Key Insights

The personal care contract manufacturing industry is experiencing robust growth, driven by increasing demand for personalized and customized cosmetic and personal care products. The market, currently valued at approximately $XXX million (estimated based on common market sizes for related industries and the provided CAGR), is projected to exhibit a compound annual growth rate (CAGR) of 8.11% from 2025 to 2033. This expansion is fueled by several key factors, including the rising popularity of natural and organic personal care products, the growing preference for convenient and ready-to-use formulations, and the increasing outsourcing trend among personal care brands seeking to streamline operations and reduce costs. The significant presence of established players like PLZ Corp, McBride PLC, and Intercos SPA, alongside emerging companies, further underscores the industry's dynamism. Segmentation by service type (R&D, manufacturing, packaging) and product type (skincare, haircare, makeup) reveals diverse growth opportunities. Skincare and haircare remain dominant segments, reflecting escalating consumer interest in self-care and beauty regimens. Geographical expansion is another key driver, with North America and Europe currently leading the market, followed by the rapidly developing Asia-Pacific region. However, regulatory hurdles and fluctuating raw material costs represent potential restraints that could impact the industry's trajectory.

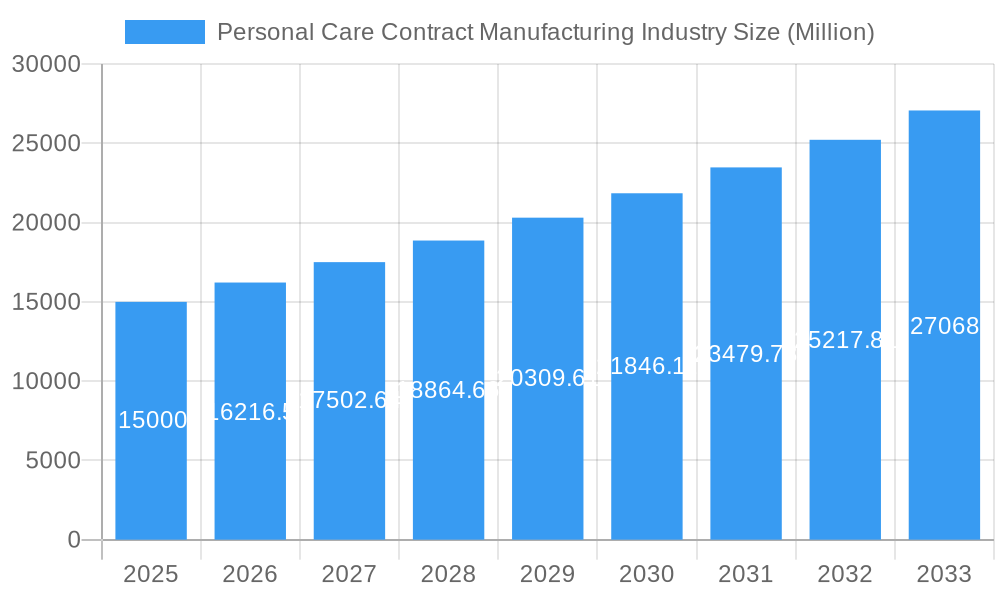

Personal Care Contract Manufacturing Industry Market Size (In Billion)

The industry's future hinges on innovation, sustainability, and technological advancements. The adoption of advanced manufacturing technologies, like automation and AI, will likely enhance efficiency and reduce production costs. A growing focus on eco-friendly packaging and sustainable sourcing practices will shape the competitive landscape, attracting environmentally conscious consumers. Furthermore, the integration of digital technologies for personalized product development and enhanced customer engagement will further drive market growth. Companies are increasingly adopting agile manufacturing strategies and collaborating across the value chain to meet evolving consumer preferences. This collaborative approach is essential for navigating the dynamic landscape and capitalizing on the projected market expansion through 2033.

Personal Care Contract Manufacturing Industry Company Market Share

Personal Care Contract Manufacturing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Personal Care Contract Manufacturing industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects market trends and growth opportunities up to 2033. The report analyzes market dynamics, leading players, and key milestones, delivering actionable intelligence for informed decision-making. The global market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Personal Care Contract Manufacturing Industry Market Dynamics & Concentration

The personal care contract manufacturing industry is characterized by a moderately concentrated market, with several large players holding significant market share. Key players like PLZ Corp, McBride PLC, and ALBEA SA compete alongside a large number of smaller, specialized firms. The industry is driven by innovation in formulations, packaging, and sustainable practices. Stringent regulatory frameworks governing ingredients and safety standards significantly influence operations. The growing demand for natural and organic products presents both opportunities and challenges, leading to increased competition and a focus on product differentiation. Mergers and acquisitions (M&A) are frequent, reflecting industry consolidation and the pursuit of scale and technological advancements. In 2024, the industry witnessed approximately xx M&A deals, indicating a continued trend of consolidation. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the global market, with the remaining xx% fragmented among numerous smaller participants.

Personal Care Contract Manufacturing Industry Industry Trends & Analysis

The personal care contract manufacturing market is experiencing robust and accelerating growth, primarily fueled by evolving consumer demand for highly personalized, premium, and ethically produced goods. Technological advancements, particularly in areas like AI-driven formulation development, advanced bio-ingredients, and sophisticated automated packaging solutions, are fundamentally reshaping the industry's operational and innovative landscape. Consumer preferences are undergoing a profound shift towards natural, organic, clean beauty, and demonstrably sustainable products, directly influencing manufacturers' R&D, sourcing, and production strategies. The market's competitive dynamics are intensifying, pushing companies to differentiate through cutting-edge innovation, optimized cost-effectiveness, and enhanced supply chain resilience and transparency. The global market is poised for significant expansion, projected to reach [Insert Specific Market Value Here] Million by 2033, underscoring the sector's inherent resilience and substantial expansion potential. This impressive growth trajectory is attributed to a confluence of factors, including rising disposable incomes in key developing economies, heightened consumer awareness regarding health and wellness, and the burgeoning popularity of bespoke and personalized beauty solutions. The strategic adoption of contract manufacturing services continues to surge, driven by the compelling advantages of cost-efficiency, scalability, and agility that these services offer to both established and emerging brands.

Leading Markets & Segments in Personal Care Contract Manufacturing Industry

The North American and European regions continue to assert their dominance in the global personal care contract manufacturing market. Within these mature yet dynamic markets, significant and sustained growth is being observed across several key segments:

-

By Service Type: While core manufacturing services continue to represent the largest segment due to inherent economies of scale and specialized expertise, there's a notable surge in demand for integrated R&D and formulation partnerships. Brands are increasingly seeking collaborative innovation to develop unique and competitive product offerings. Packaging & Allied Services are also experiencing substantial growth, driven by an escalating industry-wide focus on innovative, aesthetically pleasing, and environmentally responsible packaging solutions.

-

By Product Type: Skincare consistently holds the largest market share, reflecting its broad appeal and continuous innovation. Hair care and make-up & cosmetics follow closely. Other vital product categories, including personal hygiene essentials and advanced sun care formulations, are demonstrating steady and promising growth trajectories.

Key Drivers for Regional Dominance:

- Mature and affluent economies: High disposable incomes, sophisticated consumer bases, and deeply entrenched personal care markets create consistent demand.

- Robust and evolving regulatory frameworks: Ensure stringent product safety, quality, and consumer trust, fostering a stable environment for investment and growth.

- Advanced infrastructure: Well-developed industrial and logistical networks facilitate efficient manufacturing, quality control, and timely distribution across global supply chains.

The sustained dominance of these regions and segments is a direct result of a powerful combination of enduring consumer demand, sophisticated market infrastructure, and supportive regulatory environments.

Personal Care Contract Manufacturing Industry Product Developments

Recent product innovations focus on natural, organic, and sustainable formulations, catering to increasing consumer demand for environmentally conscious products. Advancements in packaging technology, such as sustainable materials and innovative designs, enhance product appeal and reduce environmental impact. Key competitive advantages include superior formulation expertise, faster turnaround times, and flexible manufacturing capabilities. Technological trends like AI-driven formulation development and automated manufacturing are transforming industry practices. The market fits the increased demand for personalized and customized products, leading to niche product development and flexible manufacturing strategies.

Key Drivers of Personal Care Contract Manufacturing Industry Growth

Several key factors fuel the growth of the personal care contract manufacturing industry:

- Technological advancements: Automation and innovative formulations drive efficiency and product differentiation.

- Economic growth: Rising disposable incomes, particularly in emerging markets, stimulate demand for personal care products.

- Favorable regulatory environment: Supportive policies incentivize industry growth and innovation. For example, incentives for sustainable practices are driving the adoption of eco-friendly manufacturing processes.

Challenges in the Personal Care Contract Manufacturing Industry Market

The industry faces challenges such as:

- Regulatory hurdles: Meeting stringent safety and labeling requirements involves significant costs and complexities.

- Supply chain disruptions: Global events can impact raw material availability and transportation, impacting production.

- Intense competition: The market is highly competitive, requiring continuous innovation and cost optimization to maintain profitability. The impact is estimated to reduce market growth by approximately xx% annually.

Emerging Opportunities in Personal Care Contract Manufacturing Industry

The personal care contract manufacturing industry is poised for significant future growth, driven by a compelling array of emerging opportunities:

- Technological breakthroughs: The integration of AI in formulation development, advancements in personalized product customization through data analytics, and the use of novel bio-based ingredients are creating entirely new product categories and market niches.

- Strategic partnerships and collaborations: Deeper, more integrated partnerships between contract manufacturers and brands are fostering co-creation, accelerating product innovation cycles, and enabling more effective market penetration strategies.

- Market expansion into high-growth regions: Untapped and rapidly growing potential in emerging markets across Asia, Latin America, and Africa presents lucrative expansion opportunities. The strategic entry and successful establishment in these markets are projected to significantly boost overall market growth by [Insert Specific Percentage Here]% in the next five years.

- Focus on Sustainability and Circular Economy: Innovations in eco-friendly packaging, biodegradable ingredients, and waste reduction initiatives are not only meeting consumer demand but also opening avenues for specialized manufacturing services.

Leading Players in the Personal Care Contract Manufacturing Industry Sector

- PLZ Corp

- McBride PLC

- Vistta Cosmetics

- CoValence Laboratories

- Colep Consumer Products

- ALBEA SA

- Fareva Group

- Powerpack Cosmetics

- Intercos SPA

- Voyant Beauty

- Hair Styling Applications SpA

- FORMULA CORP

- Clarion Cosmetics

- HCT Group

- [Insert New Leading Player Here]

- [Insert New Leading Player Here]

Key Milestones in Personal Care Contract Manufacturing Industry Industry

- April 2023: TruArcPartners' investment in Trademark Cosmetics (TCI) signals a trend of private equity investment driving industry consolidation and expansion.

- February 2023: BASF's showcasing of sustainable personal care solutions at PCHi highlights the growing focus on eco-friendly practices.

Strategic Outlook for Personal Care Contract Manufacturing Industry Market

The personal care contract manufacturing market is characterized by significant and sustained long-term growth potential. Key strategic imperatives for success include proactively capitalizing on emerging technological advancements, deeply embedding sustainable practices across all operational facets, and strategically expanding market presence into high-growth emerging economies. Companies that excel in navigating complex global supply chain dynamics, demonstrate agility in adapting to rapidly evolving consumer preferences and regulatory landscapes, and foster a culture of continuous innovation will be best positioned to thrive in this dynamic and competitive environment. A relentless focus on developing unique capabilities, forging strategic alliances, and delivering exceptional value will be crucial for securing a competitive edge and fully realizing the immense potential of this vibrant market.

Personal Care Contract Manufacturing Industry Segmentation

-

1. Service Type

- 1.1. R&D & Formulation

- 1.2. Manufacturing

- 1.3. Packaging & Allied Services

-

2. Product Type

- 2.1. Skin Care

- 2.2. Hair Care

- 2.3. Make-up & Cosmetics

- 2.4. Other Product Types

Personal Care Contract Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 4. Australia and New Zealand

- 5. Rest of the World

Personal Care Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Personal Care Contract Manufacturing Industry

Personal Care Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Skin Care Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. R&D & Formulation

- 5.1.2. Manufacturing

- 5.1.3. Packaging & Allied Services

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Skin Care

- 5.2.2. Hair Care

- 5.2.3. Make-up & Cosmetics

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. R&D & Formulation

- 6.1.2. Manufacturing

- 6.1.3. Packaging & Allied Services

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Skin Care

- 6.2.2. Hair Care

- 6.2.3. Make-up & Cosmetics

- 6.2.4. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. R&D & Formulation

- 7.1.2. Manufacturing

- 7.1.3. Packaging & Allied Services

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Skin Care

- 7.2.2. Hair Care

- 7.2.3. Make-up & Cosmetics

- 7.2.4. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. R&D & Formulation

- 8.1.2. Manufacturing

- 8.1.3. Packaging & Allied Services

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Skin Care

- 8.2.2. Hair Care

- 8.2.3. Make-up & Cosmetics

- 8.2.4. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. R&D & Formulation

- 9.1.2. Manufacturing

- 9.1.3. Packaging & Allied Services

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Skin Care

- 9.2.2. Hair Care

- 9.2.3. Make-up & Cosmetics

- 9.2.4. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of the World Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. R&D & Formulation

- 10.1.2. Manufacturing

- 10.1.3. Packaging & Allied Services

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Skin Care

- 10.2.2. Hair Care

- 10.2.3. Make-up & Cosmetics

- 10.2.4. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PLZ Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 McBride PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vistta Cosmetics*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CoValence Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colep Consumer Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ALBEA SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fareva Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powerpack Cosmetics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intercos SPA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Voyant Beauty

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hair Styling Applications SpA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FORMULA CORP

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Clarion Cosmetics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HCT Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 PLZ Corp

List of Figures

- Figure 1: Global Personal Care Contract Manufacturing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Care Contract Manufacturing Industry?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Personal Care Contract Manufacturing Industry?

Key companies in the market include PLZ Corp, McBride PLC, Vistta Cosmetics*List Not Exhaustive, CoValence Laboratories, Colep Consumer Products, ALBEA SA, Fareva Group, Powerpack Cosmetics, Intercos SPA, Voyant Beauty, Hair Styling Applications SpA, FORMULA CORP, Clarion Cosmetics, HCT Group.

3. What are the main segments of the Personal Care Contract Manufacturing Industry?

The market segments include Service Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages.

6. What are the notable trends driving market growth?

Skin Care Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

April 2023: TruArcPartners, a private equity fund, invested in Trademark Cosmetics (TCI) to pursue continuous expansion and support brand partner success through organic initiatives and strategic mergers and acquisitions (M&A). TCI's formulation and production capabilities and strong customer-service focus proved important in its growth and will be the primary driver for future progress and expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Personal Care Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Personal Care Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Personal Care Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Personal Care Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence