Key Insights

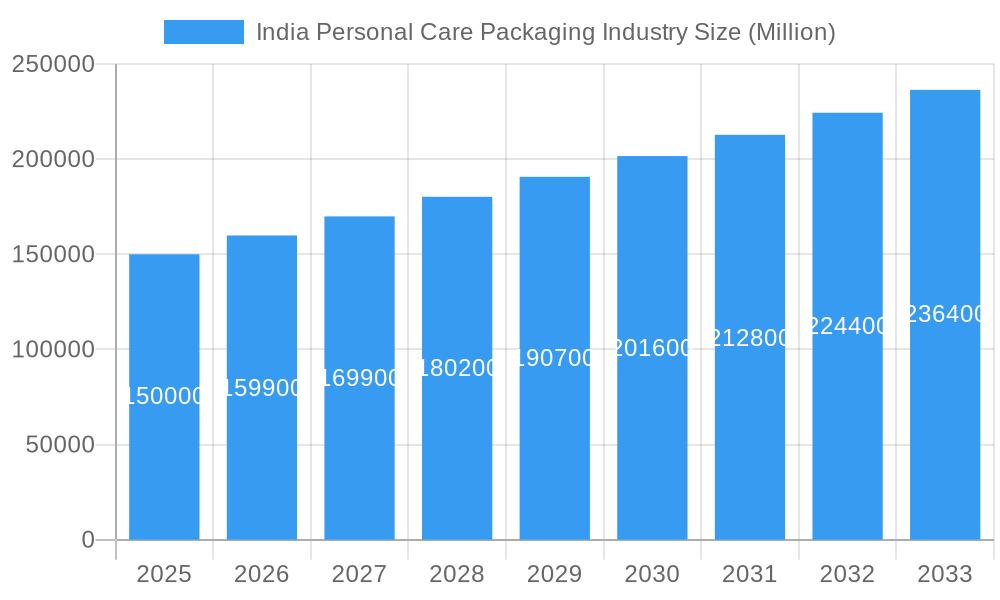

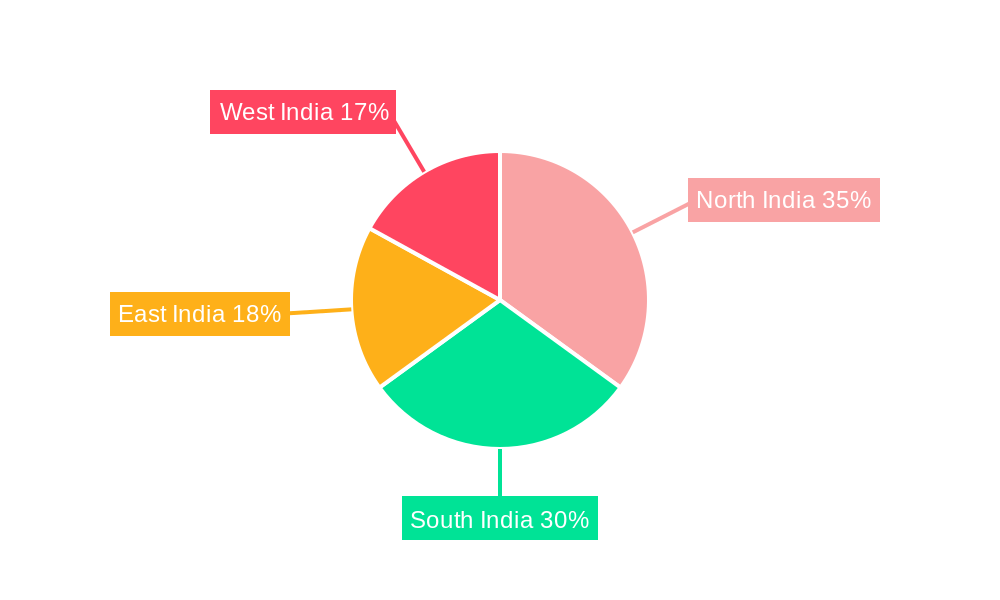

The Indian Personal Care Packaging Market is poised for significant expansion, projected to reach 38.88 billion by 2033. With a Compound Annual Growth Rate (CAGR) of 6.3% from the base year 2025, this growth is underpinned by a thriving personal care sector and escalating consumer demand for sophisticated and user-friendly packaging. Key drivers include rising disposable incomes and an expanding middle class, which are fueling demand for premium personal care products and, consequently, advanced packaging solutions. The surge in e-commerce also necessitates the development of protective and attractive packaging suitable for online retail. The market is segmented by packaging type (bottles, cans, cartons, jars, pouches, others), material (plastic, paper, metal, glass), and product category (baby care, bath & shower, oral care, skin care, sun care, hair care, fragrances). While plastic currently dominates due to its cost-effectiveness and versatility, a growing emphasis on sustainability is increasing the adoption of eco-friendly materials such as paper and recyclable options. Geographically, North and South India lead in market share, attributed to their larger populations and higher consumer spending. Intense competition exists among domestic and international players, including Winpak, RPC Group, Sonoco, Manjushree Technopack, and Amcor, all innovating to deliver sustainable, functional, and aesthetically pleasing packaging.

India Personal Care Packaging Industry Market Size (In Billion)

Market growth may be influenced by volatile raw material prices and evolving regulations concerning packaging waste. Nevertheless, the overall outlook remains optimistic. Companies are increasingly prioritizing sustainability by incorporating recycled materials and developing innovative designs to meet the demand for eco-conscious products. A trend towards lightweight packaging is also evident, aiming to minimize environmental impact and reduce logistical expenses. Further market expansion is anticipated through investments in advanced packaging technologies, such as smart packaging and tamper-evident seals. Regional market variations are expected to persist, influenced by diverse economic conditions and consumer preferences across India. The forecast period of 2025-2033 promises sustained growth and innovation, presenting substantial opportunities for established and emerging participants in the Indian personal care packaging sector.

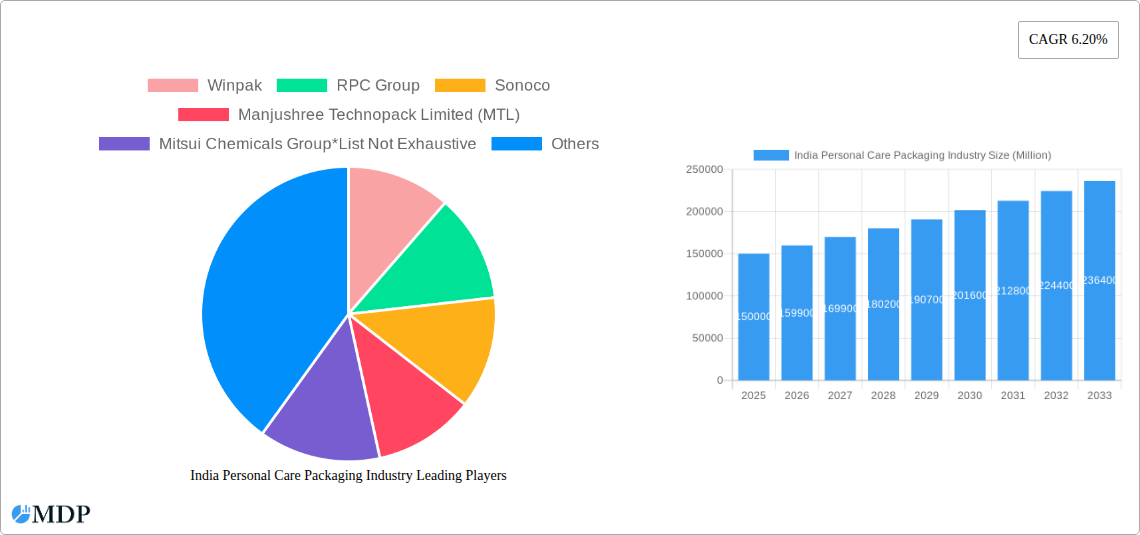

India Personal Care Packaging Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the Indian Personal Care Packaging Market, offering critical insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with 2025 as the base year, this study elucidates market dynamics, key players, emerging trends, and future growth trajectories. The market is forecast to reach approximately 38.88 billion by 2033, indicating substantial growth potential. Discover strategic approaches to navigate this dynamic market landscape.

India Personal Care Packaging Industry Market Dynamics & Concentration

The Indian personal care packaging market exhibits a moderately concentrated landscape, with key players like Amcor PLC, Winpak, RPC Group, Sonoco, and Manjushree Technopack Limited (MTL) holding significant market share. However, the market also accommodates a substantial number of smaller players, particularly in regional markets. Market concentration is further influenced by the diverse range of packaging materials and types used. Innovation is driven by consumer demand for sustainable and convenient packaging, leading to increased adoption of eco-friendly materials like paper and recycled plastics. Stringent regulatory frameworks concerning material composition and waste management further shape market dynamics. Product substitutes, such as refillable containers and packaging-free formats, are gaining traction, though they currently hold a relatively small market share (estimated at xx%). Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, indicating a potential for increased consolidation in the future. End-user trends, specifically toward premiumization and personalized products, influence packaging choices and create demand for sophisticated designs and functionalities.

India Personal Care Packaging Industry Industry Trends & Analysis

The India personal care packaging industry is experiencing robust growth, driven by several factors. The rising disposable incomes and expanding middle class are fueling demand for personal care products, consequently boosting packaging demand. Technological disruptions, such as advancements in flexible packaging and smart packaging solutions, are improving product shelf life and enhancing consumer experience. Consumers increasingly favor eco-friendly packaging, prompting manufacturers to adopt sustainable materials and processes. This shift towards sustainability is projected to significantly impact the market, driving a CAGR of xx% for sustainable packaging materials between 2025 and 2033. The market penetration of sustainable packaging is currently estimated at xx%, expected to grow to xx% by 2033. Intense competition among packaging manufacturers necessitates innovation and cost-optimization strategies. Market penetration of various packaging materials shows Plastic leading with xx%, followed by Paper at xx%, Metal at xx%, and Glass at xx%.

Leading Markets & Segments in India Personal Care Packaging Industry

The Indian personal care packaging market is predominantly driven by the rising demand for skin care and hair care products. Within packaging types, bottles currently dominate the market, followed by cartons and pouches. Plastic continues to be the leading material, owing to its versatility and cost-effectiveness, however, significant growth is anticipated in the paper and recycled plastic segments driven by environmental concerns.

Key Drivers:

- Economic Growth: Rising disposable incomes and a burgeoning middle class are significant growth drivers.

- Urbanization: Increasing urbanization leads to higher consumption of personal care products.

- E-commerce Boom: The rapid growth of e-commerce increases demand for suitable packaging.

- Government Initiatives: Favorable government policies promoting domestic manufacturing and sustainable practices provide support.

Dominance Analysis:

The dominance of bottles in the packaging type segment is due to its suitability for various personal care products. Plastic’s dominance in materials is attributed to its cost-effectiveness and adaptability, though paper and recycled materials are gaining traction due to growing consumer preference for eco-friendly solutions. The skin care and hair care product segments contribute the highest share to overall market growth due to high demand and consequent packaging needs.

India Personal Care Packaging Industry Product Developments

Recent innovations focus on sustainable and functional packaging. This includes the increasing use of recycled materials, biodegradable plastics, and paper-based alternatives. Smart packaging technologies, incorporating features like RFID tags for enhanced traceability and tamper-evident seals for security, are also gaining prominence. These developments are tailored to meet evolving consumer preferences and regulatory requirements. The emphasis is on lightweighting, improving barrier properties, and creating visually appealing designs. Companies are investing in advanced technologies to improve packaging efficiency and reduce environmental impact. These innovations offer competitive advantages by enhancing product shelf life and consumer appeal.

Key Drivers of India Personal Care Packaging Industry Growth

Several factors propel the growth of the Indian personal care packaging market. Technological advancements in packaging materials and processes allow for greater efficiency, sustainability, and improved product protection. The expanding personal care industry and growing consumer base fuel increased demand for packaging solutions. Favorable government policies promoting sustainable practices further drive market growth. For example, the introduction of stringent waste management regulations encourages the adoption of eco-friendly packaging alternatives. Economic growth contributes to higher disposable incomes, leading to increased personal care product consumption and subsequently packaging demand.

Challenges in the India Personal Care Packaging Industry Market

The industry faces several challenges, including increasing raw material costs, fluctuating crude oil prices affecting plastic pricing, and the complexity of complying with evolving regulatory requirements for sustainable packaging. Supply chain disruptions and transportation costs can also negatively impact profitability. Intense competition and the pressure to innovate continuously put pressure on profit margins. The need to balance cost-effectiveness with sustainability and consumer preferences poses a strategic challenge. These factors contribute to a complex and dynamic market environment.

Emerging Opportunities in India Personal Care Packaging Industry

Significant opportunities lie in the growing demand for sustainable and innovative packaging solutions. Strategic partnerships between packaging manufacturers and personal care brands can drive innovation and market expansion. Technological breakthroughs, such as the development of advanced biodegradable materials and smart packaging features, present lucrative growth avenues. Expansion into regional markets and tapping into the increasing demand for personalized and premium packaging products create further potential. The focus on eco-friendly and sustainable practices presents a significant opportunity for growth and market leadership.

Leading Players in the India Personal Care Packaging Industry Sector

- Winpak

- RPC Group

- Sonoco

- Manjushree Technopack Limited (MTL)

- Mitsui Chemicals Group

- Bemis Company Inc

- Mondi Group

- Amcor PLC

- BACFO Pharmaceuticals (India) Ltd

- Tredegar Corporation

- Aptar Group

- Huntsman Corporation

- Clensta International

- Silgan Holdings

- Rexam

Key Milestones in India Personal Care Packaging Industry Industry

- January 2022: Amcor Plc announced its strategic investment in PragmatIC Semiconductor, enabling smart packaging applications across the product lifecycle, boosting efficiency and consumer engagement.

- January 2022: WOW Skin Science launched a paper tube packaging initiative for its Vitamin C face wash, highlighting a growing trend towards sustainable packaging and impacting consumer perception positively.

Strategic Outlook for India Personal Care Packaging Industry Market

The Indian personal care packaging market is poised for substantial growth, driven by increasing consumer demand and a focus on sustainable practices. Strategic investments in innovative technologies, sustainable materials, and efficient manufacturing processes will be crucial for success. Companies focusing on customization, personalization, and premium packaging solutions will gain a competitive edge. Collaborations with research institutions and technology providers are key to developing innovative packaging solutions that meet both consumer needs and sustainability goals. The future success hinges on adapting to evolving consumer preferences and regulatory frameworks.

India Personal Care Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Products

- 2.1. Baby Care

- 2.2. Bath and Shower

- 2.3. Oral Care

- 2.4. Skin Care

- 2.5. Sun Care

- 2.6. Hair Care

- 2.7. Fragrances

- 2.8. Other Products

-

3. Packaging Type

- 3.1. Bottles

- 3.2. Metal Cans

- 3.3. Cartons

- 3.4. Jars

- 3.5. Pouches

- 3.6. Others

India Personal Care Packaging Industry Segmentation By Geography

- 1. India

India Personal Care Packaging Industry Regional Market Share

Geographic Coverage of India Personal Care Packaging Industry

India Personal Care Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs; Growing Usage of Substitute Products (Plastic)

- 3.4. Market Trends

- 3.4.1. Rise in Eco-friendly Bio-Degradable Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Personal Care Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Products

- 5.2.1. Baby Care

- 5.2.2. Bath and Shower

- 5.2.3. Oral Care

- 5.2.4. Skin Care

- 5.2.5. Sun Care

- 5.2.6. Hair Care

- 5.2.7. Fragrances

- 5.2.8. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Packaging Type

- 5.3.1. Bottles

- 5.3.2. Metal Cans

- 5.3.3. Cartons

- 5.3.4. Jars

- 5.3.5. Pouches

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Winpak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPC Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Manjushree Technopack Limited (MTL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsui Chemicals Group*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bemis Company Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BACFO Pharmaceuticals (India) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tredegar Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aptar Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Huntsman Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Clensta International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Silgan Holdings

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Rexam

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Winpak

List of Figures

- Figure 1: India Personal Care Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Personal Care Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: India Personal Care Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: India Personal Care Packaging Industry Revenue billion Forecast, by Products 2020 & 2033

- Table 3: India Personal Care Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 4: India Personal Care Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Personal Care Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: India Personal Care Packaging Industry Revenue billion Forecast, by Products 2020 & 2033

- Table 7: India Personal Care Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 8: India Personal Care Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Personal Care Packaging Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the India Personal Care Packaging Industry?

Key companies in the market include Winpak, RPC Group, Sonoco, Manjushree Technopack Limited (MTL), Mitsui Chemicals Group*List Not Exhaustive, Bemis Company Inc, Mondi Group, Amcor PLC, BACFO Pharmaceuticals (India) Ltd, Tredegar Corporation, Aptar Group, Huntsman Corporation, Clensta International, Silgan Holdings, Rexam.

3. What are the main segments of the India Personal Care Packaging Industry?

The market segments include Material, Products, Packaging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market.

6. What are the notable trends driving market growth?

Rise in Eco-friendly Bio-Degradable Packaging.

7. Are there any restraints impacting market growth?

Rising Operational Costs; Growing Usage of Substitute Products (Plastic).

8. Can you provide examples of recent developments in the market?

January 2022: Amcor Plc announced its strategic investment in PragmatIC Semiconductor, a world leader in ultra, low-cost electronics. This technology will enable smart packaging applications across the entire product lifecycle - from manufacturing and supply chain management to consumer engagement and even material recovery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Personal Care Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Personal Care Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Personal Care Packaging Industry?

To stay informed about further developments, trends, and reports in the India Personal Care Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence