Key Insights

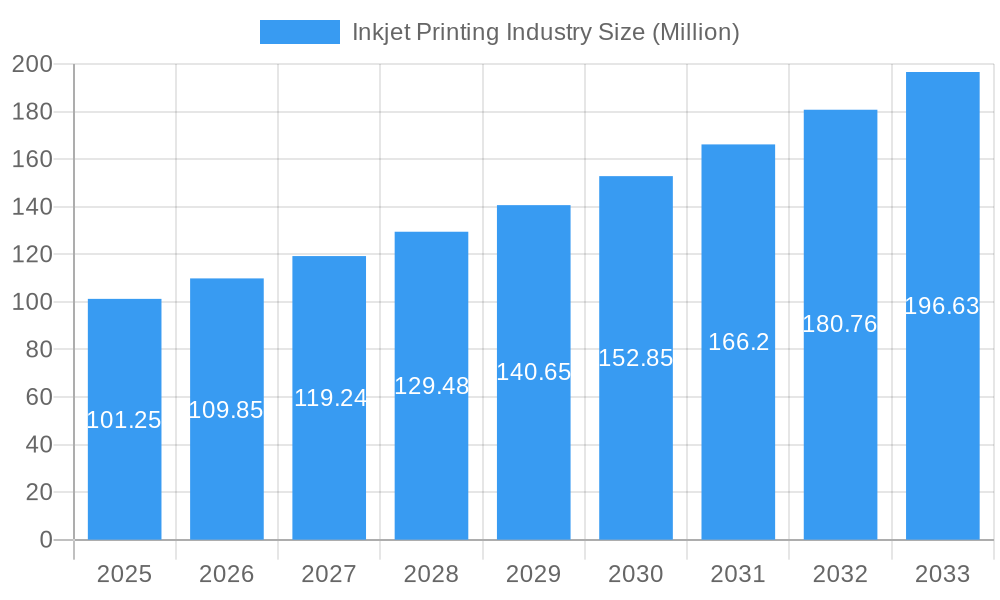

The inkjet printing industry, valued at $101.25 million in 2025, is projected to experience robust growth, driven by increasing demand across diverse applications. A Compound Annual Growth Rate (CAGR) of 8.32% from 2025 to 2033 indicates significant expansion, particularly within the commercial print, packaging, and labeling sectors. The rising adoption of inkjet technology for high-volume, high-quality printing, coupled with advancements in printhead technology and ink formulations, fuels this growth. Cost-effectiveness compared to traditional printing methods and the ability to personalize printed materials further enhance its appeal. Growth is anticipated across all geographical regions, with North America and Europe maintaining strong market positions due to established infrastructure and high technological adoption. However, the Asia-Pacific region is expected to witness the fastest growth, fueled by expanding economies and rising disposable incomes driving demand for printed products. While challenges such as the volatility of raw material prices and increasing competition from alternative printing technologies exist, the overall industry outlook remains positive, with continued innovation and market penetration anticipated in the coming years.

Inkjet Printing Industry Market Size (In Million)

The segmentation of the inkjet printing market reflects its versatility. Applications such as books/publishing and advertising benefit from inkjet's high-resolution capabilities and variable data printing, while commercial print utilizes its efficiency for large-scale projects. The packaging and labeling segments are witnessing significant growth due to the need for high-quality, customized packaging solutions across various industries. Major players like HP, Canon, and Fujifilm are actively investing in R&D to enhance print quality, speed, and sustainability, further solidifying the industry's position. Strategic partnerships and acquisitions are expected to reshape the competitive landscape, leading to further innovation and market consolidation. The continued focus on developing environmentally friendly inks and reducing the overall environmental impact of inkjet printing will also play a crucial role in shaping the future trajectory of the industry.

Inkjet Printing Industry Company Market Share

Inkjet Printing Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the inkjet printing industry, covering market dynamics, trends, leading players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders seeking actionable insights and strategic guidance. The global inkjet printing market is estimated to be worth XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Inkjet Printing Industry Market Dynamics & Concentration

The inkjet printing market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as technological innovation, regulatory changes, the availability of substitute technologies (e.g., laser printing), evolving end-user preferences (demand for high-quality, cost-effective printing solutions), and mergers and acquisitions (M&A) activities. The historical period (2019-2024) witnessed XX M&A deals, consolidating market share among key players. Currently, the top five players – including Canon Inc, HP Development Company LP, and Xerox Corporation – collectively account for an estimated XX% market share. Innovation plays a crucial role, with companies continuously investing in research and development to enhance print quality, speed, and cost-effectiveness. Stringent environmental regulations related to ink composition and waste management also influence market dynamics, pushing for sustainable solutions.

Inkjet Printing Industry Industry Trends & Analysis

The inkjet printing market has experienced significant growth driven by factors such as increasing demand for high-quality, on-demand printing across various applications. Technological advancements, such as the development of high-resolution printheads and specialized inks, have further fueled market expansion. Consumer preference for personalized and customized printing solutions, coupled with the rising adoption of digital printing technologies across various industries, is driving market growth. The market is witnessing a shift from traditional offset printing to inkjet printing due to its cost-effectiveness and flexibility. The CAGR for the forecast period (2025-2033) is projected at XX%, with market penetration increasing across various segments, particularly in packaging and labeling. Competitive dynamics are intense, with companies focusing on product differentiation, technological innovation, and strategic partnerships to gain a competitive edge.

Leading Markets & Segments in Inkjet Printing Industry

The Packaging segment is currently the dominant segment in the inkjet printing industry, driven by the rising demand for customized packaging and labels across various industries such as food & beverage, consumer goods, and pharmaceuticals. The growth of e-commerce and the need for efficient and cost-effective packaging solutions have further fueled the segment's growth. Key drivers for this dominance include:

- Technological advancements: Development of high-speed, high-resolution inkjet printing solutions specifically tailored for flexible packaging applications.

- Economic factors: Growing consumer demand for personalized and customized packaging, leading to increased adoption of inkjet printing technology.

- Infrastructure improvements: Increased investment in packaging printing infrastructure, particularly in developing economies.

Geographically, North America and Europe are currently the leading markets, but Asia Pacific is expected to witness significant growth in the coming years driven by rapid industrialization and urbanization.

Inkjet Printing Industry Product Developments

Recent years have seen significant advancements in inkjet printing technology, focusing on improved print quality, speed, and cost-effectiveness. New inkjet printheads with higher resolution and faster printing speeds are being developed. Water-based inks, designed to be more environmentally friendly, are gaining traction. The integration of smart features, such as cloud connectivity and automation, is also shaping product development, improving workflow efficiency. These developments cater to the growing demand for high-quality, efficient, and environmentally sustainable printing solutions across various applications.

Key Drivers of Inkjet Printing Industry Growth

Several key factors are driving the growth of the inkjet printing industry:

- Technological advancements: Continuous improvements in printhead technology, ink formulations, and software solutions are leading to enhanced print quality, speed, and cost-effectiveness.

- Rising demand for personalized printing: Growth in e-commerce and the increasing need for customized printing solutions in various industries are boosting market growth.

- Favorable government regulations: Policies supporting the adoption of environmentally friendly printing technologies contribute to industry growth.

Challenges in the Inkjet Printing Industry Market

Despite promising growth, the inkjet printing industry faces certain challenges:

- Intense competition: The presence of established players and emerging companies creates intense competition, impacting profitability.

- Fluctuations in raw material prices: Prices of ink and other raw materials can impact profitability.

- Environmental concerns: Regulations related to ink composition and waste management pose challenges for some manufacturers. The industry is actively mitigating these challenges through the development of sustainable solutions.

Emerging Opportunities in Inkjet Printing Industry

The inkjet printing industry is poised for significant growth driven by several emerging opportunities:

- Expansion into new applications: Opportunities exist in areas such as 3D printing, textile printing, and industrial printing.

- Strategic partnerships and collaborations: Companies are forming strategic alliances to expand market reach and offer integrated solutions.

- Development of innovative ink formulations: New inks with enhanced properties, like those offering improved durability or specific functional properties, are opening new possibilities.

Leading Players in the Inkjet Printing Industry Sector

- Jet Inks Private Limited

- Fujifilm Holdings Corporation

- Canon Inc

- Videojet Technologies Inc

- Xerox Corporation

- HP Development Company LP

- Lexmark International Inc

- Hitachi Industrial Equipment Systems Co Ltd

- Inkjet Inc

- Brother Industries Ltd

Key Milestones in Inkjet Printing Industry Industry

- June 2021: Fujifilm announced its entry into the flexible packaging market with the Jet Press FP 790.

- September 2021: Lexmark launched the Lexmark Optra IoT Platform, a cloud-based technology platform for data management.

- November 2021: Canon India launched the PIXMA E4570 inkjet multifunction printer, focusing on productivity and efficiency.

Strategic Outlook for Inkjet Printing Industry Market

The inkjet printing industry is expected to witness sustained growth driven by technological innovation, increasing demand for personalized printing, and expansion into new application areas. Strategic partnerships and investments in research and development will play a crucial role in shaping the future of the industry. Companies focusing on sustainability and cost-effectiveness will be well-positioned for success in this dynamic market.

Inkjet Printing Industry Segmentation

-

1. Application

- 1.1. Books/Publishing

- 1.2. Commercial Print

- 1.3. Advertising

- 1.4. Transaction

- 1.5. Labels

- 1.6. Packaging

- 1.7. Other Applications

Inkjet Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Inkjet Printing Industry Regional Market Share

Geographic Coverage of Inkjet Printing Industry

Inkjet Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Big Data

- 3.2.2 IoT

- 3.2.3 and Digitalization of Print Processing and Packaging; Smart Production

- 3.2.4 Speed

- 3.2.5 Flexibility

- 3.2.6 and Cost Control

- 3.3. Market Restrains

- 3.3.1. Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Advertisement is Anticipated to Hold a Dominant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Books/Publishing

- 5.1.2. Commercial Print

- 5.1.3. Advertising

- 5.1.4. Transaction

- 5.1.5. Labels

- 5.1.6. Packaging

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Books/Publishing

- 6.1.2. Commercial Print

- 6.1.3. Advertising

- 6.1.4. Transaction

- 6.1.5. Labels

- 6.1.6. Packaging

- 6.1.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Books/Publishing

- 7.1.2. Commercial Print

- 7.1.3. Advertising

- 7.1.4. Transaction

- 7.1.5. Labels

- 7.1.6. Packaging

- 7.1.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Books/Publishing

- 8.1.2. Commercial Print

- 8.1.3. Advertising

- 8.1.4. Transaction

- 8.1.5. Labels

- 8.1.6. Packaging

- 8.1.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Books/Publishing

- 9.1.2. Commercial Print

- 9.1.3. Advertising

- 9.1.4. Transaction

- 9.1.5. Labels

- 9.1.6. Packaging

- 9.1.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Inkjet Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Books/Publishing

- 10.1.2. Commercial Print

- 10.1.3. Advertising

- 10.1.4. Transaction

- 10.1.5. Labels

- 10.1.6. Packaging

- 10.1.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jet Inks Private Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fujifilm Holdings Corporation*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Canon Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Videojet Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xerox Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HP Development Company LP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lexmark International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Industrial Equipment Systems Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inkjet Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Brother Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jet Inks Private Limited

List of Figures

- Figure 1: Global Inkjet Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Inkjet Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Inkjet Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Inkjet Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Inkjet Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Inkjet Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Inkjet Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Inkjet Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inkjet Printing Industry?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the Inkjet Printing Industry?

Key companies in the market include Jet Inks Private Limited, Fujifilm Holdings Corporation*List Not Exhaustive, Canon Inc, Videojet Technologies Inc, Xerox Corporation, HP Development Company LP, Lexmark International Inc, Hitachi Industrial Equipment Systems Co Ltd, Inkjet Inc, Brother Industries Ltd.

3. What are the main segments of the Inkjet Printing Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 101.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Big Data. IoT. and Digitalization of Print Processing and Packaging; Smart Production. Speed. Flexibility. and Cost Control.

6. What are the notable trends driving market growth?

Advertisement is Anticipated to Hold a Dominant Share of the Market.

7. Are there any restraints impacting market growth?

Reliance on Other Countries for Raw Materials and Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

November 2021 - Canon India launched the all-new PIXMA E4570 inkjet multifunction printer. This is innovated to increase productivity and efficiency at work. The all-new PIXMA E4570 provides a suite of productivity features, combined with high print yields and low-cost printing, making it essential for students, home offices, and even small offices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inkjet Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inkjet Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inkjet Printing Industry?

To stay informed about further developments, trends, and reports in the Inkjet Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence