Key Insights

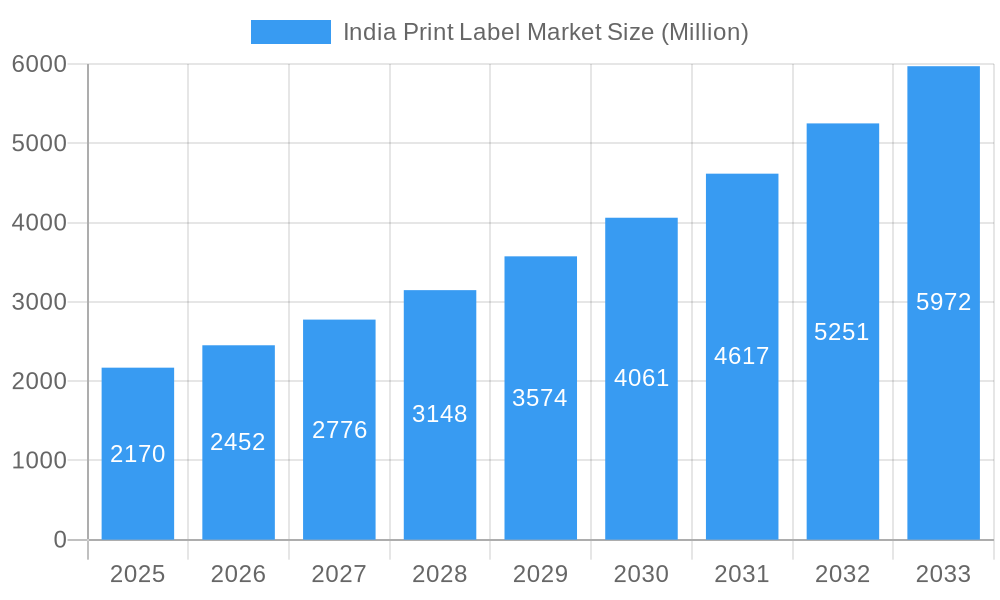

The India print label market, valued at $2.17 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 13.29% from 2025 to 2033. This significant expansion is driven by several key factors. The burgeoning e-commerce sector fuels demand for high-quality, durable labels for product identification and branding. Simultaneously, the rising consumer preference for packaged goods across diverse sectors, including food and beverages, pharmaceuticals, and cosmetics, necessitates increased label production. Furthermore, advancements in printing technologies, such as digital printing, offering greater flexibility and customization options, are contributing to market growth. Increased adoption of sustainable and eco-friendly label materials, responding to growing environmental concerns, presents another significant growth driver. While the unorganized sector still holds a considerable presence, organized players are witnessing expansion, driven by technological advancements and improved efficiency. The market is segmented based on label type (e.g., pressure-sensitive, wraparound, etc.), printing technology (e.g., flexography, digital, offset), material used (e.g., paper, film, etc.), and end-use industry (e.g., food & beverage, pharmaceuticals, cosmetics). Companies such as JK Labels Pvt Ltd, Skanem Interlabels Industries Pvt Ltd, and Ajanta Packaging are key players shaping the market's competitive landscape. The geographical distribution of customers and the presence of unorganized players are crucial factors influencing market dynamics across different Indian regions. Future growth will be further influenced by government regulations on packaging materials and the continued penetration of e-commerce within India's diverse consumer base.

India Print Label Market Market Size (In Billion)

The forecast period (2025-2033) anticipates substantial market expansion due to increasing demand from key sectors and technological advancements. The market is expected to see a shift towards greater automation, digitalization, and sustainability. The continued growth of organized players, alongside the evolution of the unorganized sector, will shape the competitive landscape. Competition will likely intensify, requiring companies to focus on innovation, operational efficiency, and a strong customer base across various sectors and geographic regions. Understanding consumer preferences, adapting to evolving regulatory frameworks, and focusing on environmentally responsible practices will be crucial for success in this expanding market.

India Print Label Market Company Market Share

India Print Label Market: A Comprehensive Report (2019-2033)

Unlocking the Potential of India's Thriving Print Label Industry: An In-depth Market Analysis

This comprehensive report provides a detailed analysis of the India print label market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete understanding of past performance, current trends, and future projections. The market size is predicted to reach xx Million by 2033, showcasing significant growth potential.

India Print Label Market Market Dynamics & Concentration

The Indian print label market exhibits a moderately concentrated structure, with several large players commanding significant market share. JK Labels Pvt Ltd, Skanem Interlabels Industries Pvt Ltd, and Ajanta Packaging are among the prominent players, although the exact market share for each requires further dedicated research. The market is experiencing significant innovation driven by the increasing demand for sophisticated labeling solutions across various industries. Stringent regulatory frameworks concerning product safety and environmental standards influence industry practices. The emergence of digital printing technologies serves as a key substitute for traditional printing methods, shaping market competition. End-user trends, particularly in the food and beverage, pharmaceutical, and consumer goods sectors, are pivotal in driving demand for specialized labels. Mergers and acquisitions (M&A) activity within the sector, though not extensively documented, is expected to contribute to market consolidation and growth (xx M&A deals recorded in the last 5 years).

- Market Concentration: Moderately concentrated, with top players holding a combined share of xx%.

- Innovation Drivers: Advancements in digital printing, sustainable materials, and smart labels.

- Regulatory Frameworks: Stringent regulations impacting materials and labeling practices.

- Product Substitutes: Digital printing technologies pose a competitive threat to traditional methods.

- End-User Trends: Growing demand from food & beverage, pharmaceutical, and consumer goods sectors.

- M&A Activity: xx M&A deals recorded in the past 5 years contributing to consolidation.

India Print Label Market Industry Trends & Analysis

The India print label market is experiencing robust growth, driven by several key factors. The rising demand for packaged goods, coupled with increasing brand awareness and customization, fuels market expansion. Technological advancements, specifically in digital printing and label materials, are reshaping the industry landscape. Consumer preferences for sustainable and eco-friendly packaging solutions are driving innovation in label production. Intense competition among players is leading to price optimization and the development of innovative products. The market is predicted to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, with market penetration reaching xx% by 2033.

Leading Markets & Segments in India Print Label Market

The report identifies the xx region as the leading market for print labels in India due to several key drivers.

- Economic Factors: High economic growth and a large consumer base are driving demand.

- Infrastructure: Well-developed infrastructure facilitates efficient production and distribution.

- Government Policies: Supportive government policies promote industrial growth.

The detailed analysis of regional dominance reveals xx as the leading segment. Growth in this region is primarily fueled by the presence of numerous manufacturing and packaging facilities. Further sub-segment analysis is detailed within the full report.

India Print Label Market Product Developments

Recent innovations in the Indian print label market include the rise of digital printing technologies, enabling higher levels of customization and shorter turnaround times. The development of sustainable and eco-friendly label materials, such as recycled paper and biodegradable plastics, caters to growing environmental concerns. These product developments provide competitive advantages by enhancing efficiency, reducing costs, and appealing to environmentally conscious consumers.

Key Drivers of India Print Label Market Growth

Several key factors are driving growth in the India print label market. Firstly, rapid economic growth and rising disposable incomes are fueling increased consumption of packaged goods, boosting label demand. Secondly, advancements in digital printing technologies, leading to faster turnaround times and greater design flexibility, increase market attractiveness. Finally, supportive government policies, particularly those promoting domestic manufacturing and sustainable practices, are also creating positive market conditions.

Challenges in the India Print Label Market Market

The Indian print label market faces several challenges, including the presence of a large unorganized sector, resulting in price competition. Supply chain disruptions, especially regarding raw material sourcing and logistics, create uncertainty. Fluctuations in raw material prices further add to cost pressures. These challenges impact the profitability of businesses operating in this sector, and the extent of this impact is quantifiable through a detailed financial analysis within the full report.

Emerging Opportunities in India Print Label Market

Significant long-term growth opportunities exist in the Indian print label market, driven by increased adoption of smart labels and packaging, incorporating RFID or NFC technologies. Strategic partnerships between label manufacturers and packaging companies will accelerate market penetration. Expansion into niche segments, such as personalized labels and specialized printing technologies, offers potential for growth and differentiation. The growing awareness regarding sustainable packaging will significantly drive the adoption of eco-friendly label materials.

Leading Players in the India Print Label Market Sector

- JK Labels Pvt Ltd

- Skanem Interlabels Industries Pvt Ltd

- Ajanta Packaging

- Sai Impression Labels & Packaging Solutions

- Pragati Pack (India) Private Limited

- Mudrika Labels Pvt Ltd

- Super Label Manufacturing Corporate

- Maanasa Graphics

- Reliance Plastic Industries

- Duralabel Graphics Pvt Ltd

Key Milestones in India Print Label Market Industry

- May 2024: Multi-Label Tech-Print (a division of Multi Printers Group) expands its market reach with the Domino N610i Digital Label Press, enhancing its digital printing capabilities and competitiveness.

- April 2024: Brother International introduces IoT-enabled label printers, improving efficiency and asset tracking capabilities for B2B clients. This represents a significant technological advancement in label printing solutions.

Strategic Outlook for India Print Label Market Market

The future of the Indian print label market is promising, with continued growth expected due to factors such as increasing demand for packaged goods, technological innovations, and a rising emphasis on sustainability. Strategic partnerships and investments in research and development will play crucial roles in maintaining competitiveness. Companies focusing on customized solutions and sustainable materials are poised to capture a larger market share. The overall market potential is significant, presenting considerable opportunities for existing and new entrants.

India Print Label Market Segmentation

-

1. Print Technology

- 1.1. Offset Lithography

- 1.2. Gravure

- 1.3. Flexography

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Electrophotography

- 1.7. Inkjet

-

2. Label Format

- 2.1. Wet-glued Labels

- 2.2. Pressure Sensitive Labels (PSL)

- 2.3. Linerless Labels

- 2.4. In-mold Labels

- 2.5. Shrink Sleeve Labels

- 2.6. Multi-part Tracking Labels

-

3. End-use Industries

- 3.1. Food

- 3.2. Beverage

- 3.3. Heathcare and Pharmaceutical

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industrial

- 3.7. Retail

- 3.8. Other En

India Print Label Market Segmentation By Geography

- 1. India

India Print Label Market Regional Market Share

Geographic Coverage of India Print Label Market

India Print Label Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Pressure-sensitive Labels Occupies the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Print Label Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 5.1.1. Offset Lithography

- 5.1.2. Gravure

- 5.1.3. Flexography

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Electrophotography

- 5.1.7. Inkjet

- 5.2. Market Analysis, Insights and Forecast - by Label Format

- 5.2.1. Wet-glued Labels

- 5.2.2. Pressure Sensitive Labels (PSL)

- 5.2.3. Linerless Labels

- 5.2.4. In-mold Labels

- 5.2.5. Shrink Sleeve Labels

- 5.2.6. Multi-part Tracking Labels

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Heathcare and Pharmaceutical

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industrial

- 5.3.7. Retail

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JK Labels Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Skanem Interlabels Industries Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ajanta Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sai Impression Labels & Packaging Solutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pragati Pack (India) Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mudrika Labels Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Super Label Manufacturing Corporate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maanasa Graphics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reliance Plastic Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Duralabel Graphics Pvt Ltd7 2 List of Customers by Region in India7 3 List of Major Unorganized Market Players in India by Regio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JK Labels Pvt Ltd

List of Figures

- Figure 1: India Print Label Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Print Label Market Share (%) by Company 2025

List of Tables

- Table 1: India Print Label Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 2: India Print Label Market Volume Billion Forecast, by Print Technology 2020 & 2033

- Table 3: India Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 4: India Print Label Market Volume Billion Forecast, by Label Format 2020 & 2033

- Table 5: India Print Label Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 6: India Print Label Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 7: India Print Label Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Print Label Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Print Label Market Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 10: India Print Label Market Volume Billion Forecast, by Print Technology 2020 & 2033

- Table 11: India Print Label Market Revenue Million Forecast, by Label Format 2020 & 2033

- Table 12: India Print Label Market Volume Billion Forecast, by Label Format 2020 & 2033

- Table 13: India Print Label Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 14: India Print Label Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 15: India Print Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Print Label Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Print Label Market?

The projected CAGR is approximately 13.29%.

2. Which companies are prominent players in the India Print Label Market?

Key companies in the market include JK Labels Pvt Ltd, Skanem Interlabels Industries Pvt Ltd, Ajanta Packaging, Sai Impression Labels & Packaging Solutions, Pragati Pack (India) Private Limited, Mudrika Labels Pvt Ltd, Super Label Manufacturing Corporate, Maanasa Graphics, Reliance Plastic Industries, Duralabel Graphics Pvt Ltd7 2 List of Customers by Region in India7 3 List of Major Unorganized Market Players in India by Regio.

3. What are the main segments of the India Print Label Market?

The market segments include Print Technology, Label Format, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Pressure-sensitive Labels Occupies the Largest Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2024: Multi-Label Tech-Print expanded its market reach with the Domino N610i Digital Label Press. Multi-Label Tech-Print, a division of Multi Printers Group, a prominent offset printing solutions provider in Ahmedabad, Gujarat, has achieved a significant milestone in its pursuit of innovation and printing. Multi-Label Tech-Print has invested in the Domino N610i digital label press to address changing printing requirements and maintain its commitment to output.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Print Label Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Print Label Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Print Label Market?

To stay informed about further developments, trends, and reports in the India Print Label Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence