Key Insights

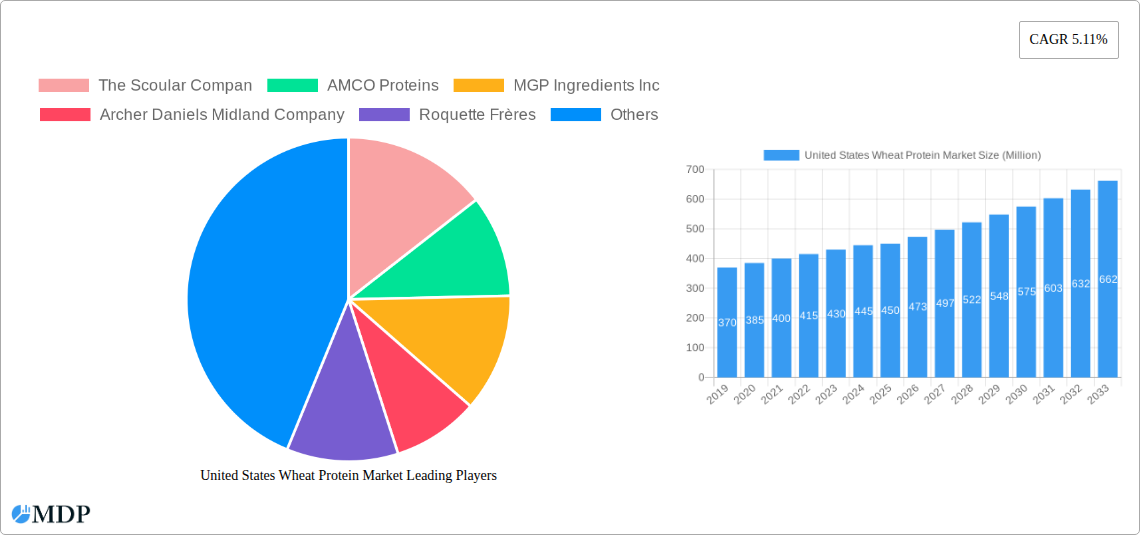

The United States Wheat Protein Market is projected for significant expansion, expected to reach $887.92 million by 2025, growing at a CAGR of 2.98% from 2025 to 2033. This growth is driven by increasing consumer preference for plant-based protein sources and the diverse applications of wheat protein. Key growth factors include the rising popularity of high-protein and gluten-free diets, expanding use in animal feed for enhanced nutrition, and its functional properties in processed foods. Innovations in processing wheat protein into isolates and concentrates are broadening its appeal across various food and beverage categories such as bakery, ready-to-eat meals, snacks, and meat alternatives.

United States Wheat Protein Market Market Size (In Million)

Market growth is further supported by the demand for clean-label ingredients and novel applications, particularly in the rapidly expanding meat and seafood alternative sectors. Potential challenges include fluctuating raw material costs and competition from alternative protein sources. The market segmentation shows strong demand for both wheat protein concentrates and isolates. Within end-user industries, Food and Beverages, encompassing bakery, meat/poultry/seafood alternatives, and ready-to-eat/cook products, is anticipated to be a primary growth driver. The Animal Feed segment also represents a significant market opportunity. Leading companies such as Archer Daniels Midland Company, Roquette Frères, and Kerry Group PLC are investing in R&D and production capacity to capitalize on this market's potential. The United States is a key region with substantial domestic consumption and production.

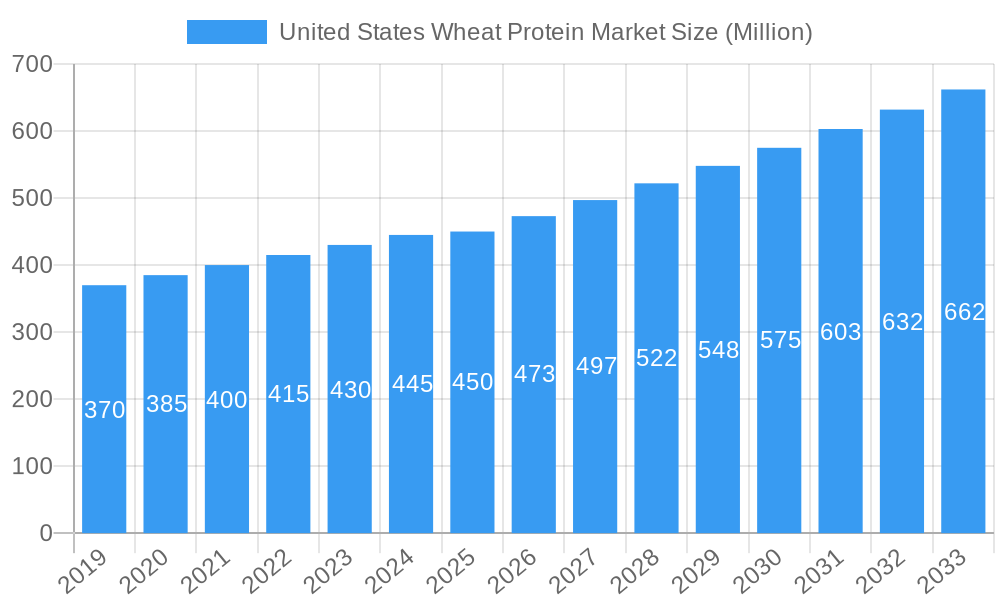

United States Wheat Protein Market Company Market Share

This comprehensive report analyzes the United States wheat protein market from 2019 to 2033, with 2025 as the base year. It provides in-depth insights into market dynamics, industry trends, key segments, product developments, growth drivers, challenges, emerging opportunities, major players, and strategic outlooks. This report is an essential resource for stakeholders in the food and beverage, animal feed, and ingredient manufacturing industries, utilizing high-impact keywords for enhanced visibility, including "wheat protein," "plant-based protein," "textured wheat protein," "food ingredients," "animal nutrition," and "protein isolates."

United States Wheat Protein Market Market Dynamics & Concentration

The United States wheat protein market is characterized by moderate concentration, with key players actively engaged in strategic initiatives to capture growing market share. Innovation remains a significant driver, fueled by the increasing demand for plant-based protein alternatives and advancements in processing technologies that enhance the functional properties of wheat protein. Regulatory frameworks, particularly those pertaining to food labeling and allergen management, influence product development and market entry. Product substitutes, such as soy and pea protein, pose a competitive challenge, necessitating continuous product differentiation and value proposition enhancement. End-user trends are heavily influenced by health and wellness consciousness, leading to a surge in demand for protein-rich foods and a decline in meat consumption, indirectly boosting the wheat protein market. Mergers and acquisitions (M&A) activities are present, indicating consolidation and strategic expansion. For example, recent M&A activities are estimated to be around 3-5 significant deals in the historical period. Market share is fragmented, with the top 5 players holding an estimated 40-50% of the market in the historical period.

United States Wheat Protein Market Industry Trends & Analysis

The United States wheat protein market is poised for robust growth, driven by a confluence of favorable industry trends and evolving consumer preferences. The increasing adoption of plant-based diets and the growing demand for alternative protein sources are primary growth catalysts. Wheat protein, with its versatile functional properties and relatively lower allergenicity compared to some other plant proteins, is well-positioned to capitalize on this trend. Technological disruptions in extraction and processing technologies are enhancing the quality, functionality, and application range of wheat protein products, leading to improved texture, solubility, and nutritional profiles. Consumer preferences are shifting towards healthier and more sustainable food options, which directly benefits wheat protein, often perceived as a more environmentally friendly protein source. Competitive dynamics are intensifying, with both established players and new entrants vying for market dominance. This includes significant investments in research and development to create novel wheat protein applications and optimize existing ones. The market penetration of wheat protein in various food categories is steadily increasing, particularly in meat alternatives and baked goods. The compound annual growth rate (CAGR) for the wheat protein market is projected to be approximately 6-8% during the forecast period (2025-2033), reflecting its strong growth trajectory.

Leading Markets & Segments in United States Wheat Protein Market

The United States wheat protein market exhibits distinct dominance across various segments and end-user applications. In terms of Form, Textured/Hydrolyzed wheat protein is emerging as a leading segment. This is largely attributed to its superior texturizing capabilities, making it an ideal ingredient for mimicking the mouthfeel and structure of meat in plant-based meat alternative products. The ability to create realistic textures is a key driver for its widespread adoption in this rapidly growing sector.

The Food and Beverages end-user segment is overwhelmingly dominant, with a significant portion attributed to Meat/Poultry/Seafood and Meat Alternative Products. This sub-end-user category is experiencing exponential growth due to evolving consumer diets and a desire for sustainable and ethical protein sources. Key drivers include:

- Rising Vegan and Flexitarian Populations: An increasing number of consumers are reducing or eliminating meat consumption, driving demand for plant-based alternatives.

- Improved Product Quality: Advancements in wheat protein processing allow for the creation of meat alternatives with enhanced taste, texture, and appearance, closely replicating traditional meat products.

- Health and Nutrition Focus: Wheat protein offers a good source of amino acids and is often perceived as a healthier protein option.

Other sub-end-user categories within Food and Beverages also contribute significantly:

- Bakery: Wheat protein enhances dough strength, improves crumb structure, and increases the protein content of baked goods, appealing to health-conscious consumers.

- RTE/RTC Food Products (Ready-to-Eat/Ready-to-Cook): The convenience factor drives demand for wheat protein in processed foods, offering functional benefits like emulsification and binding.

- Snacks: Growth in the protein-enhanced snack market is creating opportunities for wheat protein as an ingredient.

The Animal Feed segment also represents a substantial market. While traditionally a significant consumer, its growth trajectory is somewhat tempered compared to the burgeoning food and beverage sector. However, the demand for sustainable and cost-effective protein sources in animal nutrition continues to support this segment. Economic policies promoting agricultural innovation and infrastructure development that supports efficient supply chains for wheat protein are crucial for sustained growth across all segments.

United States Wheat Protein Market Product Developments

Recent product developments in the United States wheat protein market highlight a focus on enhanced functionality and application versatility. Innovations are centered around improving the texturizing capabilities and nutritional profiles of wheat protein ingredients, catering to the burgeoning demand for plant-based food solutions. Companies are investing in R&D to develop novel wheat protein isolates and concentrates with superior solubility and emulsification properties, making them ideal for a wider range of food and beverage applications. Competitive advantages are being carved out through the development of non-GMO and sustainably sourced wheat protein options, aligning with growing consumer awareness and preference for ethical and environmentally responsible products.

Key Drivers of United States Wheat Protein Market Growth

The United States wheat protein market is propelled by several key drivers. Firstly, the escalating global demand for plant-based and alternative protein sources, spurred by health consciousness and environmental concerns, is a primary accelerator. Technological advancements in protein extraction and processing are yielding higher quality and more versatile wheat protein ingredients, expanding their application range. Government initiatives promoting sustainable agriculture and food innovation also play a role. Furthermore, the increasing popularity of gluten-free diets, while seemingly counterintuitive, has also led to a greater appreciation for wheat's protein components when isolated from gluten.

Challenges in the United States Wheat Protein Market Market

Despite its growth potential, the United States wheat protein market faces several challenges. Regulatory hurdles and varying labeling requirements across different states and for different product types can create complexities for manufacturers. The availability and price volatility of raw wheat can impact production costs and market competitiveness. Competition from other plant-based protein sources, such as soy, pea, and fava bean protein, remains intense, requiring continuous innovation to maintain market share. Consumer perception regarding the taste and texture of wheat protein-based products, especially in meat alternatives, can also be a barrier, although this is steadily improving with technological advancements.

Emerging Opportunities in United States Wheat Protein Market

The United States wheat protein market is ripe with emerging opportunities. The continuous innovation in plant-based meat alternatives presents a significant avenue for growth, with wheat protein's texturizing properties being highly sought after. Strategic partnerships between ingredient suppliers and food manufacturers are fostering the development of new and improved plant-based products. Furthermore, exploring novel applications in functional foods, sports nutrition, and specialized dietary supplements can unlock new market segments. The growing interest in upcycling agricultural by-products also presents an opportunity for developing sustainable wheat protein extraction methods, further enhancing market appeal.

Leading Players in the United States Wheat Protein Market Sector

The Scoular Compan AMCO Proteins MGP Ingredients Inc Archer Daniels Midland Company Roquette Frères Kerry Group PLC Südzucker Group A Costantino & C SpA

Key Milestones in United States Wheat Protein Market Industry

- May 2022: BENEO, a subsidiary of Südzucker, entered into a purchase agreement to acquire 100% of Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.

- February 2022: MGP Ingredients announced the construction of a new extrusion plant in Kansas to manufacture its ProTerra line of texturized proteins. The USD 16.7 million facility will be located next to the company's Atchison site and will initially produce up to 10 million pounds of ProTerra per year. The new plant will assist MGP in meeting the rising demand for its ProTerra product line, which comprises pea and wheat protein ingredients used in applications such as plant-based meat substitutes.

- September 2020: ADM launched a range of textured wheat proteins that includes Prolite® MeatTEX textured wheat protein and Prolite® MeatXT non-textured wheat protein. These highly-functional protein solutions improve the texture and density of meat alternatives.

Strategic Outlook for United States Wheat Protein Market Market

The strategic outlook for the United States wheat protein market is highly optimistic, driven by sustained demand for plant-based proteins and continuous product innovation. Key growth accelerators include the expansion of its application in meat alternatives, bakery products, and convenience foods. Companies are expected to focus on vertical integration, strategic acquisitions, and robust research and development to enhance functional properties and create novel formulations. Emphasis on sustainable sourcing and production practices will be crucial for gaining a competitive edge and appealing to an increasingly eco-conscious consumer base. The market is poised for significant expansion as awareness of wheat protein's benefits and versatility continues to grow.

United States Wheat Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.5. RTE/RTC Food Products

- 2.2.1.6. Snacks

-

2.2.1. By Sub End User

United States Wheat Protein Market Segmentation By Geography

- 1. United States

United States Wheat Protein Market Regional Market Share

Geographic Coverage of United States Wheat Protein Market

United States Wheat Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins

- 3.3. Market Restrains

- 3.3.1. Stringent government regulation of food labels/claims

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Wheat Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.5. RTE/RTC Food Products

- 5.2.2.1.6. Snacks

- 5.2.2.1. By Sub End User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Scoular Compan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AMCO Proteins

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MGP Ingredients Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Archer Daniels Midland Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roquette Frères

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Group PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Südzucker Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A Costantino & C SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 The Scoular Compan

List of Figures

- Figure 1: United States Wheat Protein Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Wheat Protein Market Share (%) by Company 2025

List of Tables

- Table 1: United States Wheat Protein Market Revenue million Forecast, by Form 2020 & 2033

- Table 2: United States Wheat Protein Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: United States Wheat Protein Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: United States Wheat Protein Market Revenue million Forecast, by Form 2020 & 2033

- Table 5: United States Wheat Protein Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: United States Wheat Protein Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Wheat Protein Market?

The projected CAGR is approximately 2.98%.

2. Which companies are prominent players in the United States Wheat Protein Market?

Key companies in the market include The Scoular Compan, AMCO Proteins, MGP Ingredients Inc, Archer Daniels Midland Company, Roquette Frères, Kerry Group PLC, Südzucker Group, A Costantino & C SpA.

3. What are the main segments of the United States Wheat Protein Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 887.92 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent government regulation of food labels/claims.

8. Can you provide examples of recent developments in the market?

May 2022: BENEO, a subsidiary of Südzucker, has entered into a purchase agreement to acquire 100% of Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.February 2022: MGP Ingredients has announced the construction of a new extrusion plant in Kansas to manufacture its ProTerra line of texturized proteins. The USD 16.7 million facility will be located next to the company's Atchison site and will initially produce up to 10 million pounds of ProTerra per year. The new plant will assist MGP in meeting the rising demand for its ProTerra product line, which comprises pea and wheat protein ingredients used in applications such as plant-based meat substitutes.September 2020: ADM launched a range of textured wheat proteins that includes Prolite® MeatTEX textured wheat protein and Prolite® MeatXT non-textured wheat protein. These highly-functional protein solutions improve the texture and density of meat alternatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Wheat Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Wheat Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Wheat Protein Market?

To stay informed about further developments, trends, and reports in the United States Wheat Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence