Key Insights

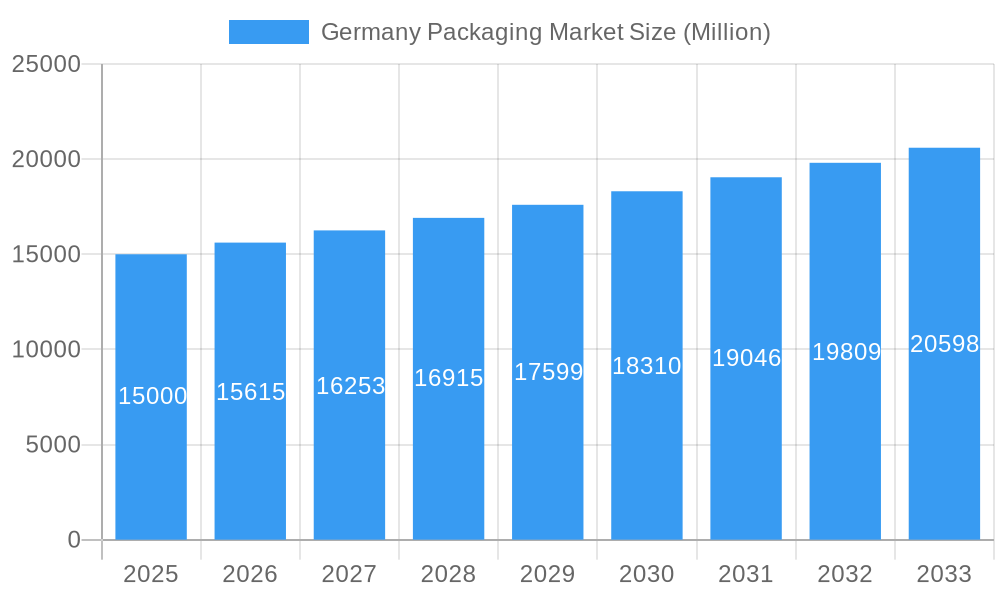

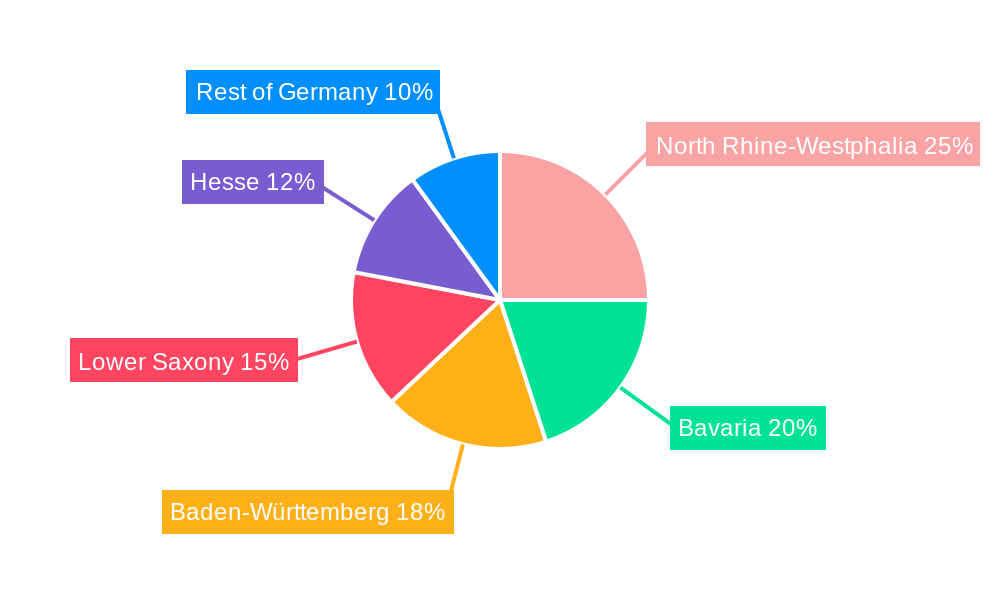

The German packaging market, valued at $14.65 billion in 2025, is forecast to grow at a compound annual growth rate (CAGR) of 4.25% from 2025 to 2033. This growth is propelled by the e-commerce surge, requiring robust transit packaging, and increasing consumer demand for sustainable materials such as recycled plastics and biodegradable alternatives. The food and beverage sector, particularly ready-to-eat options, also significantly contributes to market expansion. While challenges like fluctuating raw material costs and environmental regulations exist, they are expected to be outweighed by strong growth drivers. Key materials include glass, plastic, and metal, serving diverse end-use industries like food, beverages, pharmaceuticals, and personal care. Analysis of key German states—North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse—provides granular market insights. Leading companies such as Reynolds Group Holdings Ltd, Ball Corporation, and Amcor PLC underscore a competitive market landscape.

Germany Packaging Market Market Size (In Billion)

The projected market expansion by 2033 presents substantial opportunities for companies offering sustainable and innovative packaging solutions. Demand for specialized packaging for sensitive products, coupled with advancements in materials and design, further fuels market dynamism. Strategic partnerships, mergers, acquisitions, and product diversification will be key for competitive advantage. Regional variations within Germany offer opportunities for tailored market entry strategies, considering differing consumption patterns and regulations. A strong commitment to sustainability is essential for success in this evolving market.

Germany Packaging Market Company Market Share

Germany Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany packaging market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report leverages extensive primary and secondary research to deliver actionable intelligence, enabling informed strategic planning and investment decisions within the dynamic German packaging landscape. The market is projected to reach XX Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Germany Packaging Market Market Dynamics & Concentration

The German packaging market is characterized by a dynamic yet moderately concentrated landscape. Key global players such as Reynolds Group Holdings Ltd, Ball Corporation, International Paper Co, Amcor PLC, Mondi PLC, Crown Holdings Incorporated, Smurfit Kappa Group PLC, Berry Global Group, Inc. (formerly Berry Plastics GmbH), Sealed Air Corporation, WestRock Co, and Owens-Illinois Inc. command significant market share. However, the market also fosters a robust ecosystem of smaller and medium-sized enterprises (SMEs), particularly those specializing in niche segments and innovative solutions. This blend of large corporations and agile smaller players creates a competitive and evolving market environment.

Market concentration is meticulously shaped by a confluence of factors, including achieving economies of scale, the relentless pace of technological advancements, and navigating complex regulatory frameworks. Innovation stands as a paramount driver, compelling companies to continuously develop and implement sustainable, high-performance, and cost-effective packaging solutions. Germany's stringent environmental regulations, particularly those addressing plastic waste and promoting a circular economy, exert a profound influence on market dynamics. This regulatory pressure actively encourages the adoption of eco-friendly materials, advanced recycling technologies, and sustainable manufacturing processes. The presence of readily available substitute materials and diverse packaging types introduces substantial competitive pressure, compelling market participants to differentiate themselves through quality, functionality, and environmental credentials. Furthermore, evolving consumer preferences, with a strong emphasis on convenience, product integrity, and a demonstrable commitment to sustainability, are actively reshaping market demands and product development strategies. Mergers and acquisitions (M&A) activity within the sector remains a notable strategic tool, with approximately XX significant deals recorded between 2019 and 2024. These transactions are predominantly geared towards expanding geographical market reach, acquiring specialized technological expertise, and enhancing product portfolios, particularly in the realm of sustainable packaging. Current market share data indicates that the top 5 leading players collectively hold an estimated XX% of the overall market, underscoring the influence of these major entities while still allowing for substantial participation from other market participants.

Germany Packaging Market Industry Trends & Analysis

The German packaging market is experiencing robust growth, fueled by several key trends. Rising disposable incomes and changing consumer lifestyles contribute significantly to increased demand for packaged goods. Technological advancements in packaging materials and manufacturing processes are driving efficiency and innovation. The e-commerce boom is further augmenting the demand for protective and convenient packaging solutions. Consumer preferences are shifting toward sustainable and eco-friendly packaging options, creating significant opportunities for biodegradable and recyclable materials. Competitive dynamics are marked by innovation, price competition, and efforts towards sustainability, creating a dynamic and evolving landscape. The market is projected to witness a CAGR of xx% between 2025 and 2033, with the highest growth anticipated in the flexible packaging segment and the food and beverage end-user vertical. Market penetration of sustainable packaging is expected to increase by xx% during the forecast period.

Leading Markets & Segments in Germany Packaging Market

The German packaging market is diverse, encompassing various materials, packaging types, and end-user verticals. However, several segments dominate:

- Material: Plastic remains the leading material segment, driven by its versatility, cost-effectiveness, and ease of processing. However, growing environmental concerns are propelling the adoption of sustainable alternatives like paperboard and biodegradable plastics.

- Packaging Type: Flexible packaging is the largest segment due to its cost-effectiveness, lightweight nature, and suitability for various products. Rigid packaging maintains a significant share, particularly in the food and beverage sectors, where it offers protection and shelf-life extension.

- End-User Vertical: The food and beverage sector represents the largest end-user segment, followed by the pharmaceutical and household and personal care sectors. This high demand is driven by increasing consumption and the need for product preservation and consumer convenience.

These leading segments benefit from strong economic activity, well-developed infrastructure, and favorable government policies supporting the manufacturing and food processing sectors.

Germany Packaging Market Product Developments

Recent years have witnessed significant product innovations in the German packaging market, driven by the need for sustainability and enhanced functionality. This includes the development of lightweight and recyclable materials, such as PLA and bio-based polymers. Smart packaging solutions, including tamper-evident seals and RFID technology, are gaining traction, offering improved product traceability and security. These advancements provide competitive advantages by enhancing product protection, extending shelf life, and meeting growing consumer demands for sustainability and convenience.

Key Drivers of Germany Packaging Market Growth

Several factors are driving growth in the Germany packaging market. Technological advancements, such as the development of sustainable and innovative packaging materials, improve product protection and enhance the consumer experience. Economic growth and rising disposable incomes have increased consumer spending on packaged goods. Favorable government regulations promoting sustainable packaging practices further propel market expansion. For example, the German government’s initiatives on reducing plastic waste have significantly influenced the shift toward eco-friendly packaging solutions.

Challenges in the Germany Packaging Market Market

Despite a generally positive growth trajectory, the German packaging market faces several significant challenges that necessitate strategic adaptation and innovation. The increasingly stringent environmental regulations, while crucial for fostering sustainability, undeniably contribute to higher compliance costs for packaging manufacturers. These costs can impact profitability and necessitate significant investment in new technologies and processes. Fluctuations in global raw material prices, coupled with persistent supply chain disruptions exacerbated by geopolitical events and logistical complexities, can profoundly affect production costs and overall market stability. The intense competition among a diverse range of packaging providers, encompassing both large multinational corporations and specialized SMEs, exerts considerable downward pressure on pricing, challenging profit margins. These multifaceted challenges collectively underscore the critical need for continuous innovation, operational efficiency, and agile strategic responses to ensure sustained market success and competitive advantage. The combined impact of these challenges is conservatively estimated to moderate market growth by approximately XX% in the short to medium term.

Emerging Opportunities in Germany Packaging Market

The German packaging market is ripe with emerging opportunities, presenting substantial avenues for growth and innovation. The burgeoning advancements in sustainable materials and cutting-edge packaging technologies, such as the development and widespread adoption of biodegradable plastics, compostable packaging solutions, and advanced recyclable materials, are opening entirely new frontiers for market expansion and differentiation. Strategic collaborations and partnerships forged between packaging manufacturers and brand owners are proving instrumental in co-creating innovative packaging solutions meticulously optimized for specific product requirements, consumer convenience, and enhanced sustainability profiles. Government initiatives and robust support for circular economy principles, including investments in recycling infrastructure and waste management technologies, further catalyze opportunities for companies committed to sustainable practices and resource efficiency. These burgeoning opportunities are projected to contribute to a significant market expansion, potentially increasing the market size by approximately XX% in the long term.

Leading Players in the Germany Packaging Market Sector

- Reynolds Group Holdings Ltd

- Ball Corporation

- International Paper Co

- Amcor PLC

- Mondi PLC

- Crown Holdings Incorporated

- Smurfit Kappa Group PLC

- Berry Global Group, Inc. (formerly Berry Plastics GmbH)

- Sealed Air Corporation

- WestRock Co

- Owens-Illinois Inc

Key Milestones in Germany Packaging Market Industry

- 2020: Introduction of stricter regulations on single-use plastics.

- 2021: Launch of several innovative biodegradable packaging solutions by major players.

- 2022: Significant investment in recycling infrastructure by the German government.

- 2023: Several mergers and acquisitions amongst mid-sized packaging companies.

- 2024: Increased adoption of smart packaging technologies in the food and beverage sector.

Strategic Outlook for Germany Packaging Market Market

The strategic outlook for the German packaging market is exceptionally promising, propelled by sustained growth across the consumer goods sector, continuous advancements in technological innovations focused on sustainable materials and intelligent packaging designs, and substantial government backing for the principles of a circular economy. Strategic opportunities abound for companies that adeptly prioritize the development and implementation of sustainable packaging solutions, invest in advanced packaging technologies, and optimize their supply chain efficiencies to meet evolving market demands. The market is strategically positioned for sustained expansion, exhibiting significant growth potential particularly within the flexible packaging segment and the broader adoption of innovative solutions that effectively address and anticipate dynamic consumer expectations for both convenience and environmental responsibility.

Germany Packaging Market Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastic

- 1.3. Metal

- 1.4. Other Materials

-

2. Packaging Type

- 2.1. Rigid

- 2.2. Flexible

-

3. End-user Vertical

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceutical

- 3.4. Household and Personal Care

- 3.5. Other End-user Verticalss

Germany Packaging Market Segmentation By Geography

- 1. Germany

Germany Packaging Market Regional Market Share

Geographic Coverage of Germany Packaging Market

Germany Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Demand for Convenient Packaging; Increased Emphasis for Product Differentiation

- 3.3. Market Restrains

- 3.3.1. ; Increasing Stringent Regulations Regarding Non-biodegradable Materials

- 3.4. Market Trends

- 3.4.1. Plastic Packaging to Hold Dominant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid

- 5.2.2. Flexible

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceutical

- 5.3.4. Household and Personal Care

- 5.3.5. Other End-user Verticalss

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reynolds Group Holdings Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 International Paper Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crown Holdings Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Smurfit Kappa Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Plastics GmbH*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WestRock Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Owens-Illinois Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Reynolds Group Holdings Ltd

List of Figures

- Figure 1: Germany Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Germany Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Germany Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Germany Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Germany Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Germany Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Germany Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Packaging Market?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Germany Packaging Market?

Key companies in the market include Reynolds Group Holdings Ltd, Ball Corporation, International Paper Co, Amcor PLC, Mondi PLC, Crown Holdings Incorporated, Smurfit Kappa Group PLC, Berry Plastics GmbH*List Not Exhaustive, Sealed Air Corporation, WestRock Co, Owens-Illinois Inc.

3. What are the main segments of the Germany Packaging Market?

The market segments include Material, Packaging Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.65 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Demand for Convenient Packaging; Increased Emphasis for Product Differentiation.

6. What are the notable trends driving market growth?

Plastic Packaging to Hold Dominant Share.

7. Are there any restraints impacting market growth?

; Increasing Stringent Regulations Regarding Non-biodegradable Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Packaging Market?

To stay informed about further developments, trends, and reports in the Germany Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence