Key Insights

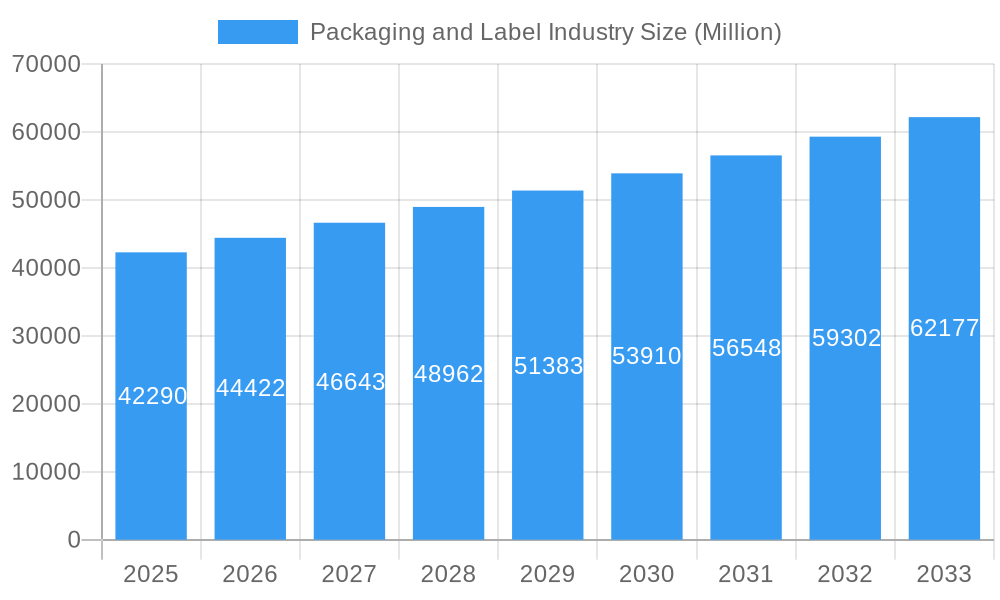

The global packaging and label industry, currently valued at $42.29 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.90% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, along with the pharmaceutical and healthcare industries, are major contributors to demand, necessitating sophisticated and durable labels for product identification, branding, and consumer information. E-commerce's continued growth is another significant driver, as it increases the need for secure and visually appealing packaging and labels to enhance brand recognition and protect products during transit. Furthermore, the increasing adoption of sustainable packaging materials, like paper and biodegradable plastics (PLA, PO), reflects a growing consumer preference for environmentally friendly options, shaping industry innovation and investment. The diverse product segments, including liner, linerless, and specialty labels (VIP, Prime, functional & security, promotional), offer opportunities for market players to cater to specific industry needs and consumer preferences. Technological advancements in printing processes, such as digital printing, allow for increased customization and efficiency. Regional variations in growth rates are anticipated, with developing economies in Asia-Pacific potentially showcasing higher growth trajectories compared to mature markets in North America and Europe.

Packaging and Label Industry Market Size (In Billion)

Competition in this dynamic market is intense, with established players like Avery Dennison, CCL Industries, and 3M competing alongside regional and specialized label manufacturers. Successful strategies for companies will involve investing in research and development to create innovative and sustainable label solutions, expanding into high-growth regions, and leveraging digital technologies to improve efficiency and personalization. While challenges such as fluctuating raw material prices and increasing regulatory scrutiny exist, the long-term outlook for the packaging and label industry remains positive, particularly with continued global economic growth and the ongoing trends towards enhanced product branding and sustainable packaging practices. The market segmentation by product type, material, print process, and end-user industry allows for detailed analysis and identification of niche opportunities. This allows businesses to tailor their offerings to meet specific market demands and optimize their competitive advantages.

Packaging and Label Industry Company Market Share

Packaging and Label Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Packaging and Label Industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils key trends, opportunities, and challenges shaping the industry's future. The market is valued at $xx Million in 2025 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%. The report covers various segments including product types (liner, linerless, VIP, prime, functional & security, promotional), end-user industries (food & beverages, pharmaceutical & healthcare, others), materials (PVC, PET, PE, OPP & OPS, paper, polyester, PP, and others), label types (pressure-sensitive, shrink sleeve, stretch sleeve), and print processes (offset, flexography, gravure, digital). Leading players such as Avery Dennison, Mondi, and 3M are analyzed, alongside emerging trends and competitive dynamics.

Packaging and Label Industry Market Dynamics & Concentration

The global packaging and label industry is characterized by a moderately concentrated market structure, with several multinational corporations holding significant market share. Avery Dennison, CCL Industries, and 3M are among the leading players, commanding a combined market share estimated at xx%. However, the market also features a considerable number of smaller regional and specialized players, particularly in niche segments like functional and security labels.

Market concentration is influenced by several factors, including:

- Innovation: Continuous innovation in materials, printing technologies (digital printing is gaining traction), and label designs drives market expansion and creates opportunities for both established and emerging players.

- Regulatory Frameworks: Growing environmental concerns and stricter regulations regarding material recyclability and sustainability are driving demand for eco-friendly packaging and labeling solutions. This presents opportunities for companies offering sustainable alternatives.

- Product Substitutes: The existence of substitute materials and technologies, such as biodegradable plastics and digital printing, presents both challenges and opportunities. Companies are constantly adapting their offerings to stay competitive.

- End-User Trends: Changing consumer preferences (e.g., demand for convenient packaging, sustainable products, and personalized labels) are significantly shaping market demand. This includes growing demand for e-commerce packaging and tamper-evident labels.

- M&A Activities: The industry has witnessed significant mergers and acquisitions (M&As) in recent years. For instance, Fort Dearborn's acquisition of Hammer Packaging Corporation in March 2021 exemplifies the trend towards consolidation and expansion of geographic reach and capabilities. The number of M&A deals in the period 2019-2024 is estimated to be xx.

Packaging and Label Industry Industry Trends & Analysis

The packaging and label industry is experiencing a dynamic period of robust growth, propelled by a confluence of transformative trends that are reshaping consumer expectations and business strategies. This evolving landscape presents both challenges and significant opportunities for stakeholders.

- E-commerce Dominance: The unprecedented surge in e-commerce continues to be a primary growth driver. This has amplified the demand for a diverse array of packaging solutions, ranging from robust shipping labels designed for transit to specialized protective packaging that ensures product integrity throughout the supply chain. The efficiency and branding potential of these solutions are paramount.

- The Imperative of Sustainability: Mounting global environmental concerns are unequivocally steering the industry towards eco-friendly alternatives. The demand for materials such as recycled paper, plant-based plastics, and compostable packaging is escalating, fostering innovation and creating entirely new market segments focused on circular economy principles.

- Technological Revolution in Printing: Digital printing is fundamentally disrupting traditional printing methods. Its inherent flexibility, unparalleled customization capabilities, and significant improvements in operational efficiency are setting new benchmarks. This trend is anticipated to accelerate, enabling on-demand printing, variable data printing, and reduced lead times.

- Brand Differentiation Through Packaging: In an increasingly saturated marketplace, brands are strategically leveraging innovative packaging and labels as potent tools for product differentiation. This has ignited a demand for sophisticated, customized designs, premium label materials, and interactive packaging elements that enhance consumer engagement and brand recall.

- Ensuring Food Safety and Traceability: A heightened consumer focus on food safety, provenance, and transparency is driving a critical need for advanced packaging solutions. Tamper-evident labels, smart packaging with embedded traceability features, and materials that actively preserve product integrity are becoming indispensable, bolstering consumer trust and product security.

The market is projected to maintain a strong and sustained growth trajectory, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The market penetration of sustainable packaging solutions is anticipated to reach an impressive XX% by 2033, underscoring the industry's commitment to environmental stewardship.

Leading Markets & Segments in Packaging and Label Industry

The global packaging and label market is geographically diverse, with North America and Europe currently holding the largest market shares. However, Asia-Pacific is expected to witness the fastest growth rate due to rapid economic development and increasing consumption in emerging economies.

Key drivers for regional dominance include:

- Economic Policies: Government initiatives promoting industrial growth and infrastructure development contribute to market expansion in certain regions.

- Infrastructure: Well-developed infrastructure, including logistics and distribution networks, supports efficient packaging and labeling operations.

Within the segments, pressure-sensitive labels dominate the market by type, followed by shrink and stretch sleeves. The food and beverage industry is the largest end-user segment, followed by pharmaceuticals and healthcare. In terms of materials, paper and plastic (PET, PE, PVC) continue to be dominant. However, the increasing demand for sustainable alternatives is driving growth in bioplastics and other eco-friendly materials. The functional and security labels segments are also exhibiting high growth due to increased demand for anti-counterfeiting measures and product authentication.

Packaging and Label Industry Product Developments

Recent years have witnessed a flurry of groundbreaking innovations within the packaging and label sector, particularly concerning materials and printing technologies. The development of more sustainable options, such as Mondi's February 2021 launch of advanced recycled paper liners and novel biodegradable plastics, signifies a strong industry pivot towards environmental responsibility. Complementing these material advancements are significant leaps in printing technologies, with digital printing emerging as a transformative force. This enables unprecedented levels of personalization, reduces material waste through on-demand production, and enhances overall operational efficiency. These integrated developments empower companies to deliver highly tailored solutions that precisely meet specific end-user requirements, dramatically improve brand visibility through striking aesthetics, and bolster product security through advanced features. This progressive trend is set to continue as companies prioritize differentiation, efficiency, and a reduced environmental footprint.

Key Drivers of Packaging and Label Industry Growth

Several factors are driving growth in the packaging and label industry:

- Technological advancements: Digital printing, improved material science, and automation are enhancing efficiency and customization.

- Economic growth: Expanding economies, particularly in developing countries, drive increased consumption and packaging demand.

- Regulatory changes: Stringent regulations on food safety and product labeling are influencing market trends.

Challenges in the Packaging and Label Industry Market

The industry faces various challenges:

- Fluctuating raw material prices: Changes in the cost of raw materials impact profitability and product pricing.

- Supply chain disruptions: Global supply chain vulnerabilities can lead to production delays and shortages.

- Intense competition: The presence of numerous players creates a competitive environment, requiring continuous innovation and efficient operations. The impact of this is a pressure on profit margins.

Emerging Opportunities in Packaging and Label Industry

The packaging and label market presents exciting opportunities:

- Smart packaging: Integration of technology into packaging, such as RFID tags, enhances product traceability and consumer engagement.

- Sustainable packaging solutions: Growth in demand for environmentally friendly packaging materials presents significant opportunities for companies focused on sustainability.

- Market expansion in developing economies: Rapidly developing economies offer substantial growth potential.

Leading Players in the Packaging and Label Industry Sector

- Avery Dennison Corporation: A global leader in labeling and packaging materials and solutions.

- Leading Edge Labels & Packaging: Known for innovative labeling and packaging solutions.

- Taghleef Industries Inc: A major global producer of biaxially oriented polypropylene (BOPP) films.

- WestRock Company: A leading provider of paper and packaging solutions.

- Vintech Polymers Private Limited: Specializes in polymer-based packaging solutions.

- Fort Dearborn Company: A prominent supplier of labels and packaging.

- KRIS FLEXIPACKS PVT LTD: Offers a range of flexible packaging solutions.

- Constantia Flexibles Group GmbH: A leading global manufacturer of flexible packaging solutions.

- Bemis Company (now part of Amcor): A significant player in flexible packaging.

- UPM Raflatac: A global supplier of self-adhesive label materials.

- Royal Sens Group: Focuses on innovative packaging solutions with an emphasis on consumer engagement.

- Klockner Pentaplast: A leading global manufacturer of plastic films and packaging.

- CCL Industries LLC: A world leader in specialty label and packaging solutions.

- 3M Company: Offers a broad range of adhesive and label solutions.

- Huhtamaki Group: A global food-serving packaging company.

- Lintec Corporation: A leading manufacturer of adhesive materials and related products.

- Multi-Color Corporation: A premier global supplier of labels and packaging solutions.

- Fuji Seal International Inc: A leading global provider of heat-shrinkable sleeve labels and seals.

- Lintec (reiterated, often refers to specific divisions or subsidiaries within the group).

- Mondi Group: A global leader in sustainable packaging and paper.

- CPC Packaging: A provider of innovative packaging solutions.

- Berry Global: A major manufacturer and distributor of plastic packaging products.

- GTPL (General Technology Group): A key player in flexible packaging solutions.

- Neenah Inc: A leading global producer of specialty paper and packaging solutions.

Key Milestones in Packaging and Label Industry Industry

- March 2021: Fort Dearborn Company strategically acquired Hammer Packaging Corporation, significantly expanding its market reach and enhancing its manufacturing capabilities in the label and packaging sector.

- February 2021: Mondi Group unveiled an innovative range of sustainable paper-based release liners, marking a significant advancement in promoting environmentally responsible solutions within the industry.

Strategic Outlook for Packaging and Label Industry Market

The packaging and label industry is exceptionally well-positioned for sustained and robust growth, driven by a powerful synergy of rapid technological advancements, escalating consumer demand for convenience and engagement, and an unwavering global commitment to sustainability. To thrive in this highly dynamic and competitive landscape, companies must prioritize strategic collaborations, significant investments in research and development, and aggressive expansion into emerging markets. Those organizations that demonstrate agility in adapting to evolving consumer preferences, stringent environmental regulations, and the imperative for digital integration will undoubtedly be best equipped to capitalize on the abundant future market opportunities.

Packaging and Label Industry Segmentation

-

1. Type

-

1.1. Pressure-Sensitive Label

-

1.1.1. By Print Process

- 1.1.1.1. Offset Printing

- 1.1.1.2. Flexography Printing

- 1.1.1.3. Gravure

- 1.1.1.4. Other Analog Printing Process

- 1.1.1.5. Digital Printing

-

1.1.2. By Product Type

- 1.1.2.1. Liner

- 1.1.2.2. Linerless

- 1.1.2.3. VIP

- 1.1.2.4. Prime

- 1.1.2.5. Functional & Security

- 1.1.2.6. Promotional

-

1.1.3. End-User Industry

- 1.1.3.1. Food & Beverages

- 1.1.3.2. Pharmaceutical & Healthcare

- 1.1.3.3. Other End-Users

-

1.1.1. By Print Process

-

1.2. Shrink & Stretch Sleeve Label

- 1.2.1. Shrink Sleeve

-

1.2.2. By Material

- 1.2.2.1. PVC

- 1.2.2.2. PET

- 1.2.2.3. OPP & OPS

- 1.2.2.4. Other Materials (PO, PLA, etc.)

- 1.3. In-Mold Label

- 1.4. Wet Glue Label

-

1.5. Thermal Transfer Label

- 1.5.1. Paper

- 1.5.2. Polyester

- 1.6. Wrap Around Label

-

1.1. Pressure-Sensitive Label

Packaging and Label Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. Latin America

Packaging and Label Industry Regional Market Share

Geographic Coverage of Packaging and Label Industry

Packaging and Label Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The issues related to recycling of release liners and the ability to enable direct digital printing is expected to spur demand; Ability to conform to any size and shape

- 3.2.2 and yet provide the necessary protection

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Oil Prices

- 3.4. Market Trends

- 3.4.1. Food and Beverage End-User Segment is Expected to Drive Growth of Labels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure-Sensitive Label

- 5.1.1.1. By Print Process

- 5.1.1.1.1. Offset Printing

- 5.1.1.1.2. Flexography Printing

- 5.1.1.1.3. Gravure

- 5.1.1.1.4. Other Analog Printing Process

- 5.1.1.1.5. Digital Printing

- 5.1.1.2. By Product Type

- 5.1.1.2.1. Liner

- 5.1.1.2.2. Linerless

- 5.1.1.2.3. VIP

- 5.1.1.2.4. Prime

- 5.1.1.2.5. Functional & Security

- 5.1.1.2.6. Promotional

- 5.1.1.3. End-User Industry

- 5.1.1.3.1. Food & Beverages

- 5.1.1.3.2. Pharmaceutical & Healthcare

- 5.1.1.3.3. Other End-Users

- 5.1.1.1. By Print Process

- 5.1.2. Shrink & Stretch Sleeve Label

- 5.1.2.1. Shrink Sleeve

- 5.1.2.2. By Material

- 5.1.2.2.1. PVC

- 5.1.2.2.2. PET

- 5.1.2.2.3. OPP & OPS

- 5.1.2.2.4. Other Materials (PO, PLA, etc.)

- 5.1.3. In-Mold Label

- 5.1.4. Wet Glue Label

- 5.1.5. Thermal Transfer Label

- 5.1.5.1. Paper

- 5.1.5.2. Polyester

- 5.1.6. Wrap Around Label

- 5.1.1. Pressure-Sensitive Label

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure-Sensitive Label

- 6.1.1.1. By Print Process

- 6.1.1.1.1. Offset Printing

- 6.1.1.1.2. Flexography Printing

- 6.1.1.1.3. Gravure

- 6.1.1.1.4. Other Analog Printing Process

- 6.1.1.1.5. Digital Printing

- 6.1.1.2. By Product Type

- 6.1.1.2.1. Liner

- 6.1.1.2.2. Linerless

- 6.1.1.2.3. VIP

- 6.1.1.2.4. Prime

- 6.1.1.2.5. Functional & Security

- 6.1.1.2.6. Promotional

- 6.1.1.3. End-User Industry

- 6.1.1.3.1. Food & Beverages

- 6.1.1.3.2. Pharmaceutical & Healthcare

- 6.1.1.3.3. Other End-Users

- 6.1.1.1. By Print Process

- 6.1.2. Shrink & Stretch Sleeve Label

- 6.1.2.1. Shrink Sleeve

- 6.1.2.2. By Material

- 6.1.2.2.1. PVC

- 6.1.2.2.2. PET

- 6.1.2.2.3. OPP & OPS

- 6.1.2.2.4. Other Materials (PO, PLA, etc.)

- 6.1.3. In-Mold Label

- 6.1.4. Wet Glue Label

- 6.1.5. Thermal Transfer Label

- 6.1.5.1. Paper

- 6.1.5.2. Polyester

- 6.1.6. Wrap Around Label

- 6.1.1. Pressure-Sensitive Label

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure-Sensitive Label

- 7.1.1.1. By Print Process

- 7.1.1.1.1. Offset Printing

- 7.1.1.1.2. Flexography Printing

- 7.1.1.1.3. Gravure

- 7.1.1.1.4. Other Analog Printing Process

- 7.1.1.1.5. Digital Printing

- 7.1.1.2. By Product Type

- 7.1.1.2.1. Liner

- 7.1.1.2.2. Linerless

- 7.1.1.2.3. VIP

- 7.1.1.2.4. Prime

- 7.1.1.2.5. Functional & Security

- 7.1.1.2.6. Promotional

- 7.1.1.3. End-User Industry

- 7.1.1.3.1. Food & Beverages

- 7.1.1.3.2. Pharmaceutical & Healthcare

- 7.1.1.3.3. Other End-Users

- 7.1.1.1. By Print Process

- 7.1.2. Shrink & Stretch Sleeve Label

- 7.1.2.1. Shrink Sleeve

- 7.1.2.2. By Material

- 7.1.2.2.1. PVC

- 7.1.2.2.2. PET

- 7.1.2.2.3. OPP & OPS

- 7.1.2.2.4. Other Materials (PO, PLA, etc.)

- 7.1.3. In-Mold Label

- 7.1.4. Wet Glue Label

- 7.1.5. Thermal Transfer Label

- 7.1.5.1. Paper

- 7.1.5.2. Polyester

- 7.1.6. Wrap Around Label

- 7.1.1. Pressure-Sensitive Label

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure-Sensitive Label

- 8.1.1.1. By Print Process

- 8.1.1.1.1. Offset Printing

- 8.1.1.1.2. Flexography Printing

- 8.1.1.1.3. Gravure

- 8.1.1.1.4. Other Analog Printing Process

- 8.1.1.1.5. Digital Printing

- 8.1.1.2. By Product Type

- 8.1.1.2.1. Liner

- 8.1.1.2.2. Linerless

- 8.1.1.2.3. VIP

- 8.1.1.2.4. Prime

- 8.1.1.2.5. Functional & Security

- 8.1.1.2.6. Promotional

- 8.1.1.3. End-User Industry

- 8.1.1.3.1. Food & Beverages

- 8.1.1.3.2. Pharmaceutical & Healthcare

- 8.1.1.3.3. Other End-Users

- 8.1.1.1. By Print Process

- 8.1.2. Shrink & Stretch Sleeve Label

- 8.1.2.1. Shrink Sleeve

- 8.1.2.2. By Material

- 8.1.2.2.1. PVC

- 8.1.2.2.2. PET

- 8.1.2.2.3. OPP & OPS

- 8.1.2.2.4. Other Materials (PO, PLA, etc.)

- 8.1.3. In-Mold Label

- 8.1.4. Wet Glue Label

- 8.1.5. Thermal Transfer Label

- 8.1.5.1. Paper

- 8.1.5.2. Polyester

- 8.1.6. Wrap Around Label

- 8.1.1. Pressure-Sensitive Label

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure-Sensitive Label

- 9.1.1.1. By Print Process

- 9.1.1.1.1. Offset Printing

- 9.1.1.1.2. Flexography Printing

- 9.1.1.1.3. Gravure

- 9.1.1.1.4. Other Analog Printing Process

- 9.1.1.1.5. Digital Printing

- 9.1.1.2. By Product Type

- 9.1.1.2.1. Liner

- 9.1.1.2.2. Linerless

- 9.1.1.2.3. VIP

- 9.1.1.2.4. Prime

- 9.1.1.2.5. Functional & Security

- 9.1.1.2.6. Promotional

- 9.1.1.3. End-User Industry

- 9.1.1.3.1. Food & Beverages

- 9.1.1.3.2. Pharmaceutical & Healthcare

- 9.1.1.3.3. Other End-Users

- 9.1.1.1. By Print Process

- 9.1.2. Shrink & Stretch Sleeve Label

- 9.1.2.1. Shrink Sleeve

- 9.1.2.2. By Material

- 9.1.2.2.1. PVC

- 9.1.2.2.2. PET

- 9.1.2.2.3. OPP & OPS

- 9.1.2.2.4. Other Materials (PO, PLA, etc.)

- 9.1.3. In-Mold Label

- 9.1.4. Wet Glue Label

- 9.1.5. Thermal Transfer Label

- 9.1.5.1. Paper

- 9.1.5.2. Polyester

- 9.1.6. Wrap Around Label

- 9.1.1. Pressure-Sensitive Label

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Packaging and Label Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pressure-Sensitive Label

- 10.1.1.1. By Print Process

- 10.1.1.1.1. Offset Printing

- 10.1.1.1.2. Flexography Printing

- 10.1.1.1.3. Gravure

- 10.1.1.1.4. Other Analog Printing Process

- 10.1.1.1.5. Digital Printing

- 10.1.1.2. By Product Type

- 10.1.1.2.1. Liner

- 10.1.1.2.2. Linerless

- 10.1.1.2.3. VIP

- 10.1.1.2.4. Prime

- 10.1.1.2.5. Functional & Security

- 10.1.1.2.6. Promotional

- 10.1.1.3. End-User Industry

- 10.1.1.3.1. Food & Beverages

- 10.1.1.3.2. Pharmaceutical & Healthcare

- 10.1.1.3.3. Other End-Users

- 10.1.1.1. By Print Process

- 10.1.2. Shrink & Stretch Sleeve Label

- 10.1.2.1. Shrink Sleeve

- 10.1.2.2. By Material

- 10.1.2.2.1. PVC

- 10.1.2.2.2. PET

- 10.1.2.2.3. OPP & OPS

- 10.1.2.2.4. Other Materials (PO, PLA, etc.)

- 10.1.3. In-Mold Label

- 10.1.4. Wet Glue Label

- 10.1.5. Thermal Transfer Label

- 10.1.5.1. Paper

- 10.1.5.2. Polyester

- 10.1.6. Wrap Around Label

- 10.1.1. Pressure-Sensitive Label

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Avery Dennison

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leading Edge labels & Packaging*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Taghleef Industries Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WestRock Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vintech Polymers Private Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fort Dearborn

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KRIS FLEXIPACKS PVT LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fort Dearborn Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Constantia Flexibles Group GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bemis Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 UPM Raflatc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Royal Sens Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Klockner Pentaplast

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 CCL Industries LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 3M Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Huhtamaki Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Lintec Corporation

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Multi-Color Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Fuji Seal International Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Lintec

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Mondi

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 CPC Packaging

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Berry Global

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 GTPL

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Neenah Inc

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Avery Dennison

List of Figures

- Figure 1: Global Packaging and Label Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Packaging and Label Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Latin America Packaging and Label Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America Packaging and Label Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Packaging and Label Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Packaging and Label Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Packaging and Label Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Packaging and Label Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging and Label Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Packaging and Label Industry?

Key companies in the market include Avery Dennison, Leading Edge labels & Packaging*List Not Exhaustive, Taghleef Industries Inc, WestRock Company, Vintech Polymers Private Limited, Fort Dearborn, KRIS FLEXIPACKS PVT LTD, Fort Dearborn Company, Constantia Flexibles Group GmbH, Bemis Company, UPM Raflatc, Royal Sens Group, Klockner Pentaplast, CCL Industries LLC, 3M Company, Huhtamaki Group, Lintec Corporation, Multi-Color Corporation, Fuji Seal International Inc, Lintec, Mondi, CPC Packaging, Berry Global, GTPL, Neenah Inc.

3. What are the main segments of the Packaging and Label Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.29 Million as of 2022.

5. What are some drivers contributing to market growth?

The issues related to recycling of release liners and the ability to enable direct digital printing is expected to spur demand; Ability to conform to any size and shape. and yet provide the necessary protection.

6. What are the notable trends driving market growth?

Food and Beverage End-User Segment is Expected to Drive Growth of Labels.

7. Are there any restraints impacting market growth?

; Fluctuating Oil Prices.

8. Can you provide examples of recent developments in the market?

March 2021 - Dearborn Company has announced that it has acquired Hammer Packaging Corporation. The combined organization takes advantage of Hammer's state-of-the-art technology to enhance Fort Dearborn's leadership position in the decorative label and packaging marketplace by further expanding the company's geographic footprint, capacity, and capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging and Label Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging and Label Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging and Label Industry?

To stay informed about further developments, trends, and reports in the Packaging and Label Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence