Key Insights

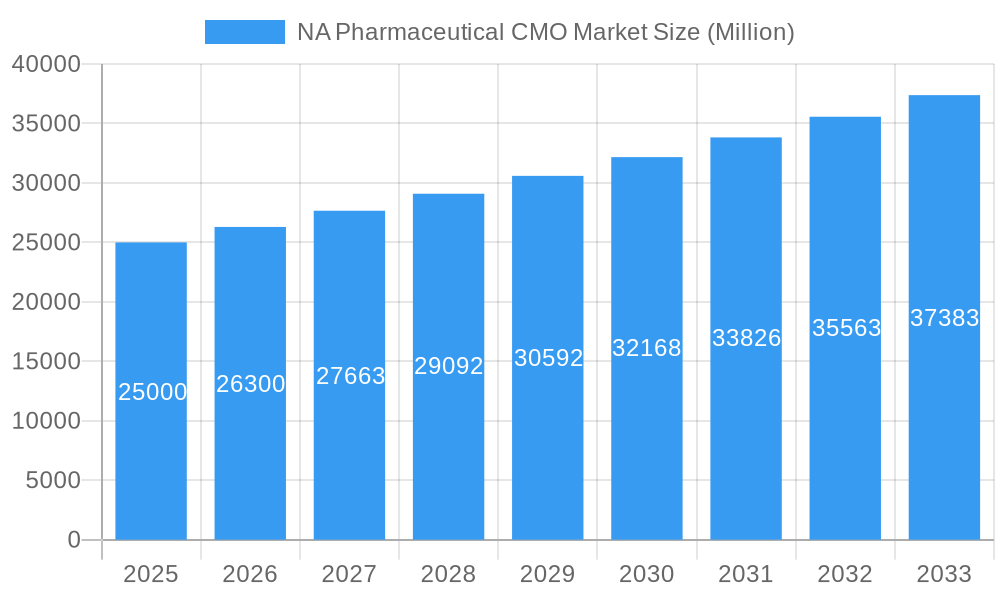

The North American pharmaceutical contract manufacturing organization (CMO) market is experiencing robust growth, driven by several key factors. The increasing complexity of drug development, coupled with rising R&D costs, is prompting pharmaceutical companies to outsource manufacturing processes to specialized CMOs. This trend is further amplified by the growing demand for biologics, advanced therapies, and personalized medicines, which require sophisticated manufacturing capabilities beyond the reach of many smaller pharmaceutical firms. The market's expansion is also fueled by the ongoing consolidation within the pharmaceutical industry, with larger companies acquiring smaller firms and outsourcing their manufacturing needs to established CMOs. The high potency API (HPAPI) segment, in particular, is witnessing significant growth due to the increasing number of oncology and other specialized drugs requiring this expertise. Finished dosage formulation (FDF) development and manufacturing, alongside injectable dose formulation and secondary packaging, represent further significant market segments within North America, attracting considerable investment and driving competition among established players and new entrants. Given the 5.20% CAGR, and considering typical market maturation curves, a reasonable projection anticipates continued, though potentially slightly decelerating, growth in the coming years, driven by ongoing innovation in drug delivery and increasing regulatory approvals.

NA Pharmaceutical CMO Market Market Size (In Billion)

The North American market, comprising the United States and Canada, dominates the region due to its robust pharmaceutical ecosystem, advanced infrastructure, and stringent regulatory standards. Major players like Thermo Fisher Scientific (Patheon), Siegfried, Aenova, Lonza, and Catalent are aggressively competing for market share by investing in cutting-edge technologies, expanding their manufacturing capacities, and developing specialized service offerings. The market is also characterized by a significant number of smaller, niche CMOs catering to specific therapeutic areas or manufacturing needs. While the exact market size for 2025 is not explicitly given, a reasonable estimation, based on the provided 5.20% CAGR from a prior period, would place it in the high billions of dollars, with continued growth projected over the next decade, driven by the factors outlined above. However, potential restraints include fluctuating raw material costs, increasing regulatory scrutiny, and the ongoing challenges of managing global supply chains.

NA Pharmaceutical CMO Market Company Market Share

North American Pharmaceutical CMO Market Report: 2019-2033 Forecast

Gain a comprehensive understanding of the North American Pharmaceutical Contract Manufacturing Organization (CMO) market with this in-depth report, projecting a market value of xx Million by 2033. This insightful analysis covers the period from 2019 to 2033, providing a historical overview (2019-2024), an estimated snapshot for 2025, and a detailed forecast (2025-2033). The report examines key segments including Active Pharmaceutical Ingredient (API) Manufacturing, High Potency API (HPAPI) Finished Dosage Formulation (FDF) Development and Manufacturing, and Injectable Dose Formulation & Secondary Packaging, across the United States and Canada. Maximize your strategic planning with this data-driven resource.

NA Pharmaceutical CMO Market Market Dynamics & Concentration

The North American pharmaceutical CMO market is experiencing dynamic shifts driven by a confluence of factors. Market concentration is moderate, with several large players commanding significant shares, but a considerable number of smaller, specialized CMOs also contribute significantly. Thermo Fisher Scientific (Patheon), Siegfried AG, Aenova Group, Lonza Group AG, and Catalent Inc. are among the key players, each possessing a unique market niche and strategic focus. The market share for these top 5 companies is estimated at xx% in 2025. Innovation is a crucial driver, with ongoing research and development in advanced manufacturing technologies like continuous manufacturing and cell and gene therapy manufacturing driving significant growth. Regulatory frameworks, particularly those concerning Good Manufacturing Practices (GMP) and data integrity, are constantly evolving, influencing operational costs and strategic decisions for CMOs. Substitutes for CMO services are limited, with internal manufacturing representing the primary alternative, but this option is often cost-prohibitive for smaller pharmaceutical companies. End-user trends such as the increasing demand for personalized medicine and biologics are reshaping the CMO landscape, pushing innovation and expansion in specialized services. Mergers and acquisitions (M&A) activity has been robust in recent years, with xx M&A deals recorded between 2019 and 2024, consolidating the market and fostering greater operational efficiency and scale. This trend is anticipated to continue in the coming years.

NA Pharmaceutical CMO Market Industry Trends & Analysis

The North American pharmaceutical Contract Manufacturing Organization (CMO) market is experiencing significant expansion, projecting a robust Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR]%** during the forecast period (2025-2033). This upward trajectory is underpinned by several pivotal factors. Foremost among these is the escalating trend of pharmaceutical companies strategically outsourcing their manufacturing operations. This allows them to optimize costs, streamline operations, and crucially, dedicate more resources and focus to their core competencies in research and development and commercialization. Furthermore, the market is being dramatically reshaped by substantial technological advancements. Innovations in areas like Process Analytical Technology (PAT), advanced automation, and continuous manufacturing are not only enhancing production efficiency but also elevating product quality and consistency to new heights. In 2025, it's estimated that **[Insert specific percentage]%** of CMOs are actively integrating automated systems into their workflows, reflecting a significant shift towards Industry 4.0 principles. Concurrently, evolving consumer preferences are driving demand for more personalized and targeted therapies. This necessitates that CMOs adapt and invest in specialized manufacturing capabilities to handle novel drug modalities, including biologics, cell and gene therapies, and mRNA-based vaccines. The competitive landscape is characterized by a dynamic interplay between established, large-scale CMOs and emerging specialized niche players. Fierce price competition coexists with differentiation strategies centered on cutting-edge technological expertise, comprehensive service portfolios, and a demonstrated ability to handle complex manufacturing processes.

Leading Markets & Segments in NA Pharmaceutical CMO Market

The United States represents the dominant market within North America, accounting for approximately xx% of the total market value in 2025. This is primarily due to factors such as:

- Robust pharmaceutical industry: The presence of numerous large pharmaceutical companies and biotech firms creates a high demand for CMO services.

- Favorable regulatory environment: While stringent, the regulatory framework in the US fosters innovation and attracts significant investment.

- Well-developed infrastructure: Access to advanced technologies, skilled labor, and efficient logistics networks are key advantages.

Canada also holds a significant market share, driven by:

- Growing biotech sector: Increased investment in research and development within the Canadian pharmaceutical sector drives outsourcing needs.

- Government support for innovation: Initiatives focused on promoting the life sciences sector provide opportunities for growth.

Among the service types, Active Pharmaceutical Ingredient (API) Manufacturing currently holds the largest market share, fueled by the rising demand for generic drugs and increasing complexity of API manufacturing. However, the High Potency API (HPAPI) and Injectable Dose Formulation segments are experiencing faster growth rates, driven by increasing demand for specialized drug products.

NA Pharmaceutical CMO Market Product Developments

Recent product innovations in the NA pharmaceutical CMO market include advanced manufacturing technologies like continuous flow manufacturing, which enhances efficiency and reduces costs. The focus on specialized services, such as cell and gene therapy manufacturing and the development of complex injectable formulations, is gaining momentum. These innovations are improving drug quality, reducing manufacturing timelines, and providing competitive advantages to CMOs. The market fit for these developments is strong, particularly among companies seeking to improve efficiency, reduce costs, and meet increasing demand for complex therapies.

Key Drivers of NA Pharmaceutical CMO Market Growth

The North American pharmaceutical CMO market's impressive growth is propelled by a confluence of powerful drivers. Paramount among these are continuous technological advancements, including the integration of sophisticated analytical tools, artificial intelligence (AI) for process optimization, and widespread automation, all of which significantly boost manufacturing efficiency, reduce batch-to-batch variability, and elevate overall product quality. Favorable economic conditions within the broader healthcare and pharmaceutical sectors, marked by increased investment and a supportive venture capital environment, create a fertile ground for CMO expansion. While regulatory frameworks in North America are undoubtedly stringent, they also foster a culture of innovation and reinforce the paramount importance of drug safety and efficacy, ultimately benefiting the entire ecosystem. The persistent and growing demand for outsourcing services is a fundamental driver, empowering pharmaceutical companies to strategically de-risk their manufacturing operations and concentrate on their strengths in drug discovery, clinical trials, and market penetration.

Challenges in the NA Pharmaceutical CMO Market Market

Despite its robust growth, the NA pharmaceutical CMO market navigates a landscape fraught with significant challenges. Rigorous and evolving regulatory compliance requirements, including stringent Good Manufacturing Practices (GMP) and evolving data integrity standards, present substantial hurdles for both new entrants and established players, demanding continuous investment in quality systems and personnel. Disruptions within the global supply chain, particularly concerning the sourcing of critical raw materials, specialized excipients, and advanced manufacturing equipment, can have a considerable impact on production schedules and delivery timelines, leading to potential delays and increased costs. The intense competitive environment, characterized by both established global players and agile, specialized niche providers, exerts considerable price pressures and necessitates relentless innovation and service enhancement to maintain market share. These combined challenges are estimated to influence market growth by approximately **[Insert specific percentage]%** in 2025, underscoring the critical need for CMOs to adopt agile operational strategies, forge robust strategic partnerships, and maintain a proactive approach to risk mitigation.

Emerging Opportunities in NA Pharmaceutical CMO Market

Emerging opportunities for the NA pharmaceutical CMO market include leveraging technological breakthroughs, like AI-driven process optimization and real-time quality control, to boost efficiency and reduce costs. Strategic partnerships between CMOs and pharmaceutical companies to develop innovative drug delivery systems and complex therapies create significant growth potential. Market expansion into niche therapeutic areas, such as personalized medicine and gene therapy, opens new avenues for growth and profitability. These combined factors project a substantial market growth potential in the coming years.

Leading Players in the NA Pharmaceutical CMO Market Sector

Key Milestones in NA Pharmaceutical CMO Market Industry

- 2020: The COVID-19 pandemic dramatically accelerated the demand for outsourced Active Pharmaceutical Ingredient (API) manufacturing as companies sought to secure supply chains and meet surging global needs.

- 2021: A wave of significant investments by major CMOs into advanced manufacturing technologies, including continuous manufacturing and single-use systems, marked a commitment to future-proofing their capabilities.

- 2022: Increased regulatory scrutiny from agencies like the FDA and Health Canada intensified focus on data integrity, supply chain transparency, and the validation of complex manufacturing processes.

- 2023: A notable period of consolidation through strategic Mergers & Acquisitions (M&A) deals led to greater market concentration among key players, enhancing their capacity and service offerings.

- 2024: The launch of several new, state-of-the-art manufacturing facilities dedicated to specialized advanced therapies, such as cell and gene therapies, signaled a growing industry focus on high-value, complex biologics.

Strategic Outlook for NA Pharmaceutical CMO Market Market

The strategic outlook for the NA pharmaceutical CMO market is exceptionally promising, fueled by the sustained growth of the global pharmaceutical industry, the increasing complexity and specialization of drug development, and the ongoing, rapid adoption of cutting-edge manufacturing technologies. Success in this dynamic environment will hinge on the cultivation of strategic partnerships, substantial investments in innovation, and the strategic expansion into high-growth segments, such as biologics and novel modalities. CMOs that effectively focus on developing specialized capabilities for niche therapies and leverage digital technologies to enhance operational efficiency, quality control, and supply chain visibility will gain a significant competitive advantage. This forward-looking perspective suggests substantial long-term growth potential, with the NA pharmaceutical CMO market poised to capitalize extensively on technological advancements and the evolving demands of the pharmaceutical landscape.

NA Pharmaceutical CMO Market Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

NA Pharmaceutical CMO Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Pharmaceutical CMO Market Regional Market Share

Geographic Coverage of NA Pharmaceutical CMO Market

NA Pharmaceutical CMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing emphasis on drug discovery and outsourcing of manufacturing; Strong R&D Investments

- 3.3. Market Restrains

- 3.3.1. Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Finished Dosage Formulation (FDF) Development and Manufacturing is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Pharmaceutical CMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siegfried AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aenova Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lonza Group AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pfizer CentreSource (Pfizer Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AbbVie Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Baxter Biopharma Solutions (Baxter International Inc )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Thermo Fisher Scientific Inc (Patheon Inc )

List of Figures

- Figure 1: Global NA Pharmaceutical CMO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NA Pharmaceutical CMO Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America NA Pharmaceutical CMO Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America NA Pharmaceutical CMO Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America NA Pharmaceutical CMO Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Pharmaceutical CMO Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the NA Pharmaceutical CMO Market?

Key companies in the market include Thermo Fisher Scientific Inc (Patheon Inc ), Siegfried AG*List Not Exhaustive, Aenova Group, Lonza Group AG, Pfizer CentreSource (Pfizer Inc ), AbbVie Inc, Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB, Baxter Biopharma Solutions (Baxter International Inc ).

3. What are the main segments of the NA Pharmaceutical CMO Market?

The market segments include Service Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing emphasis on drug discovery and outsourcing of manufacturing; Strong R&D Investments.

6. What are the notable trends driving market growth?

Finished Dosage Formulation (FDF) Development and Manufacturing is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Pharmaceutical CMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Pharmaceutical CMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Pharmaceutical CMO Market?

To stay informed about further developments, trends, and reports in the NA Pharmaceutical CMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence