Key Insights

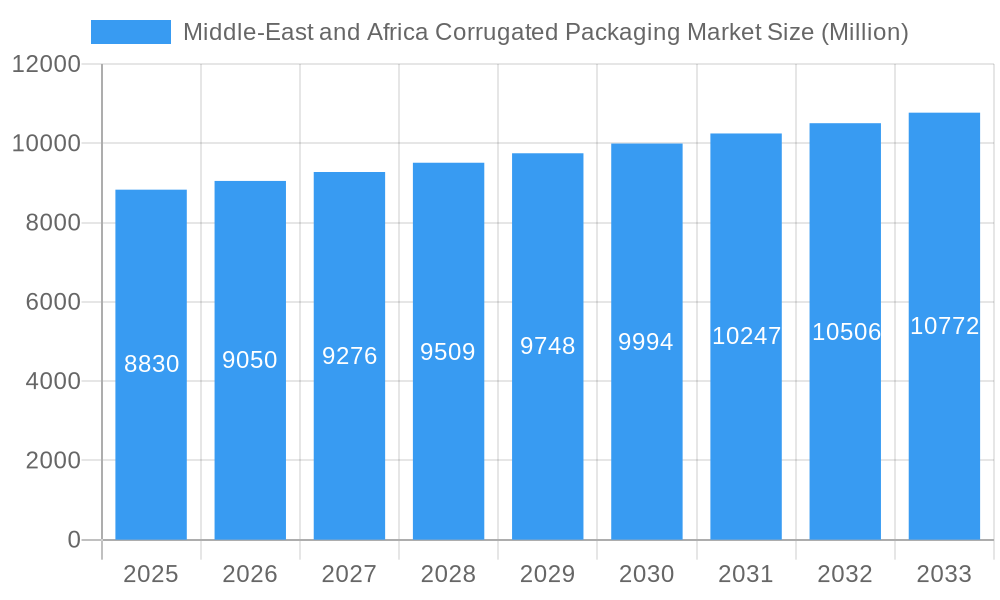

The Middle East and Africa corrugated packaging market, valued at $8.83 billion in 2025, is projected to experience steady growth, driven by a burgeoning e-commerce sector, increasing consumer goods demand, and a rise in the food and beverage industry. A Compound Annual Growth Rate (CAGR) of 2.28% is anticipated from 2025 to 2033, indicating a consistent, albeit moderate, expansion. This growth is fueled by several factors: the increasing adoption of corrugated packaging for its cost-effectiveness and durability, particularly in sectors like FMCG and logistics; government initiatives promoting sustainable packaging solutions in several regional countries; and the expansion of manufacturing and industrial activities across the region. However, fluctuations in raw material prices, particularly recycled paper, and the competitive landscape featuring both established players and new entrants, pose potential challenges to market growth. The market segmentation likely encompasses various packaging types (e.g., boxes, sheets, displays), end-use industries (e.g., food and beverage, consumer goods, electronics), and packaging solutions (e.g., plain, printed, customized). The competitive landscape shows a mixture of established players and local companies reflecting varying levels of market penetration and technological sophistication.

Middle-East and Africa Corrugated Packaging Market Market Size (In Billion)

Key players like Arabian Packaging Co LLC, Queenex Corrugated Carton Factory, and United Carton Industries Company (UCIC) are expected to maintain their market presence through strategic investments in innovation and capacity expansion. The market’s future hinges on adapting to the increasing demand for sustainable and customized packaging, particularly with the growing emphasis on e-commerce fulfillment and the need for environmentally conscious solutions. Companies will need to invest in innovative technologies and sustainable practices to remain competitive and cater to evolving consumer preferences. Regional variations in growth are likely, reflecting economic conditions and infrastructural development in different countries across the Middle East and Africa. Further market research would be needed to accurately quantify the contributions from different segments and regions.

Middle-East and Africa Corrugated Packaging Market Company Market Share

Middle East & Africa Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa corrugated packaging market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. The report leverages extensive data analysis to forecast market size and growth, providing actionable strategies for navigating this dynamic sector.

Middle-East and Africa Corrugated Packaging Market Market Dynamics & Concentration

The Middle East and Africa corrugated packaging market exhibits a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors including economies of scale, technological advancements, and strategic acquisitions. The market is witnessing a surge in innovation, driven by the need for sustainable and cost-effective packaging solutions. Regulatory frameworks, including those related to environmental sustainability and product safety, significantly impact market dynamics. The market also experiences competitive pressure from alternative packaging materials, including plastic and paper-based options. End-user trends, particularly within the e-commerce and food & beverage sectors, are key drivers of market growth.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024, indicating consolidation within the industry.

- Innovation Drivers: Growing demand for eco-friendly packaging and customized solutions fuels innovation.

- Regulatory Frameworks: Government regulations on packaging waste management influence material choices and manufacturing processes.

- Product Substitutes: Competition from alternative packaging materials presents a challenge.

- End-User Trends: E-commerce growth and changing consumer preferences drive demand for specialized packaging.

Middle-East and Africa Corrugated Packaging Market Industry Trends & Analysis

The Middle East and Africa corrugated packaging market is experiencing robust and dynamic growth, propelled by a confluence of powerful factors. The relentless expansion of the e-commerce sector continues to be a primary growth engine, creating an ever-increasing demand for reliable and efficient packaging solutions to facilitate online retail. Coupled with this is a discernible rise in consumer spending across many nations in the region, particularly in burgeoning middle-class populations, which directly translates to higher consumption of packaged goods. Furthermore, the accelerated growth of diverse end-use industries, including food and beverages, pharmaceuticals, electronics, and consumer durables, significantly contributes to the escalating need for corrugated packaging.

The industry is also undergoing a profound transformation driven by rapid technological advancements. The integration of automation in manufacturing processes is revolutionizing operational efficiency, reducing production times, and enhancing cost-effectiveness. Digital printing technologies are opening new avenues for customization, personalization, and on-demand production, catering to specific brand requirements and consumer preferences. Simultaneously, there is a pronounced shift in consumer preferences towards sustainable and eco-friendly packaging solutions. This growing awareness is influencing material selection, pushing for the adoption of recycled content, biodegradable options, and lightweight designs that minimize environmental impact. The competitive landscape is intensely shaped by strategic pricing, a strong emphasis on product differentiation through innovative designs and functionalities, and the continuous investment in cutting-edge technological capabilities.

The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately **6.8%** during the forecast period (2025-2033). The market penetration of innovative packaging solutions, including those with enhanced barrier properties and smart packaging features, is expected to increase significantly, potentially by **25%** by 2033.

Leading Markets & Segments in Middle-East and Africa Corrugated Packaging Market

The report identifies **South Africa** as the leading region in the Middle East and Africa corrugated packaging market in 2025, driven by a combination of economic vitality, well-established industrial base, and progressive consumer market.

- Key Drivers in South Africa:

- Strong economic growth and rising disposable incomes, particularly in urban centers.

- Robust infrastructure development supporting sophisticated logistics and efficient distribution networks across the country and neighboring regions.

- Favorable government policies and initiatives aimed at promoting industrial growth, manufacturing, and export activities.

- Increasing adoption of e-commerce and online retail, mirroring global trends and creating substantial demand for shipping and product packaging.

- A mature and diverse food and beverage sector, a significant consumer of corrugated packaging.

This regional dominance is meticulously analyzed based on comprehensive data regarding consumption volumes, overall market size, and projected growth rates. The report further delves into leading segments within the market, providing in-depth insights into their individual growth trajectories, market share, and future prospects, thereby offering a granular understanding of the market's structure and opportunities.

Middle-East and Africa Corrugated Packaging Market Product Developments

The market witnesses continuous product innovations focusing on enhancing functionalities, such as improved durability, increased sustainability (using recycled materials), and enhanced printability. Technological advancements, such as digital printing and automated packaging lines, are enabling customized packaging solutions and streamlining production processes. The focus on lightweight yet strong materials is driven by cost efficiency and environmental concerns. These developments provide manufacturers with significant competitive advantages, leading to market share gains and improved profitability.

Key Drivers of Middle-East and Africa Corrugated Packaging Market Growth

Several pivotal factors are acting as powerful accelerators for the growth of the Middle East and Africa corrugated packaging market. The unprecedented expansion of the e-commerce sector across the region is a paramount driver, directly necessitating a continuous increase in the demand for robust, secure, and cost-effective packaging solutions for product delivery. Concurrently, a growing emphasis on environmental sustainability and responsible consumption is leading to the implementation of government regulations and consumer-driven initiatives that actively promote the adoption of eco-friendly and recyclable packaging materials. Technological advancements, particularly in the realm of automation and digital printing, are playing a transformative role by significantly enhancing production efficiency, reducing operational costs, and enabling greater customization and flexibility. The burgeoning food and beverage industry, a consistently large consumer of corrugated packaging, alongside the broader trend of rising consumer spending power in many African nations, further contribute to the sustained and robust expansion of this vital market.

Challenges in the Middle-East and Africa Corrugated Packaging Market Market

The market faces several challenges, including fluctuating raw material prices (especially paper pulp), impacting production costs. Supply chain disruptions and logistical hurdles can cause delays and increase expenses. Intense competition among established players and new entrants puts pressure on pricing and margins. Stringent environmental regulations require companies to adapt to sustainable practices, incurring additional costs. These challenges collectively impact the market's overall growth trajectory.

Emerging Opportunities in Middle-East and Africa Corrugated Packaging Market

Significant and lucrative opportunities are emerging within the Middle East and Africa corrugated packaging market, ripe for exploration by forward-thinking businesses. The escalating adoption of e-commerce presents a substantial and growing demand for highly customized and specialized packaging solutions that can ensure product integrity during transit and enhance the unboxing experience for consumers. Strategic collaborations and partnerships between corrugated packaging manufacturers and leading e-commerce platforms can unlock immense market expansion potential, creating tailored solutions that meet the unique needs of online retail. Investments in advanced technologies, such as sophisticated automation for high-volume production and digital printing for rapid prototyping and short-run customization, are critical for enhancing operational efficiency and bolstering competitive advantage. Moreover, the increasing global and regional focus on sustainable and eco-friendly packaging materials creates substantial opportunities for manufacturers that can innovate and offer solutions derived from recycled content, biodegradable components, or lightweight yet durable designs. These opportunities are set to shape the future of the market and drive its next phase of growth.

Leading Players in the Middle-East and Africa Corrugated Packaging Market Sector

- Arabian Packaging Co LLC

- Queenex Corrugated Carton Factory

- United Carton Industries Company (UCIC)

- Napco National

- Cepack Group

- Falcon Pack

- World Pack Industries LLC

- Universal Carton Industries Group

- Express Pack Print

- Green Packaging Boxes IND LLC

- Tarboosh Packaging Co LLC

- Unipack Containers & Carton Products LLC

- Al Rumanah Packaging

- NBM Pack

- *List Not Exhaustive

Key Milestones in Middle-East and Africa Corrugated Packaging Market Industry

- August 2022: The International Trade Administration highlighted the significant impact of rising e-commerce adoption in Kenya on market growth, accelerated by the COVID-19 pandemic and increasing 4G coverage.

- July 2022: The expansion of Pizza Hut franchises across Saudi Arabia (excluding Jeddah) by Americana Restaurants, under a Yum! franchise agreement, signifies the market's growth within the food service sector.

Strategic Outlook for Middle-East and Africa Corrugated Packaging Market Market

The Middle East and Africa corrugated packaging market is poised for considerable growth, driven by expanding e-commerce, rising consumer demand, and increasing investments in infrastructure. Strategic partnerships, technological advancements, and a focus on sustainable packaging will be crucial for success. Companies that adapt to changing consumer preferences and regulatory landscapes will benefit from significant market opportunities in the coming years. Focusing on innovation and efficiency will be key to navigating the competitive landscape and capitalizing on long-term growth potential.

Middle-East and Africa Corrugated Packaging Market Segmentation

-

1. Type

- 1.1. Slotted Containers

- 1.2. Die-cut Containers

- 1.3. Five-panel Folder Boxes

- 1.4. Other Types

-

2. End User

- 2.1. Food

- 2.2. Beverages

- 2.3. Electric Goods

- 2.4. Personal Care and Household Care

- 2.5. Other End Users

Middle-East and Africa Corrugated Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Corrugated Packaging Market Regional Market Share

Geographic Coverage of Middle-East and Africa Corrugated Packaging Market

Middle-East and Africa Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 3.3. Market Restrains

- 3.3.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 3.4. Market Trends

- 3.4.1. Increased Demand from the E-commerce Sector to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Corrugated Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Slotted Containers

- 5.1.2. Die-cut Containers

- 5.1.3. Five-panel Folder Boxes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Electric Goods

- 5.2.4. Personal Care and Household Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian Packaging Co LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Queenex Corrugated Carton Factory

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Carton Industries Company (UCIC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Napco National

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cepack Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Falcon Pack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 World Pack Industries LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Universal Carton Industries Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Express Pack Print

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Green Packaging Boxes IND LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tarboosh Packaging Co LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Unipack Containers & Carton Products LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Al Rumanah Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NBM Pack*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Arabian Packaging Co LLC

List of Figures

- Figure 1: Middle-East and Africa Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Corrugated Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Corrugated Packaging Market?

The projected CAGR is approximately 2.28%.

2. Which companies are prominent players in the Middle-East and Africa Corrugated Packaging Market?

Key companies in the market include Arabian Packaging Co LLC, Queenex Corrugated Carton Factory, United Carton Industries Company (UCIC), Napco National, Cepack Group, Falcon Pack, World Pack Industries LLC, Universal Carton Industries Group, Express Pack Print, Green Packaging Boxes IND LLC, Tarboosh Packaging Co LLC, Unipack Containers & Carton Products LLC, Al Rumanah Packaging, NBM Pack*List Not Exhaustive.

3. What are the main segments of the Middle-East and Africa Corrugated Packaging Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments.

6. What are the notable trends driving market growth?

Increased Demand from the E-commerce Sector to Drive the Market.

7. Are there any restraints impacting market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments.

8. Can you provide examples of recent developments in the market?

August 2022 - International Trade Administration stated that the increasing e-commerce adoption in Kenya would aid the market's growth. Consumer demand for e-commerce was accelerated mainly during the COVID-19 pandemic. The government is pushing for 4G universal coverage, and smartphone ownership is accelerating, making Kenya one of the fastest-growing e-commerce markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence