Key Insights

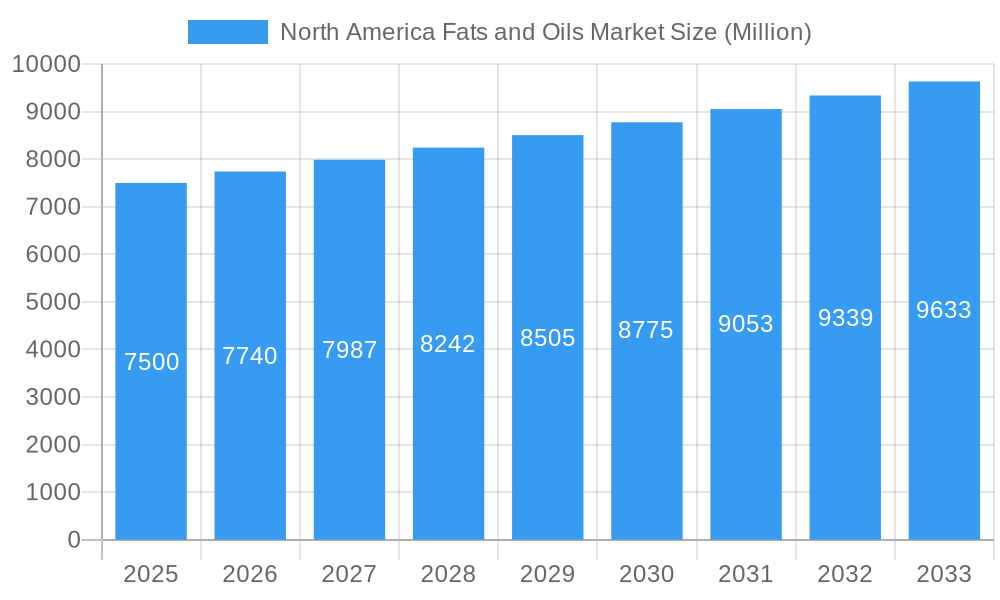

The North America Fats and Oils Market is projected for robust expansion, anticipated to reach 19.58 billion USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.51% during the forecast period. Key growth drivers include sustained demand from the food and beverage sector, particularly for bakery, confectionery, snacks, and dairy applications. Evolving consumer preferences towards healthier fat profiles and plant-based alternatives are also significantly influencing market trends. Emerging applications within personal care and cosmetics, driven by the demand for natural and sustainable ingredients, further bolster market growth. The animal feed industry remains a consistent and substantial consumer of various fats and oils.

North America Fats and Oils Market Market Size (In Billion)

The competitive environment features prominent players like Cargill Incorporated, Archer Daniels Midland Company, and Wilmar International Ltd, who are actively pursuing product innovation, strategic collaborations, and capacity enhancements to address dynamic consumer demands and regulatory shifts. While robust demand fuels market growth, potential challenges encompass raw material price fluctuations, heightened consumer awareness of fat-related health concerns, and the impact of stringent environmental regulations. Nevertheless, ongoing development of novel applications, advancements in processing technologies, and persistent demand for processed foods are expected to ensure a positive growth trajectory for the North America Fats and Oils Market.

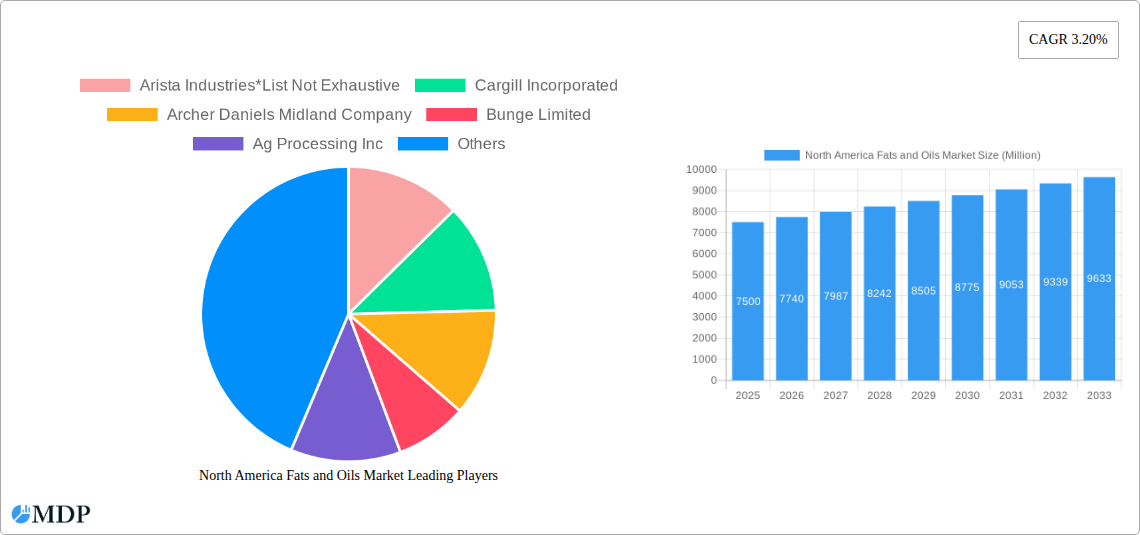

North America Fats and Oils Market Company Market Share

North America Fats and Oils Market: Navigating a Multi-Billion Dollar Industry

This comprehensive report delves into the dynamic North America Fats and Oils Market, a sector projected to reach $XX Million by 2025. Explore critical insights into market size, growth trends, and the strategic landscape of key players. Our analysis spans the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering unparalleled foresight for industry stakeholders.

North America Fats and Oils Market Market Dynamics & Concentration

The North America Fats and Oils Market exhibits a moderate to high concentration, with a few key players holding significant market share. The market is driven by continuous innovation, particularly in developing healthier and more sustainable fat and oil products. Regulatory frameworks surrounding food safety and ingredient labeling play a crucial role in shaping market entry and product development. The availability of product substitutes, such as plant-based alternatives and different oil varieties, influences consumer choices and necessitates strategic product differentiation. End-user trends, including a growing demand for convenience foods, plant-based diets, and clean-label products, are significantly impacting the types of fats and oils that gain traction. Mergers and Acquisitions (M&A) are a notable feature, with recent activities indicating consolidation and strategic expansion. For instance, the acquisition of ADM's oilseeds business by Bunge exemplifies this trend, reshaping the competitive landscape. The market has witnessed XX M&A deal counts between 2019 and 2024, underscoring an active consolidation phase. The market share distribution is roughly estimated with leading players holding XX% combined market share.

North America Fats and Oils Market Industry Trends & Analysis

The North America Fats and Oils Market is on a robust growth trajectory, characterized by a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by several interconnected factors. A primary driver is the escalating demand for food and beverage applications, particularly in bakery and confectionary, savory snacks, and dairy sectors, where fats and oils are integral to texture, flavor, and shelf-life. The increasing global population and rising disposable incomes contribute to higher consumption of processed foods, thereby bolstering the demand for these ingredients.

Technological advancements are playing a transformative role. Investments in advanced extraction technologies are leading to more efficient production processes, higher yields, and the development of novel oil and fat formulations with improved nutritional profiles and functionalities. This includes the exploration of enzymatic modifications and interesterification to create trans-fat-free alternatives. Furthermore, the growing awareness surrounding health and wellness is driving a shift towards healthier fat options, such as olive oil, sunflower seed oil, and canola oil, which are rich in unsaturated fats and offer various health benefits. The market penetration of these healthier alternatives is steadily increasing as consumers actively seek ingredients that align with their wellness goals.

Consumer preferences are also evolving, with a significant surge in demand for plant-based diets and products perceived as natural and sustainable. This trend is creating opportunities for a wider range of vegetable oils and fats derived from non-animal sources. The personal care and cosmetics industry is another significant contributor, with an increasing use of natural oils and butters in formulations for their moisturizing and emollient properties.

Competitive dynamics are intense, with major players continuously vying for market share through product innovation, strategic partnerships, and market expansion. The launch of initiatives like the Sustainable Palm Oil Coalition highlights the industry's response to growing consumer and regulatory pressure for more ethically and environmentally sourced ingredients. This focus on sustainability is becoming a critical competitive differentiator. The market penetration of specialty oils and fats tailored for specific applications, such as high-oleic oils for frying stability, is also on the rise, catering to niche market demands and enhancing overall market growth.

Leading Markets & Segments in North America Fats and Oils Market

The United States stands as the dominant market within North America for fats and oils, driven by its large consumer base, sophisticated food processing industry, and significant agricultural output. Its economic policies, robust infrastructure, and high disposable incomes create a fertile ground for market expansion across all segments.

Product Segmentation Dominance:

- Oils: Soybean Oil and Canola Oil command the largest market share due to their widespread use in food production, animal feed, and industrial applications, coupled with their availability from domestic production. Palm Oil also holds a substantial share, driven by its versatility and cost-effectiveness in various food applications, despite ongoing sustainability discussions.

- Fats: Butter (Excluding Dairy Butter) and Other Fats collectively represent a significant portion, catering to the baking and confectionery industries. Lard's share, while still present, is influenced by evolving consumer preferences.

Application Segmentation Dominance:

- Food and Beverage: This segment is the undisputed leader, with sub-segments like Bakery and Confectionary and Savory Snacks consuming vast quantities of fats and oils for texture, flavor, and preservation. The Dairy sector also relies heavily on these ingredients for producing various dairy-based products.

- Animal Feed: A crucial segment, as fats and oils are vital components of animal nutrition, contributing to energy and essential fatty acids.

- Personal Care and Cosmetics: This segment is experiencing steady growth, with an increasing demand for natural and organic oils and butters in skincare, haircare, and cosmetic formulations.

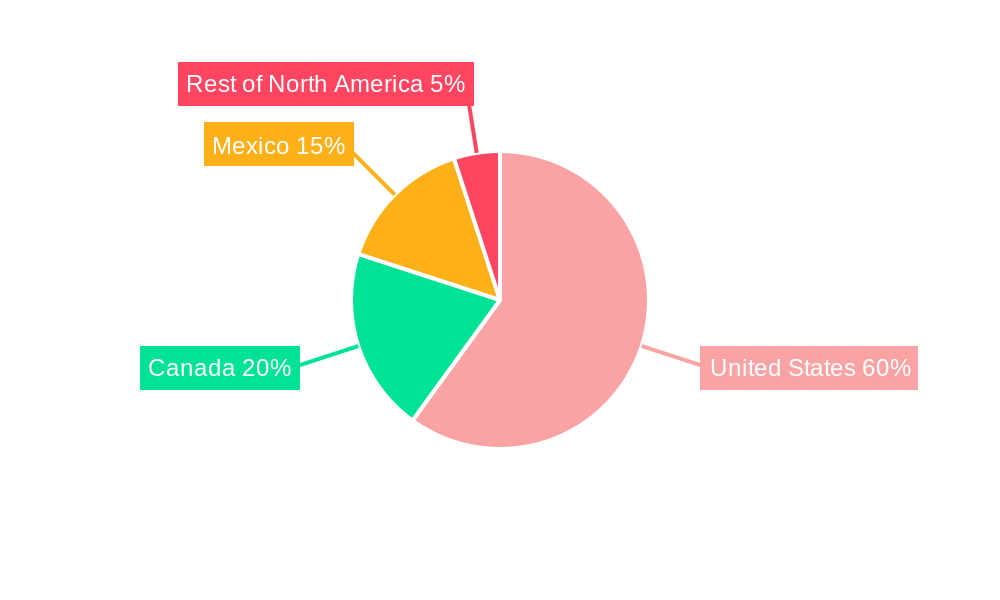

Geographical Dominance and Growth Factors:

- United States: Its dominance is further amplified by extensive research and development in food science and a strong consumer demand for convenience and processed foods. Economic policies favoring agricultural production and trade agreements enhance its position.

- Canada: A major producer of canola and soybean, Canada plays a significant role, particularly in the oils segment. Its agricultural sector and strong export markets contribute to its market presence.

- Mexico: Shows promising growth due to an expanding food processing industry and increasing consumer demand for a wider variety of food products. Its strategic location and trade relationships are key drivers.

- Rest of North America: Encompasses emerging markets and niche opportunities, contributing to the overall regional market.

The dominance of these segments and regions is underpinned by factors such as population size, per capita consumption, industrialization levels, and the presence of major food manufacturers and agricultural producers.

North America Fats and Oils Market Product Developments

Product innovations in the North America Fats and Oils Market are heavily focused on enhancing nutritional profiles, improving functionality, and ensuring sustainability. Companies are actively developing specialized oils and fats, such as high-oleic variants for enhanced stability in frying applications and mid-chain triglycerides (MCTs) for their health benefits. The development of trans-fat-free formulations and the incorporation of functional ingredients are key trends, driven by consumer demand for healthier options. Furthermore, advancements in processing technologies allow for the extraction of oils from novel sources and the creation of value-added products with improved sensory attributes and shelf-life. These developments aim to meet evolving consumer preferences for clean labels, natural ingredients, and products that support a healthy lifestyle, thereby providing a competitive advantage.

Key Drivers of North America Fats and Oils Market Growth

The North America Fats and Oils Market is propelled by several key drivers. The burgeoning food and beverage industry, with its continuous demand for versatile ingredients, is a primary catalyst. Growing consumer awareness and preference for healthier dietary choices, including the demand for unsaturated fats and reduced trans-fat products, are significantly influencing market growth. Furthermore, technological advancements in extraction and processing are leading to more efficient production and the development of innovative products. The increasing use of fats and oils in animal feed to enhance livestock nutrition and productivity also contributes substantially. Regulatory support for certain agricultural products and the exploration of biofuel applications for specific oils are further accelerating market expansion.

Challenges in the North America Fats and Oils Market Market

Despite robust growth, the North America Fats and Oils Market faces several challenges. Volatility in raw material prices, influenced by weather patterns, global supply, and demand, can impact profit margins and necessitate price adjustments. Stringent regulatory requirements regarding food safety, labeling, and environmental impact, particularly for ingredients like palm oil, can pose compliance hurdles. The growing scrutiny around sustainability and ethical sourcing requires significant investment in supply chain transparency and responsible production practices. Furthermore, intense competitive pressures from both established players and emerging niche brands necessitate continuous innovation and cost optimization. The availability and increasing popularity of substitute ingredients also present a challenge that requires strategic product positioning.

Emerging Opportunities in North America Fats and Oils Market

The North America Fats and Oils Market presents numerous emerging opportunities for growth and innovation. The escalating demand for plant-based and vegan food products is creating a significant opening for a wider array of vegetable oils and fats. The increasing focus on functional ingredients that offer specific health benefits, such as omega-3 fatty acids or antioxidants, presents a lucrative avenue. Advancements in biotechnology and precision fermentation could unlock novel fat and oil sources with unique properties. Strategic partnerships and collaborations between ingredient suppliers and food manufacturers are crucial for developing tailored solutions for emerging market trends. Furthermore, the growing emphasis on circular economy principles and the utilization of agricultural by-products for oil extraction offers sustainable growth potential.

Leading Players in the North America Fats and Oils Market Sector

- Arista Industries

- Cargill Incorporated

- Archer Daniels Midland Company

- Bunge Limited

- Ag Processing Inc

- Olam International

- Wilmar International Ltd

- Richardson International Limited

Key Milestones in North America Fats and Oils Market Industry

- 2023: Acquisition of ADM's oilseeds business by Bunge, a significant consolidation event reshaping the North American market landscape.

- 2022: Launch of the Sustainable Palm Oil Coalition, signaling a collective industry commitment towards responsible sourcing and production of palm oil.

- 2024: Increased investment in advanced extraction technologies, focusing on methods like enzymatic extraction and supercritical fluid extraction for higher purity and yield.

- 2021: Growing adoption of high-oleic oils in the food service sector for improved frying performance and extended shelf life.

- 2020: Introduction of novel plant-based fat blends designed to mimic the texture and functionality of animal fats in various food applications.

Strategic Outlook for North America Fats and Oils Market Market

The strategic outlook for the North America Fats and Oils Market is characterized by continued expansion driven by evolving consumer preferences and technological advancements. Key growth accelerators include the increasing demand for health-conscious ingredients, the burgeoning plant-based food sector, and the ongoing innovation in sustainable sourcing and production. Companies that can effectively navigate regulatory landscapes, invest in R&D for novel product development, and forge strong partnerships across the value chain will be well-positioned for success. The market's future potential lies in its ability to adapt to these dynamic trends, offering diverse, high-quality, and sustainably produced fats and oils that cater to the multifaceted needs of consumers and industries.

North America Fats and Oils Market Segmentation

-

1. Product

-

1.1. Oils

- 1.1.1. Soybean Oil

- 1.1.2. Canola Oil

- 1.1.3. Palm Oil

- 1.1.4. Olive Oil

- 1.1.5. Sunflower Seed Oil

- 1.1.6. Other Oils

-

1.2. Fats

- 1.2.1. Butter(Excluding Dairy Butter)

- 1.2.2. Lard

- 1.2.3. Other Fats

-

1.1. Oils

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery and Confectionary

- 2.1.2. Savory Snacks

- 2.1.3. Dairy

- 2.1.4. Other Food and Beverage

- 2.2. Animal Feed

- 2.3. Personal Care and Cosmetics

- 2.4. Other Applications

-

2.1. Food and Beverage

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Fats and Oils Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Fats and Oils Market Regional Market Share

Geographic Coverage of North America Fats and Oils Market

North America Fats and Oils Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Rise in the Consumption of Olive Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fats and Oils Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Oils

- 5.1.1.1. Soybean Oil

- 5.1.1.2. Canola Oil

- 5.1.1.3. Palm Oil

- 5.1.1.4. Olive Oil

- 5.1.1.5. Sunflower Seed Oil

- 5.1.1.6. Other Oils

- 5.1.2. Fats

- 5.1.2.1. Butter(Excluding Dairy Butter)

- 5.1.2.2. Lard

- 5.1.2.3. Other Fats

- 5.1.1. Oils

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery and Confectionary

- 5.2.1.2. Savory Snacks

- 5.2.1.3. Dairy

- 5.2.1.4. Other Food and Beverage

- 5.2.2. Animal Feed

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Other Applications

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Fats and Oils Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Oils

- 6.1.1.1. Soybean Oil

- 6.1.1.2. Canola Oil

- 6.1.1.3. Palm Oil

- 6.1.1.4. Olive Oil

- 6.1.1.5. Sunflower Seed Oil

- 6.1.1.6. Other Oils

- 6.1.2. Fats

- 6.1.2.1. Butter(Excluding Dairy Butter)

- 6.1.2.2. Lard

- 6.1.2.3. Other Fats

- 6.1.1. Oils

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Bakery and Confectionary

- 6.2.1.2. Savory Snacks

- 6.2.1.3. Dairy

- 6.2.1.4. Other Food and Beverage

- 6.2.2. Animal Feed

- 6.2.3. Personal Care and Cosmetics

- 6.2.4. Other Applications

- 6.2.1. Food and Beverage

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Fats and Oils Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Oils

- 7.1.1.1. Soybean Oil

- 7.1.1.2. Canola Oil

- 7.1.1.3. Palm Oil

- 7.1.1.4. Olive Oil

- 7.1.1.5. Sunflower Seed Oil

- 7.1.1.6. Other Oils

- 7.1.2. Fats

- 7.1.2.1. Butter(Excluding Dairy Butter)

- 7.1.2.2. Lard

- 7.1.2.3. Other Fats

- 7.1.1. Oils

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Bakery and Confectionary

- 7.2.1.2. Savory Snacks

- 7.2.1.3. Dairy

- 7.2.1.4. Other Food and Beverage

- 7.2.2. Animal Feed

- 7.2.3. Personal Care and Cosmetics

- 7.2.4. Other Applications

- 7.2.1. Food and Beverage

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Fats and Oils Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Oils

- 8.1.1.1. Soybean Oil

- 8.1.1.2. Canola Oil

- 8.1.1.3. Palm Oil

- 8.1.1.4. Olive Oil

- 8.1.1.5. Sunflower Seed Oil

- 8.1.1.6. Other Oils

- 8.1.2. Fats

- 8.1.2.1. Butter(Excluding Dairy Butter)

- 8.1.2.2. Lard

- 8.1.2.3. Other Fats

- 8.1.1. Oils

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Bakery and Confectionary

- 8.2.1.2. Savory Snacks

- 8.2.1.3. Dairy

- 8.2.1.4. Other Food and Beverage

- 8.2.2. Animal Feed

- 8.2.3. Personal Care and Cosmetics

- 8.2.4. Other Applications

- 8.2.1. Food and Beverage

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of North America North America Fats and Oils Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Oils

- 9.1.1.1. Soybean Oil

- 9.1.1.2. Canola Oil

- 9.1.1.3. Palm Oil

- 9.1.1.4. Olive Oil

- 9.1.1.5. Sunflower Seed Oil

- 9.1.1.6. Other Oils

- 9.1.2. Fats

- 9.1.2.1. Butter(Excluding Dairy Butter)

- 9.1.2.2. Lard

- 9.1.2.3. Other Fats

- 9.1.1. Oils

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.1.1. Bakery and Confectionary

- 9.2.1.2. Savory Snacks

- 9.2.1.3. Dairy

- 9.2.1.4. Other Food and Beverage

- 9.2.2. Animal Feed

- 9.2.3. Personal Care and Cosmetics

- 9.2.4. Other Applications

- 9.2.1. Food and Beverage

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Arista Industries*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cargill Incorporated

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Archer Daniels Midland Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bunge Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ag Processing Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Olam International

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wilmar International Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Richardson International Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Arista Industries*List Not Exhaustive

List of Figures

- Figure 1: North America Fats and Oils Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fats and Oils Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fats and Oils Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Fats and Oils Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Fats and Oils Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Fats and Oils Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Fats and Oils Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: North America Fats and Oils Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Fats and Oils Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Fats and Oils Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Fats and Oils Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: North America Fats and Oils Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: North America Fats and Oils Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Fats and Oils Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Fats and Oils Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: North America Fats and Oils Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: North America Fats and Oils Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Fats and Oils Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Fats and Oils Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: North America Fats and Oils Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: North America Fats and Oils Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Fats and Oils Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fats and Oils Market?

The projected CAGR is approximately 3.51%.

2. Which companies are prominent players in the North America Fats and Oils Market?

Key companies in the market include Arista Industries*List Not Exhaustive, Cargill Incorporated, Archer Daniels Midland Company, Bunge Limited, Ag Processing Inc, Olam International, Wilmar International Ltd, Richardson International Limited.

3. What are the main segments of the North America Fats and Oils Market?

The market segments include Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Rise in the Consumption of Olive Oil.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Acquisition of ADM's oilseeds business by Bunge 2. Launch of Sustainable Palm Oil Coalition 3. Investment in advanced extraction technologies

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fats and Oils Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fats and Oils Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fats and Oils Market?

To stay informed about further developments, trends, and reports in the North America Fats and Oils Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence