Key Insights

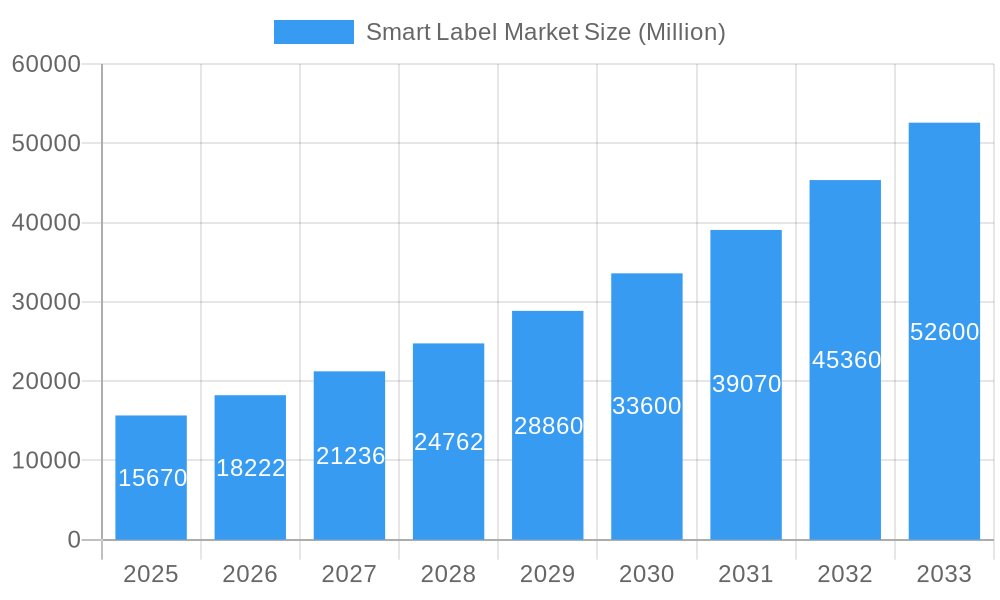

The global smart label market, valued at $15.67 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 16.34% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of RFID (Radio-Frequency Identification) and Electronic Shelf Labels (ESLs) across various industries, notably retail, healthcare, and logistics, is a primary driver. Retailers are leveraging smart labels to enhance inventory management, reduce stockouts, and improve the overall customer experience through real-time product information and enhanced traceability. The healthcare and pharmaceutical sectors are adopting smart labels for drug tracking and anti-counterfeiting measures, ensuring product authenticity and patient safety. Furthermore, the growing demand for efficient supply chain management and optimized logistics operations is propelling the adoption of smart labels in these sectors. Technological advancements, such as the development of more cost-effective and energy-efficient smart label technologies, are further contributing to market expansion.

Smart Label Market Market Size (In Billion)

However, certain restraints might temper growth. Initial investment costs associated with implementing smart label technology can be significant for some businesses, potentially hindering adoption among smaller enterprises. Concerns about data security and privacy related to the collection and transmission of product information via smart labels also pose a challenge. Nevertheless, ongoing technological improvements and decreasing costs are gradually mitigating these constraints. The market is segmented by technology (EAS, RFID, sensing labels, NFC, ESL) and end-user industry (retail, healthcare, logistics, manufacturing). The retail sector currently holds the largest market share, but significant growth is anticipated across all segments, driven by the increasing demand for improved efficiency and transparency across diverse supply chains. Leading players like Honeywell International Inc., Sato Holdings Corp., and Zebra Technologies Corp. are actively contributing to innovation and market penetration. The Asia-Pacific region, particularly China and India, is expected to exhibit substantial growth due to the burgeoning retail sector and increasing manufacturing activities.

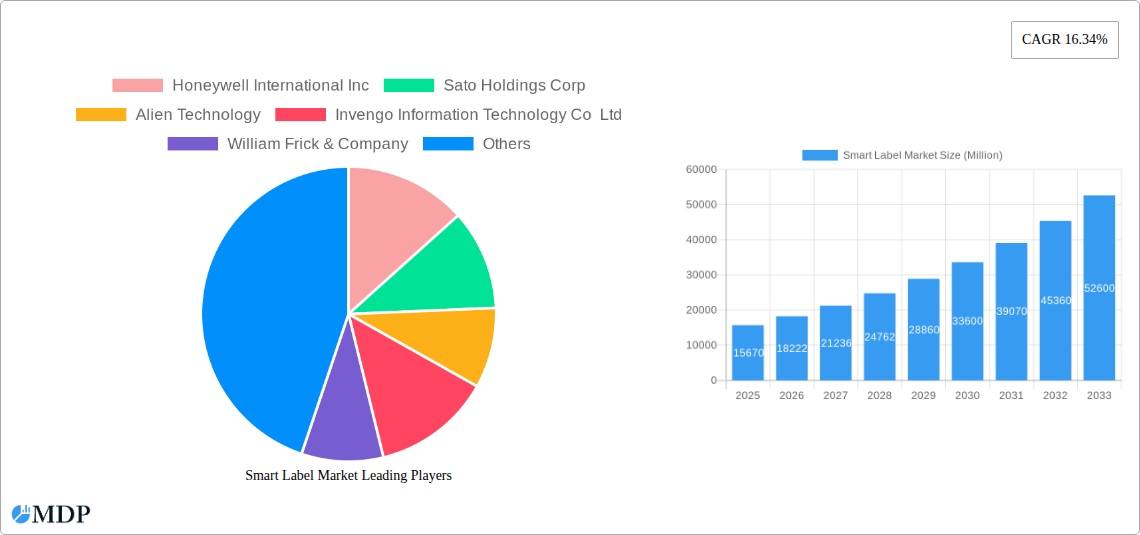

Smart Label Market Company Market Share

Smart Label Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Smart Label Market, projecting a robust growth trajectory fueled by technological advancements and increasing adoption across diverse end-user industries. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. With a forecast period from 2025 to 2033 and historical data from 2019 to 2024, this report is your essential guide to understanding and capitalizing on the opportunities within the smart label sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Smart Label Market Market Dynamics & Concentration

The smart label market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, Sato Holdings Corp, Alien Technology, Invengo Information Technology Co Ltd, William Frick & Company, Scanbuy Inc, CCL Industries Inc, Avery Dennison Corporation, and Zebra Technologies Corp holding significant market share. However, the market also presents opportunities for smaller, specialized players to thrive. Innovation is a primary driver, with continuous advancements in RFID, NFC, and ESL technologies shaping market dynamics. Stringent regulatory frameworks concerning data privacy and product traceability are increasingly influencing market practices. The market sees substantial M&A activity, with xx deals recorded in the past five years, indicating consolidation and strategic expansion among key players. The market share of the top 5 players is estimated to be around xx%. Product substitutes, such as traditional labels, face growing competition due to the superior functionalities offered by smart labels. End-user trends reflect a growing preference for automation and real-time data tracking, accelerating the adoption of smart label solutions.

- Market Concentration: Moderately concentrated

- Innovation Drivers: RFID, NFC, ESL technology advancements

- Regulatory Frameworks: Data privacy, product traceability regulations

- M&A Activity: xx deals in the last 5 years

- End-User Trends: Automation, real-time data tracking

Smart Label Market Industry Trends & Analysis

The smart label market is experiencing robust growth, driven by escalating demand across various sectors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by the increasing need for efficient supply chain management, enhanced product traceability, and improved consumer experiences. Technological disruptions, such as the integration of AI and IoT, are further propelling market expansion. Consumer preferences are shifting towards convenient and information-rich packaging, leading to wider adoption of smart labels. The competitive landscape is characterized by intense rivalry among established players and emerging innovative companies. Market penetration is highest in the retail sector, with significant potential for expansion in healthcare, logistics, and manufacturing. The global market penetration rate for smart labels in 2025 is estimated at xx%.

Leading Markets & Segments in Smart Label Market

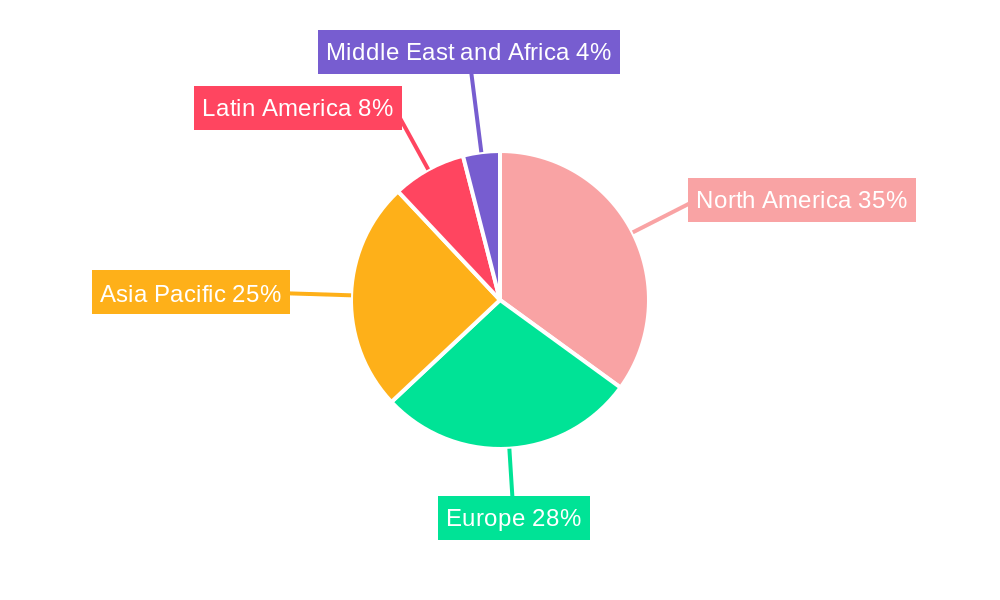

The retail sector currently dominates the smart label market, followed by the healthcare and pharmaceutical industries. Geographically, North America and Europe hold a significant market share, driven by strong technological adoption and regulatory support. However, the Asia-Pacific region shows immense growth potential, fueled by rapid industrialization and increasing consumer spending.

Key Drivers by Segment:

By Technology:

- RFID: High accuracy, wide-range tracking capabilities.

- NFC: Seamless mobile integration, enhanced consumer engagement.

- ESL: Dynamic pricing, reduced manual labor costs.

- EAS: Loss prevention, improved inventory management.

By End-user Industry:

- Retail: Improved inventory management, enhanced customer experience.

- Healthcare & Pharmaceutical: Enhanced drug traceability, patient safety.

- Logistics: Efficient tracking, real-time visibility.

Dominance Analysis:

The Retail segment holds the largest market share due to its high adoption of RFID and ESL technologies for inventory management and consumer engagement. North America and Europe are currently the leading regions owing to early technology adoption and well-established supply chains.

Smart Label Market Product Developments

Recent product innovations focus on enhancing functionalities, integrating advanced sensors, and improving data analytics capabilities. Miniaturization and cost reduction are also key development trends. These innovations cater to specific industry requirements, such as improved temperature monitoring in healthcare and real-time location tracking in logistics. Competitive advantages are increasingly defined by data integration, platform compatibility, and the provision of comprehensive data analytics solutions.

Key Drivers of Smart Label Market Growth

Technological advancements, particularly in RFID, NFC, and ESL technologies, are major growth drivers. The increasing demand for efficient supply chain management and enhanced product traceability across diverse industries is significantly boosting market expansion. Government regulations aimed at improving product safety and reducing counterfeiting are also contributing to market growth. For instance, the implementation of traceability standards in the food industry is driving the adoption of smart labels.

Challenges in the Smart Label Market Market

High initial investment costs associated with implementing smart label solutions can be a barrier to adoption, particularly for small and medium-sized enterprises (SMEs). Supply chain disruptions and fluctuating raw material prices can impact the cost-effectiveness of smart labels. Intense competition among established players and the entry of new competitors pose challenges to maintaining profitability. The impact of these factors on market growth is estimated to be around xx% collectively.

Emerging Opportunities in Smart Label Market

The integration of AI and IoT with smart labels presents significant opportunities for expanding functionalities and unlocking new applications. Strategic partnerships between technology providers, label manufacturers, and end-user industries will further accelerate market expansion. The growing demand for sustainable and eco-friendly packaging solutions presents opportunities for developing biodegradable and recyclable smart labels. Market expansion into emerging economies with rapidly developing industries holds immense growth potential.

Leading Players in the Smart Label Market Sector

- Honeywell International Inc

- Sato Holdings Corp

- Alien Technology

- Invengo Information Technology Co Ltd

- William Frick & Company

- Scanbuy Inc

- CCL Industries Inc

- Avery Dennison Corporation

- Zebra Technologies Corp *List Not Exhaustive

Key Milestones in Smart Label Market Industry

- March 2023: The Premier League and Avery Dennison partnered to launch a new font for Premier League jerseys, enhancing visibility and impacting both on and off-field branding. This collaboration showcases the growing application of smart labels in sports and apparel.

- February 2023: Danavation Technologies Corp. secured contracts for four new digital smart label installations, indicating rising demand for digital smart labels in retail. This demonstrates increasing adoption of digital technologies within the sector.

Strategic Outlook for Smart Label Market Market

The smart label market is poised for continued growth, driven by technological advancements, increasing demand across diverse sectors, and supportive regulatory frameworks. Strategic partnerships, product diversification, and expansion into emerging markets will be crucial for success in this dynamic landscape. The development of innovative solutions addressing specific industry needs and integrating cutting-edge technologies will further accelerate market growth. Focus on sustainability and eco-friendly solutions will also be key strategic differentiators in the future.

Smart Label Market Segmentation

-

1. Technology

- 1.1. Electronic Article Surveillance (EAS)

- 1.2. RFID

- 1.3. Sensing Label

- 1.4. NFC

- 1.5. Electronic Shelf Label (ESL)

-

2. End-user Industry

- 2.1. Retail

- 2.2. Healthcare and Pharmaceutical

- 2.3. Logistics

- 2.4. Manufacturing

- 2.5. Other End-user Industries

Smart Label Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Smart Label Market Regional Market Share

Geographic Coverage of Smart Label Market

Smart Label Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Security and Tracking Solutions

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Retail End User Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Electronic Article Surveillance (EAS)

- 5.1.2. RFID

- 5.1.3. Sensing Label

- 5.1.4. NFC

- 5.1.5. Electronic Shelf Label (ESL)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Healthcare and Pharmaceutical

- 5.2.3. Logistics

- 5.2.4. Manufacturing

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Electronic Article Surveillance (EAS)

- 6.1.2. RFID

- 6.1.3. Sensing Label

- 6.1.4. NFC

- 6.1.5. Electronic Shelf Label (ESL)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Healthcare and Pharmaceutical

- 6.2.3. Logistics

- 6.2.4. Manufacturing

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Electronic Article Surveillance (EAS)

- 7.1.2. RFID

- 7.1.3. Sensing Label

- 7.1.4. NFC

- 7.1.5. Electronic Shelf Label (ESL)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Healthcare and Pharmaceutical

- 7.2.3. Logistics

- 7.2.4. Manufacturing

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Electronic Article Surveillance (EAS)

- 8.1.2. RFID

- 8.1.3. Sensing Label

- 8.1.4. NFC

- 8.1.5. Electronic Shelf Label (ESL)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Healthcare and Pharmaceutical

- 8.2.3. Logistics

- 8.2.4. Manufacturing

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Electronic Article Surveillance (EAS)

- 9.1.2. RFID

- 9.1.3. Sensing Label

- 9.1.4. NFC

- 9.1.5. Electronic Shelf Label (ESL)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Healthcare and Pharmaceutical

- 9.2.3. Logistics

- 9.2.4. Manufacturing

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Electronic Article Surveillance (EAS)

- 10.1.2. RFID

- 10.1.3. Sensing Label

- 10.1.4. NFC

- 10.1.5. Electronic Shelf Label (ESL)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Healthcare and Pharmaceutical

- 10.2.3. Logistics

- 10.2.4. Manufacturing

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sato Holdings Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alien Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Invengo Information Technology Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 William Frick & Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Scanbuy Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avery Dennison Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zebra Technologies Corp *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Smart Label Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: Latin America Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Label Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Smart Label Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 25: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Label Market?

The projected CAGR is approximately 16.34%.

2. Which companies are prominent players in the Smart Label Market?

Key companies in the market include Honeywell International Inc, Sato Holdings Corp, Alien Technology, Invengo Information Technology Co Ltd, William Frick & Company, Scanbuy Inc, CCL Industries Inc, Avery Dennison Corporation, Zebra Technologies Corp *List Not Exhaustive.

3. What are the main segments of the Smart Label Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Security and Tracking Solutions.

6. What are the notable trends driving market growth?

Retail End User Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

March 2023: The Premier League and Avery Dennison collaborated on the new font, which is only the fourth makeover in Premier League history. The new font has enhanced visibility and impacts both on and off the pitch due to an increase in number height and the incorporation of the Premier League's unique graphic design. The new numbers, names, and sleeve badges will be available in the spring, following the release of each Premier League club's 2023-24 season shirt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Label Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Label Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Label Market?

To stay informed about further developments, trends, and reports in the Smart Label Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence