Key Insights

The North American rigid plastic packaging market is poised for sustained expansion, projected to reach $15.51 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.13%. This growth is propelled by escalating demand for convenient and economical packaging across diverse industries. The food and beverage sector remains a primary driver, fueled by increasing consumption of packaged goods. The healthcare industry's need for secure, tamper-evident pharmaceutical and medical device packaging also contributes significantly. The cosmetics and personal care segment, prioritizing aesthetic and protective solutions, further fuels market expansion. While environmental concerns regarding plastic waste and stringent regulations present challenges, the increasing adoption of sustainable and recyclable plastics is effectively mitigating these issues. Innovations in lightweighting and enhanced barrier properties in packaging design are also key growth enablers. PET and PP are anticipated to lead material usage due to their adaptability, recyclability, and cost-effectiveness. Leading market participants are committed to research and development to refine their offerings and broaden their market footprint. Variations in regional growth rates are expected, influenced by economic conditions and sector-specific advancements.

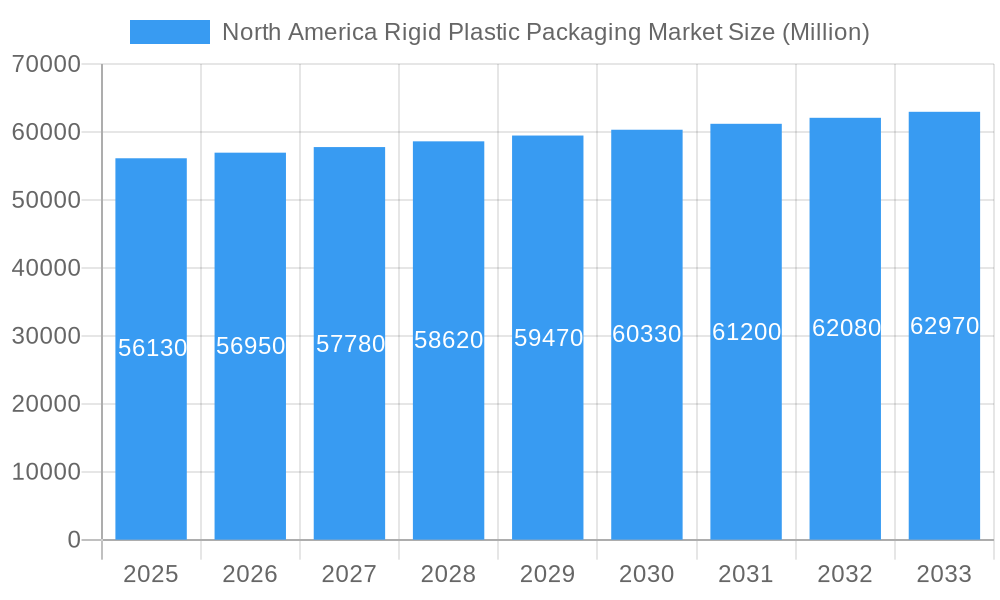

North America Rigid Plastic Packaging Market Market Size (In Million)

Within North America, the United States leads the market, followed by Canada. Mexico and the rest of North America exhibit strong growth potential, driven by industrialization and urbanization trends. The competitive landscape features a blend of global corporations and specialized enterprises. Market competition is expected to remain robust, with companies focusing on product innovation, strategic alliances, and mergers to solidify their positions. The forecast period (2025-2033) anticipates continued, albeit moderate, growth, balancing market drivers and constraints. Sector-specific growth will be shaped by evolving regulations, consumer preferences, and technological progress. The pervasive trend towards sustainable packaging solutions will critically influence the market's future direction.

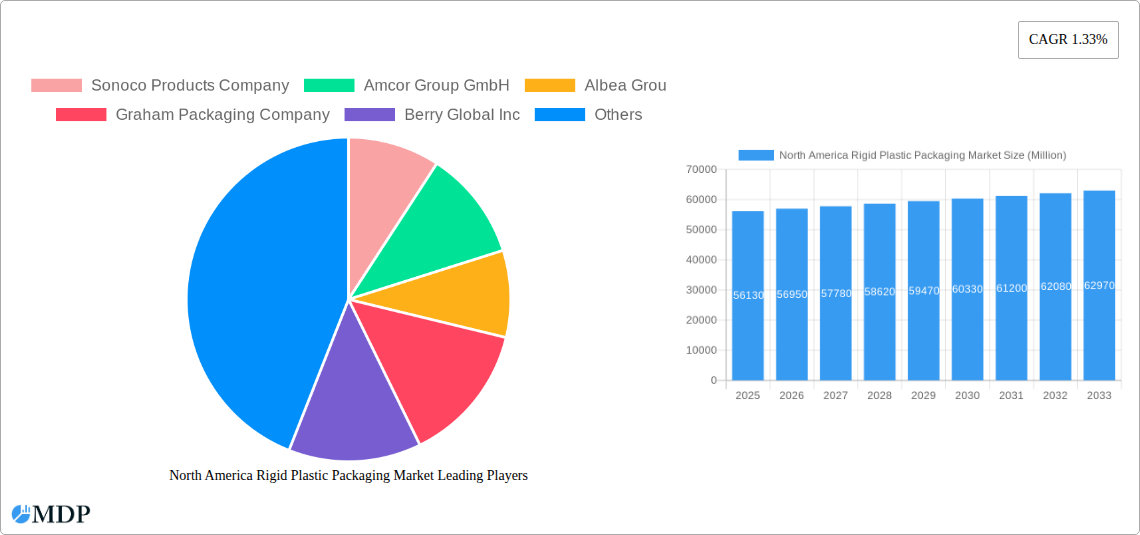

North America Rigid Plastic Packaging Market Company Market Share

North America Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the North America rigid plastic packaging market, providing invaluable insights for stakeholders seeking to navigate this dynamic industry. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report delves into market dynamics, industry trends, leading segments, and key players, equipping you with the knowledge to make informed strategic decisions. The market is estimated to be worth xx Million in 2025.

North America Rigid Plastic Packaging Market Dynamics & Concentration

The North American rigid plastic packaging market is characterized by a moderately concentrated landscape, with key players like Sonoco Products Company, Amcor Group GmbH, Albea Group, Graham Packaging Company, Berry Global Inc, Silgan Holdings Inc, Plastipak Holding Inc, Sealed Air Corporation, Alpla Werke Alwin Lehner GmbH & Co KG, and Huhtamaki Inc. Market share is largely driven by economies of scale, technological advancements, and brand recognition. Innovation is a crucial driver, with companies continuously developing sustainable and recyclable packaging solutions to meet growing environmental concerns. Stringent regulatory frameworks regarding plastic waste management influence market dynamics, pushing for increased recycled content and reduced environmental impact. The market also faces competition from alternative packaging materials such as paperboard and glass, necessitating continuous innovation to maintain competitiveness. Mergers and acquisitions (M&A) play a significant role in shaping the market landscape, with xx M&A deals recorded in the last five years (2019-2024), resulting in increased market consolidation.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Sustainable Packaging, Recyclability, Enhanced Barrier Properties

- Regulatory Frameworks: Increasingly Strict Regulations on Plastic Waste

- Product Substitutes: Paperboard, Glass, Metal

- End-User Trends: Growing Demand for Convenience, Sustainability, and Brand Differentiation

- M&A Activity: xx deals (2019-2024), leading to increased market consolidation.

North America Rigid Plastic Packaging Market Industry Trends & Analysis

The North American rigid plastic packaging market is witnessing robust growth, driven by factors such as the rising demand for packaged goods across diverse end-use industries, including food and beverage, healthcare, and cosmetics. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological advancements in plastic materials, particularly in lightweighting and barrier properties, are playing a crucial role in shaping the market's trajectory. Consumer preference for sustainable and eco-friendly packaging is driving the adoption of recycled content and biodegradable alternatives. Intense competition among existing players and the emergence of new entrants are further shaping market dynamics, leading to increased product differentiation and innovation. Market penetration of sustainable packaging solutions is steadily increasing, with xx% of the market adopting eco-friendly options in 2024.

Leading Markets & Segments in North America Rigid Plastic Packaging Market

The United States dominates the North American rigid plastic packaging market, accounting for approximately xx% of the total market share in 2024. This dominance is driven by its large and diversified consumer base, robust manufacturing infrastructure, and established packaging industry. Canada represents a significant but smaller market share. Among the product segments, bottles and jars hold the largest market share, followed by trays and containers, reflecting the widespread use of these packaging types across various industries. The Polyethylene Terephthalate (PET) material segment holds a significant share, owing to its versatility, recyclability, and cost-effectiveness. The food and beverage industry is the largest end-user segment, driven by the high demand for packaged food and beverages.

Key Drivers by Segment:

- United States: Large consumer base, robust manufacturing infrastructure, established packaging industry.

- Bottles & Jars: High demand across food and beverage, personal care, and other industries.

- Polyethylene Terephthalate (PET): Versatility, recyclability, and cost-effectiveness.

- Food & Beverage: High demand for packaged food and beverages.

North America Rigid Plastic Packaging Market Product Developments

Recent product developments focus on improving sustainability, recyclability, and barrier properties. Lightweighting techniques are reducing material usage, while innovations in barrier materials are enhancing product shelf life and reducing food waste. The increased use of recycled content in packaging is a significant trend, responding to environmental concerns and consumer demand for sustainable products. Companies are also investing in innovative packaging designs that enhance product protection and consumer convenience, thereby improving market fit and generating competitive advantages.

Key Drivers of North America Rigid Plastic Packaging Market Growth

Growth is fueled by several factors: increasing demand for packaged goods across diverse sectors (especially food & beverage); advancements in lightweighting and barrier technologies enhancing product protection and shelf life; rising consumer preference for convenience and sustainability, driving demand for recycled and eco-friendly options; and favorable regulatory frameworks promoting sustainable packaging practices.

Challenges in the North America Rigid Plastic Packaging Market Market

The market faces challenges including: fluctuating raw material prices impacting profitability; stringent environmental regulations increasing compliance costs; intense competition requiring continuous innovation and cost optimization; and concerns about plastic waste and its environmental impact, potentially leading to decreased demand for certain packaging types. The industry also faces supply chain disruptions, resulting in an xx% increase in production costs during 2022.

Emerging Opportunities in North America Rigid Plastic Packaging Market

Significant opportunities exist in the development and adoption of sustainable and biodegradable packaging solutions. Strategic partnerships between packaging companies and recycling initiatives can open new avenues for growth. Expanding into emerging markets within North America with a focus on tailored packaging solutions for regional needs presents substantial growth potential. Technological advancements in materials science and packaging design offer avenues for creating innovative and cost-effective packaging options.

Leading Players in the North America Rigid Plastic Packaging Market Sector

- Sonoco Products Company

- Amcor Group GmbH

- Albea Group

- Graham Packaging Company

- Berry Global Inc

- Silgan Holdings Inc

- Plastipak Holding Inc

- Sealed Air Corporation

- Alpla Werke Alwin Lehner GmbH & Co KG

- Huhtamaki Inc

Key Milestones in North America Rigid Plastic Packaging Market Industry

- February 2023: Ecolab and TotalEnergies partnered to incorporate post-consumer recycled plastic into packaging for heavy-duty cleaning products, showcasing a commitment to sustainability.

- April 2023: Tesco and Faerch launched a closed-loop recycling system for ready-meal trays, transforming used trays into new food-grade trays. This innovative approach significantly advances the circular economy within the industry.

Strategic Outlook for North America Rigid Plastic Packaging Market Market

The North American rigid plastic packaging market is poised for continued growth, driven by the factors mentioned above. Strategic investments in sustainable packaging solutions, coupled with technological advancements and innovative partnerships across the value chain, will be crucial for sustained success. Companies that can effectively balance cost optimization with environmental responsibility will be best positioned to capitalize on the market's future potential.

North America Rigid Plastic Packaging Market Segmentation

-

1. Resin Type

-

1.1. Polyethylene (PE)

- 1.1.1. Low-Dens

- 1.1.2. High Density Polyethylene (HDPE)

- 1.2. Polyethylene terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 1.5. Polyvinyl chloride (PVC)

- 1.6. Other Resin Types

-

1.1. Polyethylene (PE)

-

2. Product Type

- 2.1. Bottles and Jars

- 2.2. Trays and Containers

- 2.3. Caps and Closures

- 2.4. Intermediate Bulk Containers (IBCs)

- 2.5. Drums

- 2.6. Pallets

- 2.7. Other Product Types

-

3. End-use Industries

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Others Foodservice Sectors

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other End User Industries

-

3.1. Food

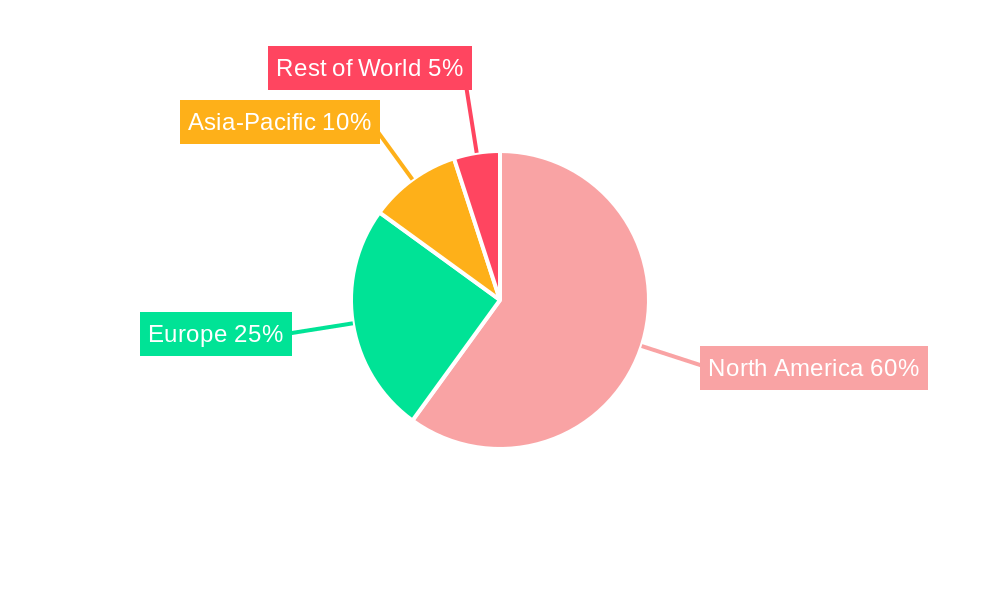

North America Rigid Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of North America Rigid Plastic Packaging Market

North America Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of FMCG Industry to Propel the Market; Cosmetic and Personal Care Sector Witnesses Soaring Demand for Rigid Plastic Packaging

- 3.3. Market Restrains

- 3.3.1. Flexible Plastic Packaging Drive Shift Benefits Over Rigid Plastic Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyethylene (PE)

- 5.1.1.1. Low-Dens

- 5.1.1.2. High Density Polyethylene (HDPE)

- 5.1.2. Polyethylene terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.1.5. Polyvinyl chloride (PVC)

- 5.1.6. Other Resin Types

- 5.1.1. Polyethylene (PE)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Jars

- 5.2.2. Trays and Containers

- 5.2.3. Caps and Closures

- 5.2.4. Intermediate Bulk Containers (IBCs)

- 5.2.5. Drums

- 5.2.6. Pallets

- 5.2.7. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Others Foodservice Sectors

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other End User Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albea Grou

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berry Global Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silgan Holdings Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plastipak Holding Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alpla Werke Alwin Lehner GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huhtamaki Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: North America Rigid Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Rigid Plastic Packaging Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: North America Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: North America Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 4: North America Rigid Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Rigid Plastic Packaging Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 6: North America Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: North America Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 8: North America Rigid Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Rigid Plastic Packaging Market?

The projected CAGR is approximately 2.13%.

2. Which companies are prominent players in the North America Rigid Plastic Packaging Market?

Key companies in the market include Sonoco Products Company, Amcor Group GmbH, Albea Grou, Graham Packaging Company, Berry Global Inc, Silgan Holdings Inc, Plastipak Holding Inc, Sealed Air Corporation, Alpla Werke Alwin Lehner GmbH & Co KG, Huhtamaki Inc.

3. What are the main segments of the North America Rigid Plastic Packaging Market?

The market segments include Resin Type, Product Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of FMCG Industry to Propel the Market; Cosmetic and Personal Care Sector Witnesses Soaring Demand for Rigid Plastic Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Flexible Plastic Packaging Drive Shift Benefits Over Rigid Plastic Packaging.

8. Can you provide examples of recent developments in the market?

April 2023: Tesco and Faerch collaborated to create a totally new way to package ready meals - by recycling used plastic trays and turning them into food-grade trays. This is the first of its kind in the industry and will involve collecting PET trays from customers and recycling them back into trays. Tesco's trays already have a minimum recycled tray content of up to 75%, but now the company is getting better - with the help of Faerch, Tesco will use bottles of flake plastic to recycle up to 30% of their tray content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the North America Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence