Key Insights

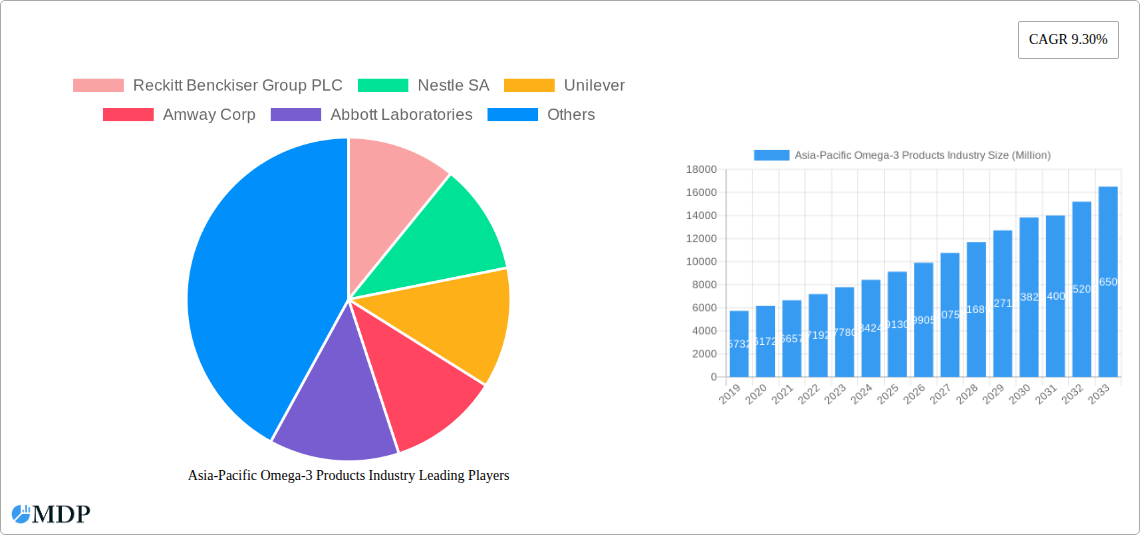

The Asia-Pacific Omega-3 Products market is projected to achieve a size of $8.50 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 7.77% through 2033. This growth is attributed to increasing consumer health consciousness, growing awareness of Omega-3's cardiovascular and cognitive benefits, and a preference for natural, functional foods. Rising disposable incomes in key markets like China and India further fuel demand for supplements and fortified products, supported by a shift towards preventative healthcare.

Asia-Pacific Omega-3 Products Industry Market Size (In Billion)

Key market trends include the rise of sustainable algae-based Omega-3s and innovative product formats such as gummies and beverages. Expanding e-commerce and online pharmacies enhance product accessibility. Challenges include raw material price volatility, purity concerns, and regulatory complexities. Despite these, strong health perceptions and continuous product innovation by leading companies are expected to sustain market expansion.

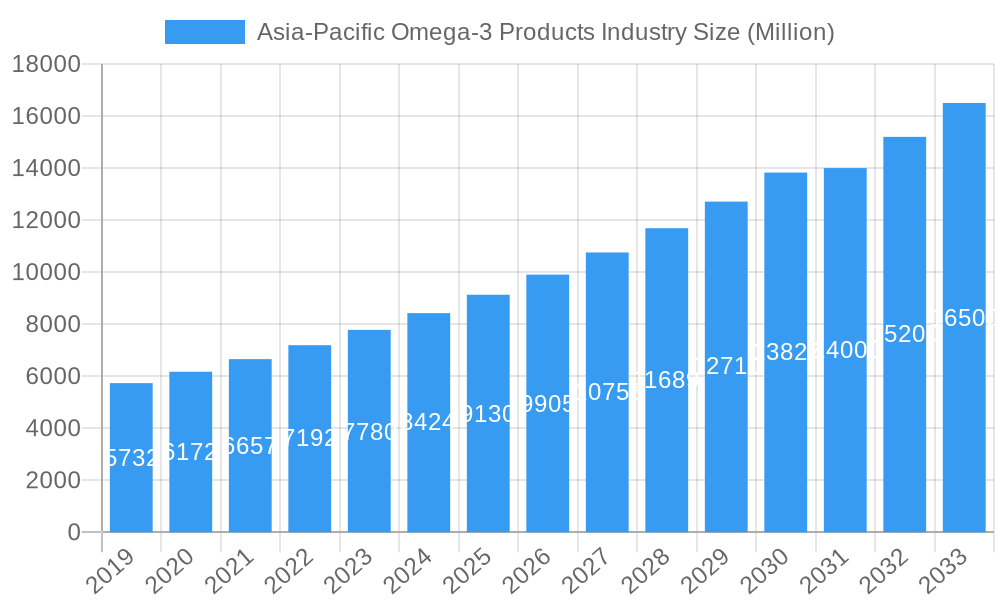

Asia-Pacific Omega-3 Products Industry Company Market Share

This report offers a comprehensive analysis of the Asia-Pacific Omega-3 Products Industry, covering market dynamics, growth forecasts, and strategic opportunities from 2019 to 2033, with a base year of 2025. It examines segments including functional food, dietary supplements, infant nutrition, pet food, and pharmaceuticals, across distribution channels such as grocery retailers, pharmacies, and online. Key geographies covered are China, India, Japan, Australia, and the Rest of Asia-Pacific.

Asia-Pacific Omega-3 Products Industry Market Dynamics & Concentration

The Asia-Pacific Omega-3 Products Industry exhibits a moderate to high concentration, with established multinational corporations and agile domestic players vying for market share. Innovation serves as a primary driver, with continuous research into novel sources of omega-3s, improved bioavailability, and fortified product formulations. Regulatory frameworks, while evolving, present both opportunities for standardization and challenges for market entry. Product substitutes, primarily other functional ingredients offering perceived health benefits, are present but struggle to replicate the scientifically validated advantages of omega-3 fatty acids. End-user trends are heavily influenced by growing health consciousness, an aging population, and increasing disposable incomes, particularly in emerging economies. Merger and acquisition (M&A) activities have been steady, signaling consolidation and strategic expansion. For instance, approximately 15 significant M&A deals were observed in the historical period (2019-2024), with an estimated market share concentration of around 55% held by the top five players.

Asia-Pacific Omega-3 Products Industry Industry Trends & Analysis

The Asia-Pacific Omega-3 Products Industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by a confluence of factors, including heightened consumer awareness regarding the health benefits of omega-3s, such as improved cardiovascular health, cognitive function, and anti-inflammatory properties. The rising prevalence of chronic diseases and an increasing focus on preventative healthcare are compelling consumers to incorporate omega-3 rich products into their diets. Technological advancements are playing a pivotal role, with innovations in extraction, purification, and encapsulation technologies enhancing product quality and efficacy, and expanding application possibilities. Consumer preferences are shifting towards more natural and sustainably sourced omega-3 ingredients, driving demand for algal and krill-based products alongside traditional fish oil. The competitive landscape is intensifying, characterized by aggressive product launches, strategic partnerships, and increased marketing efforts by key players to capture market share. Market penetration for omega-3 products is steadily increasing across all segments, with dietary supplements and functional foods leading the charge. The influence of digital platforms for product discovery and purchase is also a significant trend, reshaping distribution strategies. The industry is also witnessing a growing demand for specialized omega-3 formulations catering to specific demographic groups and health needs, such as prenatal supplements and products for athletes.

Leading Markets & Segments in Asia-Pacific Omega-3 Products Industry

The Dietary Supplements segment is a dominant force within the Asia-Pacific Omega-3 Products Industry, driven by a strong consumer emphasis on proactive health management and the accessibility of these products across various distribution channels. Within this segment, Japan consistently emerges as a leading market, characterized by a sophisticated consumer base with a high propensity for health-conscious purchases and a well-established supplement culture. Key drivers for Japan's dominance include robust government initiatives promoting preventive healthcare, advanced research and development capabilities in the nutraceutical sector, and a mature distribution network that effectively reaches consumers through pharmacies and specialized health stores. Furthermore, the increasing aging population in Japan significantly contributes to the demand for omega-3s for cognitive and cardiovascular health.

- Functional Food: Experiencing substantial growth due to the integration of omega-3s into everyday consumables like dairy products, bread, and beverages, appealing to a broader consumer base seeking convenient health benefits.

- Infant Nutrition: A critical segment driven by parental awareness of omega-3s' role in infant brain and eye development, leading to high demand for fortified infant formulas.

- Pet Food and Feed: Witnessing a significant upswing as pet owners increasingly prioritize the health and well-being of their animals, recognizing the benefits of omega-3s for skin, coat, and joint health in pets.

- Pharmaceuticals: While a smaller segment, it holds significant potential for highly regulated, therapeutic omega-3 products addressing specific medical conditions.

Geographically, China is a rapidly expanding market, propelled by a burgeoning middle class with increasing disposable income and a growing awareness of health and wellness. The vast population and the government’s focus on improving public health are significant growth accelerators. India presents another high-potential market, driven by a large and young population, increasing urbanization, and a growing adoption of Western dietary habits and health trends.

- Distribution Channel Dominance:

- Internet Retailing: This channel is exhibiting exponential growth across the region, empowered by e-commerce infrastructure and the convenience it offers consumers in accessing a wide array of omega-3 products.

- Pharmacies and Drug Stores: Remain crucial for credibility and consumer trust, particularly for dietary supplements and specialized pharmaceutical-grade omega-3 products.

- Grocery Retailers: Increasingly incorporating omega-3 enriched functional foods, catering to everyday consumer purchases.

Asia-Pacific Omega-3 Products Industry Product Developments

Product innovation in the Asia-Pacific Omega-3 Products Industry is characterized by a focus on enhanced bioavailability and targeted delivery systems. Advancements in microencapsulation and liposomal technologies are yielding omega-3 products with improved absorption rates, leading to greater efficacy. Companies are also developing specialized formulations catering to specific life stages and health concerns, such as omega-3 supplements for prenatal health and cognitive support in adults. The growing demand for sustainable and traceable sourcing is driving the development of algal and krill-based omega-3 products, offering alternatives to fish oil. These innovations aim to provide consumers with more palatable, effective, and ethically produced omega-3 solutions, thereby expanding market appeal and competitive advantage.

Key Drivers of Asia-Pacific Omega-3 Products Industry Growth

The Asia-Pacific Omega-3 Products Industry is propelled by several key drivers. Growing health consciousness and an aging population are increasing demand for preventative healthcare solutions. Technological advancements in extraction and formulation are enhancing product efficacy and accessibility. Rising disposable incomes, particularly in emerging economies, are enabling wider consumer access to premium health products. Furthermore, supportive government initiatives promoting public health and wellness are creating a favorable market environment. The increasing awareness of omega-3s' benefits for cognitive function and cardiovascular health are significant consumer-driven factors.

Challenges in the Asia-Pacific Omega-3 Products Industry Market

Despite robust growth, the Asia-Pacific Omega-3 Products Industry faces several challenges. Stringent and varying regulatory landscapes across different countries can impede market entry and product approval processes, leading to significant compliance costs. Supply chain volatility, particularly concerning the sourcing of raw materials like fish oil, can impact product availability and pricing. Intense competition from both global and local players necessitates continuous innovation and aggressive marketing strategies. Furthermore, consumer misinformation and skepticism regarding the efficacy and sourcing of omega-3 products can act as a restraint on market penetration.

Emerging Opportunities in Asia-Pacific Omega-3 Products Industry

Emerging opportunities in the Asia-Pacific Omega-3 Products Industry lie in the continuous exploration of novel omega-3 sources, such as microalgae and genetically modified crops, to ensure sustainable and ethical supply chains. Strategic partnerships between supplement manufacturers and food and beverage companies offer significant potential for expanding the reach of omega-3 enriched functional foods. The growing acceptance of personalized nutrition and the increasing availability of advanced diagnostic tools will drive demand for tailored omega-3 supplements addressing specific individual health needs. Market expansion into underserved regions within Southeast Asia and the Pacific Islands also presents significant long-term growth catalysts.

Leading Players in the Asia-Pacific Omega-3 Products Industry Sector

- Reckitt Benckiser Group PLC

- Nestle SA

- Unilever

- Amway Corp

- Abbott Laboratories

- Herbalife Nutrition

- Healthvit

Key Milestones in Asia-Pacific Omega-3 Products Industry Industry

- 2019: Increased investment in research for algal omega-3 sources due to sustainability concerns.

- 2020: Surge in demand for immune-boosting supplements, including omega-3s, amid global health events.

- 2021: Launch of innovative omega-3 fortified functional foods in key Asian markets.

- 2022: Growing adoption of e-commerce for omega-3 product sales, particularly in China and India.

- 2023: Focus on advanced delivery systems like microencapsulation for improved omega-3 absorption.

- 2024: Increased M&A activity as larger players seek to consolidate market presence.

Strategic Outlook for Asia-Pacific Omega-3 Products Industry Market

The strategic outlook for the Asia-Pacific Omega-3 Products Industry is highly positive, driven by sustained consumer demand for health and wellness products. Future growth accelerators will involve intensified focus on product innovation, particularly in areas of bioavailability and specialized formulations for different demographics. Strategic alliances and partnerships across the value chain, from sourcing to retail, will be crucial for market expansion and operational efficiency. Investing in consumer education and transparent marketing practices will be paramount in building trust and overcoming market barriers. The industry is poised for continued expansion, with opportunities for market leadership for companies that can effectively navigate regulatory complexities and cater to evolving consumer preferences.

Asia-Pacific Omega-3 Products Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Dietary Supplements

- 1.3. Infant Nutrition

- 1.4. Pet Food and Feed

- 1.5. Pharmaceuticals

-

2. Distribution Channel

- 2.1. Grocery Retailers

- 2.2. Pharmacies and Drug Store

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia-Pacific

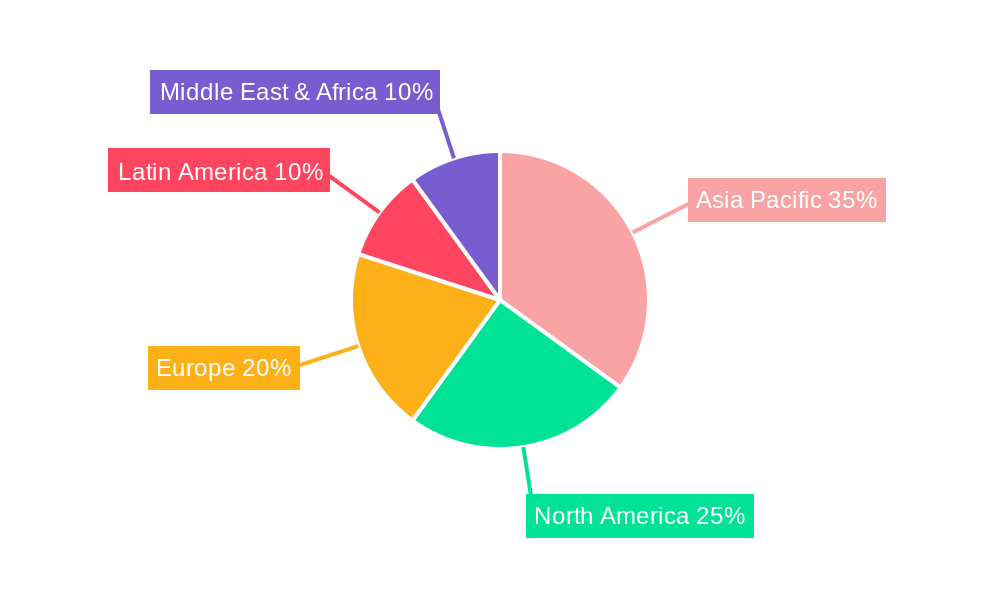

Asia-Pacific Omega-3 Products Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Omega-3 Products Industry Regional Market Share

Geographic Coverage of Asia-Pacific Omega-3 Products Industry

Asia-Pacific Omega-3 Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Omega-3 supplements can be expensive compared to other nutritional products

- 3.4. Market Trends

- 3.4.1. Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Omega-3 Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Dietary Supplements

- 5.1.3. Infant Nutrition

- 5.1.4. Pet Food and Feed

- 5.1.5. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Grocery Retailers

- 5.2.2. Pharmacies and Drug Store

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reckitt Benckiser Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herbalife Nutrition

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Healthvit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: Asia-Pacific Omega-3 Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Omega-3 Products Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Omega-3 Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia-Pacific Omega-3 Products Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Omega-3 Products Industry?

The projected CAGR is approximately 7.77%.

2. Which companies are prominent players in the Asia-Pacific Omega-3 Products Industry?

Key companies in the market include Reckitt Benckiser Group PLC, Nestle SA, Unilever, Amway Corp, Abbott Laboratories, Herbalife Nutrition, Healthvit.

3. What are the main segments of the Asia-Pacific Omega-3 Products Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness of the health benefits of Omega-3 fatty acids; Rising Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Growing interest in plant-based diets and veganism is driving demand for plant-derived Omega-3 sources.

7. Are there any restraints impacting market growth?

Omega-3 supplements can be expensive compared to other nutritional products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Omega-3 Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Omega-3 Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Omega-3 Products Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Omega-3 Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence