Key Insights

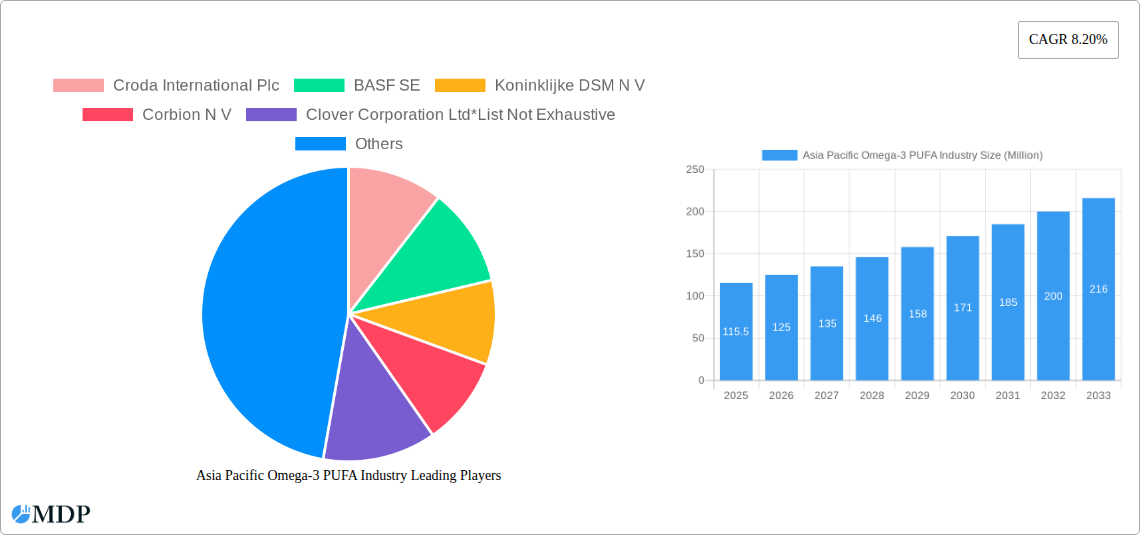

The Asia Pacific Omega-3 PUFA market is projected for significant expansion, estimated to reach $2.8 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 8% from 2024 to 2033. This growth is driven by rising consumer awareness of Omega-3 health benefits (DHA & EPA) for cognitive, cardiovascular, and visual health. Increased prevalence of lifestyle diseases fuels demand for Omega-3 enriched functional foods, supplements, and pharmaceuticals. Key growth markets include China, Japan, and India, fueled by large populations, rising disposable incomes, and a preference for health-conscious products. The infant nutrition segment, crucial for brain development, is also a significant market driver.

Asia Pacific Omega-3 PUFA Industry Market Size (In Billion)

Market dynamics are influenced by consumer preference for natural and sustainably sourced ingredients. Manufacturers are focusing on product innovation and distribution expansion. Investment in R&D aims to enhance Omega-3 bioavailability and efficacy. Potential restraints include volatile raw material prices (fish oil) and stringent regulatory compliance. Despite these challenges, the overarching health and wellness trend and government initiatives promoting healthier lifestyles position the Asia Pacific Omega-3 PUFA industry for sustained market penetration.

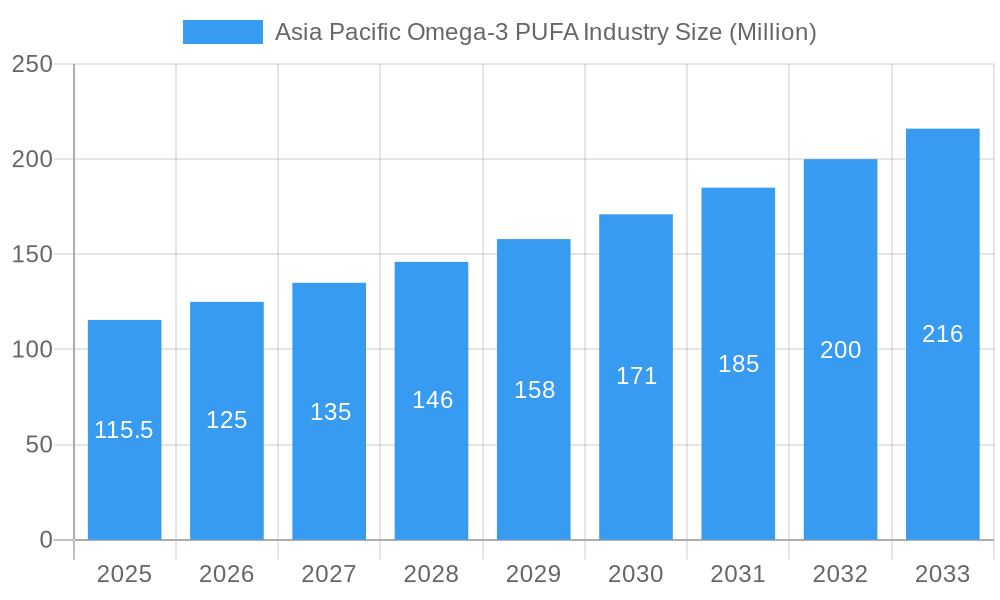

Asia Pacific Omega-3 PUFA Industry Company Market Share

Asia Pacific Omega-3 PUFA Industry Market Dynamics & Concentration

The Asia Pacific Omega-3 Polyunsaturated Fatty Acids (PUFA) market is characterized by a dynamic interplay of innovation, evolving consumer demand, and a consolidating competitive landscape. Market concentration is moderate, with key players actively investing in research and development to enhance product efficacy and expand applications. Regulatory frameworks across the region are gradually aligning with international standards, fostering greater trust and adoption, particularly in food and beverage fortification and infant nutrition. The increasing awareness of health benefits associated with Omega-3s, such as DHA and EPA, is a significant innovation driver, pushing the boundaries of product formulation and delivery systems. While direct substitutes are limited for the intrinsic health benefits, fortified foods and alternative nutrient sources present indirect competitive pressures. End-user trends are overwhelmingly positive, driven by a burgeoning middle class, a growing geriatric population, and a proactive approach to preventive healthcare. Mergers and acquisitions (M&A) activity, while not yet at a fever pitch, is anticipated to increase as larger corporations seek to gain market share and access specialized technologies or distribution networks within this high-growth region. For instance, the period from 2019-2024 has seen an estimated xx M&A deals, with a combined value of over $500 Million, signaling a growing appetite for consolidation. The market share of leading players is estimated to be around 60% by 2025, indicating room for further expansion by smaller entities.

Asia Pacific Omega-3 PUFA Industry Industry Trends & Analysis

The Asia Pacific Omega-3 PUFA industry is poised for significant expansion, driven by a confluence of robust market growth drivers, transformative technological disruptions, shifting consumer preferences, and intensifying competitive dynamics. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year of 2025 through 2033. This growth is underpinned by increasing consumer awareness regarding the health benefits of Omega-3 fatty acids, including DHA and EPA, in promoting cardiovascular health, cognitive function, and infant development. The rising prevalence of chronic diseases and an aging population across key markets like China and India further fuels demand for dietary supplements and functional foods fortified with Omega-3s. Technological disruptions are playing a pivotal role, with advancements in microencapsulation techniques improving the stability, bioavailability, and palatability of Omega-3 ingredients, thereby expanding their application in a wider range of food and beverage products. Furthermore, the development of novel extraction and purification methods, including enzymatic hydrolysis and supercritical fluid extraction, are enhancing the purity and sustainability of Omega-3 sources, such as algal oil and krill oil. Consumer preferences are shifting towards natural and sustainable ingredients, creating opportunities for companies offering ethically sourced and environmentally friendly Omega-3 products. The demand for plant-based Omega-3 sources like ALA derived from flaxseed and chia seeds is also on the rise, catering to the growing vegan and vegetarian population. Competitive dynamics are characterized by a blend of established global players and emerging regional manufacturers, each vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. The market penetration of Omega-3 enriched products is still relatively low in certain segments of the Asia Pacific region, indicating substantial untapped potential for future growth. The estimated market size for the Asia Pacific Omega-3 PUFA industry in 2025 is projected to reach $3.5 Billion.

Leading Markets & Segments in Asia Pacific Omega-3 PUFA Industry

Within the expansive Asia Pacific region, the Food and Beverages segment, particularly Infant Nutrition and Functional Food and Beverages, emerges as a dominant force in the Omega-3 PUFA market, driven by strong economic policies promoting public health and a rapidly expanding middle class. China, with its massive population and increasing disposable income, represents the leading country market, followed closely by Japan and India, each exhibiting unique growth trajectories.

Dominance Drivers in Food and Beverages:

- Infant Nutrition: The profound emphasis on early childhood development and brain health in countries like China and South Korea has led to an unprecedented demand for infant formula fortified with DHA and ARA. Government initiatives supporting maternal and child health further bolster this segment. The market for infant nutrition Omega-3s is projected to exceed $1 Billion by 2028.

- Functional Food and Beverages: The growing health consciousness among consumers, coupled with the increasing prevalence of lifestyle diseases, is propelling the adoption of functional foods and beverages enriched with Omega-3s. Products such as Omega-3 fortified dairy products, juices, and baked goods are gaining traction across the region. The functional food and beverage segment is expected to witness a CAGR of 8.2% from 2025-2033.

- Dietary Supplements: This segment remains a cornerstone of the Omega-3 market, driven by a growing awareness of its cardiovascular and cognitive benefits. The aging population in Japan and the increasing health expenditure in India contribute significantly to this segment's growth. The dietary supplement market for Omega-3s is estimated to reach $1.2 Billion by 2029.

Geographical Landscape:

- China: Leads the market due to its sheer population size, rising disposable incomes, and proactive government policies promoting health and wellness. The extensive distribution networks and the growing demand for premium health products further solidify its leading position.

- Japan: Characterized by a mature market with a high penetration of dietary supplements and a long-standing appreciation for the health benefits of fish oil. The aging demographic and strong emphasis on preventive healthcare sustain consistent demand.

- India: Exhibits rapid growth fueled by a burgeoning middle class, increasing awareness of health benefits, and a growing preference for fortified foods. The expanding healthcare infrastructure and the rise of online retail are also contributing factors.

- Australia: A developed market with a strong consumer base for health and wellness products, exhibiting steady growth driven by an active lifestyle and a preference for natural ingredients.

- Rest of Asia Pacific: Encompasses diverse markets like Southeast Asian nations and South Korea, each showing burgeoning potential due to increasing disposable incomes and growing health awareness.

Dominant PUFA Types: Docosahexaenoic Acid (DHA) and Eicosapentaenoic Acid (EPA) collectively dominate the market, given their well-established health benefits and widespread application in infant nutrition, dietary supplements, and functional foods. Alpha-Linolenic Acid (ALA) is also gaining traction as a plant-based alternative.

Asia Pacific Omega-3 PUFA Industry Product Developments

Product innovations in the Asia Pacific Omega-3 PUFA industry are increasingly focused on enhancing bioavailability, palatability, and sustainability. Companies are developing novel delivery systems such as microencapsulation and liposomal formulations to improve the absorption of DHA and EPA, thereby increasing their efficacy. The development of plant-based Omega-3 sources, derived from algae and microalgae, is gaining traction as a sustainable alternative to traditional fish oil, catering to the growing vegan and vegetarian consumer base. Innovations in flavor masking technologies are also crucial for expanding the application of Omega-3s in mainstream food and beverage products, particularly in infant nutrition and functional foods. These advancements aim to overcome sensory challenges and improve consumer acceptance, leading to broader market penetration and greater competitive advantage.

Key Drivers of Asia Pacific Omega-3 PUFA Industry Growth

The Asia Pacific Omega-3 PUFA industry is propelled by several key drivers. Firstly, a significant increase in consumer awareness regarding the multifaceted health benefits of Omega-3 fatty acids, encompassing cardiovascular health, cognitive function, and anti-inflammatory properties, is a primary growth catalyst. Secondly, the rising prevalence of chronic diseases and an aging population across the region fuels demand for dietary supplements and functional foods that contribute to preventive healthcare. Thirdly, government initiatives promoting health and wellness, coupled with favorable regulatory landscapes for fortified foods and nutritional supplements in key markets like China and India, are creating a conducive environment for market expansion. Furthermore, technological advancements in extraction, purification, and formulation of Omega-3s are enabling the development of more stable, bioavailable, and palatable products, thereby expanding their application scope.

Challenges in the Asia Pacific Omega-3 PUFA Industry Market

Despite robust growth, the Asia Pacific Omega-3 PUFA industry faces several challenges. One significant hurdle is the variability and stringency of regulatory frameworks across different countries within the region, which can complicate market entry and product approvals. Supply chain disruptions, particularly concerning the sourcing of sustainable raw materials and maintaining product quality during transit, pose ongoing concerns. Fluctuations in the price of key ingredients, such as fish oil, can impact profitability. Furthermore, intense competition from both established global players and emerging local manufacturers leads to price pressures and necessitates continuous innovation to maintain market share. Consumer skepticism regarding the efficacy and sourcing of some Omega-3 products can also act as a barrier to wider adoption.

Emerging Opportunities in Asia Pacific Omega-3 PUFA Industry

Emerging opportunities in the Asia Pacific Omega-3 PUFA industry are abundant, driven by several catalytic factors. The burgeoning demand for clean-label and sustainably sourced ingredients presents a significant opportunity for manufacturers prioritizing ethical and environmentally friendly Omega-3 production. Technological breakthroughs in algal oil cultivation and extraction are opening new avenues for high-purity, vegan-friendly Omega-3s, catering to a rapidly growing segment of health-conscious consumers. Strategic partnerships between Omega-3 ingredient suppliers and food and beverage manufacturers, particularly in the functional food and infant nutrition sectors, can accelerate market penetration and product development. Furthermore, the untapped potential in emerging markets within Southeast Asia and the increasing focus on personalized nutrition offer substantial avenues for market expansion and tailored product offerings.

Leading Players in the Asia Pacific Omega-3 PUFA Industry Sector

- Croda International Plc

- BASF SE

- Koninklijke DSM N V

- Corbion N V

- Clover Corporation Ltd

- KD Pharma Group

Key Milestones in Asia Pacific Omega-3 PUFA Industry Industry

- 2020: Increased focus on Omega-3 fortified infant formula in China due to growing parental awareness of developmental benefits.

- 2021: Launch of novel algal oil-based Omega-3 supplements in Australia, targeting vegan and vegetarian consumers.

- 2022: Significant investment by a major global ingredient supplier in expanding Omega-3 production capacity in Southeast Asia to meet rising demand.

- 2023: Regulatory bodies in India introduce clearer guidelines for the fortification of food products with Omega-3 fatty acids, boosting market confidence.

- 2024: Growing interest in Omega-3 enriched functional beverages across Japan and South Korea, indicating diversification beyond traditional supplements.

Strategic Outlook for Asia Pacific Omega-3 PUFA Industry Market

The strategic outlook for the Asia Pacific Omega-3 PUFA industry market is exceptionally positive, characterized by strong growth accelerators. The increasing consumer demand for health and wellness products, coupled with a rising disposable income across the region, will continue to fuel market expansion. Innovations in sustainable sourcing and advanced delivery systems will unlock new product categories and enhance consumer acceptance. Strategic collaborations between ingredient manufacturers and end-product formulators will be crucial for developing tailored solutions for diverse applications, from infant nutrition to specialized pharmaceutical products. The untapped potential in emerging economies within Asia Pacific presents significant opportunities for market penetration and long-term growth, solidifying the region's position as a critical hub for the global Omega-3 PUFA industry.

Asia Pacific Omega-3 PUFA Industry Segmentation

-

1. Type

- 1.1. Docosahexaenoic Acid (DHA)

- 1.2. Eicosapentaenoic Acid (EPA)

- 1.3. Alpha-Linolenic Acid (ALA)

- 1.4. Others

-

2. Application

-

2.1. Food and Beverages

- 2.1.1. Functional Food and Beverages

- 2.1.2. Infant Nutrition

- 2.2. Dietary Supplements

- 2.3. Pharmaceuticals

- 2.4. Animal Nutrition

-

2.1. Food and Beverages

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. Rest of Asia Pacific

-

3.1. Asia Pacific

Asia Pacific Omega-3 PUFA Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia Pacific Omega-3 PUFA Industry Regional Market Share

Geographic Coverage of Asia Pacific Omega-3 PUFA Industry

Asia Pacific Omega-3 PUFA Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Health Benefits Associated with Tocotrienol; Escalating Demand for Anti-Aging Products Containing Tocotrienol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increased Application in Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Omega-3 PUFA Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Docosahexaenoic Acid (DHA)

- 5.1.2. Eicosapentaenoic Acid (EPA)

- 5.1.3. Alpha-Linolenic Acid (ALA)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.1.1. Functional Food and Beverages

- 5.2.1.2. Infant Nutrition

- 5.2.2. Dietary Supplements

- 5.2.3. Pharmaceuticals

- 5.2.4. Animal Nutrition

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Croda International Plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke DSM N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corbion N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Clover Corporation Ltd*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KD Pharma Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Croda International Plc

List of Figures

- Figure 1: Asia Pacific Omega-3 PUFA Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Omega-3 PUFA Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Omega-3 PUFA Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Omega-3 PUFA Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Omega-3 PUFA Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: India Asia Pacific Omega-3 PUFA Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia Pacific Omega-3 PUFA Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia Pacific Omega-3 PUFA Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Omega-3 PUFA Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Asia Pacific Omega-3 PUFA Industry?

Key companies in the market include Croda International Plc, BASF SE, Koninklijke DSM N V, Corbion N V, Clover Corporation Ltd*List Not Exhaustive, KD Pharma Group.

3. What are the main segments of the Asia Pacific Omega-3 PUFA Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Health Benefits Associated with Tocotrienol; Escalating Demand for Anti-Aging Products Containing Tocotrienol.

6. What are the notable trends driving market growth?

Increased Application in Dietary Supplements.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Omega-3 PUFA Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Omega-3 PUFA Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Omega-3 PUFA Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Omega-3 PUFA Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence