Key Insights

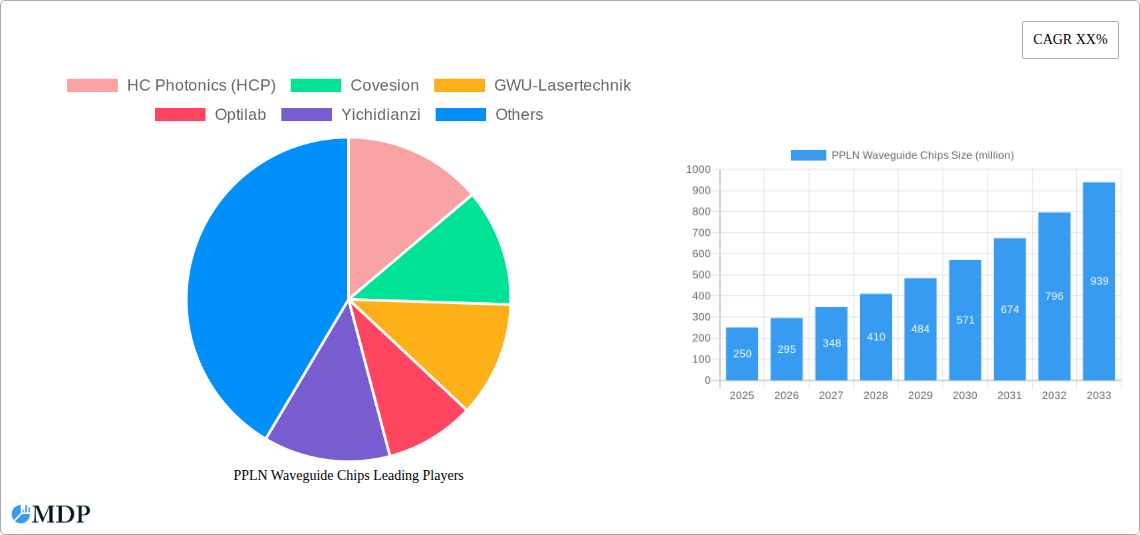

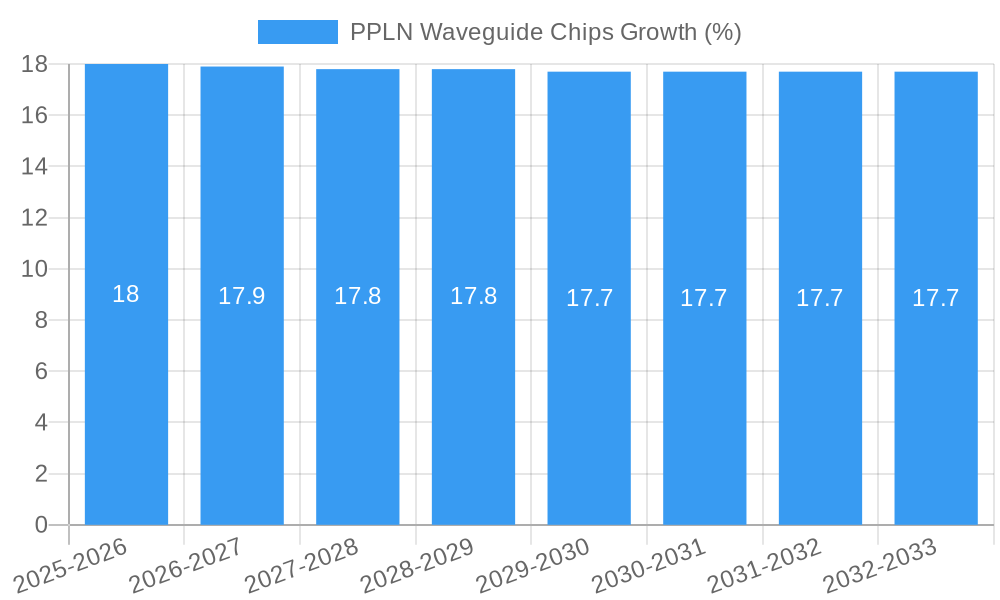

The PPLN Waveguide Chips market is poised for significant expansion, projected to reach an estimated $250 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18% over the forecast period from 2025 to 2033. This substantial growth is primarily driven by the escalating demand for high-speed data processing and the widespread adoption of 5G communication technologies. The intricate capabilities of PPLN waveguides in enabling efficient nonlinear optical processes are crucial for advancing applications requiring precise wavelength conversion and signal amplification, directly benefiting the infrastructure development of next-generation networks. Furthermore, the increasing integration of Big Data processing solutions across various industries necessitates advanced optical components that can handle the immense volume and velocity of data, further fueling market expansion. Key market players are actively investing in research and development to enhance waveguide performance, reduce fabrication costs, and explore novel applications, contributing to the market's dynamic nature.

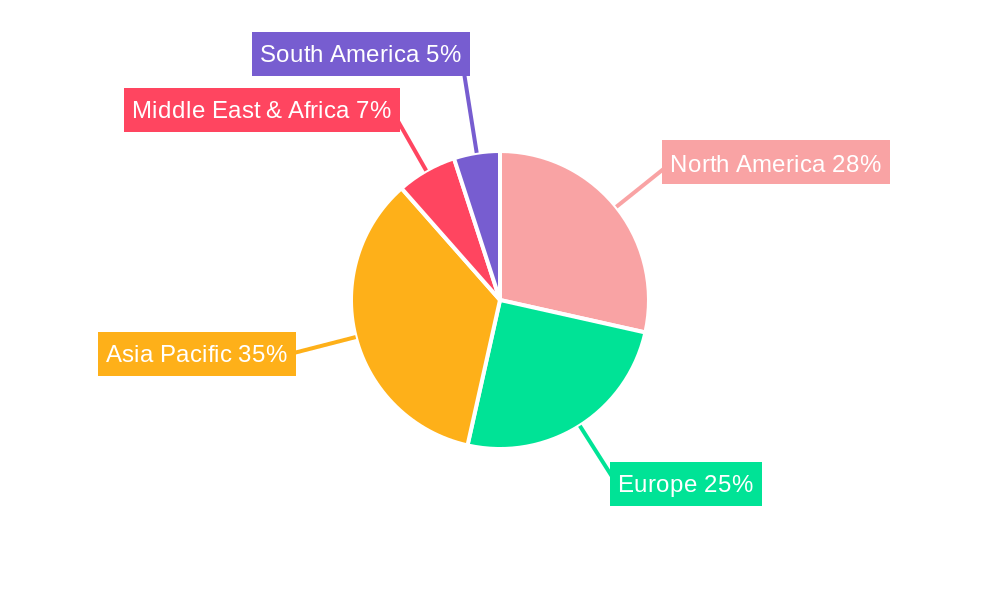

The market's trajectory is further shaped by evolving technological trends and strategic investments. The proliferation of optical interconnects in data centers and the growing interest in quantum computing present lucrative opportunities for PPLN waveguide chip manufacturers. While the market benefits from these growth drivers, certain restraints, such as the high initial cost of specialized manufacturing equipment and the need for skilled expertise in fabricating these complex devices, could pose challenges. However, ongoing advancements in fabrication techniques and the growing number of industry collaborations are expected to mitigate these limitations. Regionally, Asia Pacific is anticipated to lead market growth, driven by substantial investments in 5G infrastructure and a burgeoning electronics manufacturing sector, particularly in China and Japan. North America and Europe are also expected to witness steady growth due to strong R&D capabilities and the presence of leading technology companies. The market segmentation reveals a balanced demand across different applications, with 5G Communication and Big Data Processing emerging as dominant segments, while innovation in Types such as Proton in-diffused (RPE) Waveguides and Ridge-Waveguides will continue to drive product development.

Unveiling the PPLN Waveguide Chips Market: A Comprehensive Analysis (2019-2033)

This in-depth report offers a definitive guide to the PPLN waveguide chips market, a critical component for advanced photonic applications. Dive deep into market dynamics, technological advancements, and strategic imperatives shaping the future of nonlinear optics and photonics. Explore the burgeoning demand for frequency conversion, telecommunications components, and optical signal processing driven by the relentless growth of 5G communication, big data processing, and emerging applications. With comprehensive coverage of proton in-diffused (RPE) waveguides and ridge-waveguides, this report is an indispensable resource for stakeholders seeking to capitalize on this high-growth sector. Gain actionable insights from market leaders like HC Photonics (HCP), Covesion, GWU-Lasertechnik, Optilab, and Yichidianzi.

PPLN Waveguide Chips Market Dynamics & Concentration

The PPLN waveguide chips market is characterized by a dynamic interplay of innovation, strategic partnerships, and evolving end-user demands. Market concentration is moderately high, with a few key players dominating the landscape, contributing to an estimated 500 million market share in the base year 2025. Innovation drivers are primarily fueled by the escalating need for higher bandwidth, lower power consumption, and compact optical solutions across various applications. Regulatory frameworks, while generally supportive of technological advancement, can influence manufacturing processes and material sourcing, with an estimated 300 million impact on operational costs. Product substitutes, though present in nascent stages, have yet to offer the same level of performance and integration as PPLN waveguides for high-efficiency nonlinear optical processes. End-user trends lean towards miniaturization, increased functionality, and cost-effectiveness, pushing manufacturers to innovate rapidly. Mergers and acquisitions (M&A) activities are expected to see a significant uptick, with an estimated 15 deal counts projected over the forecast period, aimed at consolidating market share, acquiring proprietary technologies, and expanding geographical reach. This consolidation will likely reshape market leadership and foster new collaborative ecosystems.

PPLN Waveguide Chips Industry Trends & Analysis

The PPLN waveguide chips industry is poised for substantial expansion, driven by a confluence of technological breakthroughs and robust market demand. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025–2033. This impressive growth is underpinned by several key market growth drivers. The relentless expansion of 5G communication networks necessitates high-performance optical components for signal processing and wavelength conversion, a segment estimated to contribute 2 billion to the market. Similarly, the exponential growth in big data processing requires advanced optical solutions for data transmission and manipulation, opening up another significant revenue stream estimated at 1.5 billion. Technological disruptions, such as advancements in material science for improved nonlinear coefficients and fabrication techniques for enhanced waveguide uniformity, are continuously pushing the boundaries of performance. Consumer preferences are increasingly favoring smaller form factors, lower insertion losses, and higher power handling capabilities, directly influencing product development strategies. Competitive dynamics are intensifying, with both established players and emerging innovators vying for market dominance through product differentiation and strategic pricing. Market penetration is expected to rise significantly, reaching an estimated 60% of its potential market by 2033, driven by increasing adoption in diverse industrial and scientific applications. The historical period (2019–2024) saw foundational growth, laying the groundwork for the accelerated expansion anticipated in the coming years. The estimated market size in the base year 2025 is 8 billion, with projections to reach 20 billion by 2033.

Leading Markets & Segments in PPLN Waveguide Chips

The Asia-Pacific region stands as the dominant market for PPLN waveguide chips, driven by its robust manufacturing capabilities, significant investments in telecommunications infrastructure, and a burgeoning demand for advanced optical technologies. Within this region, China is a key country, accounting for an estimated 40% of the global market share in the base year 2025, supported by government initiatives promoting indigenous technological development and extensive deployment of 5G networks.

Application-wise Dominance:

- 5G Communication: This segment is the primary growth engine, representing an estimated 60% of the market. Key drivers include the global rollout of 5G infrastructure, which demands high-speed optical transceivers, signal repeaters, and frequency converters. Economic policies favoring digital transformation and substantial investments in telecommunications infrastructure by governments and private entities are critical accelerators.

- Big Data Processing: This segment is rapidly gaining traction, projected to capture 25% of the market. The increasing volume of data generated and processed necessitates efficient optical interconnects and signal manipulation capabilities, driving demand for PPLN waveguides in data centers and high-performance computing.

- Others: This segment encompasses applications in scientific research, medical diagnostics, laser systems, and quantum technologies, contributing an estimated 15% to the market. Advancements in these niche areas are continuously expanding the utility of PPLN waveguide chips.

Type-wise Dominance:

- Proton in-diffused (RPE) Waveguides: These waveguides hold a dominant position, estimated at 70% of the market share. Their superior performance in terms of nonlinear conversion efficiency, low insertion loss, and robustness makes them ideal for demanding applications. Continuous improvements in fabrication processes are further solidifying their lead.

- Ridge-Waveguides: While currently holding a smaller share of 30%, ridge-waveguides are experiencing significant growth. Their simpler fabrication process and cost-effectiveness make them attractive for certain applications, and ongoing research aims to enhance their nonlinear performance to compete more directly with RPE waveguides.

The dominance of these segments is further amplified by factors such as a skilled workforce, a well-established supply chain for optical components, and a strong research and development ecosystem focused on photonic integration.

PPLN Waveguide Chips Product Developments

Recent product developments in the PPLN waveguide chips sector are characterized by a strong emphasis on enhancing nonlinear conversion efficiency, expanding operational bandwidth, and improving integration capabilities. Manufacturers are innovating to create smaller, more robust waveguide designs capable of handling higher optical powers with minimal loss. Key technological trends include the development of periodically poled lithium niobate (PPLN) with advanced poling techniques to achieve finer domain structures for wider wavelength tuning. These advancements are directly translating into competitive advantages, enabling more compact and efficient devices for applications like optical parametric oscillators (OPOs), second-harmonic generation (SHG), and wavelength conversion for telecommunications. The market fit for these innovations is exceptionally strong, driven by the persistent demand for higher performance and smaller form factors in next-generation optical systems.

Key Drivers of PPLN Waveguide Chips Growth

The PPLN waveguide chips market is propelled by several powerful growth drivers. Technologically, the insatiable demand for higher bandwidth in 5G communication and the ever-increasing data volumes in big data processing are paramount. Innovations in nonlinear optics, such as improved poling techniques and material engineering of lithium niobate, are enabling greater efficiency and wider wavelength tunability. Economically, substantial global investments in upgrading telecommunications infrastructure and expanding data center capacity are directly fueling market expansion. Regulatory factors, including government initiatives promoting technological self-sufficiency and the development of advanced manufacturing, also play a supportive role. The continuous drive for miniaturization and higher performance in photonic devices further accelerates adoption.

Challenges in the PPLN Waveguide Chips Market

Despite the promising growth, the PPLN waveguide chips market faces several challenges. Regulatory hurdles related to the manufacturing and handling of specialized materials can add complexity and cost. Supply chain issues, particularly concerning the availability and consistency of high-quality lithium niobate wafers, can impact production timelines and costs, with an estimated 100 million potential disruption. Competitive pressures from alternative nonlinear optical technologies, though currently less efficient for many applications, necessitate continuous innovation and cost optimization. Furthermore, the high initial investment required for advanced fabrication equipment can be a barrier for new entrants. The market also faces challenges in scaling up production while maintaining stringent quality control, impacting the ability to meet surging demand, with a potential loss of 200 million in untapped revenue.

Emerging Opportunities in PPLN Waveguide Chips

The PPLN waveguide chips market is ripe with emerging opportunities for long-term growth. Technological breakthroughs in areas like mid-infrared generation and quantum computing components are opening up entirely new application frontiers. Strategic partnerships between PPLN waveguide manufacturers and leading telecommunications companies, cloud service providers, and research institutions are crucial for co-developing next-generation solutions and accelerating market adoption. Market expansion into emerging economies with rapidly developing digital infrastructure presents significant untapped potential, estimated to unlock an additional 1 billion in revenue over the forecast period. Furthermore, the development of integrated photonic circuits incorporating PPLN waveguides promises to revolutionize optical signal processing, creating synergistic growth opportunities.

Leading Players in the PPLN Waveguide Chips Sector

- HC Photonics (HCP)

- Covesion

- GWU-Lasertechnik

- Optilab

- Yichidianzi

Key Milestones in PPLN Waveguide Chips Industry

- 2019: Significant advancements in poling techniques for higher nonlinear coefficients reported by leading research institutions.

- 2020: Increased adoption of PPLN waveguides in high-speed optical transceivers for data centers.

- 2021: Major manufacturers announce expanded production capacities to meet growing demand from 5G deployments.

- 2022: Breakthroughs in miniaturization of PPLN waveguide devices for portable sensing applications.

- 2023: Growing interest in PPLN waveguides for quantum information processing applications.

- 2024: Strategic partnerships formed to accelerate the development of integrated photonic chips incorporating PPLN technology.

Strategic Outlook for PPLN Waveguide Chips Market

The strategic outlook for the PPLN waveguide chips market is exceptionally positive, driven by accelerating technological advancements and expanding application horizons. The continued growth of 5G communication and big data processing will remain primary demand catalysts. Strategic opportunities lie in the further development of tunable and broadband PPLN waveguides and their integration into complex photonic systems. Collaborations with end-users to tailor waveguide designs for specific niche applications, such as advanced medical imaging and scientific instrumentation, will unlock significant value. The ongoing trend towards denser and more efficient optical networks will ensure sustained demand for PPLN waveguide chips, positioning them as a cornerstone technology for future photonic innovations. The market is projected to grow from an estimated 8 billion in 2025 to over 20 billion by 2033, indicating robust long-term potential.

PPLN Waveguide Chips Segmentation

-

1. Application

- 1.1. 5G Communication

- 1.2. Big Data Processing

- 1.3. Others

-

2. Types

- 2.1. Proton in-diffused (RPE) Waveguides

- 2.2. Ridge-Waveguides

PPLN Waveguide Chips Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PPLN Waveguide Chips REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PPLN Waveguide Chips Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. 5G Communication

- 5.1.2. Big Data Processing

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Proton in-diffused (RPE) Waveguides

- 5.2.2. Ridge-Waveguides

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America PPLN Waveguide Chips Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. 5G Communication

- 6.1.2. Big Data Processing

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Proton in-diffused (RPE) Waveguides

- 6.2.2. Ridge-Waveguides

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America PPLN Waveguide Chips Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. 5G Communication

- 7.1.2. Big Data Processing

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Proton in-diffused (RPE) Waveguides

- 7.2.2. Ridge-Waveguides

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe PPLN Waveguide Chips Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. 5G Communication

- 8.1.2. Big Data Processing

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Proton in-diffused (RPE) Waveguides

- 8.2.2. Ridge-Waveguides

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa PPLN Waveguide Chips Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. 5G Communication

- 9.1.2. Big Data Processing

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Proton in-diffused (RPE) Waveguides

- 9.2.2. Ridge-Waveguides

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific PPLN Waveguide Chips Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. 5G Communication

- 10.1.2. Big Data Processing

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Proton in-diffused (RPE) Waveguides

- 10.2.2. Ridge-Waveguides

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HC Photonics (HCP)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Covesion

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GWU-Lasertechnik

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Optilab

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yichidianzi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 HC Photonics (HCP)

List of Figures

- Figure 1: Global PPLN Waveguide Chips Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America PPLN Waveguide Chips Revenue (million), by Application 2024 & 2032

- Figure 3: North America PPLN Waveguide Chips Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America PPLN Waveguide Chips Revenue (million), by Types 2024 & 2032

- Figure 5: North America PPLN Waveguide Chips Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America PPLN Waveguide Chips Revenue (million), by Country 2024 & 2032

- Figure 7: North America PPLN Waveguide Chips Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America PPLN Waveguide Chips Revenue (million), by Application 2024 & 2032

- Figure 9: South America PPLN Waveguide Chips Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America PPLN Waveguide Chips Revenue (million), by Types 2024 & 2032

- Figure 11: South America PPLN Waveguide Chips Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America PPLN Waveguide Chips Revenue (million), by Country 2024 & 2032

- Figure 13: South America PPLN Waveguide Chips Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe PPLN Waveguide Chips Revenue (million), by Application 2024 & 2032

- Figure 15: Europe PPLN Waveguide Chips Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe PPLN Waveguide Chips Revenue (million), by Types 2024 & 2032

- Figure 17: Europe PPLN Waveguide Chips Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe PPLN Waveguide Chips Revenue (million), by Country 2024 & 2032

- Figure 19: Europe PPLN Waveguide Chips Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa PPLN Waveguide Chips Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa PPLN Waveguide Chips Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa PPLN Waveguide Chips Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa PPLN Waveguide Chips Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa PPLN Waveguide Chips Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa PPLN Waveguide Chips Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific PPLN Waveguide Chips Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific PPLN Waveguide Chips Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific PPLN Waveguide Chips Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific PPLN Waveguide Chips Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific PPLN Waveguide Chips Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific PPLN Waveguide Chips Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PPLN Waveguide Chips Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global PPLN Waveguide Chips Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global PPLN Waveguide Chips Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global PPLN Waveguide Chips Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global PPLN Waveguide Chips Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global PPLN Waveguide Chips Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global PPLN Waveguide Chips Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global PPLN Waveguide Chips Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global PPLN Waveguide Chips Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global PPLN Waveguide Chips Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global PPLN Waveguide Chips Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global PPLN Waveguide Chips Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global PPLN Waveguide Chips Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global PPLN Waveguide Chips Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global PPLN Waveguide Chips Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global PPLN Waveguide Chips Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global PPLN Waveguide Chips Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global PPLN Waveguide Chips Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global PPLN Waveguide Chips Revenue million Forecast, by Country 2019 & 2032

- Table 41: China PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific PPLN Waveguide Chips Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PPLN Waveguide Chips?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the PPLN Waveguide Chips?

Key companies in the market include HC Photonics (HCP), Covesion, GWU-Lasertechnik, Optilab, Yichidianzi.

3. What are the main segments of the PPLN Waveguide Chips?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PPLN Waveguide Chips," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PPLN Waveguide Chips report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PPLN Waveguide Chips?

To stay informed about further developments, trends, and reports in the PPLN Waveguide Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence