Key Insights

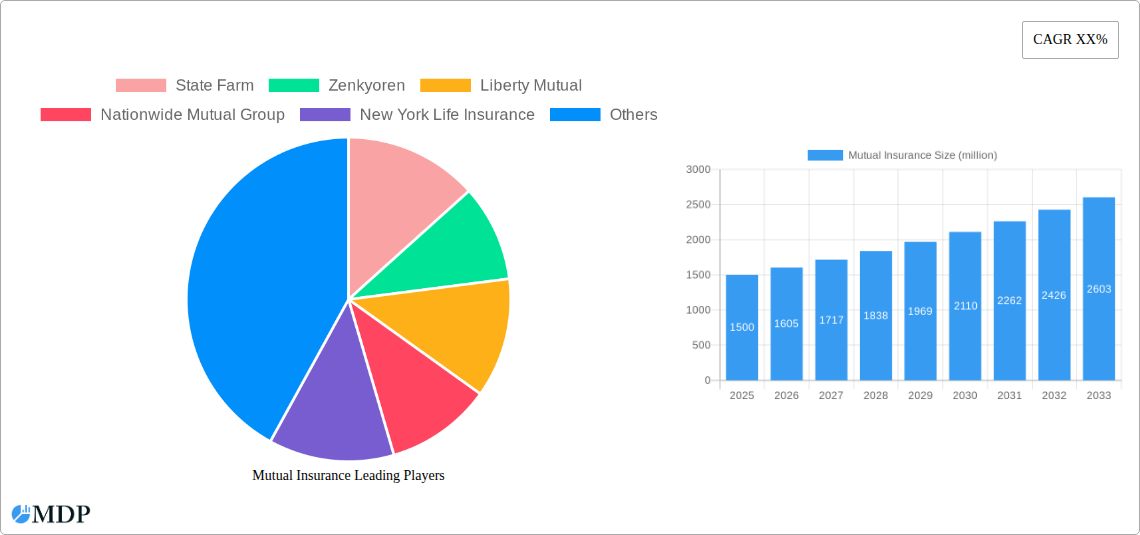

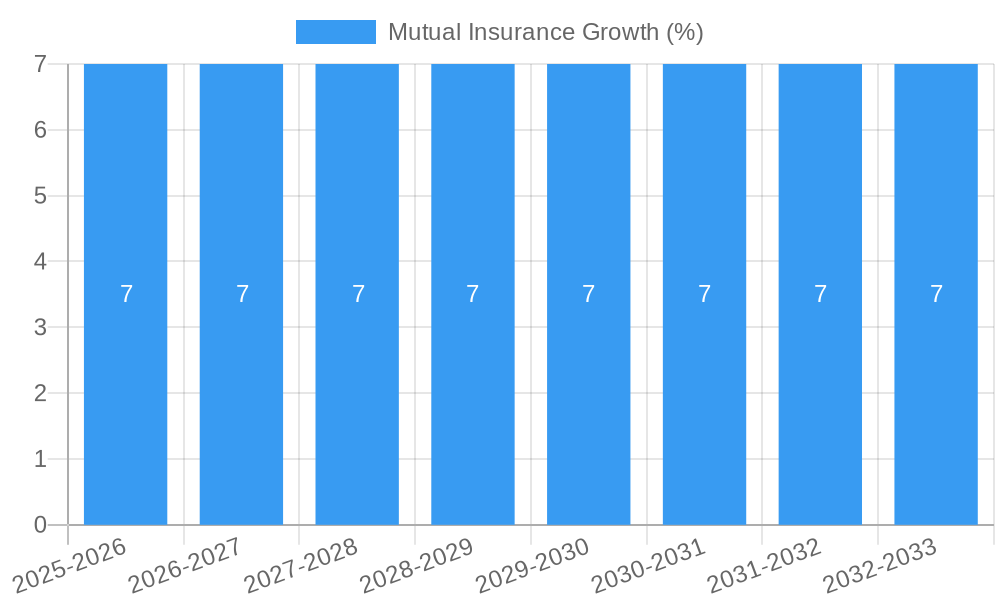

The global mutual insurance market is experiencing robust growth, projected to reach a significant market size of approximately $1,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This expansion is largely fueled by increasing consumer trust in the mutual model, which prioritizes policyholder benefits over shareholder profits. Key drivers include a growing awareness of the financial security and long-term stability offered by mutual insurers, especially during periods of economic uncertainty. Furthermore, the emphasis on customer-centric approaches and personalized service, inherent to the mutual structure, resonates strongly with individuals and businesses seeking reliable and value-driven insurance solutions. The market is witnessing a surge in demand across various applications, with individuals and commercial entities alike opting for mutual policies that offer competitive pricing and potential dividends.

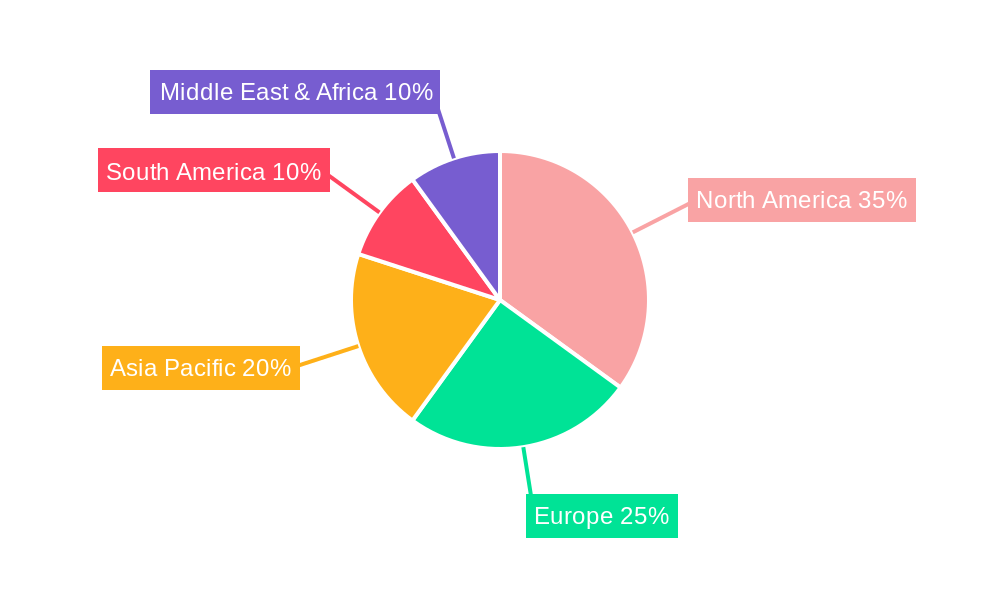

The market's dynamism is further shaped by evolving consumer needs and technological advancements. While the core products like car insurance, life insurance, and accident insurance continue to dominate, emerging "other" categories, potentially encompassing specialized coverage or innovative digital offerings, are gaining traction. Geographically, North America is expected to maintain a leading position, driven by established players and a strong affinity for mutual organizations. However, Asia Pacific, with its rapidly growing economies and increasing disposable incomes, presents a substantial opportunity for market expansion, alongside steady growth in Europe and other developing regions. Restraints, such as intense competition from stock insurers and the complex regulatory landscape, are being navigated through strategic partnerships, digital transformation initiatives, and a continued focus on member value. Companies like State Farm, Liberty Mutual, and New York Life Insurance are at the forefront, leveraging their established reputations and comprehensive product portfolios to capture market share.

Sure, here is the SEO-optimized, engaging report description for Mutual Insurance:

Mutual Insurance Market Dynamics & Concentration

This comprehensive report offers an in-depth analysis of the global mutual insurance market, examining its intricate dynamics and concentration from 2019 to 2033. The study period captures significant shifts, with 2025 serving as the base and estimated year, and a robust forecast period extending to 2033. Within the historical period (2019–2024), we observe evolving market shares and a notable increase in Mergers & Acquisitions (M&A) activities. The report delves into the drivers of innovation, including advancements in insurtech and data analytics, which are reshaping product offerings and customer engagement strategies. Regulatory frameworks, while generally supportive of mutual structures, also present evolving compliance landscapes that stakeholders must navigate. The availability of product substitutes, ranging from traditional insurance products offered by stock companies to alternative risk transfer mechanisms, influences competitive positioning. End-user trends, particularly the growing demand for personalized coverage and digital accessibility, are compelling mutual insurers to adapt their service models. M&A activities are a key indicator of market consolidation, with an estimated XX million deals observed historically, contributing to a market concentration that is increasingly shaped by the strategic alignment of key players. This section provides actionable insights into market positioning and competitive strategies for mutual insurance providers.

- Market Concentration Drivers: Technological integration, strategic partnerships, and economies of scale.

- Innovation Catalysts: Insurtech adoption, AI-powered underwriting, and blockchain for claims processing.

- Regulatory Landscape: Evolving compliance requirements, data privacy regulations, and consumer protection initiatives.

- Product Substitutes: Stock insurance, peer-to-peer insurance models, and parametric insurance solutions.

- End-User Trends: Demand for digital channels, personalized risk assessments, and proactive risk management services.

- M&A Activities: Strategic consolidations, vertical integrations, and acquisitions of insurtech startups.

Mutual Insurance Industry Trends & Analysis

The global mutual insurance industry is experiencing a period of dynamic transformation, driven by a confluence of technological advancements, evolving consumer behaviors, and shifting economic landscapes. This report provides a deep dive into the key trends shaping the market from 2019 to 2033, with a focus on the forecast period of 2025–2033. Market growth drivers are robust, fueled by increasing awareness of insurance needs across both individual and commercial segments. The Compound Annual Growth Rate (CAGR) for the mutual insurance sector is projected to be approximately XX% over the forecast period, reflecting sustained expansion. Technological disruptions are at the forefront, with the widespread adoption of artificial intelligence (AI) for underwriting and claims processing, alongside the integration of the Internet of Things (IoT) for real-time risk monitoring and personalized pricing. Consumer preferences are rapidly shifting towards digital-first experiences, demanding seamless online applications, self-service portals, and instant claims settlements. This necessitates significant investment in digital transformation by mutual insurers. Competitive dynamics are intensifying, with both traditional mutual players and agile insurtech startups vying for market share. The unique member-centric model of mutual insurance, however, continues to resonate with policyholders seeking trust and long-term value. Market penetration is expected to increase, particularly in emerging economies as financial literacy and insurance awareness grow. This section analyzes how these forces are reshaping strategies and creating new avenues for growth and engagement in the mutual insurance space.

Leading Markets & Segments in Mutual Insurance

This section meticulously dissects the leading markets and segments within the global mutual insurance sector, providing a granular view of dominance and growth potential from 2019 to 2033. The Individual application segment, particularly for Car Insurance and Life Insurance, consistently exhibits strong performance and is projected to remain a dominant force throughout the forecast period. The United States, with its mature insurance market and strong emphasis on member benefits, emerges as a leading country in terms of market share and premium volume, expected to hold over XX% of the global market by 2025. Economic policies that favor stable financial markets and robust consumer spending directly impact the uptake of life and accident insurance. Furthermore, extensive infrastructure, including widespread digital connectivity, facilitates the reach and accessibility of insurance products to a broader population. In the commercial segment, while demand for liability and property insurance remains high, the growth in specialized commercial insurance types, driven by evolving business risks, presents significant opportunities. The increasing complexity of business operations, coupled with stringent regulatory compliance for businesses, drives the demand for tailored commercial mutual insurance solutions.

- Dominant Application Segment: Individual insurance, driven by the universal need for protection across life stages.

- Key Driver (Individual): Growing middle class, increasing disposable income, and heightened awareness of financial planning.

- Specific Metric: Projected CAGR of XX% for individual life insurance within the mutual sector.

- Dominant Product Type: Car Insurance, characterized by high frequency of purchase and essentiality.

- Key Driver (Car Insurance): Rising vehicle ownership, urbanization, and sophisticated risk assessment technologies.

- Specific Metric: Market penetration of car insurance expected to reach XX% by 2025.

- Leading Geographic Market: United States, due to its established regulatory framework and high consumer trust in mutual entities.

- Key Driver (US Market): Favorable regulatory environment, strong historical presence of mutual insurers, and a culture of long-term financial planning.

- Specific Metric: United States' share of global mutual insurance premiums estimated at XX% in 2025.

- Emerging Segment (Commercial): Cyber insurance and business interruption insurance, driven by increasing digital risks and global supply chain vulnerabilities.

- Key Driver (Commercial): Escalating cyber threats, complex supply chain networks, and regulatory mandates for business continuity.

- Specific Metric: Anticipated growth of XX% in commercial cyber insurance premiums.

Mutual Insurance Product Developments

Mutual insurance companies are at the forefront of product innovation, driven by technological advancements and evolving consumer needs. The focus is increasingly on developing highly personalized and flexible insurance solutions. This includes the integration of telematics for car insurance, offering pay-as-you-drive options and incentivizing safe driving behaviors. In life insurance, there's a growing trend towards flexible premium structures and riders that cater to specific life events or health conditions. Accident insurance is being reimagined with more comprehensive coverage for critical illnesses and income protection, often leveraging AI for faster claims processing and risk assessment. The competitive advantage lies in leveraging member data responsibly to create tailored products that offer superior value and enhanced policyholder experiences, aligning with the core principles of mutual insurance.

Key Drivers of Mutual Insurance Growth

Several key drivers are propelling the growth of the mutual insurance market. Technological advancements, particularly in AI and data analytics, are enabling more accurate risk assessment, personalized product development, and efficient claims processing. This leads to improved customer satisfaction and operational efficiency. Economic stability and rising disposable incomes in many regions contribute to increased demand for various insurance products, from life and health to property and casualty. Evolving regulatory frameworks that support consumer protection and fair practices can also foster trust and encourage participation in the mutual insurance model. For instance, regulatory incentives for digital adoption by insurers can accelerate the integration of new technologies.

Challenges in the Mutual Insurance Market

Despite robust growth, the mutual insurance market faces several challenges. Intense competitive pressure from both traditional stock insurance companies and agile insurtech startups necessitates continuous innovation and cost optimization. Navigating complex and evolving regulatory landscapes across different jurisdictions can be a significant hurdle, impacting compliance costs and operational flexibility. Supply chain issues, particularly in areas like data security and technology infrastructure, can affect the seamless delivery of services. Furthermore, adapting to rapid technological shifts and investing in necessary digital transformation requires substantial capital outlay and strategic foresight. The challenge of maintaining member engagement in an increasingly digital world also requires innovative communication and service strategies.

Emerging Opportunities in Mutual Insurance

The mutual insurance sector is poised to capitalize on several emerging opportunities. Leveraging big data and AI for advanced analytics presents a significant catalyst for long-term growth. This includes hyper-personalization of products, proactive risk management solutions for policyholders, and fraud detection. Strategic partnerships with insurtech firms can accelerate digital transformation and expand market reach. Expansion into underserved markets, particularly in developing economies, offers substantial growth potential as financial literacy and insurance penetration increase. The growing demand for sustainability and ESG-aligned investments within the financial sector also provides an opportunity for mutual insurers to differentiate themselves by aligning their investment strategies with their members' values.

Leading Players in the Mutual Insurance Sector

- State Farm

- Zenkyoren

- Liberty Mutual

- Nationwide Mutual Group

- New York Life Insurance

- TIAA

- Northwestern Mutual

- Amica

- Hastings Mutual

- North Star Mutual

- Vermont Mutual

- Brotherhood Mutual

- Acuity

- Wisconsin Mutual

- Church

- Texas Mutual

- RAM Mutual

- Harford Mutual

- Oregon Mutual

- Brethren Mutual

- Franklin Mutual

- A.I.M. Mutual

Key Milestones in Mutual Insurance Industry

- 2019: Increased adoption of AI for claims processing, enhancing efficiency and accuracy.

- 2020: Surge in demand for life and health insurance due to global health events, prompting product innovation.

- 2021: Significant investments in insurtech startups by established mutual insurers to drive digital transformation.

- 2022: Expansion of parametric insurance products for climate-related risks, offering faster payouts.

- 2023: Enhanced focus on data privacy and cybersecurity measures in response to evolving regulations and threats.

- 2024: Growth in embedded insurance solutions, integrating coverage seamlessly into other products and services.

- 2025: Projected acceleration of blockchain adoption for enhanced transparency and security in transactions.

- 2026: Anticipated rise in personalized insurance based on real-time data from IoT devices.

- 2027: Development of advanced risk assessment models for emerging risks like cyber warfare and climate disruption.

- 2028: Increased consolidation through strategic M&A activities to achieve economies of scale and market dominance.

- 2029: Greater emphasis on customer-centric digital platforms for policy management and engagement.

- 2030: Integration of behavioral economics principles to encourage proactive risk mitigation among policyholders.

- 2031: Expansion of offering ESG-focused investment options for policyholder funds.

- 2032: Maturation of AI in underwriting, leading to highly dynamic and personalized pricing.

- 2033: Widespread adoption of virtual customer service assistants for instant support and engagement.

Strategic Outlook for Mutual Insurance Market

The strategic outlook for the mutual insurance market remains exceptionally positive, driven by a fundamental commitment to policyholder value and a burgeoning embrace of digital innovation. Growth accelerators include the continued integration of AI and machine learning for enhanced risk assessment and personalized customer experiences, alongside the expansion of flexible and on-demand insurance products. Strategic partnerships with technology providers and a focus on expanding into emerging markets will further fuel expansion. The inherent trust and member-centric ethos of mutual insurers position them well to capitalize on evolving consumer preferences for transparency and long-term relationships, solidifying their competitive advantage in the years to come.

Mutual Insurance Segmentation

-

1. Application

- 1.1. Individual

- 1.2. Commercial

-

2. Types

- 2.1. Car Insurance

- 2.2. Life Insurance

- 2.3. Accident Insurance

- 2.4. Others

Mutual Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mutual Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mutual Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individual

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Car Insurance

- 5.2.2. Life Insurance

- 5.2.3. Accident Insurance

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mutual Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individual

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Car Insurance

- 6.2.2. Life Insurance

- 6.2.3. Accident Insurance

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mutual Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individual

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Car Insurance

- 7.2.2. Life Insurance

- 7.2.3. Accident Insurance

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mutual Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individual

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Car Insurance

- 8.2.2. Life Insurance

- 8.2.3. Accident Insurance

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mutual Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individual

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Car Insurance

- 9.2.2. Life Insurance

- 9.2.3. Accident Insurance

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mutual Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individual

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Car Insurance

- 10.2.2. Life Insurance

- 10.2.3. Accident Insurance

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 State Farm

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zenkyoren

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liberty Mutual

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nationwide Mutual Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 New York Life Insurance

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TIAA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northwestern Mutual

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hastings Mutual

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 North Star Mutual

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vermont Mutual

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Brotherhood Mutual

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Acuity

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wisconsin Mutual

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Church

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Texas Mutual

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RAM Mutual

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Harford Mutual

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Oregon Mutual

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Brethren Mutual

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Franklin Mutual

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 A.I.M. Mutual

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 State Farm

List of Figures

- Figure 1: Global Mutual Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mutual Insurance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Mutual Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Mutual Insurance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Mutual Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Mutual Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mutual Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mutual Insurance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Mutual Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Mutual Insurance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Mutual Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Mutual Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mutual Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mutual Insurance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Mutual Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mutual Insurance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Mutual Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Mutual Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mutual Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mutual Insurance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Mutual Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Mutual Insurance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Mutual Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Mutual Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mutual Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mutual Insurance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Mutual Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Mutual Insurance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Mutual Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Mutual Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mutual Insurance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mutual Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mutual Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Mutual Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Mutual Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mutual Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Mutual Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Mutual Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mutual Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Mutual Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Mutual Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mutual Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Mutual Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Mutual Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mutual Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Mutual Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Mutual Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mutual Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Mutual Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Mutual Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mutual Insurance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mutual Insurance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Mutual Insurance?

Key companies in the market include State Farm, Zenkyoren, Liberty Mutual, Nationwide Mutual Group, New York Life Insurance, TIAA, Northwestern Mutual, Amica, Hastings Mutual, North Star Mutual, Vermont Mutual, Brotherhood Mutual, Acuity, Wisconsin Mutual, Church, Texas Mutual, RAM Mutual, Harford Mutual, Oregon Mutual, Brethren Mutual, Franklin Mutual, A.I.M. Mutual.

3. What are the main segments of the Mutual Insurance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mutual Insurance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mutual Insurance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mutual Insurance?

To stay informed about further developments, trends, and reports in the Mutual Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence