Key Insights

The protective packaging market, valued at approximately 33.92 billion in 2025, is poised for significant expansion. Projected to grow at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033, this growth is attributed to several key factors. The burgeoning e-commerce sector is a primary driver, escalating demand for secure transit packaging. Concurrently, increased emphasis on product safety and preservation across industries such as food & beverage, pharmaceuticals, and electronics necessitates advanced protective solutions. Emerging trends like sustainable materials and intelligent packaging, featuring real-time monitoring, are actively reshaping the market. While challenges like raw material price volatility and stringent environmental regulations persist, the market outlook remains favorable. The market is segmented by material (plastic, paper & paperboard, others), product (rigid, flexible), and end-user vertical (food & beverage, industrial, pharmaceuticals, consumer electronics, beauty & home care, others). The flexible packaging segment is anticipated to lead due to its versatility and cost-effectiveness. The food & beverage industry represents a substantial end-user segment, driven by the critical need for quality preservation. Key industry players are investing in R&D to foster innovation and sustainability. The Asia-Pacific region is expected to witness considerable growth due to economic expansion and industrialization.

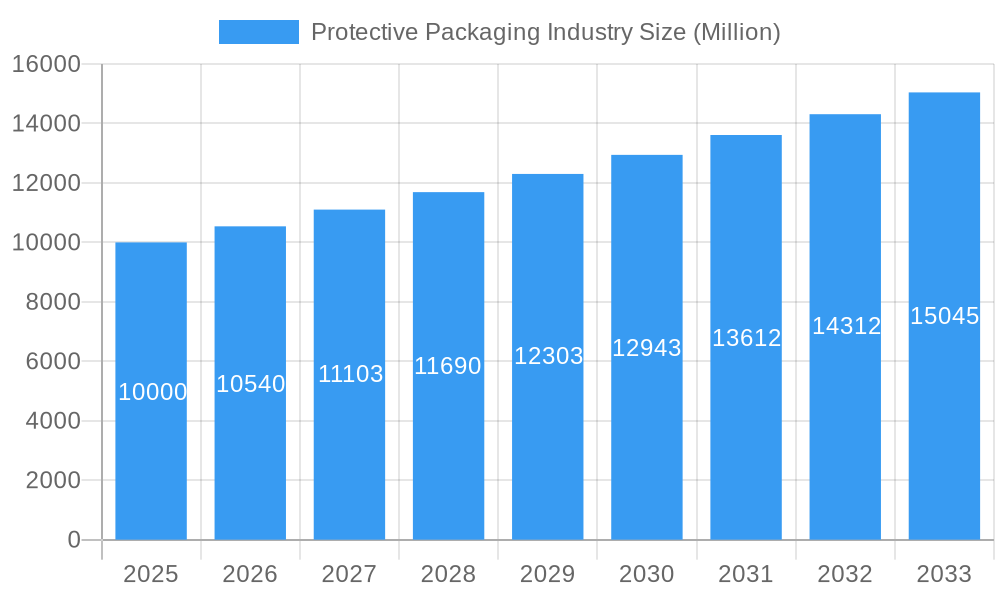

Protective Packaging Industry Market Size (In Billion)

The competitive environment features a mix of large corporations and specialized firms. Mergers and acquisitions are prevalent as companies seek to broaden product offerings and global presence. Enhanced supply chain resilience and a focus on minimizing shipping damage further bolster market growth. Despite potential short-term impacts from economic fluctuations, the long-term prospects for protective packaging are robust, underscored by the fundamental requirement for product protection across all sectors. Continuous innovation in materials, design, and technology ensures the industry's adaptability to evolving consumer and business demands. Detailed regional analysis will enable more precise market forecasting.

Protective Packaging Industry Company Market Share

Protective Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global protective packaging industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils key trends, challenges, and opportunities shaping the future of protective packaging. The market is valued at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%. Key players analyzed include Sonoco Products Company, Smurfit Kappa Group, Storopack Hans Reichenecker GmbH, Pro-Pac Packaging Limited, DS Smith PLC, Huhtamaki Group, Riverside Paper Co, Pregis Corporation, International Paper Company, Signode Protective Packaging Solutions, Crown Holdings Inc, Intertape Polymer Group Inc, and Sealed Air Corporation. This is not an exhaustive list.

Protective Packaging Industry Market Dynamics & Concentration

The protective packaging market is characterized by a moderately concentrated landscape, with several major players holding significant market share. The industry's dynamics are driven by innovation in materials and design, stringent regulatory frameworks concerning sustainability and material safety, and the constant emergence of product substitutes. End-user trends, particularly towards e-commerce and customized packaging solutions, are significant growth drivers. Mergers and acquisitions (M&A) are common, reflecting the industry's consolidation and pursuit of economies of scale.

- Market Concentration: The top 10 players account for approximately xx% of the global market share in 2025.

- Innovation Drivers: Focus on sustainable materials (bioplastics, recycled content), lightweighting for cost and environmental benefits, and intelligent packaging solutions with integrated sensors and traceability.

- Regulatory Frameworks: Growing regulations concerning recyclability, compostability, and the use of specific materials (e.g., restrictions on certain plastics) are shaping product development and material sourcing.

- Product Substitutes: The rise of alternative packaging materials and technologies, such as reusable containers and biodegradable options, presents competitive pressure.

- End-User Trends: E-commerce boom driving demand for robust and secure packaging, along with customized packaging for enhanced brand experience.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024, reflecting a trend towards consolidation and expansion of market reach.

Protective Packaging Industry Industry Trends & Analysis

The protective packaging market is experiencing robust growth, propelled by several key factors. E-commerce expansion continues to fuel demand for reliable shipping solutions, driving innovation in cushioning materials and packaging designs. Technological advancements are leading to lighter, more sustainable, and efficient packaging materials. Consumer preferences are shifting towards eco-friendly and ethically sourced packaging, placing pressure on manufacturers to adopt sustainable practices. Competitive dynamics are intense, with companies vying for market share through innovation, cost optimization, and strategic partnerships. The market is witnessing a significant shift towards sustainable and eco-friendly packaging options, driven by increasing consumer awareness and stringent environmental regulations.

- Market Growth Drivers: E-commerce growth, rising consumer spending, increasing demand for fragile goods protection.

- Technological Disruptions: Advancements in materials science, automation, and digital printing are transforming packaging design and production processes.

- Consumer Preferences: Growing demand for sustainable and convenient packaging solutions, impacting material selection and product design.

- Competitive Dynamics: Intense competition among established players and emerging companies, leading to price wars and innovation races.

Leading Markets & Segments in Protective Packaging Industry

The North American region currently dominates the protective packaging market, followed by Europe and Asia Pacific. Within segments, the Food and Beverage sector accounts for the largest share, driven by stringent safety and preservation requirements. Plastic remains the most widely used material, although the demand for sustainable alternatives is growing rapidly. Rigid packaging holds a larger market share compared to flexible packaging, though the latter is experiencing faster growth due to its versatility.

- Key Drivers for North American Dominance: Strong e-commerce infrastructure, high consumer spending, and established manufacturing base.

- Food and Beverage Segment Dominance: Strict regulations and the need to preserve product integrity are key drivers.

- Plastic Material Dominance: Cost-effectiveness, versatility, and established infrastructure contribute to its widespread use.

- Rigid Packaging Dominance: Offers superior protection for fragile goods and greater branding opportunities.

Protective Packaging Industry Product Developments

Recent product innovations focus on sustainable materials (bio-based plastics, recycled paperboard), improved cushioning technologies (air pillows, void-fill systems), and intelligent packaging features (sensors for temperature and humidity monitoring). These advancements enhance product protection, reduce environmental impact, and improve supply chain visibility.

Key Drivers of Protective Packaging Industry Growth

Growth is primarily driven by e-commerce expansion, the rising demand for fragile goods protection, increased consumer spending, and stringent regulatory compliance requirements mandating sustainable packaging solutions. Technological advancements in materials and processes further enhance efficiency and sustainability.

Challenges in the Protective Packaging Industry Market

Fluctuating raw material prices, stringent environmental regulations imposing higher production costs, intense competition, and the need to balance sustainability with cost-effectiveness pose significant challenges. Supply chain disruptions and geopolitical instability further complicate the operational landscape. These factors can impact margins and lead to production delays.

Emerging Opportunities in Protective Packaging Industry

The industry is witnessing emerging opportunities in sustainable packaging solutions, personalized packaging, and the integration of smart technologies. Strategic partnerships, market expansion into developing economies, and the development of innovative packaging designs are key growth catalysts.

Leading Players in the Protective Packaging Industry Sector

- Sonoco Products Company

- Smurfit Kappa Group

- Storopack Hans Reichenecker GmbH

- Pro-Pac Packaging Limited

- DS Smith PLC

- Huhtamaki Group

- Riverside Paper Co

- Pregis Corporation

- International Paper Company

- Signode Protective Packaging Solutions

- Crown Holdings Inc

- Intertape Polymer Group Inc

- Sealed Air Corporation

Key Milestones in Protective Packaging Industry Industry

- 2020: Increased focus on sustainable packaging solutions driven by heightened consumer awareness and stricter regulations.

- 2021: Several key players invested heavily in R&D for biodegradable and compostable packaging alternatives.

- 2022: Significant M&A activity consolidated market share among leading players.

- 2023: Launch of several innovative packaging solutions incorporating smart technologies and improved cushioning systems.

Strategic Outlook for Protective Packaging Industry Market

The protective packaging market presents significant long-term growth potential, driven by evolving consumer preferences, technological advancements, and the continued expansion of e-commerce. Companies that effectively integrate sustainability, innovation, and strategic partnerships are poised to capitalize on these opportunities and secure a leading position in this dynamic market.

Protective Packaging Industry Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Other Material Types

-

2. Product

-

2.1. Rigid

- 2.1.1. Corrugated Paperboard Protectors

- 2.1.2. Molded Pulp

- 2.1.3. Insulated Shipping Containers

- 2.1.4. Other Product Types

-

2.2. Flexible

- 2.2.1. Protective Mailers

- 2.2.2. Bubble Wraps

- 2.2.3. Air Pillows/Air Bags

- 2.2.4. Paper Fill

- 2.2.5. Other Fl

-

2.3. Foam

- 2.3.1. Molded Foam

- 2.3.2. Foam in Place (FIP)

- 2.3.3. Loose Fill

- 2.3.4. Foam Rolls/Sheets

- 2.3.5. Other Types of Foam (Corner Blocks, etc.)

-

2.1. Rigid

-

3. End-user Vertical

- 3.1. Food and Beverage

- 3.2. Industrial

- 3.3. Pharmaceuticals

- 3.4. Consumer Electronics

- 3.5. Beauty and Home Care

- 3.6. Other End-user Verticals

Protective Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Protective Packaging Industry Regional Market Share

Geographic Coverage of Protective Packaging Industry

Protective Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Trend of E-Commerce

- 3.3. Market Restrains

- 3.3.1. ; Alternative Forms of Packaging

- 3.4. Market Trends

- 3.4.1. Plastic-based Protective Packaging is Expected to Occupy Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Rigid

- 5.2.1.1. Corrugated Paperboard Protectors

- 5.2.1.2. Molded Pulp

- 5.2.1.3. Insulated Shipping Containers

- 5.2.1.4. Other Product Types

- 5.2.2. Flexible

- 5.2.2.1. Protective Mailers

- 5.2.2.2. Bubble Wraps

- 5.2.2.3. Air Pillows/Air Bags

- 5.2.2.4. Paper Fill

- 5.2.2.5. Other Fl

- 5.2.3. Foam

- 5.2.3.1. Molded Foam

- 5.2.3.2. Foam in Place (FIP)

- 5.2.3.3. Loose Fill

- 5.2.3.4. Foam Rolls/Sheets

- 5.2.3.5. Other Types of Foam (Corner Blocks, etc.)

- 5.2.1. Rigid

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Industrial

- 5.3.3. Pharmaceuticals

- 5.3.4. Consumer Electronics

- 5.3.5. Beauty and Home Care

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.2. Paper and Paperboard

- 6.1.3. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Rigid

- 6.2.1.1. Corrugated Paperboard Protectors

- 6.2.1.2. Molded Pulp

- 6.2.1.3. Insulated Shipping Containers

- 6.2.1.4. Other Product Types

- 6.2.2. Flexible

- 6.2.2.1. Protective Mailers

- 6.2.2.2. Bubble Wraps

- 6.2.2.3. Air Pillows/Air Bags

- 6.2.2.4. Paper Fill

- 6.2.2.5. Other Fl

- 6.2.3. Foam

- 6.2.3.1. Molded Foam

- 6.2.3.2. Foam in Place (FIP)

- 6.2.3.3. Loose Fill

- 6.2.3.4. Foam Rolls/Sheets

- 6.2.3.5. Other Types of Foam (Corner Blocks, etc.)

- 6.2.1. Rigid

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Food and Beverage

- 6.3.2. Industrial

- 6.3.3. Pharmaceuticals

- 6.3.4. Consumer Electronics

- 6.3.5. Beauty and Home Care

- 6.3.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.2. Paper and Paperboard

- 7.1.3. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Rigid

- 7.2.1.1. Corrugated Paperboard Protectors

- 7.2.1.2. Molded Pulp

- 7.2.1.3. Insulated Shipping Containers

- 7.2.1.4. Other Product Types

- 7.2.2. Flexible

- 7.2.2.1. Protective Mailers

- 7.2.2.2. Bubble Wraps

- 7.2.2.3. Air Pillows/Air Bags

- 7.2.2.4. Paper Fill

- 7.2.2.5. Other Fl

- 7.2.3. Foam

- 7.2.3.1. Molded Foam

- 7.2.3.2. Foam in Place (FIP)

- 7.2.3.3. Loose Fill

- 7.2.3.4. Foam Rolls/Sheets

- 7.2.3.5. Other Types of Foam (Corner Blocks, etc.)

- 7.2.1. Rigid

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Food and Beverage

- 7.3.2. Industrial

- 7.3.3. Pharmaceuticals

- 7.3.4. Consumer Electronics

- 7.3.5. Beauty and Home Care

- 7.3.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.2. Paper and Paperboard

- 8.1.3. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Rigid

- 8.2.1.1. Corrugated Paperboard Protectors

- 8.2.1.2. Molded Pulp

- 8.2.1.3. Insulated Shipping Containers

- 8.2.1.4. Other Product Types

- 8.2.2. Flexible

- 8.2.2.1. Protective Mailers

- 8.2.2.2. Bubble Wraps

- 8.2.2.3. Air Pillows/Air Bags

- 8.2.2.4. Paper Fill

- 8.2.2.5. Other Fl

- 8.2.3. Foam

- 8.2.3.1. Molded Foam

- 8.2.3.2. Foam in Place (FIP)

- 8.2.3.3. Loose Fill

- 8.2.3.4. Foam Rolls/Sheets

- 8.2.3.5. Other Types of Foam (Corner Blocks, etc.)

- 8.2.1. Rigid

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Food and Beverage

- 8.3.2. Industrial

- 8.3.3. Pharmaceuticals

- 8.3.4. Consumer Electronics

- 8.3.5. Beauty and Home Care

- 8.3.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.2. Paper and Paperboard

- 9.1.3. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Rigid

- 9.2.1.1. Corrugated Paperboard Protectors

- 9.2.1.2. Molded Pulp

- 9.2.1.3. Insulated Shipping Containers

- 9.2.1.4. Other Product Types

- 9.2.2. Flexible

- 9.2.2.1. Protective Mailers

- 9.2.2.2. Bubble Wraps

- 9.2.2.3. Air Pillows/Air Bags

- 9.2.2.4. Paper Fill

- 9.2.2.5. Other Fl

- 9.2.3. Foam

- 9.2.3.1. Molded Foam

- 9.2.3.2. Foam in Place (FIP)

- 9.2.3.3. Loose Fill

- 9.2.3.4. Foam Rolls/Sheets

- 9.2.3.5. Other Types of Foam (Corner Blocks, etc.)

- 9.2.1. Rigid

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Food and Beverage

- 9.3.2. Industrial

- 9.3.3. Pharmaceuticals

- 9.3.4. Consumer Electronics

- 9.3.5. Beauty and Home Care

- 9.3.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East Protective Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.2. Paper and Paperboard

- 10.1.3. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Rigid

- 10.2.1.1. Corrugated Paperboard Protectors

- 10.2.1.2. Molded Pulp

- 10.2.1.3. Insulated Shipping Containers

- 10.2.1.4. Other Product Types

- 10.2.2. Flexible

- 10.2.2.1. Protective Mailers

- 10.2.2.2. Bubble Wraps

- 10.2.2.3. Air Pillows/Air Bags

- 10.2.2.4. Paper Fill

- 10.2.2.5. Other Fl

- 10.2.3. Foam

- 10.2.3.1. Molded Foam

- 10.2.3.2. Foam in Place (FIP)

- 10.2.3.3. Loose Fill

- 10.2.3.4. Foam Rolls/Sheets

- 10.2.3.5. Other Types of Foam (Corner Blocks, etc.)

- 10.2.1. Rigid

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Food and Beverage

- 10.3.2. Industrial

- 10.3.3. Pharmaceuticals

- 10.3.4. Consumer Electronics

- 10.3.5. Beauty and Home Care

- 10.3.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sonoco Products Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smurfit Kappa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Storopack Hans Reichenecker Gmbh

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pro-Pac Packaging Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huhtamaki Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Riverside Paper Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pregis Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 International Paper Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Signode Protective Packaging Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Crown Holdings Inc *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Intertape Polymer Group Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sealed Air Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Sonoco Products Company

List of Figures

- Figure 1: Global Protective Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Protective Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Protective Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Protective Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 5: North America Protective Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Protective Packaging Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 7: North America Protective Packaging Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Protective Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Protective Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Protective Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Protective Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Protective Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 13: Europe Protective Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Protective Packaging Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 15: Europe Protective Packaging Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Protective Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Protective Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Protective Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Protective Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Protective Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: Asia Pacific Protective Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Pacific Protective Packaging Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Protective Packaging Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Protective Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Protective Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Protective Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Latin America Protective Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Protective Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 29: Latin America Protective Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Latin America Protective Packaging Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Protective Packaging Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Protective Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Protective Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Protective Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 35: Middle East Protective Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East Protective Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 37: Middle East Protective Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Middle East Protective Packaging Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 39: Middle East Protective Packaging Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East Protective Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Protective Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Protective Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Protective Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Global Protective Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Protective Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Protective Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Protective Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global Protective Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Protective Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Protective Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: Global Protective Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Protective Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Protective Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Protective Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: Global Protective Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 15: Global Protective Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Protective Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Protective Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global Protective Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 19: Global Protective Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Protective Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Protective Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 22: Global Protective Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global Protective Packaging Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Protective Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Protective Packaging Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Protective Packaging Industry?

Key companies in the market include Sonoco Products Company, Smurfit Kappa Group, Storopack Hans Reichenecker Gmbh, Pro-Pac Packaging Limited, DS Smith PLC, Huhtamaki Group, Riverside Paper Co, Pregis Corporation, International Paper Company, Signode Protective Packaging Solutions, Crown Holdings Inc *List Not Exhaustive, Intertape Polymer Group Inc, Sealed Air Corporation.

3. What are the main segments of the Protective Packaging Industry?

The market segments include Material Type, Product, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.92 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Trend of E-Commerce.

6. What are the notable trends driving market growth?

Plastic-based Protective Packaging is Expected to Occupy Significant Market Share.

7. Are there any restraints impacting market growth?

; Alternative Forms of Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Protective Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Protective Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Protective Packaging Industry?

To stay informed about further developments, trends, and reports in the Protective Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence