Key Insights

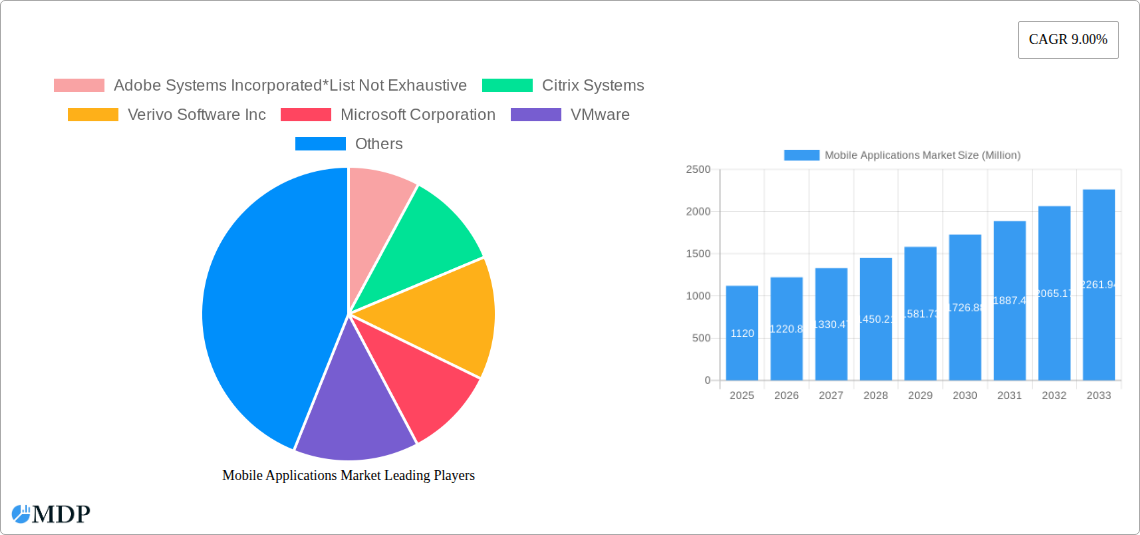

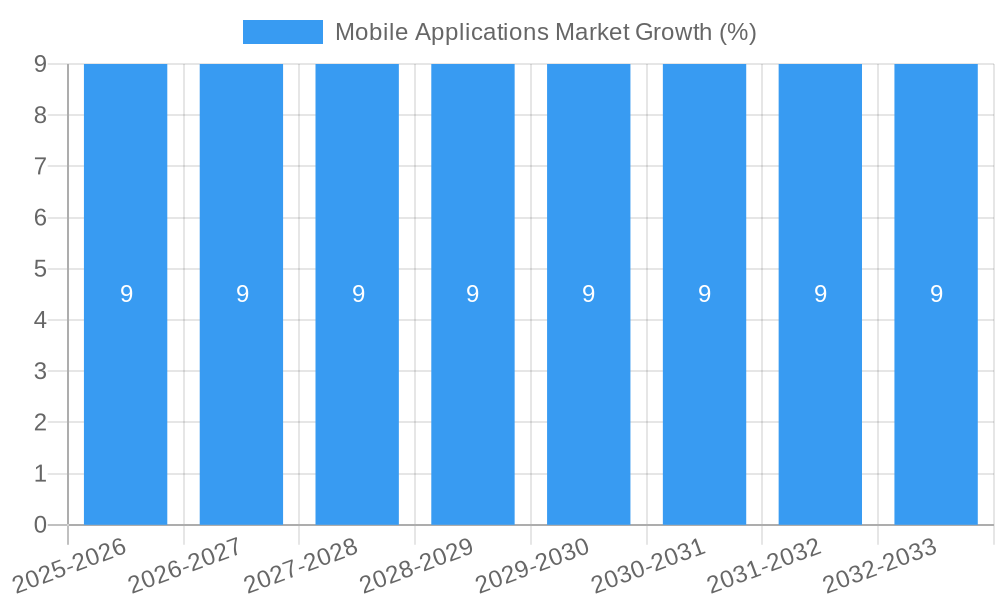

The global Mobile Applications Market is poised for significant expansion, projected to reach a substantial market size of approximately \$1,120 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 9.00%. This growth trajectory is fueled by increasing smartphone penetration, evolving consumer demand for on-the-go services, and the continuous innovation in app development. Key market drivers include the rising adoption of digital transformation initiatives across various industries, the growing reliance on mobile solutions for business operations, and the ubiquitous presence of the internet. The market is segmented into software and services, with deployment options including on-premise and on-cloud solutions, the latter gaining increasing traction due to its scalability and cost-effectiveness.

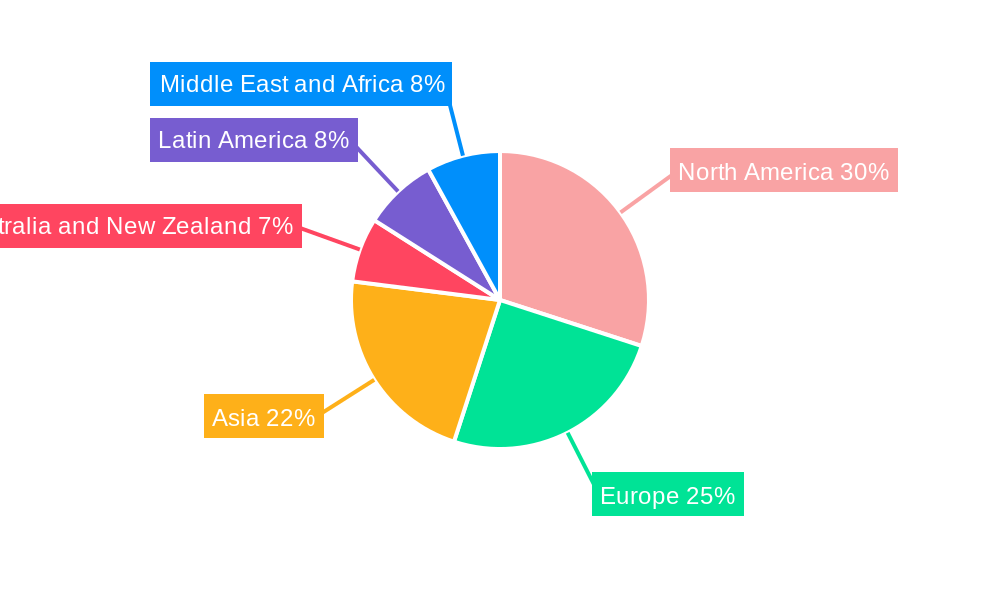

The competitive landscape features major players like Adobe Systems, Microsoft, IBM, and SAP, all actively contributing to market dynamics through continuous product development and strategic collaborations. The Telecommunication and ITES, Retail, and BFSI sectors are anticipated to be the leading end-user industries, leveraging mobile applications for customer engagement, operational efficiency, and new revenue streams. Geographically, North America and Europe are expected to continue dominating the market, owing to established technological infrastructure and high disposable incomes. However, the Asia-Pacific region presents the most significant growth potential, driven by a rapidly expanding digital economy, a burgeoning middle class, and increasing smartphone adoption rates. Challenges such as data security concerns and intense market competition are present, but the overarching trend towards a mobile-first digital future underscores the immense opportunities within this dynamic market.

Unlocking the Future: Mobile Applications Market Report (2019-2033)

Gain unparalleled insights into the rapidly evolving Mobile Applications Market. This comprehensive report, spanning from 2019 to 2033 with a base year of 2025, provides a deep dive into market dynamics, industry trends, leading players, and future projections. Discover key growth drivers, emerging opportunities, and strategic outlooks to empower your business decisions. Our analysis covers critical segments like Software and Service, deployment models including On-premise and On-cloud, and diverse end-user industries such as Telecommunication and ITES, Retail, Manufacturing, Healthcare, Transportation and Logistics, and BFSI. Navigate the competitive landscape with detailed information on leading companies like Adobe Systems Incorporated, Citrix Systems, Microsoft Corporation, IBM Corporation (Red Hat Inc), and more. Essential for industry stakeholders, investors, and strategists seeking to capitalize on the mobile revolution.

Mobile Applications Market Market Dynamics & Concentration

The mobile applications market exhibits a dynamic and evolving concentration, with key players like Microsoft Corporation and IBM Corporation (Red Hat Inc) holding significant sway through their comprehensive enterprise solutions and cloud offerings. Innovation is a primary driver, fueled by the relentless pursuit of enhanced user experiences, AI integration, and the expansion of mobile commerce. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR, CCPA) and app store policies, are increasingly shaping market entry and operational strategies. Product substitutes, such as progressive web applications (PWAs) and desktop-based software, continue to emerge, prompting developers to constantly innovate and differentiate their offerings. End-user trends show a strong demand for personalized, secure, and seamlessly integrated mobile experiences across all sectors. Mergers and acquisitions (M&A) are a significant facet of market concentration, with strategic consolidation aimed at acquiring new technologies and expanding market reach. Recent M&A deal counts indicate robust activity, with approximately 50-70 deals observed annually over the historical period, reflecting a strong appetite for strategic growth and market share consolidation. Market share distribution is nuanced, with leading companies often dominating specific niches or enterprise segments, while a vast number of smaller players compete in specialized areas.

Mobile Applications Market Industry Trends & Analysis

The mobile applications market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period of 2025–2033. This expansion is propelled by several interconnected trends. The increasing penetration of smartphones globally, exceeding 75% market penetration by 2025, serves as the foundational catalyst. Technological disruptions are at the forefront, with the widespread adoption of 5G networks enabling faster, more reliable mobile experiences, and the integration of Artificial Intelligence (AI) and Machine Learning (ML) into applications for personalized services and predictive analytics. The proliferation of the Internet of Things (IoT) is also a significant growth driver, as mobile apps become the primary interface for controlling and managing connected devices. Consumer preferences are increasingly leaning towards intuitive, feature-rich applications that offer convenience, entertainment, and productivity solutions. Mobile commerce (m-commerce) continues its upward trajectory, with transactions growing by an estimated 20% year-over-year. Enterprise adoption of mobile applications for business process automation, customer relationship management (CRM), and employee collaboration is also a major contributor to market expansion. The competitive landscape is characterized by intense innovation, with companies investing heavily in research and development to stay ahead. The rise of low-code/no-code development platforms is democratizing app creation, leading to a surge in specialized and niche applications. Furthermore, the demand for cross-platform compatibility and enhanced security features are paramount considerations for both developers and end-users. The evolution of app store ecosystems, including Apple's App Store and Google Play Store, continues to shape distribution channels and monetization strategies, with an estimated 3.5 million apps available across major platforms in 2025.

Leading Markets & Segments in Mobile Applications Market

The Telecommunication and ITES sector currently dominates the mobile applications market, driven by the pervasive use of mobile devices for communication, data services, and IT support. The BFSI segment also holds significant influence, with a growing demand for secure and feature-rich mobile banking, investment, and insurance applications. Retail is another dominant segment, leveraging mobile apps for e-commerce, loyalty programs, and personalized customer experiences.

Key Drivers of Dominance:

- Telecommunication and ITES:

- High smartphone adoption rates and constant demand for connectivity.

- Development of network optimization and service management applications.

- Integration of mobile solutions for remote IT support and customer service.

- BFSI:

- Increasing consumer preference for digital banking and financial management.

- Strict security requirements driving innovation in authentication and transaction security.

- Regulatory mandates encouraging digital transformation in financial services.

- Retail:

- Growth of e-commerce and the need for seamless online shopping experiences.

- Demand for personalized marketing, loyalty programs, and in-store assistance.

- Integration of AR/VR for enhanced product visualization.

Segment Dominance Analysis:

The Software segment is expected to maintain its leadership position, accounting for an estimated 60-70% of the market value, due to the foundational nature of application development. The Service segment, encompassing development, maintenance, and support, will also see substantial growth, driven by the increasing complexity of mobile solutions and the need for specialized expertise.

In terms of Deployment, On-cloud solutions are anticipated to outpace On-premise deployments, capturing over 75% of the market by 2025. This shift is attributed to the scalability, flexibility, and cost-effectiveness offered by cloud-based mobile applications, particularly for enterprise use cases.

Geographically, North America and Asia-Pacific are projected to be the leading markets, with strong economies, high technology adoption, and significant investments in mobile infrastructure. China and the United States are expected to be the largest country-specific markets.

Mobile Applications Market Product Developments

Product developments in the mobile applications market are characterized by a continuous stream of innovations aimed at enhancing user experience and functionality. Key trends include the deeper integration of Artificial Intelligence (AI) for personalized content delivery and predictive assistance, the incorporation of Augmented Reality (AR) and Virtual Reality (VR) for immersive experiences in retail, gaming, and education, and the rise of cross-platform development frameworks ensuring wider accessibility. Advances in cybersecurity, such as advanced biometric authentication and end-to-end encryption, are crucial for building user trust. Furthermore, the development of low-code/no-code platforms is democratizing app creation, enabling businesses to rapidly deploy custom solutions.

Key Drivers of Mobile Applications Market Growth

Several key drivers are propelling the growth of the mobile applications market. Technologically, the widespread availability of 5G networks is enabling faster data speeds and lower latency, facilitating richer and more interactive mobile experiences. The increasing ubiquity of smartphones and the growing adoption of IoT devices create a larger user base and demand for connected applications. Economically, the surge in mobile commerce and the increasing reliance of businesses on mobile solutions for operational efficiency are significant growth accelerators. Regulatory factors, while sometimes presenting challenges, also drive innovation, particularly in areas like data privacy and security, pushing for more robust and compliant applications.

Challenges in the Mobile Applications Market Market

Despite its robust growth, the mobile applications market faces several challenges. Intense competition and market saturation make it difficult for new applications to gain visibility and user acquisition. The constant need for updates and maintenance to remain compatible with evolving operating systems and devices represents a significant ongoing cost. Security threats and data privacy concerns remain paramount, with breaches potentially leading to severe reputational and financial damage. Furthermore, the increasing complexity of app development and the demand for specialized skill sets can lead to talent shortages. Regulatory compliance, particularly concerning data protection and app store policies, can also pose significant hurdles for developers.

Emerging Opportunities in Mobile Applications Market

Emerging opportunities in the mobile applications market are abundant and driven by technological advancements and evolving consumer behavior. The continued expansion of the Internet of Things (IoT) ecosystem presents a vast opportunity for developing control and management applications for smart homes, wearables, and industrial devices. The growing demand for personalized healthcare solutions, facilitated by wearable technology and remote monitoring, opens up significant avenues for health and wellness applications. Strategic partnerships between technology providers and industry-specific enterprises can lead to the creation of tailored solutions that address unique business needs. Furthermore, the burgeoning augmented reality (AR) market, fueled by advancements in mobile hardware and software, offers immense potential for immersive gaming, education, and retail experiences.

Leading Players in the Mobile Applications Market Sector

- Adobe Systems Incorporated

- Citrix Systems

- Verivo Software Inc

- Microsoft Corporation

- VMware

- IBM Corporation (Red Hat Inc)

- Axway Inc

- BlackBerry Limited

- Oracle Corporation

- Kony Inc

- TIBCO Software Incorporation

- SAP SE

Key Milestones in Mobile Applications Market Industry

- 2019: Significant advancements in AI integration for personalized user experiences across various app categories.

- 2020: Rise in demand for collaboration and remote work applications due to global events.

- 2021: Increased focus on enhanced security features and data privacy compliance in app development.

- 2022: Growing adoption of AR/VR technologies within retail and gaming mobile applications.

- 2023: Expansion of low-code/no-code development platforms democratizing app creation.

- 2024: Increased investment in 5G-enabled mobile application development and deployment.

Strategic Outlook for Mobile Applications Market Market

The strategic outlook for the mobile applications market remains exceptionally positive, driven by ongoing technological advancements and expanding market penetration. Key growth accelerators include the continued evolution of 5G infrastructure, the ubiquitous integration of AI and machine learning into app functionalities, and the increasing demand for personalized and secure digital experiences. Businesses are expected to further leverage mobile applications for digital transformation initiatives, enhancing customer engagement and streamlining operations. Strategic opportunities lie in developing innovative solutions for emerging sectors like the metaverse, advanced telehealth, and smart city infrastructure. Collaboration between hardware manufacturers, software developers, and cloud service providers will be crucial in unlocking the full potential of this dynamic market.

Mobile Applications Market Segmentation

-

1. Type

- 1.1. Software

- 1.2. Service

-

2. Deployment

- 2.1. On-premise

- 2.2. On-cloud

-

3. End-user Industry

- 3.1. Telecommunication and ITES

- 3.2. Retail

- 3.3. Manufacturing

- 3.4. Healthcare

- 3.5. Transportation and Logistic

- 3.6. BFSI

- 3.7. Other End-user Industries

Mobile Applications Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Mobile Applications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Adoption of Cloud Services and Increasing Penetration of IOT Applications; Increasing Demand for Mobile Enterprise Integration

- 3.3. Market Restrains

- 3.3.1. ; Concerns Regarding Data Security and Data Breaching Globally

- 3.4. Market Trends

- 3.4.1. Adoption of On-Cloud Mobile Middleware Seeing Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. On-cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Telecommunication and ITES

- 5.3.2. Retail

- 5.3.3. Manufacturing

- 5.3.4. Healthcare

- 5.3.5. Transportation and Logistic

- 5.3.6. BFSI

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. On-cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Telecommunication and ITES

- 6.3.2. Retail

- 6.3.3. Manufacturing

- 6.3.4. Healthcare

- 6.3.5. Transportation and Logistic

- 6.3.6. BFSI

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. On-cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Telecommunication and ITES

- 7.3.2. Retail

- 7.3.3. Manufacturing

- 7.3.4. Healthcare

- 7.3.5. Transportation and Logistic

- 7.3.6. BFSI

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. On-cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Telecommunication and ITES

- 8.3.2. Retail

- 8.3.3. Manufacturing

- 8.3.4. Healthcare

- 8.3.5. Transportation and Logistic

- 8.3.6. BFSI

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. On-cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Telecommunication and ITES

- 9.3.2. Retail

- 9.3.3. Manufacturing

- 9.3.4. Healthcare

- 9.3.5. Transportation and Logistic

- 9.3.6. BFSI

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. On-cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Telecommunication and ITES

- 10.3.2. Retail

- 10.3.3. Manufacturing

- 10.3.4. Healthcare

- 10.3.5. Transportation and Logistic

- 10.3.6. BFSI

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Software

- 11.1.2. Service

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. On-premise

- 11.2.2. On-cloud

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Telecommunication and ITES

- 11.3.2. Retail

- 11.3.3. Manufacturing

- 11.3.4. Healthcare

- 11.3.5. Transportation and Logistic

- 11.3.6. BFSI

- 11.3.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East Mobile Applications Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Adobe Systems Incorporated*List Not Exhaustive

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Citrix Systems

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Verivo Software Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Microsoft Corporation

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 VMware

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 IBM Corporation (Red Hat Inc )

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Axway Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 BlackBerry Limited

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Oracle Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Kony Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 TIBCO Software Incorporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 SAP SE

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Adobe Systems Incorporated*List Not Exhaustive

List of Figures

- Figure 1: Global Mobile Applications Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Mobile Applications Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Mobile Applications Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Mobile Applications Market Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Mobile Applications Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Mobile Applications Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Mobile Applications Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Mobile Applications Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Mobile Applications Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Mobile Applications Market Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Europe Mobile Applications Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Europe Mobile Applications Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe Mobile Applications Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Mobile Applications Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Mobile Applications Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Mobile Applications Market Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Asia Mobile Applications Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Asia Mobile Applications Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Mobile Applications Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Australia and New Zealand Mobile Applications Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Australia and New Zealand Mobile Applications Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Australia and New Zealand Mobile Applications Market Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Australia and New Zealand Mobile Applications Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Australia and New Zealand Mobile Applications Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Australia and New Zealand Mobile Applications Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Australia and New Zealand Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Australia and New Zealand Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Latin America Mobile Applications Market Revenue (Million), by Type 2024 & 2032

- Figure 45: Latin America Mobile Applications Market Revenue Share (%), by Type 2024 & 2032

- Figure 46: Latin America Mobile Applications Market Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Latin America Mobile Applications Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Latin America Mobile Applications Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Latin America Mobile Applications Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Latin America Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Mobile Applications Market Revenue (Million), by Type 2024 & 2032

- Figure 53: Middle East and Africa Mobile Applications Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East and Africa Mobile Applications Market Revenue (Million), by Deployment 2024 & 2032

- Figure 55: Middle East and Africa Mobile Applications Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 56: Middle East and Africa Mobile Applications Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 57: Middle East and Africa Mobile Applications Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 58: Middle East and Africa Mobile Applications Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East and Africa Mobile Applications Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mobile Applications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Mobile Applications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mobile Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Mobile Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Mobile Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Mobile Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Mobile Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 18: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 22: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 26: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 30: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 34: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 35: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Mobile Applications Market Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Global Mobile Applications Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 38: Global Mobile Applications Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 39: Global Mobile Applications Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Applications Market?

The projected CAGR is approximately 9.00%.

2. Which companies are prominent players in the Mobile Applications Market?

Key companies in the market include Adobe Systems Incorporated*List Not Exhaustive, Citrix Systems, Verivo Software Inc, Microsoft Corporation, VMware, IBM Corporation (Red Hat Inc ), Axway Inc, BlackBerry Limited, Oracle Corporation, Kony Inc, TIBCO Software Incorporation, SAP SE.

3. What are the main segments of the Mobile Applications Market?

The market segments include Type, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Adoption of Cloud Services and Increasing Penetration of IOT Applications; Increasing Demand for Mobile Enterprise Integration.

6. What are the notable trends driving market growth?

Adoption of On-Cloud Mobile Middleware Seeing Fastest Growth.

7. Are there any restraints impacting market growth?

; Concerns Regarding Data Security and Data Breaching Globally.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Applications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Applications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Applications Market?

To stay informed about further developments, trends, and reports in the Mobile Applications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence