Key Insights

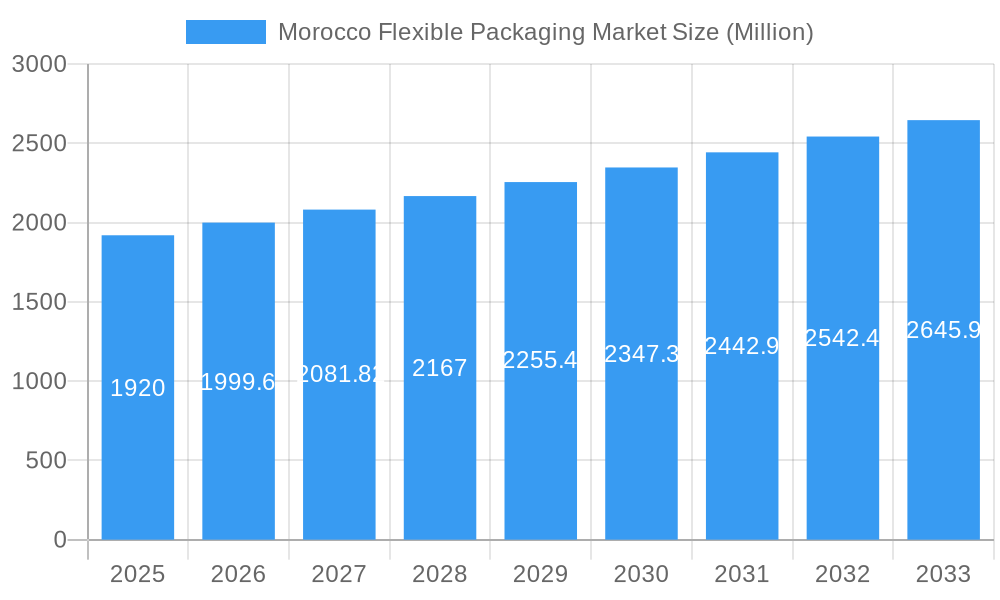

The Morocco flexible packaging market, valued at $1.92 billion in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 4.17% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector in Morocco, coupled with increasing consumer demand for convenient and shelf-stable products, is a significant driver. The rising popularity of e-commerce and online grocery shopping further boosts the need for robust and protective flexible packaging solutions. Growth in the household and personal care segments also contributes to market expansion. The market is segmented by product type (pouches, bags, films and wraps, others), end-user industry (food, beverages, household & personal care, others), and material (paper, plastic, aluminum foil). Key players like Unibag Maghreb, Compagnie Industrielle Des Fibres, and Mondi Pap Sac Maghreb SA are shaping market competition through innovation and expansion. While the market faces challenges such as fluctuating raw material prices and environmental concerns related to plastic waste, the overall outlook remains positive, driven by sustained economic growth and evolving consumer preferences.

Morocco Flexible Packaging Market Market Size (In Billion)

The market's segmentation provides opportunities for specialized players. Companies focusing on sustainable and eco-friendly packaging materials, such as biodegradable plastics or recycled paper, are expected to gain significant traction. Further growth will depend on the ability of manufacturers to meet increasing demand for customized packaging solutions tailored to specific product needs and branding requirements. Government initiatives promoting sustainable packaging practices and regulations addressing plastic waste will also play a crucial role in shaping the future landscape of the Moroccan flexible packaging market. This growth trajectory suggests significant investment opportunities and strategic partnerships within the sector for the foreseeable future.

Morocco Flexible Packaging Market Company Market Share

Morocco Flexible Packaging Market: A Comprehensive Report (2019-2033)

Unlocking Growth Opportunities in Morocco's Dynamic Flexible Packaging Sector. This in-depth report provides a comprehensive analysis of the Morocco flexible packaging market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a meticulous study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers actionable intelligence to navigate the evolving landscape. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a robust CAGR of XX%.

Morocco Flexible Packaging Market Market Dynamics & Concentration

The Morocco flexible packaging market is characterized by a moderately concentrated landscape, with key players vying for market share. Market concentration is further shaped by the entry of international players alongside established domestic entities. Innovation is a key driver, with companies focusing on sustainable and functional packaging solutions. The regulatory framework, while evolving, presents both opportunities and challenges. Product substitutes, primarily rigid packaging, pose some competitive pressure, although the convenience and cost-effectiveness of flexible packaging maintain its dominant position. End-user trends toward convenience and sustainability are significantly impacting material choices and product design. M&A activity in the sector remains moderate, with a total of xx deals recorded in the last five years. Key players are strategically expanding through partnerships and acquisitions to gain access to new technologies and markets. Market share distribution in 2025 is predicted to be as follows: Leading players hold approximately 60% of the market, while the remaining 40% is distributed among smaller and emerging companies.

Morocco Flexible Packaging Market Industry Trends & Analysis

The Morocco flexible packaging market is experiencing significant growth driven by several key factors. The burgeoning food and beverage industry, coupled with a rising population and changing consumer preferences, fuels demand for flexible packaging. Technological advancements, such as advancements in barrier materials and printing technologies, enable the creation of more sustainable and aesthetically appealing packaging. Consumer preferences are shifting towards convenient, tamper-evident, and environmentally friendly options, influencing the demand for innovative flexible packaging solutions. Competitive dynamics are intensifying, prompting companies to invest in R&D, enhance operational efficiency, and build strong brand recognition. The market's growth is further amplified by the expanding e-commerce sector and the increasing adoption of flexible packaging in the personal care and pharmaceutical sectors. The market penetration rate of flexible packaging, especially in the food and beverage segment, is projected to reach xx% by 2033. This is driven by the increasing demand for convenience and ease of use of flexible packaging, along with its ability to extend the shelf life of products.

Leading Markets & Segments in Morocco Flexible Packaging Market

- By Product Type: Pouches currently dominate the market, driven by their versatility and ease of use. Bags represent a significant segment, particularly for dry goods and consumer products. Films and Wraps are witnessing increasing demand from the food and beverage industry, offering enhanced barrier properties and preservation. Other Product Types account for a smaller but growing share of the market.

- By End-user Industry: The food and beverage sector leads the demand, followed by household and personal care. Other end-user industries including pharmaceuticals, industrial goods and agricultural sectors are gradually increasing their adoption of flexible packaging, creating growth opportunities for the market.

- By Material: Plastic remains the most widely used material, owing to its cost-effectiveness and versatility. However, there is a growing trend towards eco-friendly alternatives like paper and biodegradable plastics, driven by environmental regulations and consumer consciousness. Aluminum foil segments also have a significant presence in packaging certain food and beverage products.

Key drivers for these segments include the increasing urbanization, growing disposable income, and the rise in popularity of packaged foods and beverages. The economic policies promoting local manufacturing and industrialization, along with investments in infrastructure are also creating a positive impact on the market. The expansion of the retail sector in Morocco is creating significant opportunities for the flexible packaging market.

Morocco Flexible Packaging Market Product Developments

The Moroccan flexible packaging market is witnessing a dynamic evolution, driven by a strong emphasis on sustainability and enhanced functionality. Recent innovations have seen a significant surge in the adoption of eco-friendly materials, including bio-based polymers derived from renewable resources and a growing range of compostable and biodegradable options. These developments are not only a response to mounting global environmental concerns but also a direct alignment with the increasingly discerning preferences of Moroccan consumers who are actively seeking greener alternatives. Concurrently, advancements in high-definition printing technologies are empowering brands with unprecedented capabilities for intricate designs and vibrant visuals, facilitating superior product differentiation and a more impactful shelf presence. This technological leap is crucial in an increasingly competitive landscape. Furthermore, there is a pronounced focus on bolstering barrier properties in flexible packaging. This is particularly critical for safeguarding the integrity and extending the shelf-life of sensitive products like dairy items, fresh produce, and processed foods, thereby offering greater convenience and reduced waste for both consumers and retailers. The integration of smart packaging solutions, such as embedded QR codes and NFC tags, is also gaining traction, promising to revolutionize consumer engagement by offering direct access to product information, authenticity verification, and interactive experiences, while simultaneously bolstering supply chain traceability.

Key Drivers of Morocco Flexible Packaging Market Growth

The Moroccan flexible packaging market is propelled by a confluence of factors. The expanding food processing and beverage industries fuel demand for efficient and protective packaging solutions. Increased consumer disposable incomes boost demand for packaged goods, while the growth of e-commerce necessitates robust and protective packaging for delivery. Government initiatives promoting sustainable packaging are driving the adoption of eco-friendly materials. Finally, investments in modernizing infrastructure improve supply chain efficiency and support market expansion.

Challenges in the Morocco Flexible Packaging Market Market

Despite its promising trajectory, the Morocco flexible packaging market is confronted with a series of intricate challenges. A primary concern remains the inherent volatility of raw material prices, which can significantly impact production costs and profit margins for manufacturers. Furthermore, persistent global supply chain disruptions, coupled with evolving logistics complexities within the region, present ongoing operational hurdles that necessitate agile and resilient strategies. The market is also characterized by intense competition, not only from established local players but also from an increasing influx of emerging international entities, compelling businesses to continuously pursue innovation, operational efficiency, and cost optimization. Adhering to increasingly stringent environmental regulations, both national and international, and meeting the escalating consumer demand for sustainable and ethically produced packaging requires substantial and continuous investment in cutting-edge technologies, research and development into novel sustainable materials, and the adoption of circular economy principles. Additionally, navigating existing regulatory frameworks for the import and export of certain packaging materials and components can introduce significant barriers to market entry and expansion for both domestic and foreign companies.

Emerging Opportunities in Morocco Flexible Packaging Market

The Moroccan flexible packaging market is ripe with significant growth opportunities, primarily fueled by a growing global and local emphasis on environmental responsibility. A key area of opportunity lies in the continued exploration, development, and scaling of sustainable and eco-friendly packaging solutions. This includes leveraging recycled content, further advancing biodegradable and compostable alternatives, and exploring innovative material science. Strategic collaborations and partnerships with international packaging leaders can serve as a powerful catalyst, providing access to state-of-the-art technologies, best practices, and broader global market reach, thereby accelerating innovation and competitiveness. Investing in advanced printing and finishing technologies offers a distinct avenue for product differentiation, allowing brands to create visually stunning and unique packaging that captures consumer attention and enhances brand loyalty. The expanding pharmaceutical and medical packaging sector presents a substantial untapped opportunity, given the stringent requirements for sterility, protection, and traceability in these industries. Moreover, capitalizing on the burgeoning demand for smart packaging solutions, by integrating features like enhanced traceability, anti-counterfeiting measures, and interactive consumer experiences, offers a pathway to significant market expansion and premium product offerings.

Leading Players in the Morocco Flexible Packaging Market Sector

- Unibag Maghreb

- Compagnie Industrielle Des Fibres

- Mondi Pap Sac Maghreb SA (Mondi PLC)

- Hotpack Packaging Industries LLC

- Alpla Werke Alwin Lehner GmbH & Co KG

- Almapack

- Afrimag Glue

- Amcor Group GmbH

- Atlantic Packaging SA (Diana Holding)

- Societe Nouvelle Des Etablissements Manusac

Key Milestones in Morocco Flexible Packaging Market Industry

- July 2023: Smurfit Kappa's substantial EUR 38.51 Million investment in a new state-of-the-art facility in Rabat marks a significant commitment to the Moroccan market and its strategic position for broader African expansion. This investment is poised to considerably boost production capacity, enhance operational efficiencies, and elevate overall market competitiveness.

- October 2023: The strategic collaboration between ITC Packaging and Erum Group to establish ITCErum Packaging signifies a pivotal moment. This alliance is expected to significantly expand product portfolios, foster synergistic innovation, and strengthen the competitive landscape within the Moroccan flexible packaging sector, potentially unlocking new market reach and driving advancements.

Strategic Outlook for Morocco Flexible Packaging Market Market

The Moroccan flexible packaging market presents a compelling investment opportunity for companies seeking to capitalize on steady growth and expanding demand. Strategic partnerships, investments in sustainable solutions, and innovations in advanced packaging technologies are critical factors shaping the market’s future. Companies that adapt to evolving consumer preferences and leverage technological advancements will be well-positioned to capture significant market share in the years to come. The market's long-term outlook remains optimistic, fueled by strong economic growth and increasing consumer demand for packaged goods.

Morocco Flexible Packaging Market Segmentation

-

1. Material

- 1.1. Paper

- 1.2. Plastic

- 1.3. Aluminum Foil

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Household and Personal Care

- 3.4. Other End-User Industries

Morocco Flexible Packaging Market Segmentation By Geography

- 1. Morocco

Morocco Flexible Packaging Market Regional Market Share

Geographic Coverage of Morocco Flexible Packaging Market

Morocco Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging Solution; Growing Demand for Sustainable Packaging Solution

- 3.3. Market Restrains

- 3.3.1. Fluctuation in the Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Plastic is Expected to Dominate the Material Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper

- 5.1.2. Plastic

- 5.1.3. Aluminum Foil

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Household and Personal Care

- 5.3.4. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unibag Maghreb

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Industrielle Des Fibres

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi Pap Sac Maghreb SA (Mondi PLC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hotpack Packaging Industries LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alpla Werke Alwin Lehner GmbH & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Almapack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Afrimag Glue

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor Group GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Atlantic Packaging SA (Diana Holding)*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Societe Nouvelle Des Etablissements Manusac

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Unibag Maghreb

List of Figures

- Figure 1: Morocco Flexible Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Morocco Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Morocco Flexible Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Morocco Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Morocco Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Morocco Flexible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Morocco Flexible Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Morocco Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Morocco Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Morocco Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Flexible Packaging Market?

The projected CAGR is approximately 4.17%.

2. Which companies are prominent players in the Morocco Flexible Packaging Market?

Key companies in the market include Unibag Maghreb, Compagnie Industrielle Des Fibres, Mondi Pap Sac Maghreb SA (Mondi PLC), Hotpack Packaging Industries LLC, Alpla Werke Alwin Lehner GmbH & Co KG, Almapack, Afrimag Glue, Amcor Group GmbH, Atlantic Packaging SA (Diana Holding)*List Not Exhaustive, Societe Nouvelle Des Etablissements Manusac.

3. What are the main segments of the Morocco Flexible Packaging Market?

The market segments include Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging Solution; Growing Demand for Sustainable Packaging Solution.

6. What are the notable trends driving market growth?

Plastic is Expected to Dominate the Material Segment.

7. Are there any restraints impacting market growth?

Fluctuation in the Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

July 2023: Smurfit Kappa made a substantial investment of approximately EUR 4.7 billion (USD 5.17 billion) to support its global customer base. The company inaugurated its site in North Africa, a state-of-the-art integrated plant in Rabat, Morocco. Smurfit Kappa's strategic positioning in Morocco allows it to efficiently serve the local market and the broader African regions across various sectors, including industrial, agriculture, automotive, consumer products, and pharmaceutical. Notably, the group invested more than EUR 35 million (USD 38.51 million) in this expansive 25,000 m2 facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Morocco Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence