Key Insights

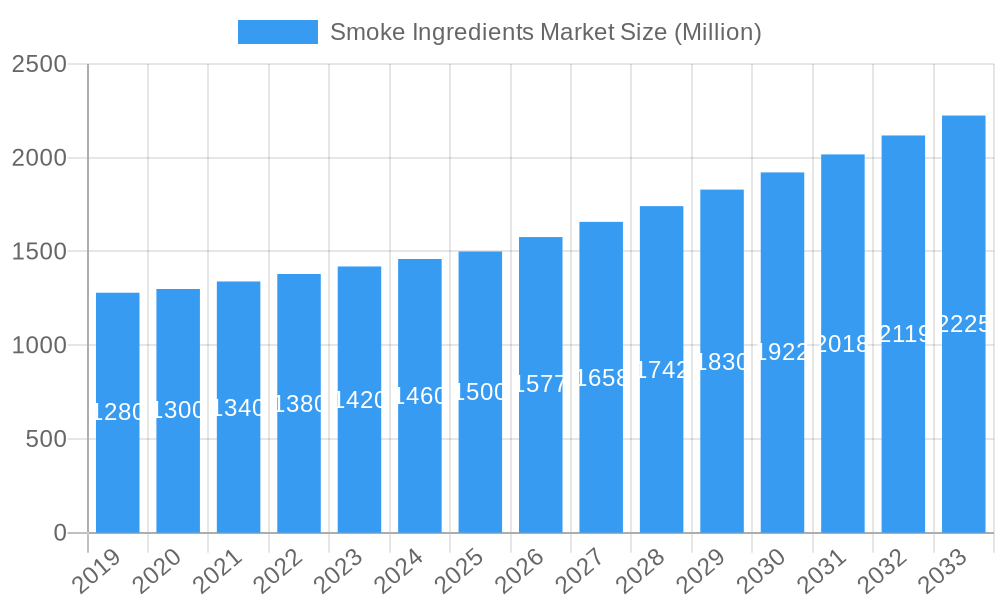

The global smoke ingredients market is projected for substantial growth, estimated to reach $285.34 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.4% through 2033. This expansion is driven by increasing consumer demand for authentic smoky flavors and the convenience of smoke ingredients in diverse food applications. Liquid smoke formulations are gaining prominence due to their ease of use, consistent results, and superior dispersibility, making them a preferred choice for manufacturers in the dairy, bakery, confectionery, meat, and seafood sectors. Technological advancements in natural extraction methods and the development of clean-label alternatives are further propelling market growth.

Smoke Ingredients Market Market Size (In Million)

Evolving consumer preferences for processed and convenience foods, coupled with the critical role of smoke ingredients in enhancing taste profiles and replicating traditional smoking, are significant market drivers. The bakery and confectionery segment, in particular, is witnessing substantial adoption for innovative flavor combinations. Leading players such as Kerry Group, International Flavors & Fragrances Inc., and Essentia Protein Solutions are actively engaged in research and development to introduce novel smoke ingredient solutions and broaden their product portfolios. While opportunities abound, fluctuating raw material prices and regional regulatory landscapes for food additives require careful consideration.

Smoke Ingredients Market Company Market Share

This report provides a comprehensive analysis of the dynamic smoke ingredients market, detailing its growth trajectory, key trends, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this study offers critical insights into market dynamics, competitive landscapes, and emerging opportunities. We examine the interplay of smoke flavorings, natural smoke extracts, and liquid smoke, vital components across meat processing, bakery products, and dairy items.

The global smoke ingredients market is forecast to reach an estimated value of $285.34 million by 2025, exhibiting a robust CAGR of 5.4%. Driven by evolving consumer preferences for authentic smoky taste profiles and the rising demand for natural, clean-label ingredients, the market is poised for significant expansion. The report meticulously analyzes market segmentation by form (liquid, powder, other foams) and application (dairy, bakery and confectionery, meat and seafood, snacks and sauces), offering granular insights into segment-specific growth drivers and challenges.

Our expert analysis highlights key industry developments, including strategic acquisitions and technological innovations, that are shaping the smoke flavor market. We identify leading market players and their strategic initiatives, providing a competitive snapshot of the food ingredients sector. Furthermore, the report dissects the critical drivers, challenges, and emerging opportunities that will define the future of the smoked flavor market. This report delivers essential data and strategic intelligence for manufacturers, suppliers, investors, and industry analysts to navigate and capitalize on opportunities within the smoke ingredients market.

Smoke Ingredients Market Market Dynamics & Concentration

The smoke ingredients market exhibits a moderate to high concentration, characterized by the presence of both large, established global players and smaller, specialized ingredient providers. Innovation drivers are primarily focused on developing natural smoke flavors, clean-label solutions, and ingredients that replicate authentic smoking experiences with enhanced safety and consistency. Regulatory frameworks, particularly concerning the permissible levels of Polycyclic Aromatic Hydrocarbons (PAHs) in smoke-derived products, are a critical factor influencing product development and market entry. For instance, regulations around PAH content directly impact the adoption of certain processing methods and ingredient formulations. Product substitutes, such as artificial smoke flavorings or alternative smoking techniques, are present but often fall short of delivering the nuanced sensory attributes of traditional smoke ingredients. End-user trends heavily favor the demand for ingredients that align with consumer preferences for naturalness, health, and premium taste. This includes a growing interest in plant-based smoked alternatives and a reduction in artificial additives. Mergers and acquisitions (M&A) activities are prominent, with key players consolidating their market positions and expanding their product portfolios. For example, Azelis Holdings’ acquisition of Smoky Light B.V. in January 2023 underscores the strategic importance of expanding regional presence and product offerings in the food and nutrition ingredients market. This strategic move aimed to bolster Azelis's market share in the Benelux region and beyond, highlighting the ongoing consolidation trend driven by the pursuit of market leadership and synergistic growth. The M&A landscape reflects a strong trend towards vertical integration and diversification, with companies seeking to control more of the value chain and offer comprehensive solutions to their clients. The market is also characterized by a dynamic competitive environment where companies are continuously investing in research and development to create novel smoke ingredient technologies.

Smoke Ingredients Market Industry Trends & Analysis

The smoke ingredients market is experiencing robust growth, propelled by a confluence of evolving consumer preferences, technological advancements, and strategic industry consolidations. A primary growth driver is the escalating consumer demand for authentic, smoky flavor profiles in a wide range of food products. This trend is particularly pronounced in the meat and seafood sector, where consumers increasingly seek the taste of traditionally smoked items, even in convenience-oriented formats. The drive towards natural and clean-label ingredients further fuels the demand for natural smoke flavors and liquid smoke derived from actual wood smoking processes, as opposed to artificial alternatives. Technological disruptions are playing a pivotal role in enhancing the safety, consistency, and efficiency of smoke ingredient production. Innovations in microfiltration technologies, such as Besmoke Ltd's Puresmoke technology, which effectively removes harmful compounds like PAHs from smoke, are enabling the creation of healthier and more compliant smoke ingredients. This technology allows for the infusion of authentic smoked flavors while addressing regulatory concerns, thereby expanding the application scope of these ingredients. International Flavors & Fragrances Inc.'s merger with DuPont's Nutrition and Biosciences in February 2021 exemplifies a strategic move to expand product portfolios and innovate in the food additives space, including smoke-related solutions. This merger aimed to leverage combined expertise to develop novel, creative solutions that cater to changing consumer preferences and dietary trends. The competitive dynamics within the market are characterized by a continuous focus on product differentiation through claims of naturalness, health benefits, and superior sensory experiences. Companies are investing heavily in research and development to optimize extraction processes, enhance flavor profiles, and develop new delivery systems for smoke ingredients. The market penetration of smoke flavorings is steadily increasing across diverse food categories, including snacks, sauces, and even dairy and bakery products, as manufacturers explore new avenues to impart desirable smoky notes and enhance product appeal. The global smoke ingredients market is projected to witness a significant CAGR of approximately XX% from 2025 to 2033, indicating a sustained period of expansion driven by these multifaceted trends. This growth is further supported by the increasing adoption of smoke ingredients in plant-based food products, aiming to replicate the savory, umami characteristics often associated with smoked meats.

Leading Markets & Segments in Smoke Ingredients Market

The smoke ingredients market is segmented by form into Liquid Smoke, Powdered Smoke, and Other Foams. The Liquid Smoke segment currently dominates the market, driven by its ease of use, versatility, and effective dispersion in various food matrices. Its widespread application in marinades, rubs, sauces, and processed meats makes it a cornerstone ingredient for imparting authentic smoky flavor. The Powdered Smoke segment is also experiencing significant growth, particularly in dry seasoning blends, snack coatings, and convenience food products where a dry application is preferred for stability and shelf-life.

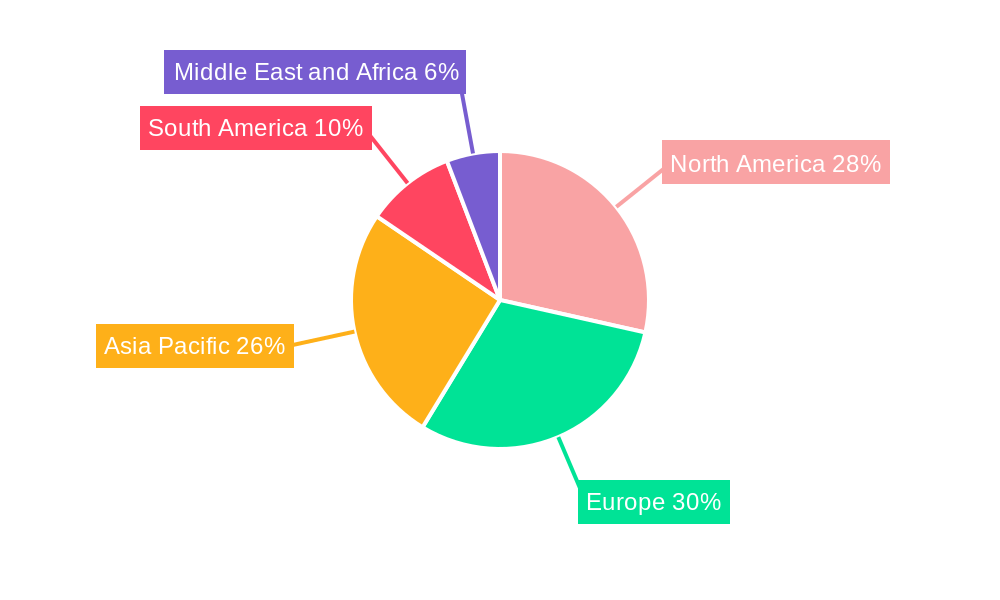

Geographically, North America and Europe represent the leading markets for smoke ingredients. In North America, the strong consumer preference for barbecued and smoked meats, coupled with a well-established processed food industry, fuels consistent demand. The region's robust food manufacturing sector, with stringent quality control measures and a keen eye for consumer trends, actively adopts innovative smoke ingredient solutions. Economic policies in these regions often support the development and adoption of novel food ingredients, provided they meet safety and labeling standards.

The Meat and Seafood application segment holds the largest market share within the smoke ingredients market. This dominance is attributed to the historical and ongoing reliance on smoke for preservation, flavor enhancement, and visual appeal in these product categories. The growing demand for value-added meat products, such as smoked sausages, bacon, and jerky, directly translates into increased consumption of smoke ingredients.

The Bakery and Confectionery segment, while smaller, is a rapidly expanding area. Smoke flavors are increasingly being used to create unique flavor profiles in baked goods, like smoked chocolate or savory crackers, appealing to adventurous palates. The ability of smoke ingredients to add depth and complexity to sweet and savory applications is driving innovation in this segment.

The Dairy application segment is also showing promising growth, with smoke flavors being incorporated into cheese, yogurts, and dairy-based dips to create novel taste experiences. The rising popularity of artisanal and specialty cheeses, often with a smoked characteristic, contributes significantly to this growth.

The Snacks and Sauces segment continues to be a significant contributor, as manufacturers leverage smoke flavors to create distinctive and appealing snack products, from potato chips to extruded snacks, and to develop complex, savory sauces. Key drivers in this segment include the constant need for product differentiation and the creation of 'indulgent' flavor experiences that consumers actively seek. Economic policies that encourage food innovation and export, alongside robust infrastructure for ingredient distribution, further bolster the dominance of these leading markets and segments.

Smoke Ingredients Market Product Developments

Product development in the smoke ingredients market is heavily focused on delivering authentic, natural, and clean-label smoke flavors while addressing safety and regulatory concerns. Innovations include the refinement of extraction processes to isolate desirable flavor compounds from wood smoke, minimizing the presence of undesirable byproducts. Companies are actively developing liquid smoke concentrates and powdered smoke solutions that offer enhanced stability, controlled flavor release, and simplified incorporation into diverse food formulations. A key competitive advantage lies in the ability to offer ingredients that mimic traditional smoking methods without lengthy curing or smoking times, thereby improving processing efficiency for food manufacturers. Furthermore, product developments are increasingly emphasizing the "natural" aspect, utilizing specific wood types and carefully controlled smoking processes to create distinct flavor profiles that cater to evolving consumer demands for transparency and perceived health benefits. The integration of these advanced smoke ingredient technologies allows food producers to enhance the sensory appeal of their products, meet market trends for smoky notes, and maintain cost-effectiveness.

Key Drivers of Smoke Ingredients Market Growth

The smoke ingredients market is propelled by several key drivers that are shaping its growth trajectory. A primary driver is the increasing consumer demand for authentic, savory, and smoky flavor profiles across a broad spectrum of food products. This desire for traditional taste experiences, often associated with artisanal or home-cooked meals, is driving manufacturers to incorporate smoke flavors. The growing trend towards natural and clean-label ingredients is another significant catalyst; consumers are actively seeking products with recognizable ingredients and fewer artificial additives, making natural smoke extracts and liquid smoke a preferred choice. Technological advancements in extraction and processing techniques are enabling the development of safer, more consistent, and highly effective smoke ingredients, such as those with reduced PAH content. Furthermore, the expansion of the processed food industry, particularly in emerging economies, coupled with the introduction of innovative applications in bakery, confectionery, and dairy products, is creating new avenues for market growth. The ability of smoke ingredients to add depth and complexity to plant-based alternatives is also contributing to market expansion as this sector continues to grow.

Challenges in the Smoke Ingredients Market Market

Despite its robust growth, the smoke ingredients market faces several challenges that can impact its expansion. A significant hurdle is the stringent regulatory landscape surrounding smoke-derived products, particularly concerning the permissible levels of Polycyclic Aromatic Hydrocarbons (PAHs) like Benzo(a)Pyrene. Compliance with these evolving regulations necessitates significant investment in research and development for safer processing techniques. Supply chain complexities, including the sourcing of specific wood types and ensuring consistent quality of raw materials, can also pose challenges. Competitive pressures from both established players and new entrants, as well as the availability of product substitutes like artificial smoke flavors, require continuous innovation and differentiation. Furthermore, consumer perception and education regarding the safety and benefits of natural smoke ingredients remain crucial; overcoming any lingering skepticism associated with smoke-related products is an ongoing endeavor.

Emerging Opportunities in Smoke Ingredients Market

The smoke ingredients market is ripe with emerging opportunities driven by evolving consumer palates and technological advancements. A significant opportunity lies in the growing demand for plant-based smoked alternatives, where smoke flavors are essential for replicating the savory and umami profiles of traditional meat products. The development of specialized smoke ingredients tailored for specific plant-based matrices offers a vast growth potential. Furthermore, the expanding market for convenience foods and ready-to-eat meals presents opportunities for easy-to-incorporate smoke flavor solutions that deliver authentic taste experiences. Strategic partnerships between smoke ingredient suppliers and food manufacturers can lead to the co-creation of innovative products that cater to niche markets and premium segments. The exploration of new wood types and smoking techniques to create unique flavor profiles and cater to regional taste preferences also represents a promising avenue for market expansion. Investments in advanced filtration technologies that guarantee the absence of harmful compounds while retaining desirable flavor notes will further unlock market potential and enhance consumer trust.

Leading Players in the Smoke Ingredients Market Sector

- Kerry Group

- Besmoke Ltd

- Azelis Holdings

- International Flavors & Fragrances Inc.

- Essentia Protein Solutions

- Stringer Flavours Ltd

- B&G Foods

- MSK Ingredients Ltd

- FlavourStream SRL

- Henning Gesellschaft für Nahrungsmitteltechnik mbH

Key Milestones in Smoke Ingredients Market Industry

- January 2023: Azelis Holdings acquired Smoky Light B.V., an ingredients distributor in the BENELUX region. This acquisition bolstered Azelis’s portfolio with smoke, grill, and cooking flavors, browning agents, and additives for the food and nutrition industries, aiming to expand market share across Europe, the Middle East, and Africa.

- August 2021: TMI Foods, a UK supplier of cooked bacon and Pigs In Blankets, partnered with Besmoke Ltd, a smoke and grill flavor supplier. This collaboration integrated Besmoke's Puresmoke technology, a microfiltration system designed to remove harmful PAHs, into TMI Foods' processes to deliver authentic, clean wood smoke flavors.

- February 2021: International Flavors & Fragrances Inc. merged with DuPont's Nutrition and Biosciences division. This strategic merger aimed to expand the combined company's product portfolio and drive innovation in food additives, offering new creative solutions to meet evolving consumer preferences.

Strategic Outlook for Smoke Ingredients Market Market

The strategic outlook for the smoke ingredients market is one of continued and accelerated growth, driven by a confluence of favorable market forces and ongoing innovation. The increasing consumer demand for natural, authentic, and health-conscious food products will remain a paramount growth accelerator. Manufacturers will continue to invest in and adopt natural smoke flavors and liquid smoke solutions to meet these expectations, particularly as concerns around artificial additives persist. The expansion of the plant-based food sector presents a significant opportunity for smoke ingredient suppliers to develop and offer specialized flavor profiles that mimic traditional smoky meat tastes. Continued investment in research and development, focusing on advanced processing technologies that ensure safety, consistency, and environmental sustainability, will be crucial for market leaders. Strategic partnerships and collaborations will also play a vital role in expanding market reach, co-creating innovative applications, and addressing evolving consumer needs. The market's trajectory indicates a strong future for ingredients that can deliver desirable sensory experiences while aligning with health, wellness, and clean-label trends.

Smoke Ingredients Market Segmentation

-

1. Foam

- 1.1. Liquid

- 1.2. Powder

- 1.3. Other Foams

-

2. Application

- 2.1. Dairy

- 2.2. Bakery and Confectionery

- 2.3. Meat and Seafood

- 2.4. Snacks and Sauces

Smoke Ingredients Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Smoke Ingredients Market Regional Market Share

Geographic Coverage of Smoke Ingredients Market

Smoke Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Smoked Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smoke Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Foam

- 5.1.1. Liquid

- 5.1.2. Powder

- 5.1.3. Other Foams

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery and Confectionery

- 5.2.3. Meat and Seafood

- 5.2.4. Snacks and Sauces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Foam

- 6. North America Smoke Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Foam

- 6.1.1. Liquid

- 6.1.2. Powder

- 6.1.3. Other Foams

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy

- 6.2.2. Bakery and Confectionery

- 6.2.3. Meat and Seafood

- 6.2.4. Snacks and Sauces

- 6.1. Market Analysis, Insights and Forecast - by Foam

- 7. Europe Smoke Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Foam

- 7.1.1. Liquid

- 7.1.2. Powder

- 7.1.3. Other Foams

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy

- 7.2.2. Bakery and Confectionery

- 7.2.3. Meat and Seafood

- 7.2.4. Snacks and Sauces

- 7.1. Market Analysis, Insights and Forecast - by Foam

- 8. Asia Pacific Smoke Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Foam

- 8.1.1. Liquid

- 8.1.2. Powder

- 8.1.3. Other Foams

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy

- 8.2.2. Bakery and Confectionery

- 8.2.3. Meat and Seafood

- 8.2.4. Snacks and Sauces

- 8.1. Market Analysis, Insights and Forecast - by Foam

- 9. South America Smoke Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Foam

- 9.1.1. Liquid

- 9.1.2. Powder

- 9.1.3. Other Foams

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy

- 9.2.2. Bakery and Confectionery

- 9.2.3. Meat and Seafood

- 9.2.4. Snacks and Sauces

- 9.1. Market Analysis, Insights and Forecast - by Foam

- 10. Middle East and Africa Smoke Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Foam

- 10.1.1. Liquid

- 10.1.2. Powder

- 10.1.3. Other Foams

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy

- 10.2.2. Bakery and Confectionery

- 10.2.3. Meat and Seafood

- 10.2.4. Snacks and Sauces

- 10.1. Market Analysis, Insights and Forecast - by Foam

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kerry Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Besmoke Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Azelis Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 International Flavors & Fragrances Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Essentia Protein Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stringer Flavours Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B&G Foods

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MSK Ingredients Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FlavourStream SRL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henning Gesellschaft für Nahrungsmitteltechnik mbH*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Kerry Group

List of Figures

- Figure 1: Global Smoke Ingredients Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Smoke Ingredients Market Revenue (million), by Foam 2025 & 2033

- Figure 3: North America Smoke Ingredients Market Revenue Share (%), by Foam 2025 & 2033

- Figure 4: North America Smoke Ingredients Market Revenue (million), by Application 2025 & 2033

- Figure 5: North America Smoke Ingredients Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Smoke Ingredients Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Smoke Ingredients Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smoke Ingredients Market Revenue (million), by Foam 2025 & 2033

- Figure 9: Europe Smoke Ingredients Market Revenue Share (%), by Foam 2025 & 2033

- Figure 10: Europe Smoke Ingredients Market Revenue (million), by Application 2025 & 2033

- Figure 11: Europe Smoke Ingredients Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Smoke Ingredients Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Smoke Ingredients Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smoke Ingredients Market Revenue (million), by Foam 2025 & 2033

- Figure 15: Asia Pacific Smoke Ingredients Market Revenue Share (%), by Foam 2025 & 2033

- Figure 16: Asia Pacific Smoke Ingredients Market Revenue (million), by Application 2025 & 2033

- Figure 17: Asia Pacific Smoke Ingredients Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Smoke Ingredients Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smoke Ingredients Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Smoke Ingredients Market Revenue (million), by Foam 2025 & 2033

- Figure 21: South America Smoke Ingredients Market Revenue Share (%), by Foam 2025 & 2033

- Figure 22: South America Smoke Ingredients Market Revenue (million), by Application 2025 & 2033

- Figure 23: South America Smoke Ingredients Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Smoke Ingredients Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America Smoke Ingredients Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smoke Ingredients Market Revenue (million), by Foam 2025 & 2033

- Figure 27: Middle East and Africa Smoke Ingredients Market Revenue Share (%), by Foam 2025 & 2033

- Figure 28: Middle East and Africa Smoke Ingredients Market Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Smoke Ingredients Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Smoke Ingredients Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smoke Ingredients Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smoke Ingredients Market Revenue million Forecast, by Foam 2020 & 2033

- Table 2: Global Smoke Ingredients Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Smoke Ingredients Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Smoke Ingredients Market Revenue million Forecast, by Foam 2020 & 2033

- Table 5: Global Smoke Ingredients Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Smoke Ingredients Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Smoke Ingredients Market Revenue million Forecast, by Foam 2020 & 2033

- Table 12: Global Smoke Ingredients Market Revenue million Forecast, by Application 2020 & 2033

- Table 13: Global Smoke Ingredients Market Revenue million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Germany Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: France Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Russia Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Smoke Ingredients Market Revenue million Forecast, by Foam 2020 & 2033

- Table 22: Global Smoke Ingredients Market Revenue million Forecast, by Application 2020 & 2033

- Table 23: Global Smoke Ingredients Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: India Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: China Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Japan Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Australia Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global Smoke Ingredients Market Revenue million Forecast, by Foam 2020 & 2033

- Table 30: Global Smoke Ingredients Market Revenue million Forecast, by Application 2020 & 2033

- Table 31: Global Smoke Ingredients Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Brazil Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Global Smoke Ingredients Market Revenue million Forecast, by Foam 2020 & 2033

- Table 36: Global Smoke Ingredients Market Revenue million Forecast, by Application 2020 & 2033

- Table 37: Global Smoke Ingredients Market Revenue million Forecast, by Country 2020 & 2033

- Table 38: South Africa Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Smoke Ingredients Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smoke Ingredients Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Smoke Ingredients Market?

Key companies in the market include Kerry Group, Besmoke Ltd, Azelis Holdings, International Flavors & Fragrances Inc, Essentia Protein Solutions, Stringer Flavours Ltd, B&G Foods, MSK Ingredients Ltd, FlavourStream SRL, Henning Gesellschaft für Nahrungsmitteltechnik mbH*List Not Exhaustive.

3. What are the main segments of the Smoke Ingredients Market?

The market segments include Foam, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 285.34 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Smoked Food.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023, Azelis Holdings acquired Smoky Light B.V., an ingredients distributor in the BENELUX region. For the food and nutrition industries, Smoky Light B.V. provides smoke, grill, cooking flavors, browning agents, and additives. With this acquisition, Azelis aims to increase its market share in the Benelux region as well as throughout Europe, the Middle East, and Africa for smoke ingredients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smoke Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smoke Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smoke Ingredients Market?

To stay informed about further developments, trends, and reports in the Smoke Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence