Key Insights

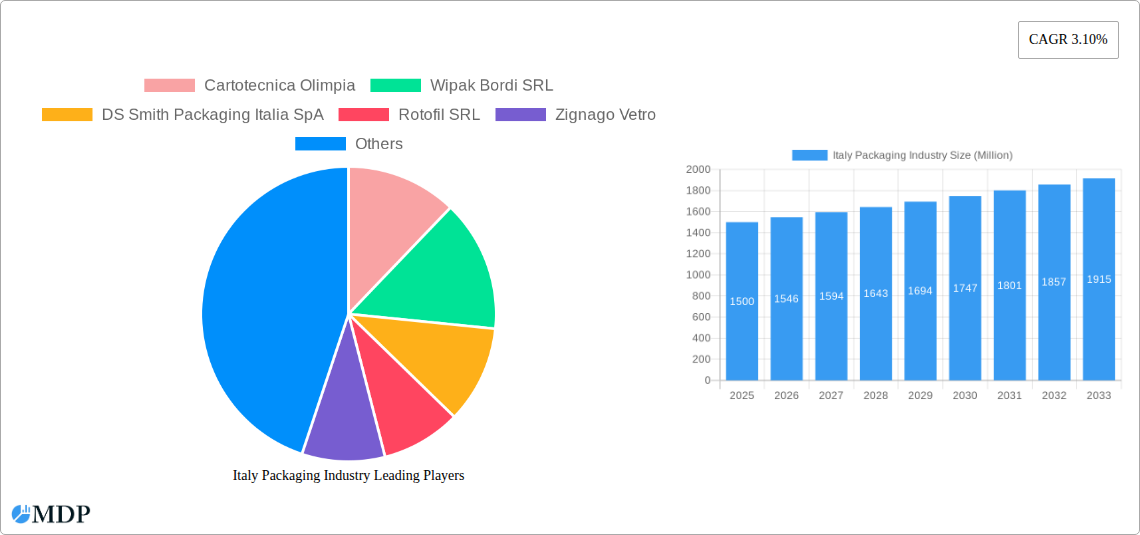

The Italian packaging industry, valued at approximately €X million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is experiencing steady growth, projected at a CAGR of 3.10% from 2025 to 2033. This growth is fueled by several key drivers. The flourishing food and beverage sector in Italy, renowned for its culinary heritage and exports, significantly contributes to packaging demand. Furthermore, the increasing adoption of e-commerce and the consequent rise in online grocery shopping are driving demand for robust and efficient packaging solutions. Growth is also seen in the pharmaceutical and personal care sectors, emphasizing the need for protective and tamper-evident packaging. Trends toward sustainable packaging materials, such as recycled paper and biodegradable plastics, are gaining momentum, influencing material choices across the industry. However, fluctuating raw material prices and stringent environmental regulations present challenges. The market is segmented by material (paper, plastic, metal, glass), packaging type (rigid, flexible), and end-user industry (food, beverages, pharmaceuticals, personal care, and others). Key players like Cartotecnica Olimpia, Wipak Bordi SRL, and DS Smith Packaging Italia SpA are actively shaping the market landscape through innovation and strategic partnerships.

Italy Packaging Industry Market Size (In Billion)

The Italian packaging market's future trajectory hinges on the continued success of the nation's food and beverage exports, the sustained growth of e-commerce, and the adoption of environmentally responsible practices. Companies are focusing on developing innovative packaging solutions that meet evolving consumer demands for convenience, sustainability, and product protection. The competitive landscape is characterized by both established players and emerging companies, fostering innovation and driving efficiency improvements. The projected growth provides ample opportunities for companies to invest in research and development, expand their production capacity, and explore new market segments. This requires a keen understanding of evolving consumer preferences and regulatory changes within the Italian context.

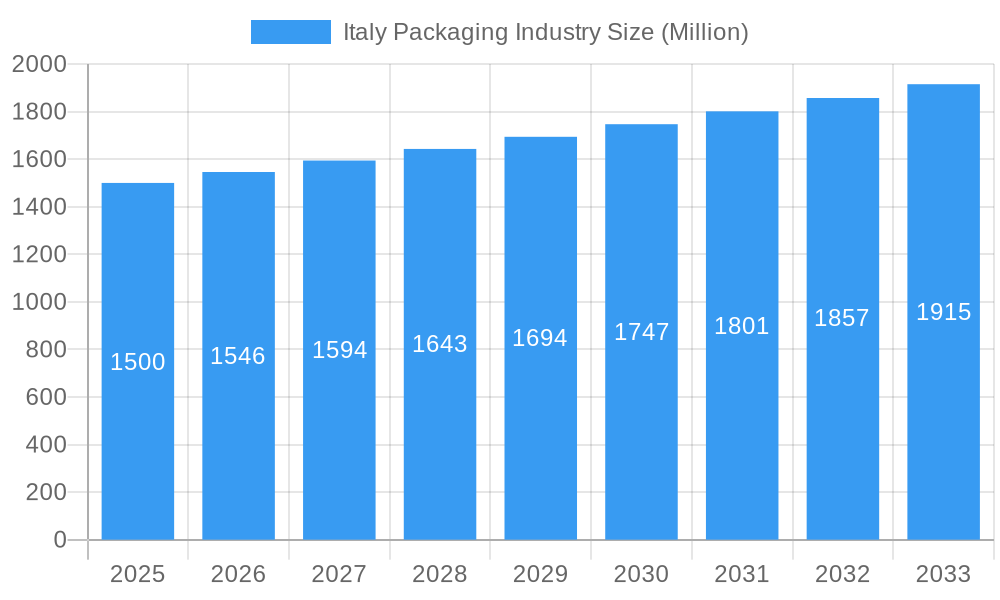

Italy Packaging Industry Company Market Share

Uncover lucrative opportunities and navigate the complexities of the Italian packaging market with this comprehensive report. This in-depth analysis provides a 360° view of the Italy packaging industry, covering market dynamics, leading players, emerging trends, and future growth prospects. The study period spans 2019-2033, with a focus on 2025 as the base and estimated year. This report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers seeking to capitalize on the dynamic Italian packaging landscape.

Italy Packaging Industry Market Dynamics & Concentration

The Italian packaging market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape. While a few large multinational players hold significant market share, numerous smaller, specialized companies cater to niche segments. Market concentration is influenced by factors including M&A activity, the dominance of certain packaging materials, and evolving regulatory frameworks focusing on sustainability. Innovation is driven by the growing demand for eco-friendly packaging solutions, particularly within the food and beverage sectors. Stringent EU regulations on material recyclability and food safety significantly impact market dynamics, forcing companies to adopt sustainable packaging materials and manufacturing processes. Furthermore, consumer preference shifts towards convenience and product preservation are pushing for innovation in packaging designs and materials. Substitutes, like reusable containers, are gaining traction but currently represent a small market share. M&A activity has seen approximately xx deals in the past five years, mainly focused on consolidation and expansion into new market segments. Key players are actively pursuing acquisitions to enhance their product portfolios and geographic reach.

- Market Share: Smurfit Kappa Italia SpA and Tetra Pak Italiana SpA hold a combined estimated 25% market share.

- M&A Deal Count (2019-2024): Approximately xx deals.

- Innovation Drivers: Sustainability regulations, consumer demand for convenience, and technological advancements.

Italy Packaging Industry Industry Trends & Analysis

The Italy packaging market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by several key factors. Growth is fueled by a resurgence in the tourism sector, a robust domestic food and beverage industry, and increasing e-commerce penetration. Technological disruptions, such as the rise of smart packaging and automation in production, are reshaping the market. Consumer preferences lean towards eco-friendly and convenient packaging options, placing pressure on manufacturers to adopt sustainable practices. Competitive dynamics are intensifying as companies seek to differentiate themselves through innovation, cost optimization, and superior supply chain management. Market penetration of sustainable packaging materials is expected to increase to xx% by 2033.

Leading Markets & Segments in Italy Packaging Industry

The Northern region of Italy dominates the packaging market, driven by its established industrial base and proximity to major consumer markets. Within material segments, paper packaging maintains a leading share due to its cost-effectiveness and versatility, followed closely by plastic and glass, which are predominantly used in the food and beverage industries. Rigid packaging holds a larger market share than flexible packaging due to its suitability for various products, especially in the food sector. The food and beverage sector is the most significant end-user industry, driven by high domestic consumption and exports. The personal care segment is also exhibiting strong growth.

- Dominant Region: Northern Italy

- Dominant Material Segment: Paper packaging.

- Dominant Packaging Type: Rigid Packaging.

- Dominant End-user Industry: Food and Beverages

Key Drivers:

- Economic Policies: Government incentives for sustainable packaging and manufacturing.

- Infrastructure: Robust logistics network facilitating efficient distribution.

- Consumer Preferences: Growing demand for convenient and sustainable packaging.

Italy Packaging Industry Product Developments

Recent product developments focus heavily on sustainability, with companies introducing innovative materials like biodegradable plastics and recycled paperboard. Technological advancements are facilitating the integration of smart packaging features such as RFID tags for improved supply chain traceability and anti-counterfeiting measures. Companies are developing custom packaging solutions that cater to specific product needs and enhance brand appeal, enhancing market fit. Competition is driving innovation, and the market witnesses a steady stream of new products and improved functionalities.

Key Drivers of Italy Packaging Industry Growth

The growth of the Italian packaging industry is propelled by several factors. Firstly, the strong growth of the food and beverage sector, along with increasing demand for convenient and premium packaging solutions, is significantly contributing to market expansion. Secondly, e-commerce expansion is increasing demand for protective and durable packaging materials. Finally, governmental support for sustainable practices and technological advancements in packaging production technology are further stimulating growth.

Challenges in the Italy Packaging Industry Market

The Italian packaging industry faces challenges like increasing raw material prices and fluctuating exchange rates, impacting profitability. Supply chain disruptions are posing difficulties, and intense competition for market share is forcing companies to constantly innovate to remain competitive. Regulatory hurdles related to environmental regulations and complex labeling requirements also contribute to the cost of doing business. These factors can lead to a xx% reduction in profit margins if not properly managed.

Emerging Opportunities in Italy Packaging Industry

The Italian packaging industry presents significant opportunities for long-term growth. The increasing adoption of sustainable packaging materials, coupled with growing demand for innovative packaging solutions in the food, e-commerce, and personal care sectors, presents significant potential. Strategic partnerships and mergers & acquisitions further contribute to opportunities for market expansion and enhanced product portfolios. Technological breakthroughs in smart packaging and automation are expected to drive efficiency and open new market segments.

Leading Players in the Italy Packaging Industry Sector

- Cartotecnica Olimpia

- Wipak Bordi SRL

- DS Smith Packaging Italia SpA

- Rotofil SRL

- Zignago Vetro

- Tetra Pak Italiana SpA

- SAIDA Group

- Vetroelite S r l

- Smurfit Kappa Italia SpA

- Vetreria Etrusca

Key Milestones in Italy Packaging Industry Industry

- July 2022: Zignago Vetro’s new furnace in Fossalta di Portogruaro expands its production capacity for F&B glass containers by 370 tonnes. This significantly increases their market share within the glass container segment for food and beverages.

- June 2022: IPV PACK's expansion into Serbia signifies a major step in internationalizing the Italian packaging industry, signaling increased demand and competitiveness in European markets.

- April 2022: Zignago Vetro's launch of the 100ml LAMA glass bottle for the perfumery sector demonstrates product innovation catering to a growing niche market.

Strategic Outlook for Italy Packaging Industry Market

The Italy packaging market presents a promising outlook, driven by continuous technological advancement, sustainable solutions, and shifting consumer preferences. Strategic opportunities lie in adopting circular economy models, investing in automation and digitalization, and focusing on specialized packaging solutions for emerging sectors like e-commerce. Companies that prioritize sustainability, innovation, and efficient supply chain management will be best positioned for success in the coming years.

Italy Packaging Industry Segmentation

-

1. Material

- 1.1. Paper

- 1.2. Plastic

- 1.3. Metal

- 1.4. Glass

-

2. Packaging Type

- 2.1. Rigid Packaging

- 2.2. Flexible Packaging

-

3. End-User Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Pharmaceuticals

- 3.4. Personal Care

- 3.5. Other End-User Industries

Italy Packaging Industry Segmentation By Geography

- 1. Italy

Italy Packaging Industry Regional Market Share

Geographic Coverage of Italy Packaging Industry

Italy Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Environmental Concerns; Government Regulations for Consumables

- 3.3. Market Restrains

- 3.3.1. ; High Costs Compared to Normal Plastic

- 3.4. Market Trends

- 3.4.1. Plastic Packaging to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid Packaging

- 5.2.2. Flexible Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Pharmaceuticals

- 5.3.4. Personal Care

- 5.3.5. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cartotecnica Olimpia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipak Bordi SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DS Smith Packaging Italia SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rotofil SRL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zignago Vetro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tetra Pak Italiana SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAIDA Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vetroelite S r l

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smurfit Kappa Italia SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vetreria Etrusca

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cartotecnica Olimpia

List of Figures

- Figure 1: Italy Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Italy Packaging Industry Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Italy Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Italy Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Italy Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Italy Packaging Industry Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Italy Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Italy Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Packaging Industry?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Italy Packaging Industry?

Key companies in the market include Cartotecnica Olimpia, Wipak Bordi SRL, DS Smith Packaging Italia SpA, Rotofil SRL, Zignago Vetro, Tetra Pak Italiana SpA, SAIDA Group, Vetroelite S r l, Smurfit Kappa Italia SpA, Vetreria Etrusca.

3. What are the main segments of the Italy Packaging Industry?

The market segments include Material, Packaging Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Environmental Concerns; Government Regulations for Consumables.

6. What are the notable trends driving market growth?

Plastic Packaging to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; High Costs Compared to Normal Plastic.

8. Can you provide examples of recent developments in the market?

July 2022: Zignago Vetro's site at Fossalta di Portogruaro started up a new furnace, which can produce up to 370 tonnes thanks to its four lines, two of which can manage products in tandem. It specializes in F&B containers in flint glass, mainly jars but also bottles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Packaging Industry?

To stay informed about further developments, trends, and reports in the Italy Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence