Key Insights

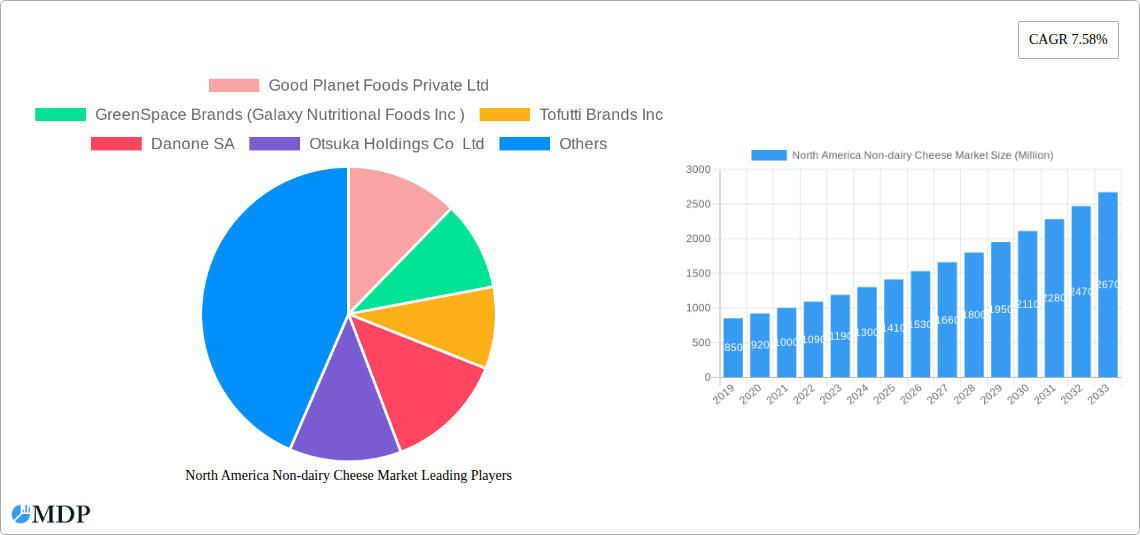

The North American non-dairy cheese market is projected for significant expansion, with an estimated market size of $2149.77 million by 2025. The market is expected to experience a robust Compound Annual Growth Rate (CAGR) of 14.34% through 2033. This growth is primarily attributed to evolving consumer preferences for health-conscious, environmentally sustainable, and ethically produced food options. Key drivers include the rising vegan and flexitarian populations, alongside an increasing incidence of lactose intolerance and dairy allergies, which are collectively boosting demand for plant-based cheese alternatives. Furthermore, continuous innovation in product development, enhancing taste, texture, and meltability, is making non-dairy cheeses more appealing to a wider consumer base, including flexitarians.

North America Non-dairy Cheese Market Market Size (In Billion)

The market's dynamics are further shaped by segment and distribution channel performance. Off-trade channels, particularly online retail and supermarkets/hypermarkets, are anticipated to lead sales due to convenience and product availability. Convenience stores and specialist retailers will also cater to immediate and niche demands. Key trends include product innovation, such as the introduction of artisanal and gourmet non-dairy varieties, and a focus on clean-label ingredients, significantly influencing consumer purchasing decisions. However, market restraints such as the comparatively higher price point of some non-dairy cheeses and lingering consumer skepticism regarding taste and texture present ongoing challenges. Despite these hurdles, the prevailing positive consumer sentiment driven by health and ethical concerns, coupled with ongoing product advancements, indicates a promising future for the North American non-dairy cheese market.

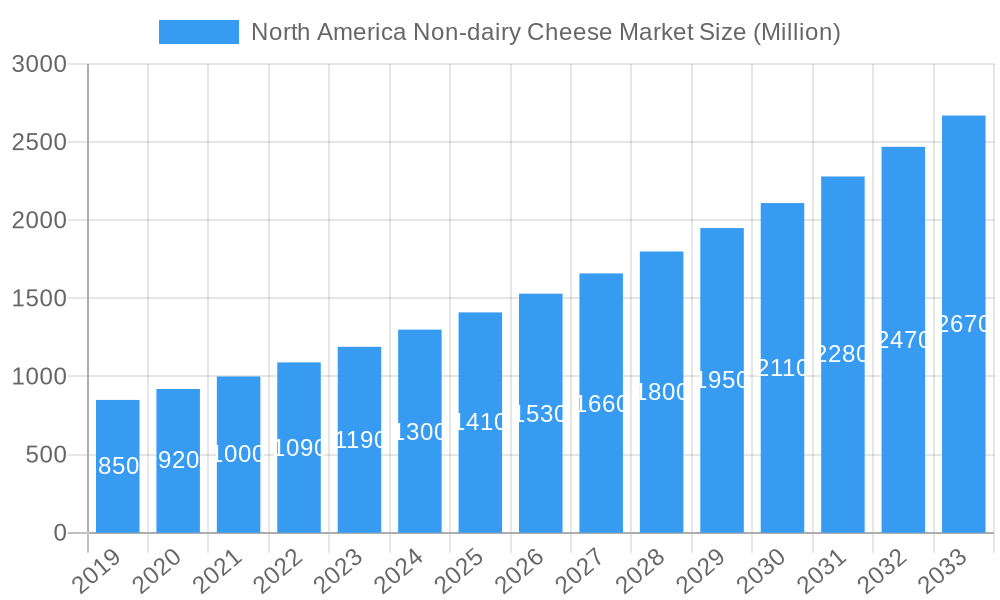

North America Non-dairy Cheese Market Company Market Share

This report provides an in-depth analysis of the North America Non-Dairy Cheese Market, offering critical insights for stakeholders in this evolving sector. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025–2033, the report delivers actionable intelligence on market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and significant milestones. Explore the projected market expansion, driven by increasing consumer demand for vegan cheese, plant-based dairy alternatives, and lactose-free cheese options.

North America Non-Dairy Cheese Market Market Dynamics & Concentration

The North America Non-Dairy Cheese Market is characterized by a dynamic and moderately concentrated landscape, with a growing number of innovative companies driving expansion. Key innovation drivers include the rising demand for healthy food options, a surge in vegan and vegetarian lifestyles, and advancements in food technology enabling the creation of palatable and versatile non-dairy cheese alternatives. Regulatory frameworks, while evolving, are generally supportive of food innovation, with a focus on clear labeling and nutritional transparency for allergy-friendly foods. Product substitutes remain a competitive factor, primarily traditional dairy cheese and other alternative protein sources; however, the improving taste and texture profiles of non-dairy cheeses are diminishing their impact. End-user trends reveal a strong preference for sustainable food products, ethical sourcing, and plant-based diets, particularly among millennials and Gen Z. Mergers and acquisitions (M&A) activities are on the rise as established food giants and innovative startups seek to expand their portfolios and market share in this burgeoning segment. We anticipate XX M&A deals in the historical period and expect this to grow to XX deals during the forecast period, with an estimated market share shift driven by strategic consolidations.

North America Non-Dairy Cheese Market Industry Trends & Analysis

The North America Non-Dairy Cheese Market is poised for significant growth, propelled by a confluence of powerful industry trends. A primary market growth driver is the escalating consumer awareness regarding the health benefits associated with plant-based diets, including reduced risk of chronic diseases and improved digestive health. This awareness is translating into a greater adoption of vegan cheese and other plant-based cheese alternatives, pushing market penetration rates higher. Technological disruptions are playing a pivotal role, with continuous advancements in ingredient formulation, processing techniques, and flavoring agents leading to non-dairy cheeses that closely mimic the taste, texture, and meltability of traditional dairy cheese. This innovation is crucial for overcoming historical consumer skepticism and expanding the appeal beyond strict vegans and lactose-intolerant individuals. Consumer preferences are increasingly leaning towards clean label products, demanding transparency in ingredients and a preference for naturally derived components. The competitive dynamics are intensifying, with a mix of established dairy giants venturing into the non-dairy space and agile startups focusing on niche product development. The overall market penetration of non-dairy cheese is projected to reach XX% by 2033, a substantial increase from XX% in 2019, demonstrating the rapid mainstreaming of these products. The projected market size of $XX Billion by 2033 underscores the immense growth potential within this sector.

Leading Markets & Segments in North America Non-Dairy Cheese Market

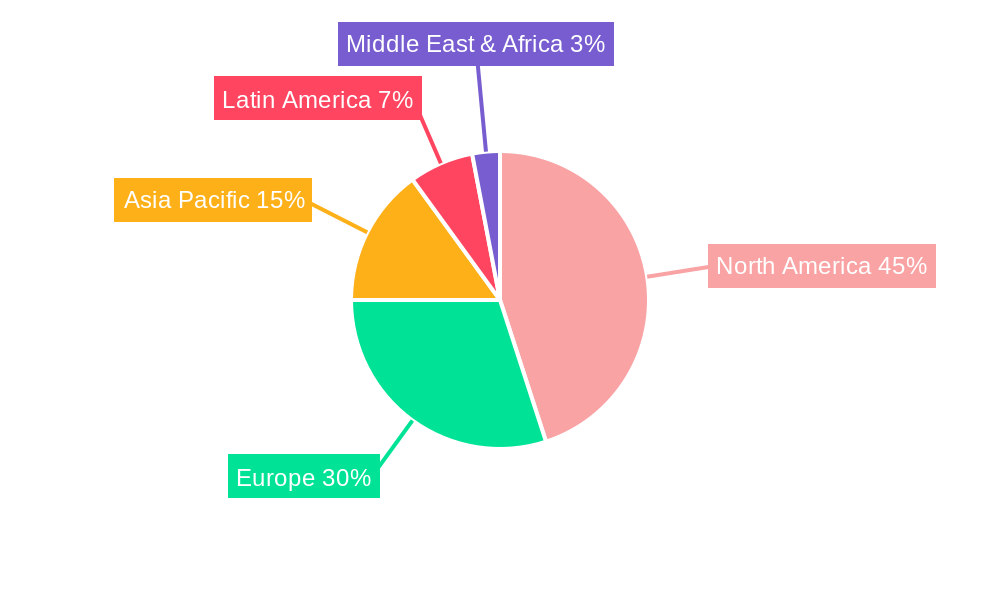

The United States stands as the dominant market within the North America Non-Dairy Cheese sector, driven by its large consumer base, high disposable income, and a well-established culture of health and wellness. Within the United States, the Off-Trade distribution channel commands the largest market share, reflecting the increasing preference of consumers to purchase vegan cheese and plant-based cheese for home consumption.

Distribution Channel Dominance:

- Off-Trade: This segment is further segmented, with Supermarkets and Hypermarkets leading the way due to their extensive product selection, accessibility, and promotional activities. These retail giants are increasingly dedicating prime shelf space to plant-based dairy alternatives, catering to a broad spectrum of consumer needs.

- Key Drivers: Widespread availability of private label lactose-free cheese, strategic product placement, and competitive pricing strategies.

- Online Retail: This segment is experiencing rapid growth, fueled by the convenience of e-commerce and the increasing availability of specialized vegan cheese and dairy-free cheese products online. Consumers can readily access a wider variety of brands and product types, from artisanal to mainstream options.

- Key Drivers: Convenience, wider product assortment, home delivery services, and targeted marketing campaigns by online retailers.

- Specialist Retailers: These stores, focusing on health foods, organic products, and niche dietary needs, play a crucial role in offering premium and innovative plant-based cheese options. They cater to discerning consumers seeking unique flavors and high-quality ingredients.

- Key Drivers: Curated product selection, knowledgeable staff, and association with healthy and ethical consumption.

- Convenience Stores: While currently a smaller segment, convenience stores are increasingly stocking a basic range of non-dairy cheese products, driven by the demand for on-the-go vegan snacks and quick meal solutions.

- Key Drivers: Growing demand for portable plant-based options and increasing accessibility.

- Others (Warehouse clubs, gas stations, etc.): This segment represents a nascent but growing opportunity, particularly for bulk purchasing options in warehouse clubs and the availability of vegan cheese snacks at gas stations.

- Key Drivers: Value for money in warehouse clubs, and the growing demand for convenient dairy-free alternatives in transit locations.

The On-Trade segment, encompassing restaurants, cafes, and food service establishments, is also a significant contributor, driven by the integration of vegan cheese options on menus to cater to a growing demographic of flexitarians and vegans. The demand for plant-based cheese slices, shredded vegan cheese, and specialty dairy-free cheese for culinary applications is a key trend within this segment.

North America Non-Dairy Cheese Market Product Developments

The North America Non-Dairy Cheese Market is witnessing a wave of innovative product developments aimed at enhancing taste, texture, and functionality. Companies are focusing on creating vegan cheese varieties that closely replicate the melting and stretching properties of traditional dairy cheese, making them ideal for pizza, sandwiches, and other culinary applications. Product innovations include the introduction of specific cheese styles such as vegan cheddar, vegan mozzarella, and vegan parmesan, catering to diverse consumer preferences. The use of advanced ingredients like cashew, almond, coconut oil, and potato starch, combined with sophisticated flavoring techniques, contributes to the superior sensory experience of these plant-based dairy alternatives. Competitive advantages are being gained through allergen-free formulations, organic certifications, and the development of novel cheese types, such as nut-free vegan cheese and soy-free cheese, expanding the market's reach to consumers with specific dietary restrictions.

Key Drivers of North America Non-Dairy Cheese Market Growth

Several key factors are accelerating the growth of the North America Non-Dairy Cheese Market. The surging consumer interest in plant-based diets, driven by health consciousness, ethical considerations, and environmental concerns, is a primary growth catalyst. Technological advancements in food science are enabling the production of vegan cheese that rivals traditional dairy in taste, texture, and functionality, overcoming previous limitations. Increasing awareness and availability of lactose-free cheese and dairy-free cheese options cater to a broader consumer base. Furthermore, supportive government initiatives promoting sustainable agriculture and healthy eating habits, coupled with the proactive expansion strategies of leading food manufacturers, are significantly boosting market penetration. The rising prevalence of food allergies and intolerances also presents a substantial opportunity for allergy-friendly foods like non-dairy cheese.

Challenges in the North America Non-Dairy Cheese Market Market

Despite its robust growth trajectory, the North America Non-Dairy Cheese Market faces several challenges. The high cost of production compared to traditional dairy cheese can be a barrier to wider consumer adoption. Supply chain complexities and the sourcing of specialized plant-based ingredients can also pose logistical hurdles. Consumer perception and taste preferences, while improving, still represent a challenge, with some consumers finding certain non-dairy cheeses to be less palatable than their dairy counterparts. Regulatory hurdles related to labeling and ingredient claims require careful navigation. Finally, intense competition from both established dairy players and emerging non-dairy brands necessitates continuous innovation and effective marketing to maintain market share.

Emerging Opportunities in North America Non-Dairy Cheese Market

The North America Non-Dairy Cheese Market is ripe with emerging opportunities for sustained long-term growth. Technological breakthroughs in fermentation and enzyme technology are paving the way for the development of non-dairy cheese with even more authentic flavors and textures. Strategic partnerships between vegan cheese manufacturers and food service providers can unlock significant potential in the out-of-home consumption market. Furthermore, market expansion into untapped regions and the development of niche product categories, such as keto-friendly vegan cheese or high-protein plant-based cheese, present substantial growth avenues. The increasing focus on sustainable packaging and circular economy principles within the food industry also offers opportunities for companies to differentiate themselves and appeal to environmentally conscious consumers.

Leading Players in the North America Non-Dairy Cheese Market Sector

- Good Planet Foods Private Ltd

- GreenSpace Brands (Galaxy Nutritional Foods Inc.)

- Tofutti Brands Inc.

- Danone SA

- Otsuka Holdings Co Ltd

- Maple Leaf Food

- Miyoko's Creamery

- Saputo Inc.

Key Milestones in North America Non-Dairy Cheese Market Industry

- October 2022: Good Planet Foods Private Ltd launched a new range of limited-edition holiday offerings, including White Cheddar and Cranberry flavors, catering to seasonal demand for vegan cheese.

- September 2022: For the expansion of the Non-Dairy Cheese segment, Good Planet Foods Private Ltd launched convenient plant-based snack packs, enhancing accessibility for on-the-go consumers seeking dairy-free options.

- March 2022: Otsuka Holdings Co. Ltd launched a versatile four-cheese blend in two distinct varieties: Italian (parmesan, mozzarella, provolone, and asiago) and Mexican (cheddar, Monterey jack, asadero, and queso quesadilla shreds), offering expanded choices for plant-based cheese enthusiasts.

Strategic Outlook for North America Non-Dairy Cheese Market Market

The strategic outlook for the North America Non-Dairy Cheese Market is exceptionally positive, driven by ongoing innovation and expanding consumer acceptance. Growth accelerators include continued investment in research and development to improve taste and functionality, strategic mergers and acquisitions to consolidate market presence, and aggressive marketing campaigns to educate consumers about the benefits of plant-based cheese. Companies that can effectively leverage technological advancements, build strong distribution networks, and respond to evolving consumer preferences for health, sustainability, and taste will be best positioned for success. The increasing demand for vegan cheese and other dairy-free alternatives indicates a sustained upward trajectory, making this a prime sector for investment and strategic focus within the broader food industry.

North America Non-dairy Cheese Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

-

1.1.1. By Sub Distribution Channels

- 1.1.1.1. Convenience Stores

- 1.1.1.2. Online Retail

- 1.1.1.3. Specialist Retailers

- 1.1.1.4. Supermarkets and Hypermarkets

- 1.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

1.1.1. By Sub Distribution Channels

- 1.2. On-Trade

-

1.1. Off-Trade

North America Non-dairy Cheese Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Non-dairy Cheese Market Regional Market Share

Geographic Coverage of North America Non-dairy Cheese Market

North America Non-dairy Cheese Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Non-dairy Cheese Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. By Sub Distribution Channels

- 5.1.1.1.1. Convenience Stores

- 5.1.1.1.2. Online Retail

- 5.1.1.1.3. Specialist Retailers

- 5.1.1.1.4. Supermarkets and Hypermarkets

- 5.1.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.1.1.1. By Sub Distribution Channels

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Good Planet Foods Private Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GreenSpace Brands (Galaxy Nutritional Foods Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tofutti Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Otsuka Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maple Leaf Food

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Miyoko's Creamery

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saputo Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Good Planet Foods Private Ltd

List of Figures

- Figure 1: North America Non-dairy Cheese Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Non-dairy Cheese Market Share (%) by Company 2025

List of Tables

- Table 1: North America Non-dairy Cheese Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: North America Non-dairy Cheese Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: North America Non-dairy Cheese Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Non-dairy Cheese Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States North America Non-dairy Cheese Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Non-dairy Cheese Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Non-dairy Cheese Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Non-dairy Cheese Market?

The projected CAGR is approximately 14.34%.

2. Which companies are prominent players in the North America Non-dairy Cheese Market?

Key companies in the market include Good Planet Foods Private Ltd, GreenSpace Brands (Galaxy Nutritional Foods Inc ), Tofutti Brands Inc, Danone SA, Otsuka Holdings Co Ltd, Maple Leaf Food, Miyoko's Creamery, Saputo Inc.

3. What are the main segments of the North America Non-dairy Cheese Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2149.77 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

October 2022: Good Planet Foods Private Ltd launched a new range of limited-edition holiday offerings. This limited edition includes White Cheddar and Cranberry.September 2022: For the expansion of the Non-Dairy Cheese segment, Good Planet Foods Private Ltd launched plant-based snack packs.March 2022: Otsuka Holdings Co. Ltd launched a four-cheese blend in two varieties: Italian (made up of thinly shredded parmesan, mozzarella, provolone, and asiago) and Mexican (which features cheddar, Monterey jack, asadero, and queso quesadilla shreds).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Non-dairy Cheese Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Non-dairy Cheese Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Non-dairy Cheese Market?

To stay informed about further developments, trends, and reports in the North America Non-dairy Cheese Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence