Key Insights

The European innovative wall coverings market, comprising wallpaper, wall panels, decorative tiles, and metal panels, is set for robust expansion. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.8%, reaching a market size of 6.6 billion by 2025. Key growth drivers include a rising demand for aesthetically pleasing and durable interior design solutions in both commercial and residential sectors. Technological advancements in materials are introducing innovative products with enhanced sound insulation, fire resistance, and ease of installation. Increased disposable incomes across European nations, particularly in Western Europe, are further fueling market growth. Germany, France, Italy, and the United Kingdom are leading markets, driven by strong construction and renovation activity. Challenges include raw material price volatility and potential economic downturns impacting consumer spending. The market is segmented by application, with wallpaper and wall panels holding significant share. The growing preference for sustainable and eco-friendly building materials presents opportunities for manufacturers offering recycled or low-impact products. Competition is intense, with both international and regional players.

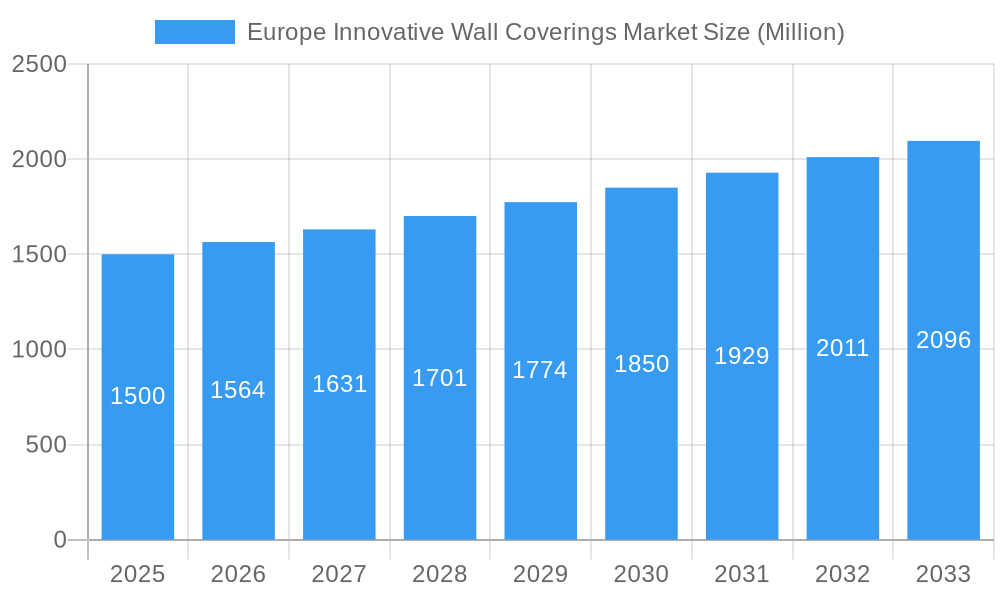

Europe Innovative Wall Coverings Market Market Size (In Billion)

The European innovative wall coverings market outlook is positive, with continued growth anticipated, subject to macroeconomic factors. Market players are prioritizing product diversification, targeting niche segments in commercial and residential applications, including personalized and customizable options. Technological innovations in digital printing and smart materials are enhancing design flexibility and functionality. Sustainability trends will significantly influence product development and consumer choices, driving demand for eco-friendly alternatives. The expansion of e-commerce platforms will improve market accessibility and broaden customer reach. Overall, the market demonstrates significant potential for growth driven by innovation, evolving consumer preferences, and sustained demand for attractive and functional interior design.

Europe Innovative Wall Coverings Market Company Market Share

Europe Innovative Wall Coverings Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Innovative Wall Coverings Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The report utilizes detailed data analysis and expert insights to present a holistic view of this dynamic market, expected to reach xx Million by 2033.

Europe Innovative Wall Coverings Market Market Dynamics & Concentration

The European innovative wall coverings market is characterized by a dynamic interplay of forces shaping its competitive landscape. Market concentration is assessed, with a notable presence of established players alongside emerging innovators. Key drivers of innovation are deeply rooted in the pursuit of sustainability, the integration of advanced smart technologies, and an increasing demand for bespoke and personalized aesthetic solutions. The regulatory environment, particularly EU directives concerning Volatile Organic Compound (VOC) emissions and material safety standards, plays a crucial role in guiding product development and market trends. Competitors face pressure from readily available product substitutes, primarily traditional paints and other wall finishing options. Evolving end-user preferences are a significant factor, with both commercial and residential sectors increasingly seeking wall coverings that offer not only visual appeal but also enhanced functionality and longevity. Strategic mergers and acquisitions (M&A) activities are a testament to the industry's drive towards consolidation and market expansion. In 2025, key players like Nippon Paint Group are estimated to hold approximately XX% of the market share, with significant contributions also coming from Adfors (Saint Gobain) and Walker Greenbank PLC, underscoring a moderately concentrated market structure.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at XX in 2025, indicating a moderately concentrated market, suggesting room for both established leaders and agile new entrants.

- Innovation Drivers: The market is propelled by a strong push towards sustainable materials derived from recycled or rapidly renewable sources, the incorporation of smart technologies such as self-cleaning or air-purifying surfaces, and the growing demand for personalized and customizable designs that cater to individual aesthetic preferences.

- Regulatory Framework: Strict EU regulations on VOC emissions and robust material safety standards are not just compliance requirements but are actively shaping product formulation, manufacturing processes, and overall market trends towards healthier and environmentally responsible solutions.

- Product Substitutes: The market contends with established substitutes such as conventional paints and other decorative wall finishes. While these offer cost-effectiveness, innovative wall coverings differentiate themselves through unique textures, patterns, functionalities, and sustainability credentials.

- End-User Trends: A significant shift in end-user preferences is observed, with a pronounced demand for aesthetically pleasing, durable, and performance-oriented wall coverings across both the commercial (hospitality, offices, retail) and residential segments. This is a key driver for market growth.

- M&A Activity: The historical period between 2019 and 2024 saw an estimated XX M&A deals, signifying a considerable level of consolidation as companies seek to enhance their product portfolios, expand their geographical reach, and leverage synergies for competitive advantage.

Europe Innovative Wall Coverings Market Industry Trends & Analysis

The Europe Innovative Wall Coverings Market is on a robust growth trajectory, driven by a confluence of economic, technological, and societal factors. Rising disposable incomes across the continent, coupled with increasing urbanization, are fueling demand for sophisticated interior design solutions. Consumers are increasingly prioritizing aesthetically appealing, durable, and easy-to-maintain wall coverings for both new constructions and renovations. Technological advancements are revolutionizing the industry, with innovations like high-resolution 3D-printed wall coverings and highly customizable digitally printed wallpapers offering unprecedented design flexibility and unique tactile experiences. These technological disruptions are not only expanding the product offering but also personalizing the consumer experience. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033, with market penetration expected to reach an impressive XX% by 2033. This expansion is largely attributed to the growing popularity of a diverse range of wallpaper and wall panel solutions in both domestic and commercial settings. A significant trend is the consumer's increasing demand for eco-friendly and sustainable options, presenting substantial opportunities for manufacturers who can integrate recycled materials and environmentally conscious production methods. The competitive landscape is characterized by intense rivalry among established global brands and agile new entrants, prompting continuous innovation in product design, material science, and marketing strategies to capture market share and influence pricing dynamics.

Leading Markets & Segments in Europe Innovative Wall Coverings Market

This section identifies the dominant regions, countries, and product segments within the European innovative wall coverings market. Germany, France, and the UK are currently leading markets, accounting for xx% of the total market value.

By Product:

- Wallpaper: Remains the largest segment, driven by its versatility, affordability, and ease of installation. Its dominance is attributable to the ongoing preference for traditional wall coverings and the introduction of innovative designs and materials.

- Wall Panel: Shows significant growth potential due to its durability, ease of maintenance, and design flexibility, particularly in commercial settings.

- Decorative Tile: Maintains a steady market share owing to its longevity and aesthetic appeal, largely influenced by its utilization in high-end residential and commercial projects.

- Metal Panel: While a smaller segment, metal panels are gaining traction due to their modern aesthetic and durability, mainly in commercial and industrial applications.

- Other Products: This segment encompasses less common materials and shows slow but consistent growth driven by niche market demands.

By Application:

- Commercial: The commercial sector represents a larger portion of the market driven by the need for high durability and low maintenance materials in public spaces and offices.

- Non-commercial (Residential): This segment is experiencing robust growth fueled by the increasing preference for personalized home décor and improving disposable incomes.

Key drivers for the leading segments and countries include robust construction activity, favorable government policies, rising disposable incomes, and the growing influence of interior design trends.

Europe Innovative Wall Coverings Market Product Developments

Recent product developments in the Europe innovative wall coverings market emphasize sustainability, functionality, and design flexibility. Manufacturers are incorporating eco-friendly materials, such as recycled paper and bamboo, and introducing smart features like soundproofing and temperature regulation. Digitally printed wallpapers allow for personalized designs and high-resolution imagery, expanding design possibilities significantly. These innovations are driving market growth and increasing consumer preference for sophisticated and functional wall coverings.

Key Drivers of Europe Innovative Wall Coverings Market Growth

Several factors are driving the growth of the Europe Innovative Wall Coverings Market. Technological advancements, such as 3D printing and digital printing, are expanding design possibilities and enabling mass customization. Furthermore, the increasing focus on sustainable and eco-friendly materials aligns with growing environmental concerns. Favorable economic conditions and increased construction activity in several European countries are creating strong demand for innovative wall coverings in both residential and commercial sectors.

Challenges in the Europe Innovative Wall Coverings Market Market

The European innovative wall coverings market faces challenges including increasing raw material costs, fluctuating energy prices impacting manufacturing costs, and intense competition. Supply chain disruptions caused by global events can impact production and delivery timelines. Stringent environmental regulations related to material composition and manufacturing processes can add to the overall cost of production. These factors can hinder market growth and affect the profitability of manufacturers.

Emerging Opportunities in Europe Innovative Wall Coverings Market

The European innovative wall coverings market presents a fertile ground for emerging opportunities, particularly in the realm of advanced functionalities and sustainable practices. A significant avenue lies in the development of smart wall coverings that integrate technology to enhance living and working environments. This includes features such as integrated LED lighting for ambient effects, advanced sound insulation for improved acoustics, and even climate control capabilities through materials that regulate temperature. Strategic collaborations and partnerships between leading manufacturers and renowned interior designers are poised to unlock new product innovations, aesthetic frontiers, and expansive market reach. Furthermore, a strong focus on exploring novel, eco-friendly materials and championing sustainable production methods will resonate with the growing segment of environmentally conscious consumers, thereby creating a distinct market advantage. The demand for highly customized and personalized wall coverings, tailored to meet unique individual preferences and project-specific requirements, offers substantial growth prospects, moving beyond mass production to bespoke solutions.

Leading Players in the Europe Innovative Wall Coverings Market Sector

- Nippon Paint Group

- Adfors (Saint Gobain)

- Walker Greenbank PLC

- Grandeco Wallfashion Group

- A S Création Tapten AG

- Benjamin Moore & Co

- Brewster Home Fashions LLC

- Grespania Cerámica

- Ahlstrom-munksjö Oyj

- AkzoNobel NV

Key Milestones in Europe Innovative Wall Coverings Market Industry

- 2020: A notable year for environmental consciousness, with several major manufacturers introducing a range of eco-friendly wallpaper options to meet growing consumer demand for sustainable products.

- 2021: Marked a significant surge in the online sales channel for innovative wall coverings, reflecting a broader shift in consumer purchasing habits and increased digital adoption.

- 2022: Witnessed the innovative launch of 3D-printed wall panels by a prominent industry player, showcasing advancements in manufacturing technology and design possibilities.

- 2023: The market saw increased consolidation with a merger between two smaller players, indicating a trend towards strategic alliances and increased market share concentration.

- 2024: Several key manufacturers proactively released new collections heavily featuring sustainable and recycled materials, underscoring a commitment to environmental responsibility and appealing to a growing eco-conscious consumer base.

Strategic Outlook for Europe Innovative Wall Coverings Market Market

The future of the Europe Innovative Wall Coverings Market appears promising, driven by continued technological advancements, sustainability concerns, and increasing consumer demand for sophisticated and personalized interior designs. Strategic partnerships, focusing on product innovation and market expansion, will be crucial for success. Companies that prioritize sustainable production methods and cater to evolving consumer preferences will likely gain a competitive edge in this dynamic market. The market is set for continued growth and presents ample opportunities for both established players and new entrants.

Europe Innovative Wall Coverings Market Segmentation

-

1. Product

- 1.1. Wallpaper

- 1.2. Wall Panel

- 1.3. Decorative Tile

- 1.4. Metal Panel

- 1.5. Other Products

- 2. Interior Paints Market

-

3. Application

- 3.1. Commercial

- 3.2. Non-commercial

Europe Innovative Wall Coverings Market Segmentation By Geography

-

1. Europe

- 1.1. UK

- 1.2. France

- 1.3. Germany

- 1.4. Spain

- 1.5. The Netherlands

- 1.6. Belgium

- 1.7. Portugal

- 1.8. Russia

- 1.9. Poland

- 1.10. Italy

Europe Innovative Wall Coverings Market Regional Market Share

Geographic Coverage of Europe Innovative Wall Coverings Market

Europe Innovative Wall Coverings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Higher Demand for Home Furnishing among the European Countries; Availability of Styled Products

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Non-commercial is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Innovative Wall Coverings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wallpaper

- 5.1.2. Wall Panel

- 5.1.3. Decorative Tile

- 5.1.4. Metal Panel

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Interior Paints Market

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Non-commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nippon Paint Group*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adfors (Saint Gobain)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Walker Greenbank PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grandeco Wallfashion Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A S Création Tapten AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Benjamin Moore & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brewster Home Fashions LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grespania Cerámica

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ahlstrom-munksjö Oyj

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AkzoNobel NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nippon Paint Group*List Not Exhaustive

List of Figures

- Figure 1: Europe Innovative Wall Coverings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Innovative Wall Coverings Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Interior Paints Market 2020 & 2033

- Table 3: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Interior Paints Market 2020 & 2033

- Table 7: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Innovative Wall Coverings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: UK Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: France Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Spain Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: The Netherlands Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Belgium Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Portugal Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Poland Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Europe Innovative Wall Coverings Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Innovative Wall Coverings Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Europe Innovative Wall Coverings Market?

Key companies in the market include Nippon Paint Group*List Not Exhaustive, Adfors (Saint Gobain), Walker Greenbank PLC, Grandeco Wallfashion Group, A S Création Tapten AG, Benjamin Moore & Co, Brewster Home Fashions LLC, Grespania Cerámica, Ahlstrom-munksjö Oyj, AkzoNobel NV.

3. What are the main segments of the Europe Innovative Wall Coverings Market?

The market segments include Product, Interior Paints Market, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Higher Demand for Home Furnishing among the European Countries; Availability of Styled Products.

6. What are the notable trends driving market growth?

Non-commercial is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Innovative Wall Coverings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Innovative Wall Coverings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Innovative Wall Coverings Market?

To stay informed about further developments, trends, and reports in the Europe Innovative Wall Coverings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence