Key Insights

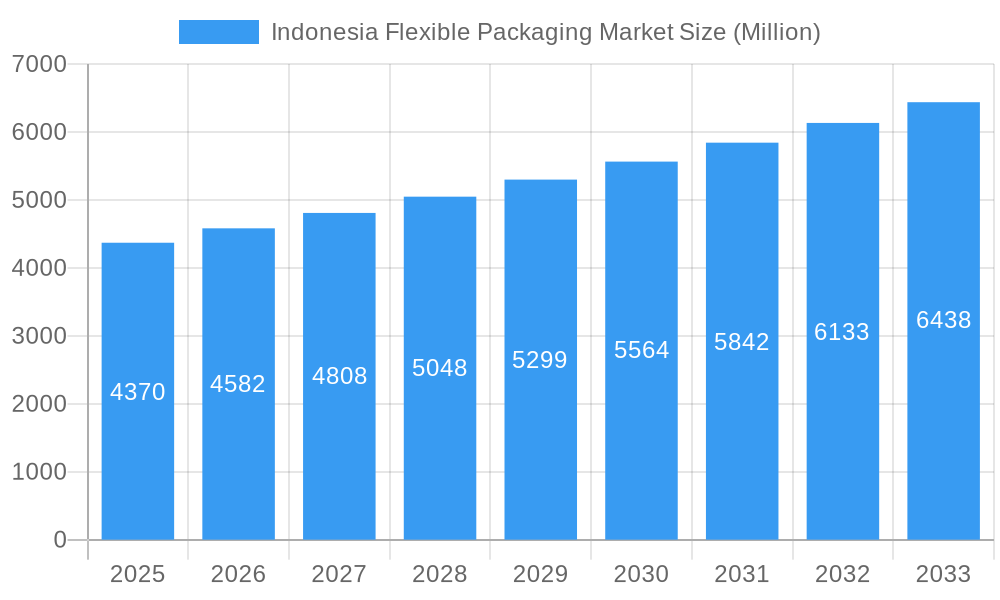

The Indonesia flexible packaging market, valued at $4.37 billion in 2025, is projected to experience robust growth, driven by a burgeoning food and beverage sector, rising e-commerce activity fueling demand for convenient packaging, and a growing pharmaceutical industry requiring specialized flexible packaging solutions. The market's Compound Annual Growth Rate (CAGR) of 4.75% from 2025 to 2033 indicates a significant expansion opportunity. Key segments include plastic, paper, and metal materials, with pouches, bags, and wraps dominating structural formats. The food and beverage application holds the largest market share, followed by pharmaceuticals and personal care. Leading players like PT Trias Sentosa Tbk, PT Indopoly Swakarsa Industry Tbk, and Mondi Group are actively shaping the market landscape through product innovation and strategic partnerships. The Asia-Pacific region, particularly Indonesia, benefits from a growing middle class, increasing disposable incomes, and evolving consumer preferences towards convenient and sustainable packaging, further driving market expansion. Challenges, however, include fluctuating raw material prices and environmental concerns related to plastic waste, necessitating the adoption of eco-friendly alternatives and sustainable packaging practices.

Indonesia Flexible Packaging Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth fueled by government initiatives promoting domestic manufacturing and increasing investments in advanced packaging technologies. The market's segmentation offers various avenues for growth, with opportunities for companies specializing in sustainable and innovative packaging solutions. The competitive landscape is characterized by both local and multinational players, leading to increased competition and innovation. Growth will likely be particularly strong in the e-commerce sector, given its rapid growth and increasing reliance on flexible packaging for product protection and delivery. Analyzing regional variations within Indonesia will also be critical for targeted market penetration strategies.

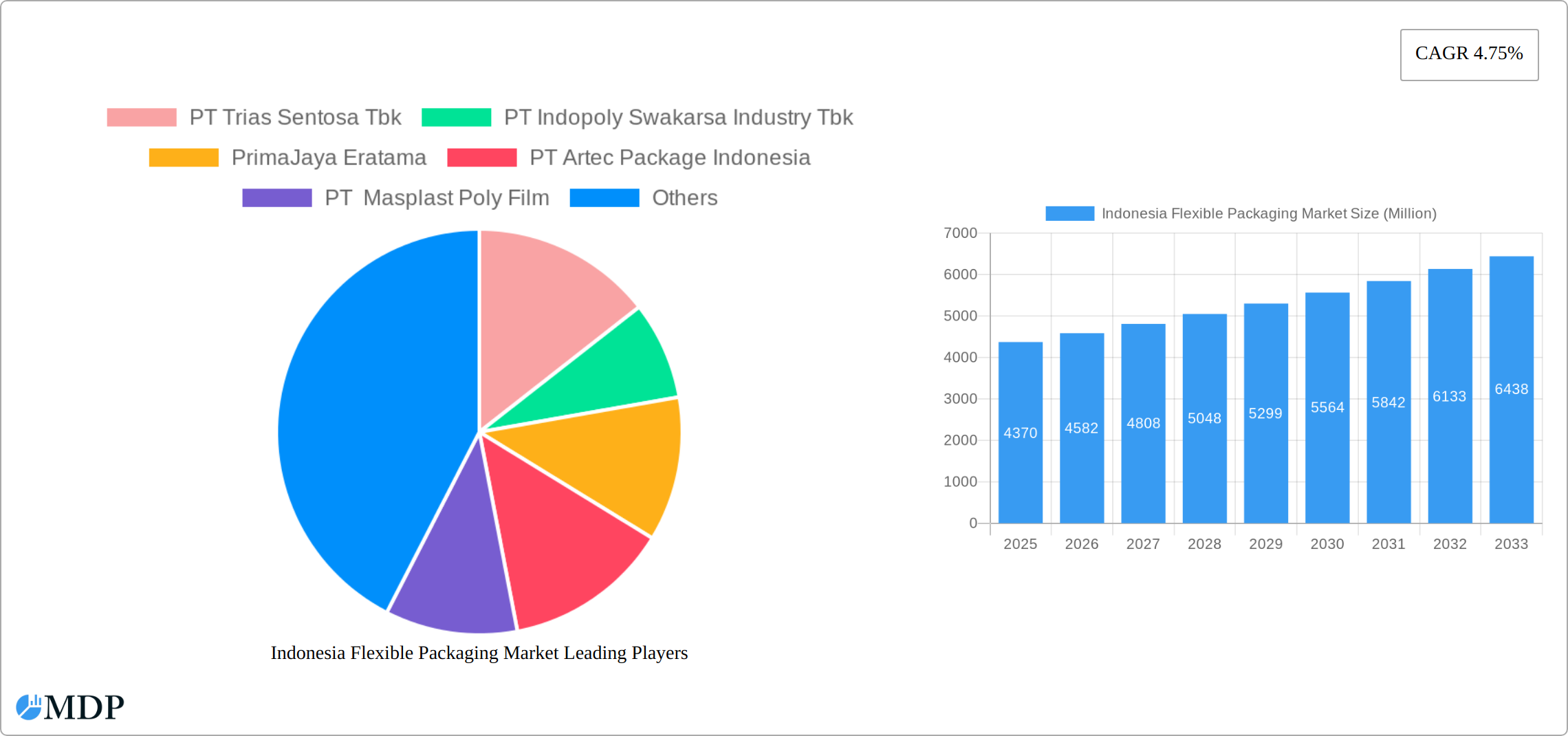

Indonesia Flexible Packaging Market Company Market Share

Indonesia Flexible Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia flexible packaging market, offering invaluable insights for stakeholders including manufacturers, investors, and industry professionals. The report covers market dynamics, industry trends, leading segments, key players, and future growth opportunities, utilizing data from 2019 to 2024 (historical period), with estimations for 2025 (base and estimated year) and forecasts extending to 2033 (forecast period). This report is crucial for navigating the complexities of this rapidly evolving market and making informed strategic decisions.

Indonesia Flexible Packaging Market Dynamics & Concentration

The Indonesian flexible packaging market is characterized by a moderately concentrated landscape with several major players vying for market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and brand recognition. While precise market share figures for individual companies are unavailable at this time, PT Trias Sentosa Tbk, PT Indopoly Swakarsa Industry Tbk, and Mondi Group are considered to be among the leading players. The market is witnessing increased innovation driven by consumer demand for sustainable and functional packaging solutions. Regulatory frameworks, including those related to food safety and environmental sustainability, are also shaping market dynamics. Product substitution is a factor, with increasing interest in biodegradable and compostable materials. End-user trends, particularly in the food and beverage and personal care sectors, drive demand for specialized packaging solutions. Mergers and acquisitions (M&A) activity is moderate, with approximately xx M&A deals recorded over the historical period. Key factors influencing the M&A activity include expansion strategies of major players and the desire to gain access to advanced technologies or wider market coverage.

Indonesia Flexible Packaging Market Industry Trends & Analysis

The Indonesian flexible packaging market is experiencing robust and dynamic growth, fueled by a confluence of powerful drivers. The nation's rapidly expanding food and beverage sector, coupled with a steadily increasing disposable income and urbanization, is propelling demand for packaged goods. Consumers are actively seeking convenience and premium product presentation, which directly translates into a higher appetite for sophisticated flexible packaging solutions. Technological advancements are at the forefront of this evolution, with manufacturers increasingly adopting sophisticated printing techniques for enhanced visual appeal and innovative barrier materials that significantly extend product shelf life and minimize spoilage. A critical and growing trend is the palpable shift towards sustainable and eco-friendly packaging materials. This not only presents a vital opportunity for companies championing green initiatives but also necessitates adaptation and investment in recyclable, biodegradable, and compostable alternatives to meet evolving consumer and regulatory expectations. The market's penetration of flexible packaging is currently at **xx%** and is projected to reach **xx%** by 2033, a testament to its growing adoption across various consumer segments. The Compound Annual Growth Rate (CAGR) for the Indonesian flexible packaging market during the forecast period (2025-2033) is estimated to be a substantial **xx%**. The competitive landscape is characterized by intense rivalry, with a healthy mix of established domestic giants and agile international players vying for significant market share.

Leading Markets & Segments in Indonesia Flexible Packaging Market

Dominant Segment: The plastic segment dominates the material type category, driven by its cost-effectiveness, versatility, and barrier properties. Pouches are the most prevalent structure, due to their high versatility, while the food and beverage sector represents the largest application segment in terms of volume.

Key Drivers:

- Economic Growth: Indonesia's expanding economy fuels higher disposable incomes and increased consumer spending on packaged goods.

- Urbanization: The increasing urban population drives demand for convenient and readily available packaged food and beverages.

- Government Initiatives: Initiatives promoting the food industry and local manufacturing indirectly boost the flexible packaging sector.

- Infrastructure Development: Improved infrastructure enhances logistics and distribution efficiency, supporting market expansion.

The dominance of plastic reflects its wide applicability across various end-use segments. However, increasing awareness of environmental concerns and growing demand for eco-friendly alternatives are creating opportunities for paper and metal-based flexible packaging solutions. While pouches remain the leading structure, bags and wraps retain significant market share. The food and beverage industry's dominance reflects high consumption of packaged foods and beverages in the country.

Indonesia Flexible Packaging Market Product Developments

Product development in the Indonesian flexible packaging market is heavily focused on innovation that addresses both consumer desires and environmental imperatives. Key advancements include the creation of highly efficient recyclable and biodegradable films, designed to minimize environmental impact without compromising on performance. Enhanced barrier properties are a significant area of research, leading to the development of pouches with superior oxygen and moisture resistance, crucial for extending the shelf life of sensitive food products and pharmaceuticals. Furthermore, the focus on improved printability allows for vibrant, high-resolution graphics, elevating brand appeal and consumer engagement. Innovations also extend to the creation of smart packaging solutions that can offer features like tamper evidence, freshness indicators, and even interactive elements. These developments are collectively aimed at providing consumers with convenient, safe, aesthetically pleasing, and environmentally responsible packaging options that meet the stringent demands of a modern marketplace.

Key Drivers of Indonesia Flexible Packaging Market Growth

Several factors contribute to the market's robust growth:

- Rising Disposable Incomes: Increased purchasing power fuels demand for packaged goods.

- Expanding Food & Beverage Sector: The growth of this sector is directly correlated with flexible packaging demand.

- Technological Advancements: Innovations in materials and production techniques drive efficiency and sustainability.

- Government Support for Domestic Manufacturing: Policies promoting local industries positively impact the flexible packaging market.

Challenges in the Indonesia Flexible Packaging Market

Despite its promising growth trajectory, the Indonesian flexible packaging market faces several significant challenges. The inherent volatility of raw material prices, particularly for petroleum-based plastics, can lead to unpredictable production costs and impact profit margins. Global and local supply chain disruptions, exacerbated by logistical complexities in an archipelago nation, can hinder timely delivery and increase operational expenses. The market is characterized by intense competition, not only from established multinational corporations but also from a growing number of domestic manufacturers. This necessitates continuous innovation and strategic differentiation to maintain market relevance. Additionally, navigating a complex regulatory environment, encompassing food safety standards, material certifications, and evolving environmental mandates, requires substantial investment and diligent compliance efforts.

Emerging Opportunities in Indonesia Flexible Packaging Market

The Indonesian flexible packaging market is ripe with emerging opportunities for forward-thinking companies. The burgeoning consumer awareness and demand for sustainable and eco-friendly packaging present a significant avenue for growth. Manufacturers that can offer innovative recyclable, compostable, or biodegradable solutions are poised to capture a substantial market share. Strategic partnerships and collaborations are becoming increasingly crucial for accessing cutting-edge technologies, expanding manufacturing capabilities, and broadening distribution networks, particularly into the vast and diverse Indonesian archipelago. Market expansion into underserved rural and remote regions through targeted distribution strategies offers untapped potential. Furthermore, the relentless growth of e-commerce in Indonesia is a powerful catalyst, driving demand for robust, protective, and aesthetically appealing flexible packaging solutions designed for safe transit and delivery.

Leading Players in the Indonesia Flexible Packaging Market Sector

- PT Trias Sentosa Tbk

- PT Indopoly Swakarsa Industry Tbk

- PrimaJaya Eratama

- PT Artec Package Indonesia

- PT Masplast Poly Film

- Mondi Group

- PT Karuniatama Polypack

- PT Indonesia Toppan Group

- PT Polidayaguna Perkasa

- PT Dinakara Putra

- PT ePac Flexibles Indonesia

- PT Argha Prima Industry

- PT Lotte Packaging

Key Milestones in Indonesia Flexible Packaging Market Industry

- September 2022: Toyobo's substantial USD 71 Million investment in a new polyester packaging film factory in Indonesia signifies a major commitment to expanding production capacity. This strategic move is particularly focused on enhancing the supply of sustainable and environmentally friendly film products within the domestic market.

- May 2022: Lamipak's significant USD 193.04 Million investment in a state-of-the-art aseptic packaging factory represents a pivotal advancement in Indonesia's packaging infrastructure. This investment introduces a new level of advanced technology to the market, underscoring strong confidence in the long-term growth potential and evolving demands of the Indonesian flexible packaging sector.

Strategic Outlook for Indonesia Flexible Packaging Market

The Indonesian flexible packaging market holds immense potential for future growth. Continued economic expansion, rising consumer demand, and increasing adoption of sustainable packaging solutions will drive market expansion. Strategic investments in research and development, focusing on innovative materials and packaging designs, will be key for manufacturers to maintain a competitive edge. Companies focusing on sustainable solutions and catering to the growing e-commerce sector are expected to experience significant growth in the coming years.

Indonesia Flexible Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Flexible Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Flexible Packaging Market Regional Market Share

Geographic Coverage of Indonesia Flexible Packaging Market

Indonesia Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift Toward Light Weight and Smaller Pack Types to aid the Demand for Flexible Packaging; Packaging Films are Expected to Register Strong Growth in the Food and Pharmaceutical Sector

- 3.3. Market Restrains

- 3.3.1. Lack of a Defined Recycling Plans Coupled with Environmental Challenges

- 3.4. Market Trends

- 3.4.1. Packaging Films to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Trias Sentosa Tbk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Indopoly Swakarsa Industry Tbk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PrimaJaya Eratama

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Artec Package Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Masplast Poly Film

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mondi Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Karuniatama Polypack

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Indonesia Toppan Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Polidayaguna Perkasa*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Dinakara Putra

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT ePac Flexibles Indonesia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Argha Prima Industry

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT Lotte Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 PT Trias Sentosa Tbk

List of Figures

- Figure 1: Indonesia Flexible Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Flexible Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Flexible Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Flexible Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Flexible Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Flexible Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Flexible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Indonesia Flexible Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Flexible Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Flexible Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Flexible Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Flexible Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Flexible Packaging Market?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Indonesia Flexible Packaging Market?

Key companies in the market include PT Trias Sentosa Tbk, PT Indopoly Swakarsa Industry Tbk, PrimaJaya Eratama, PT Artec Package Indonesia, PT Masplast Poly Film, Mondi Group, PT Karuniatama Polypack, PT Indonesia Toppan Group, PT Polidayaguna Perkasa*List Not Exhaustive, PT Dinakara Putra, PT ePac Flexibles Indonesia, PT Argha Prima Industry, PT Lotte Packaging.

3. What are the main segments of the Indonesia Flexible Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift Toward Light Weight and Smaller Pack Types to aid the Demand for Flexible Packaging; Packaging Films are Expected to Register Strong Growth in the Food and Pharmaceutical Sector.

6. What are the notable trends driving market growth?

Packaging Films to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of a Defined Recycling Plans Coupled with Environmental Challenges.

8. Can you provide examples of recent developments in the market?

September 2022 - Toyobo, a Japanese textile and fiber manufacturer, announced plans to build a polyester packaging film factory in Indonesia. To address the rising demand for environmentally friendly film products, the factory will be situated at Pt Trias Toyobo Astria (TTA), a joint venture (JV) established by Toyobo and Indonesian (plastic) filmmaker PT Trias Sentosa (Trias). The project will receive an investment from Toyobo of about JPY 10 billion (USD 71 million), and work is expected to start in early 2024. According to the firm, the investment will increase TTA's production capacity and is anticipated to be operational by late 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence