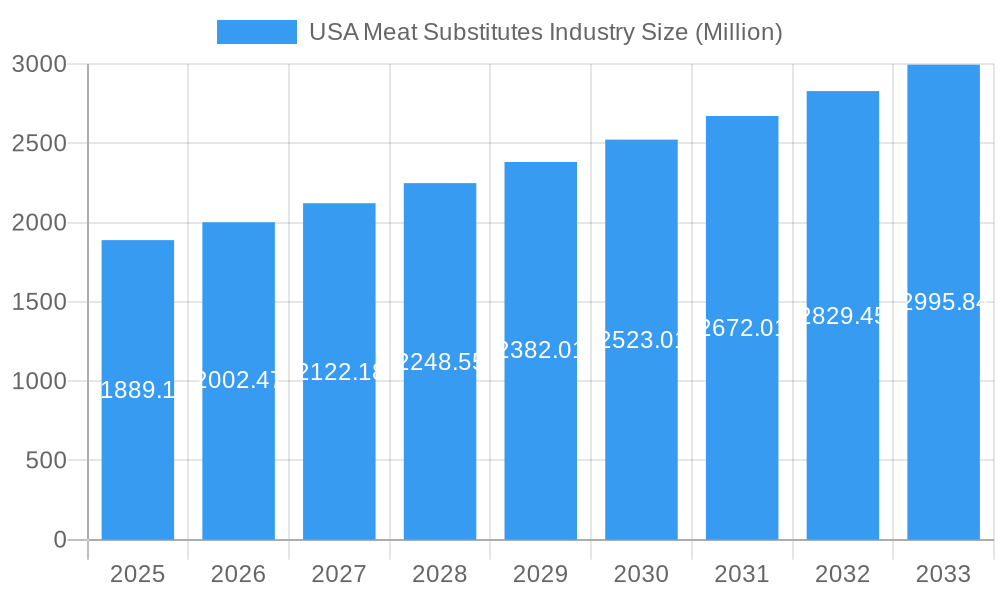

The US meat substitutes market is experiencing robust growth, projected to reach an estimated $1,889.1 million by 2025. This expansion is fueled by a confluence of escalating consumer demand for healthier and more sustainable food options, a growing awareness of the environmental impact of traditional meat production, and a significant increase in the availability and variety of plant-based products. The CAGR of 6.02% over the forecast period (2025-2033) indicates sustained momentum, suggesting that the market is well-positioned for continued development. Key drivers include increasing disposable incomes, a greater emphasis on preventative healthcare and dietary management, and the innovative product development strategies adopted by leading companies. The market is witnessing a clear shift towards diverse product offerings, with tempeh, textured vegetable protein (TVP), and tofu leading the charge, alongside a burgeoning category of "other meat substitutes" that reflects ongoing innovation.

USA Meat Substitutes Industry Market Size (In Billion)

Distribution channels are also evolving, with off-trade sales, particularly through online channels and supermarkets/hypermarkets, demonstrating strong performance. This indicates a consumer preference for convenient access to these products. While the market presents immense opportunities, it is not without its challenges. High retail prices compared to conventional meat and consumer perceptions regarding taste and texture remain significant restraints. However, ongoing advancements in food technology and ingredient formulation are actively addressing these issues, paving the way for wider consumer adoption. The competitive landscape is dynamic, with major players like The Kellogg Company, Beyond Meat Inc., and Impossible Foods Inc. actively investing in research and development, marketing, and strategic partnerships to capture market share. The US market's dominance is further solidified by its diversified regional penetration across North America, reflecting a widespread acceptance and demand for meat alternatives.

USA Meat Substitutes Industry Company Market Share

USA Meat Substitutes Industry: Market Dynamics, Trends, and Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the USA Meat Substitutes Industry, offering critical insights into market dynamics, evolving trends, and future projections. With a study period spanning from 2019 to 2033, and a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the significant growth opportunities within the plant-based and alternative protein sectors. We delve into market concentration, innovation drivers, regulatory landscapes, consumer preferences, and the competitive environment, providing actionable intelligence for strategic decision-making.

USA Meat Substitutes Industry Market Dynamics & Concentration

The USA Meat Substitutes Industry is experiencing dynamic shifts characterized by increasing market concentration among a few dominant players, yet simultaneously fostering innovation from emerging companies. Market share analysis reveals a growing dominance of key players, with the plant-based meat market segment showing particularly robust consolidation. Innovation drivers are primarily fueled by consumer demand for healthier, sustainable, and ethical food options. Regulatory frameworks are evolving to accommodate novel ingredients and production methods, though some challenges remain in standardizing labeling and ingredient definitions. Product substitutes, ranging from traditional vegetarian options to advanced lab-grown meats, are diversifying the market, forcing established companies to innovate rapidly. End-user trends indicate a strong preference for convenient, ready-to-cook, and flavorful meat alternatives. Mergers and acquisitions (M&A) activities have been significant, with an estimated xx M&A deals in the historical period, indicating strategic consolidation and expansion efforts by major corporations aiming to capture a larger share of this burgeoning market.

USA Meat Substitutes Industry Industry Trends & Analysis

The USA Meat Substitutes Industry is poised for substantial growth, driven by a confluence of factors including escalating consumer awareness regarding health and environmental sustainability, coupled with significant technological advancements in food science. The market penetration of meat substitutes is rapidly increasing, transitioning from niche products to mainstream grocery staples. A projected Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025–2033) underscores the immense potential. Technological disruptions are at the forefront, with ongoing research and development focused on enhancing taste, texture, and nutritional profiles to more closely mimic conventional meat products. This includes innovations in protein extraction, fermentation, and 3D printing of food. Consumer preferences are evolving beyond simple dietary restrictions; consumers are actively seeking products that align with their values, prioritizing ethical sourcing, reduced environmental impact, and clean labels. The competitive dynamics are intensifying, with both established food giants and agile startups vying for market dominance. Key trends include the expansion of product portfolios to include a wider variety of animal protein alternatives (e.g., fish, poultry, pork), the growing popularity of flexitarian diets, and a heightened focus on appealing to a broader consumer base, not just vegans and vegetarians. The market is also witnessing a surge in investment, both from venture capital and corporate R&D budgets, further fueling innovation and market expansion. The increasing availability of diverse and appealing meat substitute options, coupled with aggressive marketing campaigns highlighting the benefits of plant-based diets, is accelerating the shift away from traditional animal agriculture. Furthermore, the industry is responding to growing demands for transparency in sourcing and production processes, pushing for more sustainable and ethical practices throughout the value chain.

Leading Markets & Segments in USA Meat Substitutes Industry

The USA Meat Substitutes Industry exhibits distinct leadership across various segments and distribution channels.

Dominant Segments by Type:

- Textured Vegetable Protein (TVP): Currently holds a significant market share due to its versatility, affordability, and established presence in the market. Its ability to be incorporated into a wide range of dishes makes it a staple for many manufacturers and consumers.

- Other Meat Substitutes: This category is experiencing rapid growth, encompassing innovative products like mycoprotein-based alternatives, seaweed-based seafood substitutes, and emerging cultured meat products. These innovations are driving consumer interest and expanding the overall market.

- Tofu: While a long-standing meat substitute, tofu continues to maintain a strong presence, particularly in its traditional culinary applications and among health-conscious consumers.

- Tempeh: Showing steady growth, tempeh is gaining popularity for its fermented properties, nutritional benefits, and unique texture.

Dominant Segments by Distribution Channel:

- Off-Trade: This channel is overwhelmingly dominant, with a substantial lead over On-Trade.

- Supermarkets and Hypermarkets: These remain the primary point of purchase for meat substitutes, offering wide product variety and convenience for consumers. Economic policies supporting healthy food choices and large retail footprints contribute to their dominance.

- Online Channel: Experiencing exponential growth, the online channel is becoming increasingly crucial for reaching a broader consumer base and offering specialized or niche products. E-commerce infrastructure development and evolving consumer shopping habits are key drivers.

- Convenience Stores: A growing segment, offering readily available, single-serving, or quick-meal options, catering to impulse purchases and on-the-go consumers.

- Others: Includes specialty food stores and farmer's markets, which cater to specific consumer demographics and niche product offerings.

- On-Trade: While smaller in comparison, the on-trade sector (restaurants, cafes, institutional catering) is a crucial segment for driving trial and mainstream adoption of meat substitutes. Partnerships with food service providers and the growing inclusion of plant-based options on menus are key drivers.

USA Meat Substitutes Industry Product Developments

Product development in the USA Meat Substitutes Industry is marked by a relentless pursuit of sensory and nutritional parity with conventional meat. Innovations are focused on improving the 'bite,' juiciness, and flavor profiles of plant-based alternatives. Companies are leveraging advanced ingredient technologies, such as pea protein, soy protein, and novel plant-based fats, to achieve superior product performance. Furthermore, there's a significant push towards clean label formulations, reducing the use of artificial additives and preservatives. Applications are expanding beyond burgers and sausages to include premium offerings like plant-based steaks, chicken fillets, and seafood. These developments aim to capture a broader consumer base, including flexitarians, by offering familiar formats with enhanced health and sustainability benefits. The competitive advantage lies in achieving a superior taste and texture experience, coupled with transparent sourcing and appealing brand narratives.

Key Drivers of USA Meat Substitutes Industry Growth

The robust growth of the USA Meat Substitutes Industry is propelled by several interconnected drivers. Technological advancements in food science are continuously improving the taste, texture, and nutritional value of plant-based alternatives, making them more appealing to a wider consumer base. Growing consumer awareness regarding the health benefits of reduced meat consumption, such as lower cholesterol and saturated fat intake, is a significant factor. Furthermore, increasing concern over the environmental impact of animal agriculture, including greenhouse gas emissions and land/water usage, is driving demand for sustainable protein sources. Economic factors, such as the rising cost of conventional meat, also make plant-based alternatives more competitive. Regulatory support for plant-based products and evolving labeling standards are further facilitating market expansion.

Challenges in the USA Meat Substitutes Industry Market

Despite its promising trajectory, the USA Meat Substitutes Industry faces several challenges. Regulatory hurdles, particularly concerning accurate and consistent product labeling, can create consumer confusion and hinder market acceptance. Supply chain complexities for novel ingredients and the need for specialized processing equipment can impact production scalability and cost-effectiveness. Consumer perception and taste preferences remain a significant barrier, with some consumers still finding meat substitutes to be less satisfying than conventional meat. Competitive pressures from both established meat producers and an increasing number of plant-based startups necessitate continuous innovation and aggressive marketing. The cost parity with conventional meat is also a crucial factor influencing widespread adoption, with some premium plant-based products still being more expensive.

Emerging Opportunities in USA Meat Substitutes Industry

The USA Meat Substitutes Industry is ripe with emerging opportunities for long-term growth. Technological breakthroughs in areas like cellular agriculture and precision fermentation promise to create even more sophisticated and sustainable meat alternatives, potentially bridging the gap in taste and texture even further. Strategic partnerships between ingredient suppliers, food manufacturers, and retailers can streamline product development and distribution, increasing market reach. Market expansion into new product categories, such as plant-based dairy alternatives and novel protein sources, presents significant untapped potential. Furthermore, increasing global demand for sustainable protein sources and the growing influence of flexitarian diets worldwide offer substantial export opportunities. The development of specialized products catering to specific dietary needs (e.g., allergen-free, high-protein) also presents niche market expansion avenues.

Leading Players in the USA Meat Substitutes Industry Sector

- The Kellogg Company

- Beyond Meat Inc

- The Campbell Soup Company

- The Hain Celestial Group Inc

- Conagra Brands Inc

- Wicked Foods Inc

- The Kraft Heinz Company

- Hormel Foods Corporation

- Amy's Kitchen Inc

- Maple Leaf Foods

- Impossible Foods Inc

Key Milestones in USA Meat Substitutes Industry Industry

- April 2023: Beyond Meat, a leader in plant-based meat, announced the launch of Beyond Pepperoni and Beyond Chicken Fillet, building on their recent rollout of Beyond Steak.

- February 2023: Impossible Foods launched plant based spicy chicken nuggets, spicy chicken patties, and chicken tenders.

- September 2022: Gathered Foods has been acquired by Wicked Kitchen, a plant-based product selling brand based in North America.

Strategic Outlook for USA Meat Substitutes Industry Market

The strategic outlook for the USA Meat Substitutes Industry remains exceptionally strong, driven by enduring consumer shifts towards healthier, more sustainable, and ethical food choices. Future market potential is amplified by ongoing technological innovations that promise to enhance product appeal and reduce production costs. Strategic opportunities lie in further diversifying product portfolios to encompass a wider range of animal protein alternatives, including seafood and poultry, thereby appealing to a broader flexitarian demographic. Collaborations with food service providers to integrate plant-based options into mainstream dining experiences will be crucial for accelerating adoption. Continued investment in R&D for novel ingredients and processing techniques will be essential for maintaining competitive advantage and driving long-term growth in this dynamic and rapidly evolving market.

USA Meat Substitutes Industry Segmentation

-

1. Type

- 1.1. Tempeh

- 1.2. Textured Vegetable Protein

- 1.3. Tofu

- 1.4. Other Meat Substitutes

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

USA Meat Substitutes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

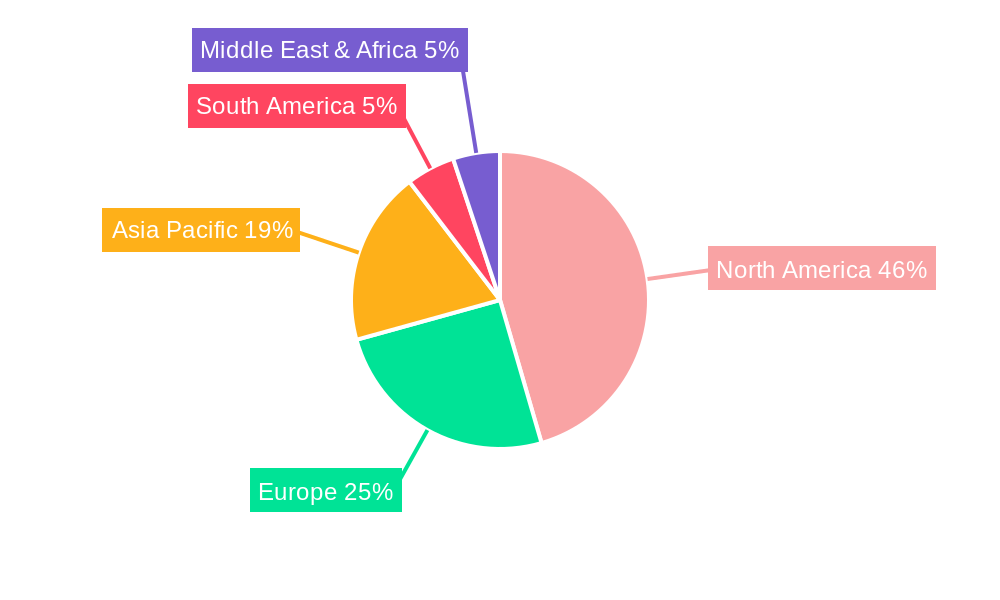

USA Meat Substitutes Industry Regional Market Share

Geographic Coverage of USA Meat Substitutes Industry

USA Meat Substitutes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Meat Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tempeh

- 5.1.2. Textured Vegetable Protein

- 5.1.3. Tofu

- 5.1.4. Other Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America USA Meat Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tempeh

- 6.1.2. Textured Vegetable Protein

- 6.1.3. Tofu

- 6.1.4. Other Meat Substitutes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Convenience Stores

- 6.2.1.2. Online Channel

- 6.2.1.3. Supermarkets and Hypermarkets

- 6.2.1.4. Others

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America USA Meat Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tempeh

- 7.1.2. Textured Vegetable Protein

- 7.1.3. Tofu

- 7.1.4. Other Meat Substitutes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Convenience Stores

- 7.2.1.2. Online Channel

- 7.2.1.3. Supermarkets and Hypermarkets

- 7.2.1.4. Others

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe USA Meat Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tempeh

- 8.1.2. Textured Vegetable Protein

- 8.1.3. Tofu

- 8.1.4. Other Meat Substitutes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Convenience Stores

- 8.2.1.2. Online Channel

- 8.2.1.3. Supermarkets and Hypermarkets

- 8.2.1.4. Others

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa USA Meat Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tempeh

- 9.1.2. Textured Vegetable Protein

- 9.1.3. Tofu

- 9.1.4. Other Meat Substitutes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Convenience Stores

- 9.2.1.2. Online Channel

- 9.2.1.3. Supermarkets and Hypermarkets

- 9.2.1.4. Others

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific USA Meat Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Tempeh

- 10.1.2. Textured Vegetable Protein

- 10.1.3. Tofu

- 10.1.4. Other Meat Substitutes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Convenience Stores

- 10.2.1.2. Online Channel

- 10.2.1.3. Supermarkets and Hypermarkets

- 10.2.1.4. Others

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Kellogg Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beyond Meat Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Campbell Soup Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Hain Celestial Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Conagra Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wicked Foods Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Kraft Heinz Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hormel Foods Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amy's Kitchen Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maple Leaf Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Impossible Foods Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 The Kellogg Company

List of Figures

- Figure 1: Global USA Meat Substitutes Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Meat Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America USA Meat Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America USA Meat Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America USA Meat Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Meat Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: South America USA Meat Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America USA Meat Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America USA Meat Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Meat Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe USA Meat Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe USA Meat Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe USA Meat Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Meat Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa USA Meat Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa USA Meat Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Meat Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Meat Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific USA Meat Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific USA Meat Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Meat Substitutes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global USA Meat Substitutes Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Meat Substitutes Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the USA Meat Substitutes Industry?

Key companies in the market include The Kellogg Company, Beyond Meat Inc, The Campbell Soup Company, The Hain Celestial Group Inc, Conagra Brands Inc, Wicked Foods Inc, The Kraft Heinz Company, Hormel Foods Corporation, Amy's Kitchen Inc, Maple Leaf Foods, Impossible Foods Inc.

3. What are the main segments of the USA Meat Substitutes Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,889.1 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

April 2023: Beyond Meat, a leader in plant-based meat, announced the launch of Beyond Pepperoni and Beyond Chicken Fillet, building on their recent rollout of Beyond Steak.February 2023: Impossible foods launched plant based spicy chicken nuggets, spicy chicken patties, and chicken tenders.September 2022: Gathered Foods has been acquired by Wicked Kitchen a plant-based product selling brand based in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Meat Substitutes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Meat Substitutes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Meat Substitutes Industry?

To stay informed about further developments, trends, and reports in the USA Meat Substitutes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence