Key Insights

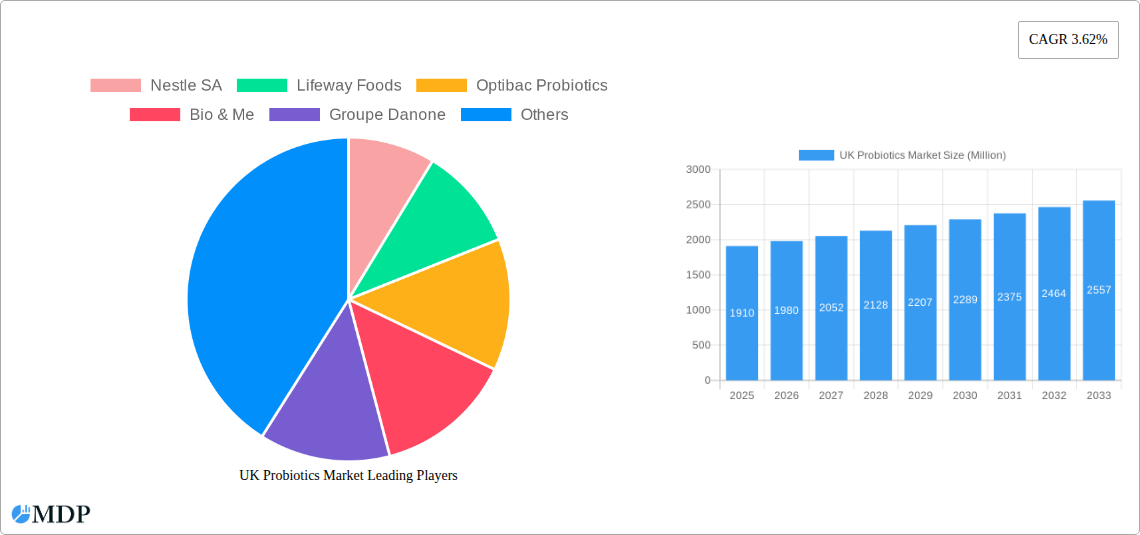

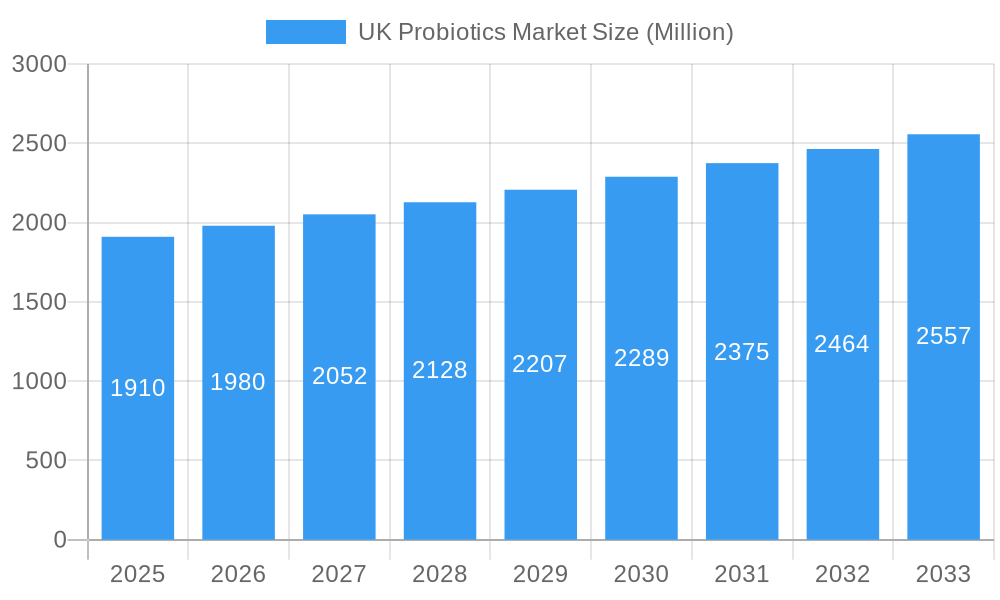

The UK probiotics market is poised for substantial growth, reflecting a global shift towards preventative healthcare and a growing consumer understanding of the gut-brain axis and its impact on overall well-being. With a current market size of approximately £1.91 billion and a projected Compound Annual Growth Rate (CAGR) of 3.62% through 2033, the industry demonstrates robust expansion potential. This growth is fueled by an increasing demand for functional foods and beverages that offer health benefits beyond basic nutrition. Consumers are actively seeking products that can support digestive health, immune function, and even mental wellness, positioning probiotics as a key ingredient in modern dietary choices. The dietary supplements segment continues to be a dominant force, driven by individuals looking for targeted solutions for specific health concerns. Furthermore, the rising awareness of the role of gut microbiota in both human and animal health is driving innovation and market penetration across various applications.

UK Probiotics Market Market Size (In Billion)

The market's trajectory is also significantly influenced by evolving distribution channels. While traditional avenues like supermarkets and health stores/pharmacies remain crucial, the rapid ascent of online retail stores is reshaping accessibility and consumer purchasing habits. This digital shift offers convenience and broader product selection, catering to a tech-savvy demographic. Key players are strategically investing in product innovation, research and development, and marketing campaigns to capitalize on these trends. Companies like Nestle SA, Groupe Danone, and Pepsico Inc. are expanding their portfolios to include a wider array of probiotic-infused products. However, challenges such as stringent regulatory frameworks and the need for greater consumer education regarding product efficacy and strain specificity may moderate the pace of growth. Despite these considerations, the overarching trend towards personalized nutrition and the proven benefits of a healthy gut microbiome ensure a bright future for the UK probiotics market.

UK Probiotics Market Company Market Share

Unlocking the Potential: A Comprehensive Report on the UK Probiotics Market (2019–2033)

Gain critical insights into the rapidly expanding UK probiotics market with this definitive report. Spanning 2019 to 2033, with a detailed analysis of the base year 2025 and a forecast period extending to 2033, this report delves deep into the dynamics, trends, and future trajectory of this vital sector. We provide actionable intelligence for stakeholders looking to capitalize on the burgeoning demand for gut health solutions, covering everything from market size projections in millions to evolving consumer preferences and groundbreaking product innovations. Explore the competitive landscape, identify key growth drivers, and navigate the challenges and opportunities shaping the UK's probiotics industry. This report is an indispensable resource for manufacturers, distributors, investors, and researchers seeking a competitive edge in the UK probiotics market.

UK Probiotics Market Market Dynamics & Concentration

The UK probiotics market is characterized by a moderate to high concentration, with key players like Nestle SA, Groupe Danone, and Pepsico Inc. holding significant market share, particularly in the functional food and beverage segment. Innovation is a primary driver, fueled by increasing consumer awareness of gut health's impact on overall well-being. This has led to a surge in research and development for novel probiotic strains and delivery methods. Regulatory frameworks, while generally supportive of health-promoting foods and supplements, require stringent adherence to claims and ingredient sourcing, influencing product development. Product substitutes, such as prebiotics and synbiotics, offer alternative gut health solutions, posing a competitive challenge. End-user trends are strongly influenced by a desire for natural, preventative healthcare and personalized nutrition, driving demand for specialized probiotic formulations. Mergers and acquisitions (M&A) are present, though less frequent than in more mature markets, with companies strategically acquiring smaller, innovative players to expand their product portfolios and market reach. The estimated M&A deal count for the historical period (2019-2024) is xx, indicating a consolidating yet dynamic landscape. The market share of leading companies fluctuates based on product launches and strategic marketing campaigns, with estimations suggesting the top 3 players command over 40% of the total market.

UK Probiotics Market Industry Trends & Analysis

The UK probiotics market is experiencing robust growth, driven by a confluence of factors including escalating health consciousness among consumers, a growing understanding of the gut-brain axis, and an increasing preference for natural and preventative healthcare solutions. The historical period (2019-2024) has witnessed a Compound Annual Growth Rate (CAGR) of approximately 7.5%, a testament to the sector's resilience and expansion. Market penetration is steadily increasing, particularly within the dietary supplements and functional food and beverage segments, as consumers actively seek products that offer tangible health benefits beyond basic nutrition. Technological disruptions are playing a crucial role, with advancements in strain identification, fermentation techniques, and encapsulation technologies enabling the development of more potent and targeted probiotic formulations. These innovations are enhancing the viability and efficacy of probiotics, leading to greater consumer trust and adoption. Consumer preferences are evolving towards personalized nutrition and condition-specific solutions. For instance, there's a growing demand for probiotics tailored for digestive health, immune support, and even mental well-being. This shift is pushing manufacturers to diversify their offerings beyond general-purpose probiotics. The competitive landscape is intensifying, with both established food and beverage giants and specialized probiotic companies vying for market share. The entry of new players and the expansion of existing ones, through both organic growth and strategic partnerships, are contributing to this dynamic environment. The increasing availability of probiotics across various retail channels, from supermarkets to online platforms, further fuels market accessibility and growth. The estimated market value for the base year 2025 is £X.XX Million, with projections indicating a significant upward trajectory in the coming years, driven by sustained consumer interest and ongoing innovation.

Leading Markets & Segments in UK Probiotics Market

The Functional Food and Beverages segment is the undisputed leader within the UK probiotics market, driven by its broad consumer appeal and the integration of probiotics into everyday consumable products. This segment's dominance is bolstered by economic policies encouraging healthier food options and the widespread availability of these products through Supermarkets/Hypermarkets, which represent the most significant distribution channel. Consumers are increasingly opting for yogurts, dairy drinks, and fortified juices containing probiotics as a convenient way to support their gut health. The economic policies promoting healthy eating and the strong infrastructure of major supermarket chains facilitate high sales volumes.

- Functional Food and Beverages: This segment benefits from impulse purchases and widespread consumer familiarity. Key drivers include the convenience of incorporation into daily diets, increasing consumer awareness of the link between gut health and overall well-being, and the supportive regulatory environment for functional foods in the UK.

- Dietary Supplements: This segment holds significant growth potential, catering to consumers seeking targeted health solutions. Its expansion is supported by robust health store and pharmacy networks, as well as a growing online retail presence.

- Key Drivers: Growing demand for specialized health solutions, increasing research backing the efficacy of probiotic supplements for various conditions, and the accessibility through specialized health stores and online platforms.

- Animal Feed: While a smaller segment, the animal feed sector is witnessing steady growth due to increasing awareness among livestock farmers and pet owners about the benefits of probiotics for animal health, growth, and feed efficiency.

- Key Drivers: Focus on improving animal gut health for better feed conversion and reduced antibiotic use, and increasing demand for premium pet food products with added health benefits.

The Supermarkets/Hypermarkets distribution channel commands the largest market share due to the sheer volume of consumer traffic and the ease of access to a wide range of probiotic products. However, Online Retail Stores are rapidly gaining prominence, offering greater convenience, wider product selection, and competitive pricing, particularly for niche and specialized probiotic brands. Health Stores/Pharmacies remain crucial for specialized, high-potency probiotic supplements and expert advice.

UK Probiotics Market Product Developments

Product innovation in the UK probiotics market is increasingly focused on targeted delivery systems and specific health benefits. Companies are developing multi-strain formulations designed to address particular digestive issues, immune system support, and even mood enhancement. Technological advancements in encapsulation and shelf-life stabilization are ensuring higher efficacy and bioavailability of probiotic strains. The competitive advantage lies in demonstrating scientifically proven benefits and appealing to consumer demand for natural, safe, and effective health solutions. Examples include the development of vegan-friendly probiotic gummies and yogurts with unique flavor profiles, reflecting a growing market for diverse dietary needs and preferences.

Key Drivers of UK Probiotics Market Growth

Several key drivers are propelling the growth of the UK probiotics market. An escalating consumer demand for preventative healthcare and natural remedies is paramount, as individuals proactively seek ways to improve their well-being. The growing scientific understanding and public awareness linking gut health to overall physical and mental health is a significant catalyst. Furthermore, technological advancements in probiotic research and development, leading to more effective and targeted formulations, are driving innovation and consumer confidence. Supportive regulatory frameworks that encourage the marketing of health-promoting products also contribute to market expansion.

Challenges in the UK Probiotics Market Market

Despite its growth, the UK probiotics market faces several challenges. Regulatory hurdles, particularly concerning health claims and product labeling, can slow down innovation and market entry. Intense competition from both established food and beverage giants and emerging specialized probiotic brands necessitates continuous differentiation and investment in marketing. Consumer education and combating misinformation surrounding probiotics remain crucial to ensure accurate understanding of their benefits and proper usage. Supply chain complexities, especially for live microbial products requiring specific storage conditions, can also pose logistical challenges. The estimated cost of navigating complex regulatory approvals for new probiotic strains can range from £XX,XXX to £XXX,XXX.

Emerging Opportunities in UK Probiotics Market

Emerging opportunities in the UK probiotics market are abundant, driven by ongoing scientific breakthroughs and evolving consumer needs. The development of personalized probiotic solutions, tailored to individual microbiomes and health goals, represents a significant growth frontier. Strategic partnerships between probiotic manufacturers and healthcare providers, as well as food and beverage companies, can unlock new market segments and distribution channels. Furthermore, the expansion of probiotics into new application areas, such as infant nutrition and specialized medical nutrition, presents substantial untapped potential. Investment in R&D for novel strains with specific health benefits, such as those targeting inflammation or metabolic health, will also be a key growth accelerator.

Leading Players in the UK Probiotics Market Sector

- Nestle SA

- Lifeway Foods

- Optibac Probiotics

- Bio & Me

- Groupe Danone

- Pepsico Inc.

- BioGaia

- Now Foods

- Yakult Honsha

- Protexin Probiotics

Key Milestones in UK Probiotics Market Industry

- February 2022: Optibac Probiotics launched new vegan gummies for adults in the UK, targeting gut and immune health, available in strawberry flavor.

- August 2021: Muller introduced its gut health yogurt, Gut Glory, to the UK market in various flavors like salted caramel, strawberry with fiber, rhubarb peach, and mango with thread.

- June 2021: HempFusion partnered with Probulin to launch a probiotic line offering products for various gut health solutions, promoting immune health and overall well-being.

Strategic Outlook for UK Probiotics Market Market

The strategic outlook for the UK probiotics market is highly optimistic, poised for continued expansion fueled by a deepening consumer focus on health and wellness. Future growth will be driven by innovation in personalized nutrition, with a greater emphasis on microbiome-specific formulations and targeted health benefits. Strategic alliances and collaborations between supplement manufacturers, food producers, and research institutions will be crucial for product development and market penetration. The increasing adoption of probiotics in infant formula and specialized dietary interventions also presents a significant opportunity. Furthermore, a greater understanding of the gut-brain axis will unlock new product categories and marketing strategies, solidifying probiotics as a cornerstone of preventative healthcare in the UK. The estimated investment in probiotic R&D for the forecast period is projected to exceed £XXX Million.

UK Probiotics Market Segmentation

-

1. Type

- 1.1. Functional Food and Beverages

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Health Stores/Pharmacies

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

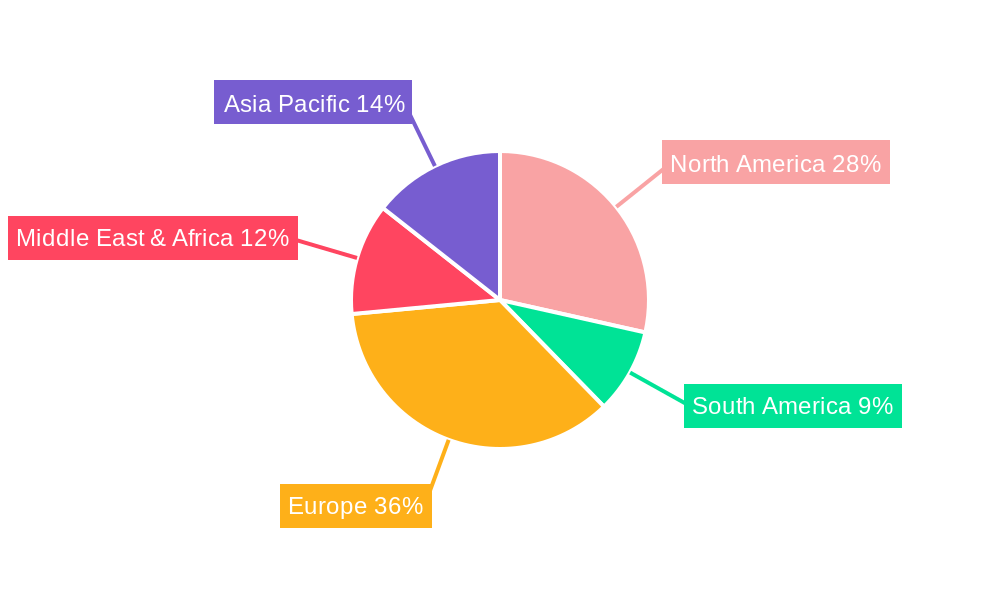

UK Probiotics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Probiotics Market Regional Market Share

Geographic Coverage of UK Probiotics Market

UK Probiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Demand for Probiotic Infused Functional Food & Beverages Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Functional Food and Beverages

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Health Stores/Pharmacies

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Functional Food and Beverages

- 6.1.2. Dietary Supplements

- 6.1.3. Animal Feed

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Health Stores/Pharmacies

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Functional Food and Beverages

- 7.1.2. Dietary Supplements

- 7.1.3. Animal Feed

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Health Stores/Pharmacies

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Functional Food and Beverages

- 8.1.2. Dietary Supplements

- 8.1.3. Animal Feed

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Health Stores/Pharmacies

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Functional Food and Beverages

- 9.1.2. Dietary Supplements

- 9.1.3. Animal Feed

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Health Stores/Pharmacies

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Functional Food and Beverages

- 10.1.2. Dietary Supplements

- 10.1.3. Animal Feed

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Health Stores/Pharmacies

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lifeway Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Optibac Probiotics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio & Me

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Groupe Danone

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pepsico Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BioGaia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Now Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yakult Honsha

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Protexin Probiotics *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global UK Probiotics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Probiotics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific UK Probiotics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific UK Probiotics Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific UK Probiotics Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific UK Probiotics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Probiotics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UK Probiotics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global UK Probiotics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Probiotics Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global UK Probiotics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Probiotics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Probiotics Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the UK Probiotics Market?

Key companies in the market include Nestle SA, Lifeway Foods, Optibac Probiotics, Bio & Me, Groupe Danone, Pepsico Inc, BioGaia, Now Foods, Yakult Honsha, Protexin Probiotics *List Not Exhaustive.

3. What are the main segments of the UK Probiotics Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Demand for Probiotic Infused Functional Food & Beverages Products.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

In February 2022, Optibac Probiotics company launched its new vegan gummies for adults across the United Kingdom. The company claims that these products are designed to support adults' gut and immune health. These products are available in strawberry flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Probiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Probiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Probiotics Market?

To stay informed about further developments, trends, and reports in the UK Probiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence